YOUR FREEDOM AT RISK: New Update on Government Control..HEADLINE NEWS with LYNETTE ZANG

TRANSCRIPT FROM VIDEO:

Just wait until you see what I found today. I’m going to show you the reasons why inflation is going to continue to run hot, and it is not transitory, but really significantly the loss of global confidence in the U.S. and not just the government, but the currency as well. But of course, desperate governments do desperate things. So we’re going to talk about how they are tightening control and how they will use these weapons against you. And that’s really why this report today is so important because it’s showing us that we are edging closer and closer and closer to a Fiat money collapse and I don’t know anybody that’s about my age or lived through 1971 I’m pretty sure they can feel that same kind of frenetic energy that’s just whirling all around us. And it shows us the importance. I’m going to show you this, and please, please the importance of holding wealth outside the system. Because if you don’t hold it, you don’t own it. And if you want to retain your freedom and your choices, you definitely better pay attention to today’s video, coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading. And I mean, honestly, if I were not doing this job, I would not really realize how close we are to collapse. And I have to show you everything today. So first we’re going to do a couple of updates because the reality is is that your freedom, our freedom is at risk. And I’m going to show you that.

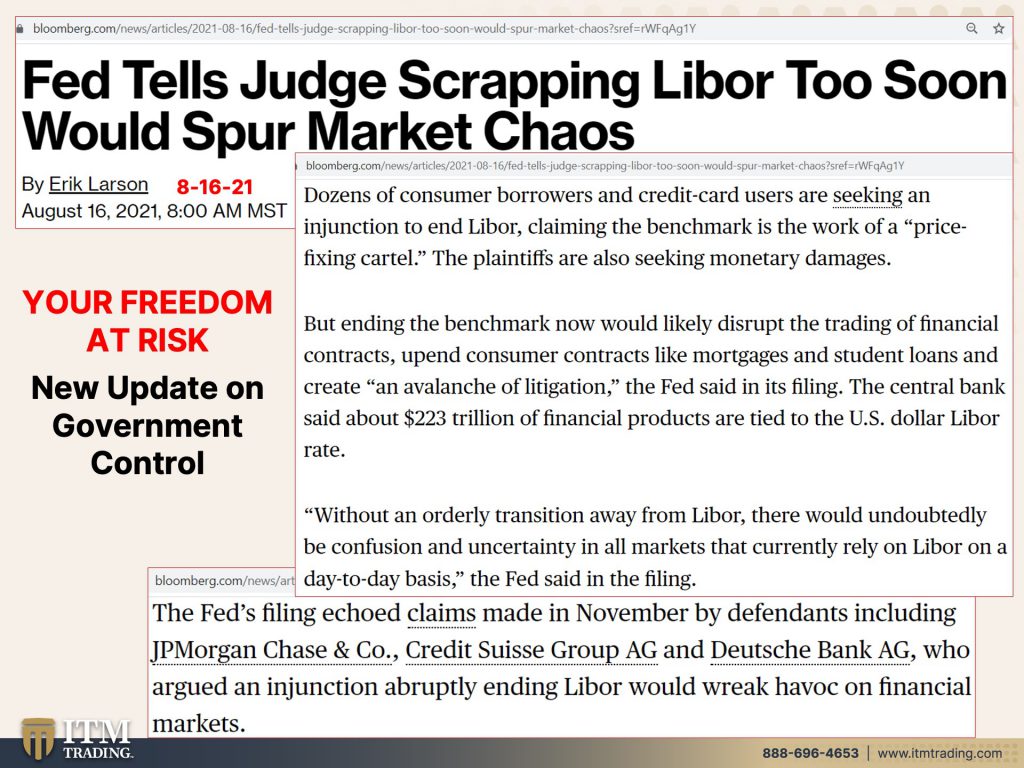

Let’s talk about the libor for just a minute, because you know, the deadline keeps coming closer and closer, and now there is a class action suit. That’s trying to force the end of it because remember the libor, and we’ve done lots of, lots of videos on the libor, and maybe you can post those in the blog. But remember, the libor is an interest rate that is a stated rate. So if a handful of banks get together and say, Hey, if you are going to lend money overnight, this is what we recharge. And if we were going to borrow money overnight, this is what we’d be willing to pay. And that was discovered the crisis and 2012. So they have to end that and, and convert trillions, many hundreds of trillions of dollars worth of contracts. So this is what’s happening there. Dozens of consumer borrowers and credit card users are seeking an injunction to end the libor claiming the benchmark is the work of price fixing cartel, which is absolutely true and admitted, but ending the benchmark now, which it was supposed to already be ended. They tested it in October with 80 trillion, and it was a big fat fail, but you couldn’t find anything about it, just that a couple of weeks or three weeks after they ran that test, they suddenly postponed a libor coming to conclusion until 2023. And there still are contracts that are written against that benchmark. But by ending the benchmark now would likely disrupt the trading of financial contracts, derivatives, upend consumer contracts, like mortgages and student loans, and create an avalanche of litigation. The fed said, and it’s filing…Ya think?! They cannot, this is a big experiment. And I think it will be a big fat fail because they’re admitting to 223 trillion in derivative contracts or contracts that are written against libor. When in reality, it’s more globally. They’re just talking about the U.S. Globally. It’s like over 600 trillion. And remember, most of those are derivatives, which do not reflect the real value that is at risk. This would overwhelm the system so you could keep postponing, but now you’ve got the class action suits because everybody knows this is simply a stated manipulated rate. If they don’t know they could get away with it, they’ve gotten away with it since the eighties, but now everybody knows, and they can’t get away with it without an orderly transition away from libor. There would undoubtedly be confusion and uncertainty and all markets that currently rely on market on a day-to-day basis. Yes, indeed. That is true. And they’ve had, since the markets have had since 2012 to figure out a new benchmark, which they’ve done a number of central banks, including the fed has done that, but they have not been able to really create a market and transfer or restructure all of those contracts into this new benchmark, including credit cards and mortgages, etcetera. But the Feds filing echoed claims made in November by defendants, including JP Morgan Chase, Credit Suisse Group AG and Deutsche Bank AG, who argued an injunction abruptly ending lie, bore would wreak havoc of financial markets. As it would have. And as it will, there will never be, in my opinion, this is my opinion. There will never be a good time to make this transition. It’s just not possible. And there’s no historic precedents for central banks and banks to be able to make this kind of shift. So they continue to use the libor. Even Powell in March of 2020, when he had a chance to really build out that market by tying a lot of this new debt to it. Did he do that? No, no, no. He went right back and tied the the debt to libor. So they’re not going to be able to do it, but I think it’s really interesting that there is a class action suit and we’ll see what happens with it. I mean, I’m pretty sure it’s going to be postponed.

