WHY THE EVERGRANDE COLLAPSE MATTERS…by LYNETTE ZANG

You might not think that what happens to a corporation in China, will have any impact on you, particularly since you don’t think you hold any of their bonds. But you would be wrong in this interconnected world.

It is quite normal for governments and central bankers to sit back and allow private corporations to create fiat wealth and expand their influence when it supports their goals, only reining these corporations in when they threaten their sovereignty.

We can see it particularly well in the private crypto currency vs CBDC (Central Bank Digital Currency) space. But the focus of this piece is Evergrande, a Chinese corporation that was allowed to grow and expand as this growth supported the Chinese governments goal of global financial dominance.

But many Chinese corporations grew too big, powerful and therefore dangerous to the communist party authority and a strong reversal of policy is now underway.

Many are equating Evergrande, China’s largest and most indebted real estate company, with Shearson Lehman, my alma matter and the final trigger that pushed the global financial system into the “Great Recessionâ€. This is because of the extreme level of debt held in the globally systemic Chinese banks, like Industrial & commercial Bank of China (ICBC), which is connected to every other globally important bank, as well as their off-balance sheet debt, which actually hides the level of unpayable debt owed by Evergrande.

Like Lehman, all the world saw was the top of the debt ice burg, while the real danger was in the unknown.

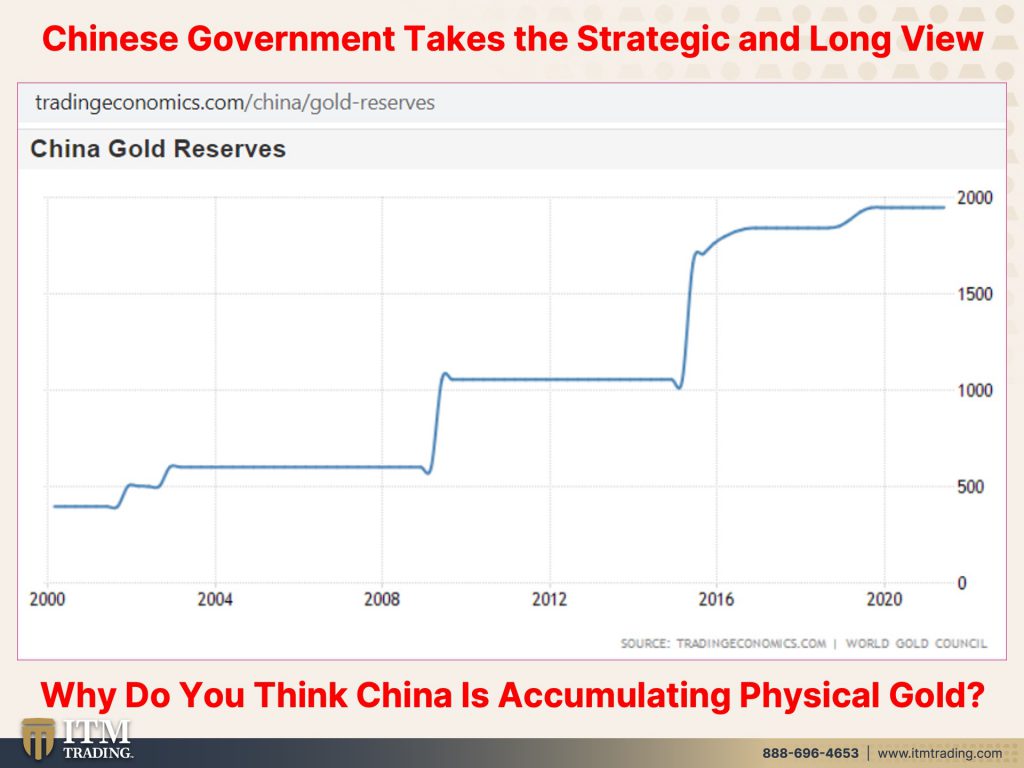

Will the Chinese government bail-out Evergrande? We’ll know the answer to this shortly. But perhaps this is one reason why China has grown their physical gold stockpile, to weather financial shocks. I can tell you for a fact, that this is why I’ve grown mine and why I think you should too.

TRANSCRIPT FROM VIDEO:

Are we about to experience another Lehman moment? Well, let me just check my magic eight ball. Wow! It is decidedly. So we’re going to be talking about why coming up.

I’m Lynette Zang, Chief Market Analyst at ITM Trading, a full service, physical gold and silver dealer. And today we’re going to be talking about the potential for another Lehman moment. For those that really don’t know what a Lehman moment was. It was, and Lehman was my Alma mater. That’s where I became a stockbroker. And I will tell you that it was hard to believe that the federal reserve would actually allow Shearson Lehman to fail. And they did. And that brought on the onset of what they call the great recession. But what I say is when the system actually died and we have a threat to that right now with Evergrande over in China. So we’ve got to look at why this collapse would matter to you because you could say, well, that’s over in China, I’m here. But remember we are all incestuously connected through the global banking system. And we’re going to be talking quite a bit about that today.

