The Great Taking: Understanding the Shift in Global Debt | A Deep Dive into Financial Collateral

From Nixon taking us off the gold standard in 1971 to the current supercycle of consistently lowering interest rates, Lynette Zang, Chief Market Analyst at ITM Trading, breaks down the intricacies of “The Great Taking.” Learn how debt accumulation and central bank actions have led to the greatest wealth transfer in history – “The Great Taking.” 📚 Discover the insights from the book that unveils the system’s abuse and soaring debt levels. Join the conversation on the impending challenges of 2024 and beyond.

CHAPTERS:

0:00 The Great Taking

7:00 M2

12:46 Dark Cloud Over America

21:25 Wealth Transfer Tool

25:48 Devaluing Peso

28:00 Legal Owners

38:50 Argentina Privatizations

SOURCES:

https://fred.stlouisfed.org/series/M2SL

https://fred.stlouisfed.org/series/M2V

https://wid.world/country/usa/

https://www.xe.com/currencycharts/?from=XAU&to=ARS&view=1M

Milei Sets Up Argentina Privatizations for Airline, YPF – Bloomberg

VIDEO TRANSCRIPT:

00:00:00:00 – 00:00:03:02

In 1971 when Nixon took

00:00:03:02 – 00:00:06:02

us off the gold standard,

00:00:06:02 – 00:00:09:06

we became our currency became purely

00:00:09:06 – 00:00:12:11

based on the issuance of debt,

00:00:12:13 – 00:00:16:21

and we began a supercycle by consistently

00:00:16:23 – 00:00:22:10

lowering interest rates

and encouraging everyone, governments,

00:00:22:10 – 00:00:25:17

corporations

and individual oils to take on

00:00:25:17 – 00:00:28:17

even more debt.

00:00:28:19 – 00:00:32:06

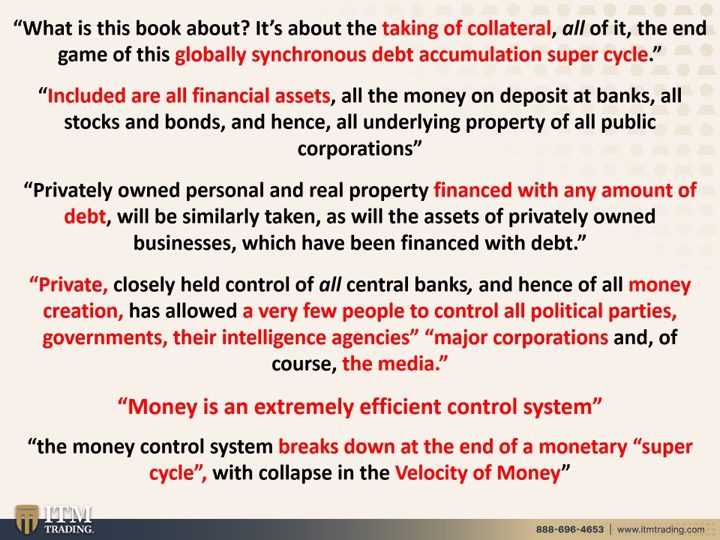

Many best about this book,

The Great Taking,

00:00:32:08 – 00:00:38:06

and we’re going to talk about that today

because really the system is

00:00:38:08 – 00:00:43:10

has been so abused,

the debt levels are so high.

00:00:43:12 – 00:00:45:16

Some of it’s based on collateral.

00:00:45:16 – 00:00:48:16

Some of it’s not based on collateral.

00:00:48:19 – 00:00:52:12

But in this, it’s

the taking of all collateral.

00:00:52:17 – 00:00:56:01

So when you hear people

talk about the greatest wealth

00:00:56:01 – 00:00:59:17

transfer in history,

00:00:59:19 – 00:01:00:23

it’s the great taking.

00:01:00:23 – 00:01:05:16

We’re going to talk about it coming up.

00:01:05:18 – 00:01:06:19

I’m Lynette Zang

00:01:06:19 – 00:01:09:19

chief market analyst at ITM Trading

00:01:09:20 – 00:01:14:19

and I would like to welcome you

to the New Year.

00:01:15:01 – 00:01:17:01

I can’t believe it’s 2024.

00:01:17:01 – 00:01:20:23

And what an interesting year

this is most likely to be.

00:01:21:01 – 00:01:23:20

There are a lot of things that I see

coming up,

00:01:23:20 – 00:01:28:02

but definitely

the Great taking is one of them.

00:01:28:04 – 00:01:29:22

So what’s this book about?

00:01:29:22 – 00:01:32:10

And by the way,

I think Taylor Kenny is coming out

00:01:32:10 – 00:01:38:01

also with a video on this on Sunday since

so many people wanted to talk about it.

00:01:38:03 – 00:01:40:18

And what this does is just kind of put

00:01:40:18 – 00:01:44:07

in small format size,

what we’ve been talking about

00:01:44:12 – 00:01:48:16

for years and years and years

and what is the great reset,

00:01:48:18 – 00:01:53:12

but a shift in the collateral

from the many to the few.

00:01:53:12 – 00:01:54:21

What’s inflation?

00:01:54:21 – 00:01:58:11

A shift from the many to the few.

00:01:58:16 – 00:02:01:16

So this is really what

we’ve been talking about.

00:02:01:20 – 00:02:03:10

Now, what is this book about?

00:02:03:10 – 00:02:08:15

It’s the taking of collateral

globally synchronized debt

00:02:08:15 – 00:02:13:12

accumulation, supercycle,

which is what has been engineered

00:02:13:12 – 00:02:17:16

by the central banks

by consistently lowering interest rates.

00:02:17:18 – 00:02:24:01

At the peak they were at intraday

I think it was 21 and change

00:02:24:03 – 00:02:27:02

interest down to zero

00:02:27:02 – 00:02:30:01

and was held at zero for 15 years.

00:02:30:01 – 00:02:35:15

But it includes this great

taking, includes all financial assets,

00:02:35:17 – 00:02:39:21

all the money on deposit in the banks,

all stocks and bonds

00:02:39:21 – 00:02:45:03

and has all underlying property

of all public corporations.

00:02:45:05 – 00:02:50:06

And I know that this can seem outrageous,

but the difference between inflation

00:02:50:06 – 00:02:55:06

and hyperinflation is simply

the speed of that inflation.

00:02:55:08 – 00:02:57:16

If it happens slowly, it still happens.

00:02:57:16 – 00:02:59:21

You just don’t notice it.

00:02:59:21 – 00:03:04:16

Privately owned personal and real property

financed with any amount of debt,

00:03:04:21 – 00:03:10:10

will be similarly taken, as will

the assets of privately owned businesses,

00:03:10:15 – 00:03:15:03

which have them financed with debt.

00:03:15:05 – 00:03:19:00

And keep in mind that if you owe

00:03:19:03 – 00:03:24:04

somebody money on that collateral

and you can’t pay it,

00:03:24:06 – 00:03:25:12

guess what?

00:03:25:12 – 00:03:29:01

They’re going to take that collateral away

from you.

00:03:29:02 – 00:03:33:06

Private closely held

control of all central banks

00:03:33:08 – 00:03:38:07

and hence of all money

creation has allowed a very few people

00:03:38:07 – 00:03:43:08

to control all political parties,

governments, their intelligence agencies,

00:03:43:10 – 00:03:47:17

major corporations,

and of course, the media and everything.

00:03:47:17 – 00:03:52:05

We have a semblance or an image of choice,

00:03:52:09 – 00:03:57:05

but in reality

everything is owned by a very few people.

00:03:57:07 – 00:04:00:22

And these entities have been consolidating

00:04:00:22 – 00:04:04:16

over the years,

the banks, particularly since 2000.

00:04:04:21 – 00:04:11:00

When a bank fails, the good assets

go to the few and then and then the

00:04:11:01 – 00:04:15:08

the bad assets are absorbed by the many,

the taxpayers.

00:04:15:10 – 00:04:16:04

Right.

00:04:16:04 – 00:04:21:13

So by controlling the narrative,

that’s that perception, manage moment

00:04:21:15 – 00:04:24:20

where they want to control how you think

00:04:25:01 – 00:04:30:13

and therefore how you move into

and through a circumstance.

00:04:30:15 – 00:04:35:01

And it’s easier to get people

to cooperate with deception

00:04:35:03 – 00:04:39:01

because once you know the truth,

you make different choices

00:04:39:03 – 00:04:42:00

and that takes away

some level of their control.

00:04:42:00 – 00:04:46:03

I remember we vote with our wallets

and we vote with our purses.

00:04:46:04 – 00:04:51:00

And so this is

my vote is out of the system.

00:04:51:02 – 00:04:55:09

And as the Bank for

International Settlements so aptly states,

00:04:55:11 – 00:04:58:15

gold, physical gold in your possession

00:04:58:15 – 00:05:04:01

is the only financial asset

that does not run counterparty risk,

00:05:04:07 – 00:05:07:03

therefore does not risk

00:05:07:03 – 00:05:09:18

the loss of that collateral

00:05:09:18 – 00:05:13:16

money

is an extremely efficient control system.

00:05:13:17 – 00:05:17:12

If you have

everybody bought into the same system

00:05:17:18 – 00:05:23:09

because all they have to do

is push a button and create devaluation

00:05:23:10 – 00:05:27:19

and they can even do that

by decree pretty easily.

