CRISIS AT THE IMF: Why Does Gold & Silver Dump? (SUMMARY)…by LYNETTE ZANG

TRANSCRIPT FROM VIDEO:

If I can just get everybody out there to look at things just a little differently. I’m telling you right now, you will be amazed at what you see. I’ve got goosebumps already because the IMF issued a whole bunch of SDRs. We’re going to talk about that, I thought I was thinking in one direction, and then as I was doing my work on it this morning, I saw something else that I’m telling ya scares the bejesus out of me. And we’re going to talk about that coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading. And I am so grateful to be able to be here and show you what I’m going to show you today, because is there a crisis at the IMF? Well, yes and then I’m going to show you what I just saw. And that’s like basically blown me away. And we’re also going to talk about why gold & silver has taken a big dumperooskey on Friday and you know, this morning overnight, actually overnight, we’re going to talk about all of that because frankly it’s all interconnected. These are not disjointed things. And one thing that we absolutely know is that whenever there’s a major news thing that comes out some major piece, significant news that they don’t play up, it’s really significant. It’s kind of underneath. You will see gold, primarily gold drop dramatically and for no real apparent reason, because they do not want you to fly to the safety of gold and silver, physical. They don’t want you to do it. They don’t want you to protect yourself, but I do. So let me show you what I found.

Okay. So the IMF has approved a historic 650 billion SDR allocation of special drawing rights. Now, if you haven’t been watching my work for awhile, I’ll go over a little bit with the SDRs in just about two seconds, but this is a historic decision. The largest SDR allocation in the history of the IMF and it will benefit all members. So it is a general allocation to all of their members, which is pretty much everybody on the planet, 189 members. All of the members at the IMF are treasury secretaries and central bank heads. Now the SDR is the currency of the International Monetary Fund. The IMF it is a basket of currencies that are composed of five different currencies. The U.S. Dollar, the Euro dollar the Chinese Yuan, the British pound & I don’t know something else, but they can expand that basket to include all the currencies that they want. It was created in 1969 to take over as the world reserve currency from the U.S. Dollar. But then Kissinger went to Saudi Arabia. They created the petrodollar. And so the SDR went to sleep and all the mechanisms that they created to make this transfer happen, went to sleep in 2008, of course, we had the financial crisis and it was actually one of the, in China. They came out and said, well, what about the SDR? And I thought, well, that’s absolutely right. And so they tested all of these mechanisms to see if they would work. And so, yes, there is a crisis, but it’s much bigger than that. So the special drawing rights, you know, I mean, why do you care? Right. Well, I’m telling you right now, you really need to care about this because it has impact on your very life, your standard of living and everything, because one of the tools, which I’m not going into, but I’ve done a bunch of work on the SDR in the past, and maybe Edgar, we can put all those links together so you can watch it and you should watch it. But you know, you should care because right now the U.S. Dollar is still classified as the world reserve currency, which up until like 99, basically, if you were a government, a corporation, and this is certainly still true, if you’re an individual going outside of your borders and buying anything, lumber, steel, oil, medicine, whatever it is you want to buy, you had to use U.S. Dollars to do so. So the world is a flooded and a wash of U.S. With U.S. Dollars. Well, when we convert to the SDR, guess what? A lot of those dollars are coming back home. So did they try and create some mechanism? Sure. They have the substitution fund. If you own a U.S. dollar denominated bond or dollars or whatever, you can deposit it into the substitution fund. And then the IMF can determine, well, they’ll convert them into SDR, denominated, Fiat assets, and then they can determine, or they think they can. Anyway, the timing of when that comes back to the U.S. To the final destruction of whatever, itty bitty bit of purchasing power yet might remain in the U.S. Dollar at that point. So you need to care about this because this is going to impact your life, your children’s life, your children’s children’s life and so on and so forth and so on and so forth. And if you are not in the right position as we go through this, you know, it’s a big club and you and I are not invited, but let’s create our own club. How about we do that?