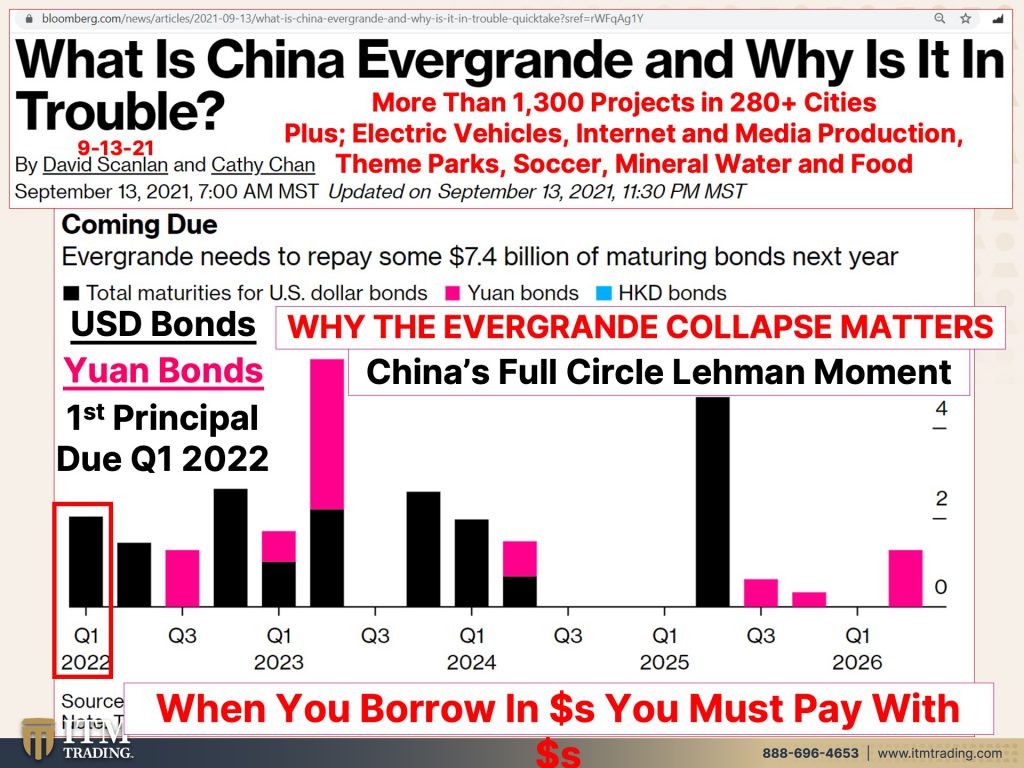

So for those that are not familiar with Evergrande, let’s just do a quick little review because they are integrated. They were founded in 1996 and through debt through lots and lots and lots of debt, they now have more than 1300 projects in over 280 cities in China, plus their tentacles have gone into all different industries, electric vehicles, internet, media production, theme parks, soccer clubs, mineral water, and food. So they’re kind of a big deal in China and they are by the way, the most indebted company.

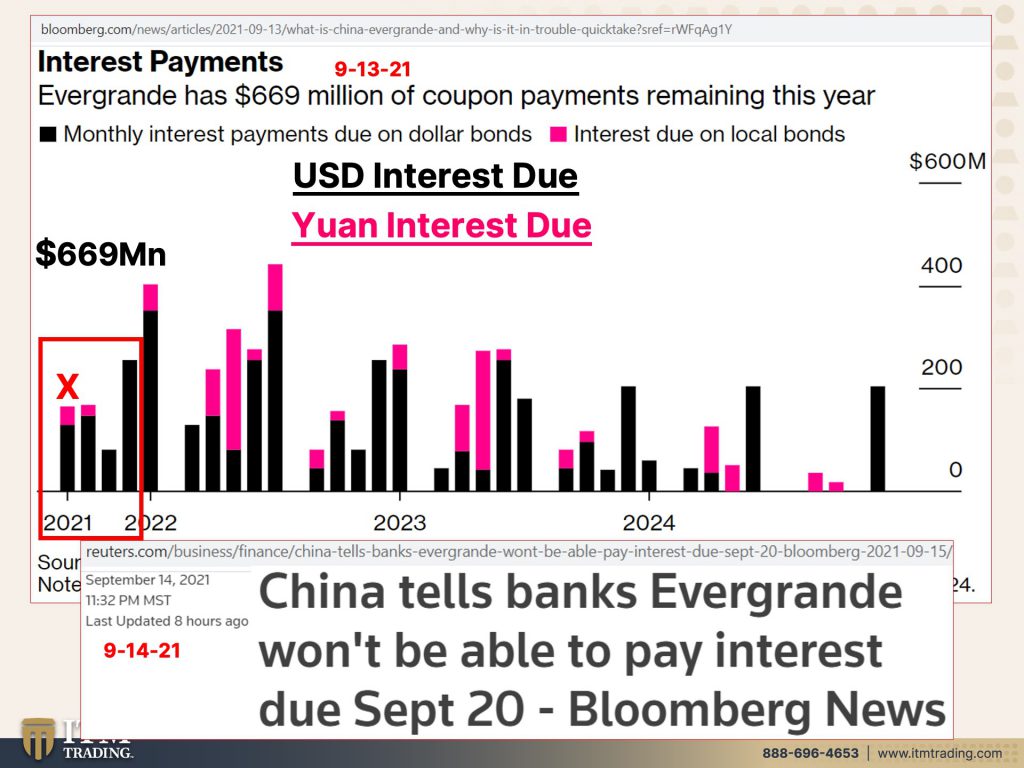

So now you might notice right here that in the black, these are U.S. Dollar denominated bonds, and in the hot pink are Yuan denominated bonds. Now this is a Chinese company, so they earn Yuan, but they have to convert it into dollars, which we’ll talk about a little bit more in a second. Now the principle on this debt does not come due, until the first or start to come due until the first quarter of 2022. But interest payments are due now. When you borrow in dollars, you have to pay in dollars. So this is Yuan versus the U.S. Dollar. And when you see the Yuan move down against the U.S. Dollar, that means that in order to make those interest payments or in order to make those debt repayments, they have to go out and buy dollars. So both of those transactions are a lot more expensive. And for a company that’s loaded up on cheap debt, that can be a big problem. These are the interest payments. So like I said, even though there’s no principal due until the first quarter of 2022, which is really not that far away since we’ve now entered or are about to enter the last quarter of the year, but still the black is the U.S. Dollar interest due. And the pink is in the Yuan. So, I mean, it’s pretty clear that Evergrande has issued a whole lot more dollar denominated debt. This is something that we’ve talked about quite a bit over the years, but again, when you borrow in terms of U.S. Dollars, you have to pay the interest in the principal back in terms of U.S. Dollars. If your currency, if the Yuan had strengthened against the dollar, then all of these payments would have been a lot less, but as I just showed you, that’s not really the case. And so they’re definitely in a cash crunch for many different reasons, but now China is actually telling the banks that Evergrande will not be able to pay the interest that’s due on September 20th, which is just a few days away. So this is a big problem.

