Unveiling the Hidden Forces Controlling Inflation | The Shocking Truth Revealed

Uncover the truth about who really controls inflation! Revealing the financialization of America since Nixon and how every asset is now a trading product for Wall Street. 💸 Discover the impact on your finances and why you need a plan. 📈 Chief Market Analyst Lynnette Zang breaks down the rising financialization of the US economy and exposes the role of algorithmic bot traders in market volatility. Don’t miss out on understanding the strategies behind inflation control and protecting your wealth.

0:00 The Powers That Be

1:25 The Rising Financialization

3:49 A Financial Product

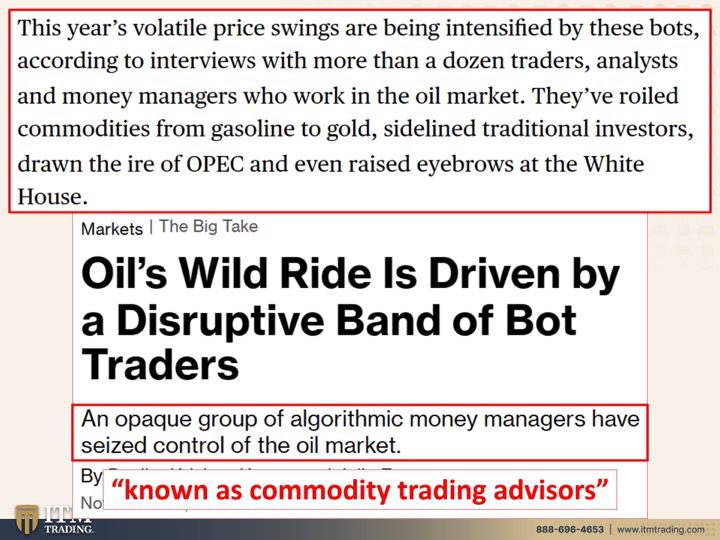

7:46 Oil’s Wild Ride

10:47 Managed Money Positions

15:17 Water Futures

17:44 Groundwater Goldrush

21:02 Benchmark Commodity Products

25:48 Get Your Strategy

SOURCES:

Oil Prices Face Wild Swings With Bot Traders Driving the Market – Bloomberg

US regulator welcomes water futures as tool to manage climate risk (ft.com)

https://www.cmegroup.com/company/membership/international-incentives.html

VIDEO TRANSCRIPT:

00:00:00:02 – 00:00:04:09

You know, the powers that be would like you to think that it is Fed

00:00:04:09 – 00:00:08:18

chair that has control over inflation But what’s been happening

00:00:09:00 – 00:00:13:12

since Nixon took us off the gold standard has been

00:00:13:16 – 00:00:20:06

the financialization of America every asset now has been turned into

00:00:20:09 – 00:00:24:06

a financial trading product for Wall Street.

00:00:24:08 – 00:00:28:09

And this should matter to you So let me show you the truth

00:00:28:14 – 00:00:32:17

of why the Fed’s controling inflation.

00:00:32:19 – 00:00:36:06

Coming up.

00:00:36:08 – 00:00:38:14

I’m Lynnette Zang, chief market analyst

00:00:38:14 – 00:00:42:18

at ITM Trading Full service physical.

00:00:42:18 – 00:00:45:07

I cannot stress that enough.

00:00:45:07 – 00:00:51:07

Gold and silver dealer specializing in custom strategies.

00:00:51:09 – 00:00:55:05

And you know, wouldn’t it have been nice if you realized the government

00:00:55:05 – 00:00:58:18

and the central bank’s strategy back in 1971?

00:00:58:23 – 00:01:02:18

And then of course, when it was legal to buy

00:01:02:20 – 00:01:06:11

physical gold again, you would have loaded up on that

00:01:06:11 – 00:01:10:18

in no time if you understood what was happening today.

00:01:10:20 – 00:01:14:14

So it’s critically important for you to have a plan and a strategy

00:01:14:19 – 00:01:21:03

because I’m going to show you their plan and their strategy right now.

00:01:21:04 – 00:01:24:10

So let’s get let’s just just get started.

00:01:24:12 – 00:01:29:00

The rising financialization of the US economy, what does that mean?

00:01:29:02 – 00:01:31:20

That means that that

00:01:31:20 – 00:01:34:20

financialization is where Wall Street

00:01:34:21 – 00:01:38:09

becomes more important than Main Street.

00:01:38:11 – 00:01:43:04

And it is critically important in the financial crisis in 2008.

00:01:43:04 – 00:01:46:04

Seven, eight, nine should have shown you

00:01:46:09 – 00:01:49:19

who the government and the central banks

00:01:49:19 – 00:01:54:21

think is the most important, because you and I did not get bailed out.

00:01:55:03 – 00:01:59:12

It was Wall Street and the banking system that got bailed out.

00:01:59:18 – 00:02:02:18

And what happened in the most recent crisis.

00:02:02:18 – 00:02:05:18

Right. Who really got bailed out?

00:02:05:18 – 00:02:07:23

It was not you or me.

00:02:07:23 – 00:02:12:17

We’ve been having to deal with the aftermath of the inflation

00:02:12:19 – 00:02:17:23

that they utilized to make things to paper over things that make things

00:02:18:01 – 00:02:21:20

look okay, while in reality what they’re really doing

00:02:21:20 – 00:02:25:22

and what these financial products really do is transfer that risk

00:02:26:02 – 00:02:32:03

from the few, from the 1%, from the powers that be to the many to the public.

00:02:32:04 – 00:02:35:18

And we are the ones that always pay.

00:02:35:20 – 00:02:37:02

Let me show you what I mean.

00:02:37:02 – 00:02:40:02

And I’ve talked about this in previous videos as well.

00:02:40:06 – 00:02:43:13

This is the financial services sector controls

00:02:43:13 – 00:02:46:13

a widening swath of the U.S.

00:02:46:13 – 00:02:49:05

economy. And here it is.

00:02:49:05 – 00:02:52:05

This is going back to 1948 40,

00:02:52:10 – 00:02:55:07

where it was a little bit more than 10%.

00:02:55:07 – 00:03:01:14

Well, now it’s closer to 25%, or at least in 2020.

