Treasury Secretary Yellen Reveals NWO Agenda…HEADLINE NEWS with Lynette Zang

From one crisis to another crisis, to another crisis — the global economy is cracking! But don’t worry, Treasury Secretary Janet Yellen, along with the IMF, are going to show you how we’re going to come up with a new world order.

TRANSCRIPT FROM VIDEO:

From one crisis to another crisis, to another crisis, the global economy is cracking, but don’t worry…Treasury Secretary Janet Yellen, along with the IMF. Oh, they’re gonna show you how we’re gonna come up with a New World Order, coming up.

I’m Lynette, Zang, Chief Market Analyst here at ITM Trading a full service, physical gold and silver dealer specializing in custom strategies. So you wanna know the strategies that are coming up and what the powers that be have in mind for us all?

Well, let’s just take a look at Janet Yellen, challenges, China, in a moment for choosing on the world order. So China has a choice. They can either back Russia or they can back the U.S. So sides are definitely being developed either way, but this is the approach that she says we should take. Number one, we should modernize the approach to trade integration, where supply chains are made up of trusted countries. Oh, so if you play the game the way we want you to play it, then you’re in and if you don’t, then you’re out. And I think that was pretty apparent with what has been going on in the world right now, frankly, they wanna revamp the governance of the IMF to reflect their underlying principles and objectives. Of course, that’s all really rather subjective, isn’t it. But again, you either play our way or it’s the highway. I love this. I don’t really love this, but I’m just saying. Revisit our strategies, policies, and institutions to better mobilize capital. Now, I don’t know if you’ve been listening, but presumably there’s a whole lot of cash sitting on the sideline. Of course, all of that cash was created from lots of debt. We’ll talk more about that in a minute, but private capital, meaning you and me, can be better mobilized in a world so a wash with savings that risk rates have been dropping for decades. How about the reality that the world is a wash in debt and interest rates had to fall to be able to continue to grow even more debt? And what they’re really talking about here is the, the ability to take us into negative rates. Because if we see our principle evaporating, we’re more likely to go out and spend it. I’m not really thrilled with this. I gotta tell you because the other thing that governments can do, and I want you to know when I’m talking about Russia, it is definitely not because I agree with what they’re doing and all of that, but it is a really good example on all the levels, because frankly, whether you’re a government, a corporation or an individual, there are still some simple rules of the economy that work for everyone.

