One Group’s Recession is Another’s Depression

Happy New Year! I don’t think the stock market and the bond market and the real estate market are having such a good year, but what you likely do not realize is a hidden threat to your wealth that is lurking just beneath the surface and could very well be putting in jeopardy any kind of gains in fiat money wealth for this year. Let me show you those hidden dangers!

CHAPTERS:

0:00 What’s Ahead for 2023

1:31 US Stocks Suffer Worst Year

4:38 Pledging Shares

15:21 Central Banks Balance Sheet

17:33 Global Stocks Face Trouble in 2023

23:54 How to Protect Your Wealth?

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

Well, happy New Year <laugh>. I don’t think the stock market and the bond market and the real estate market are having such a good year, but what you likely do not realize is a hidden threat to your wealth that is lurking just beneath the surface and could very well be putting in jeopardy any kind of gains in fiat money wealth for this year. And it’s only the third. We’re gonna be talking about that. Let me show you those hidden dangers coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading a full service, physical gold and silver dealer. And thank goodness we specialize in strategies, but these are not rocket science. It’s just a repetition of history and that is most likely to put you in absolutely the best position that you can be. And 2023, if 2022 is a pivotal year, 2023 could very well be a make or break year and unfortunately more likely to be a break than a make year.

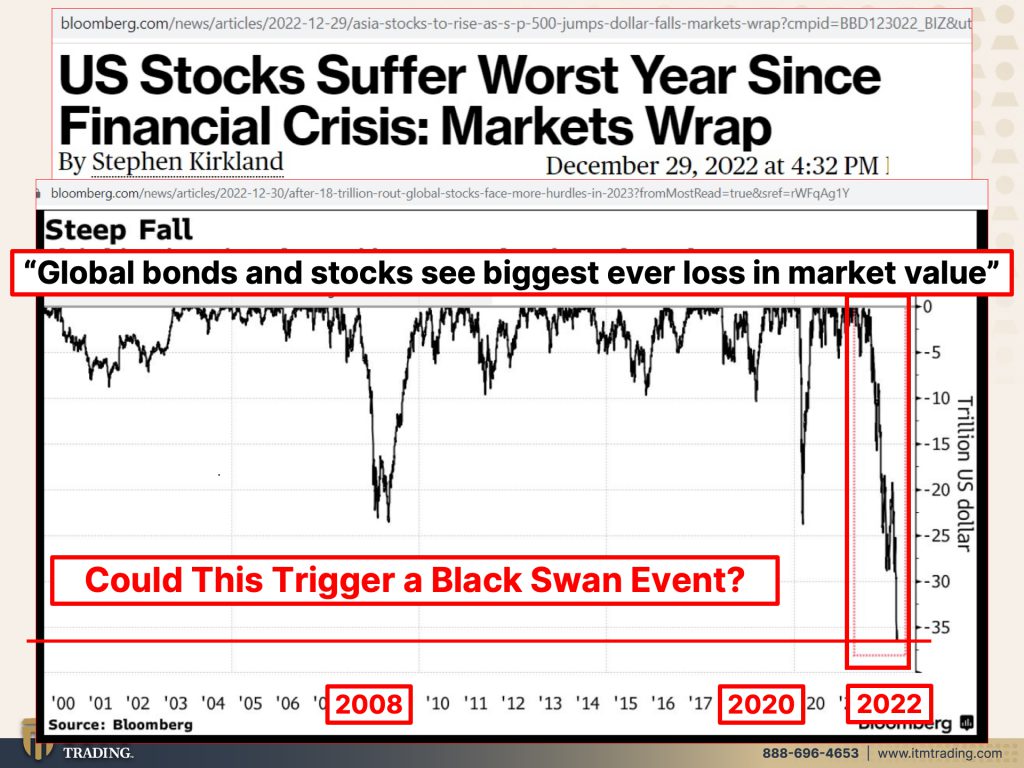

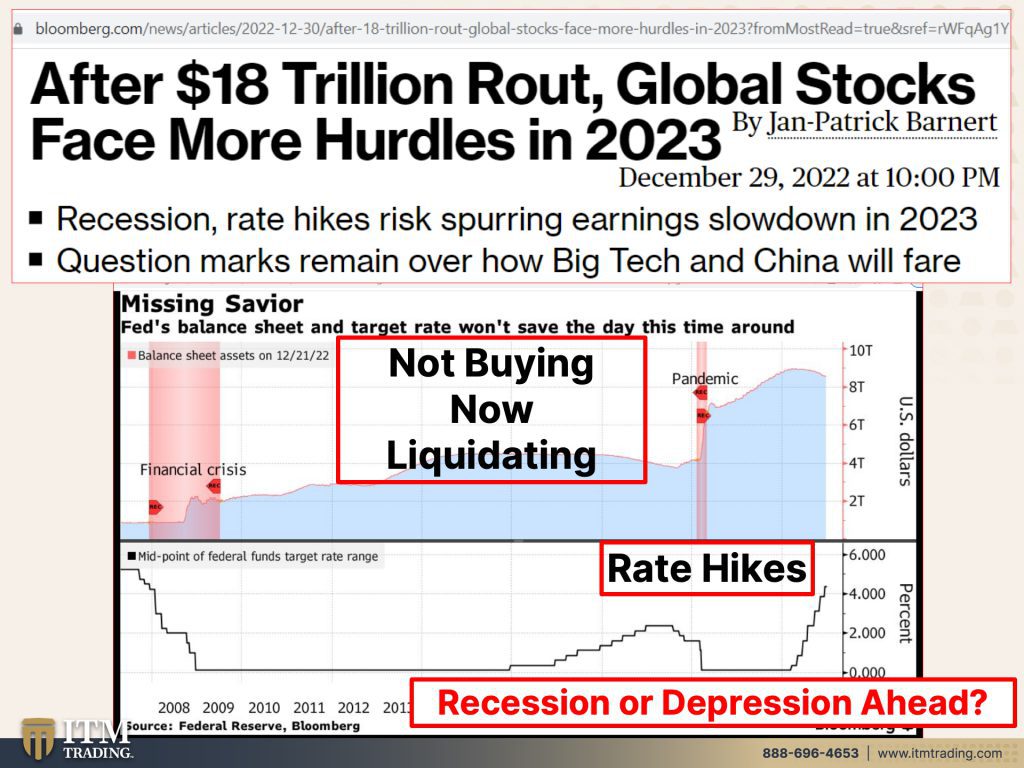

So let’s just dive right in and get started because we all know that US stocks suffer worst year since financial crisis going all the way back to 2008. Why? Because they never healed what happened in 2008, they just papered over it and we’re so proud, proud, proud of themselves that they kept that inflation contained, yeah, to the stock bond