Debt Levels Now at a Inflection Point as Gold Demand Skyrockets Among Central Banks

Are we on the brink of a revolution? I’m with Ray on this one! 🔄 But hold on, the US is hitting an inflection point, and the debt issue is like a hockey stick 🏒⬆️ Learn why soaring government debt might lead to even bigger problems! 💰💡 Let’s dive deep into the financial landscape and understand why a financially strong economy is crucial! 🌐💪 Don’t miss out on the insights – we’re breaking it down today! 🔍📊

CHAPTERS::

0:00 The Worse It Gets

1:10 Inflection Point

3:37 Moody’s Negative

6:29 Interest Cost

9:57 Federal Surplus or Deficit

13:56 Current Expenditures

15:54 S&P Defies Fed Push Back

18:20 Global Central Bank Buying

VIDEO TRANSCRIPT:

00:00:00:00 – 00:00:04:08

The worse that gets, the more we are going to have that long term problem.

00:00:04:14 – 00:00:06:24

And it’s just you can see it in the numbers.

00:00:06:24 – 00:00:08:07

It’s just a matter of numbers.

00:00:08:07 – 00:00:09:29

We are near that inflection point.

00:00:09:29 – 00:00:15:16

So higher for longer keeps being the mantra for the central banks.

00:00:15:18 – 00:00:19:09

The markets believe that the Fed is going to pivot.

00:00:19:11 – 00:00:23:13

the meantime, debt right now is a whole

00:00:23:13 – 00:00:27:09

lot more expensive via interest rates

00:00:27:11 – 00:00:31:04

than it used to be for the 15 years that they kept it

00:00:31:04 – 00:00:35:17

at zero interest rate policy or in other words, zip.

00:00:35:19 – 00:00:39:22

this is a problem because that debt just keeps growing and growing and growing.

00:00:39:27 – 00:00:44:23

has that gone better or what are the implications for you and me?

00:00:44:25 – 00:00:49:27

Let’s talk about this coming up.

00:00:49:29 – 00:00:50:29

I’m Lynette Zang,

00:00:50:29 – 00:00:54:26

chief market analyst here at ITM trading of full service

00:00:54:26 – 00:01:00:23

physical gold and silver dealer specializing in custom strategies.

00:01:00:29 – 00:01:02:06

And by the way,

00:01:02:06 – 00:01:06:21

if you haven’t gotten your strategy in place, click that cowardly link below.

00:01:06:22 – 00:01:08:11

We are running out of time.

00:01:08:11 – 00:01:13:10

And I’m going to start out with Ray Dalio, who expects a revolution.

00:01:13:10 – 00:01:16:02

And I you guys know I agree with him.

00:01:16:02 – 00:01:18:00

And I think we need it badly.

00:01:18:00 – 00:01:21:29

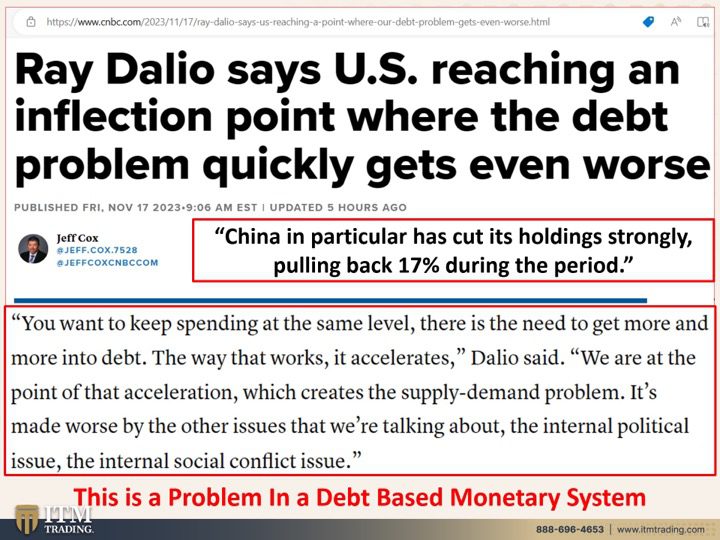

But he’s also saying that the US is reaching an inflection point

00:01:22:06 – 00:01:26:21

where the debt problem quickly gets worse because that

00:01:26:21 – 00:01:31:01

all of that interest is like a hockey stick up now, right?

00:01:31:04 – 00:01:33:19

So that can crowd other things out.

00:01:33:19 – 00:01:35:26

And we’re going to talk about that today.

00:01:35:26 – 00:01:37:08

But soaring U.S.

00:01:37:08 – 00:01:42:19

government debt is reaching a point where it will begin creating larger problems.

00:01:42:22 – 00:01:46:27

Economically strong means financially strong.

00:01:47:00 – 00:01:50:12

And right now, this, I think, is interesting.

00:01:50:19 – 00:01:55:01

The government spent 659 billion on net interest cost

00:01:55:01 – 00:01:59:25

in fiscal 2023 to finance the debt.

00:01:59:28 – 00:02:02:21

Now, here’s the thing about that, though.

00:02:02:21 – 00:02:06:14

When they don’t take in enough money and we’re going to look at this,

00:02:06:18 – 00:02:10:29

when they don’t take enough money in to pay all the interest on the debt,

00:02:11:01 – 00:02:14:11

and then any of the principal,

00:02:14:13 – 00:02:18:02

all of that interest goes into the principal

00:02:18:05 – 00:02:22:19

and it compounds and it compounds very rapidly,

00:02:22:23 – 00:02:25:23

especially in a higher interest rate environment.