00:05:27:21 – 00:05:29:12

So keep that in mind.

00:05:29:12 – 00:05:32:17

Many say an extremely efficient

control system.

00:05:32:19 – 00:05:35:19

If you are dependent upon the money

00:05:35:21 – 00:05:40:00

that you earn from the system by design,

00:05:40:03 – 00:05:44:05

you are earning less

and less over time through inflation.

00:05:44:07 – 00:05:49:07

Remember, they knew two key pieces

when they set the system up.

00:05:49:09 – 00:05:54:21

Number one was that people marry

the legal money of the state

00:05:55:02 – 00:05:57:22

and they cannot help

but think that at some point

00:05:57:22 – 00:06:01:04

it must regain some of its former glory,

which

00:06:01:04 – 00:06:04:10

it never does, because by design

00:06:04:12 – 00:06:08:07

being debt based in the interest

you have to pay on that debt

00:06:08:12 – 00:06:13:20

and the ability of central banks

to print us into oblivion.

00:06:13:22 – 00:06:16:15

See, there’s lots

and lots of data on this.

00:06:16:15 – 00:06:21:07

It is the same old story

over and over again, which also means

00:06:21:07 – 00:06:25:17

that there are repeatable patterns

that if you can learn how to see them,

00:06:25:19 – 00:06:31:21

you can make different choices

and not be subject to this great taking.

00:06:31:23 – 00:06:32:07

And then

00:06:32:07 – 00:06:38:05

finally, the money control system

breaks down at the end of a monetary

00:06:38:05 – 00:06:42:22

super cycle

with collapse in the velocity of money.

00:06:43:00 – 00:06:44:17

So let’s examine that.

00:06:44:17 – 00:06:47:23

This is something that we’ve talked

about a lot, and it’s also something

00:06:47:23 – 00:06:52:10

I said

when this shift occurs in a pervasive way,

00:06:52:12 – 00:06:56:21

then I believe we will be at the beginning

of the hyperinflationary cycle.

00:06:57:02 – 00:06:59:16

So we’re going to look at that right now.

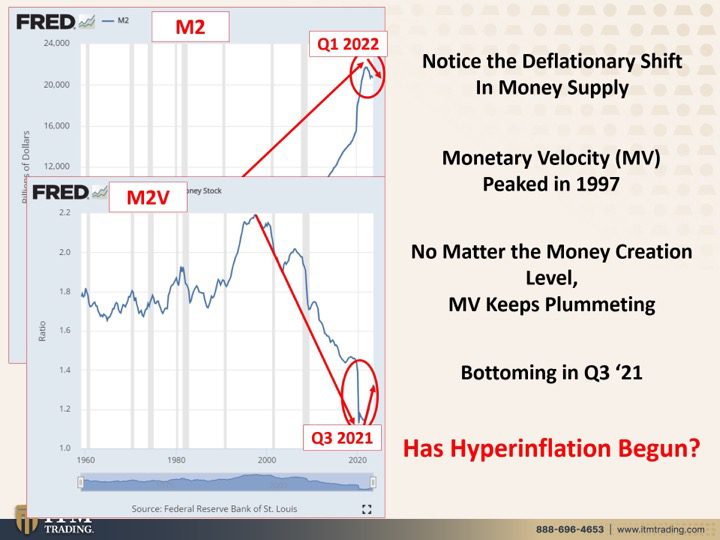

00:06:59:16 – 00:07:04:15

And what you’re looking at here

is the M2, the money supply.

00:07:04:15 – 00:07:06:09

It’s not the total money supply.

00:07:06:09 – 00:07:10:05

They took that away from us,

the M3 in 2006.

00:07:10:07 – 00:07:13:07

But the M2 will just use as a proxy.

00:07:13:07 – 00:07:17:02

And you can see how much and how quickly

00:07:17:04 – 00:07:20:00

we have printed money into oblivion.

00:07:20:00 – 00:07:24:03

But look at what we’re facing right now,

00:07:24:04 – 00:07:28:11

which is a decline in the M2.

00:07:28:13 – 00:07:31:20

So money is actually

when they’re tightening.

00:07:32:00 – 00:07:37:21

Do you see anything that looks like that

leading up to this point?

00:07:37:21 – 00:07:44:02

And this is from 1960,

and that would be an absolute no.

00:07:44:04 – 00:07:48:13

So notice the deflationary shift

in the money supply.

00:07:48:15 – 00:07:51:10

This is a pattern shift.

00:07:51:10 – 00:07:53:05

It is any indication,

00:07:53:05 – 00:07:57:03

even if you don’t know what it means,

it doesn’t really matter.

00:07:57:05 – 00:08:01:08

What this tells you is things have changed

00:08:01:08 – 00:08:04:19

or are changing

or in the process of changing.

00:08:04:21 – 00:08:08:19

This is a heads up

that we have entered a new part.

00:08:08:19 – 00:08:13:19

And I think the beginning

of the hyperinflation, even though

00:08:13:21 – 00:08:19:09

the IMF came out and said, look at this,

the Fed has engineered a soft landing.

00:08:19:11 – 00:08:22:11

zip a dee doo dah. Great, great day.

00:08:22:11 – 00:08:24:23

This is not over yet.

00:08:24:23 – 00:08:28:14

And the IMF is just doing their job,

00:08:28:14 – 00:08:32:04

which is to keep you comfortable

and keep you in the system.

00:08:32:08 – 00:08:33:14

It ain’t over yet.

00:08:33:14 – 00:08:37:05

It ain’t over by a mile yet

because this debt

00:08:37:05 – 00:08:42:08

supercycle is over and the central bank’s

popped it themselves.

00:08:42:10 – 00:08:47:22

Now what you’re looking at here

is the velocity of the money supply.

00:08:47:22 – 00:08:53:13

And it was in 1997

when we hit our peak right there.

00:08:53:15 – 00:08:56:21

And you can see how much

that has declined.

00:08:56:21 – 00:09:01:01

And I tried to line this up

so that you could see

00:09:01:03 – 00:09:05:07

that one is coordinated

with the with the other,

00:09:05:09 – 00:09:08:07

because up until the recent shift,

00:09:08:07 – 00:09:14:12

no matter how much money

they pushed into the system,

00:09:14:14 – 00:09:15:20

the velocity of

00:09:15:20 – 00:09:18:23

money, the times that the number of times

00:09:18:23 – 00:09:23:02

that money changes

hands has been plummeting.

00:09:23:04 – 00:09:26:10

So it’s like pushing on a string

and it takes more.

00:09:26:10 – 00:09:31:12

And we’ve seen this certainly through

all of the money printing in the QE,

00:09:31:13 – 00:09:36:21

no matter how much more they did,

it really didn’t move the envelope enough.

00:09:36:21 – 00:09:39:11

And it’s like any other kind of drug.

00:09:39:11 – 00:09:44:12

The more you take,

the more you need just to feel normal.

00:09:44:16 – 00:09:50:02

So the more that it’s taken of the money

printing to make things appear normal.

00:09:50:06 – 00:09:51:19

But they’re not normal.

00:09:51:19 – 00:09:55:20

And now you can see this shift

00:09:55:21 – 00:09:59:13

where money is changing hands

a lot more quickly.

00:09:59:15 – 00:10:04:09

Part of that is due to the inflation

that we’ve been experiencing.

00:10:04:11 – 00:10:08:17

You know, if they can keep it at 2%,

then they’re still getting

00:10:08:17 – 00:10:12:06

a decline in the purchasing power

value of the currency.

00:10:12:08 – 00:10:14:01

But you don’t notice it.

00:10:14:01 – 00:10:19:21

You don’t make changes in

asking for more money from your job

00:10:19:23 – 00:10:24:17

or even in the choices that you make

and how you spend your money.

00:10:24:19 – 00:10:29:02

But when inflation happens noticeably,

00:10:29:04 – 00:10:31:21

you start to make the different changes.

00:10:31:21 – 00:10:37:07

And you can see from here

that changes are definitely

00:10:37:10 – 00:10:41:03

being made

and I want you to notice something.

00:10:41:05 – 00:10:41:20

Okay.

00:10:41:20 – 00:10:46:07

This peak hit in the first quarter of 22.

00:10:46:09 – 00:10:49:09

Well, when did the shift in money

spending happen?

00:10:49:09 – 00:10:53:04

And that was in the third quarter of 2021.

00:10:53:06 – 00:10:58:09

So the shift had already taken place

00:10:58:11 – 00:11:02:08

with more money chasing fewer goods.

00:11:02:10 – 00:11:06:03

And this is why I’m telling you, hey,

I could be wrong, right?

00:11:06:03 – 00:11:08:22

This is not something

that’s within my control.

00:11:08:22 – 00:11:13:22

But I’ve been in these markets

on some level since 1964,

00:11:14:00 – 00:11:17:11

and I’ve been a stockbroker,

I’ve been a banker, I’ve paid attention

00:11:17:11 – 00:11:22:04

to currency issues and the lifecycle

of currencies since 1987.

00:11:22:10 – 00:11:24:19

And I’m telling you, we are at the end.

00:11:24:19 – 00:11:26:03

There’s no doubt in my mind.

00:11:26:03 – 00:11:29:05

That’s why I’ve done everything

that I’ve done with my urban

00:11:29:05 – 00:11:33:01

farm in the bug out location

and everything else.