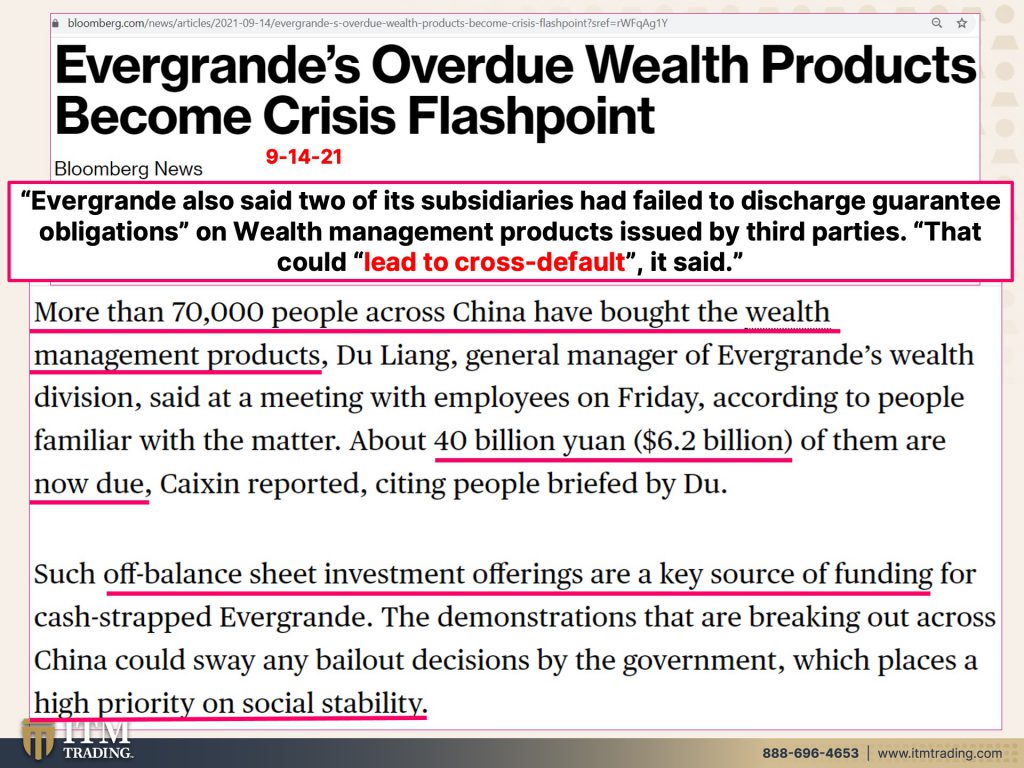

Additionally, they have not made payments on some of their wealth products. And we’re going to talk more about that in just a second. But part of the problem is that home price growth weakens. Now, look, this is all about confidence. How much have we been talking about confidence lately, right? As long as people maintain, the public maintains confidence in the government and the central bank in a corporation, well, then they can continue to borrow. They can continue to spend, they can continue to do a lot of things. They will stay in power and therefore control. But when confidence wanes, then you have a problem. You’re not loaning them any more money, etcetera. And so confidence toward developers may weaken further. So it’s not just Evergrande. It’s also other developers. This is a huge part of the Chinese economy. But after a spate of protest broke out at Evergrande offices across China in recent days, raising the specter of social unrest. Now the last thing that the Chinese government wants is social unrest. Evergreen said Tuesday, that it, that it expects a significant drop in property sales in the normally buoyant month of September because of waning confidence among home buyers. This is really a huge problem, not just for Evergrande but you know, Evergrande’s debt is junk status and it really has been, it’s been high junk status. Now it’s low junk status indicating the likelihood of default with more than 300 billion in liabilities Evergrande has been slashing prices on apartments to raise cash. So if they’re slashing prices, what does that do to their competitors? It forces them also to slash those prices. So now we aren’t even talking about profits. We’re just turning, talking about turning cash to have cash to work with, which I think is really interesting, but they have received down payments on yet to be complete properties from more than 1.5 million home buyers that was as of last December. So can you start to see the problem and the reason why they’re saying that this could cause social unrest? And so far the Chinese government has avoided a bail-in or a bailout, I should say rather. I mean, if they go away, I guess they kind of get bailed in because they get to keep all of the money. Well, they don’t really get to keep it because they’ve already spent it, but, you know, they won’t have to repay all of those lenders to Evergrande. But again, I said earlier, it’s not just in the real estate sector, but in order to fund that they’ve done some off balance sheet work with wealth products. So in addition to the 1.5 million people that have given them deposits on real estate, that is not yet completed, there are more than 70,000 people across China who have bought their wealth management products. And it’s a contract I’ll bet you, they didn’t read the small print. Just like if you own any of that crap, or if your perception is that you own anything, it’s a contract and you probably did not read the fine print either. So about $6.2 billion worth of those products are now due. And this was all done off balance sheet. Now I want you to think about, and you know, this balance sheet thing, honestly, I want you to think about the fact that most derivative contracts by like 90% still are off balance sheet and that hides the risk. It’s just not as visible. So nobody really knows how much Evergrande really owes, these are best guesstimates, but it could be much bigger than this actually. And the government and China really does put high priority on social stability because that’s one of the ways that they get the whole public to comply. I mean, there’s certainly a whole lot more Chinese citizens than there are communist party members or those that run the government. So they need everybody to comply. Therefore they need them to be happy. We’re going to talk a lot more about this next week when we get into more of what China is doing and why, but Evergrande also said that two of its subsidiaries had failed to discharge, guaranteed obligations. So people think, well, I have a guarantee on this insurance annuity or this product. Well, any guarantee any contract for that matter is only as good as the counterparty, who ever is on the other side of that contract. And if you have an annuity, you should read that it’s based upon, the guarantee is based upon the claims paying ability of the company. So in this case, Evergrande did not have any claims paying ability. So it couldn’t, it didn’t. That could, but here’s the big piece on that that could lead to cross default, because this really is, which you’ll see again in a minute, a spider web effect. So, okay. You’re looking over here, but what you don’t realize are all of the strings to all of these other products in places that are impacted kind of like a domino, oh, I should have had dominoes. Could you write that down? We’ll get some dominoes, but you know, it’s kind of like a domino effect in the first domino falls and then the rest of them fall as well because it triggers it. And that’s what they’re talking about here. It’s one of the reasons why this is, you know, thought of as a Lehman moment, because it wasn’t just Lehman that went down. It was everybody tied to Lehman that also went down.