00:03:01:16 – 00:03:05:13

It would be higher than that today, three years later.

00:03:05:15 – 00:03:10:09

And that 25%

00:03:10:11 – 00:03:12:09

actually controls

00:03:12:09 – 00:03:16:00

much more of the GDP in the global economy.

00:03:16:06 – 00:03:21:12

U.S. Bureau of Economic Analysis Data show that financial sector profits

00:03:21:16 – 00:03:27:20

and their share of GDP have skyrocketed, skyrocketed

00:03:27:22 – 00:03:30:09

since the 1970s.

00:03:30:09 – 00:03:35:10

What happened in the 1970s, our government handed over

00:03:35:10 – 00:03:41:18

full control of inflation to a private bank, the Federal Reserve.

00:03:41:20 – 00:03:43:19

Well, who benefits?

00:03:43:19 – 00:03:46:20

Because since then, everything. Everything.

00:03:46:20 – 00:03:50:01

Everything has been turned into a financial product

00:03:50:07 – 00:03:54:11

because it is so critically important that the banks make their profit.

00:03:54:15 – 00:03:56:01

Not how you and I are

00:03:56:01 – 00:03:59:23

and the prices that you and I pay, but the banks make their profit.

00:04:00:01 – 00:04:02:12

And so they created derivatives.

00:04:02:12 – 00:04:03:13

Now, look, derivatives,

00:04:03:13 – 00:04:07:10

speculative derivatives, derivatives have been around for a long time.

00:04:07:15 – 00:04:11:08

If I were a farmer and I’m planting my crops in the spring

00:04:11:13 – 00:04:14:23

and I’m not going to be able to harvest them until the fall,

00:04:15:01 – 00:04:18:10

I have no idea what the weather conditions

00:04:18:10 – 00:04:21:20

are going to be, what the water conditions are going to be.

00:04:21:22 – 00:04:24:09

If I’m going to recoup my costs

00:04:24:09 – 00:04:27:22

from planting this crop and all the costs associated with it.

00:04:28:03 – 00:04:32:09

If I’m going to make a profit, am I going to be able to stay around?

00:04:32:11 – 00:04:35:11

So a derivative for a farmer

00:04:35:14 – 00:04:38:20

insures it’s an insurance contract, right?

00:04:38:22 – 00:04:42:11

He can buy or she can buy a derivative contract

00:04:42:11 – 00:04:46:06

that ensures that they’re corn or they’re soy or whatever.

00:04:46:06 – 00:04:49:14

They’re growing, that they at least break even

00:04:49:14 – 00:04:53:13

so they can live for another day if they don’t need it.

00:04:53:15 – 00:04:55:01

Okay. It goes away.

00:04:55:01 – 00:04:56:15

It’s just the cost of insurance.

00:04:56:15 – 00:05:00:03

But if they do need it, it can save their lives.

00:05:00:05 – 00:05:01:21

Rather, what’s happened?

00:05:01:21 – 00:05:04:21

Because this can. We thank you.

00:05:05:02 – 00:05:08:02

This green line, those are end user contracts.

00:05:08:02 – 00:05:11:10

So you can see they’ve kind of stayed pretty stable.

00:05:11:15 – 00:05:16:02

But these are the speculative derivative contracts.

00:05:16:04 – 00:05:19:04

This there’s 2008.

00:05:19:10 – 00:05:23:09

So you can see quite clearly that they’re higher

00:05:23:11 – 00:05:27:04

than they were during the crisis because the banks

00:05:27:07 – 00:05:30:07

have to make a profit.

00:05:30:08 – 00:05:34:21

And the more trading products that there are and I mean, we’ve witnessed

00:05:34:23 – 00:05:37:20

through many means cryptocurrencies for one.

00:05:37:20 – 00:05:39:07

How do you create a market?

00:05:39:07 – 00:05:42:14

You know, you start getting eyes on it and you start trading it.

00:05:42:14 – 00:05:45:19

And before you know it, there is a new asset class.

00:05:45:21 – 00:05:47:20

Okay. Out of thin air.

00:05:47:20 – 00:05:49:14

And that’s how they do it.

00:05:49:14 – 00:05:53:17

But what it does is it ensures their profits.

00:05:53:19 – 00:05:59:13

In fact, this is from the most current office of the Comptroller of the Currency.

00:05:59:18 – 00:06:04:10

Derivatives in the FDIC

00:06:04:10 – 00:06:07:10

insured banks.

00:06:07:12 – 00:06:11:11

And we can see that this is this is 50% right there.

00:06:11:11 – 00:06:14:03

That red line, that’s 50%.

00:06:14:03 – 00:06:17:01

So banks actually this past quarter

00:06:17:01 – 00:06:21:19

generated over 51.7% of their profits

00:06:22:00 – 00:06:26:06

from trading these speculative derivatives.

00:06:26:07 – 00:06:31:11

And it’s taken more and more speculation to generate these products.

00:06:31:16 – 00:06:33:08

I mean, these profits.

00:06:33:08 – 00:06:39:04

And so what is that really telling you that there is a lot more risk

00:06:39:05 – 00:06:43:03

in the banking sector system.

00:06:43:05 – 00:06:44:07

And since

00:06:44:07 – 00:06:50:12

2013, they created these different products to consolidate the trades.

00:06:50:16 – 00:06:54:18

And so every single entity, whether it’s the FDIC,

00:06:54:18 – 00:07:00:16

the federal Reserve, the Bank for International Settlements, any of them

00:07:00:18 – 00:07:04:02

admit openly that no one, no one,

00:07:04:02 – 00:07:07:07

no one really knows the true value at risk.

00:07:07:12 – 00:07:11:21

When you’re looking at these charts and graphs, All you’re really seeing

00:07:11:23 – 00:07:16:23

is the market, the current market valuation

00:07:17:01 – 00:07:21:21

of these contracts, which are all count or party risk.

00:07:21:23 – 00:07:25:04

What financial asset does not run counterparty risk?

00:07:25:10 – 00:07:28:04

According to the Bank for International Settlements.

