WORSENING CORRUPTION DANGERS AHEAD: Your Future is Being Sold Down the River…by LYNETTE ZANG

TRANSCRIPT FROM VIDEO:

You guys know my favorite question is, how many times can you be lied to when you do not know the truth? Well, what if you, as the public are being lied to by everybody at the top of the pyramid, like Congress, the Fed, the IMF, the world bank, I got to tell you pardon my French, but that really, really me off. And that’s what we’re going to talk about today because it’s not okay with me and it shouldn’t be okay with you and you better do something to protect yourself, your wealth, your freedom, you better do something. We’re going to talk about that today. Coming up.

I’m Lynette Zang, Chief Market Analyst at ITM Trading, a full service physical gold and silver dealer, but really specializing in custom strategies. And I’m going to tell you, without any doubt in my mind, you better have a strategy right now because the powers that be definitely do have a strategy and that strategy is wealth transfer their way. But you know, the thing that’s interesting is we elect these people, not all of them, some of them are just appointed. We’ll talk about that too. But we elect these people and we are trusting that they have our best interests at heart, but do they really, the reality is, is you will have your own best interests at heart. First, do not take anybody’s word for anything, do your due diligence, understand what it is that you’re dealing with so that you can actually make educated choices that support your best interests and your best interests need to be at the top of the pile.