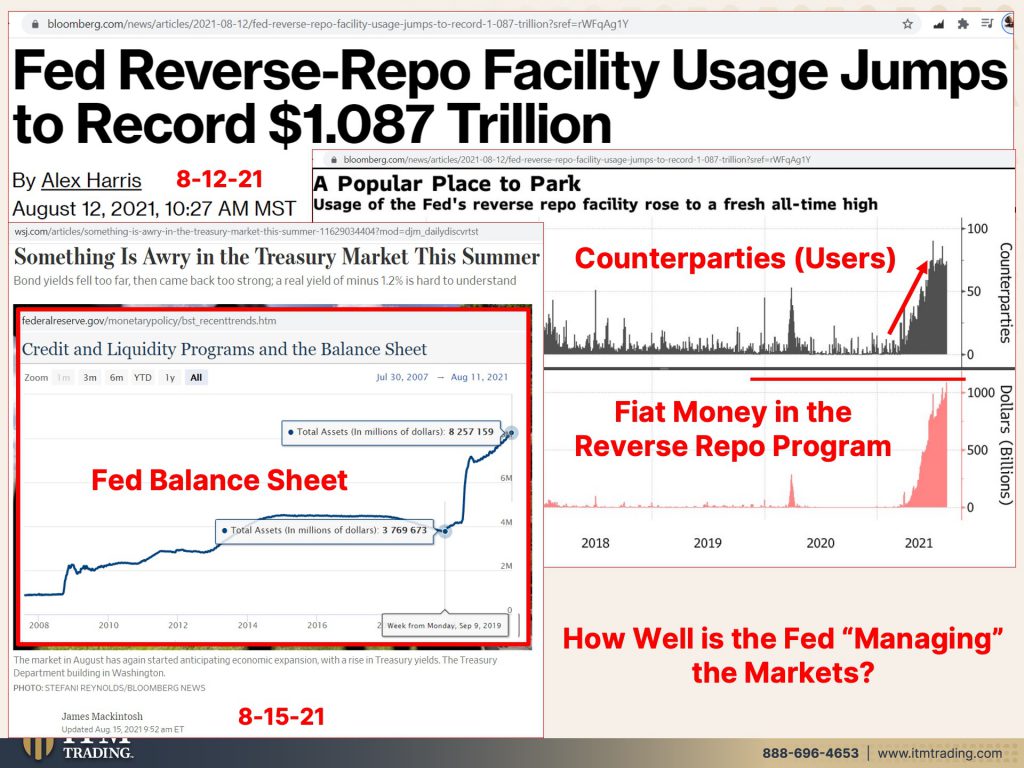

The Fed came out and overtly said that they were going to be “managing” the markets. Yeah, absolutely. So. Well, how well have they done that? With all of the pumping of new liquidity into the system, there’s too much liquidity in the system and they need to pull some out. So the reverse repo facility and on the top, these are the counter parties. So the number of other people on the other side of this contract, and you can see that it’s at the highest level that it’s ever been including through 2016 and 17. And then this next first graph shows you the fiat money in this program, which obviously dwarfs, you know, 16 and 17. And it’s continuing to make new highs in excess of a trillion dollars. Now, for those of you that are not familiar with the reverse repo market and go, well, why do I even care? Because that’s wall street, this is what underlies your money market funds. So if you have parked money in a money market thinking, well, this is kind of like a savings account, which is what we’ve been taught to think of it as well. It’s in danger. And it really, I’m sorry, I’m sorry. I wish I could say something different, but it really doesn’t matter what kind of money market you have this money in. It is not safe. They are counting on your deposits to fund a lot of the activity, the trading activity, the derivative activity, which are just big bets that you can’t convert into your money, that you deposited to money markets funds this it’s like the plumbing that that goes underneath the entire global financial system. And it is breaking down. And we remember what happened in September. And now they’re asking the question…And they use treasuries. A lot of it uses treasuries back and forth. So the government creates these treasuries sells them. And then the entities can use that to borrow overnight or different lengths of time to borrow using that collateral that was created, well it’s debt collateral. And so they’re saying something is awry in the treasury market this summer. Ya think? How about the Fed’s balance sheets? That just continues to go higher? No, to answer the questions are out there. Can’t they just keep doing this? The answer is no, but when you asked me, you know, well maybe they’ll control the inflation, which is what they’ve done since 1913 in truth. But we are at the end of this experiment with interest rates anchored at zero and debt levels at nosebleed levels. This is all of the cash that is waiting to go into the real economy and create that hyperinflation. It was a question just gestured, or maybe it was last week or yesterday. Hard for me to remember. Sorry, but it was something like, well, why are you so convinced that we’re going to have hyperinflation? This is why. Now a melt up, so you’re watching the stock market. We’ll see what happens with that. But you know, the stock market can rise on all of this liquidity, but the value of the currency continues to go down. So would I say that they’ve done a good job in managing the markets? No, I would not. I would give them a big old F I just don’t want that to happen to you because inflation is not transitory. It is built into the system. And much of when they talk about GDP growth is based upon inflation, which makes the GDP look better because, Hey, if you need that banana and that banana costs $20, well, you’re going to buy that banana because you need it. But as credit card data, that just came out, which I don’t have the title on, but that just came out, has been saying, consumers are shifting their spending away from, from unnecessary things. So that means they’re focusing on necessary. And food inflation is, is enormous and rent and living inflation is also enormous. I was listening to George Gammon’s, and I did tweet this out so if you haven’t seen it yet, I thought it was a phenomenal video. We’re going to have George on next week. And we’re definitely going to be talking about this, but he made a statement in this video that he did this morning on food inflation being up 30% year over year. And we certainly know that real estate is up about 23% year over year, but while wages have risen, they have not risen that high. So you go watch the video. You know, he was talking about potential civil war there, and it may sound outrageous, but I don’t think it’s so outrageous. Go watch the video. Well, let’s put the link to that. We’ll put the link to that below as well.