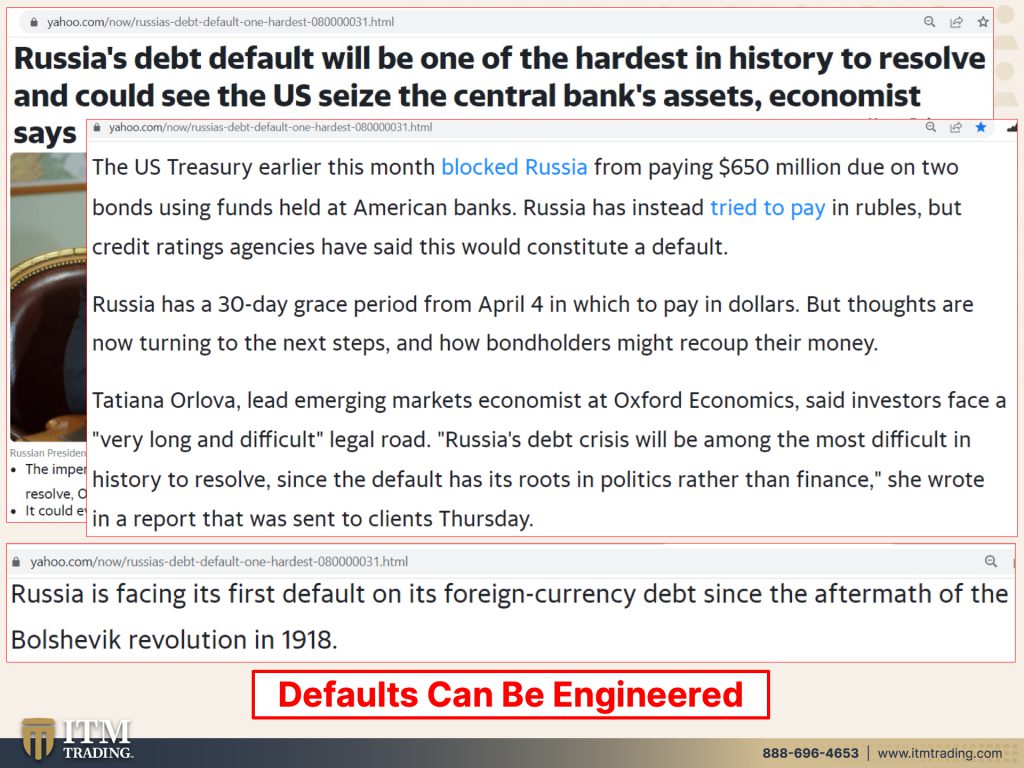

One thing you need to really be aware of is that, you know, quite honestly you can, be pushed into default. So if you stop and think about what happened in 2008, with all of those mortgages, I mean, you know, it was the derivatives markets. It was the banks. When the structure, the debt structure froze, but who really paid the heaviest price? It was the public that paid the heaviest price. It was a public that was encouraged to take on this debt, but they were the low guy on the totem pole. And so they ended up losing everything. So let’s just in this, this is at a much higher level than an individual level, but there are lessons in here for all of us. The U.S. Treasury earlier this month, blocked Russia blocked them from paying 650 million due on two bonds using funds held at American banks. Russia has instead tried to pay in rubles, but credit rating agencies, oh, I don’t know, like S&P and Moodys, have said that that would constitute a default. So it isn’t that they don’t have the ability to pay, which it’s typically, that’s what happens to the general public. They simply do not have the ability to pay, but Russia can create money at will just like the U.S. can. However, the NATO allies have decided that that money is not good anywhere, right? Gold money is still good, but the Fiat money, no. Russia has a 30-day grace period. So we’ll see what happens on May 4th, but let’s see, this is a very, a long and difficult legal road. Russia’s debt crisis will be among the most difficult in history to resolve since the default has its roots in politics rather than finance. And if you don’t think that you can be through perception management, manipulated into making poor choices that do not support your best interest, and then others taking advantage of that, you really need to think about it again. How many time can you be lied to when you do not know the truth? And this is a con game, don’t be conned. This is the first default on its foreign currency debt. Since the Bolshevik revolution in 1918, I think it’s really interesting.