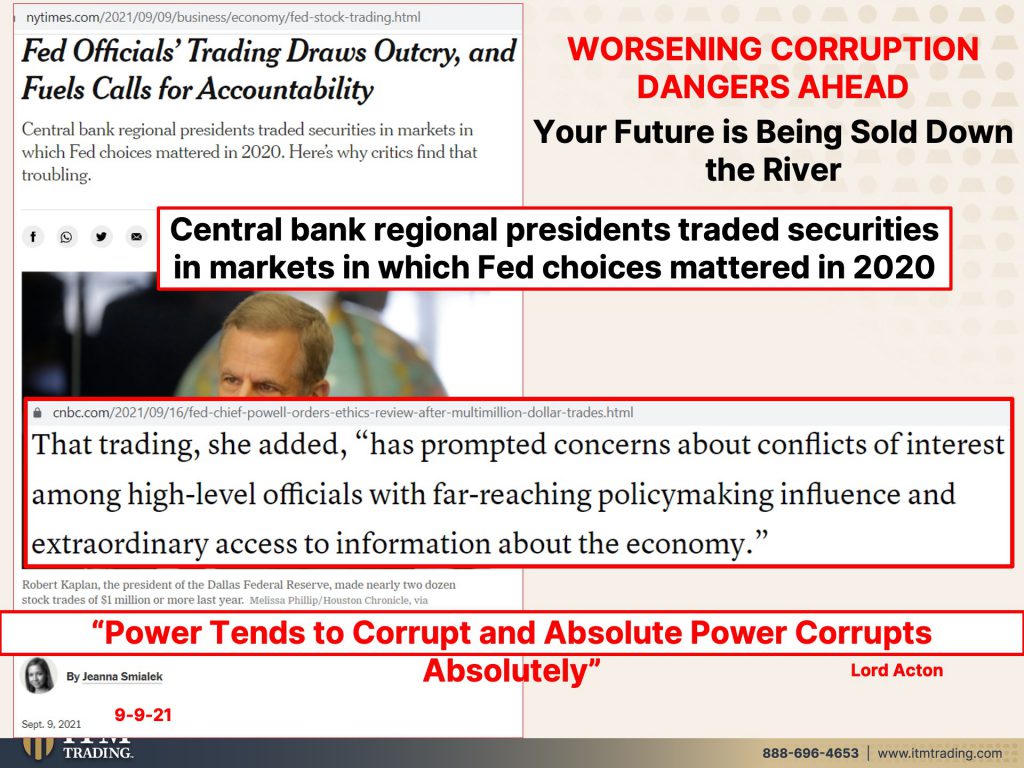

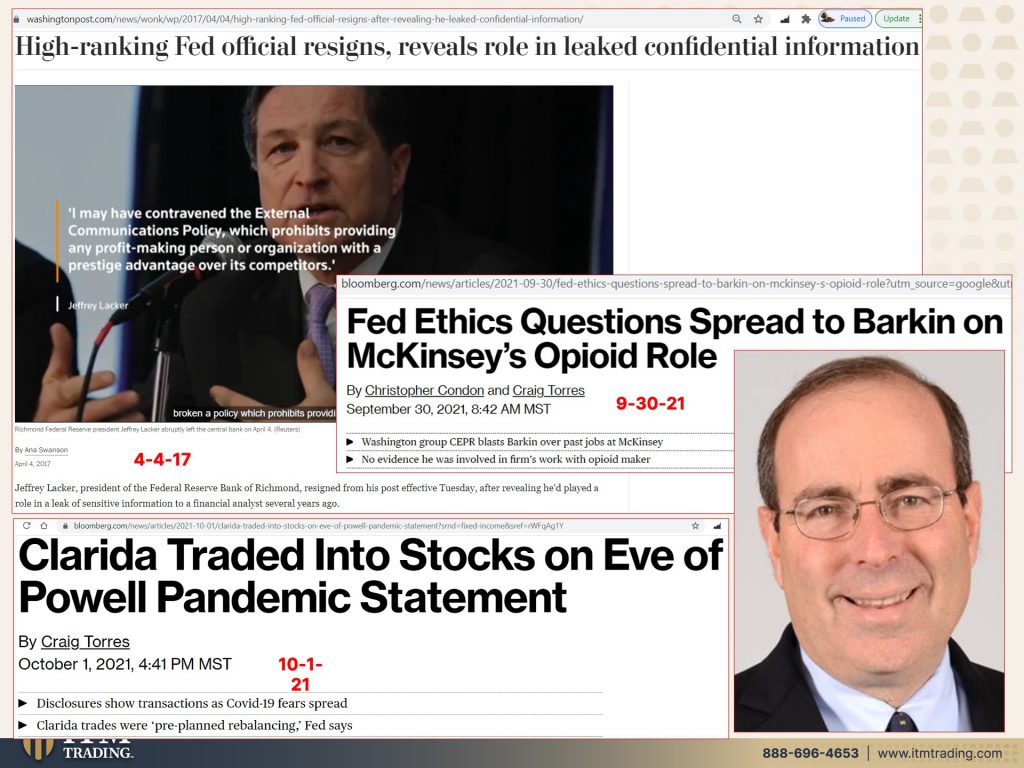

So let’s get started because the reality is, is your future is being sold down the river. And so are your children’s and your grandchildren and your great grandchildren. And when is it gonna stop? Because I say it stops now, if not me, who, if not not now, when, so you’ve probably heard about, I hope you’ve heard anyway, about what’s been happening at the Fed with officials training and all of this kind of stuff. Now has anything changed? or this something that’s new? Oh, heck no, it’s not new, but central bank, regional presidents traded securities in markets in which Fed choices mattered in 2020. If you create the playbook, then I guess you can benefit from it. You and I don’t get to create that playbook. The federal reserve gets to create that playbook. The congress gets to create that playbook, but here’s the piece. And I talk about it all the time, because this is a Ponzi game and all Ponzi games require confidence. So when this kind of stuff leaks, it erodes the confidence. And that my friends is the only thing that’s really holding this farce together. And it is a farce. I mean, you got look at what’s happening. And if you think that that’s the real economy, if you think that stock, market’s making constant new highs and going up thousands of percent in 12 or 24 months, if you think that that’s a normal economy and a normal market, then you need to think again. And oh, by the way, I have this bridge in Brooklyn that I’d really like to sell you. I mean, seriously, now the trading has prompted concerns about conflicts of interest among high level officials with far reaching policymaking influence and extraordinary access to information about the economy. And not only do they have extraordinary access about information in the economy, but they have the ability to impact what happens on the short term basis. So many people say to me all the time, well, can’t, they do this forever. And the answer is no history shows us that you cannot, they cannot do it forever. And, and really most of that is around the confidence. So this kind of stuff getting out is really not a good thing, but it’s not a new thing either.

I mean, wow, Boston Fed stunned by conflict of interest. And so what’s the solution. Well, the first solution is, well, I’ll sell those stocks. What happens to the money from selling those stocks? I mean, millions, I think this guy did something like 27 transactions worth over a million dollars per transaction. I could show you all that. It doesn’t matter if he did one transaction or he did a gazillion transactions. The point is, is that he had insider information and he used it to his benefit. And that is that really okay with you? The Fed has a problem with public perception and often the reality that they favor the interests of wall street. Ya think? It makes both of these problems worse when influential Fed presidents are actively trading stocks using that. They’re the only ones that are actively trading stocks and do think that is selling these stocks that he bought. He gets to keep the ill gotten gains. Did it diffuse the situation? Did it fix the situation and is he the only one that’s doing it? No, no.