and real estate markets. And that whole piece now is unraveling because in efforts to fight the inflation, well they are ratcheting up interest rates. Does it look like they’re gonna stop before something really, really breaks? No. cause I think they really need something to break in a big way to hide what they fear of this transition from LIBOR to SOFR. Now I’m hanging my hat a lot on that. It’s something that I talk about a lot and they don’t like to talk about it at all. But it’s a grand experiment and it is more than likely to fail than it is to succeed. I mean, they’ve done such a great job, but if you listen to the talking heads, oh, equities are super cheap. Well, they’ve gone down a lot, however, they have had so much of this money printing juice pushed into them and that all has to come out. So in my opinion, and also technically they’re not cheap yet, they will get a whole lot cheaper.

This is what it looks like right now. There was 2008. Well, it’s way worse than 2008, isn’t it? Now, 2020 matched that. But remember, whenever anything changes, there is a pattern shift. It means something. You don’t even necessarily need to know exactly what it means, but it means something. And so in this particular case, look, here was a level of support right across here, right? Same level. But boy did that get blown out of the water by a very wide margin. And I think that’s what this year is gonna look like. Much worse than before because they’ve used up all their tools, they’re trying to raise interest rates only so they can lower them again. And their balance sheet remains extremely bloated. Though they are minuscule selling off or not and not reinvesting some of their, some of their portfolio in mortgage backed securities. But this is also a global issue. This is not a good sign, especially starting out the year. And you know, could this alone trigger a black swan event? No, no, they’re fiat money markets, but there’s something underneath them that definitely could.