00:07:28:04 – 00:07:32:14

Gold is the only financial asset,

00:07:32:15 – 00:07:35:15

not one of two or three or four or five.

00:07:35:16 – 00:07:38:15

The only financial asset

00:07:38:18 – 00:07:41:18

that does not run counterparty risk.

00:07:41:20 – 00:07:44:19

And I think that is really significant.

00:07:44:19 – 00:07:46:22

And I want to talk to you about oil,

00:07:46:22 – 00:07:50:13

because when oil was rising so rapidly, we saw it.

00:07:50:14 – 00:07:53:14

The consumer saw it at the at the gas pumps.

00:07:53:14 – 00:07:57:20

And that was scaring a lot of people that were having trouble

00:07:58:00 – 00:08:01:14

putting food on the table and gas in their tanks.

00:08:01:16 – 00:08:03:20

So, look, oil’s wild ride.

00:08:03:20 – 00:08:08:02

Does that really indicate a true supply and demand market?

00:08:08:03 – 00:08:09:15

Of course it does.

00:08:09:15 – 00:08:15:05

Oil’s wild ride is driven by a disruptive band of bot traders.

00:08:15:11 – 00:08:16:17

What’s a bot?

00:08:16:17 – 00:08:21:01

A bot is an algorithm, an opaque group of algorithm.

00:08:21:01 – 00:08:21:16

Make money.

00:08:21:16 – 00:08:25:04

Managers have seized control of the oil market.

00:08:25:06 – 00:08:29:17

These guys have seized control of all of the markets.

00:08:29:19 – 00:08:32:18

But let’s just look at that a little bit deeper.

00:08:32:18 – 00:08:37:07

This year’s volatile price swings are being intensified by these bots,

00:08:37:13 – 00:08:41:15

According to interviews with more than a dozen traders, analysts

00:08:41:15 – 00:08:46:00

and Money Mart managers who work in the oil market.

00:08:46:02 – 00:08:50:04

They’ve roiled commodities for gasoline from gasoline to gold.

00:08:50:09 – 00:08:53:04

Sidelined traditional investors, drawn

00:08:53:04 – 00:08:57:02

the ire of OPEC and even raised eyebrows at the White House.

00:08:57:06 – 00:09:01:05

But the reality is and what they’re also saying and here is

00:09:01:05 – 00:09:05:00

that traders are the ones that are determining the prices

00:09:05:05 – 00:09:10:09

of all of these commodities and assets that you’re buying.

00:09:10:11 – 00:09:14:23

And so do you think that might have a little bit to do with inflation

00:09:15:01 – 00:09:18:10

and when inflation was obviously running rampant

00:09:18:10 – 00:09:22:20

and the prices at the gas pump were obviously going up?

00:09:22:22 – 00:09:25:22

How did that make consumers feel?

00:09:25:23 – 00:09:30:23

And 70% of our GDP, that’s all the money that flows through

00:09:30:23 – 00:09:34:20

the system is consumer spending.

00:09:34:22 – 00:09:38:08

This is frankly a very big deal.

00:09:38:14 – 00:09:40:03

This is an opaque.

00:09:40:03 – 00:09:46:06

These markets are opaque, admittedly so, and especially to me.

00:09:46:06 – 00:09:49:08

Well, not me, because I do pay attention to this, but

00:09:49:08 – 00:09:53:09

to most people that don’t pay attention, they don’t even know where to look.

00:09:53:09 – 00:09:55:21

They don’t even know how to pay attention.

00:09:55:21 – 00:09:58:04

Why isn’t that more open?

00:09:58:04 – 00:10:00:18

Why does it have to be this opaque?

00:10:00:18 – 00:10:04:01

And how does that impact you and me?

00:10:04:03 – 00:10:06:07

That’s why you don’t see a crisis

00:10:06:07 – 00:10:11:14

until it occurs, and then it’s too late to do anything about it.

00:10:11:16 – 00:10:13:22

And what they said was this.

00:10:13:22 – 00:10:15:20

I’m just going to repeat it.

00:10:15:20 – 00:10:20:05

These this opaque, opaque group of algorithmic money

00:10:20:05 – 00:10:24:10

managers have roiled commodities

00:10:24:10 – 00:10:29:03

from gasoline to gold.

00:10:29:05 – 00:10:29:20

Well, good.

00:10:29:20 – 00:10:34:19

I mean, don’t we all want computers to be determining everything?

00:10:34:21 – 00:10:39:12

And this entity is known as climate City Trading Advisors.

00:10:39:15 – 00:10:41:16

So it’s not one entity.

00:10:41:16 – 00:10:43:15

It’s a group of entities.

00:10:43:15 – 00:10:46:02

So let’s take a look at that a little bit closer.

00:10:46:02 – 00:10:48:06

And I wanted to give you that name.

00:10:48:06 – 00:10:50:16

If you need it, write it down.

00:10:50:16 – 00:10:51:21

Go into the blog.

00:10:51:21 – 00:10:54:23

You can find all of these slides on the blog and certainly

00:10:54:23 – 00:11:00:03

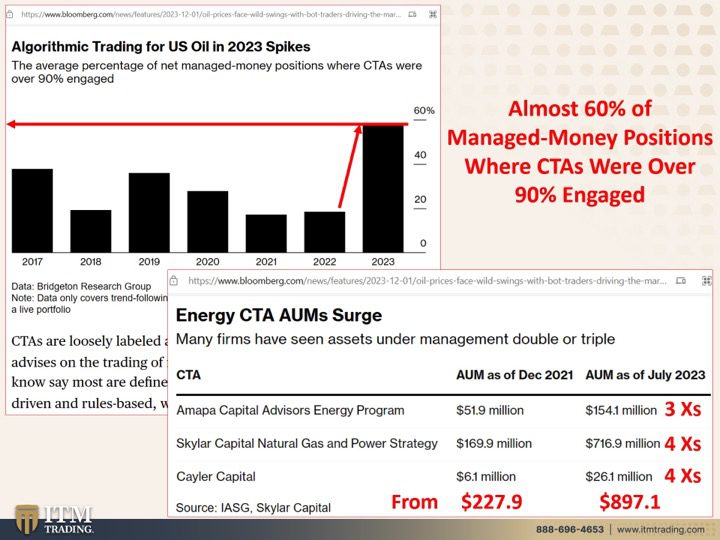

all of the links, but almost 60% of manage money positions

00:11:00:05 – 00:11:03:00

where CTA A’s remember

00:11:03:00 – 00:11:08:11

commodity trading advisors, that CTA is

00:11:08:13 – 00:11:12:13

were over 90% engaged.