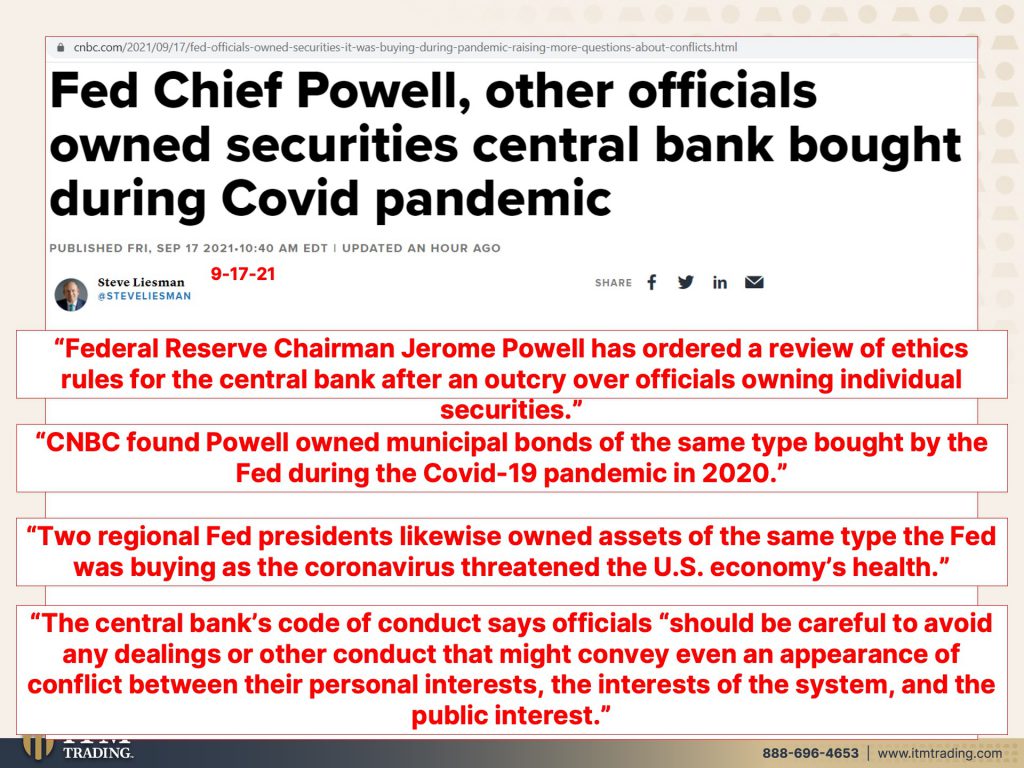

Even Fed chief pal, federal reserve chairman Jerome Powell has ordered a review of ethics rules for the central bank. After an outcry over officials, owning individual securities. I got to say, I don’t think it gives a crap if it’s an individual security or you’re participating in the whole market, because if you’re participating in the market, then you have a vested interest in keeping these assets inflated and even pushing their valuations up. In fact, CNBC found that Powell owned municipal bonds of the same type bought by the Fed during the COVID 19 pandemic in 2020 isn’t that interesting? Two regional Fed presidents, likewise owned assets of the same type the Fed was buying as the Corona virus threatened the U S economy’s health. This is all according to CNBC, the central banks code of conduct says, officials should be careful to avoid any dealings or other conduct that might convey even an appearance of conflict between their personal interests, the interest of the systems and the public interest. Do you think this issue just cropped up because it did not. This is something that keeps coming up over and over and over again. Why? Because there’s no reason to stop there. Isn’t a big public outcry about it. People aren’t even paying attention to it, and even worse. People do not understand how this impacts them. Let me tell you, it impacts everybody. The choices that the guys at the top of the, this big, huge pyramid scheme, and that’s exactly what it is. It impacts their choices that has like a domino effect, like repercussions against all areas of the economy. Because if they are spending money, they’re creating new money propping up and inflating the markets that they are participating in, then that money, that wealth, number one, it does two things. And we’re going to see this well, it does more than two things, but two key things. Number one, every single time the federal reserve creates new money. The value, the purchasing power value, which is the real trend. This is what we’re really, really, really, really talking about. I’ve been talking about it for years. This is the one that matters to you. But what they’re doing is they’re hiding the real trend, which is negative. And that’s in purchasing power. You can have five gazillion dollars, but if you can’t buy a loaf of bread with them, what good do they do? You they’re just digits.

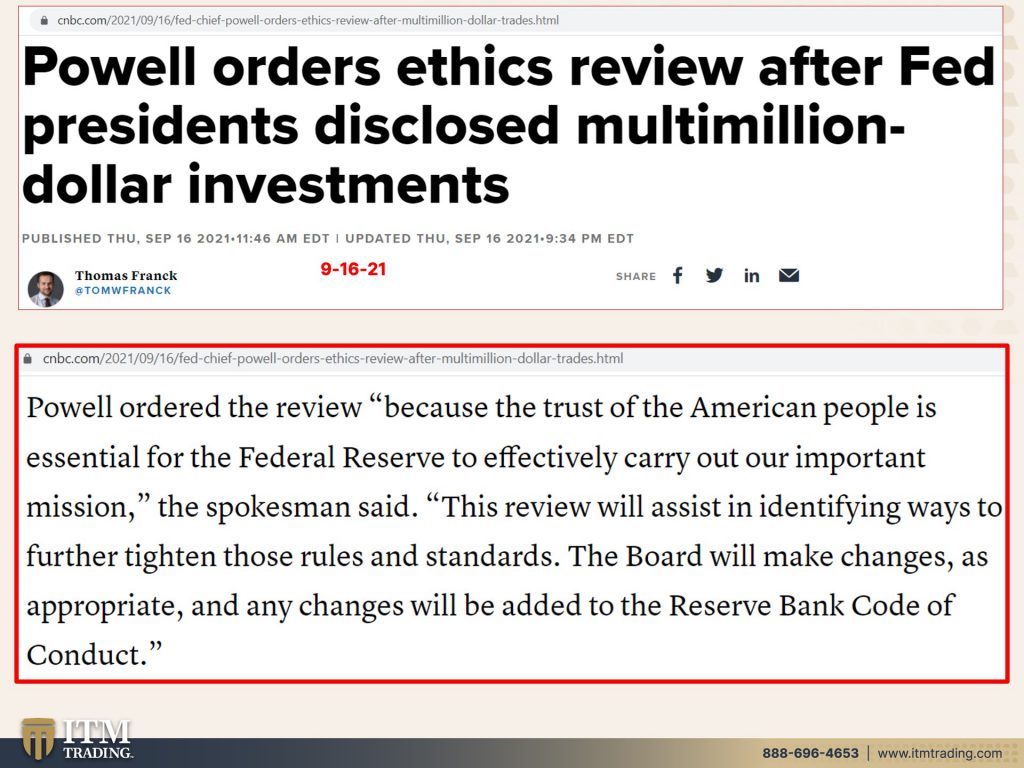

So here’s the ethics review after all of well, he’s part of it. And he’s not the only one that’s part of it, but he ordered the review because of the trust. I love this. The trust of the American people is essential for the federal reserve to effectively carry out our important mission. I am so annoyed with this. I can’t even tell I’m so pissed off, this review will assist in identifying ways to further tighten, further tighten? How about tighten! Those rules and standards? The board will make changes as appropriate. Oh, that’s all garbage. Okay. Because of the code of conduct, but the real big kicker in here is because of the trust of the American people is essential for the federal reserve to effectively carry out for, let me just paraphrase here…The trust in the American people is essential for them to continue to &%#$ you. Don’t bend over. That’s all I can say. Don’t bend over and I’m sorry. I don’t want to offend anybody.