00:02:25:29 – 00:02:28:03

So I thought that was interesting.

00:02:28:03 – 00:02:31:03

But you want to keep spending at the same level.

00:02:31:09 – 00:02:34:19

There is the need to get more and more into debt.

00:02:34:22 – 00:02:37:11

The way that works, it accelerates.

00:02:37:11 – 00:02:42:23

We are at the point of that acceleration, which creates a supply demand problem.

00:02:42:24 – 00:02:45:14

In other words, our governments are issuing a whole lot more debt.

00:02:45:14 – 00:02:46:22

Who’s going to be buying it?

00:02:46:22 – 00:02:48:20

We’ve been talking about this.

00:02:48:20 – 00:02:52:08

It’s made worse by the other issues that we’re talking about,

00:02:52:11 – 00:02:55:27

the internal political issue, the internal societal

00:02:56:01 – 00:02:59:11

soci social conflict issue.

00:02:59:13 – 00:03:04:19

Yeah, and China in particular, looking at all the issues that the U.S.

00:03:04:19 – 00:03:06:25

has and others as well.

00:03:06:25 – 00:03:10:00

China in particular has cut its holdings strongly,

00:03:10:07 – 00:03:15:26

pulling back 17% during the period.

00:03:15:28 – 00:03:18:25

This is the problem when you’re in a debt based system.

00:03:18:25 – 00:03:21:27

When you get to a point where it’s not just

00:03:21:27 – 00:03:25:18

that it’s not sustainable, but it is not payable

00:03:25:21 – 00:03:28:21

and you need to take on more and more debt

00:03:28:21 – 00:03:33:06

to pay the debt that you already have.

00:03:33:08 – 00:03:37:11

At some point, creditors say no,

00:03:37:13 – 00:03:40:18

and we are getting rapidly to that point.

00:03:40:18 – 00:03:43:18

And actually in some cases we’re already there.

00:03:43:25 – 00:03:47:28

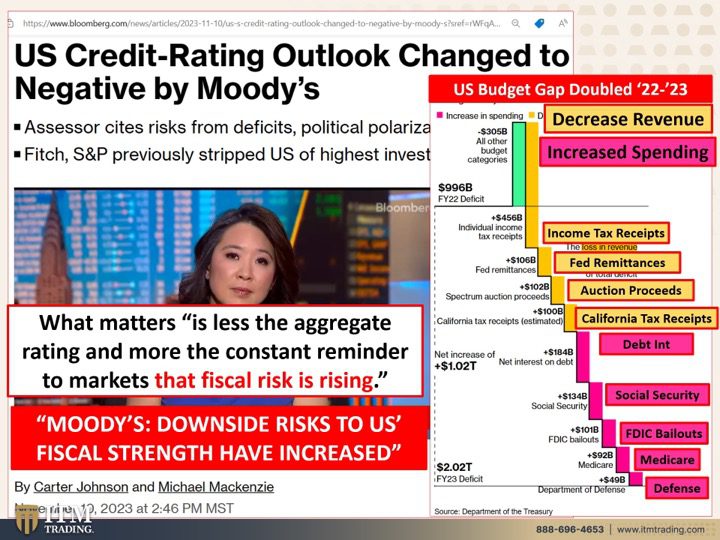

U.S. Credit Rating outlook Changed to Negative by Moody’s.

00:03:48:03 – 00:03:51:23

Now, Fitch and S&P previously stripped the U.S.

00:03:51:28 – 00:03:54:06

of its highest investment grade.

00:03:54:06 – 00:03:59:19

So the world is starting to shift in its confidence because the U.S.

00:03:59:19 – 00:04:05:10

budget gap doubled between 22 and 23.

00:04:05:12 – 00:04:07:12

Wait a minute.

00:04:07:12 – 00:04:12:07

We didn’t really have a whole lot of problems in 22.

00:04:12:07 – 00:04:15:16

Well, 22 between 22 and 23.

00:04:15:16 – 00:04:16:10

Did we?

00:04:16:10 – 00:04:22:02

I mean, we’re told that our economy is really strong and chugging right along.

00:04:22:04 – 00:04:23:15

What matters is

00:04:23:15 – 00:04:26:21

less the aggregate rating and more

00:04:26:21 – 00:04:29:21

the constant reminder to markets

00:04:29:23 – 00:04:33:24

that fiscal risk is rising.

00:04:33:26 – 00:04:36:26

If you were if that were you,

00:04:37:02 – 00:04:40:00

you know, and it doesn’t matter whether you are a government,

00:04:40:00 – 00:04:44:10

a corporation or an individual, the laws of economy

00:04:44:12 – 00:04:47:01

and finance work the same for everyone.

00:04:47:01 – 00:04:50:15

The difference is that governments and central bankers

00:04:50:18 – 00:04:53:08

have a money gun and they can just print money out,

00:04:53:08 – 00:04:56:14

will counterfeit it, because this is real money.

00:04:56:15 – 00:04:57:28

Jp morgan Chase.

00:04:57:28 – 00:05:01:15

Jp morgan said only gold is money.

00:05:01:18 – 00:05:03:06

Everything else is credit.

00:05:03:06 – 00:05:04:26

That means that it’s debt.

00:05:04:26 – 00:05:07:04

That is an accurate statement.

00:05:07:04 – 00:05:11:04

So let’s take a look at what is really happening

00:05:11:04 – 00:05:13:18

and how it’s likely to impact you.

