EMERGING MARKETS DEBT BOMB…HEADLINE NEWS with LYNETTE ZANG

TRANSCRIPT FROM VIDEO:

You know, I was just asked about black swans and of course a black Swan event is an event that you can’t see coming. And this event that we’re gonna talk about today, well, we’ve been watching it develop, and I think it could very well be here this year.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading, a full service, physical and silver dealer specializing in custom strategies. And you gotta have one. If you don’t have one in place yet, get it in place now, I’m telling you so many things are happening now, before we dig into the meat of this, I’m gonna give you a quick little 101 so that you know why this matters to you. And you have a foundation to understand what I’m gonna talk about. So let’s just dig right in and begin. This is the valuations of the U.S. Dollar, because you may have heard that the U.S. Dollar is getting stronger, which is this little uptick here. Okay. It is in a negative trend, but getting stronger. Well, you know, isn’t that good? Well, you know, let, let’s just kinda look at that for a second, but before we do, I wanna point out that in 2007, the dollar against other currencies, that’s what you’re looking at here, a basket currencies, broke to levels never before seen. And then after it did that, well let’s see we had the great financial crisis, right? So you think nothing happened? Well, it was a huge deterioration, but what I wanna point out was when the dollar was weaker and even recently, which I’ll show you, emerging markets or countries that do not print dollars, like we do here in the U.S. Loaded up on dollar denominated debt. For those that have been watching us for a while, then you’ll recall that this is something that we’ve talked about over the years. Why? Because it seemed cheaper to service that debt when dollars were cheaper. But now because of the interest rates, the dollar is getting or appears to be getting stronger. Now this may look a little catty wampus here, but I’m taking this from 1971 and you can see this big, huge Paul Volker spike in both interest rates. And then the dollar, it attracts foreign buyers when interest rates go up because it pays more. So interest rates will have an impact on the perceived value from one currency to another currency in the dollar. But at the same time, all of this debt that they accumulate at cheaper prices like down here and here, well, when the dollar goes up, then it does just the opposite and it makes that debt more expensive to service. That becomes a problem because if they can’t service that debt, what are they likely to do? They’re likely to default on that debt. I mean, we’ve been going through this with China and China is still classified as an emerging market, but that debt implosion could trigger a global response from the central bankers to turn on these printing presses like crazy again.

And there you go. Welcome in hyperinflation. Now, why does hyperinflation matter to you? Because any wealth that you hold in in dollars or in terms of dollars, so stocks, bonds, annuities, CDs, anything that you can only convert into dollars? Well, we know they lose value in hyperinflation. So unless you’re properly positioned, you know what you risk, you risk an implosion of the global economy.

So that’s how it impacts you and why this is so important for you to understand because the emerging market debt bomb. Well, is it about to explode? Personally, I think so this has been brewing for a long time because wow, look at this. The fed says they’re gonna raise rates. And what happens to the dollar in terms of other currencies, it hits the highest levels since 2020. And then if they actually do start raising rates, it’ll bring more foreign currency in to buy more dollars pushing the value of the dollar up. Okay. So more buyers come in. The value of the dollar goes up, making it a lot harder to service all of this accumulated debt by the foreign entities emerging markets. And so what are they talking about? Fed rate hikes will intensify a global debt crisis. Yeah, no kidding. The federal open market committee meets this week to decide the path and they got a whole lot more hawkish, which means they’re talking, they’re talking more aggressively and here’s the problem.