But let me show you the waivers that makes this kind of behavior legal, because it’s not just at the Fed. It’s also in the Congress. This is from the New York Fed. Here’s the waiver section 208 pursuant to this of Title 18 blah, blah, blah. These waivers are issued by the president or first vice president. These waivers allow an employee, hence the federal presidents, regional presidents to work on a particular matter, even though the employee has a financial interest that might be affected by the matter, because the employee’s participation is critically important to the bank and the financial interest is not so significant that it would compromise the employee’s judgment. I mean, think about this. If you’re sitting in stocks and bonds, and then you’re determined, and the market’s imploding, who’s best interest, is it in to prop this market up? Don’t we have a K-shaped recovery where we’ve got those at the top that are doing enormously well. And those at the bottom that are suffering even more. So has this been a broad base recovery? No, it has not, but those are the top that are in the stock market. Yeah. It’s been a pretty good recovery for them and it covers Congress too. I mean, come on four U.S. Senators sold stock after getting coronavirus threat briefings in January. Hm. You think they might have known something that you didn’t know and do you think they might’ve acted on their best interest putting their best interests first? Did they come out and say, you know, you might want to sell your stocks and bonds. Heck no, they’re not going to say that to you, and they’re not going to do it for themselves. This growing conflict it’s growing understood is growing conflict of interest problem is in the U.S. Congress too.

Now these are elected officials. Personally, I think anybody that’s really going to make a decision about the markets and about the economy shouldn’t own any of these assets, these Fiat money assets, because that’s the only way their choices can be clean. It’s the only way, and Hey! If the dollar is so great, hold them in dollars while you’re a part of the government. Why not? Congress people in both political parties have substantial holdings in firms, their legislative actions affect. And this number has grown substantially in recent years while roughly 20%, 20% of lawmakers own stock in 2001. Hm, that number had more than doubled by 2013, as of the most recent data. I think it’s quite interesting that they don’t have really current data, but the most current 2014 from the Senate and 2016 from the house and we are in what year? 2021, I think that’s quite interesting and quite telling what are you hiding? Over half of Congress owned stocks, many withholdings in excess of a hundred thousand dollars in stocks alone, not to mention mutual funds and other forms of investments. In addition, as of 2014, I’m pretty sure this is higher now. Over half of lawmakers were millionaires. How nice is that? Are they going to protect their interests? Or are they really looking to protect your interests? You trust these guys? I’m sorry. I wish I, I wish I was so naive to be able to trust it, but I do too much research. I look at too many things.

If you think it’s just there, well, look at how the revolving doors spins from FDA to the industry. And that’s a lot of them. And we used to talk about the revolving door of Goldman Sachs to the government, to the treasury, etcetera. This is not new stuff, but this is really why you need to become your own central banker because you’re required. I mean, look, you do whatever you want, but you are not too big to fail. They are too big to fail are we talking about the banks, right? Well, we’re talking about our government officials and we’re talking about private bank, the Fed officials, and it goes higher still, but capturing the government, big Pharma’s takeover of policymaking, new brief explores how drug companies influence policymakers and the resulting harm in patient outcomes. I’m not going to say too much more about it, but use your imagination to what I’m thinking. I’m sure you can.