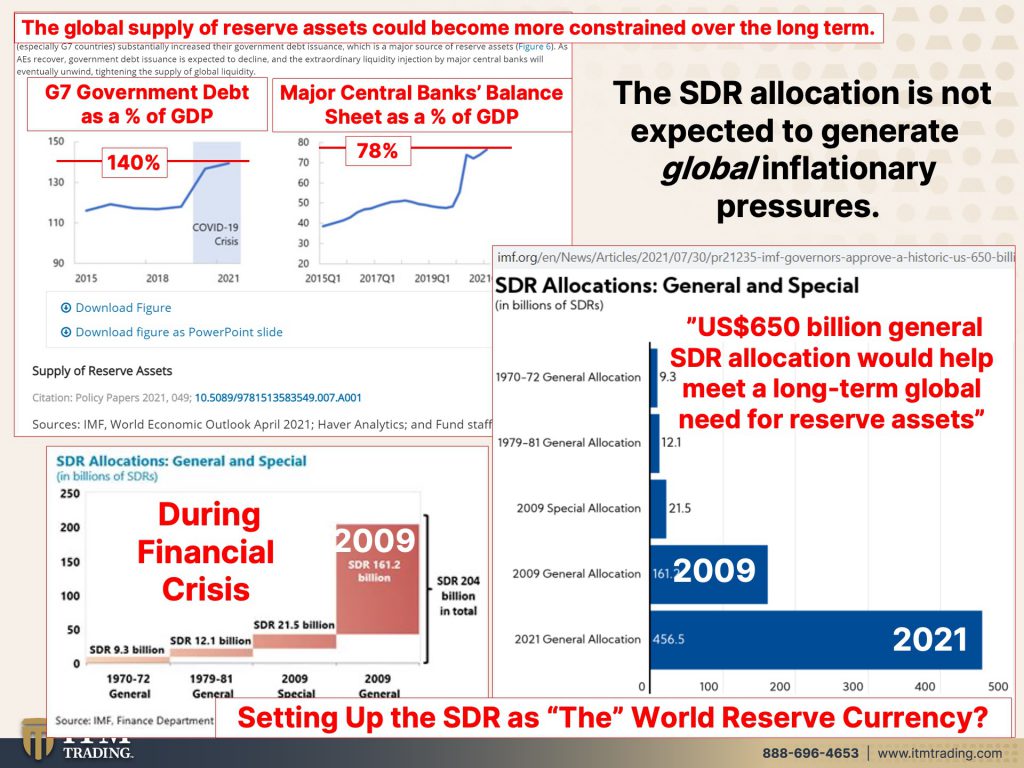

Okay. So what I’m going to show you is the global supply of reserve assets. Now, this is the reason that they give for this huge allocation and distribution of brand new SDRs that are created with a button push, right? The global supply of reserve assets could become more constrained over the long term, really? Okay, well, let’s look at that because they show in there, this is G7. So the top seven economies, the government debt, as a percentage of GDP, which is 140% and continuing to grow, right. And we’re going to raise the debt ceiling. I mean, this happens every time either they’re going to suspend it, or they’re going to raise it. They’re probably suspended because then there’s no limitations on how much they can spend until it comes up again. And then also major central banks balance sheet, as a percentage of GDP. We’re talking global here. Can you see the problem? Because, and if you can’t, what the real problem is here is that there comes a point where debt is not just unsustainable, but actually has the reverse impact. And we are there. That’s why all of this new money creation, all this new debt creation that has been happening, particularly since 2008, has not been effective in really growing the real economy. Now, growing billionaire’s economy, absolutely, growing the stock market and all of these bubbles, absolutely! But really there’s been a small number of people that have benefited compared to the many. Now, this is what they did when they were testing out the system. Here is a little test here, and there’s the big test. So you can kind of get an idea of the size. This was, as the crisis was unfolding, as the central banks, as the a federal reserve began quantitative easing, which is massive money printing in March of 2009. That’s when that started. And you see where the global, where the SDRs came out, and this is what just is happening. I mean, it goes into effect in about another week. Yeah. About another week. Okay. So you can see that this dwarfs What was happening, what they did in 2009, and that was in the middle of a crisis scenario. And this is also…when I really looked at this and what they’re saying here, U.S. 650 billion, general SDR allocation. So they just push a button, create it, and then give it to everybody would help meet a long-term global need for reserve assets. And there’s part of me that goes, yeah, because this wasn’t enough, you know, 140% of GDP. I mean, just keep printing that money, just keep taking on that debt. And then that’s when it hit me. When I looked at it, are we in crisis? A hundred percent we’re in crisis. There’s not one doubt about it. I don’t give a crap. What they tell you, their actions tell me, we are, they are trying to battle this huge crisis. We are in crisis. The wheels are falling off the bus. What they have done, all of their experiments are not working. But what I also see here, especially when they’re talking about the long-term global need for reserve assets, is I see the police positioning of the SDR as the world reserve currency. I mean, honestly, it always made sense to me because since it’s a basket of currencies, there are no limitations to how many currencies they can put in that basket. So I mean, it really does make sense to be a global currency that can be converted into the local currency. So U.S. Dollars or Euros, or Yen, or, or what have you, because it’s part of that basket. But you also have to wonder about the impact on you and me. So I believe that what we’re looking at here is two fold number one it’s crisis, because they’re not saying, well, we’re going to issue this in the long-term no they’re issuing them this month, but it’ll go in as a reserve asset, building their position, getting into position after all these years, since 1969 people to be the world reserve currency. And then you have the IMF and they’ve done so much work on holding title to your property, to your real property, and any equity that you own in digital coins. And then this will be completely under control of the International Monetary Fund, which again, it’s every treasury secretary. It’s every central bank, chief. They’re all unelected officials.