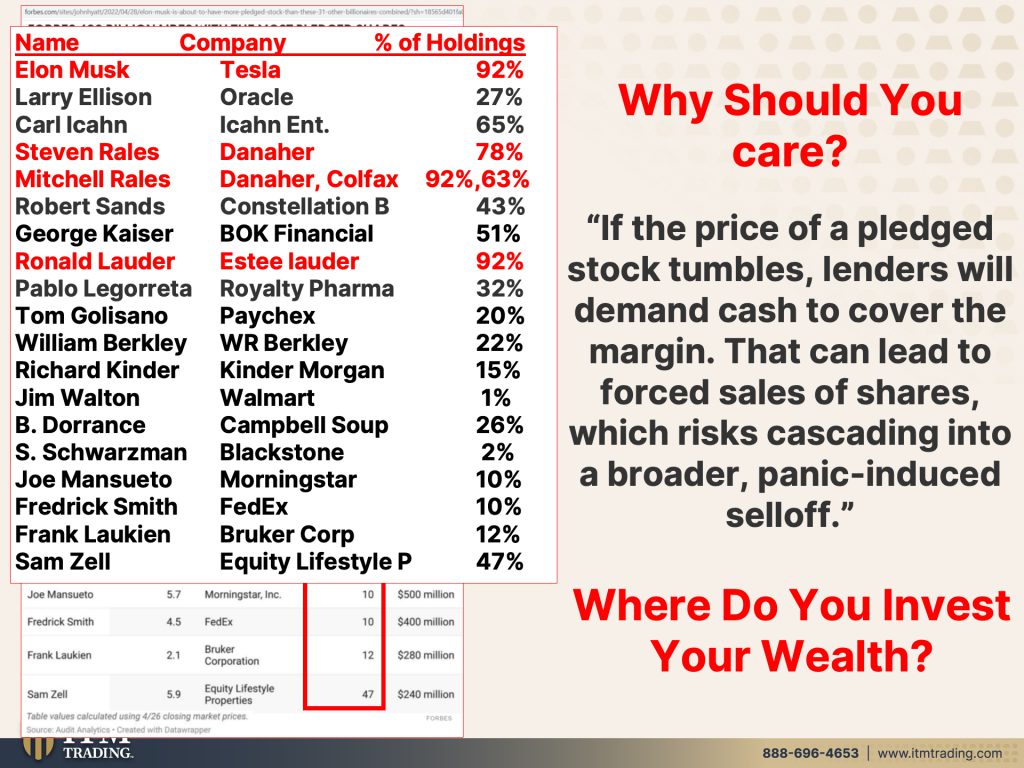

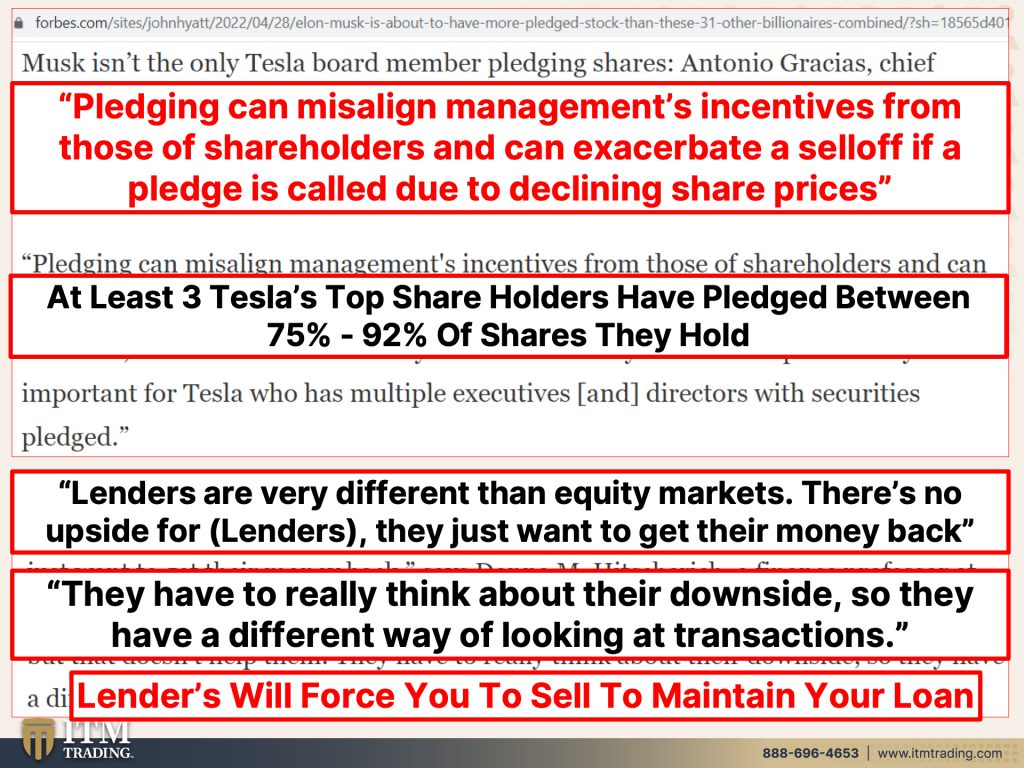

Now, Tesla’s been in the news quite a bit. We know that especially with the Twitter and all of that. But what you might not realize is how Elon has managed to fund all of these purchases, etcetera. Now, pledging, what the they do, the very wealthy is they pledge their stocks pledging, enables stockholders to use loans for spending money or to make other investments, all while holding onto their stock as it increases in value and it as it increases in value, then they can take out more and more debt on it. We need to think about this because this is not just happening in this arena, though this is the one we’re talking about today. But in all, all those margin calls, this is what’s happening. And most famously, it allows them to delay or sometimes avoid paying capital gains taxes since they can ring cash outta the shares without having to sell them. Isn’t that interesting? So if you do that, you’re gonna have to pay taxes. But there’s a way, you know, really, is this a level playing field? No, it’s never been a level playing field. Chances are pretty darn good. It never will be a level playing field. And that means it’s all more important for you to be managing your own wealth. Quite honestly, why would you give it to someone else? But pledging allows founders and heirs to enjoy a billionaire’s lifestyle while holding onto their shares, preserving their influence and voting rights at a company, which I find really interesting. I also find that while Elon, now this is a list of pledge shares and as you know, there are links to all of these articles below. So just go ahead and follow them. So you can see this list a lot more specifically, but you wonder what was the percentage of shares that they pledged, because based upon that you might have a little bit of an insight into how the founder really feels about this. Or is this just a cash generating machine without taxes? So let’s look at that a little bit more deeply. And the ones, you know, there’s Elon Musk right up there. So he has now pledged 92% of his Tesla shares. And you can see that there are a number of others in there that have also done that. So he’s pulled this money out. Now, a lot of times, like they said, it enables you to live a billionaire’s lifestyle. So maybe that wealth isn’t coming back to repay these debts, then who’s left holding the bag? The banks that loaned them the money on these shares, especially when the shares start prices fall. So you might be saying, but why do I care about that? Well, how about caring about that because it impacts you if the price of a pledge stock tumbles traders will demand cash to cover the margin that can lead to forced sales. In other words, I get a call, I gotta send another a hundred million dollars to them. Maybe I have that cash lying around. Maybe I have to give them more shares like these billionaires, right? I’ll give you more shares to meet that margin requirement. Or I’m gonna sell other assets that I have with the market will bear. And let’s say it’s Tesla stock, is it really any wonder that it continues its decline? When I looked this morning, I don’t know where it is at