00:11:12:15 – 00:11:15:07

So that’s almost 60% of the trading market.

00:11:15:07 – 00:11:19:06

That’s huge algorithmic trading for oil.

00:11:19:08 – 00:11:21:09

We’re just talking about oil here.

00:11:21:09 – 00:11:23:14

2023 Spike.

00:11:23:14 – 00:11:24:23

Look at this.

00:11:24:23 – 00:11:27:18

This is who’s controlling everything.

00:11:27:18 – 00:11:30:10

CTAs are loosely labeled

00:11:30:10 – 00:11:33:10

as an individual or organization

00:11:33:13 – 00:11:38:22

that advises on the trading of futures options or swaps.

00:11:39:01 – 00:11:41:06

Those are all derivatives, by the way.

00:11:41:06 – 00:11:44:06

A rose by any other name is still the same.

00:11:44:07 – 00:11:49:04

But those in the know say that most are defined by their trading strategies,

00:11:49:06 – 00:11:55:16

computer driven and rules based with a relatively limited time horizons.

00:11:55:18 – 00:11:59:07

So that means that there isn’t anybody to put the brakes on.

00:11:59:08 – 00:12:03:10

These are all algorithms and they are just going to move based upon

00:12:03:10 – 00:12:06:14

whatever is happening in the market at that moment in time.

00:12:06:18 – 00:12:11:00

But this is also what creates all of the whipsaw volatility

00:12:11:06 – 00:12:14:02

and not just that we’ve seen in the oil markets,

00:12:14:02 – 00:12:17:12

but also in the Treasury markets and the Treasury markets

00:12:17:12 – 00:12:21:07

are the flipping foundation of the global financial system.

00:12:21:09 – 00:12:23:22

How does that make you feel?

00:12:23:22 – 00:12:25:18

Because it makes me feel awful.

00:12:25:18 – 00:12:28:17

It scares me. This is why I’m in gold.

00:12:28:17 – 00:12:30:14

I don’t want to be in those markets

00:12:30:14 – 00:12:33:04

where they’re the ones that are controlling everything.

00:12:33:04 – 00:12:34:17

I want to hold it.

00:12:34:17 – 00:12:36:08

I want to own it outright.

00:12:36:08 – 00:12:37:23

I want it to be invisible.

00:12:37:23 – 00:12:41:05

I want to always have access to it.

00:12:41:07 – 00:12:45:15

But just so you can see how this has grown.

00:12:45:17 – 00:12:46:19

Right.

00:12:46:19 – 00:12:49:19

Energy sector’s up

00:12:49:20 – 00:12:54:08

three times from 2021 to 2023.

00:12:54:08 – 00:12:59:14

This is December of 2021 to July of 2023 a year.

00:12:59:14 – 00:13:01:11

What is that? A year and a half?

00:13:01:11 – 00:13:06:17

Year and a half up three times up four times.

00:13:06:20 – 00:13:11:21

This is just the top three, up four times.

00:13:11:23 – 00:13:14:06

As my grandson would say.

00:13:14:06 – 00:13:18:02

I mean, do you get that There are bots,

00:13:18:02 – 00:13:23:07

just computer algorithms that are trading these markets

00:13:23:07 – 00:13:28:22

that you put your hard earned money into through your 401.

00:13:28:22 – 00:13:30:18

K through your.

00:13:30:18 – 00:13:34:17

Annuity variable annuity through your IRAs

00:13:34:17 – 00:13:37:17

when you buy mutual funds or ETFs

00:13:37:21 – 00:13:41:09

or any of these managed products.

00:13:41:11 – 00:13:45:23

And these are traded by algorithms, not humans.

00:13:46:01 – 00:13:50:09

And this is this is really quite critical because algorithms don’t care

00:13:50:09 – 00:13:54:18

about anything other than the formulas that are put in.

00:13:54:20 – 00:13:58:16

That makes me, to be honest with you,

00:13:58:18 – 00:14:01:09

a bit uncomfortable, to say the least,

00:14:01:09 – 00:14:04:21

because these are completely opaque, opaque.

00:14:04:23 – 00:14:09:21

That’s why I always tell you I would rather be two weeks, ten years too early.

00:14:09:22 – 00:14:13:18

I don’t care how early I am, but I don’t even

00:14:13:18 – 00:14:17:11

want to be one second too late.

00:14:17:13 – 00:14:21:02

So too many people think that they’re going to magically know

00:14:21:06 – 00:14:25:13

and have the time, ability and money to get prepared.

00:14:25:15 – 00:14:27:00

Well, you don’t.

00:14:27:00 – 00:14:30:08

And if you go back to 2008, in September

00:14:30:08 – 00:14:34:00

when Lehman failed, did you know that was going to happen?

00:14:34:02 – 00:14:35:21

Or were you shocked?

00:14:35:21 – 00:14:38:08

Because I was paying very close attention.

00:14:38:08 – 00:14:41:10

Lehman’s my alma mater, and I couldn’t

00:14:41:10 – 00:14:44:10

have told you 5 minutes before it actually happened

00:14:44:11 – 00:14:49:16

that I would have believed that what happened could have happened.

00:14:49:18 – 00:14:51:02

And I don’t think.

00:14:51:02 – 00:14:52:15

Well, there are certainly people

00:14:52:15 – 00:14:55:15

that pay more attention to the markets than I do, I’m sure.

00:14:55:20 – 00:14:59:12

But most normal people do not for sure.

00:14:59:14 – 00:15:03:04

So the time to get prepared is now

00:15:03:06 – 00:15:05:16

while we still have the time

00:15:05:16 – 00:15:08:15

and the opportunity and available.