Don’t worry about it because it’s not expected to generate any global inflationary pressures. Well, if it doesn’t, it’s because they’re sitting there waiting to be used, but QE, if you ask the central banks, QE doesn’t create any, any inflationary pressures. I cannot wait to show you the the House of Lords and the Bank of England that disputes this, because we know everything’s a whole lot more expensive than it was in 2008. And there are some that have benefited and many that have not. I think that this is about two things. Number one, it’s about making sure because when they give them SDRs, what they’re like is like ice cubes in a glass of water, right? So the U.S. Dollar has reserves. Now they have SDRs in reserve and it makes the glass look more full. It doesn’t really make it more full, because again, these are created from nothing. Can you create your money from nothing? Well, I mean, you know, government’s trying to give it to you so that you’re more dependent on them, but for me, frankly, I’ve never found an easy button for me. I have had to work my butt off for absolutely everything. And I cannot push a button and create more money. Unlike central banks, unlike governments. And, you know, I hope I’m explaining this clearly, because I know this stuff is complicated, but you also probably have noticed how many additional and special things that we’re doing, because things are heating up. So when you see something like this, you know, you see this special allocation that, you know, makes what they did in 2009 look like chump change, which is exactly what we saw with the federal reserve, between what they did in 2008, that QE injection to what they did in 2020. Makes it look insane! I mean, it makes it look like there’s a crisis happening that they are reflating reflating, reflating people ask me all the time about deflation. That’s what they’re fighting with all this money printing. And there’s only one way to do it. And that’s with inflation. I gotta tell you, it will say, I don’t care what anybody says. I don’t care what anybody says. This will a hundred percent send us into a hyperinflationary depression. There is no other way. There’s no way! I mean the garbage when you listen to them. “Well, we’re looking at how the fed is going to unwind their balance sheet. I read it’s written”. I mean, Bull%$&^* I’ll censor myself. If Gerald was here, he wouldn’t censor anything, but that’s garbage when they tried to do it before it was a big fat fail. So it’s garbage. It’s just something for them to talk about. Just something to justify the garbage in the Fiat markets and them still telling us “well the markets are undervalued”. Oh my God. If I could have reached to the screen & throttle these people, I would a hundred percent do it. Okay, let’s go back to this.