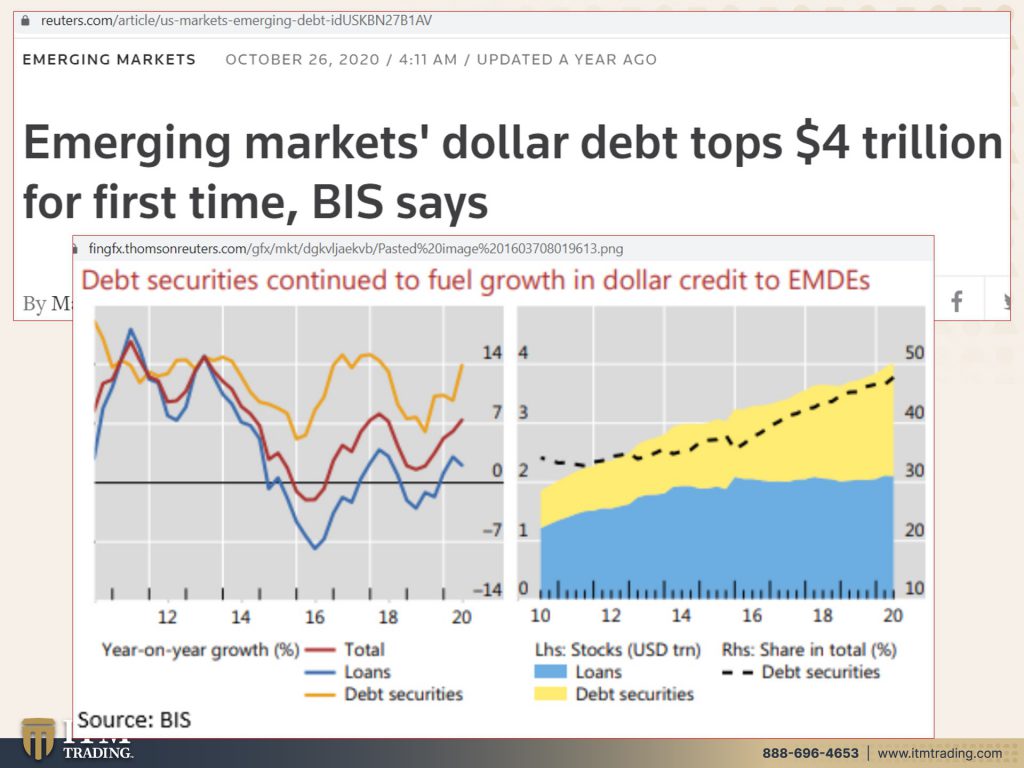

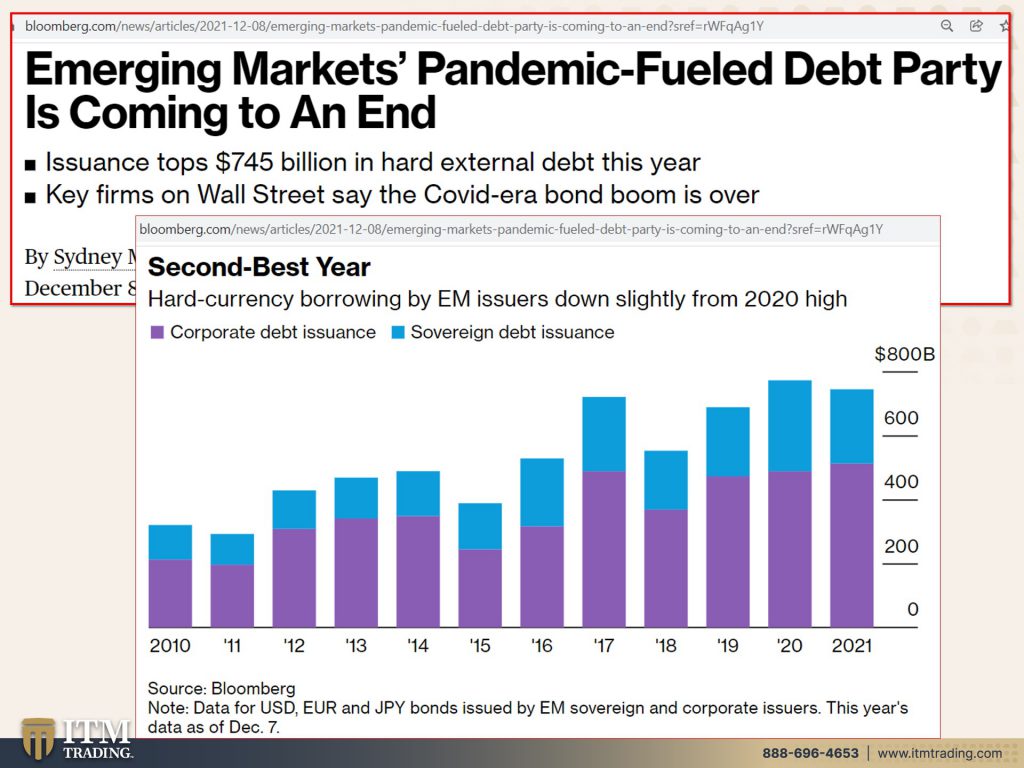

Emerging market debt is over 4 trillion. And this was back in 2020, October of 2020. So they issued a whole lot more debt since then. And all of that debt must be serviced by another country corporation. Whoever bought that, or whoever issued that dollar denominated debt needing to go in and buy dollars in the market, the dollars are more expensive. And I hope you can see the problem. And if I’m not clear, let me know. And let me address it on, on a Q&A because emerging markets, pandemic, fuel debt party, well, it’s coming to an end and it’s, this is a very abrupt end. And we remember we are all incestuously intertwined. So any crisis that really starts elsewhere is most likely to flow through, why? Because look at this corporate debt issuance, right? So this is corporations, non-financial corporations that issued the debt.