00:11:33:03 – 00:11:35:09

No more procrastinating.

00:11:35:09 – 00:11:39:16

If you haven’t clicked that cowardly

link yet and set up a time to get your own

00:11:39:16 – 00:11:43:12

personal strategy in place,

I suggest you do it today.

00:11:43:15 – 00:11:48:02

Now, this moment,

00:11:48:04 – 00:11:49:03

because I

00:11:49:03 – 00:11:52:20

can’t

tell you when all choices will be lost.

00:11:52:22 – 00:11:55:23

We’re seeing spot over 2000 bucks

announced.

00:11:55:23 – 00:12:00:02

It’s still dirt

cheap to its fundamental value.

00:12:00:04 – 00:12:02:21

So again, it bottomed.

00:12:02:21 – 00:12:08:09

The monetary velocity

bottomed in Q3 of 2021.

00:12:08:15 – 00:12:11:21

And then we saw the shift after that

00:12:11:23 – 00:12:15:11

in Q1 of 2022.

00:12:15:13 – 00:12:18:13

In the money that’s in the system.

00:12:18:18 – 00:12:22:13

Personally, I think the hyperinflation

has already begun

00:12:22:15 – 00:12:26:08

and all of this is smoke and mirrors

that you’re seeing around there,

00:12:26:10 – 00:12:31:16

the IMF coming out and saying,

look at the Fed, no recession.

00:12:31:18 – 00:12:34:02

We have not felt

00:12:34:02 – 00:12:37:02

how bad this is going to be.

00:12:37:03 – 00:12:41:14

But the more they protest me

thinks they protest too much.

00:12:41:16 – 00:12:43:00

They know what I’m showing you.

00:12:43:00 – 00:12:45:10

They know even more than that.

00:12:45:10 – 00:12:50:04

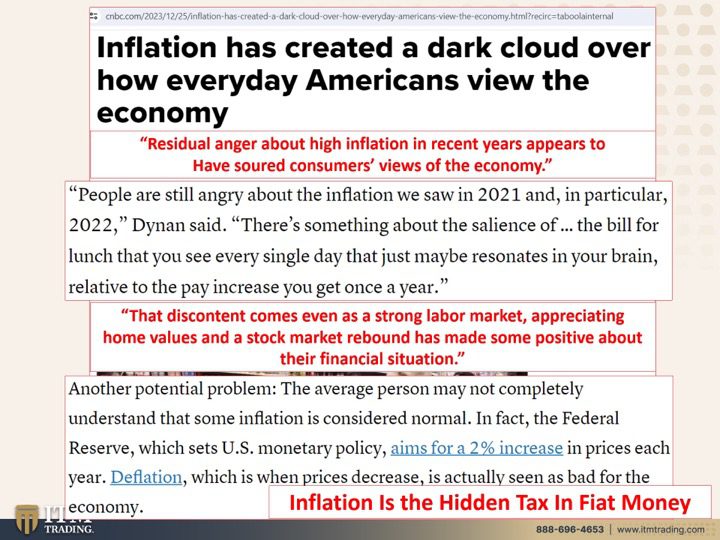

But the reality is, is that inflation

has created a dark cloud over

00:12:50:04 – 00:12:54:22

how everyday Americans view the economy

because they’re the ones that are paying

00:12:54:22 – 00:13:00:22

attention to the gas prices, to the food

prices, and maybe having to make choices

00:13:01:00 – 00:13:05:07

on whether or not they put

food in the farm on the family table

00:13:05:12 – 00:13:10:14

or gas in the car to get to work or not

get to work or or what have you.

00:13:10:18 – 00:13:12:21

So they want us to think one thing.

00:13:12:21 – 00:13:19:05

But I’m thinking that the American public

is starting to wake up to this

00:13:19:07 – 00:13:22:22

residual anger about high inflation

in recent years

00:13:22:22 – 00:13:27:08

appears to have soured

consumer views of the economy.

00:13:27:10 – 00:13:29:02

That’s not a good thing.

00:13:29:02 – 00:13:33:03

Since the consumer is 70% of the economy.

00:13:33:07 – 00:13:35:22

We need them to keep consuming.

00:13:35:22 – 00:13:42:06

People are still angry about the inflation

we saw in 2021 and in particular 2022.

00:13:42:08 – 00:13:46:15

There’s something about the salience

of the bill for lunch

00:13:46:18 – 00:13:52:20

that you see every single day

that just maybe resonates in your brain

00:13:52:20 – 00:13:56:19

relative to the pay increases

you get once a year.

00:13:56:20 – 00:14:00:04

So by design and from the beginning,

00:14:00:06 – 00:14:05:06

what why was the fiat money

set up in 1913 to begin with?

00:14:05:08 – 00:14:06:03

Number one,

00:14:06:03 – 00:14:10:15

because government wanted to tax you

without having to go through legislation.

00:14:10:18 – 00:14:13:20

And inflation

does that because they’re the ones that

00:14:13:20 – 00:14:18:10

get to use the money first

when it has the most value

00:14:18:10 – 00:14:21:18

by the time it trickles through the system

and we get it,

00:14:21:20 – 00:14:25:12

it has a far less purchasing power value.

00:14:25:14 – 00:14:30:14

And number two, corporations

want to pay you less, but they knew

00:14:30:14 – 00:14:33:21

if you’re used to getting ten bucks,

you’re not going to accept five.

00:14:33:23 – 00:14:39:07

But if they can make that

ten bucks, spend like five,

00:14:39:09 – 00:14:42:09

then you that creates that

00:14:42:11 – 00:14:47:12

nominal confusion in both cases

where you’re looking at a higher number.

00:14:47:12 – 00:14:49:07

So you think you’re getting more.

00:14:49:07 – 00:14:53:08

But inflation is moving much more quickly

than the raise in wages.

00:14:53:13 – 00:14:58:04

And so in reality,

corporations are paying you less and less.

00:14:58:10 – 00:15:02:19

And this is what has enabled

that wealth and income inequality.

00:15:02:21 – 00:15:06:22

But people are starting to wake up

and things are shifting.

00:15:06:22 – 00:15:11:09

And I hope they wake up fast enough

because we vote with our wallets.

00:15:11:09 – 00:15:13:15

And this is my vote.

00:15:13:15 – 00:15:17:19

The discontent comes

even as a strong labor market

00:15:17:21 – 00:15:21:23

appreciating home values

and the stock market rebound

00:15:22:02 – 00:15:26:06

has made some positive

about their financial situation

00:15:26:08 – 00:15:29:07

because there’s nothing more depressing

than opening up

00:15:29:07 – 00:15:33:22

your 401k statement

and seeing your holdings go down.

00:15:34:00 – 00:15:37:23

So if they can make things

appear to be going up,

00:15:38:01 – 00:15:42:01

then you feel wealthy,

you’re more likely to continue to spend.

00:15:42:03 – 00:15:46:09

But in reality, when you go to the

grocery store, when you go out for dinner,

00:15:46:14 – 00:15:50:19

when you go out for lunch

and you see those new prices,

00:15:50:21 – 00:15:55:17

I mean, doesn’t

it give you cause for pause?

00:15:55:19 – 00:15:56:10

Doesn’t that

00:15:56:10 – 00:15:59:10

make you

wonder what’s really happening here?

00:15:59:10 – 00:16:03:22

And if you understand the truth,

because the truth is, is we’re at the end

00:16:03:22 – 00:16:08:18

of of this whole fiat money

experiment at the end.

00:16:08:19 – 00:16:12:00

Another potential problem,

the average person

00:16:12:03 – 00:16:17:13

may not completely understand

that some inflation is considered normal.

00:16:17:16 – 00:16:21:07

Who’s considered normal buy

because inflation is not

00:16:21:07 – 00:16:25:11

a monetary phenomena

and it’s a fiat money phenomenon.

00:16:25:11 – 00:16:29:14

It’s by design

because because inflation creates

00:16:29:14 – 00:16:33:22

nominal confusion,

nominal confusion is really simple.

00:16:34:00 – 00:16:37:08

You had a $20 bill a year ago,

you got a $20 bill.

00:16:37:08 – 00:16:40:16

Today, it’s the same $20 bill.

00:16:40:18 – 00:16:43:15

But what that $20 bill bought you

00:16:43:15 – 00:16:47:18

a year ago, six months ago, a week ago,

and what it buys

00:16:47:18 – 00:16:51:12

you today is vastly, vastly different.

00:16:51:14 – 00:16:54:10

That’s where your gold comes in, because

00:16:54:10 – 00:16:57:19

gold holds

your purchasing power over time.

00:16:58:01 – 00:16:59:06

They can manipulate it.

00:16:59:06 – 00:17:01:22

They can make it

look this way or that way.

00:17:01:22 – 00:17:04:18

The truth

lies in the physical only markets

00:17:04:18 – 00:17:08:18

where you can see these coins making

00:17:08:20 – 00:17:11:14

new highs,

and especially in the ultra rarities,

00:17:11:14 – 00:17:14:11

which are where the one percenters

hang out.

00:17:14:11 – 00:17:17:21

But okay, some inflation is considered

00:17:17:21 – 00:17:21:01

normal by central banks

00:17:21:03 – 00:17:24:05

and in fact, the Federal Reserve,

which sets U.S.