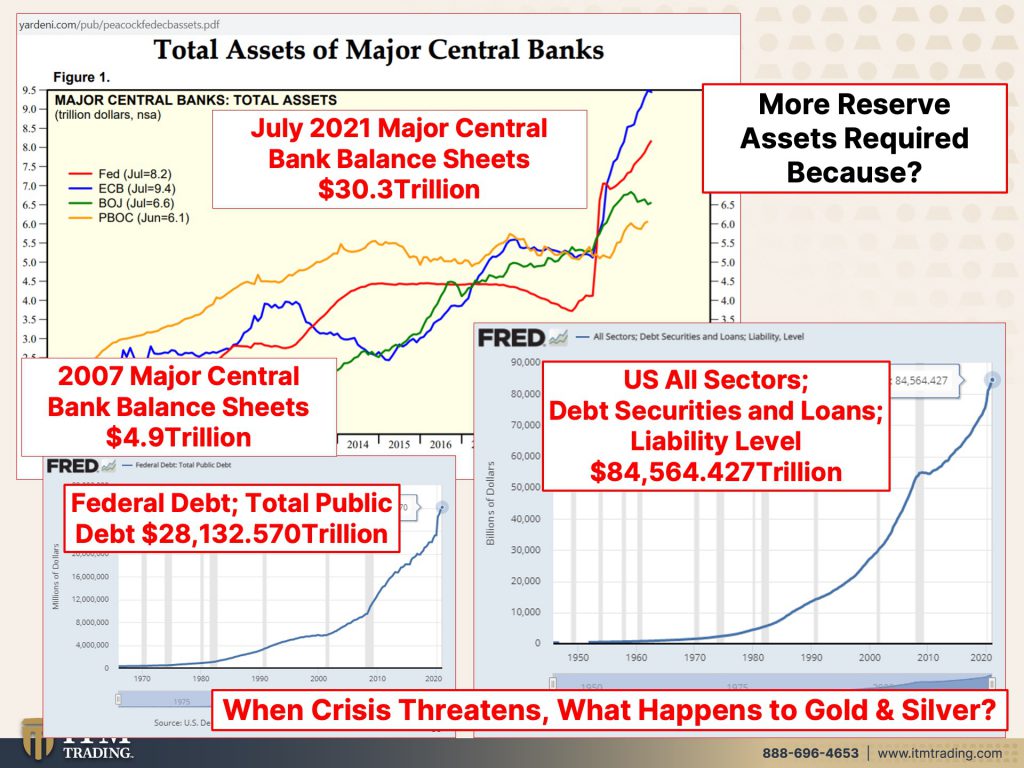

I’m really…you know…I’m telling you I’m freaked out, the reports that I’ve been reading, the events that I’m reading. This is happening so rapidly. I feel like I am on a freight train. You know, just headed to that wall really, really fast because they need more reserve assets? I mean, central banks are not creating enough? 2007, the major central bank balance sheets were 4.9 trillion, in 2007. Now they’re 30.3 trillion. Did it actually stimulate the economy? No, look at this is where the fed attempted to raise rates and run off their balance sheet and run off their balance sheet didn’t mean to stop buying, but they were reinvesting dividends and principle. So that’s all they were doing was not reinvesting that amount of money. And what happened? Wel,l September 2019, when the plumbing, the repo markets, the plumbing of the global economy froze, it froze. And you can see it right here, right there. Okay. That’s what they did after the freeze. And then 2020, the timing of everything is kind of, I don’t know, coincidental or convenient, whatever you choose. And I won’t go more into that than that. But you’ve got the federal debt over 28 trillion. You’ve got the, in the U.S. All sector debt over 84 trillion. You’ve got the bank balance sheets over 30, trillion it’s not enough. We need more reserve assets. Really? You know what I say to them? This (finger)! Because they don’t care enough to give their very best.