00:05:13:18 – 00:05:18:11

Because revenues are decreasing, income tax fed remittances.

00:05:18:11 – 00:05:21:19

We’ve talked about both of those auction proceeds.

00:05:21:19 – 00:05:24:18

And California tax receipts are all lower.

00:05:24:18 – 00:05:29:06

At the same time, increased spending on debt, interest rates,

00:05:29:06 – 00:05:34:24

Social Security, the FDIC bailouts, which I thought was really interesting

00:05:34:24 – 00:05:40:20

since they told us back in March and April and June, don’t call this a bailout.

00:05:40:22 – 00:05:44:09

This is it was a bailout because they weren’t ready for you yet

00:05:44:09 – 00:05:48:16

to know about the balance, Medicare and defense.

00:05:48:18 – 00:05:52:04

So all of those spending things have increased

00:05:52:11 – 00:05:55:11

while their revenues have decreased.

00:05:55:18 – 00:05:57:11

Can you see the problem?

00:05:57:11 – 00:06:01:04

Can you see why the fiscal risk is rising?

00:06:01:06 – 00:06:06:20

Because Moody’s downside risk to the US fiscal strength have increased.

00:06:06:23 – 00:06:08:14

What are you waiting for?

00:06:08:14 – 00:06:12:10

They want you to rush in and fill this gap in all the treasuries

00:06:12:10 – 00:06:16:27

that they want to sell to you because the normal buyers are out.

00:06:17:00 – 00:06:20:00

We’re at least severely reduce their purchases.

00:06:20:07 – 00:06:23:02

They need you, the public,

00:06:23:02 – 00:06:27:24

to buy more debt so they can do more of the same.

00:06:27:24 – 00:06:30:03

And rob you more U.S.

00:06:30:03 – 00:06:36:09

kicks off 50 fiscal year with an 87% surge in interest costs.

00:06:36:15 – 00:06:38:25

The fiscal year ends in October.

00:06:38:25 – 00:06:41:25

So this was written on November 13th.

00:06:42:00 – 00:06:46:11

The budget deficit shrank in October because of deferred taxes,

00:06:46:13 – 00:06:49:13

but the interest cost climbing due to rising

00:06:49:13 – 00:06:52:13

Treasury bills is really a problem.

00:06:52:19 – 00:06:57:25

And this is for the fiscal year through September, actually not even October.

00:06:57:27 – 00:07:00:03

Effectively doubled U.S.

00:07:00:03 – 00:07:01:13

debt interest bill.

00:07:01:13 – 00:07:09:08

Rockets passed a cool trillion a year.

00:07:09:10 – 00:07:12:05

And keep in mind that the issuance

00:07:12:05 – 00:07:17:18

not just from 2020 as the government was dealing with the pandemic,

00:07:17:20 – 00:07:20:14

but all of the debt that has been

00:07:20:14 – 00:07:23:25

issued needs to be refinanced.

00:07:23:28 – 00:07:25:12

Who’s going to buy?

00:07:25:12 – 00:07:26:10

That’s the question.

00:07:26:10 – 00:07:31:26

The question besides deficits of over 2 trillion in the foreseeable future.

00:07:31:29 – 00:07:35:25

Climbing maturities following the increase of issuance

00:07:35:25 – 00:07:41:06

from March 2020 will also need to be refinanced.

00:07:41:09 – 00:07:44:09

Well, the more debt they take on,

00:07:44:12 – 00:07:48:06

the more interest payment, the more interest they have to pay.

00:07:48:14 – 00:07:51:11

And those interest payments can crowd out other

00:07:51:11 – 00:07:54:18

spending programs like we saw.

00:07:54:24 – 00:07:57:24

Well, if you watch Montre Monday, we’ve seen this

00:07:57:24 – 00:08:01:00

just recently in

00:08:01:03 – 00:08:05:09

where is a Chicago or there is somewhere that no New York City

00:08:05:16 – 00:08:08:16

that has to reduce their police force

00:08:08:22 – 00:08:12:01

because of the interest on the debt that they’re paying.

00:08:12:04 – 00:08:14:08

All right. Well, let’s take a look at this.

00:08:14:08 – 00:08:19:03

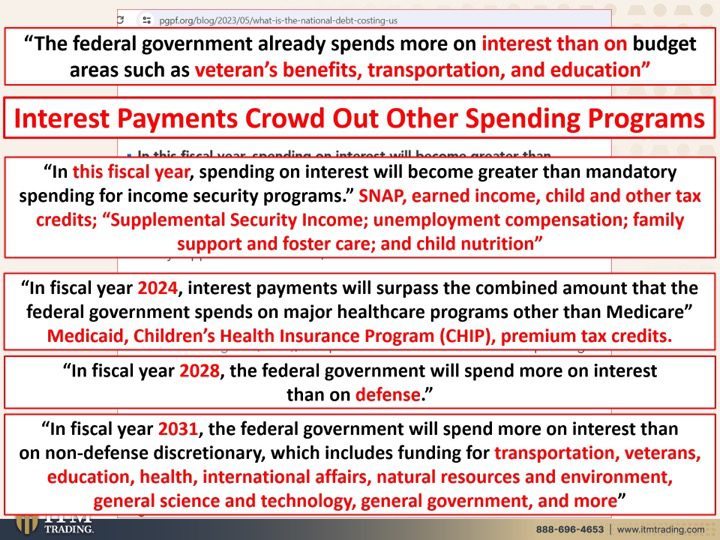

The federal government already spends more on interest than on budget areas

00:08:19:03 – 00:08:23:20

such as veterans benefits, transportation and education.