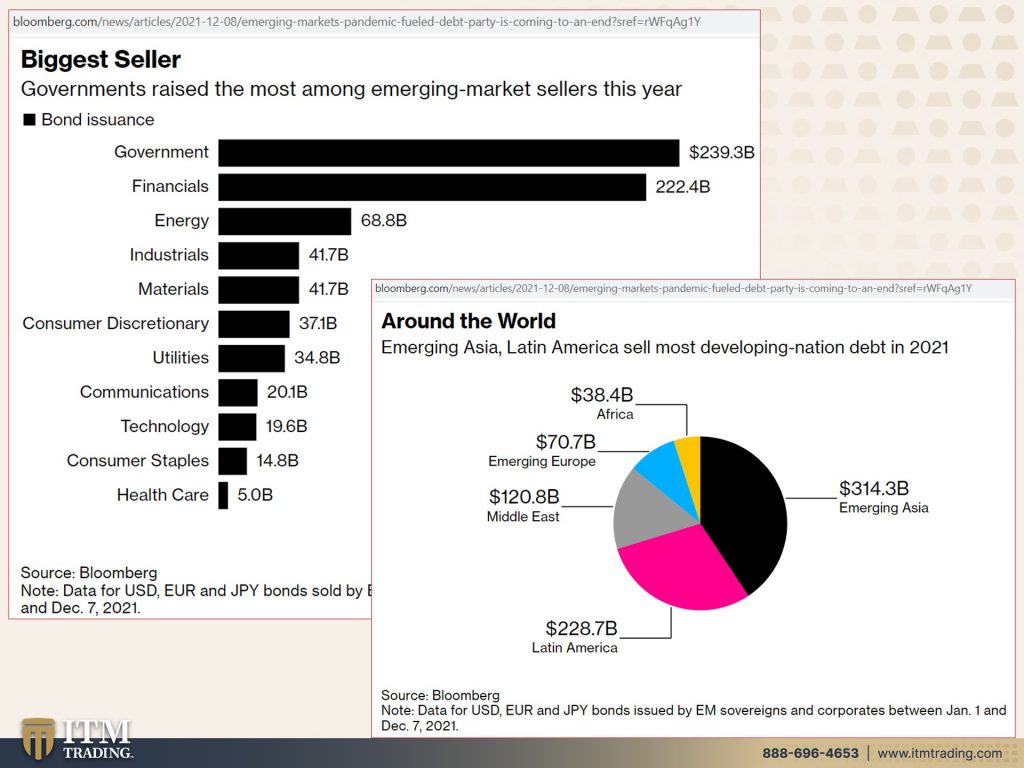

And this is financial debt is issuance. And what’s really interesting is governments, global governments have issued the more dollar denominated bonds than anybody else. And the second level are financials. What are financials? Well, those are banks. And do we not know that the banks are incestuously intertwined? Yes, we do. And that’s why if this trigger is really pulled that this could be the justification or the provocation, maybe for the central banks globally to be issuing lots more new money. And what does that do? Well, it’s gonna exacerbate the inflation that we’re already experiencing, and this is around the world, Latin America, Asia. So that would include China, Africa, emerging Europe, the middle east.