the moment, but when I was looking this morning from the data that I’m showing you it was down in the last couple days, another 10%. So that could create that doom loop, right? Where you get this margin call, you have to sell shares, you get it, and then the shares go down. So you get another margin call, you have to sell shares. So the shares go down. Can you see that? It’s a doom loop. It keeps going around and around and ending up at the same place, but then your shares decline. So if you’re sitting in a 401K or maybe an IRA with all these ETFs and mutual funds, etcetera, I’ve shown you over the years how, how just the top funds all invest in the same things and that trade is now unraveling. So it looks great on the way up, but now you’re starting to see what it looks like on the way down. And it’s not very pretty. And of course we have been trained by the central banks that stock markets always come back. But let’s see, how many years will you have to wait? And more important than that, what is going to be the value of the currency as we’re going through this whole transition and until it does come back? Because it does not matter how many of these that you have, it matters what you can convert it into. And we all know that we’re likely going into a digital system, but pledging can misalign management’s incentives from those of shareholders and can exacerbate a selloff if a pledge is called due to declining share prices. You see that doom loop. And you gotta wonder if they’ve pledge, if Elon has pledged 92% of his Tesla shares, how really important is Tesla to him? Because what’s that saying? It’s something like if I owe you a hundred bucks, I have a problem. If I owe you a million bucks, you have a problem. And that’s the problem. And I hope you can see it, because at least three of Tesla’s top shareholders have pledged between 75 and 92% of the shares that they hold. So the three top people, they’ve been using their Tesla shares as a piggy bank. Now this is not all about Tesla. And I want you to understand that it’s just a great example of this hidden danger. And by the way, this is something that I have actually been wanting to talk about for many, many, many years. So I’m glad that it’s finally risen to the top where I do get to talk about it. Because we don’t see these things and we just make all sorts of assumptions with that normalcy bias. That’s just not true. Lenders are very different than equity markets, right? You’re a shareholder if you own shares of stock and Tesla, yeah, you’re feeling the pain, but there’s nothing you can do about it. If you have loaned Elon money against those Tesla shares, well, you know, he doesn’t care. A lender doesn’t care if the stock market goes up or down, they just want to get their money back. That’s all. And they don’t really care what you have to sell in order to make that happen. They really, they have to really think about their downside so that they have a different way at looking at transactions. Again, they just want to get their money back. So they will force you to sell whatever the market will buy in order to maintain at the minimum, maintain your loan and that margin requirement of that loan and pay that loan.