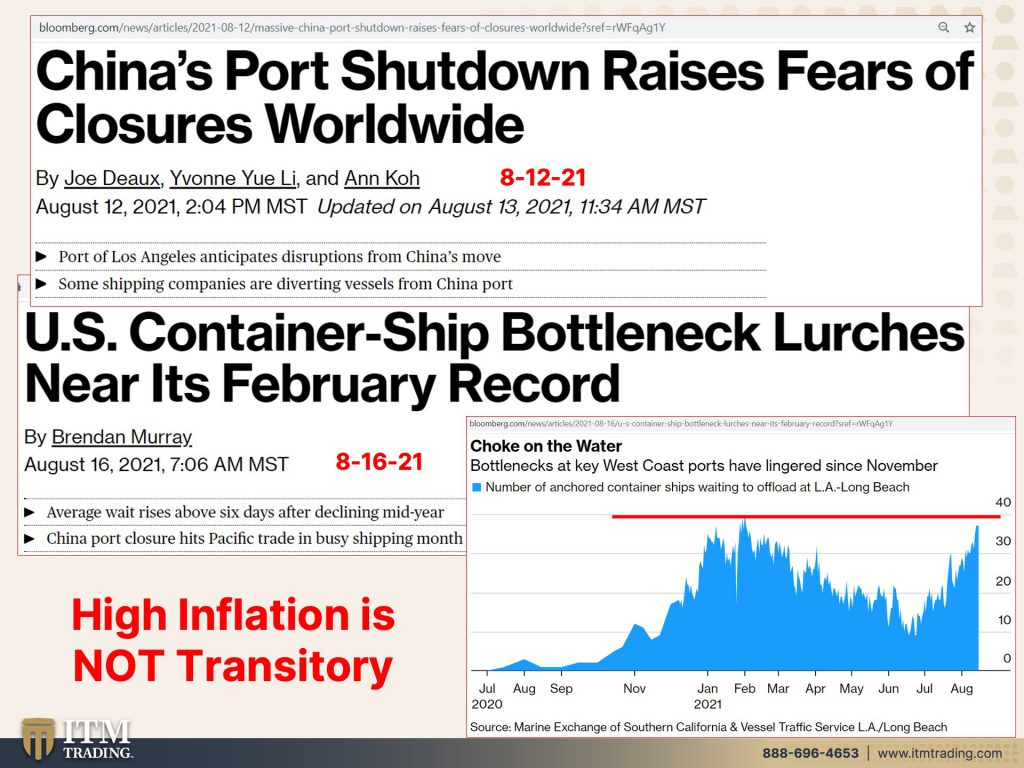

So this is one of the reasons why I’m telling you that we aren’t even moderately near any, any end to the speed. Remember inflation is baked into the system. So what the central bank was really trying to do is control the rate and speed of inflation. But when you let a genie out of the bag, it’s hard to get it back in because there are other forces that come to play. And certainly one of the forces is in shipping and all of these bottlenecks. I mean, you can see that’s the BDI, the Baltic Dry Index, which tells you shipping costs, but you can see that they are rising no matter what, one of the indexes or charts that you look at the cost of shipping from in that, the chart on the right is from Shanghai to New York and Shanghai, wherever, but BDI is a global index. It doesn’t matter where you’re shipping from the benchmark cost of shipping. A container has risen 10% since mid July. This looks like a trend to me, especially since we’ve got port shut downs and these costs are gonna have to be transferred. So China closed the third largest port in the world, but it also looks to raise fears of closures worldwide. And guess what? This is U.S. Container ship in LA in the port in LA. And they also have a lot of backlog. So this kind of shutdown is happening that will add to the costs for you and me. These costs will have to be transferred to the end user. Now, if your income is not able to handle these increases, you are in trouble. And certainly the raises even the $15 an hour. I mean, that’s not really 11. I mean a living wage. It’s just not. So I’m telling you, high inflation is not transitory. I, you know, look officially 50% inflation is classified as hyperinflation. So in the seventies, as we were transitioning from a gold standard to a debt-based standard, I mean, we really did that transition long before that, but while it’s still had a tie into the currency, let me say that while it was still convertible into the currency, that’s the best way to really, to say that I remember in anybody that’s, you know, somewhere around my age, I’m sure you’re going to remember this too. We were dealing with official 45% inflation, but you never hear that there was hyperinflation in the U.S., But it was very challenging for a lot of people. My first mortgage was at 12%. I remember that. I remember that, but this inflation has never been transitory and higher inflation like we’re dealing with. That’s not going away, especially when you’re seeing ports close, that all adds to it. And that adds to what you can do to get prepared, to withstand this transition, which really is…Which really is food, water, energy, security, barterability, wealth preservation, community, and shelter. Those are all the elements that you need to have a reasonable standard of living and to sustain your standard of living and potentially, and probably to put you in a position to benefit and come out the other end of this even better. But do governments really want you to come out better? No, the whole system is designed just the opposite.