00:15:08:15 – 00:15:11:16

Kitty, because this market is drying up

00:15:11:16 – 00:15:16:00

pretty quickly, especially when we see the breakout

00:15:16:05 – 00:15:21:17

that recently happened in the spot gold contracts.

00:15:21:19 – 00:15:24:07

Well, what about something that’s an absolute

00:15:24:07 – 00:15:28:00

necessity for you and I to have, which is water.

00:15:28:02 – 00:15:29:10

We can live without oil.

00:15:29:10 – 00:15:33:12

We can walk, we can ride horses, we can ride bicycles.

00:15:33:14 – 00:15:35:23

But can we live without water?

00:15:35:23 – 00:15:37:12

No, we can.

00:15:37:12 – 00:15:40:12

If you do not have water, you die.

00:15:40:18 – 00:15:43:09

And well, let’s see. When was this?

00:15:43:11 – 00:15:45:11

eight, 20, 28,

00:15:45:11 – 00:15:49:11

21 of 2020.

00:15:49:13 – 00:15:53:21

So a little bit more than three years ago.

00:15:53:23 – 00:15:54:13

The U.S.

00:15:54:13 – 00:15:57:14

regulator welcomes a water futures

00:15:57:18 – 00:16:01:11

as a tool to manage climate risk.

00:16:01:13 – 00:16:06:23

Do you really want to be controlled by these opaque computers

00:16:07:03 – 00:16:10:17

and those that make the rules and the laws?

00:16:10:19 – 00:16:12:22

This is why Here’s the motto.

00:16:12:22 – 00:16:14:19

You guys have heard it a gazillion times.

00:16:14:19 – 00:16:16:00

You’ll hear it again.

00:16:16:00 – 00:16:19:12

Food, water, energy, security,

00:16:19:16 – 00:16:24:07

barter, ability, wealth preservation, community and shelter.

00:16:24:09 – 00:16:28:08

Get it done because you cannot live without water.

00:16:28:12 – 00:16:32:03

So now that that’s been turned into a trading asset,

00:16:32:08 – 00:16:35:04

what do you think the impact of that is?

00:16:35:04 – 00:16:37:16

Well, let’s just keep reading this.

00:16:37:16 – 00:16:42:06

The CME, which operates the Chicago Futures Exchange last week, said

00:16:42:06 – 00:16:46:09

that it would begin trading the world’s first futures contracts for water

00:16:46:15 – 00:16:52:13

tied to prices in, of all places, California.

00:16:52:15 – 00:16:53:08

Well,

00:16:53:08 – 00:16:59:02

you know, we’ve already had the experience with Enron and other entities on on

00:16:59:06 – 00:17:03:13

how California, particularly their energy,

00:17:03:18 – 00:17:07:10

their rights, have been traded away.

00:17:07:12 – 00:17:12:04

But the contracts are a really good thing.

00:17:12:06 – 00:17:12:22

Yeah.

00:17:12:22 – 00:17:15:16

Water derivatives and other investment

00:17:15:16 – 00:17:18:21

products linked to environmental, social

00:17:18:21 – 00:17:22:18

and governance factors will help stakeholder viewers.

00:17:22:20 – 00:17:24:18

There was a stakeholder.

00:17:24:18 – 00:17:26:18

those are deep pockets.

00:17:26:18 – 00:17:28:23

There are the stakeholders, not you or me.

00:17:28:23 – 00:17:31:22

Help stakeholders manage the risk

00:17:31:22 – 00:17:36:10

that is going to continue to present itself to us.

00:17:36:12 – 00:17:39:12

so it’s supposed to be a good thing for you and me?

00:17:39:17 – 00:17:41:13

Is it?

00:17:41:13 – 00:17:43:07

I don’t think so.

00:17:43:07 – 00:17:44:16

Here we are.

00:17:44:16 – 00:17:48:08

April 11, 2023.

00:17:48:10 – 00:17:50:18

So not even three years later.

00:17:50:18 – 00:17:52:14

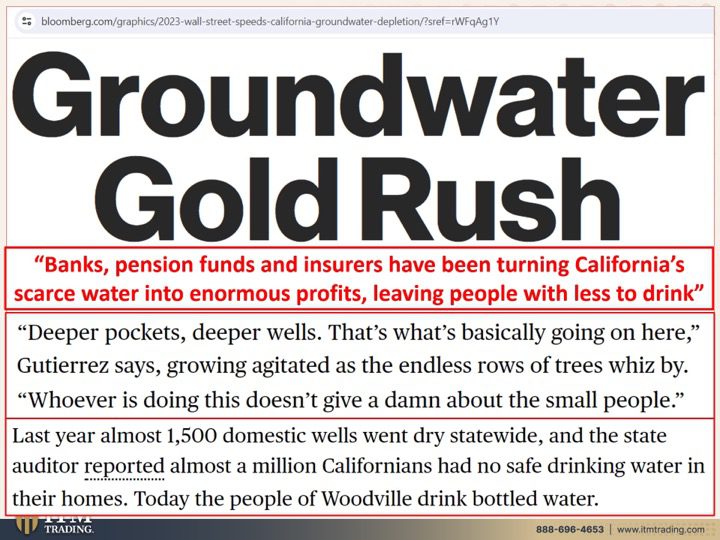

Ground water, gold rush.

00:17:52:14 – 00:17:54:17

What a shocker.

00:17:54:17 – 00:17:57:08

I mean, seriously, banks, pension

00:17:57:08 – 00:18:01:03

funds and insurers have been turning to California’s scarce water

00:18:01:07 – 00:18:07:19

into enormous profits, leaving people with less to drink.

00:18:07:21 – 00:18:09:15

Yeah.

00:18:09:15 – 00:18:11:16

Isn’t that interesting thing

00:18:11:16 – 00:18:15:08

that just not even three short years after this

00:18:15:08 – 00:18:19:16

was turned into a financial trading product

00:18:19:16 – 00:18:23:19

that was supposed to be a good thing for stakeholders to manage risk?

00:18:23:21 – 00:18:26:01

Now, who’s really at risk?

00:18:26:01 – 00:18:26:22

You and I are.

00:18:26:22 – 00:18:30:23

If we are completely dependent upon the normal water supply.

00:18:31:04 – 00:18:32:09

We’re in trouble.