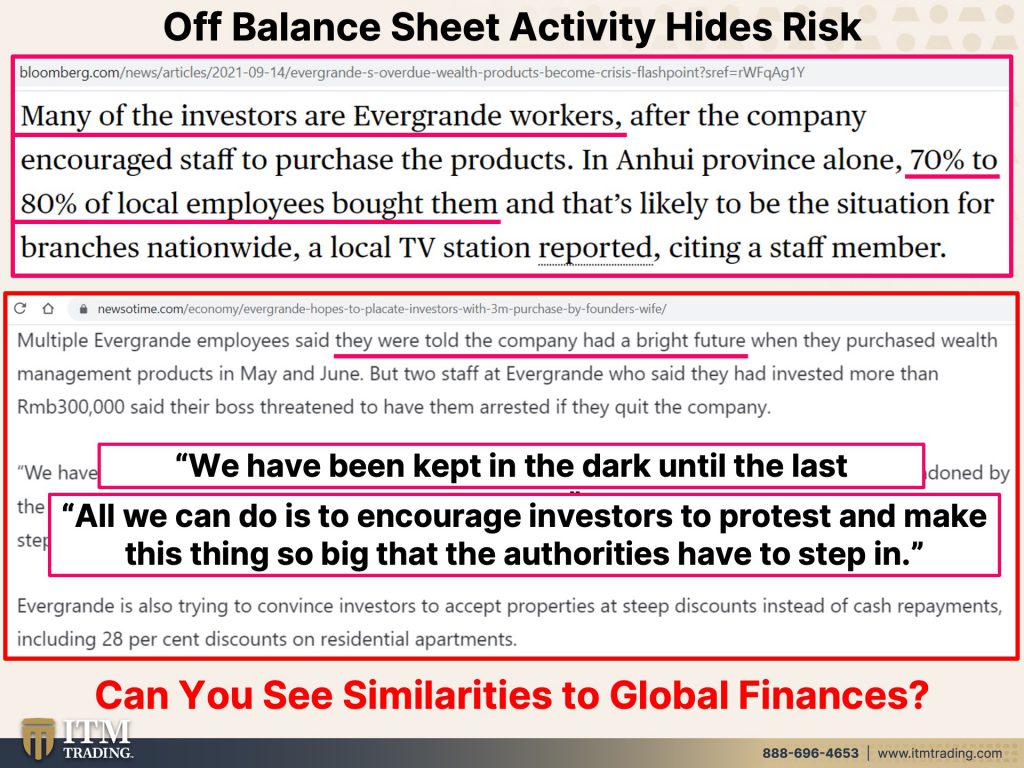

Again, off balance sheet just hide the risk because a lot of the investors were oh guess who? Evergrande workers in fact, 70-80% of local employees bought these wealth products because they were told that the company has a bright future. Wha? Wow, this was just not even all that long ago, may and June of this year, we are in September of this year. So a few months ago, we know we’ve got bright prospects. Everything is just great, really? And shocker, we have been kept in the dark until the last moment I’m telling you, you are never going to know when a collapse happens, because when, you know, in advance like I do like you do, if you’ve been watching the videos and other people’s videos that speak in this area, I mean, I would always rather be two weeks too early than one second, too late, because when it’s too late, it’s too late. You have simply lost all of your choices. All we can do is encourage investors to protest and make this thing so big that authorities have to step in. Now, what they’re referring to here is the Chinese government bailing out all of the investors in Evergrande. Is that a possibility? Well, they’ve been asking for it so far. And so far they’ve been turned away, but yeah, it’s a possibility. So that, that contagion does not spread. So tax payers pay for it, but it does not make this company healthy again. So it’s an ongoing issue. And that’s why if we go back to 2008, if we go back to Lehman, you know they made everything look okay by growing that balance sheet, but there are even limitations on balance sheet growth. And I don’t care if it’s China central bank or the global central banks or the U.S. Central banks, that’s the problem. They have used up all of their tools and the growth of the balance sheet really doesn’t work anymore. And I find it really interesting how much, what we’re seeing here, parallels what the world is going through with the central banks, because what do we keep hearing? We keep hearing that the economy is growing and yet we have a K-shaped recovery. So you’ve got the billionaires that are doing a whole lot better. And you’ve got most of the people at the very bottom that are doing a whole lot worse. And particularly when you look at the level of inflation that has come into play, now little bit of inflation is not going to bother those at the top that have a lot of money, but it does bother those at the bottom that are already having trouble paying for their food, their water, their energy, their security, their barterabilities, or wealth preservation, which is why community is so flipping important and why being prepared is so important. And I think that’s really, what really struck me was when I’m reading this and I’m thinking about what’s happening globally, and I’m thinking about what’s happening in each and every country and the similarities that I’m seeing. Can you see that? I hope so. I hope so.