So now I’m not sure that that people are going to like what I’m going to say in this little piece, but I got to say it anyway. So just bare with me on this. Okay? So the Taliban, we know what’s going on in Afghanistan and they are entitled to a level of reserves from that SDR distribution, U.S. Treasury secretary, Janet Yellen should intervene in the International Monetary Fund to prevent the Taliban led Afghanistan from being able to use almost 500 million in reserves, Republican house members said, the group of 18 lawmakers, including blah-blah-blah wrote to Yellen on Tuesday in a letter obtained by Bloomberg news, asking Yellen to take action at the fund and respond to their request by Thursday afternoon, they also called on Yellen to provide more detail on measures, being taken at the IMF to make sure the assets known as Special Drawing Rights, right? Which they, they pushed a button they’re going to be distributed on the 23rd, 650 billion, that the assets aren’t used in ways that run counter to us national interest. Now it’s going to be very interesting to see if Janet Yellen still has the clout to block this because what I’m seeing is that potentially no, now here’s another piece. And then I’m going to tie it back to why you should even care about this and how this impacts you, because this is really important. Bank Adverse Taliban leaves you as struggling for financial edge, right? Because they don’t use the traditional global banking system like swift, right. Where the U.S. could put sanctions on them and cut them off their money. Now, do you think it’s possible that our government, wanting to force you into different things that I can’t even say on air, might use that as a tool to block you from the money that’s in the Fiat markets? We’re going to see how that’s being used by another government and I’d say yes, absolutely. For now, President Joe Biden’s administration has taken efforts to halt money from flowing into Taliban hands because they use cash and they use an honor system as well. Hawala and the U.S. Has frozen roughly 9 billion in assets. I love this, belonging to the Afghani Central Bank. Bottom line, the nation’s central bank, about 7 billion of that is with the federal reserve bank of New York. So if you don’t hold it, you don’t own it. Period. End of discussion. Regardless of your perception, it does not matter. The administration has also stopped shipments of cash since that’s key to what they use, U.S. Dollars in cash. And then the honor system. I firmly believe in my heart of hearts, that there is a lesson in here for each individual, because desperate governments do desperate things. And when the currency is hyperinflating and losing all of its value and the public has lost all of its confidence, they will do anything. And they will do anything to force you to stay in the system, but they are doing anything to keep you in the system, period. End of discussion. Why do you think the stock market has to stay up in the real estate market has to stay up and the bond market has to stay up. Interest rates have to stay down. That is all smoke and mirrors to make you think that…and look, we’ve been taught that the only alternatives for investment are stocks and bonds and wall street. It’s not flipping true. It’s not true at all, this, although I don’t think I’m supposed to call it an investment, but this holds your purchasing power, this was out of the system. And as the Bank for International Settlements tells us it runs no counter party risk. You hold your wealth in this system. It is all counterparty risk. Take heed, please.