00:08:23:22 – 00:08:27:08

In this fiscal year, spending on interest will become greater

00:08:27:08 – 00:08:31:13

than mandatory spending for income security programs.

00:08:31:15 – 00:08:36:00

So SNAP, earned, Earned Income, Child and other tax

00:08:36:00 – 00:08:39:29

credits, supplemental Security Income, Unemployment compensation,

00:08:40:05 – 00:08:44:00

family support and foster care and child nutrition.

00:08:44:02 – 00:08:47:08

All of these programs, we’re going to get to a point

00:08:47:15 – 00:08:50:21

that this interest is going to crowd them out.

00:08:50:23 – 00:08:54:01

They anticipate in 2024

00:08:54:04 – 00:08:58:15

that those interest payments will surpass the combined amount

00:08:58:22 – 00:09:02:10

that the federal government spends on major health care programs

00:09:02:12 – 00:09:03:26

other than Medicare.

00:09:03:26 – 00:09:06:28

So Medicaid, children’s health insurance programs

00:09:06:28 – 00:09:10:15

and premium tax credits by 2028.

00:09:10:17 – 00:09:14:08

They’ll spend more on interest than on defense, and this could happen

00:09:14:08 – 00:09:18:05

much sooner, especially with that higher for longer mantra.

00:09:18:07 – 00:09:22:06

In 3031, the federal government will spend more on interest

00:09:22:06 – 00:09:26:24

than on non-defense discretionary, which includes funding for transfer

00:09:26:24 – 00:09:30:13

station, veterans, education, health, international affairs,

00:09:30:19 – 00:09:34:17

natural resources and environment, general science and technology,

00:09:34:23 – 00:09:37:16

general government and more.

00:09:37:19 – 00:09:39:21

Can you see what I’m talking about?

00:09:39:21 – 00:09:42:06

Because debtors want to get paid.

00:09:42:06 – 00:09:44:00

They want to get paid.

00:09:44:00 – 00:09:46:21

And this is why we’re goofing around.

00:09:46:21 – 00:09:49:19

Our government is goofing around with our credit rating

00:09:49:19 – 00:09:52:19

because the lower the credit rating is as well.

00:09:52:20 – 00:09:53:23

Guess what?

00:09:53:23 – 00:09:56:17

The higher investors demand?

00:09:56:17 – 00:10:01:28

And for taking that risk, of course, they can hide that risk for a long time.

00:10:02:03 – 00:10:04:26

Sovereign debt. Government debt.

00:10:04:26 – 00:10:08:29

But this is through October 24th.

00:10:09:01 – 00:10:12:09

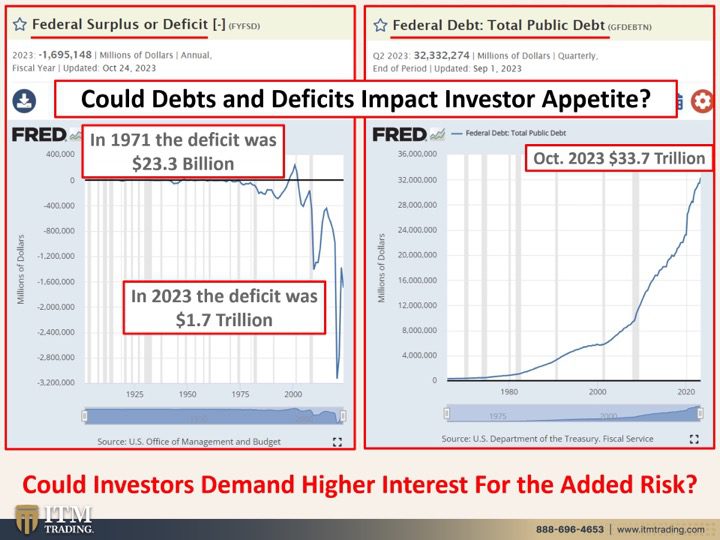

The federal surplus or deficit.

00:10:12:09 – 00:10:15:09

And you can see what I was talking about before

00:10:15:13 – 00:10:18:14

we actually had no it was an accounting gimmick.

00:10:18:14 – 00:10:19:10

It wasn’t real.

00:10:19:10 – 00:10:23:18

But okay, we actually ran a surplus

00:10:23:20 – 00:10:26:20

back in like 99.

00:10:26:20 – 00:10:28:26

Right. And you can see that

00:10:28:26 – 00:10:32:19

once we went off the debt standard, it’s deficits ever since.

00:10:32:21 – 00:10:36:12

Well, this is 2008 right here.

00:10:36:15 – 00:10:39:22

This is 2020 right here.

00:10:39:24 – 00:10:45:23

And you can see that it’s going down again with all of this spending

00:10:45:25 – 00:10:50:00

in 1971, the deficit was 23.3 billion.

00:10:50:02 – 00:10:55:13

Now it’s 1.7 trillion.

00:10:55:15 – 00:10:58:10

Compounding interest.

00:10:58:10 – 00:11:03:02

Compounding interest is not a good thing when you’re the one that’s paying it.

00:11:03:05 – 00:11:05:18

Think about your credit card bills, right?

00:11:05:18 – 00:11:10:26

If you don’t pay all the interest plus principal,

00:11:10:29 – 00:11:13:12

then you start to compound interest.