00:18:32:09 – 00:18:35:23

What have you done to ensure

00:18:35:23 – 00:18:40:17

that you always have water to drink and water to grow food with

00:18:40:19 – 00:18:45:10

and clean yourselves with and all the other very important things

00:18:45:12 – 00:18:49:14

that water provides for us, the ability to live.

00:18:49:16 – 00:18:51:09

Because here’s the truth.

00:18:51:09 – 00:18:54:01

Deeper pockets, deeper wells.

00:18:54:01 – 00:18:57:17

That’s what’s basically going on here.

00:18:57:19 – 00:18:59:21

Whoever is doing this doesn’t

00:18:59:21 – 00:19:03:13

give a damn about the small people.

00:19:03:15 – 00:19:05:23

Well, as traders, they don’t give a damn about that.

00:19:05:23 – 00:19:07:20

They only care about profits.

00:19:07:20 – 00:19:11:21

Last year, almost 1500 domestic

00:19:11:21 – 00:19:16:15

wells went dry statewide, and the state auditor reported

00:19:16:15 – 00:19:22:17

almost a million Californians had no safe drinking water in their homes.

00:19:22:19 – 00:19:28:15

Today, the people of Woodville drink bottled water.

00:19:28:17 – 00:19:29:19

So what if you have a pump

00:19:29:19 – 00:19:34:17

to your home is going to cost you more, and now you have to go out and buy water.

00:19:34:19 – 00:19:39:18

Now, I know a lot of people do buy water that creates some other things as well.

00:19:39:20 – 00:19:43:05

But my point here is everything has been turned

00:19:43:05 – 00:19:47:13

into a financial product and it’s all controlled by traders.

00:19:47:15 – 00:19:53:04

So that creates a problem for the central banks that are raising

00:19:53:04 – 00:19:57:05

or lower or lowering rates in an attempt to control inflation.

00:19:57:10 – 00:20:03:12

Because what they’re really depending upon is a true supply and demand market.

00:20:03:18 – 00:20:07:15

But what they’re really playing with

00:20:07:16 – 00:20:10:06

is Wall Street

00:20:10:06 – 00:20:13:00

and that derivatives market,

00:20:13:00 – 00:20:16:19

which again, everybody admits

00:20:16:19 – 00:20:21:12

every single governing entity admits

00:20:21:13 – 00:20:26:05

that nobody knows the true value at risk.

00:20:26:07 – 00:20:29:20

I’m going back to this one for a second.

00:20:29:22 – 00:20:33:10

Nobody knows the true value at risk

00:20:33:12 – 00:20:38:23

in these speculative derivatives in which banks and wall.

00:20:39:03 – 00:20:40:14

Well, this is just banks.

00:20:40:14 – 00:20:43:12

So it’s different for Wall Street firms.

00:20:43:12 – 00:20:49:05

Banks make 51.7% in at least in last quarter.

00:20:49:08 – 00:20:52:05

Sometimes it is closer to 100%

00:20:52:05 – 00:20:55:22

in trading revenue in all of their revenues.

00:20:56:00 – 00:20:59:00

Don’t you think that’s kind of significant?

00:20:59:00 – 00:21:03:13

Who’s more important to you on Wall Street?

00:21:03:15 – 00:21:06:11

Well, financialization

00:21:06:11 – 00:21:10:06

is where Wall Street becomes far more important than Main Street.

00:21:10:11 – 00:21:12:17

And Wall Street has one.

00:21:12:17 – 00:21:16:06

And this is another big reason why the whole system

00:21:16:10 – 00:21:20:02

has to reset,

00:21:20:04 – 00:21:22:01

because we’re at the end.

00:21:22:01 – 00:21:27:05

They’ve gotten everything or they’re about to get everything they can out of us

00:21:27:07 – 00:21:29:01

or go into a hyperinflationary

00:21:29:01 – 00:21:32:06

depression and convert into a new system.

00:21:32:08 – 00:21:35:08

And this is why community is so important,

00:21:35:14 – 00:21:40:16

because if we stand alone, there’s no one thing we can do

00:21:40:18 – 00:21:42:09

against these entities.

00:21:42:09 – 00:21:44:17

There are too powerful.

00:21:44:17 – 00:21:48:15

But if we come together, there are more of us than there are of them.

00:21:48:15 – 00:21:50:15

And we have more pocketbooks than they do.

00:21:50:15 – 00:21:51:17

They have leverage.

00:21:51:17 – 00:21:53:02

We have pocketbooks.

00:21:53:02 – 00:21:55:22

And how do you stand against them?

00:21:55:22 – 00:21:58:22

This is how you do it.

00:21:59:03 – 00:22:03:13

You take your wealth out of the system

00:22:03:15 – 00:22:08:21

and you put it in something that is real, like real money

00:22:08:23 – 00:22:14:16

that is used in every single sector of the global economy.

00:22:14:17 – 00:22:19:23

So there is always real demand and

00:22:20:01 – 00:22:24:15

not the fake demand that all of these trading contracts

00:22:24:17 – 00:22:28:14

create and the leverage that they create.

00:22:28:16 – 00:22:31:16

You hold it, you own it outright.

00:22:31:19 – 00:22:35:16

Let me show you just, you know, a few examples.

00:22:35:18 – 00:22:38:15

And understand everything has been turned into this.

00:22:38:15 – 00:22:40:14

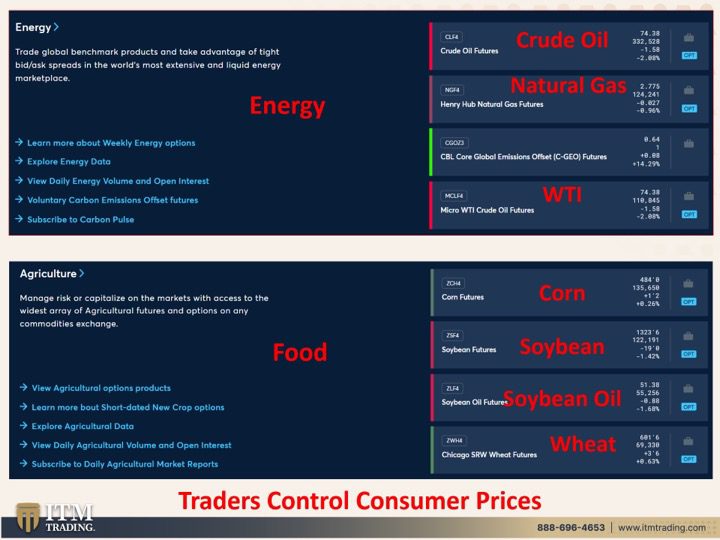

This is from the CME Group,

00:22:40:14 – 00:22:44:09

the world’s benchmark commodity products, all in one place.