This isn’t just an issue that’s happening in, you know, Afghanistan, one country it’s also Belarus who’s going to get a billion from the IMF. So the U.S. is losing clout on a global basis. No doubt about this. Belarus authoritarian regime weighed down by sanctions imposed by the U.S. and the European union, because they still do go through the system. Through the swift system is set to get an almost 1 billion lifeline from the IMF. So that SDR distribution is helping a lot of countries and basically going around what the U.S. sanctions and what the U.S. wants to have happen. And I’m thinking we are losing a lot of clout. Belarus is more in the company of countries like China, Russia, and Iran, China central bank is said to receive 42 billion, Russia 18 billion, and Iran about 5 billion in IMF assets. Keep this in mind about Iran, because I’m going to show you what they’re doing. Even if the U.S. declines to provide Belarus with hard currency. In other words, cash, the IMF has 31 other nations and institutions who have entered into voluntary trading arrangements to provide cash in exchange for SDRs, including China. So like Afghanistan, even though China has not come out officially yet and said that they acknowledge the new Taliban government, China is right in there expanding their level of influence and their level of control. These SDRs are a big deal. There is. I believe and I…We’re going to see if I’m either going to be right or I’m going to be wrong. I mean, I can’t guarantee it, but as soon as China in 2009 said, what about the SDR? And then the IMF came out and dusted off all of the old mechanisms that they put in place to take over as the world’s reserve currency. In my mind, there was absolutely no doubt that the SDR would be the new world’s reserve currency, but it doesn’t have, I mean, it’s been around for a long time, but it’s not as prominent in the markets. And in, in central bank balance sheets or reserves, I should say, not balance sheets, but the reserves as it needs to be. So a big part of this push the 650 billion, is it expanding that influence and getting into more and more reserve assets of global central banks. So we’ve got some things that are at odds and the U.S. Still, because they are the largest economy. We still have a level of clout. So it’ll be very interesting to see if we can’t, if we can’t block these distributions to the countries that we want to block them, then that’s going to basically show us and tell us and let us know that we’re losing our clout. And that would also extend to the, really the job that the fed is doing by forcing the global economies hands, which is really they’ve taken control. They’re going to manage everything and it’s not working. It’s just not working, but Iran’s accelerating weapons grade uranium enrichment program is that’s accelerating and they’re getting what’s that 5 billion in SDR, 5 billion dollar worth of SDR’s? There are a lot of wars that we are fighting right now. Will there be even more, will there be even more? Because that’s something that always happens around a currency regime shift. It happened with the Vietnam War and, you know, the U.S. lost a lot of face during the Vietnam War and think about it. We had the Vietnam War, we had a Women’s Lib = so the Me Too movement. We had civil rights = so the Black Lives Matter movement. We had the Oil Embargo = so the U.S. is begging the Middle Eastern countries to increase their production, to lower the price. Even at the same time that they’re discouraging the U.S. Oil companies from producing more or less oil. So, you know, we are really losing that status globally.