00:11:13:12 – 00:11:15:24

You’re never getting out of debt when you do that.

00:11:15:24 – 00:11:17:18

And this is what it looks like.

00:11:17:18 – 00:11:22:03

This is the federal debt, the total public debt,

00:11:22:05 – 00:11:28:00

which is North 33.7 trillion in October of 2023

00:11:28:03 – 00:11:32:16

and going much higher because of all of the debt issuance.

00:11:32:18 – 00:11:36:09

And you know, the other part that I want to point out,

00:11:36:09 – 00:11:40:25

all of these gray bars or are official recessions,

00:11:40:28 – 00:11:44:13

and you can see that every time we hit a gray bar,

00:11:44:16 – 00:11:47:13

the speed at which we grow debt

00:11:47:13 – 00:11:51:06

is faster and faster and faster.

00:11:51:08 – 00:11:56:22

So welcome to that hockey stick where we are, essentially.

00:11:56:22 – 00:11:57:21

Well, look at this.

00:11:57:21 – 00:11:59:02

We were straight up there.

00:11:59:02 – 00:12:00:29

We’re straight up, we’re straight.

00:12:00:29 – 00:12:02:04

Frick it up.

00:12:02:04 – 00:12:04:15

How can you afford that?

00:12:04:15 – 00:12:06:27

And how about that appetite?

00:12:06:27 – 00:12:10:16

So again, I go back to institutional investors

00:12:10:22 – 00:12:16:01

that invest your money in mutual funds and ETFs in 401

00:12:16:01 – 00:12:21:04

KS and I are raised in in, in pension plans

00:12:21:06 – 00:12:24:06

because they’re not the ones that are going to eat it in the shorts.

00:12:24:08 – 00:12:26:13

You are

00:12:26:16 – 00:12:26:27

you may

00:12:26:27 – 00:12:30:01

not have choices, but I’ll tell you right now,

00:12:30:01 – 00:12:35:20

if you don’t have choices, you better balance out your portfolio with gold

00:12:35:22 – 00:12:36:25

because that’s going to give you

00:12:36:25 – 00:12:41:12

true diversification.

00:12:41:15 – 00:12:43:03

And do you think that investors

00:12:43:03 – 00:12:47:04

are going to demand higher interest rates for the added risk

00:12:47:07 – 00:12:52:03

so the markets are going nutty on the Fed pivot,

00:12:52:05 – 00:12:53:23

but those are the markets.

00:12:53:23 – 00:12:55:00

Those are the interest rates

00:12:55:00 – 00:12:59:18

of the overnight markets that they can control directly,

00:12:59:20 – 00:13:00:21

indirectly.

00:13:00:21 – 00:13:06:26

It’s buying more of the debt to create an illusion of demand.

00:13:06:28 – 00:13:09:22

And they’re trying to run off their balance sheet

00:13:09:22 – 00:13:16:06

to give them some headroom to grow that balance sheet again.

00:13:16:08 – 00:13:19:20

But we are in such a precarious position

00:13:19:20 – 00:13:22:20

when you just don’t realize it.

00:13:22:21 – 00:13:26:26

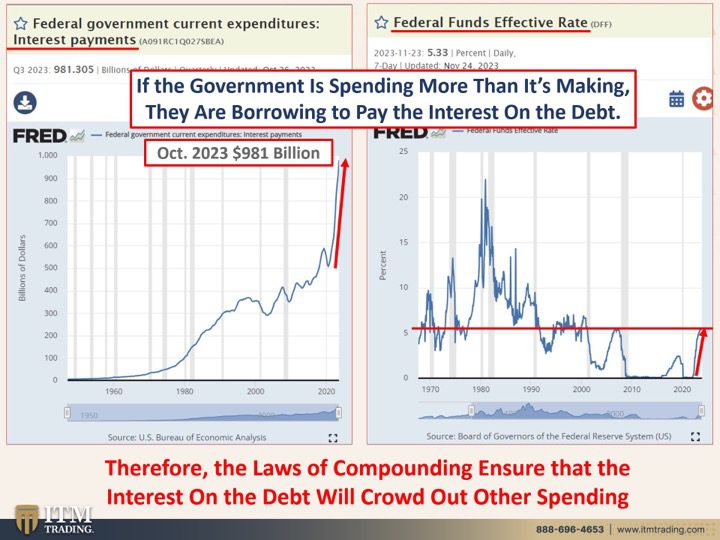

And this is federal government interest payments on the debt.

00:13:26:26 – 00:13:30:09

And remember, we’re not really seeing the truth

00:13:30:11 – 00:13:34:13

because there’s compounding interest in those deficits.

00:13:34:15 – 00:13:35:22

They don’t talk about that.

00:13:35:22 – 00:13:38:05

God forbid they should talk about that.

00:13:38:05 – 00:13:41:19

But you can go into the Fred, you have all the links on the blog,

00:13:41:21 – 00:13:44:03

you can go into the Fred.

00:13:44:03 – 00:13:47:24

And actually the one that you would go into

00:13:47:27 – 00:13:52:29

would be this one, the the total debt.

00:13:53:01 – 00:13:54:12

And you can

00:13:54:12 – 00:13:57:12

click a button and you can see the total debt

00:13:57:19 – 00:14:00:05

all the way back and do your own calculations

00:14:00:05 – 00:14:02:14

and you’ll see that what I’m saying is true.