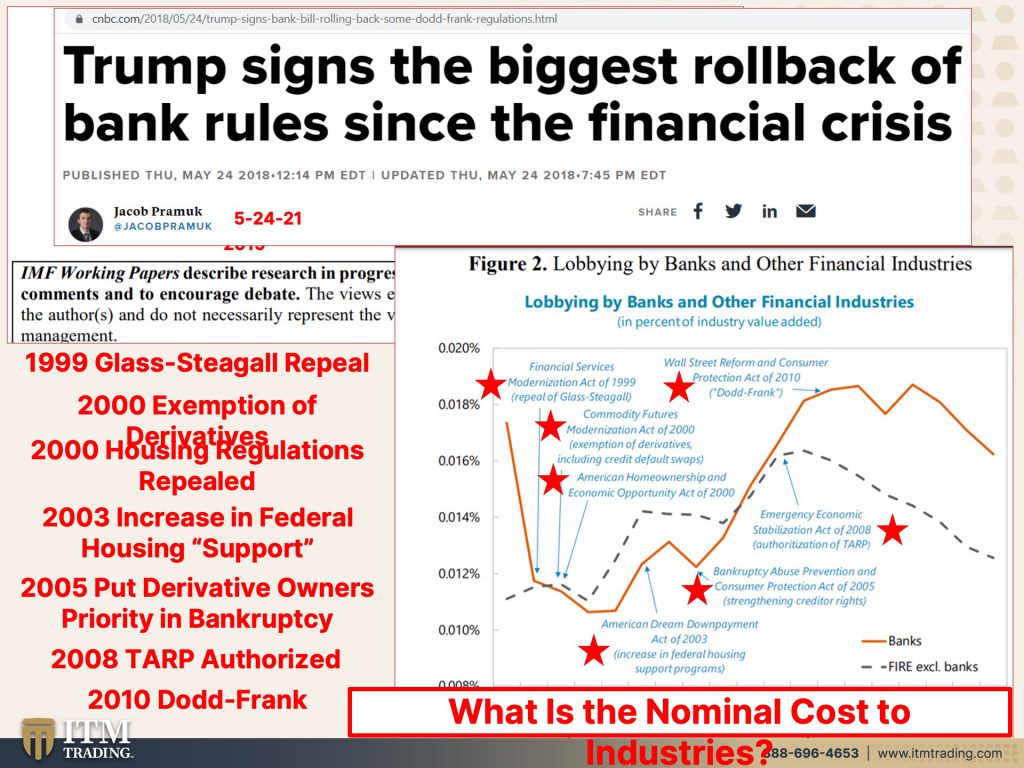

They did a research report, the IMF, a working paper research department, bank lobbying, regulatory capture and beyond. So this is just focusing on the banks. We’ll come back to the others in a minute. And they did this in August of 2019. And I found this really, really interesting. So we’re going to talk about it and that are the lobbying by banks and other financial industries in percent of the industry, whatever the value was added. Now, look, we know what happened in 2008, but it started right here with the repeal of Glass-Steagall, which separated deposit taking banks from investment banks. And suddenly, even though that was put in place back after the stock market crash in 1929, apparently it was no longer valid. You really think so because after that a year later, well, they pass the let’s see community commodity futures modernization act of 2000. And essentially what it did was said all derivative products that we’re creating, do them all over the counter. They don’t need regulation. They will self regulate. Oh right. So all of these big leveraged bets, cause that’s what a derivative is, is just a big leverage bet the banks were allowed to proliferate this arena and there was no oversight in 2000 the same year as they did the exemption for the derivatives and a year after they repealed Glass-Steagall housing regulations were repealed. Well, let’s see, did we have a housing boom or real estate boom, where people that couldn’t afford the houses encouraged to buy the most house that they could and do it with variable interest rates? And who was making money from this? Yeah, the banks, those that were doing the derivatives and lots of other companies that grew up around this housing market explosion. And I remember it was August 2005, where we got the signal that we were near a top in the real estate market. Well, it kept going up until January of 2006, but no, they cannot keep doing this forever. No, they cannot because this is insanity and this is all risk. What is the bank for international settlements say about gold. It is the only financial asset that runs no counter party risk. The only one, okay. In 2003, well, rather than controlling what was happening in the real estate market, they added more support here. They added more encouragement to go out and buy all of this real estate that they couldn’t afford. And that was a mom and pop area. Was this really setting up for this next phase that we have been enduring with corporate takeover of residential real estate and rental units. That happened since 2008? Because This one’s like this next one, 2005. I’d see what was that act called? That was 2003 here, bankruptcy abuse. And by the way, when they name these things, whatever the name is, it’s just the opposite. In reality, the name is just to cover up what they’re really doing, the deregulation and the risk that they’re adding to the market. So this one is called the bankruptcy abuse prevention and consumer protection act of 2005. And what it did was it put the holders, the owners of those derivative contracts at the front of the line in a bankruptcy. In fact, it gave these creditors, these derivative owners, the ability in many cases to push corporations into bankruptcy, to force them into bankruptcy. And then they’re first in line. So Hey, if you were a vendor that we’re selling to a company and the company didn’t pay your bill, you’re behind the person that took a bet or the entity that created a bet against that company. Does that sound right to you? Does that sound like it? Bankruptcy, abuse prevention or, oh, how about consumer protection? No, no, no, no, no. That is bend over baby. I’m sorry, I-I’m sorry. I have to calm down here. Then okay, the crisis hits and what do they do? They authorize tarp, which is giving billions and billions and billions of money to these failing institutions that made all of this money on all of these bets and whose money are they giving? That’s the piece that people really also don’t realize they’re spending your money. Congress is spending taxpayer dollars. The federal reserve is spending taxpayer dollars because we tax paper pay. I have to slow down. We taxpayers are the ones that pay for all of this. We pay for it. We are the ones that are taking the biggest risks. I mean, you don’t have to look very far to see that you can look back to last year 2020. You can look back to 2008 who really suffered the most? It was not the banks or the financial institutions or the corporations. And then of course we had Dodd-Frank. So after 2008 Congress wrote in, on their white horses and they put in place, this Dodd-Frank that was something like a zillion pages of legislation that got passed without anybody reading it. And oh, by the way, this was supposed to protect the consumers. And a lot of the things that protected the consumers were never even implemented until they started to just, you know, basically dissect and take it down. The Dodd-Frank act role back in regulations, the biggest rollback of bank rules since the financial crisis. Do you think maybe that could have set us up for more risk and why you see these markets at the highs that they are because of all of this deregulation and what that does is it adds risk to the little guy and what they’ll give the little guy a little bone so that they can then say, Hey, we’re really protecting you, but you are not the one that really benefits. I mean, we can look at oh say, the retirement crisis that we’re in so many pensions. So many retirement funds are based on stocks and bonds and ETFs and even derivatives these days and all sorts of garbage. So, Hey, they’ve got to keep a floating for that reason. It’s to keep you blind it so that you don’t really understand what’s happening. And you look at it and that nominal confusion with the market’s going up, things must be doing great. I was talking to somebody yesterday and they said to me, boy, if I didn’t know better, I would think everything was hunky dory. And I agree I’m driving around Phoenix and there are cranes all over the place. There’s buildings all over the place or things better, or are they really fixed? No, they have not fixed anything. 2008 was when the system died and it’s just been on life support and they have fixed nothing.