00:17:24:05 – 00:17:29:19

monetary policy, aims

for a 2% increases in prices each year.

00:17:29:20 – 00:17:33:01

That’s

so that it’s low enough that you don’t ask

00:17:33:01 – 00:17:36:09

for more money

and you don’t make any of those changes.

00:17:36:11 – 00:17:39:06

Deflation is when prices decrease.

00:17:39:06 – 00:17:43:08

It actually seen as bad for the economy

00:17:43:10 – 00:17:46:02

because have we not witnessed that?

00:17:46:02 – 00:17:49:22

It is very important for banks

to make a profit, for corporations

00:17:49:22 – 00:17:53:22

to make a profit,

and for the public to eat it on the chin?

00:17:53:23 – 00:17:56:05

Have we not seen that over

00:17:56:05 – 00:17:59:05

and over and over again?

00:17:59:07 – 00:18:00:05

Deflation.

00:18:00:05 – 00:18:05:07

If you have more money to buy goods and

services, why is that a bad thing for you?

00:18:05:09 – 00:18:08:07

But the reality is, is

there’s only one way

00:18:08:07 – 00:18:11:18

to fight inflation,

and that’s with deflation

00:18:11:20 – 00:18:16:07

and only one way to fight deflation,

and that’s with inflation.

00:18:16:09 – 00:18:19:09

And the way the system has been set up,

00:18:19:11 – 00:18:23:23

it’s deflationary and you can see that

from the decline in interest

00:18:24:01 – 00:18:27:10

from the seventies to the eighties, etc..

00:18:27:12 – 00:18:31:03

And so, yeah, you use the the inflation

00:18:31:03 – 00:18:35:11

and to counter that and interest rates

were the key tool

00:18:35:11 – 00:18:39:09

in regulating the rate

and speed of inflation.

00:18:39:11 – 00:18:42:03

So when interest rates were anchored

00:18:42:03 – 00:18:47:08

for 15 years at zero

00:18:47:10 – 00:18:49:02

and encouraged

00:18:49:02 – 00:18:51:23

so much debt

00:18:51:23 – 00:18:56:06

from governments,

from corporations, from individuals,

00:18:56:08 – 00:18:59:08

well if your income keeps pace with it

00:18:59:10 – 00:19:03:10

and the confidence is retained

in the currency,

00:19:03:12 – 00:19:05:13

you can make it last a long time.

00:19:05:13 – 00:19:08:20

And so people get used to it

like that’s the norm.

00:19:08:22 – 00:19:13:04

But the reality is

00:19:13:06 – 00:19:16:06

it’s a Ponzi scheme

00:19:16:09 – 00:19:18:17

and in the end of it,

00:19:18:17 – 00:19:22:05

whatever assets that you hold, well,

00:19:22:07 – 00:19:26:21

you better have a strategy

on how to pay that wealth off immediately,

00:19:26:23 – 00:19:31:01

because if you’re counting on this to do

it, it’s not going to do it.

00:19:31:03 – 00:19:35:23

Not if this is what you’re holding on to,

if you’re counting on this to do it.

00:19:36:01 – 00:19:39:23

And then when you need to pay off

that mortgage or the other fixed rate debt

00:19:39:23 – 00:19:44:01

that you have,

you convert it into there at that time.

00:19:44:03 – 00:19:45:14

Guess what?

00:19:45:14 – 00:19:47:15

That’s the government strategy.

00:19:47:15 – 00:19:51:01

You get to repay that debt with dollars

00:19:51:01 – 00:19:55:07

that have virtually no value.

00:19:55:09 – 00:20:00:10

So it might take 100,000 today.

00:20:00:12 – 00:20:03:16

I’m going to show you this

because there was another just recent

00:20:03:16 – 00:20:07:17

devaluation and I’m going to show you

what that looks like yet again.

00:20:07:19 – 00:20:09:13

But you get to repay.

00:20:09:13 – 00:20:13:12

You liquidate as much as you need to,

and you repay that debt

00:20:13:14 – 00:20:18:07

and it’ll cost you a whole lot

less tomorrow if you’re in the right place

00:20:18:12 – 00:20:22:23

at the right time with the right asset,

then it does today,

00:20:23:00 – 00:20:26:04

because the reality is, is inflation,

00:20:26:08 – 00:20:29:05

is that hidden tax in fiat money?

00:20:29:05 – 00:20:34:19

And it is absolutely what has enabled

that wealth inequality.

00:20:34:21 – 00:20:40:07

But even so,

if everything is built on debt,

00:20:40:09 – 00:20:45:01

when things go candy warps

and you can’t repay that debt,

00:20:45:03 – 00:20:49:10

then it becomes a domino effect

because it doesn’t just impact you,

00:20:49:12 – 00:20:53:03

but it impacts the lenders,

whoever loan that money to you.

00:20:53:08 – 00:20:56:19

If the collateral is now worth less

00:20:56:21 – 00:21:00:21

than the debt

that you have on that collateral,

00:21:00:23 – 00:21:03:10

you’re not even going to want to pay it.

00:21:03:10 – 00:21:07:00

And then if it impacts the lenders,

then it’s harder to generate

00:21:07:00 – 00:21:11:07

even more debt, which is what

this whole system is based on.

00:21:11:09 – 00:21:14:01

Can you see the problem?

00:21:14:01 – 00:21:15:22

And that’s what they’re talking about.

00:21:15:22 – 00:21:20:19

The talking about the taking

of all of that collateral.

00:21:20:21 – 00:21:24:18

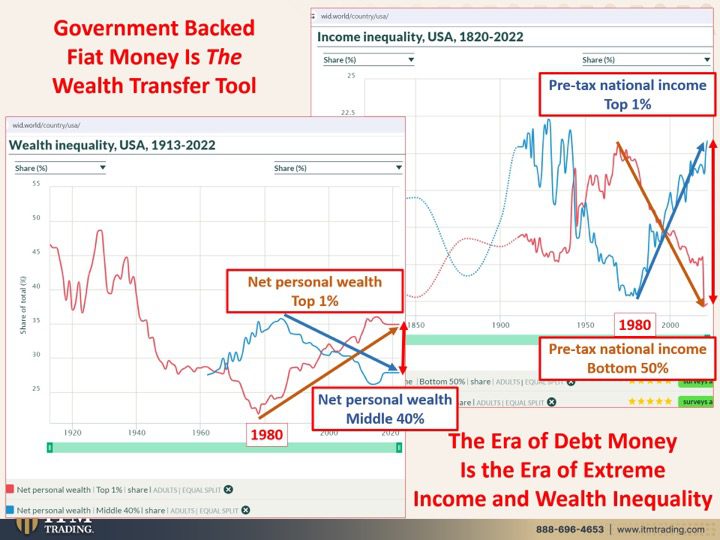

Government backed fiat money is the wealth

00:21:24:20 – 00:21:28:11

transfer tool

because they knew that people

00:21:28:11 – 00:21:32:11

marry legal of the money,

the legal money of the state.

00:21:32:13 – 00:21:34:20

This is what we’re talking about.

00:21:34:20 – 00:21:38:03

What you’re looking at here

is income inequality

00:21:38:08 – 00:21:42:17

from 1820 through 2022.

00:21:42:19 – 00:21:45:15

Here’s where it bottomed in 1980.

00:21:45:15 – 00:21:49:05

So the shift to take us

and put us on a purely debt based

00:21:49:05 – 00:21:54:21

standard with the central banks

and control occurred in 1971.

00:21:54:23 – 00:22:01:14

Then we bottomed out in 1980 or this is

this is the 1%.

00:22:01:16 – 00:22:04:09

Let me put that in there. Okay.

00:22:04:09 – 00:22:07:00

So the

00:22:07:02 – 00:22:09:16

sort of burnt orange line

00:22:09:16 – 00:22:15:09

is pretax national income

returns on the bottom 50%.

00:22:15:10 – 00:22:19:01

So in the purchasing power,

we peaked in 1980.

00:22:19:01 – 00:22:22:10

That was the most purchasing power

that you had.

00:22:22:15 – 00:22:27:16

And you can see how drastically that’s

changed through 2022.

00:22:27:18 – 00:22:30:18

And that straight line down there.

00:22:31:00 – 00:22:32:04

Thank you. Inflation.

00:22:32:04 – 00:22:35:15

It became apparent to all the blue line

00:22:35:15 – 00:22:39:19

is the pretax national

income of the top 1%.

00:22:39:21 – 00:22:42:13

So the debt based system

00:22:42:13 – 00:22:46:06

put in place in 1971

00:22:46:08 – 00:22:49:05

kicked into gear in the early eighties.

00:22:49:05 – 00:22:54:17

And for those of us that were alive

then, you might recall the greedy eighties

00:22:54:19 – 00:22:58:21

and so this is as they were making

the transition and it happens every time

00:22:59:02 – 00:23:03:18

you allow a group to make a lot of money

and to be very, very visible.

00:23:03:20 – 00:23:05:02

And then they don’t realize

00:23:05:02 – 00:23:09:14

is that anything is changed

when in reality everything has changed

00:23:09:16 – 00:23:14:12

and we are already going through this

change because how do you go below zero?

00:23:14:12 – 00:23:18:10

I mean, that’s the question that I keep

answering asking, and I’m not hearing

00:23:18:10 – 00:23:21:10

anybody really answer that question

00:23:21:12 – 00:23:24:12

because they’re not paying attention

to the purchasing power.