00:14:02:14 – 00:14:05:18

But even when you’re looking at this, these are the interest payments

00:14:05:18 – 00:14:09:23

and look at how that has spiked since 2020,

00:14:09:23 – 00:14:13:04

even ignoring the fact

00:14:13:06 – 00:14:17:19

that that those interest the interest on that debt is compounding.

00:14:17:19 – 00:14:19:03

This does not reflect that.

00:14:19:03 – 00:14:22:12

That simply reflects the interest on the debt period.

00:14:22:14 – 00:14:26:18

So I think you can see how we already are at that hockey

00:14:26:18 – 00:14:32:18

stick level of going straight up and what’s the mantra Higher for longer?

00:14:32:18 – 00:14:34:00

Higher for longer.

00:14:34:00 – 00:14:37:07

it’s a big problem when they’ve got to issue a whole bunch of debt.

00:14:37:10 – 00:14:41:22

But you can see where we are in the interest.

00:14:41:22 – 00:14:45:01

The Fed funds effective rate because this is the rate

00:14:45:01 – 00:14:48:08

that the government or the central bank controls

00:14:48:08 – 00:14:51:16

directly, the overnight rate.

00:14:51:18 – 00:14:55:02

And you can see, you know, that’s broken out, etc..

00:14:55:04 – 00:14:56:18

But if the government is spending

00:14:56:18 – 00:15:00:11

more than it’s making, they’re borrowing to pay the interest on the debt.

00:15:00:11 – 00:15:02:16

And that’s exactly what’s happening.

00:15:02:16 – 00:15:05:23

And therefore, the laws of compounding ensure

00:15:05:29 – 00:15:10:09

that the interest on the debt will crowd out other spending.

00:15:10:15 – 00:15:12:23

They’re going to have to reduce security.

00:15:12:23 – 00:15:16:20

They’re going to have to I mean, they’re really going to pay for infrastructure.

00:15:16:22 – 00:15:20:05

No, just like they’ve been postponing it forever and ever and ever.

00:15:20:11 – 00:15:22:03

They’re going to be raising taxes.

00:15:22:03 – 00:15:24:25

They don’t have any choice about that.

00:15:24:25 – 00:15:28:07

This can help protect you from that.

00:15:28:10 – 00:15:30:00

So you have to get used to

00:15:30:00 – 00:15:33:20

like the Bank of England said, get used to being poor.

00:15:33:23 – 00:15:35:17

Well, is that okay with you?

00:15:35:17 – 00:15:39:22

Because I suggest you click that cowardly link and get a strategy in place

00:15:39:22 – 00:15:42:24

and get it executed and fight.

00:15:43:00 – 00:15:44:00

That’s how we fight.

00:15:44:00 – 00:15:46:23

We fight with our wallets.

00:15:46:23 – 00:15:48:06

You’re going to stay in the system.

00:15:48:06 – 00:15:48:28

That’s your vote.

00:15:48:28 – 00:15:51:28

You’re going to buy gold and silver and pull it out of the system.

00:15:52:00 – 00:15:54:25

That’s my vote. What’s your vote?

00:15:54:25 – 00:15:59:25

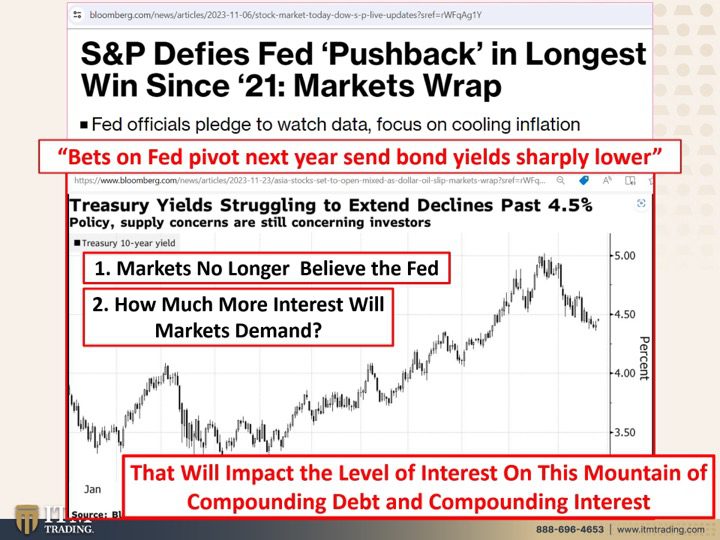

S&P defies Fed pushback in longest win since 21.

00:15:59:27 – 00:16:02:27

The markets no longer believe the Fed

00:16:03:04 – 00:16:06:03

its bets on that Fed pivot next year.

00:16:06:03 – 00:16:09:27

That sends bond yields sharply lower.

00:16:10:00 – 00:16:13:03

But it’s having problems getting past a certain point

00:16:13:08 – 00:16:17:02

because of all the problems that we’ve discussed, not just here

00:16:17:02 – 00:16:21:01

but ad nauseum for quite some time.

00:16:21:04 – 00:16:25:20

The really important piece of this is that the markets no longer

00:16:25:20 – 00:16:31:16

believe the Fed and confidence is critical in a Ponzi scheme.

00:16:31:21 – 00:16:32:21

It’s critical.

00:16:32:21 – 00:16:36:14

You gotta have that confidence and they gave it up.

00:16:36:14 – 00:16:39:08

I mean, that was like a key tool that they had.

00:16:39:08 – 00:16:41:09

They don’t have that anymore.