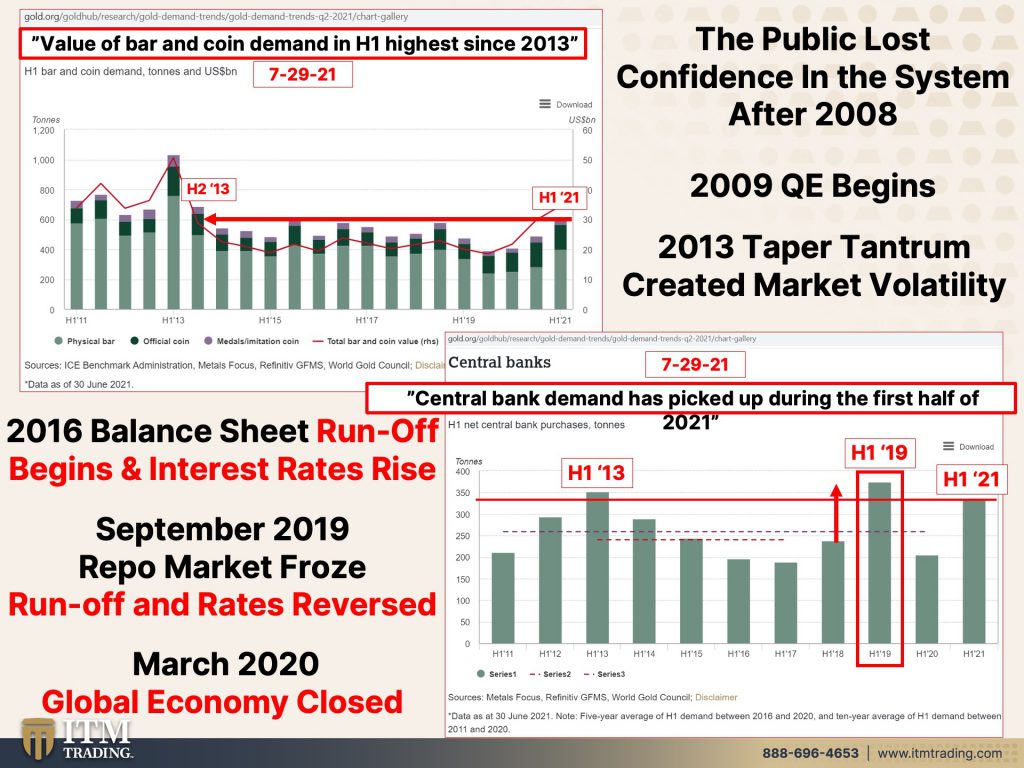

I’m sorry. I mean, I mean, this whole thing is really…because I see the positioning I see what’s happening it’s driving me crazy. So whenever anything major, whether you realize is major or not, but they know that it’s major, they know what they’re doing. They have a plan. I hope you do too, because they have a plan. Then what do they do? They dumparoosky gold and silver. We’re going to talk about that in a second. But before we do, let’s just look at the value of bar and coin demand in the first half. Each one is the first half of the year. So January to June highest, since 2013. Hmmm, 2013, there was an awful lot of confidence that was lost because we were still so close to 2008. And people saw who was chosen as too big to fail. And it wasn’t us little guys, and nobody went to jail because those contracts are written in such a way that what they did disgusting, despicable, evil, not illegal, which is what counts in a court of law. Maybe. I mean, you know, let’s face it. There are different rules. QE began in 2009. I’m going to be talking a lot more about that. When I do the bank of England thing, 2013, a taper tantrum created market volatility. So you see all of the accumulation and the public buying gold because this is bar and coin demand, right? Well, people are uncomfortable again. And that’s between January and June, first half, they should be, this should be higher than this. In my opinion, they should be. 2016 balance sheet runoff like I showed you before. They attempted to just run off that balance sheet and raise interest rates, big fat fail. Couldn’t do it, couldn’t do it. And I told you, then couldn’t do it. Every single country that has attempted to raise their interest rates and run off their balance sheet, reduce their balance sheet. Every single one has had to reverse those positions. Every single one, because the markets have a temper tantrum. Who’s really in control here. Honestly, it’s not the government or the central banks. It’s wall street. It’s the markets that’s, who’s in control of all of this. And I showed you on that TYVIX volatility chart (which they took away from us) on the treasuries you saw when it started 2013. Wow. That’s also when they changed how they did the accounting for the derivatives too. Coincidence? I don’t think so. Things got calmer because they looked calmer, but they never stopped doing what they were doing.

Alright, we know March, 2020, the global economy was shut down. What did the central banks do? Because now I have the first half anyway, there’s your 2013, central bank demand has picked up during the first half of 2021. I think so. And these are all reflective of each one. So the first half of every year in there, this was 2020. Okay. We know what was happening in 2020, but you can see, this is actually, again, I can look at a graph or a chart a hundred times. And every time I do, when I look at it just a little differently, it’s amazing. What I see. And this happens to be one of those times when I took another look at it as I was preparing for this afternoon. And, oh, huh? The first half of 2019. Why was there this huge spike above maybe even an all time high? I think I kind of remember that being an all time high, but that was the first half of 2019. Not the second half as the crisis was unfolding. You think they might know something that you don’t, you think they were getting into position because they saw this coming? Do you think the IMF is getting into position because they see the absolute destruction of the global economy & they want to be the currency for the world and control the world’s currency and all the world’s wealth, these unelected officials? You think they know something you and I don’t? My daddy always said, do what I say and not what I do. I’m so grateful for those words, because I look at what they say, everything’s hunky-dory. You don’t have to worry about a thing. We’ve got it covered. This isn’t going to create inflation. And the inflation is transitory. Don’t protect yourself. Let’s do a big dumper, risky on gold and silver. So people think, oh no, it’s going down! Are you kidding me? Flipping gift. We’ll come back to that.