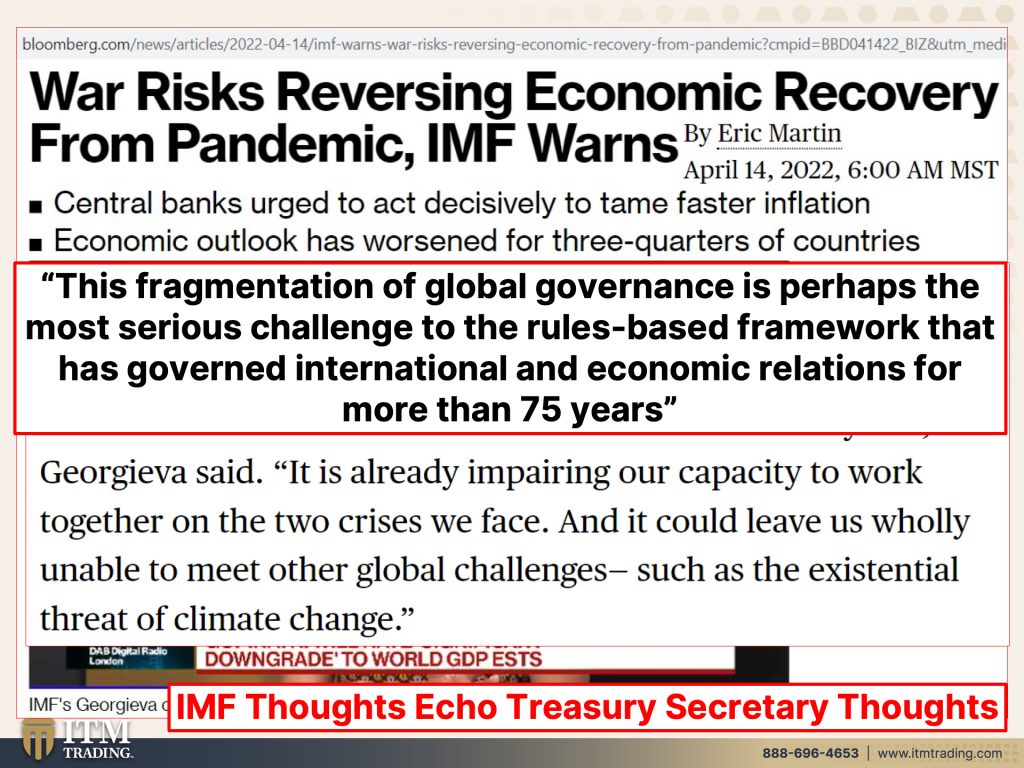

So the war risk reversing the economic recovery that was based on flipping debt from pandemic and the IMF who also came out today and lowered the globe, the, the, uh, global economic recovery and what they thought the global GDP would do. We’ll talk about that in a minute. But central banks urge to act decisively to tame faster inflation economic outlook has worsened for three quarters. 75% of the countries. The economic outlook has worsened. This fragmentation. This is a key line here. This fragmentation of global governments is perhaps the most serious challenge to the rules based framework that has governed international economic relations for more than 75 years. What did, let me just quickly go back to that. What did Janet Yellen say? Well, let’s see, we have to revamp the governance of the IMF to reflect the underlying principles and, and objectives.

So does that mean that they have not been actually reflecting the underlying objectives? But they’re gonna this fragmentation because want a global world and what’s happening right now is de-globalization. And I was there in the eighties when all the talk was about globalization. Well, it benefited the corporations, but that did not fully benefit the individuals because what happened, all the jobs were all the high paying jobs, mostly manufacturing, actually jobs in general were shipped overseas right? Now we’ve got de-globalization where they’re trying to bring everything back in because of what’s happened with the supply chains.