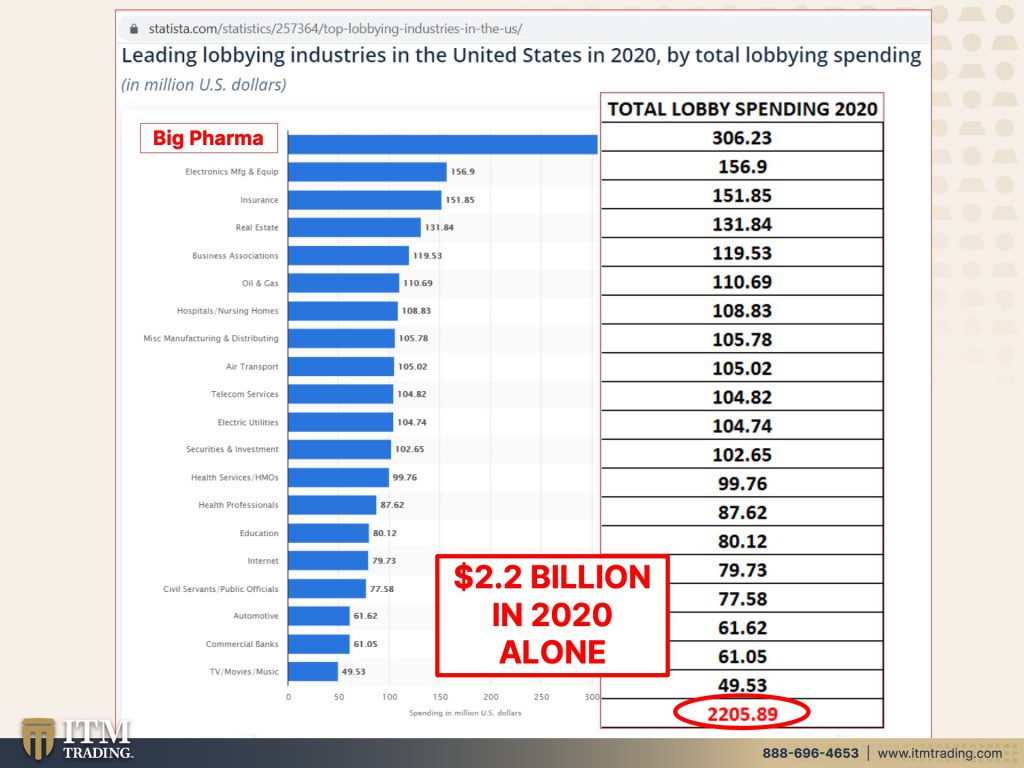

But take a look at leading lobbying. This is leaving lobbying industries and the United States in 2020. Hmm. Let’s see. Oh, big Pharma is at the top of the list. Just saying there are all sorts of others. And actually commercial banks are down here at $61.05 million. That’s how much they paid in lobbying fees. Right? So a lobbyist works in Washington and they kind of grease the wheels to make sure that the laws of the regulations that get passed or deleted support their best interest first. They contribute to election campaigns. They do all sorts of interesting things to get what they want. I guarantee you, these corporations are not putting your best interest. First. This (physical gold) puts your best interest first to the tune in one year alone, when you’re alone, $2.2 billion in lobbying went to our government. Have you put that much money in there, or even in the millions of dollars? Do you contribute at that level to an election campaign? Probably not. You’re not going to get service the way these guys will get service because you follow the buck, follow the money. The money is being spent by corporations that have a vested interest above your wellbeing, that to get these laws and regulations passed.