Historic level of IMF, SDR creations. The beginning of the year 13 trillion debt bill comes due for big economies. This debt bubble is bursting. So they keep pumping it up, creating more debt. And the central banks buying it. That’s monetization of the debt. I don’t care what name you give it, but there’s your crossover between governments and central banks. Are they independent? I don’t think so. I don’t think so at all. And what happened in February? Oh, SLV changed their prospectus, price can be unrelated to silver in midnight perspectives change. Yeah, they did that really quietly too. So you can’t pull together a basket of physical silver for SLV because the paper markets control the markets while the central banks, while, you know, smart people that are paying attention are buying freaking physical, silver and gold. I’m not selling my silver and gold into the market. Once it comes off the market, it’s off the market. I’m holding it. Look at the spot silver. I think it was like 23 bucks? I mean, please. Now, these were as a Friday, they didn’t update them. Or I would have updated both of these graphs today, but the markets hadn’t closed yet and they were not updated. Honestly, it’s a joke with the level of leverage that are in these markets that we don’t even know about quite honestly, but I can tell ya, not one little doubt in my mind, this indicates that the wheels are coming off the bus in a big way, and they’re trying to get ahead of it. But the central banks? I mean, you hear these people, you know, “well they’ll just raise the rates. We have the tools, voters raise the rates”. Because when you have enough ramp room to lower rates, 5.5-5.75% which is what they did into every crisis. Well, what? Lower rates inspires buyers, buying & borrowing & spending, raising the rates reduces borrowing and spending. They can’t raise these rates. There is too much debt on the books and they are anchored zero. They’re anchored to zero. They’re anchored at zero they’re anchored at zero. So when they talk about the fed, getting behind the eight ball it’s garbage. He’s not behind the eight ball. He’s between a rock and a hard place that is getting more and more and more and more narrow. They can’t do it. They can’t do it. They’ve used up all their tools. I don’t care what they say because all they have are interest rates and debt levels and growing more debt and creating more dollars, which devalues every single dollar that’s out there. So those that have the wherewithal and that the 1%, and they own a whole bunch of stocks and it pushes the stocks up. So they think that balances out. Yeah. Tell him that in Zimbabwe, tell him that in Venezuela, tell him that in all other countries that have experienced hyperinflation, tell him that 1929 for God’s sakes in the U.S.