00:23:24:12 – 00:23:30:02

The purchasing

power is essentially at zero.

00:23:30:04 – 00:23:32:03

So let’s take a look

00:23:32:03 – 00:23:36:01

at this, which is wealth inequality

at the same time.

00:23:36:01 – 00:23:41:17

Well, this is from 1913 to 2022.

00:23:41:19 – 00:23:42:04

Okay.

00:23:42:04 – 00:23:44:16

Now, this is the net.

00:23:44:16 – 00:23:48:13

Let’s

see the net personal wealth of the top 1%.

00:23:48:18 – 00:23:53:05

Again, it bottomed in 1980

00:23:53:07 – 00:23:55:19

and it has grown quite

00:23:55:19 – 00:23:59:10

nicely ever since,

thanks to all of that debt.

00:23:59:15 – 00:24:04:11

Now, what’s really interesting is

how much of those assets

00:24:04:13 – 00:24:07:13

are still tethered to debt

00:24:07:15 – 00:24:13:18

because ultimately all of those assets

are going to come back on to the market

00:24:13:20 – 00:24:17:10

for whoever

is holding their purchasing power.

00:24:17:12 – 00:24:18:08

Right.

00:24:18:08 – 00:24:22:23

What I’m trying to talk to you into

is taking advantage of the opportunity.

00:24:22:23 – 00:24:26:23

We can’t get out of the way,

but you can get into a position to retain

00:24:26:23 – 00:24:30:21

the wealth you’ve already accumulated

and to grow your wealth base

00:24:31:02 – 00:24:35:15

if you’re in the right place

at the right time with the right asset.

00:24:35:17 – 00:24:36:05

Right.

00:24:36:05 – 00:24:39:10

And that’s just a repetition of history

as well.

00:24:39:12 – 00:24:42:08

So net personal wealth of the top

00:24:42:08 – 00:24:47:02

1% has grown quite nicely since 1980

00:24:47:03 – 00:24:53:23

and declined

quite nicely for the middle 40%

00:24:54:01 – 00:24:57:05

at the

same time zone are the same time frame.

00:24:57:07 – 00:25:01:08

And what you need to understand

is that wealth never disappears.

00:25:01:13 – 00:25:04:13

It merely shifts location.

00:25:04:13 – 00:25:09:11

So you can see it went from the many

00:25:09:13 – 00:25:11:14

to the few.

00:25:11:14 – 00:25:15:22

It went from the many,

00:25:16:00 – 00:25:19:00

the many to the few.

00:25:19:01 – 00:25:22:01

This whole system has what’s enabled

00:25:22:02 – 00:25:25:18

income and wealth inequality.

00:25:25:20 – 00:25:29:14

Make no mistake about it,

00:25:29:16 – 00:25:32:20

the era of debt

money is the era of extreme

00:25:32:20 – 00:25:38:14

income and wealth inequality

even worse than it was 1929.

00:25:38:16 – 00:25:40:00

Quite honestly.

00:25:40:00 – 00:25:42:12

And they were kicking that system off.

00:25:42:12 – 00:25:43:20

That was the beginning.

00:25:43:20 – 00:25:46:11

This is the end.

00:25:46:11 – 00:25:47:07

Argentina.

00:25:47:07 – 00:25:51:02

I want to talk a little bit a bit

about Argentina, because it’s a great

00:25:51:02 – 00:25:55:18

example of what is coming in

our relatively near future.

00:25:55:18 – 00:25:58:15

I can’t tell you exactly when,

but it’s coming.

00:25:58:15 – 00:26:02:17

Argentine is a starts shock therapy

00:26:02:19 – 00:26:06:22

by devaluing the peso by 50%.

00:26:07:00 – 00:26:10:06

Wow. That’s pretty shocking.

00:26:10:08 – 00:26:13:06

Shock therapy already did that.

00:26:13:06 – 00:26:15:06

Who does this really hurt?

00:26:15:06 – 00:26:17:12

Who’s really shocked the most?

00:26:17:12 – 00:26:19:08

People that don’t sit in gold.

00:26:19:08 – 00:26:21:15

I’m going to show you that in a second.

00:26:21:15 – 00:26:24:12

But your salary in the private sector,

00:26:24:12 – 00:26:27:08

in the public sector, in the popular

00:26:27:08 – 00:26:32:21

in social and solidaire economy,

in the co-operative or informal sector

00:26:32:21 – 00:26:36:00

for retirees and pensioners, will you

00:26:36:00 – 00:26:39:19

you will get half in the supermarket.

00:26:39:21 – 00:26:44:04

Do you really think that people

are not going to protest?

00:26:44:06 – 00:26:48:10

Are we on the verge of a global revolt?

00:26:48:12 – 00:26:49:09

That’s my hope.

00:26:49:09 – 00:26:52:16

I mean, I hope that it is a nonviolent

00:26:52:18 – 00:26:53:18

revolt and we

00:26:53:18 – 00:26:56:21

can do

that just by voting with our wallets,

00:26:56:21 – 00:27:00:12

just by buying gold and silver

and getting your wealth out of the system.

00:27:00:16 – 00:27:06:15

We’re at least get it properly,

properly balanced, so that if everything

00:27:06:15 – 00:27:10:17

you hold in the stock market, in the bond

market goes away, this goes up.

00:27:10:17 – 00:27:13:10

And so you have maintained your wealth.

00:27:13:10 – 00:27:16:00

Again, if you have not clicked

that Cowlersley link

00:27:16:00 – 00:27:20:22

and gotten your strategy in place,

get it in place and the sooner the better,

00:27:21:00 – 00:27:23:10

because by design

00:27:23:10 – 00:27:26:19

when they do this, it’s

those that are not holding gold.

00:27:26:21 – 00:27:29:21

So the most vulnerable,

00:27:29:22 – 00:27:32:17

they’re the ones that suffer the most.

00:27:32:17 – 00:27:36:21

Just keep in mind

you vote with your wallet, food, water,

00:27:36:21 – 00:27:41:20

energy, security, barter, ability,

wealth preservation, community in shelter.

00:27:41:22 – 00:27:48:01

You got to have these things in order to

sustain a reasonable standard of living.

00:27:48:05 – 00:27:51:20

And I’ve got to remind you of this,

because how can they take all of this

00:27:51:20 – 00:27:54:03

wealth and and, you know, read the book.

00:27:54:03 – 00:27:55:07

It was a great read.

00:27:55:07 – 00:27:58:20

And and like I said, Taylor

is going to break it down even further.

00:27:59:02 – 00:28:04:19

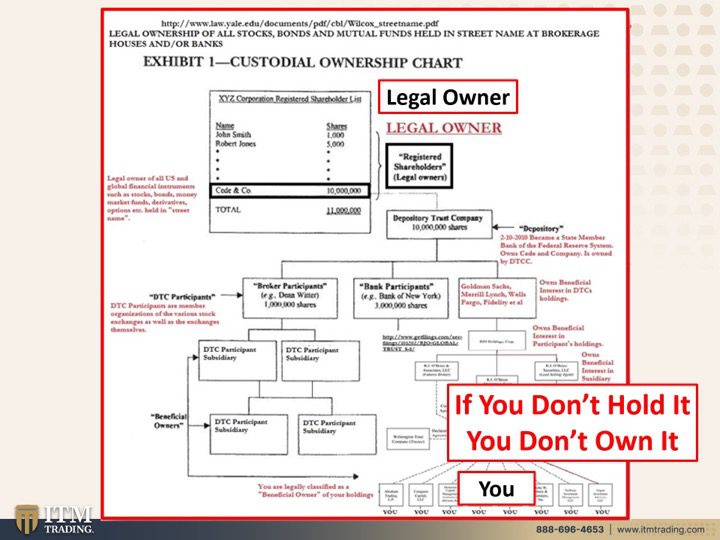

But I wanted to remind

you of really who legally

00:28:04:21 – 00:28:08:02

owns all of these fiat money

00:28:08:04 – 00:28:12:06

assets because it’s not you.

00:28:12:08 – 00:28:15:18

The legal owner is up here at the top

and it’s

00:28:15:18 – 00:28:19:12

C, then company, D, D, c, C,

and who owns that?

00:28:19:12 – 00:28:24:00

But all these small banking conglomerates,

they’re the ones that own it.

00:28:24:06 – 00:28:26:15

They’re the legal registered owner.

00:28:26:15 – 00:28:29:13

That’s the only owner

that is acknowledged.

00:28:29:13 – 00:28:34:05

That Court

You are way down here on the bottom.

00:28:34:07 – 00:28:37:23

So you make all of those deposits

and take all of those risks.

00:28:37:23 – 00:28:40:23

But everybody between here,

00:28:41:00 – 00:28:46:02

you’re just the beneficial owner

and so is everybody in between.

00:28:46:04 – 00:28:50:04

So when they’re talking about that

great taking, that’s why

00:28:50:05 – 00:28:54:23

all of that collateral is vulnerable

00:28:55:01 – 00:28:57:13

because it’s done on debt.

00:28:57:13 – 00:29:01:21

And even let’s talk about

residential real estate for a minute.

00:29:02:01 – 00:29:04:00

Let’s say your house is paid off,

00:29:04:00 – 00:29:06:16

which a lot of people’s

homes are paid off, thank goodness.