In 2022, and this was December 27th. So Tesla shares have fallen so far, like I said, 10% or more from this, but in 2022 it collapsed 69% the the price of the stock collapsed 69%. This is what that looks like. But if he has margined 92% of it, then he doesn’t even have, I mean maybe I’m wrong about this, but he doesn’t even have enough shares of Tesla to cover those margin calls. So Elon’s gotta be sweating bullets between the Tesla stock that he used to buy Twitter with and all of the debt and the loans. What we don’t know and we couldn’t find out, is how much he sold or not. He sold how much he, how much the shares were at the time that he borrowed the money. Okay? That’s what we really don’t know. So on some of it he’s probably okay, except that as the share price rises, they take these billionaires, these people have a tendency to take out more and more and more loans against it. And guess what we’re just talking about the upper, upper echelon. But the reality is, is this is how Wall Street works. This, the whole monetary system is based on debt and by lowering interest rates to zero and pumping money and putting it out into the system as fast as they could, what the central banks have done is really driven us into a ditch. But it’s not just with these few entities, it’s with look at the margin, right? It’s with anybody that is borrowed to buy stocks. And then of course the stock market was going up because of all the free money. And so people borrowed more and more and more. Now the Fed is reversing that, do really trust them to maintain control. Maybe, maybe Hopium works, but I don’t think so and I don’t trust them at all. I don’t think anybody should. I think we all need to be our own central bankers and protect our assets ourselves. I would not be counting on the central banks to do that. But the question is, will this create a funding doom loop? Because we’re hearing so much about liquidity, we’ve talked about liquidity in these markets while funding and having the ability to fund these trades. It’s a big part of that liquidity.