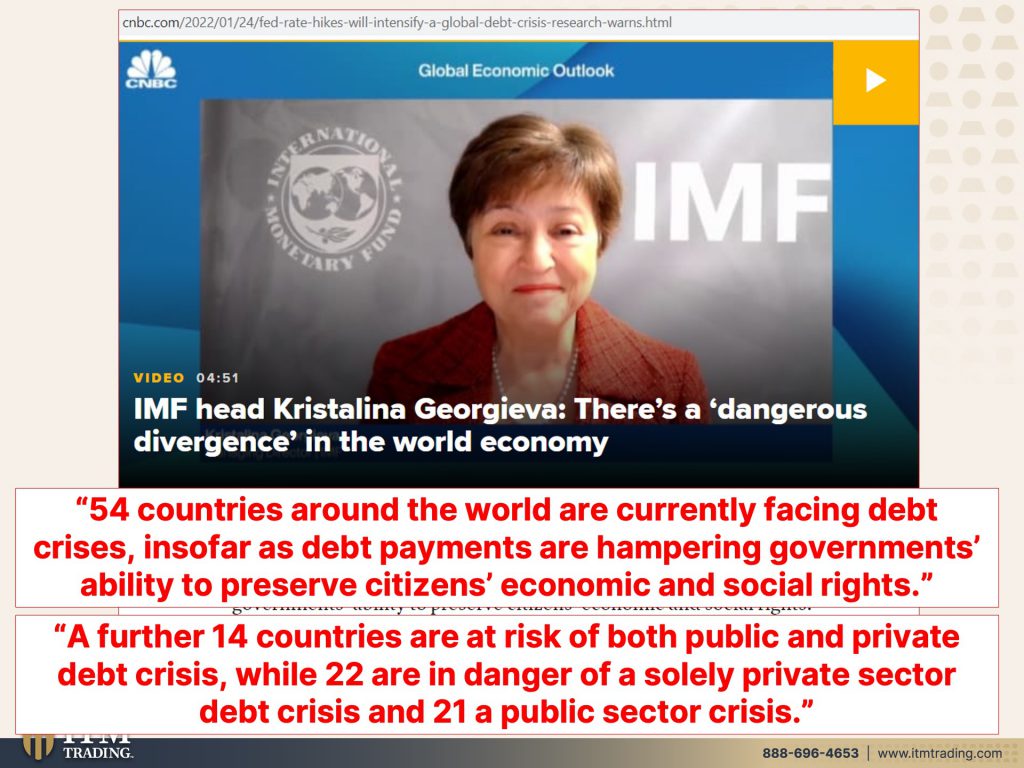

Is there gonna be any escape from this? I don’t think so. And frankly, neither do the, neither do the powers that be the IMF. Okay. You you’ve gotta listen to this, 54 countries around the world are currently facing debt crisis, insofar as debt payments are hampering government’s ability to preserve well that part’s garbage, but we already saw that the sovereigns, the governments were the biggest issuers of dollar denominated debt. So they taken tax revenue. They’ve got to pay that dollar denominated debt by going out into the open market and buying dollars to service it. Do you see that problem? But also you need to know there are 196 countries in the world. So 54 countries are currently facing debt crisis, but a further 14 countries are at risk of both public and private debt crisis. Like we just saw on that bar graph and 22 are in danger of solely private sector, debt crisis, and 21, a public sector crisis.