00:29:06:16 – 00:29:07:04

So you’re saying.

00:29:07:04 – 00:29:11:12

Well, I’m not doing that on debt,

but cities, states,

00:29:11:14 – 00:29:16:16

municipalities,

how do they generate income taxes?

00:29:16:21 – 00:29:19:03

And real estate is immovable.

00:29:19:03 – 00:29:24:03

You cannot put it on your back and

walk away with it and go somewhere else.

00:29:24:04 – 00:29:28:10

So you have to make sure that you have

and I don’t do it with this.

00:29:28:10 – 00:29:29:20

There’s another tool that I use.

00:29:29:20 – 00:29:32:05

I do it with gold.

There’s different kinds of gold.

00:29:32:05 – 00:29:36:11

There’s different levels of gold depending

upon what you need to accomplish.

00:29:36:16 – 00:29:41:07

But the strategy that we execute

can determine the most likely

00:29:41:07 – 00:29:46:17

amount of gold in the different forms

that you need to be able to

00:29:46:19 – 00:29:48:13

pay off your mortgage,

00:29:48:13 – 00:29:52:05

pay your property taxes, etc..

00:29:52:06 – 00:29:56:03

So it’s critically important

that you get this in.

00:29:56:03 – 00:30:01:05

You get into place as quickly as you can,

because as I showed you in the monetary

00:30:01:05 – 00:30:05:03

velocity chart, things are shifting

00:30:05:04 – 00:30:07:10

things are changing,

00:30:07:10 – 00:30:10:01

and we don’t know the exact moment

00:30:10:01 – 00:30:13:00

when all choice will be lost.

00:30:13:00 – 00:30:18:03

But what we do know, thanks to this Yale

Law Study,

00:30:18:05 – 00:30:20:01

is that you

00:30:20:01 – 00:30:24:04

are not the legal registered owner

of those fiat money products,

00:30:24:06 – 00:30:28:15

and you can only convert them back

into this garbage.

00:30:28:17 – 00:30:29:10

Right.

00:30:29:10 – 00:30:35:13

Which means that when all confidence

in the currency is gone, you have nothing.

00:30:35:15 – 00:30:36:18

Nothing.

00:30:36:18 – 00:30:40:10

And are you ready to work

from scratch again?

00:30:40:10 – 00:30:44:02

Because of what they have in

mind, they get to pull off.

00:30:44:04 – 00:30:46:05

Yeah.

00:30:46:05 – 00:30:48:22

The reality is

00:30:48:22 – 00:30:53:01

if you don’t hold it, you don’t own it.

00:30:53:03 – 00:30:58:01

And all of that collateral,

all that’s been used by God knows how many

00:30:58:01 – 00:31:03:09

companies between you and the legal owner

think back to 2008.

00:31:03:11 – 00:31:08:01

What happened was disgusting,

evil, despicable and everything else.

00:31:08:07 – 00:31:09:19

But who went to jail?

00:31:09:19 – 00:31:11:22

No one,

00:31:11:22 – 00:31:14:09

because they’re the ones

that write these contracts

00:31:14:09 – 00:31:17:09

on this stuff.

00:31:17:10 – 00:31:19:19

And you don’t read the contracts.

00:31:19:19 – 00:31:23:01

But the reality is you got to hold it.

00:31:23:03 – 00:31:24:12

You got to own it.

00:31:24:12 – 00:31:29:06

And gold is the only financial asset

that runs no counterparty risk.

00:31:29:08 – 00:31:36:03

Everything else, everything else is

counterparty risk and is being used

00:31:36:03 – 00:31:41:01

as collateral, which will evaporate

from one hand to the other.

00:31:41:02 – 00:31:41:20

Remember?

00:31:41:20 – 00:31:44:08

Well, never disappears.

00:31:44:08 – 00:31:46:20

It merely shifts location.

00:31:46:20 – 00:31:50:01

And I’ve had people. Question

00:31:50:03 – 00:31:51:21

Well, Lynnette, how do you know that

00:31:51:21 – 00:31:55:18

they’re going to revalue

the currency against gold?

00:31:55:20 – 00:31:57:20

Well, number one,

00:31:57:20 – 00:32:00:20

because gold is the primary

currency metal.

00:32:01:00 – 00:32:04:00

And we’ve been watching

global central banks

00:32:04:02 – 00:32:07:17

amass more gold than they ever have since.

00:32:07:17 – 00:32:10:17

Tracking

of how much they’re accumulating began.

00:32:10:18 – 00:32:14:12

They’re getting ready

for resetting the currencies.

00:32:14:14 – 00:32:17:14

Number two, because gold

00:32:17:14 – 00:32:20:13

is 100% functionality

00:32:20:18 – 00:32:24:05

and 100% intrinsic value.

00:32:24:10 – 00:32:27:09

And I know that I’m repetitive

with a lot of this stuff,

00:32:27:15 – 00:32:31:18

but that’s because it takes

the normal person at least seven times

00:32:31:18 – 00:32:35:08

of hearing the same thing

before it begins to make sense.

00:32:35:10 – 00:32:38:12

This is all intrinsic value because it is

00:32:38:12 – 00:32:41:12

used in every single sector

of the global economy,

00:32:41:14 – 00:32:44:22

and they have never been able to recreate

00:32:45:00 – 00:32:48:09

its attributes in a lab.

00:32:48:11 – 00:32:52:15

So gold

And the same thing can be said for silver.

00:32:52:17 – 00:32:57:13

So gold and silver

are have the broadest base of buyer

00:32:57:17 – 00:33:01:22

and the broadest base of functionality.

00:33:02:00 – 00:33:03:20

And if you’re going to reset something

00:33:03:20 – 00:33:07:17

that has absolutely zero value,

00:33:07:19 – 00:33:10:00

you reset it again, something

00:33:10:00 – 00:33:13:11

that’s all value

00:33:13:13 – 00:33:16:13

and gold has been proven

00:33:16:16 – 00:33:21:15

over and over and over again

to have the confidence of the masses,

00:33:21:20 – 00:33:28:04

you look no further than what’s happening

in Zimbabwe with them issuing gold coins

00:33:28:08 – 00:33:32:13

and trying to do a gold backed cbdc,

which is cloudier.

00:33:32:15 – 00:33:33:17

Okay.

00:33:33:17 – 00:33:37:00

But they know that all confidence

in that currency

00:33:37:00 – 00:33:40:00

is lost

because of the ongoing hyperinflation,

00:33:40:04 – 00:33:45:17

because they don’t change behavior,

but they don’t change here or anywhere.

00:33:45:19 – 00:33:49:20

They just change how they account

for that behavior.

00:33:49:22 – 00:33:53:00

But going back to what we said

in the beginning with

00:33:53:00 – 00:33:57:13

with the normal public

being really disillusioned because

00:33:57:14 – 00:34:02:12

their experience is too in-your-face,

now they see it too much.

00:34:02:12 – 00:34:05:12

And to easily and that’s my hope,

00:34:05:17 – 00:34:10:17

is that enough

people wake up, vote with their wallets,

00:34:10:19 – 00:34:14:00

make sure that they have food,

water, energy, security,

00:34:14:00 – 00:34:17:08

barter, ability,

wealth preservation, community in shelter

00:34:17:08 – 00:34:23:02

so that they can sustain

a reasonable standard of living.

00:34:23:04 – 00:34:24:00

We can come

00:34:24:00 – 00:34:27:18

together in community and say no.

00:34:27:20 – 00:34:31:16

And as we’ve been learning from the gains

00:34:31:16 – 00:34:36:17

and the winds from the unions,

00:34:36:19 – 00:34:40:17

when enough people come together,

00:34:40:19 – 00:34:43:07

they’ve got to hear our voices.

00:34:43:07 – 00:34:44:19

So that’s my hope.

00:34:44:19 – 00:34:50:11

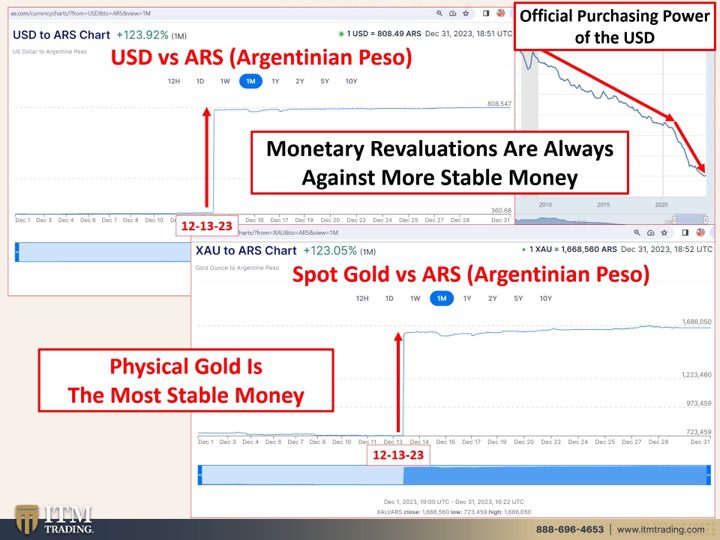

But let’s go back to here,

because this is the reset right?

00:34:50:13 – 00:34:52:02

And this is the U.S.

00:34:52:02 – 00:34:56:02

dollar versus the Argentinean peso.