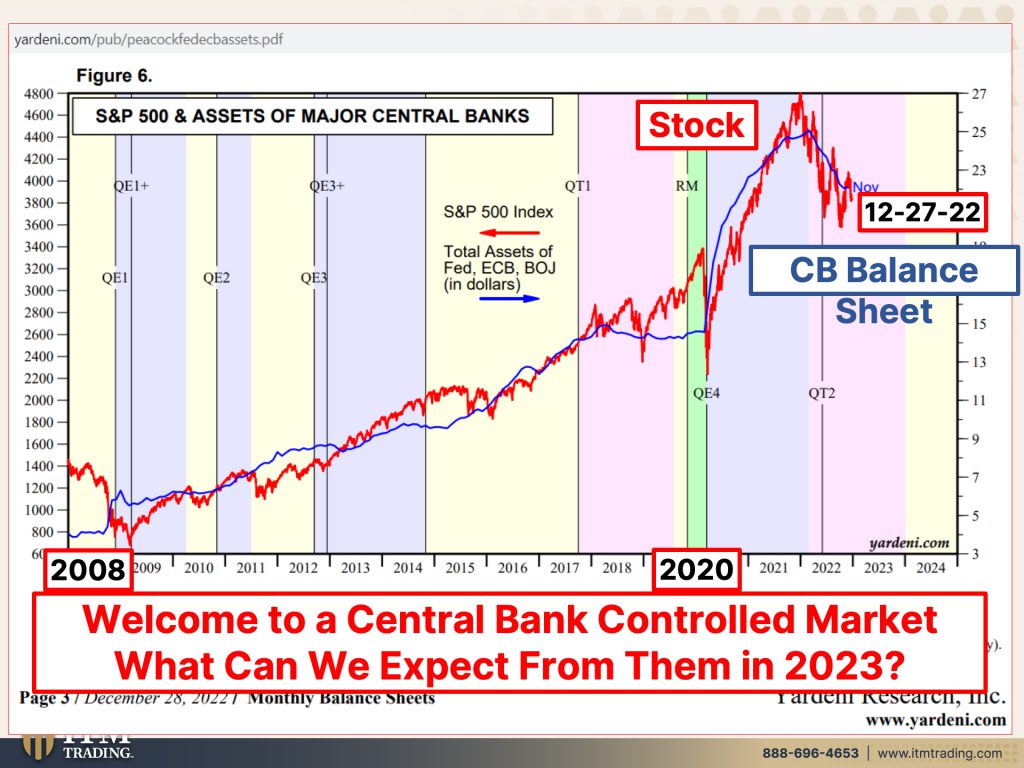

And you know, are the banks gonna be willing to continue to fund this? I don’t know. Because they’ve certainly had been instrumental in the stock markets rise. You can see the difference between the stock market, the S&P 500 and the central bank balance sheet. We’ve looked at this graph ever so many times and now they’re trying to reverse it. It’s gonna work. Probably not. There’s 2008 when QE started Quantitative Easing all this money printing crap started, right? Cause they just have to keep meddling with it. But don’t worry because once we’re in the CBDC system, they can keep their finger on that button constantly and move it around to make sure they get what they want. Do you trust them? Because if you keep your wealth in the fiat money system, that’s what you’re gonna get me. I’ve taken it out. I’ve taken it out. I trust me and my choices and my educated decisions more than theirs because their job is to keep you in and keep you calm. So what? How much more can they grow their balance sheet? They can do it until all confidence in them is lost. Forward guidance started in 2008 because of the great financial crisis. So the Central bank said this is what we’re going to do Wall Street. And then all Wall Street had to do was shift position, but incredibly, incredibly. And maybe it’s cause they just didn’t have any choice. Central bankers gave that up by surprising the markets. They didn’t have too many surprises up until 2022. That tests their credibility. And this is a con game. It requires confidence and they’re losing it.