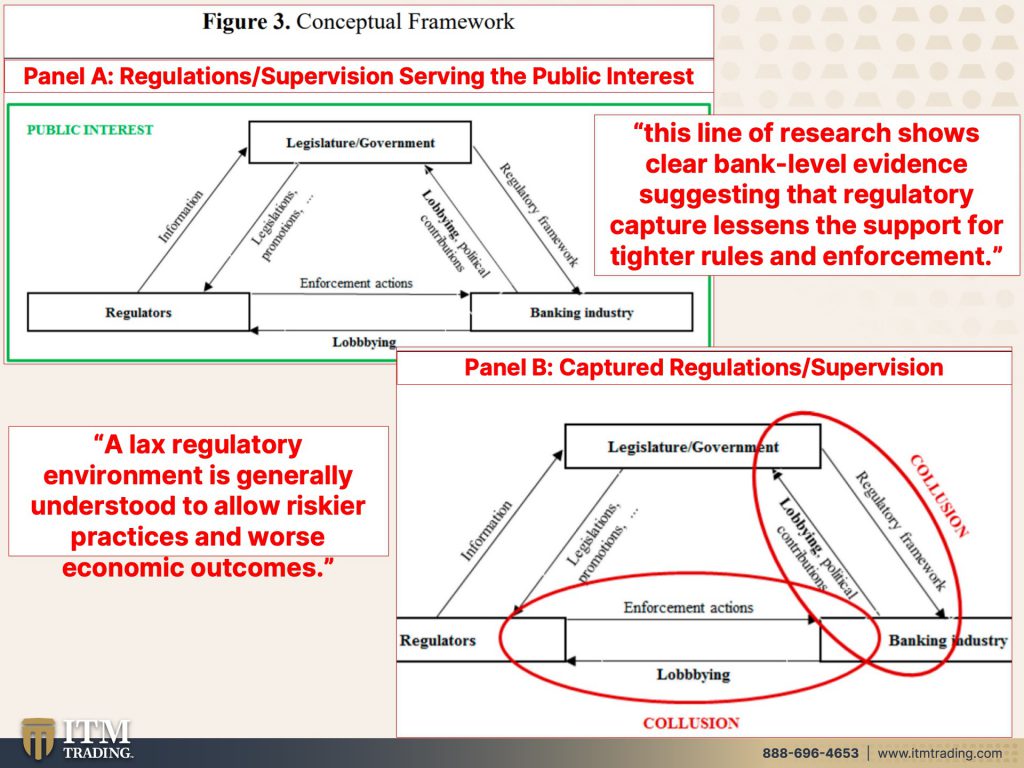

Now, this is from the IMF, a study that the IMF did on regulations slash supervisions that do serve the public interest. So here’s the government up here. Here’s the regulatory framework and the banks and lobbying and political, etcetera, etcetera. And presumably this supports the public interest. But this is what it looks like with captured regulations and supervision and these are all their lines, by the way, showing collusion, showing collusion. This line of research shows clear bank level evidence suggesting that regulatory capture lessens the support for tighter rules and enforcement. So what they’re really talking about here is how these corporations grease the wheels to get the rules and regulations that support their best interest first, not yours, theirs, and it is collusion with the government further. They say a lax regulatory environment is generally understood to allow riskier practices and worse economic outcomes. We see all of the bonuses. We see all of the stock buybacks. I mean, prior to 2003, you really couldn’t do stock buybacks, but Hey, they changed the rules. And then it was like a great thing to do. And that is a huge tool that has been used since then to push the price of the stock up at the same insider, sell out and capture those gains. But you don’t know that because you see the price of the stock go up. So you buy it when they’re selling it. That’s wealth transfer I’m by the way, all of those bonuses and dividends and stock buybacks means that when a financial crisis hits, they don’t have the money to sustain themselves as an ongoing entity. Look at what happened was Boeing, right? So the tax payers go in and bail them out. Yeah, that seems fair to me. What do you think that sounds fair to you? And it’s not just at the Fed or in or in Congress again, it’s the it’s. These are the leaders of the organizations that we are trusting to put our best interests first to make non biased decisions, to help the global economy.

IMF Chief called out on pressure to lift China ranking and report. And oh, by the way on our blog, you will have a link directly to that report. It’s an easy read. It’s a very, very, very interesting read. And if it wasn’t so awful, I would even say it’s rather entertaining, but pull that link and read it. She served as Chief executive over at the world bank. Now the world bank puts out loans to countries, right? So now she’s over at the IMF. The IMF all their members are every central bank head and every treasury secretary, pretty much in the world. So now she’s overseeing all of these unelected officials that are in like almost every country in the world, well that makes me feel good. The world bank foot found such serious ethics issues in its probe of the Doing Business report that she oversaw Georgieva oversaw, that it decided to abandon the series entirely that report’s been around forever. So when these things get leaked, like what the Fed Pres, well we’re going to sell oh and then they resigned. Does that really solve the problem? No, because it is so ingrained throughout the entire system that, you know, you find one bad apple. Well, that’s just because we happened to discover it. That happened to get leaked because what do we know? Financial markets and policy makers rely on the expertise of the multilateral lenders and that reputation is now tarnished. It goes back to confidence. It goes back to, this is a con game. I don’t have confidence in any of these guys because thanks to my father, always saying, do what I say and not what I do. That was huge training for me. And he was a great man. So don’t misunderstand cause it was mostly around driving, but I read and I watch, I watch what they say. I read the reports, which are typically different than what they’re actually saying on, on TV or out into the public. And then I watch what they do.

This is all about wealth transfer. It’s not okay with me. If they transfer my wealth, I work my butt off. I’m sure you work your butt off too. So look, here’s just a little update on a few ways that the government and the central banks keep these markets inflated and then give themselves the ability to take advantage of it. Here’s the Fed balance sheet. This is through October 13th, Fed debt held by the public. Okay, well, you know, we’ve got that debt ceiling looming. You know, it is money that’s Congress has already spent, but you know, I mean, take a look at this. This is up, this is up. And these are the reverse repos, which is the plumbing of the global markets or indicates the plump money markets are the plumbing that underline all of the global markets. I don’t know. You can go back. This goes back to 2003 and you know, so the reverse repos have been around. You can see here back in 2014, there was a shift because all that quantitative easing wasn’t really working. Wasn’t working. Even if you don’t understand reverse repos, does this look like, I don’t know, panic to you? This looks reasonably calm over here. This looks more volatile because the system died here. This is where the system died. It did. I don’t care what anybody says. That’s what the data tells me. That’s what I’m telling you. And then look at this. Here we go. This is 2020. This is the ity-bity-little bit of a recession that we had in 2020. Fastest recession in history. Why? Because of this, because of this. And now also because of this, this is an indication that the, that the underlying foundation of the global markets is falling apart and they’re doing whatever they can. Desperate governments, desperate central banks take desperate, desperate measures. Do you see this on a database day basis? No. Drive around Phoenix, all the cranes, all the building and the stock market’s flying. Everything should be hunky-dory. This is showing you, this is showing you, this is showing you and many more that I could show you. No, it is not hunky-dory and no can they, nothing goes straight up. This is going straight up. Do you think it can keep going up to these levels? Here this is a trillion. I should’ve put a line in there. This is a trillion. It was a big deal. When it hit a trillion. Now it’s getting pretty close to hitting 2 trillion a day, a day because of all the liquidity that’s in the system. It really, for every action, there is a reaction and all of the choices that the Fed has made, I’ll say in my opinion, but I’m pretty sure that history is going to bear me out. The consequences of those choices are hyperinflationary depression. That’s the consequences of these choices. I don’t want you to suffer their consequences more than you have to. I mean, everybody’s going to be impacted no matter how prepared that that you are or that you think you are.

Pandemic-era central banking is creating bubbles everywhere. I mean, can they hide the truth forever? Can they suppress the truth forever? The answer is no, because we have also been trained to think very short term. Just, just look at right now. Forget yesterday. Just look at right now. Forget tomorrow. Just look at right now. Well, that doesn’t really make sense. You’ve got to take a longer term view in order to see the truth.