00:34:56:04 – 00:34:58:13

Okay. So you can say, well, look at that.

00:34:58:13 – 00:35:02:10

They revalued the peso against the dollar

00:35:02:14 – 00:35:06:14

and look at the dollar

went bam, straight up.

00:35:06:19 – 00:35:08:12

That’s on 1213.

00:35:08:12 – 00:35:10:20

So just a couple weeks ago.

00:35:10:20 – 00:35:12:11

So look at this.

00:35:12:11 – 00:35:15:02

Doesn’t that mean that the dollar is good?

00:35:15:02 – 00:35:18:14

Well, again,

have you been out to eat lately?

00:35:18:15 – 00:35:21:10

Have you been to the grocery store lately?

00:35:21:10 – 00:35:24:07

So you’re trading one Fiat for the other.

00:35:24:07 – 00:35:28:20

And it’s this it’s the simple fact

that the Argentinean Pacer was

00:35:28:22 – 00:35:31:04

devalued overnight

00:35:31:06 – 00:35:34:22

and the US dollar was devalued.

00:35:35:00 – 00:35:36:18

Well,

00:35:36:18 – 00:35:39:20

with the inflation heating up, that’s

what made it noticeable.

00:35:40:02 – 00:35:44:22

But if they can keep it under that radar,

you stay in it and you don’t realize it.

00:35:45:03 – 00:35:48:11

And it really is like a spring

00:35:48:13 – 00:35:51:13

if you hold the spring down

because this is a suppression

00:35:51:13 – 00:35:54:13

of gold prices to its true

fundamental value

00:35:54:19 – 00:36:00:10

you hold that spring down when you release

that spring it shoots in a direction

00:36:00:15 – 00:36:04:16

and this is still not

the spring going to keep looking,

00:36:04:18 – 00:36:07:17

but it shoots in a direction

00:36:07:17 – 00:36:12:10

monetary reevaluations always

have to be against more stable money.

00:36:12:13 – 00:36:15:10

So at the moment

00:36:15:10 – 00:36:20:05

the dollar is a bit more stable

00:36:20:07 – 00:36:22:09

than the peso. Right?

00:36:22:09 – 00:36:26:02

And if I walk into your house

every night over 30 years

00:36:26:02 – 00:36:29:10

and I take one button

at the end of 30 years, I’m going to have

00:36:29:10 – 00:36:32:10

an awful lot of your buttons,

but you’re probably not going to notice.

00:36:32:13 – 00:36:36:16

If I go in tonight

and take 95% of your buttons tomorrow,

00:36:36:16 – 00:36:39:16

when you go to get dressed,

you’re probably going to notice that

00:36:39:19 – 00:36:43:03

that’s the difference

between inflation and hyperinflation.

00:36:43:05 – 00:36:47:00

That’s also the difference

between revaluing one currency against

00:36:47:00 – 00:36:52:01

another currency, which is a smokescreen

so that you don’t know what’s going on

00:36:52:07 – 00:36:57:02

and revaluing it against gold

because all you have to do

00:36:57:07 – 00:37:00:15

is look at the purchasing power of the US

00:37:00:15 – 00:37:05:00

dollar to see how much that’s declined

00:37:05:02 – 00:37:06:21

and it’s only going to get worse.

00:37:06:21 – 00:37:10:08

As I showed you in the monetary velocity,

00:37:10:10 – 00:37:11:12

Maybe I’m wrong.

00:37:11:12 – 00:37:12:18

I don’t think I’m wrong

00:37:12:18 – 00:37:14:00

and I’m not usually wrong

00:37:14:00 – 00:37:17:19

about those things because I’ve been

living in this arena forever.

00:37:17:21 – 00:37:20:20

My job is not to keep you in the system.

00:37:20:20 – 00:37:25:13

My job is to get you to protect yourself

from what they intend to do.

00:37:25:13 – 00:37:28:06

Because the more of us that understand

what’s happening

00:37:28:06 – 00:37:32:15

and move forward appropriately,

the more power we have collectively,

00:37:32:17 – 00:37:36:17

we have to come together in community

00:37:36:19 – 00:37:38:17

because that’s not getting better.

00:37:38:17 – 00:37:42:13

Now, this is spot gold versus

00:37:42:13 – 00:37:47:20

the Argentinean peso and in reality,

00:37:47:21 – 00:37:51:19

gold, physical gold is still worth

a whole lot more than that.

00:37:51:23 – 00:37:57:14

But you can see that it has the same kind

of initial price action

00:37:57:18 – 00:38:01:14

to a 50% revaluation.

00:38:01:16 – 00:38:03:17

Can you see it?

00:38:03:19 – 00:38:06:12

But physical gold is simply

00:38:06:12 – 00:38:11:09

the most stable money there is.

00:38:11:11 – 00:38:16:10

And if you want to know the US dollar

to the physical gold market,

00:38:16:15 – 00:38:19:18

I keep showing you

that which is making new highs,

00:38:20:00 – 00:38:24:10

especially where the one percenters

live in the ultra rarities.

00:38:24:12 – 00:38:27:00

So what are you going to do? Right?

00:38:27:00 – 00:38:29:18

What do you want to go into this

reset with?

00:38:29:18 – 00:38:32:22

You want to go into it with dollars.

00:38:33:01 – 00:38:37:10

And this is supposed to be I don’t know

00:38:37:12 – 00:38:43:16

the best horse in the glue factory, right?

00:38:43:18 – 00:38:46:02

Because here’s the opportunity.

00:38:46:02 – 00:38:49:02

If you hold your purchasing power

and this is what I really wanted

00:38:49:02 – 00:38:53:04

to talk to you about today,

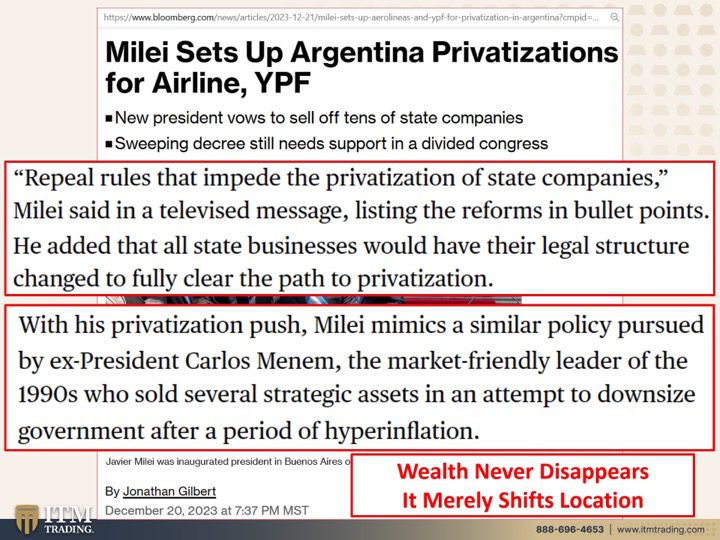

because melee sets up margins.

00:38:53:05 – 00:38:56:12

Argentina, privatizations,

00:38:56:14 – 00:39:01:00

privatizations

mean that you’re going to sell off assets

00:39:01:02 – 00:39:04:21

that the government holds to the public.

00:39:04:23 – 00:39:07:20

Like, I don’t know, let’s say the official

00:39:07:20 – 00:39:11:21

and the and the chief police station,

00:39:11:23 – 00:39:14:05

they’re going to sell them off

because they need the money

00:39:14:05 – 00:39:15:08

and then they’re going to turn around

00:39:15:08 – 00:39:18:16

and lose some back for you

because they need the police station.

00:39:18:18 – 00:39:20:21

Right. You see what I’m saying?

00:39:20:21 – 00:39:23:04

So opportunities are coming.

00:39:23:04 – 00:39:25:14

This is not the time to be doing this.

00:39:25:14 – 00:39:30:13

And your pockets are likely

not deep enough for this yet.

00:39:30:15 – 00:39:34:07

But history has shown us over

and over again

00:39:34:09 – 00:39:39:13

that these opportunities

will be will be up.

00:39:39:15 – 00:39:41:09

They’ll be so much of it.

00:39:41:09 – 00:39:44:09

If you can advantage of them.

00:39:44:12 – 00:39:46:14

Again, wealth never disappears.

00:39:46:14 – 00:39:48:10

It just shifts location.

00:39:48:10 – 00:39:51:16

So start looking at,

what would I like to own?

00:39:51:18 – 00:39:55:19

Because by the time we see that

cup formation on the bottom,

00:39:55:19 – 00:39:58:07

when things have bottomed out

and I’m going to show you that

00:39:58:07 – 00:40:03:01

because I’m going to show you when I’m

starting to shift some of my gold holdings

00:40:03:01 – 00:40:07:04

into these income producing assets

when they are undervalued.

00:40:07:07 – 00:40:10:00

Right now you have gold down here.

00:40:10:00 – 00:40:15:22

You have those other producing assets up

here, but that’s going to flip flop.

00:40:16:00 – 00:40:18:12

And once we see that cup formation,

00:40:18:12 – 00:40:22:03

that’s when we’re going to start

to convert somewhere near a bottom.

00:40:22:03 – 00:40:26:04

And frankly, if I ever get to the bottom

or out at a top, that’s luck.

00:40:26:09 – 00:40:29:09

I’m never looking

really looking to do that.