And what about 2023? Well, we keep being told that central banks are absolutely committed to continue to raise rates. That means that’s going to impact all of that debt and all of the debt that we can’t even see that has to transition from LIBOR to SOFR over 600 trillion notional value of that debt. But where the Fed was buying mortgage backed securities and treasuries before. Hmm, well they’re not really buying as much and they are committed to liquidating. Although, you can see it goes up much faster than it comes down because they can’t do it. They’re still well over 8 trillion on their balance sheet. They can do, they can continue to grow. But you gotta understand because if you listen to the talking heads, they’re saying, well the Fed is creating this recession and the Fed can stop it just by doing a pivot, just by dropping interest rates back down and printing a whole lot more money. Except that the system, it was irretrievably broken in 2008 and all they did was paper over it. So you still have all of the dangers that we had in 2008, all those legacy derivatives that as, Warren Buffet puts it are weapons of financial mass destruction. Well, they didn’t go away, those didn’t get resolved because they’re unique, right? You might have have somebody betting on whether the sky’s gonna turn orange and somebody else says, I’ll take that bet. Okay? As long as they keep paying, which means more debt, they can keep those derivatives afloat. But with the reverse of the interest rates, that’s becoming more and more challenging because all these corporations including banks. Banks are corporations. They’re not separate from that. Well, including all of these entities that create these derivatives. I mean it creates rising interest rates create a real problem because they didn’t do it gently, right? You can even see from this last attempt at rising rates, they were trying to do it very slowly. Well, interest rates, why are they raising them so fast? Because inflation is obvious to the public. That is definitely not what they want. Definitely not. So what do we have ahead? Is it gonna be a recession, which is what everybody’s calling for And although, we’re constantly told up, this is not gonna be that bad of a recession, right? It’s just gonna be a mild recession. Well, let me tell you, if you lose your job, that’s more of a depression for you. And how do you solve a recession? With inflation, right? They’re just the opposite sides of the coin. So I makes it mean, honestly, it makes it really simple. How do you fight inflation? That’s with deflation. That’s what he’s doing by raising the rates, is trying to engineer jobs that go away a higher unemployment so that people can’t ask for more money. Because it’s certainly not the guys at the top, the Teslas of the world or the Elon Musks of the world or the Carl Icons of the world, et cetera. That’s not who’s creating this inflation. Right? And and I hope you realize I’m being facetious when I say that it’s the workers that are now demanding more money because they’re having trouble feeding their families. And while we have technically seen inflation in some areas grow more narrow so that overall inflation, oh we’ve hit peak inflation. I don’t think so, especially since a big part that has driven that inflation number down a little bit has been oil. And if you read what OPEC + is talking about, well, I mean oil is somewhere around 80 bucks a barrel, give or take right now. Well they wanna see it between 110 and 120. So do I think we’ve hit peak inflation? No, I do not. Do you believe it? Because they’re gonna turn these money guns on in a very big way and they’re gonna take that, God, they’re gonna take their balance sheets to the moon. They’re already up there, they’re already by what Jupiter? I mean that’s it. We are headed to the end and we have to have a huge crisis before June 30th, I’m sorry, of 2023 because they’re gonna have to make that transition. Can they postpone it? Well I guess they can change the rules. I mean they created the rules. I guess they can change them and maybe they will postpone it because I don’t think they can pull it off. And Wall Street doesn’t think they could pull it off because they had to be, and I say this because these corporations had to be forced to use. SOFR forced January 1st, 2022, no more contracts with LIBOR in it up until that moment. The lion share, the lion share by a very wide margin of contracts that had LIBOR written into it. Do they have fallback language in those new contracts? Absolutely. But that’s not gonna stop the shift and it’s not gonna stop the revaluation. And I personally think, and maybe I’m gonna end up with egg on my face cause this is not something that I can control. But from all my experience all of this time in these markets since I was 10 years old, I don’t think it’s gonna be so easy. I just don’t think it’s gonna be so easy.