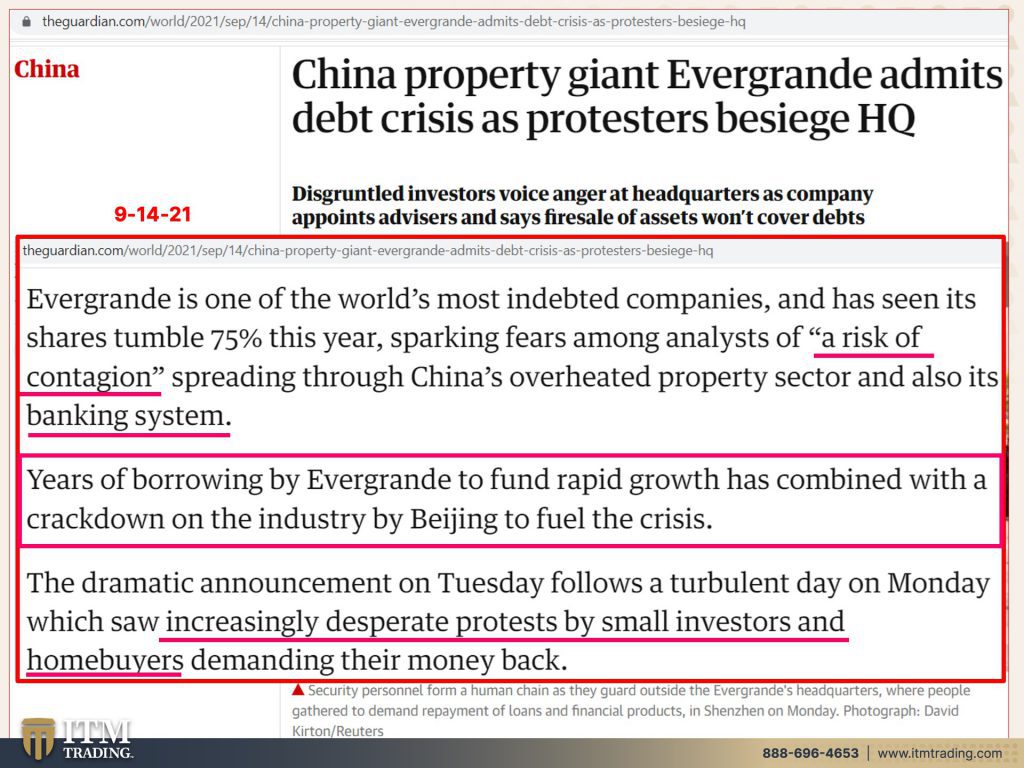

You know, I mean in China, interestingly enough, I mean, China was able to, to squash the protests for democracy in Hong Kong, but that was little. They don’t want to have to attempt to squash it in all of China, but all of those people that bought houses that bought those wealth management products that aren’t getting paid. They’re not getting the property, they’re protesting. And so you have the police they’re holding hand to hand to try and protect the let’s see security personnel from a human chain, as they guard outside the Evergrande’s headquarters, where people gathered to demand repayment of loans and financial products. Okay, well, one of the world’s most indebted companies, and it’s seen its shares of stock tumble. I mean, who gives a crap? Honestly, you know, all the stock markets are anymore is a big, huge casino. So I got to say, I don’t personally care that their shares tumbled 75% this year. But what I do care about is that risk of contagion, because it’s not just spreading through China’s overheated property sector, though that’s a big deal, the bigger deal. And the reason why it impacts you and me is because banks have given Evergrande some loans. Yeah, they’ve done a lot of off-balance sheet funding, but it’s also the global banking system. I’m going to show you that in a bit. Let me go here. Years of borrowing by Evergrande to fund rapid growth has combined with a crackdown on the industry by Beijing to fuel the crisis. Now look, every government, every central bank, I’m just going to take this off, sorry, guys, that is driving me crazy and I don’t want to pay attention to it, or I’m just going to take my butterfly pin off. Okay? Every government, every central bank, when a corporation supports the vision of where they want to go, well, then what do they do? They just sit back and the allow these private corporations to grow, thrive and take on debt. We’ve seen it with all of the giant tech companies as well. But in China, actually, you know, it’s not just China on a global basis. When these companies start to get too powerful and governments and central banks feel threatened, what do they do? Well, then they reign them in that’s what’s happening in China. And that’s also what’s happening here. But that’s another story for another day. Now, the, the dramatic announcement on Tuesday follows a turbulent day on Monday, which saw increasingly desperate protests by who? By small investors and home buyers, because the little guy is not too big to fail, but what China does not want to have happen. And this is when I talk about community, that’s where the power is, right? So what China does not want to happen with no central bank or government really wants to happen is for people, those small investors and those home buyers getting together in community, because then they are stronger and threaten the sovereignty of those that are currently in power.

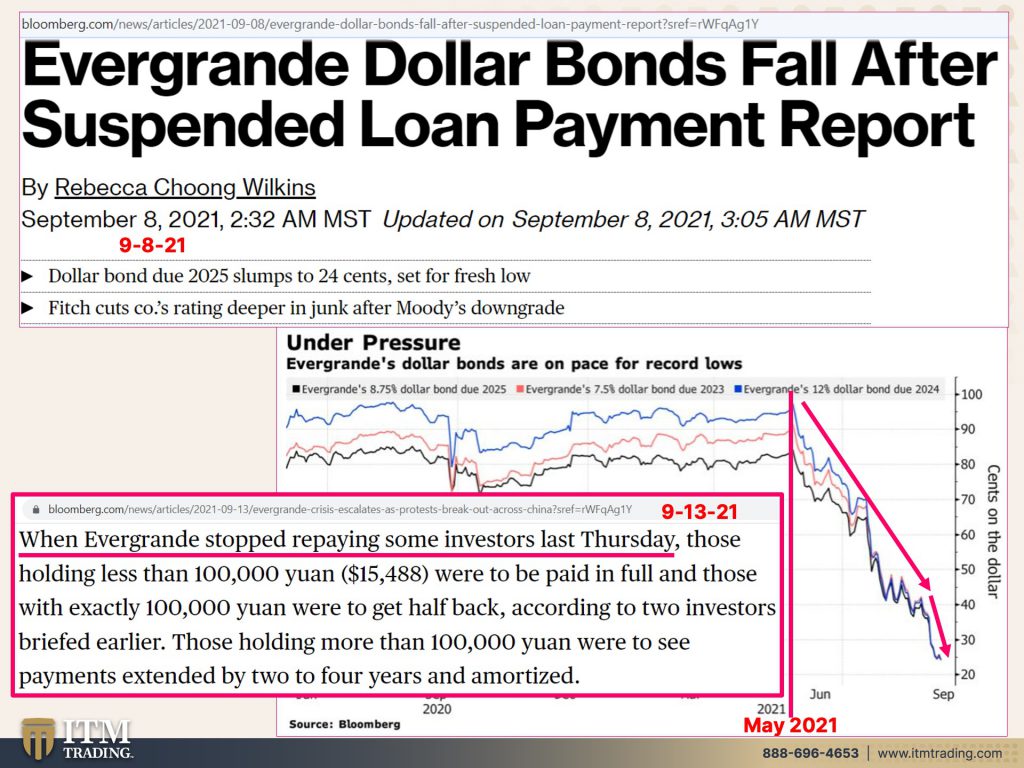

I mean, this is really so much of what we’re experiencing, but we’ll look at the markets a little bit because this, these are the debt markets. So Evergrande dollar bonds fall after they suspended the loan payments. And you can see that. Now, what I also want you to see is back in may. Well, let’s see, they were pretty close to par. They were pretty close to a thousand dollars a bond. Now they’re down at about 250 bucks a bond. When do you want to know about it? But what are they hearing back in May? Everything is just hunky-dory, put that money in. What was all that money used for? Funding day-to-day operations, which means that money is spent. It’s not there for a rainy day. They used investors’ money and those bonds, I mean, those bonds are getting pretty darn close to worthless, and that’s what happened even more so on Thursday, last Thursday, what’s today, a week ago, a week ago, today is when they stopped repaying some investors.

They did the smallest, those with exactly, let’s say those holding less than a hundred thousand, Yuan or 15,488 bucks were to be paid in full. And those with exactly a hundred thousand Yuan were to get back half. So if you had 99,000 Yuan, then you got 15,000, let’s say 450 bucks back. But if you are at a hundred thousand Yuan, you got half of that back. And if you had more than that, well then they extending your payments by two to four years and amortized. So can you see the problem? And can you see how fast that changed? And people always have hope, especially in this buy the dip mentality and what was really happening with these investors is they were counting on the government coming in and bailing out, but there are limitations and I don’t care whether you’re the central bank or you’re an individual or a corporation. The reality is there are always limitations, always limitations.