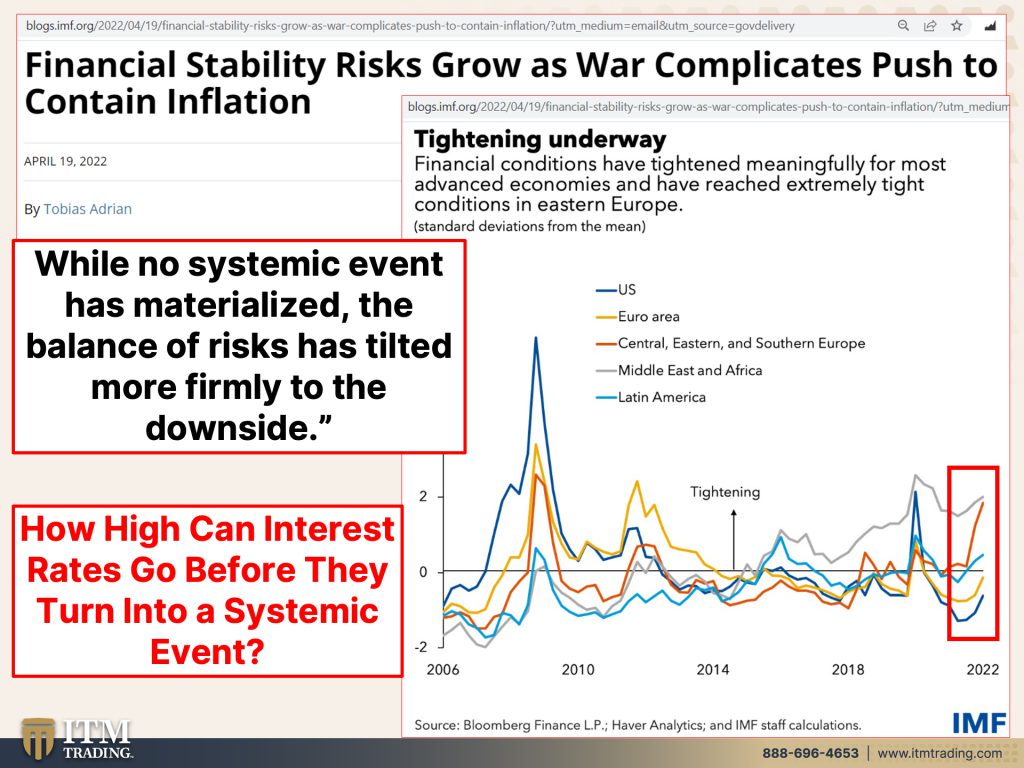

The IMF’s thoughts absolutely echo treasury secretary Yellen. So now, you know, this is taking on the level of a full blown campaign because financial stability risks grow. This is a new report from the IMF blog just today. As war complicates the push to contain inflation, I’ve said this forever, they’re between a rock and a hard place because inflation, now, they, they can’t hide it like they could before. It’s more obvious for people because it’s happening more quickly. When it happens slowly, they can get away with it. That’s their price stability. You don’t know that it’s happening. So you don’t change your choices in spending, but when inflation ticks up this rapidly, people notice they aren’t as likely to spend. They’re having to make choices on putting food on the table or buying a blouse. Guess what’s going by the wayside. They’re not buying that blouse, obviously.

So they’ve gotta raise interest rates, but for the governments, for the central bankers, that growth is all based on debt. Just keep borrowing, just keep borrowing, just keep borrowing. And now the tightening is underway. Now you can see that the tightening is happening and it’s happening globally. This is leading into, there’s not one doubt in my mind. I’m certain that we’re already at the beginning phases of the hyperinflation that is going to usher in a complete shift socially, economically, and financially, you better be. You better be prepared because while no systemic event has materialized, the balance of risk has been tilted more firmly to the downside. Well, that means that there will be an event that will push this over and central banks are trying to raise rates simply so they can lower them again. We’ll talk more about that, but how high can those interest rates go before that in and of itself turns into a systemic event?