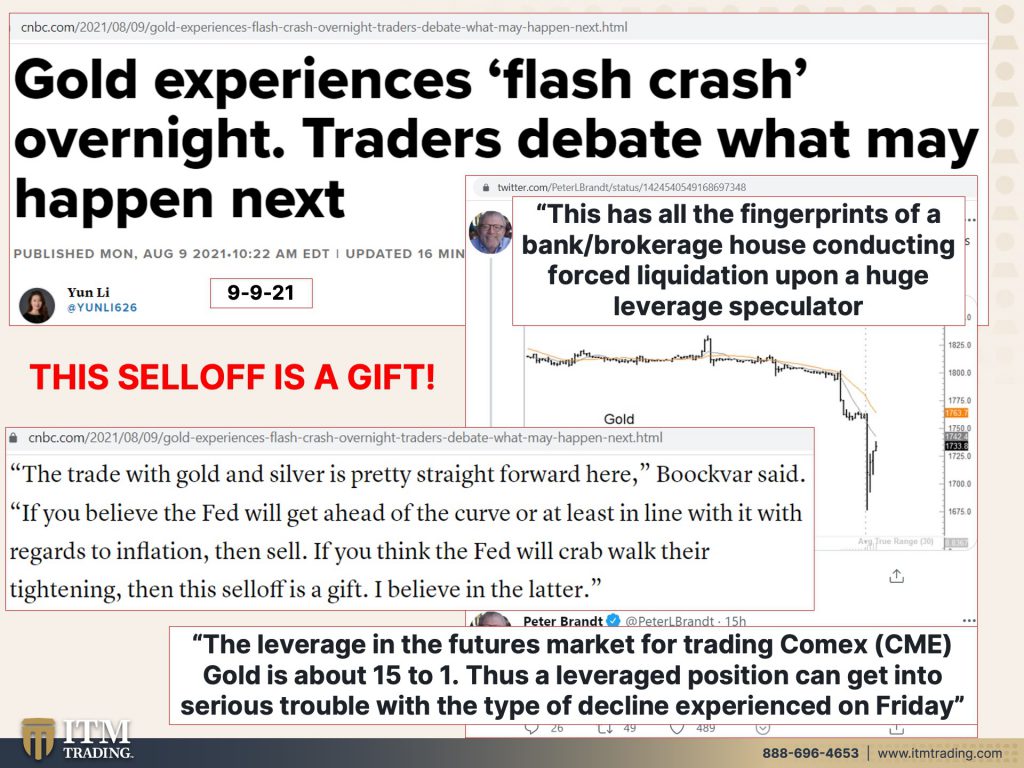

Traders debate what may happen next. I’ll tell you what, with this, I have full global demand with this too, right? Every single area of the global economy uses physical gold and silver, not spot gold or silver. This is what that looked like overnight. Now this guy has been a trader since 1975. He’s got a great bio. And he says, this has all the fingerprints of a bank brokerage house conducting forced liquidation upon a huge leverage. Speculator leverage is great on the way up, but it really stinks on the way down the leverage in the futures market for the trading COMEX, CME gold is about 15 to one. My bet is a lot higher than that and I know that it wasn’t the BIS when I last looked at it, but thus, a leverage position can get into serious trouble with the type of decline experienced on Friday. So the jobs report came out a little bit better. Oh, okay! So that means that the central bank is going to raise the rates to fight the inflation? No. They. Won’t. Mark my words on that. I’m putting my neck on the line. If they do raise them a little bit, they will be lowering them quickly thereafter. This market, the Fiat market is a house of cards. It is so vulnerable. They cannot afford even a…You saw what happened when they raised the rates! What was it? Even a quarter point? It was ridiculous just a little while ago. I did a whole thing on it. So no, they’re not going to raise the rates to fight inflation because they’re creating this inflation and it is not transitory. It is permanent. And I am now after seeing this where I was saying, you know, we could have started in the hyperinflation, but I’m not really sure yet because I’m not seeing that movement in the velocity of money. And maybe I shouldn’t say it. I’m probably going to hear about it from saying this, but yeah, after I saw the, the central bank or the IMF move with all of those SDRs and I’m watching everything else that’s going on with the central banks, I hate to say this, but I think we are ramping up for it to get really, really noticeable. If you don’t have a plan in place, get one in place now. And you know, it’s an awful lot to do food, water, energy, security, barterability, wealth, preservation, community, and shelter. But how do you eat an elephant one bite at a time? So no matter what you do get that plan in place and then you execute as you can, but you will be in a much, much, much better position if you do that, that if you just go, well, it’s too much. I can’t do all of it. I know you can’t do all of it. I’ve been working on it for a long time personally, I know you can’t, but you can do something and something is better than nothing. You need to protect yourself. This is coming down, people it’s coming. That’s why you’re seeing me on this Monday. I don’t get pretty on Mondays. We have lots of meetings, but I don’t have to be pretty for it. I got pretty today and I got to get pretty tomorrow too two days in a row. And you don’t know how long it takes me to do this. Anyway. Now you have Peter Boockvar who says the trade with gold and silver is pretty straightforward here. Boockvar said, if you believe the fed will get ahead of the curve or at least in line with it regards to inflation, then sell. If you think the fed will crab walk their tightening, then this selloff is a gift. I believe in the later. And so do I. Now I got to say, I don’t know so, well, that could be something that we’ll talk about on Wednesday with Eric, because I don’t work with the day-to-day wholesalers or any of that that I don’t do. But it’ll be interesting to see what has happened to the price because we already know that availability is not so easy to come by. Again, it goes off the market. I’m not selling mine because what you really have to understand is it, doesn’t matter how many dollars you have, it matters what you can do with them. It’s that nominal confusion piece that has enabled the average worker to work for less and less, even though nominally, his paycheck has gone up. It’s what has enabled and almost getting less invisible, but an almost invisible tax because who gets to use those new dollars first? The ones that are closest to the central bank. So corporations first, other banks, corporations, and then the government.