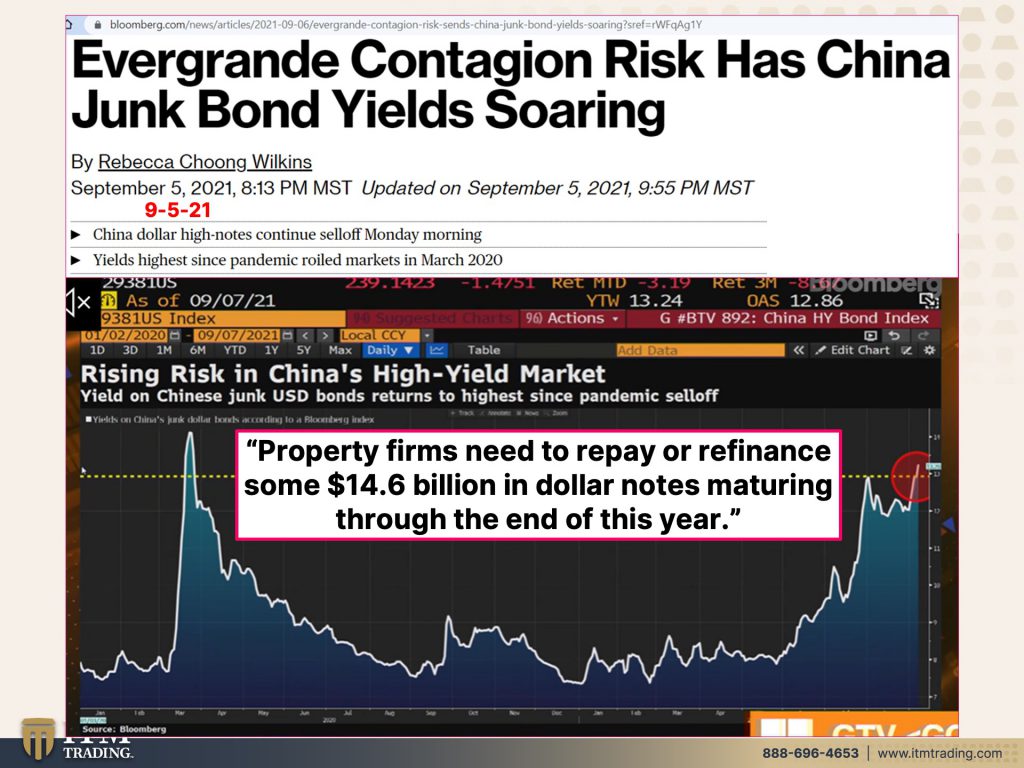

Going back to that contagion, and you have to know that that’s the real risk and it isn’t just in China’s junk bond market though. You can see what happened to the yield. And the other thing that I’ll show you is that cup formation. Now we have not yet had a breakout above here. And I can’t see how far that back that goes, but we’ve not yet had that breakout, but we’re certainly working on it. Here’s a little mini cup and we had a breakout there. So technically the next most likely outcome is for junk bond yields to continue to go up. Now, we have a tremendous amount of junk bond. We have a whole bunch of junk bonds that are actually triple B rated. And again, wow, everything is hunky Dory. Well, when that shift happens, you better be in the right position because there isn’t time to make a change then. So even though I’m talking about China, and even though I’m talking about their junk bond market or Evergrande, I’m really talking about the world. This is really representative of what’s happening all over the world and why you need to have physical gold and silver in your possession. I mean, it really is just that simple because in China property firms need to repay or refinance 14.6 billion in dollar notes maturing through the end of this year, over the next few months. Now, if the Yuan gets a whole lot stronger, well, you know, but didn’t look like it from that graph, right? So that makes it that much more expensive to refinance or not to refinance, but to repay now in the refinancing area of it, if the markets have lost confidence, if investors have lost confidence, then a couple of things happen in here. Number one, maybe they can’t refinance. Number two, if they can refinance how much interest are they going to have to pay? So this problem is way bigger than one corporation, no matter how big it is, one corporation in China.

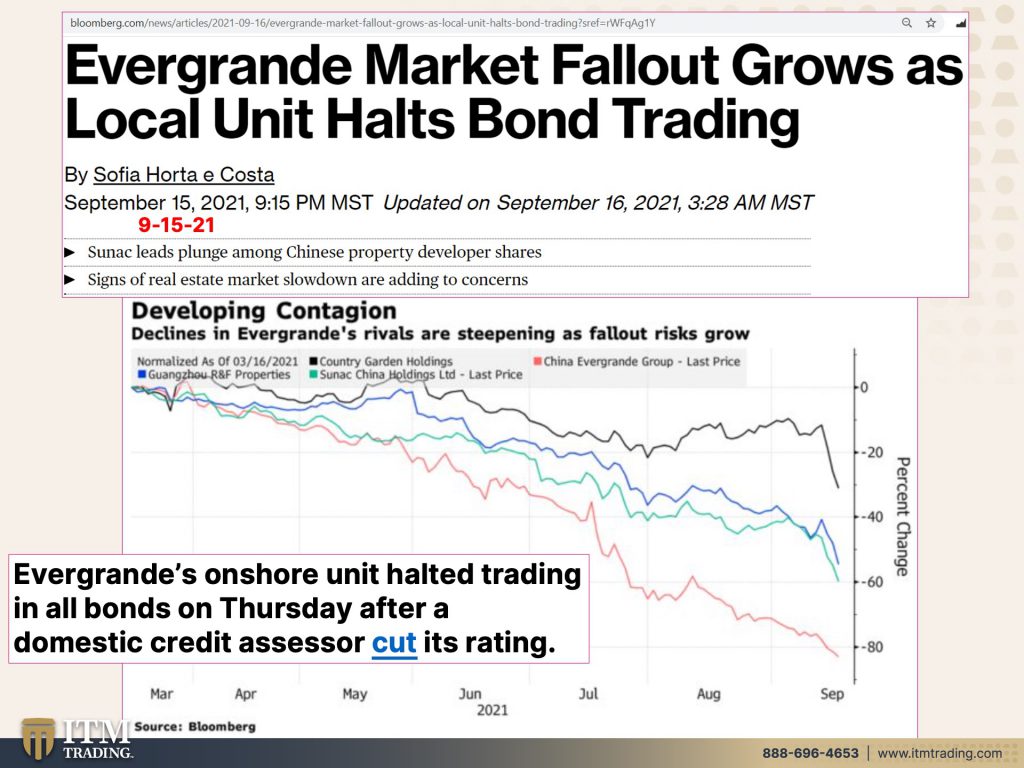

It’s growing rapidly, the problem is expanding and whether or not the government will step in? Well we’ll find out, we’ll know this pretty quickly because they halted bond trading today, Evergrande’s onshore. Now this is also where it impacts you Evergrande’s onshore unit, which means the trading in China, onshore in China halted trading in all bonds on Thursday after a domestic credit assessor cut its rating. You know, Moody’s, S&P, I mean, they’ve all cut rating, but this was a domestic, a local rating. These are Evergrande’s competitors, right? I mean, you can see what’s happening with their bonds cause remember too, okay. Interest rates – principle, when interest rates go up, the principle value of the bond goes down. That’s what you’re looking at there. That’s what you’re looking out there. So this contagion is already starting to spread.