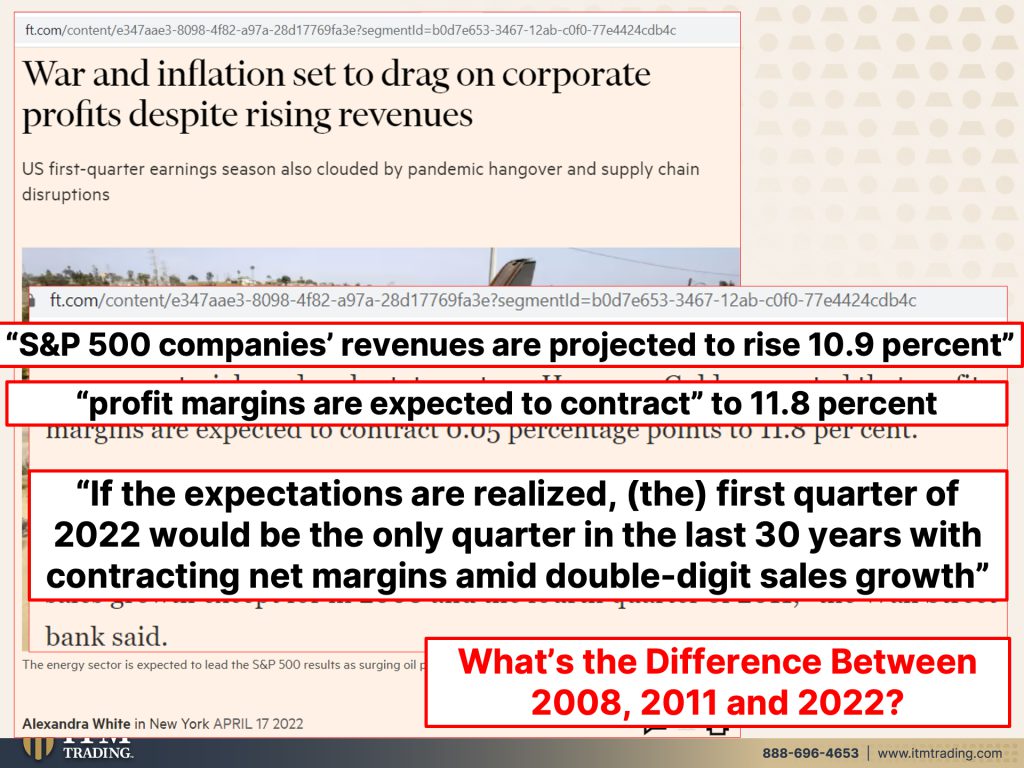

We’re going to be able to find, we’re going to find out. We don’t know yet neither do the central banks. We’re going to find out. War and Inflation set to drag on corporate profits, despite rising revenues. Yeah. We’ve gotta protect those corporate profits. I’ve you over and over again. How that’s the most important thing is corporate profits. And while most of the masses suffered greatly from what we’ve just been going through now, going into the third year, corporations profits have exploded, but now I don’t know. The inflation is kind of eroding that a little bit while the S&P 500 revenues, the company’s revenues are projected to rise 10.9%, which is really probably about the rate of inflation that we’re really dealing with. Profit margins are expected to contract two 11.8%. So down to about a half a percent from what they were, oh, no corporations. Aren’t going to make as much money. Oh, what are those CEOs? How are they gonna live? If they can’t make 13 million? Oh they’ll make it. Even if the corporation goes under, I’m sorry, they’ll make their $13 or $23 million a year. But if the expectations are realized, this is really key because this is a pattern shift. The first quarter of 2022 would be the only quarter in the last 30 years with contracting next with contracting net margins, amid double digit sales growth. The only other time that that’s happened was in 2008 crisis, 2011. That’s when they doubled down and they did QE2 and today. So what’s the difference between those dates and today? Hmm, well, they had cleaner balance sheets and they could grow those balance sheets. Interest rates were all also up a lot higher and they were able to pull them down. Well, at least in 2008, they’ve been anchored near zero since then. So this time they don’t really have the balance sheet. I mean, yeah, they can grow more debt until they can’t, but there’s a little problem with that because the markets have to accept it.