00:16:41:09 – 00:16:47:08

And by the way, how much more interest will markets demand?

00:16:47:10 – 00:16:52:09

Because when the Fed does pivot and pushes the rate those rates down,

00:16:52:12 – 00:16:56:14

how much damage will have been done to that point,

00:16:56:17 – 00:17:01:06

not just in our confidence, in our trust in the markets,

00:17:01:08 – 00:17:04:08

but in what’s happening in all of the markets.

00:17:04:14 – 00:17:09:07

How many of those zombie companies will be out of business

00:17:09:15 – 00:17:13:15

because they’re on the verge of it right now?

00:17:13:18 – 00:17:15:02

How awful

00:17:15:02 – 00:17:18:09

is the landscape, the market landscape

00:17:18:09 – 00:17:22:00

going to look because of these high interest rates?

00:17:22:05 – 00:17:27:06

They got us used to this hope, Liam, of, you know, free money, which I already did.

00:17:27:06 – 00:17:29:09

This is no more in there.

00:17:29:09 – 00:17:32:20

But they’ve already gotten this used to zero interest rates

00:17:32:20 – 00:17:34:13

and all of this free money.

00:17:34:13 – 00:17:35:26

It’s like an addict.

00:17:35:26 – 00:17:41:09

You have to keep giving them more and more and more to make them seem normal.

00:17:41:15 – 00:17:45:11

But it comes to a point where it doesn’t matter how much you give them,

00:17:45:14 – 00:17:46:29

nothing is going to work.

00:17:46:29 – 00:17:48:26

And that’s what Ray is talking about.

00:17:48:26 – 00:17:51:04

That’s what I’ve been talking about.

00:17:51:04 – 00:17:53:01

Are you ready for that?

00:17:53:01 – 00:17:54:22

We don’t have years.

00:17:54:22 – 00:17:59:07

Look at where we are. We don’t have years.

00:17:59:09 – 00:17:59:20

And it’s

00:17:59:20 – 00:18:02:20

going to impact the level of interest.

00:18:02:23 – 00:18:07:20

Both of these things, the Fed credibility and the demand from investors,

00:18:07:20 – 00:18:11:12

which we’ve seen will have an impact on the level of interest

00:18:11:12 – 00:18:14:27

on this mountain of compounding debt and compounding

00:18:14:27 – 00:18:17:27

interest,

00:18:17:29 – 00:18:19:09

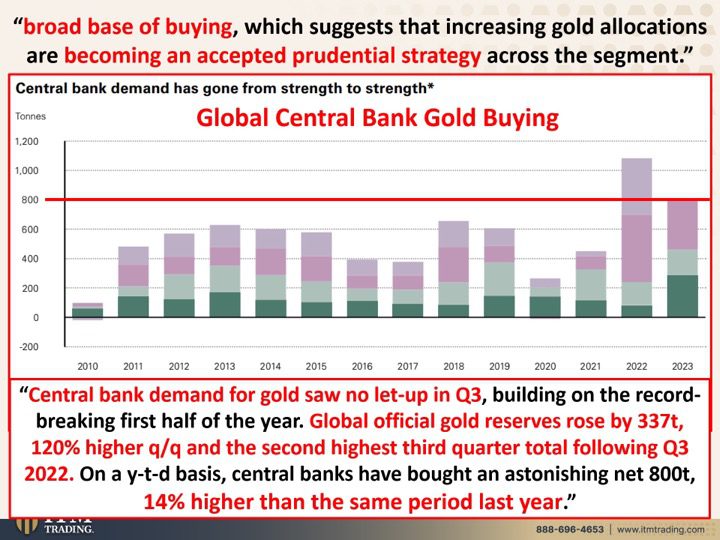

broad based buying.

00:18:19:09 – 00:18:20:23

So what’s the solution?

00:18:20:23 – 00:18:24:11

Well, let’s see what the central banks are doing for themselves,

00:18:24:11 – 00:18:27:03

because who knows more about what they’re doing than they do

00:18:27:03 – 00:18:30:17

broad base of buying, which suggests that increasing gold

00:18:30:17 – 00:18:35:26

allocations are becoming an accepted prudential strategy across the segment.

00:18:36:03 – 00:18:41:17

You think this is global central bank buying through the third quarter?

00:18:41:17 – 00:18:46:03

So we just got this and let’s take a look at that

00:18:46:03 – 00:18:51:14

being the highest that they have done on record.

00:18:51:16 – 00:18:54:22

The highest, and we haven’t completed the year.

00:18:54:29 – 00:19:01:07

Why do you think global central banks are buying so much gold?

00:19:01:10 – 00:19:03:05

Cause they know

00:19:03:05 – 00:19:07:03

he or she who holds the gold holds choices,

00:19:07:03 – 00:19:12:04

and freedom holds your freedom.

00:19:12:06 – 00:19:16:11

And if you are self-sufficient with food, water, energy, security,

00:19:16:12 – 00:19:21:24

barter, ability, wealth preservation, community and shelter,

00:19:21:26 – 00:19:25:27

you’ve got your freedom, you’ve got your choices,

00:19:26:00 – 00:19:29:00

and they can’t force you into compliance.

00:19:29:04 – 00:19:31:01

You keep everything in the system.

00:19:31:01 – 00:19:32:27

You’re forced into compliance.

00:19:32:27 – 00:19:34:22

You’re not going to have any choices.

00:19:34:22 – 00:19:36:11

I want everybody that’s watching.