So what, this is a relative performance chart of gold, silver, the Dow Jones and the dollar down here in green. Okay. So all of that debt, let me just go back to it and remind you of it. Before I go back here, all of this debt and lots, lots more tricks because of interest rates, etcetera, etcetera. And what has it accomplished? This, here’s the stock market. Okay. And when you hear the strong dollar, they’re referring to one Fiat currency against another, but here’s the strong dollar. Here’s the real dollar, because this is purchasing power. No doubt about it. We are at a critical juncture right now. I don’t know exactly how much more time we have and you know, I am not, I do not yet have the technical confirmation to come out here and say with, with absolute technical definition that we are in a hyperinflationary phase, but I would really say my head, my heart and my gut is really telling me that we have begun that. So we’re running out of time. This is not the time to procrastinate. This is not the time to worry about all his spot gold going up, or is it going down? Is spot silver going up? Or is it going down? Who cares? Honestly, that is nominal confusion. They designed it because they knew that you would marry the numbers. Don’t marry the numbers, marry the value. Because what this does is it holds your purchasing purchasing power? Thank you. It holds your purchasing power intact. This particular graph goes back to 2017 and here’s where we are in 2017. Okay. You’re so right where this little red dot is ish. Give or take a little bit, okay. This has held your purchasing power intact, and it should be clear. I hope it’s clear if it’s not let me know and I’ll figure out another way to do this, but it is clear that since 2000, which we saw the rules and regulations in the setup to the 2008 financial crisis has outperformed stocks, currencies, and everything else. Even with all the manipulation, even with all the manipulation, you really need to be protected. You need barter ability. You need wealth preservation. If you’re in the markets, okay, you want to go on that roller coaster. Okay. Just be properly diversified with something that is truly outside of the system and is the only financial asset that runs no counter party risk. All of this is all counter party risk. And I’m even referring to the spot gold and silver contracts, because that’s all they are they’re paper. They’re not even paper contracts, they’re contracts, they’re easy and cheap and they can create unlimited amounts of them. And everybody goes, yeah, yeah, yeah. Well, we know that, you know, the gold and silver are being manipulated, but they can do that forever. Can’t they? Well, you know, let’s go back and look at this. Do you really think that this can go on forever? Do you really think that this can go on forever? Because it’s been tried before it’s been tried and there are over 4,800 times. And you know, now I think I read something briefly this morning. I’m going to look at it more later about Argentina. So Brazil, Argentina, Venezuela, Zimbabwe, Turkey, you know, on and on and on the list goes, but at some point in here you will…I recognize it’s already happening to the dollar. At some point in here, you too will recognize that it is happening. What I don’t want is I do not want you to be like a deer caught in the headlights. So that that’s what happens to you because that’s not okay with me. That’s why I work so hard at all of this.

Do yourself a favor, get your insurance, get it in place. You need more than gold and silver to weather. This economic storm that we got a little taste of in 2020, you also need food, water, energy, security, community, and shelter, as well as barterability, barterability and wealth preservation, please, because if you’re concerned about when major shifts are going on in the economy, where you just want to be aware of what’s going on, so you can make educated choices. That’s what we’re about to support and around your family and your finances. Well go ahead and click that subscribe button. If you haven’t already subscribed and select that bell to let you know, because things are changing constantly. And I want you to be the first to know when I do an urgent video, my team, and I spent every day in this arena. So you don’t have to, but we also give you all the, because we encourage your due diligence. Don’t take our word for it, but come and see what’s happening. Because my goal is to translate financial noise into understandable language so that you know, what’s going on and you can get into position before it’s too late. What’s been tested gold and silver. That’s been tested over thousands of years, nothing else. And you know, I hope you know, and if you don’t know, I want you to know right now, without a doubt, it is time to cover your assets. And here at ITM, we use the wealth shield, which is based on the strategy that I created for myself after studying currencies and currency life cycles since 1987 and our team, all of us at ITM. And for those that have been there, you know, have come into the office or working with one of our consultants. I mean, you know, we really are a team and we come together regularly to make sure that everything that we do supports your educated choices. Now on Tuesday, I did a Coffee with Lynette, with Egon Von Greyerz. And I just, this man is so brilliant and so smart, and it was a fantastic interview. So if you haven’t seen it yet, make sure that you go and see it, but you can also get some behind the scenes and more trending topics on the Instagram @LynetteZang or on Twitter @ITMTrading_Zang and we also have the podcast. So if you don’t have time to watch, you can listen they’re on all major podcast stations. So they’re easy to access. And until next we beat, please be safe out there. Bye-Bye.

Link to report that Lynette mentions at 30:53: https://thedocs.worldbank.org/en/doc/84a922cc9273b7b120d49ad3b9e9d3f9-0090012021/original/DB-Investigation-Findings-and-Report-to-the-Board-of-Executive-Directors-September-15-2021.pdf

SOURCES:

https://www.nytimes.com/2021/09/09/business/economy/fed-stock-trading.html

https://news.yahoo.com/fed-officials-kaplan-rosengren-sell-143239456.html

https://www.wsj.com/articles/boston-fed-leader-rosengren-to-retire-early-from-bank-11632747033

https://www.newyorkfed.org/aboutthefed/ethics-conflicts-of-interest

https://www.newyorkfed.org/aboutthefed/ethics-conflicts-of-interest

https://hbr.org/2017/02/the-growing-conflict-of-interest-problem-in-the-u-s-congress

https://www.elibrary.imf.org/view/journals/001/2019/171/001.2019.issue-171-en.xml

https://www.cnbc.com/2018/05/24/trump-signs-bank-bill-rolling-back-some-dodd-frank-regulations.html

https://www.statista.com/statistics/257364/top-lobbying-industries-in-the-us/

https://stockcharts.com/freecharts/perf.php?$USD,$silver,$gold

https://fred.stlouisfed.org/series/CUUR0000SA0R