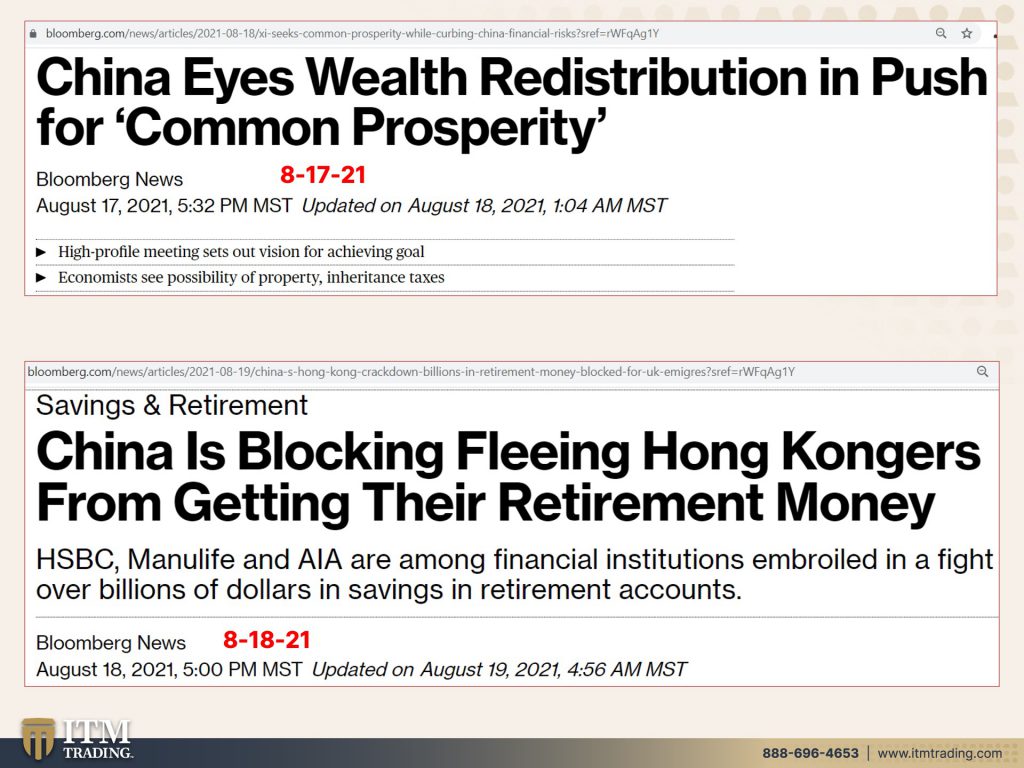

I also want you to see in here, China eyes wealth redistribution in push for ‘common prosperity’. There will still be the communist party in control. You will own nothing and you will be happy, but while it benefited the communist party to become world leader in many areas, you know, we helped them do that. We shipped all the jobs over to China, and that wasn’t the only thing that was kind of like the start of it. And they allowed just like we allowed the, the social media companies to get to be so huge. And the cryptocurrencies to flourish, the government did well because there are benefits to that, but wealth really puts you know, if you have wealth, if you have real wealth, it’s outside of the system. But if you have real wealth, you have more freedom. You have more choices. And China as a communist country does not want that. But if you really think the U.S. Is a true democracy, and that we actually are on a free market economy. I mean, I don’t even know what to say to that because it should be pretty obvious that they’re choosing who wins and who loses. And the corporations have a whole lot more clout and a whole lot more control than the individuals do. We are not too big to fail, but they are, look at the first slide I showed you on the libor. What about the children? That’s what they always say. But anyway, it’s garbage. You know, we’ve been watching the demise of Hong Kong as any kind of quasi free country, but, you know, they had an agreement that Hong Kongers with a special British passport could leave Hong Kong. And yeah, China’s blocking fleeing Hong Kongers from getting their retirement money. And where’s their retirement money being held? Oh, like companies like, I don’t know, HSBC, Manulife and AIA, are among financial institutions embroiled in a fight over billions of dollars in savings & retirement accounts. It is not the first time that those people that have been so dutiful and contributed to the retirement accounts and are counting on them that have been taken advantage of. I’ll say that, I’ll say it in a nice way, but there are some that are preparing for this.