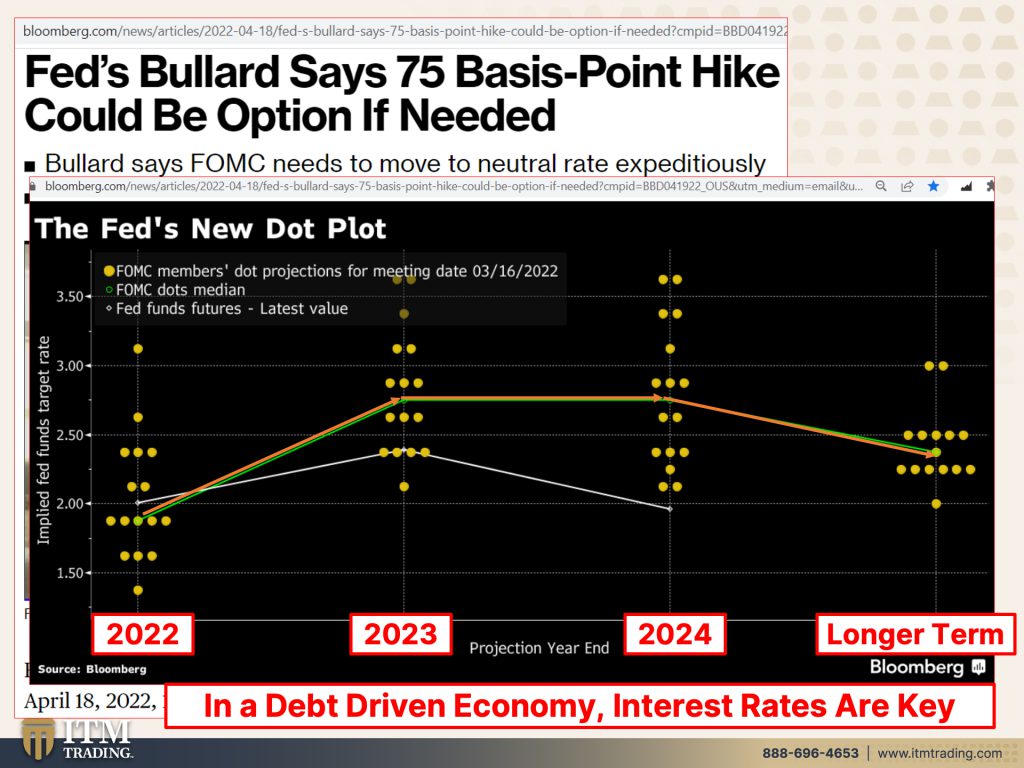

And so now fed President Bullard came out and says 75 basis-Point hike could be an option if needed that’s garbage because even if they raise it a half, which they call huge 75 basis points would be tremendous. It’s only so they can lower them. Again. This is the new dot plot. Take a, a look at this. I think this is really interesting and very telling, okay, so they’re gonna raise the rates up to about two and a half percent. This is what they anticipate two and a half percent for over, this year, between now and by 2023. And then they’re not gonna do anything. They’re just gonna keep ’em there for a year. Then they’re gonna drop ’em. Well, guess what? Into every crisis, up until this point up until 2008, they have had to lower rates, five and a half, five and three quarters percent in order to stimulate the buying. But now, since inflation is rear there it’s ugly head. Well, they don’t want to stimulate the buying because that will make the inflation run hotter. Now, can you see the problem? They’re damned if they do, and they’re damned if they don’t, you better be in safety. This is my safety net. This is my safety net. That’s where you wanna be, the safest thing that you can do, because this is not gonna be a pretty storm.