00:40:29:13 – 00:40:32:11

But I know how to read the signs

00:40:32:11 – 00:40:36:21

and that’s what we want to do. So

00:40:36:23 – 00:40:38:00

repeal rules.

00:40:38:00 – 00:40:43:06

So what they’re doing in order

to privatize and be able to sell this off

00:40:43:08 – 00:40:49:01

to private entities, private corporations,

individuals that they repeal

00:40:49:01 – 00:40:54:04

the rules that impede the private,

private ization of state companies

00:40:54:06 – 00:40:56:14

listing the reforms and bullet points.

00:40:56:14 – 00:41:01:16

He added that all state businesses

would have their legal structure changed

00:41:01:18 – 00:41:05:06

to fully clear the path to privatization.

00:41:05:08 – 00:41:07:13

That’s going to happen here as well.

00:41:07:13 – 00:41:10:10

With his privatization push, Melaye mimics

00:41:10:10 – 00:41:14:07

a similar policy pursued by ex

president, blah, blah, blah.

00:41:14:09 – 00:41:20:03

The market friendly leader of the 1990s

who sold several strategic assets

00:41:20:03 – 00:41:25:00

in an attempt to downsize government

after a period of hyperinflation.

00:41:25:02 – 00:41:28:09

This is a repetitive pattern.

00:41:28:11 – 00:41:33:13

You want to be in the right place

at the right time with the right asset.

00:41:33:15 – 00:41:39:01

This is what puts you in that position

because again, I can’t

00:41:39:01 – 00:41:40:23

I cannot repeat this.

00:41:40:23 – 00:41:43:17

Enough wealth never disappears.

00:41:43:17 – 00:41:45:13

It just shifts location.

00:41:45:13 – 00:41:49:00

If you bought a stock at 100

and it’s sitting at a buck,

00:41:49:01 – 00:41:50:17

that wealth didn’t disappear.

00:41:50:17 – 00:41:54:10

It just went to the person,

that soldier, that stock at 100.

00:41:54:12 – 00:41:58:17

Same thing

with all of these real estate assets.

00:41:58:19 – 00:42:00:08

Now, what’s going to survive?

00:42:00:08 – 00:42:04:01

Because we’re going through

a complete transformation

00:42:04:03 – 00:42:09:18

of the financial system,

the social system and the monetary system.

00:42:09:20 – 00:42:12:06

We don’t know that yet.

00:42:12:06 – 00:42:17:17

But we will moving into the future,

we will absolutely know.

00:42:17:19 – 00:42:21:23

And when we see that the smart money

has begun to accumulate,

00:42:22:04 – 00:42:27:09

like we’ve seen

the global central bankers do with gold,

00:42:27:11 – 00:42:28:14

that’s when we make our

00:42:28:14 – 00:42:31:14

shift and we do it straight logically.

00:42:31:16 – 00:42:34:05

So you should be thinking about that now

00:42:34:05 – 00:42:37:02

so that when the time comes, you’re ready.

00:42:37:02 – 00:42:41:09

But if you want to be ready, what

you should be doing is accumulating gold

00:42:41:11 – 00:42:43:23

and there are different kinds of gold.

00:42:43:23 – 00:42:45:09

So you want to accumulate.

00:42:45:09 – 00:42:47:21

In my opinion,

and what I’ve done personally,

00:42:47:21 – 00:42:52:08

not what I think you should do,

but what I’ve done personally is you want

00:42:52:10 – 00:42:56:18

I want to own the kind of gold

that is least likely

00:42:56:18 – 00:43:01:03

to be taken away from you,

or even if you say, Well, I’m

00:43:01:03 – 00:43:06:08

not going to turn in my gold,

I want the kind of gold that legally

00:43:06:10 – 00:43:10:18

I can use in the normal marketplace

to take advantage of these opportunities

00:43:10:20 – 00:43:13:13

that are coming.

00:43:13:15 – 00:43:15:00

Thank you, Uncle Al.

00:43:15:00 – 00:43:15:17

Seriously.

00:43:15:17 – 00:43:18:17

Thank you, Uncle Al,

because he was holding

00:43:18:18 – 00:43:21:12

at least 3000 ounces of gold

00:43:21:12 – 00:43:25:04

when it was in the right form,

00:43:25:06 – 00:43:29:01

when it was illegal

to hold more than five ounces

00:43:29:05 – 00:43:31:09

because he was holding it

in the right form.

00:43:31:09 – 00:43:33:04

The pre 30 threes.

00:43:33:04 – 00:43:37:06

And since gold spot

gold is so severely suppressed

00:43:37:06 – 00:43:39:12

and undervalued, it’s a bargain.

00:43:39:12 – 00:43:44:23

Even above 2000 an ounce, it should be

at least 15,000 an ounce minimum.

00:43:45:04 – 00:43:49:14

And I don’t know what that ratio

is going to be yet.

00:43:49:14 – 00:43:52:14

Nobody’s going to know it

until they announce it.

00:43:52:14 – 00:43:56:22

But you just saw in Argentina,

a 50% devaluation

00:43:56:22 – 00:43:59:22

is not going to be the last one.

00:43:59:23 – 00:44:04:08

So you really want to

look at the last video

00:44:04:08 – 00:44:09:03

that I did in uncovering the truth

about who really controls inflation,

00:44:09:08 – 00:44:14:00

because we are not inside of a true

supply demand market.

00:44:14:02 – 00:44:16:12

We’re inside of a Wall Street market.

00:44:16:12 – 00:44:19:04

And Daniela had a phenomenal interview

00:44:19:04 – 00:44:22:04

with one of my favorite people,

Jorge Gammon.

00:44:22:04 – 00:44:24:20

We all know I love him so much.

00:44:24:20 – 00:44:27:16

So you want to catch that interview

00:44:27:16 – 00:44:30:14

And Taylor, does the Fed have authority

00:44:30:14 – 00:44:35:07

to issue a CB DC

without Congress’s approval?

00:44:35:09 – 00:44:40:12

Well, you know, it’s pretty easy to change

the rules and the laws and all of that.

00:44:40:12 – 00:44:43:15

So catch that video as well.

00:44:43:17 – 00:44:44:09

So if you

00:44:44:09 – 00:44:47:14

haven’t, again, click

that cowardly link below.

00:44:47:17 – 00:44:50:17

Set up a time

with one of our strategy specialists.

00:44:50:21 – 00:44:52:01

Get your own strategy.

00:44:52:01 – 00:44:55:19

You’re not just in place to make sure

that you are in the right place

00:44:55:19 – 00:44:58:01

at the right time with the right asset,

00:44:58:01 – 00:45:02:08

that you protect your current wealth,

that you’ve managed to accumulate,

00:45:02:10 – 00:45:06:21

and that you put yourself in a position

to accumulate more.

00:45:07:02 – 00:45:09:21

Because we are definitely going

00:45:09:21 – 00:45:13:05

into a position

where they’ll just be the few.

00:45:13:05 – 00:45:17:15

It’s like the feudal system

where they’ll just be a few hands

00:45:17:20 – 00:45:20:20

and everybody else that has to lease.

00:45:20:22 – 00:45:24:02

I don’t know about you,

but I definitely do not want

00:45:24:02 – 00:45:27:19

my children to be in that position.

00:45:27:21 – 00:45:29:18

Make sure you subscribe.

00:45:29:18 – 00:45:34:19

Give us a comment, give us a thumbs up

and watch the other videos.

00:45:34:19 – 00:45:36:07

But so important.

00:45:36:07 – 00:45:37:15

Share, share, share.

00:45:37:15 – 00:45:40:02

We do have that five minute video.

00:45:40:02 – 00:45:42:05

I guess it’s 5 minutes and 40 seconds.

00:45:42:05 – 00:45:45:00

You said something like that.

00:45:45:00 – 00:45:46:22

So that is that is complete.

00:45:46:22 – 00:45:48:20

And if you’re watching this,

00:45:48:20 – 00:45:51:14

you can watch it on our

I don’t know if they’d put it

00:45:51:14 – 00:45:55:14

on a landing page that it’ll be

in the description of this video.

00:45:55:17 – 00:46:00:10

It’s okay, but it’ll be in the

in the description on this video.

00:46:00:16 – 00:46:05:02

And this is one

that was specifically designed for you

00:46:05:02 – 00:46:10:09

to share to people that don’t believe

it’s not going to scare the crap.

00:46:10:10 – 00:46:12:10

Well,

it should scare the crap out of them,

00:46:12:10 – 00:46:15:15

but it’s not designed to scare the crap

out of them.

00:46:15:16 – 00:46:20:04

It’s designed to just open their minds

just a little bit

00:46:20:06 – 00:46:22:18

so that they can see what’s happening.

00:46:22:18 – 00:46:25:18

We don’t need everybody to understand

this.

00:46:25:20 – 00:46:31:05

We just need to build and grow this

community of people that understand it

00:46:31:07 – 00:46:39:04

and are more and more vocal

and more and more people are waking up. So

00:46:39:06 – 00:46:40:01

let’s hope we can

00:46:40:01 – 00:46:44:01

have a peaceful revolution.

00:46:44:03 – 00:46:47:12

Back to sound money

00:46:47:14 – 00:46:49:14

and until next we meet.

00:46:49:14 – 00:46:51:23

Please be safe out there. But.