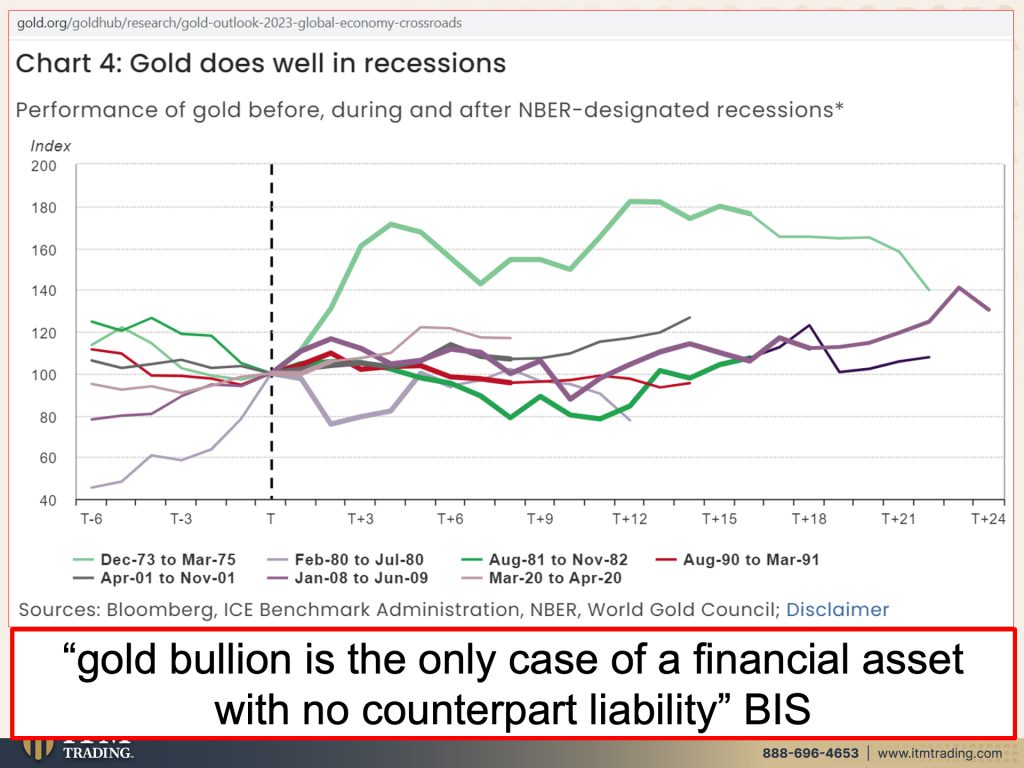

So what can you do to protect yourself? Because I think that’s a real key. And you know, frankly, gold does very well in recessions. It does even better in depressions. It does even better in hyperinflation. So that is what I’m saying that you should do because I think we run an awful lot of geopolitical risk. I mean between North Korea, South Korea, between China and the US in the Middle East, Russia, Ukraine, I mean the whole world is a hotbed. And according to the Bank for International Settlements and why globally central banks have bought more gold than they ever, ever have is because gold is the only case of a financial asset with no counterparty liability. Everything else is running counterparty liability. And with the central banks on a global basis, marching at raising rates to contain inflation so that you and I continue to trust their power. But these people are not gods. They’re not, they’re human beings. They’re fallible. They have no real world experience. What it’s like, if they’re the ones suffering through a recession or even a depression, they have no clue what it is to live and work and try and raise your family and take care of them and prepare for the future. And they don’t really care. They can’t care, they can’t care about you and me or they couldn’t do their job. Cause their job is to keep us in the system and to keep things calm and to keep our confidence and they are failing in every area.

So just as a reminder, I think it’s critically important that you subscribe because there are too many moving parts and you need to know what’s going on. So if you haven’t done that yet, hit that button. We’ll let you know when we’re going on air. And we also have podcasts. So even if you don’t have time to watch, you have time to listen maybe. And just leave us a review on Apple or Spotify or listen to us on any major platform. And if you have not done this yet, I strongly encourage you as a key action item to click that Calendly link below and set a time to meet with one of our consultants and have your goals in mind. And if you don’t really even know how to structure those, cause it can be challenging, we, we have a whole bunch of questions that we’re gonna ask you to help you define those so that you can build whatever portfolio you want to that actually supports what you’re trying to accomplish. No hopium, just the facts. If you like this, please give us a thumbs up, make sure you leave a comment and remember to share, share, share. And until next we meet. Please be safe out there. Bye-bye.

https://www.yardeni.com/pub/peacockfedecbassets.pdf

https://www.gold.org/goldhub/research/gold-outlook-2023-global-economy-crossroads