00:19:36:11 – 00:19:42:17

I want everybody that’s not watching to retain those choices.

00:19:42:19 – 00:19:44:29

Central bank demand for gold saw no

00:19:44:29 – 00:19:49:09

let up in Q3, building on the record breaking first half of the year.

00:19:49:12 – 00:19:54:18

Global official gold reserves rose by 3337 tons,

00:19:54:21 – 00:20:00:04

120% higher quarter over quarter

00:20:00:11 – 00:20:04:20

and the second highest third quarter totaling Q3

00:20:04:20 – 00:20:07:20

in 22 2022.

00:20:07:21 – 00:20:10:15

On a year to date basis, central banks have bought

00:20:10:15 – 00:20:14:10

an astonishing net 800 tons,

00:20:14:12 – 00:20:19:02

14% higher than the same period last year.

00:20:19:04 – 00:20:23:17

What does that tell you?

00:20:23:19 – 00:20:26:29

I believe so strongly that you should always do

00:20:26:29 – 00:20:31:20

what the smartest guys on any given topic are doing for themselves.

00:20:31:20 – 00:20:35:24

As I have shown you ad nauseum how easy it is

00:20:35:24 – 00:20:40:21

to manipulate that paper contract spot gold market that takes nothing.

00:20:40:21 – 00:20:43:29

It doesn’t even take very much money, easy peasy,

00:20:43:29 – 00:20:47:17

easy peasy to manipulate.

00:20:47:19 – 00:20:50:18

It’s the physical market where we see the truth

00:20:50:18 – 00:20:55:05

and whether you’re looking at the top tier or the average tier,

00:20:55:12 – 00:20:59:12

those have both broken out because demand is exceeding supply.

00:20:59:17 – 00:21:03:10

It’s a true cement demand supply market.

00:21:03:13 – 00:21:06:13

What are you doing about it?

00:21:06:16 – 00:21:08:26

The other thing that I want to keep in mind

00:21:08:26 – 00:21:13:11

is that it’s not all doom and gloom and being in the right place

00:21:13:11 – 00:21:18:26

at the right time with the right asset puts you in a position

00:21:18:28 – 00:21:19:29

where you can

00:21:19:29 – 00:21:24:26

retain your this is your freedom for yourself, for your family,

00:21:24:27 – 00:21:28:19

for people that you love and care about,

00:21:28:21 – 00:21:30:21

because everything else is a lie.

00:21:30:21 – 00:21:32:10

Everything else is a contract.

00:21:32:10 – 00:21:37:28

Everything else runs counterparty risk.

00:21:38:00 – 00:21:40:03

Speaking of that,

00:21:40:03 – 00:21:43:15

you make sure that you watch the latest video on the

00:21:43:18 – 00:21:48:08

municipal debt danger because we think that these things are so safe

00:21:48:14 – 00:21:52:05

the way they’ve been sold to us and they’re not.

00:21:52:07 – 00:21:56:08

Additionally, I’m sure you are really loving the lineup

00:21:56:08 – 00:21:59:29

that we have put together with Daniella Cambone and Taylor.

00:21:59:29 – 00:22:05:14

Kenny I mean, it really we have such a good team on this desk.

00:22:05:14 – 00:22:07:12

I’m really proud of us.

00:22:07:12 – 00:22:11:17

And again, if you haven’t done this yet, click that Colon Lee link below

00:22:11:19 – 00:22:16:16

and start your gold and silver strategy and get it executed.

00:22:16:19 – 00:22:18:24

Because having the right gold and silver

00:22:18:24 – 00:22:23:00

for your objectives and your goals is absolutely crucial.

00:22:23:04 – 00:22:24:04

And you want to do it

00:22:24:04 – 00:22:28:08

when you have the most number of choices, which is today, tomorrow.

00:22:28:08 – 00:22:32:16

I mean, I’ve seen choices be reduced since I’ve been accumulating.

00:22:32:18 – 00:22:34:16

Who knows about tomorrow?

00:22:34:16 – 00:22:38:05

This is a physical demand and supply market.

00:22:38:08 – 00:22:39:11

It’s off the market.

00:22:39:11 – 00:22:41:06

You’re not going to be able to get it.

00:22:41:06 – 00:22:44:21

So you want to get this done and executed a.S.A.P

00:22:44:21 – 00:22:47:14

because we are absolutely running out of time.

00:22:47:14 – 00:22:50:11

And if you haven’t done it yet, make sure you subscribe.

00:22:50:11 – 00:22:51:24

Leave us a comment.

00:22:51:24 – 00:22:53:11

Give us a thumbs up.

00:22:53:11 – 00:22:58:14

Share, share, share, share.

00:22:58:16 – 00:23:02:01

And remember that this

00:23:02:03 – 00:23:04:06

is your wealth shield.

00:23:04:06 – 00:23:06:19

And until next, we meet.

00:23:06:19 – 00:23:08:24

Please be safe out there. Bye bye.

SOURCES:

Ray Dalio says U.S. reaching a point where our debt problem gets even worse (cnbc.com)

US Credit-Rating Outlook Changed to Negative by Moody’s – Bloomberg

US Kicks Off Fiscal Year With an 87% Surge in Interest Costs – Bloomberg

US Government’s Debt Interest Bill Soars Past $1 Trillion a Year – Bloomberg

https://fred.stlouisfed.org/series/FYFSD

https://fred.stlouisfed.org/series/A091RC1Q027SBEA