Even so, dollar bond demand surged. It’s surged. Why? Because interest rates are held so low that savers are reaching. They’re taking more risk, trying to get yield. And by the way, the new dollar bond that they issued, 13%. So let’s see if they make the interest payment, you’re going to risk all of that principle for a poultry 13%. When I first became a stock broker back in 1986, treasuries were paying a little bit less than that. So, and that’s the thing I’ve been saying this too, right along, we are not, well, I don’t have anything invested in this garbage, but those that do, you are not getting paid for the risk that you’re taking. Maybe you don’t understand the risk that you’re taking, but without one doubt at all, especially these low injury…I mean, we just had junk bonds, not these particular bonds, but we just had junk bonds that went into because of inflation, negative territory. That means that you have guaranteed locked in losses. You want some guaranteed locked in losses. There’s a bridge in Brooklyn. I can sell you. I mean, seriously, but I needed to point this out too. This is onshore and offshore. What’s offshore. Well, you know, those MSCI funds in the U.S.? That’s offshore. So I don’t know exactly what anybody out there is positioned into, but if you’re sitting with Fiat money products, you need to really take some time and read those prospectuses. You can get them online and, and just go in and see what you’re really just put in do a control-F for find and put in holdings. H O L D I N G S. And it’ll show you what you’re holding inside of there, because I’m like, I’m so certain that if you’re holding any of this garbage, you don’t realize that you’re holding it. But that doesn’t mean that you’re not you. People don’t read the fine print. That’s why they get away with as much as they do orders for Chinese offerings were 7.7 times their issuance size last month, that’s the highest in the year. Let us just ignore, because that’s what people have been doing anyway, let’s just ignore the risk. The government’s going to come in and bail it out. What you don’t realize is that the government is spending your tax dollars. Who do you think at the end of the day, who do you think pays for all this stuff? We all know taxes have to go up. So the question on everybody’s mind is will the Chinese government save investors using tax dollars? And the answer to that is, is out. I can’t tell you one way. I can’t tell you the other, but we’ll we’ll know soon they’re going to have to do something very soon, because this is getting really bad.

Bank loans and other borrowings from firms, including trusts, accounted for about 81% of Evergrande’s, $335.5 billion Yuan or $52 billion of interest bearing debt that’s coming due in 2021 top lenders include several banks and guess what? This happens to be industrial and commercial bank of China, but these are how globally banks are interconnected. So if Evergrande does go down, if the Chinese government makes that choice and they may, because we all know China is very strategic and very patient. And we’ll talk more about what they’ve been doing next week, but globally. And those, all that gray in there that looks like spiderwebs every single financial institution. So it can be a FinTech. It can be a bank. It can be, it doesn’t matter. It can be a brokerage. Every single financial institution in the world is incestuously interconnected. So if there is an explosion, just like in 2008, when the U.S.’s Lehman exploded, well, the whole world went into what they call the great financial recession, the great recession, when that happens in China or wherever it happens. If, if this isn’t particularly it, it’s not going to matter. It’s to travel through the world. And this is my personal opinion. I can’t guarantee this, but just like the Lehman moment could be hidden from anybody. This can’t be hidden from anybody it’s big enough. It’s definitely big enough. We’re talking about the risk that China’s entire real estate sector and all of that debt. The impact that that would have globally is it’s scary to actually think of and just like they’re fully integrated into the entire global banking system. So are you, so am I, this isn’t (gold) bank for international settlements, the only financial asset that runs no counter party risk, the only one, what do you want to own going into this? Let’s see, I want gold. I agree. Crazy. Eight ball. I totally agree with you.