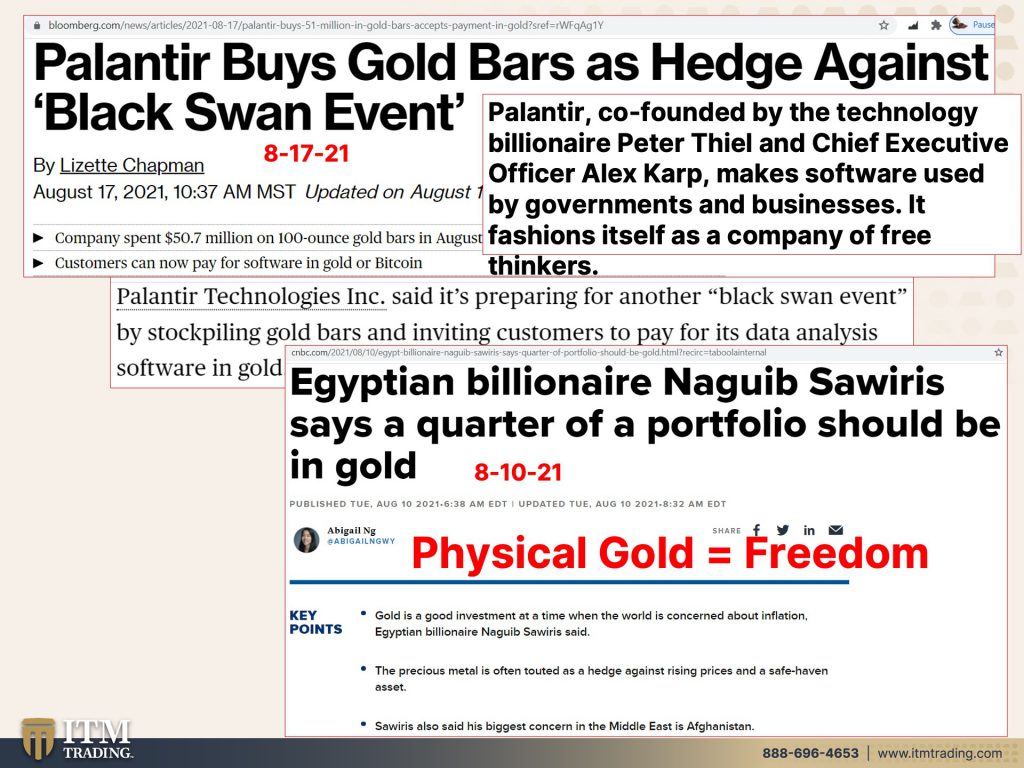

Palantir they’ve actually, you know, they actually do a lot of work with the governments and businesses. Well, they just bought a whole bunch of gold as a hedge against a black Swan event. Now what’s a black Swan event is an event that nobody can foresee coming, but it happens. And there’s chaos just like COVID was a black Swan event. And what Lehman brothers was a black Swan event. So corporations are more and more talking about a black Swan event. And some of them are doing something about it and what are they doing? They’re buying gold. Additionally, they allow customers to pay for their products with gold. People say, how can you use it? Well, last week I showed you how they’re using it in Venezuela. And this week I’m showing you how Palantir said, yep. You can buy our stuff with gold, no problem. And you can see that those in the know, those that have wealth. They want to protect their wealth. And what are they using? They’re using gold. You know, things have been tested and tried with gold. This has withstood 6,000 years of currency regime shifts, wars, pillaging, everything. Now it may change ownership, but this has withstood. And this is what they reset a currency against, gold. It’s the primary currency metal. It is indestructible. We can account for 98% of all of the gold that has ever been mined. And it meets all the criteria to be a good money. If you want to protect yourself from what’s really happening, then you have to have physical gold, wealth preservation and growth, physical silver for barterability, because I believe without one doubt in my mind that this is what’s going to ensure my freedom, my family’s freedom, your freedom, your family’s freedom and all of our future, because it should be very, very clear, desperate governments do desperate things. And if you are dependent upon the government and the central banks money, they could do any darn thing they want with you. Look at what’s happened to the purchasing power value of the dollar since they took over. And particularly since Nixon handed all the control over to them, 50 years, 50 years, I did a poem. If you didn’t read it would you, where did you put it in Twitter and stuff? Oh, in the podcast, you know, for the, for the birthday, for the anniversary of that. Not a good time, not a good time. And since then, I mean, officially we have 3 cents in purchasing power out of the original dollar, but they did that slowly. They did it in a controlled way. Can they raise rates? Because presumably that’s, what’s going to control inflation. Can they raise rates? No, they can’t. Are they going to taper? Well, they’re kind of backed into a corner, but all that means is they’re going to buy a little bit less, fewer treasury bonds and mortgage backed