Why is the government, the federal government, the state governments, the municipal governments. Why are they paying more in interest than corporations? Think about that one. This is the purchasing power. Now this was the one that I showed you last month. And I don’t know that I did such a great job with this one. I’m sorry. I mean, because I was like, I was all set on the SDRs and then of course we had what happened with gold and silver over the weekend. So I did a little bit more work, but this goes, here’s 37, right, right here, 37. Now it’s fallen even more than that. It’s on its way to zero. And what 37 means is it’s 0.037 out of the original purchasing power of the dollar. Okay. It’s gone down. This is really the fastest that I’ve been watching this go down. And this is through June, July, we’ll look even worse. Okay? Doesn’t matter how many, you could be a starving billionaire. You’ve got billions of billions of dollars, but if it cost you a billion dollars to buy one egg doesn’t work very well. And a trillion times zero is zero. So do not be fooled. If you can only convert what you have into those currencies. And they’re valued in that currency and they have a narrow base of buyer only used in one or two places. Then you are not going to be happy because leverage on the way up works great. And I have to say this…It is true. The system has been set up to support the debtors. So leverage on the way up is awesome. You can really look really, really rich, but on the way down, it is painful. It can wipe you out. Do you have a mortgage on your house? Great. I have a mortgage on my house. Great. But I also have the gold to give me the ability to pay that off like that. You have to be prepared for everything. If you have not studied currency, life cycles, you wouldn’t know all of this and there are many people that do not think that we are going into hyperinflation. You tell me…let me go back to one slide side. You tell me how we can avoid it. If all they can do is grow more debt. Can you sit there and tell me that if you continue to just grow debt, never pay it off. Not even pay all the interest on it. Can you do that forever? Particularly when your income does not keep pace with the level of debt that you’re growing, the answer would be no. And what if you lose some of your income? Well, guess what? You are a debt slave and you will have to do whatever it is that the powers that be tell you to do. I don’t want that for anybody. I don’t want that for anybody. How many times can you be lied to when you do not know the truth, I’m trying to show you the truth. I know it’s complicated, but you know what, too. We have a whole team of really smart and talented people that can walk you through this. Maybe more slowly or, or, or on an individual basis be able to figure out how to explain it to you so that you can understand it because this stuff is intentionally made complex so that you don’t even try, but you can’t afford not to try. And you can’t afford not to see what I’m trying to show you because things are speeding up. I feel like I’m on a flipping freight train. So yeah, clearly what happened at the IMF freaked me out. I mean, I planned on getting pretty today. That’s I usually, I never do that on Mondays or rarely, I should say. Not never rarely of course, shocker, that gold and silver dumped? No, not a shocker. They just positioned the next world reserve currency. They just flooded or they’re about to, cause it’s not released just yet, but in about a week, a tremendous amount of war money on top of what they’ve already done. Do we have any questions? I know we’re running long. Okay. We won’t, we won’t worry about the questions today, but if you have any, send them in or call the consultants and talk to them about this, okay, please, please, please make sure that you understand what I’m trying to show you. I’m like, I am, I’m freaked out…I don’t know how else to say it. I mean, everybody around here knows I’m freaked out. This is happening really, really fast. So you just need to really get into proper position.

I’m sure we’ll be talking about this more tomorrow on Wall Street Silver channel with Jim, Lee and Ivan. And they did such a great job the last time. So I am looking forward to it. You know, I’m looking forward to, to talking about this and getting as many people to see what I’m seeing as possible. And next week I’ll be on with my good friend Martin North, Walk The World channel and he too, you know, he’s a great little ferret boy. You know, he, I would think of myself like a ferret too. So that’s, that’s not an insult. That’s a compliment. You know, because he was the one that brought me the report from the House of Lords on QE. And I really appreciate that because one person can’t see everything. So the more people that are looking that are sending it in, even if I have seen it, I’m still good with that. So if you see something that you think I need to see, you know, send it in and I’ll look at it but for behind the scenes and updates, make sure you follow us on Instagram, especially these days. Cause I know that and Twitter as well, I don’t know how to do the one piece, but I’m, I’m working on getting better at Twitter. Anyway, (@itmtrading_zang) And really, if you have not already subscribed, please do so please do yourself a favor, hit those bell notifications. So, you know, when we go live, but this is the time to be subscribed because there are so many things that are happening all at one time, you know, things are really heating up. They are really heating up. Leave us a comment, give us a thumbs up and share, share, share, share, share this video with anybody and everybody that you actually care about because it is a gazillion trillion gazillion, however big I can make it. It’s time to cover your assets. Here at ITM Trading, we use gold and we use silver to do that because it’s real money. That is the broadest space of buyer, the broadest base of utility. It survives. What we’re going through. History has proven it over and over, over 4,800 times, history has proven that, that’s what we need. So until next we meet, which probably could be tomorrow because things are going crazy. Please, please be safe out there. Bye-Bye.

SOURCES:

https://content.govdelivery.com/accounts/USIMF/bulletins/2eb7a5c

https://www.elibrary.imf.org/view/journals/007/2021/049/007.2021.issue-049-en.xml

https://www.imf.org/en/Topics/special-drawing-right?utm_medium=email&utm_source=govdelivery

https://content.govdelivery.com/accounts/USIMF/bulletins/2eb7a5c

https://www.elibrary.imf.org/view/journals/007/2021/049/article-A001-en.xml?rskey=kynkaf&result=19#

https://www.yardeni.com/pub/peacockfedecbassets.pdf

https://fred.stlouisfed.org/series/GFDEBTN?cid=5

https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-q2-2021/chart-gallery