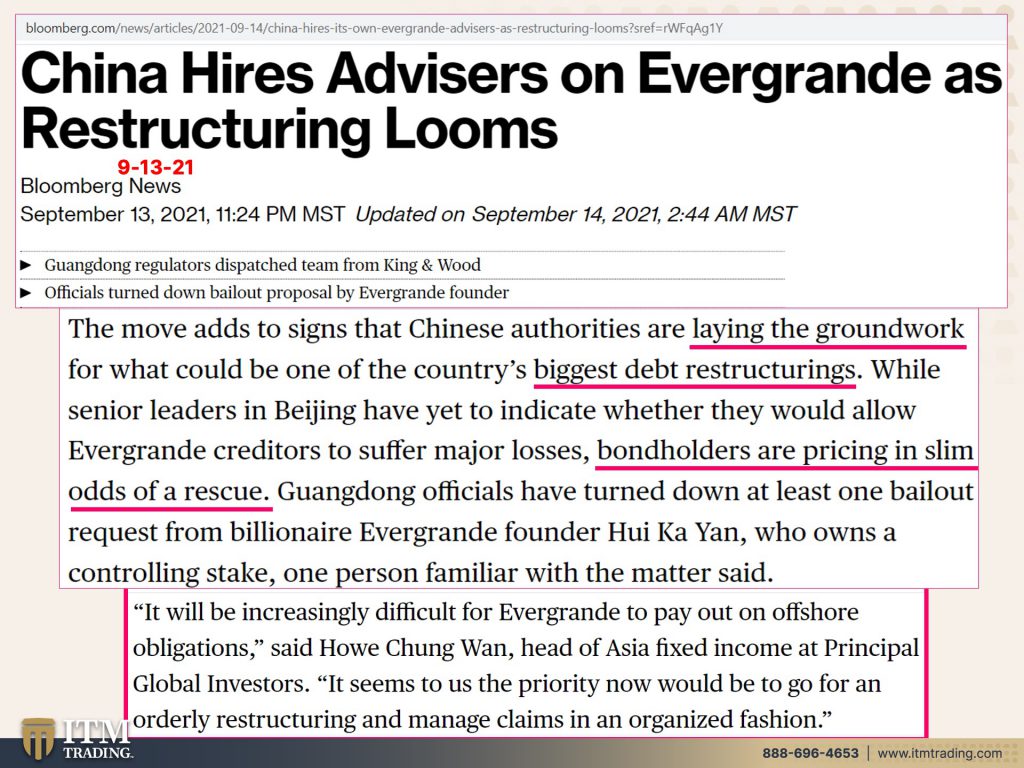

They’re getting ready for what they call like restructuring, which means that you get pennies on the dollar. If you get anything at all. And also the timing of when you get it. So if it’s due now, maybe you won’t see it for two years, four years ever or ever. And it really shows, I mean, China’s, the authorities are paying a lot of attention to this. They’re laying the groundwork for the biggest debt restructuring in that country’s history and what our bond holders pricing in slim odds of a rescue. I don’t know whether they’re going to rescue the, you know, it’s not really rescuing Evergrande. I don’t know whether or not they’re going to rescue the investors or the banks, but if they don’t, we are going to feel it all around the world. Make no mistake about it. Make no mistake about it at all. Now, again, I want to talk about the onshore versus offshore, because if China’s goal is to keep their population calm and have their population think that they’re really taking care of them. Well, you know, there’s nothing that says they can’t bail out the interior debt. So the debt that’s held in the country to keep the public calm, and it will be increasingly difficult for Evergrande to pay out on off shore obligations. That means for those bonds that are held globally through funds, through ETFs, etcetera it seems to us, the priority now would be to go for an orderly restructuring and manage claims in an organized fashion. Let us hope that that’s what happens, but the more likely outcome and what the bonds are telling us is that it’s going to be disorderly. So, you know, we’ll see, we’ll see. I mean, honest to goodness, I watched Lehman in 2008, because it’s been around for 125 years or something like that. And it was my Alma mater. I went there because at that time, anyway, they had the best training program on the street. That’s why I went there and they did. I mean, it was phenomenal. I could not believe that they would have allowed Lehman to go under. And I kept saying, no, no, they can’t do that. They’re not going to do that. I mean, they bailed out Merrill. They bailed at AIG. They bailed out a whole bunch of others. They were not going to let Lehman, they were not going to bail Lehman out. So, you know, I was watching it like voraciously and they let him, they let it go. And we’ve seen what China’s been doing over the last couple of months. They very well could have let it go. They very well could, but they take the long view on things.

Now, also they do not allow China does not allow any gold to leave their country. So even though we’re looking at the gold reserves reported, it’s probably a whole lot higher than this. Plus, in 2006, they allowed their citizens to buy gold through their banks and then hold that gold, physical gold, at their bank, which means they have easy access to it. So aside from the official reserves, how easy would it be and how likely do you think it might be for the Chinese government to confiscate the physical gold that’s sitting in Chinese bank accounts from the Chinese citizens, because while they want to maintain peace in the streets, they’re also completely controlling them in every way possible. We’ll talk more about that next week. So the question is, why do you think China is accumulating physical gold? Because they want to stay in power.

Why should you accumulate physical gold and physical silver? Because you want to stay in power. You want to protect your wealth and your family and have choices. And I think these days, it is so critical to ask, if not me, who? Who’s going to save you, who’s going to save your family. If you don’t step up to the plate, if you don’t come together with like-minded people in community and say, no, you can’t do what you’re doing to us. You can’t take away our work and our wealth through CBDC’s where there’s no limitations on negative rates and how much they can just eat your principle. And if they push a button and decide that you can, or you can’t buy something, you can, or you can’t go someplace. I mean, look at what’s happening. So if not me who? And if not now, when? We only have as much time as we have, and if you’re paying any attention at all, the loss of freedom, the loss of choice, the loss of individual control is speeding up. Who’s going to stop this? We have to come together in community. So I say me, but you should also be saying me, not me, me and what are you going to do it when it’s too late? It’s too late. So if not me, who, if not now, when I say now, and I say, me and I say, all of us means need to come together and become a we and say, no, you cannot take our civil liberties away. No, you get to make any choices that you want. I’m not telling you that you should make a choice about this, or you should make a choice about that except when it comes to this, we need to come together as a like-minded community and make a stand and say no. After 2008 happened, I changed all my plans. Honestly, I changed all my plans. What I’ve been watching over the last couple of years, almost it’s happening a lot faster than I really thought.

So I’m going to be sharing a lot of what I’ve been doing for that one hole in my strategy, food, water, energy, security, barterability, wealth preservation, community, shelter, and medicine. If you have a chronic illness, get it done, come together in community. We are here for you. We are here for you. You are not alone ignorance for those that think you’re nutty for your beliefs. It’s only because they’re not paying attention, but you are. And when they’ve lost all choice, where do you think they’re going to go? They’re going to go, oh, you were right. I wish I had listened, but yeah. And everybody has to make this choice as well. For me, I’m not going to punish them for believing the lie. They can’t help themselves. We’re asking people to make a huge paradigm shift, to ask somebody, to admit that what they have believed as the truth, their entire life is a lie is really a lot to ask. So we have to help them at whatever, wherever they are. We have to help them. Food, water, energy, security, barter ability, wealth preservation, community shelter, get it done. So you can share. Now this week I was on the Being Sons podcast with Jay Heck. And I think I said this during that podcast, when Jay was talking, not when I was talking, but when Jay was talking four times, I got chills. I don’t really exactly know why yet, but I guess we’ll find out. So the link is not out yet, but check our socials. Cause we’ll share it as soon as it is. And next week I’m going to be on with Antonio, from BA.B.Y. Investments. And it’s been about a year since I’ve been on with him. So we have an awful lot to talk about, but if you’re ready, if you haven’t done it yet, or if you need to really tweak it, get a plan together, start your gold and silver strategy and so much more. You can just click that Calendly link below and you can set up a time that works for you to talk to one of our consultants and we all work together. So, you know, or if you don’t find a time that works for you, just give us a call. 8 8 8 6 9 6 4 6 5 3, and set up a time that works for you. I’m telling you right now, you will be glad that you did very bright people. We are all here to be of service. We’re going back up to the cabin because we’re finalizing the solar on the cabin. And I think they’re putting in the battery bank in the inverters. So you know, go to our Twitter. Is that where you put it on the Twitter at (itmtrading_zang), and there’ll be some fun footage. And we have some, we have so many great things coming to you. And we’re like, I swear, we are this close, this close. I’m chomping at the bit to release all this stuff to you. But if you haven’t subscribed yet, please do yourself a favor and do so. Turn on those bell notifications. We’ll let you know when we’re going live. Leave us a comment, give us a thumbs up. Please it’ll help push it out to more people and share, share, share, share, share, and until next week, please be safe out there. Bye-Bye.

SOURCES:

https://fred.stlouisfed.org/series/DEXCHUS

https://www.fitchratings.com/entity/china-evergrande-group-88756458#ratings

https://tradingeconomics.com/china/gold-reserves