securities. They’re not going to stop. And they’re certainly not going to sell what they’re holding because they can’t. And the last time they tried, it was a big fat fail. And guess what? If they try it again this time, I can’t guarantee this, but in my opinion, strong opinion, it will be another big fat fail, but I don’t want you to fail. And so that’s why I like encourage you. People say, well, y’all you sell gold and silver. What am I supposed to tell you to do something I’m not doing for myself and for myself in order to be as independent and self-sufficient food, water, energy, security, barter, durability, wealth, preservation, community, and shelter. You have all of those things secure? Let them take everything else away from you. All the paper assets, you’re in a good position because you can always a hundred percent of the time, a hundred percent of the time, because is has the broadest base of buyer. You can always convert your physical gold and silver into any currency. Any good any service, look Palantir, they’ll take gold. You don’t even have to convert it into dollars in order to convert it into their service. That’s what I want for all of us, because that’s, what’s going to protect us as well as the rest of the things.

We are so close. I’m just kind of hinting at this, but I’m so close to, releasing something that will help you with the whole mantra. We’re so close. We’re so close. And I think you’re really going to love it. Cause we have been working on this very, very hard. So just stand by when I’m able to give you the full announcement I will. And again, next week, I’m going to have my good friend, George Gammon on Wednesday Coffee with Lynette. It will be live. We will be talking about possible civil war and everything else that’s going on in the world. He’s such a bright guy. So I’m really looking forward to that, but please, you know, start your gold and silver strategy if you have not already done. So, and just schedule a Calendly, you can find the link in the description, or you can call us (888) 696-4653 and start that have a conversation with one of our very, very brilliant consultants and get yourself a plan. Get into position. There’s no more time to wait. There’s no more time to wait. I cannot tell you that the whole thing’s going to collapse on Tuesday morning at 8 35, but it could. So if you like this, this is definitely a time to subscribe. We’ll go on live as new events unfold because I prefer to go live, frankly. So click that subscription button and make sure that you hit the bell. So we let you know, give us a thumbs up. If you like this, share, share, share, this material should be shared by everybody that you know, and that you love. And until next we meet, please be safe out there. Bye-Bye

SOURCES:

https://stockcharts.com/h-sc/ui