When they’re talking about public sector, they’re talking a about the government and what do we also have going on right now? Well, we know we have a division between what some countries are doing raising rates and what other countries are doing lowering rates and Russia and China. So the two global financial leaders are doing just the opposite, China. Well, the U.S. is being very hawkish and talking about raising rates in March and also talking about an abrupt halt to purchasing mortgage back securities and treasury securities. Okay. So that, that is supposed to happen in March. No wonder these markets don’t know what in the world to do. China, on the other hand, having, having really imploded the real estate market and the other markets there with all of their crackdowns, well, they’ve suddenly changed course, and they are lowering interest rates and doing more quantitative easing the PBOC. So that is China’s central bank has shifted away from reigning in financial risks and towards supporting growth, which means let’s see this isn’t the PBOC, but this is all sorts of new money printing. Okay. So supporting growth means creating inflation. That’s what that means. So you’ve got the two countries now, the two largest economic countries at odds, but here’s the key. And I think this is so interesting because it really indicates the shift in power from Seoul to Jakarta central bankers and FX, which is foreign exchange. Traders will have to decide whether it’s U.S. or China policy. That is the stronger anchor already. Some regional currencies are tracking the Yuan more than they used to. So we’ve been over these many years, we have been watching China’s power growth, but the reality is, have you ever seen images of a bridge? And before it collapses and it swings back and forth and parts of it start to waiver like that. And then it collapses. And that’s where we are in the global economy. That’s exactly where we are. Everything is going like this in opposite directions and it weakens absolutely everything. So that in this jenga economy, now you better be on the right side when that happens. And that’s outside of the system completely, whereas not completely because we still have to use dollars as our tool of barter, but as much as possible, you need to be out of the system. And in real money that holds your wealth real money outside of the system. This is really significant because here’s the world bank president David Malpass. Hmmm. So interesting with too many developing countries facing record levels of external and domestic debt, we cannot afford to wait any longer. You see this transition into a new system. Can you see it? It’s hiding in plain sight right before our eyes we’ve watched this evolve, the world’s poorest urgently. And of course there was “it’s the children, we have to do this for the children.” Oh my God. The world’s poorest urgently need debt relief, deep debt relief, enhanced debt transparency. And here’s the kicker, a rebalancing of creditor debt or powers. What does that mean? It means they’re changing the rules in favor of those that have taken on debt even more than they already have, because we know that on a debt based system, those that have debt or can accumulate debt well, upper, right? Not the normal public. It usually makes it very hard to service all that debt. But at the upper echelons, the corporations, the governments that have just continuously grown this debt, let’s see who’s holding that debt? Oh, that might be, I dunno. How about retirement funds and pension plan? IRA’s, mutual funds, ETF’s. And they’re gonna change the rules, not in your favor. Why in the world do you trust them? Why? Because have we not seen over and over and over and over and over again, we have to save the banks. We have to save the financial system. They are too big to fail, you are not too big to fail. I am not too big to fail, but the financial system way too big to fail corporations. If we don’t help them out or they can’t hire, let’s bring all of that money back from overseas and let them just pay basically nothing on it, because then they’re gonna expand and they’re gonna hire and that’s gonna be, oh, gee, that didn’t happen. Didn’t happen either time. That that was the strategy. And that’s what we were told was going to happen. It doesn’t happen because it’s not supposed to happen. This is, this is a club and you and I are not in them. We need to have our own club. That’s what this is about. That’s what community is all about.

Because here we are. How can you protect yourself? You can protect yourself with, with gold and silver, because if you do it in et form or any other digital paper form, no, that is totally not the same as doing it in purely physical form. That’s the way I personally hold it. That’s the way I recommend everybody personally hold it because it has no counterparty risk. And it is proven to protect you during times of crisis, get ready for this crisis, get ready, get ready. They cannot make that transition from one interest rate libor into the new interest rate SOFR in 2023, without major crisis, maybe we’ll have it now to justify not doing it then. Just like we did with a more recent crisis that we are still dealing with. I’m telling you people, every single thing that I’m seeing is telling me that we are on break. Well, I feel better knowing that I’m holding physical gold and silver in my hands, in my possession. It runs no counterparty risk. All the other stuff, all counterpart risk, all of it, including cash, all counterparty risk, eliminate as much risk as you can eliminate it by going into physical gold and physical silver. That’s really the only way that you can eliminate this risk. The only way!

This is important, I’ll continue to pay attention. You should also continue to pay attention. And if you have any questions, cause I really do wanna explain this in a way that you get this. So let me know. It’s not you that, oh gosh, I just, it so complicated again. No, no, no. My job is to explain it in a way that you can understand it. So help me do my job. If I use a word, if I say something, if I show you something and you don’t understand it, please, please let me know because I am truthfully here to be of service. And so is everybody else at ITM? If you don’t have a plan, go ahead. There’s a calendly link below, schedule an appointment with one of our consultants. You’re gonna find them, I’m sure you’re gonna find them to be highly, highly intelligent. This is critical that you get this plan in place now. And so if you like this, please give us a thumbs up. We need to spread the word as much as possible. And there’s so many important videos that I’m doing lately because it shows that bifurcation and that risk. Leave us a comment, share, share, share, get that gold and silver strategy started. That’s the foundation, but you also need food, water, energy, security, community, and shelter. And until next time, please be safe out there. Bye bye.

SOURCES:

https://tradingeconomics.com/united-states/currency

https://www.ft.com/content/77987542-8dd2-4201-b9a9-20a87fa8c647

https://stockcharts.com/h-sc/ui

https://www.reuters.com/article/us-markets-emerging-debt-idUSKBN27B1AV

https://voxeu.org/article/global-liquidity-and-dollar-debts-emerging-market-corporates

https://fingfx.thomsonreuters.com/gfx/mkt/dgkvljaekvb/Pasted%20image%201603708019613.png

https://www.reuters.com/article/us-markets-emerging-debt-idUSKBN27B1AV