00:22:44:13 – 00:22:49:09

We’re going to make it so easy to trade, engage in multi commodity strategies

00:22:49:12 – 00:22:52:14

with one connection, one clearinghouse,

00:22:52:18 – 00:22:55:15

and one window to the world’s most liquid

00:22:55:15 – 00:22:59:03

physical futures and options markets.

00:22:59:05 – 00:23:02:16

Physical meaning oil, gold,

00:23:02:18 – 00:23:07:11

lumber, steel, food, energy.

00:23:07:13 – 00:23:10:10

Physical assets that have been turned

00:23:10:10 – 00:23:13:16

into a trading contract.

00:23:13:18 – 00:23:17:04

And since it’s cheap and it’s almost free,

00:23:17:08 – 00:23:20:23

it’s cheap and it’s nothing to move in and out of these contracts.

00:23:21:01 – 00:23:23:13

They don’t care about the ultimate outcome.

00:23:23:13 – 00:23:28:13

They don’t even really care about yours or mine, short term outcome.

00:23:28:19 – 00:23:32:04

They only care about picking up some profits.

00:23:32:06 – 00:23:36:23

And here’s an example of some of those commodities in the energy space.

00:23:36:23 – 00:23:38:15

And we all use energy.

00:23:38:15 – 00:23:43:14

You got crude oil, you’ve got natural gas, you’ve got West Texas oil.

00:23:43:18 – 00:23:49:02

So processed oil and in food, corn, soybeans, soybean, oil, oil, wheat.

00:23:49:02 – 00:23:52:03

But, you know, it’s also in sugar and cocoa

00:23:52:07 – 00:23:55:17

and coffee and everything.

00:23:55:17 – 00:24:00:03

Olive oil, everything, everything, everything.

00:24:00:05 – 00:24:03:15

And anything that is

00:24:03:17 – 00:24:07:04

a tangible assets and it’s really the

00:24:07:06 – 00:24:11:06

the traders that control the consumer pricing.

00:24:11:08 – 00:24:13:04

They can drive those prices up.

00:24:13:04 – 00:24:14:06

They can drive them down.

00:24:14:06 – 00:24:19:23

Don’t you remember what was it during the pandemic when we had minus

00:24:20:04 – 00:24:23:04

I was going to pay you, a trader would pay you

00:24:23:04 – 00:24:26:14

35 bucks for a barrel of oil

00:24:26:16 – 00:24:28:04

minus.

00:24:28:04 – 00:24:31:13

So don’t be fooled by this lie.

00:24:31:14 – 00:24:35:07

Here’s another one, which is metals contracts.

00:24:35:11 – 00:24:38:00

Okay, so what do we have? We have gold.

00:24:38:00 – 00:24:39:13

We have silver.

00:24:39:13 – 00:24:40:18

We have.

00:24:40:18 – 00:24:42:19

Well, that’s those are the two that are going to show you.

00:24:42:19 – 00:24:45:13

But it’s also copper,

00:24:45:13 – 00:24:47:12

platinum, palladium.

00:24:47:12 – 00:24:49:02

Everything. Everything.

00:24:49:02 – 00:24:50:09

Everything. Everything.

00:24:50:09 – 00:24:51:10

We are at the end.

00:24:51:10 – 00:24:53:20

Everything has been commoditized.

00:24:53:20 – 00:24:56:02

Everything has been financialized.

00:24:56:02 – 00:24:59:22

It has all been trade changed into

00:25:00:00 – 00:25:02:11

a trading product.

00:25:02:11 – 00:25:07:12

And what you’re looking at is from you’ve seen this graph like lots of times

00:25:07:14 – 00:25:12:13

from the office of the the Ocz.

00:25:12:15 – 00:25:14:10

Yeah.

00:25:14:10 – 00:25:16:13

And this is gold contracts,

00:25:16:13 – 00:25:20:04

notional amounts of gold contracts.

00:25:20:06 – 00:25:24:15

And you can see how they spiked because they changed some accounting rules.

00:25:24:17 – 00:25:29:12

But do you think that this could suppress the price and manage the price?

00:25:29:18 – 00:25:33:10

And the difference between these colors are the length of the contract,

00:25:33:12 – 00:25:36:00

but it doesn’t really matter how long the contract is.

00:25:36:00 – 00:25:39:07

Not like you have to sit or the traders have to sit and hold them.

00:25:39:09 – 00:25:42:09

All they really want to do is a pickup.

00:25:42:10 – 00:25:45:00

They only care about the profits.

00:25:45:00 – 00:25:47:20

And also I will remind you

00:25:47:20 – 00:25:52:01

that we just recently had a breakout

00:25:52:03 – 00:25:55:15

from a triple top.

00:25:55:17 – 00:25:58:07

I’ve talked about this and talked about this.

00:25:58:07 – 00:26:01:13

You can refer back to the work that I’ve done on

00:26:01:13 – 00:26:05:11

what’s happening in the gold market since December 5th.

00:26:05:13 – 00:26:07:12

This is a very big deal.

00:26:07:12 – 00:26:10:21

And what this really tells me is that traders

00:26:10:22 – 00:26:15:19

see some of the writing on the wall, and they are buying gold

00:26:15:19 – 00:26:24:00

and overwhelming the Fed’s ability to keep that price suppressed.

00:26:24:02 – 00:26:26:14

Well, which camp do you want to be in?

00:26:26:14 – 00:26:29:20

You have to decide for yourself.

00:26:29:22 – 00:26:34:20

Do you want the traders to control your wealth?