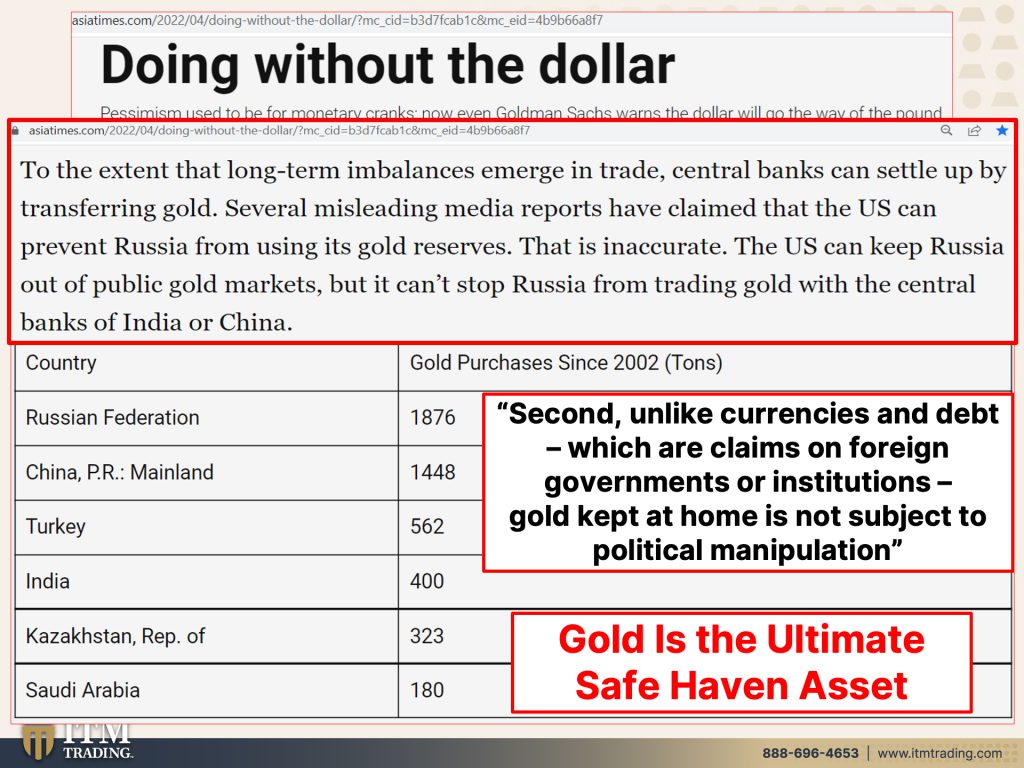

The debt driven economy in that the interest rates are the key. And that’s the only tool that central bankers really have. They always talk about all their tools, the one that they really have are interest rates. Cause if they wanna stimulate, they lower interest rates. If they wanna cool it down, they raise interest rates. Is it gonna work this time? This is a different kind of recession that we’re going into. I think we go into hyperinflation and the world. And we’ve been talking about this too, that the world is getting tired of the U.S. Dollars, being the world reserve currency and the U.S. Having all of that power over swift. So they don’t like what you’re doing. Boom. They cut you off. Imagine if we’re in an all digital world and you got a smart house and you got a smart car and you got all these smart things that can be controlled remotely. And they don’t like what you say. They don’t like what you do. Boom. They just cut you off. You better have something that’s outside of the system, physical in your possession. Cause if you don’t hold it, you don’t own it. And I don’t care what anybody says. It’s just a fact. And we’ve seen it time and time and time again by no coincidence, the same central banks that are bypassing the dollar financing. So SWIFT have bought the most gold over the past 20 years, according to the world gold council, Russia, China, Turkey, India, Kazakhstan, and Saudi Arabia. I think that’s pretty darn interesting. Don’t you? Because to the extent that long term imbalances emerge in trade central banks can settle up by transferring gold, shocker. This is why it’s the safest thing. It does not take any government to say this is money or this is not money. It has been money for thousands and thousands of years that let’s see several misleading media reports have claimed that the U.S. Can prevent Russia from using its gold reserves. That is inaccurate. The U.S. Can keep Russia out of public gold markets, but it can’t stop Russia from trading gold with central banks of India or China, which is exactly what’s happening, which is exactly why you saw secretary Janet Yellen, challenging China, really threatening China. You’ve gotta pick because right now Russia’s gold is indeed buying them the goods that they need. I’m not saying that they’re not suffering too, But you’ve got to keep in mind the bank for international settlements. What did they say?

Unlike currencies and debt, which are claims on foreign governments or institutions gold kept at home is not subject to political manipulation. So yeah, Russia lost all the reserves that were outside of its borders inside of enemy territory, but what they kept at home, they can still use to buy the goods and services they need from other countries. That’s true for individuals too. Gold and silver kept at home run, no counterparty risk and it’s real money. And this is what you need. This is what we all need, cause it is indeed the ultimate safe Haven asset.

So we have some things to coming up and I’m really excited to tell you that on June 11th, sorry about that. I will be at The Grand Wailea on Maui and that’s a Saturday and I’m going to be doing a very special, small, small, intimate retreat conversation where I’m gonna be able to talk about things there that I don’t get to talk about on air. And I’m really excited about that, cause I don’t like not being able to say everything and anything that’s on my mind. So come and join us and join us for this event. It’s gonna be really wonderful and watch my interview with Jerry Kassner from House of Prep on the Beyond Gold and Silver channel. That video is out now, as well as all of these podcasts, which you can listen to anywhere and any time on all major podcast platforms.

But if you haven’t already started your strategy you really need to get this done. There is no more time left to procrastinate. Just click that Calendly link below and give us a call. We’ll set up a time that works for you and start your own strategy. And if you’ve started it, but you haven’t finished it, get it done finish it. So if you like this, please give us a thumbs up. Make sure that you share, share, share this video and keep in mind. It is a hundred bazillion percent time to cover your assets. So until next we meet, please be safe out there. Bye bye.

SOURCES:

https://www.yahoo.com/now/russias-debt-default-one-hardest-080000031.html

https://asiatimes.com/2022/04/doing-without-the-dollar/?mc_cid=b3d7fcab1c&mc_eid=4b9b66a8f7