00:26:34:22 – 00:26:38:15

And and they’re all overvalued because of that, because it really doesn’t

00:26:38:15 – 00:26:39:00

matter.

00:26:39:00 – 00:26:43:14

And this era of cheap money is over, at least for now.

00:26:43:16 – 00:26:45:19

Or do you want to control it?

00:26:45:19 – 00:26:47:12

This puts you in the driver’s seat.

00:26:47:12 – 00:26:51:19

Why do you think they have to take gold out of the money system to begin with?

00:26:51:21 – 00:26:55:03

Because when we were on a gold standard, if you did not like

00:26:55:03 – 00:26:59:02

what the governments were doing, you simply walked into the bank

00:26:59:03 – 00:27:02:09

with, well, a $20 bill.

00:27:02:11 – 00:27:03:05

I got one.

00:27:03:05 – 00:27:08:02

But you walked in for a $20 bill and you walked out with an ounce of gold.

00:27:08:04 – 00:27:09:10

Well, that created

00:27:09:10 – 00:27:12:10

restrictions around what the government could do.

00:27:12:12 – 00:27:14:00

They did not like it.

00:27:14:00 – 00:27:18:11

Plus, corporations wanted to pay you less and less on a gold standard.

00:27:18:11 – 00:27:19:20

That really didn’t happen. I’m

00:27:19:20 – 00:27:24:05

not saying there wasn’t an ebb and flow, but it was simply an ebb and flow.

00:27:24:07 – 00:27:28:21

So they had to convert us to the fiat money system, which is just,

00:27:28:23 – 00:27:33:06

you know, their ability to print all that garbage.

00:27:33:08 – 00:27:33:19

Right.

00:27:33:19 – 00:27:37:09

And control the value of what

00:27:37:09 – 00:27:41:04

they were printing and take gold out of the system.

00:27:41:04 – 00:27:44:23

So governments had no limitations on the level of debt

00:27:45:01 – 00:27:49:11

that they could grow, which certainly we’re at a peak.

00:27:49:15 – 00:27:52:07

It’s a big concern.

00:27:52:07 – 00:27:55:10

But also the ability of corporations

00:27:55:15 – 00:27:59:20

to pay you less and less because nominally it looks like you’re making more.

00:27:59:22 – 00:28:05:09

But in reality, because inflation has robbed you of your purchasing power,

00:28:05:10 – 00:28:10:03

there is actually less and less value in these things.

00:28:10:03 – 00:28:12:20

In fact, officially $0.03.

00:28:12:20 – 00:28:15:08

What happens when you get to zero?

00:28:15:08 – 00:28:17:04

They tested negative rates.

00:28:17:04 – 00:28:20:14

That’s what the CBDCS will enable the central banks to do.

00:28:20:18 – 00:28:24:04

They tell us that once we have cbdcs,

00:28:24:05 – 00:28:29:02

there are no limits on how low we can push interest rates.

00:28:29:04 – 00:28:31:03

And they will

00:28:31:03 – 00:28:34:04

because they have to take and attack your principle.

00:28:34:08 – 00:28:36:10

That’s what negative rates do.

00:28:36:10 – 00:28:38:05

They get all the purchasing power.

00:28:38:05 – 00:28:39:21

Your principles next.

00:28:39:21 – 00:28:44:22

How do you fight that?

00:28:45:00 – 00:28:46:14

This is how you fight that.

00:28:46:14 – 00:28:47:17

It’s so simple.

00:28:47:17 – 00:28:51:01

Look at what the central banks are doing for themselves.

00:28:51:03 – 00:28:56:03

They’re buying gold hand over fist so that at the other side of this mess,

00:28:56:05 – 00:29:00:20

they retain choices, retain their freedom and retain control.

00:29:00:22 – 00:29:07:07

Same exact reason why you and I do it now.

00:29:07:09 – 00:29:10:22

Make sure that you watch the last video that we did,

00:29:11:00 – 00:29:15:07

which is interest on the debt bubble, because once you have

00:29:15:07 – 00:29:19:10

that going up like a hockey stick, there ain’t no getting out of debt.

00:29:19:10 – 00:29:22:08

You have to a hyper inflated away.

00:29:22:08 – 00:29:27:11

Also, you know, we have a great desk, which I know many of you are participating

00:29:27:11 – 00:29:30:19

in, So happy between Daniela Carmona

00:29:31:00 – 00:29:33:22

and Taylor, Kenny and me.

00:29:33:22 – 00:29:37:01

I think we’ve got you covered in every single area,

00:29:37:01 – 00:29:40:15

whether it’s interviews, deep dives or one on ones.

00:29:40:20 – 00:29:45:12

We want you to have the ability to make educated choices.

00:29:45:12 – 00:29:47:13

That puts your best interests first.

00:29:47:13 – 00:29:49:15

What a concept.

00:29:49:15 – 00:29:53:15

So if you haven’t done it yet, click that cowardly link below.

00:29:53:17 – 00:29:57:15

Get your strategy, not just set up, get it executed.

00:29:57:20 – 00:30:01:12

We only have as much time as we have, and I can’t tell you

00:30:01:12 – 00:30:04:11

the exact moment that you’re going to lose those choices.

00:30:04:14 – 00:30:06:15

But I can tell you I can this.

00:30:06:15 – 00:30:08:05

I can give you this guarantee.

00:30:08:05 – 00:30:11:05

We will come a time where you will lose those choices.

00:30:11:10 – 00:30:16:07

So make it while you can, while it’s still severely undervalued.

00:30:16:07 – 00:30:19:06

And you actually had some choices left.

00:30:19:06 – 00:30:21:21

And if you like this, please give us a thumbs up.

00:30:21:21 – 00:30:23:17

Make sure that you subscribe.

00:30:23:17 – 00:30:25:17

Leave a comment.

00:30:25:17 – 00:30:30:00

And remember, this is your wealth shield

00:30:30:02 – 00:30:32:13

physical in your possession.

00:30:32:13 – 00:30:37:10

Because if you do hold it, you don’t own it.

00:30:37:12 – 00:30:41:23

And until next wee me, please be safe out there.

00:30:42:01 – 00:30:42:14

Bye bye.