RESET PATTERNS APPEAR…HEADLINE NEWS with LYNETTE ZANG

TRANSCRIPT FROM VIDEO:

I’m Lynette Zang Chief Market Analyst here at ITM Trading, a full service, physical gold and silver dealer. And, you know, there’s a lot of news that’s coming out. There are some projects that I’m working on for you guys that I think you’re really gonna like, but today we got to talk about some headline news and the reset patterns that I’ve been noticing. And we’ve talked about before. I just need to show it to you because while I can’t tell you that everything is going to collapse on Tuesday morning at 8:35, you need to be prepared just in case it does. That’s how close we seem to be. And a lot of that hinges on confidence. And we’ll be talking about that in a minute, but I’ve also been witnessing a lot of articles referring back to the seventies. Well, let’s see what else was happening in the seventies? Well we were shifting onto a pure debt-based system guided by the central bankers who really do want to remain in control of this whole system. After we reset it into a new system. Now make no mistake about it. I’m going to say this clearly, because I don’t want you to mishear. This, I do not think that when we first go in to a central bank digital currency, that that will be the final reset. That will just be the tool to usher in the next continuation of the hyperinflationary event. And frankly, you know, I’ve kind of started talking about this, but it really is looking and feeling to me, I’m not saying this in a technical way. I’m just saying this in a sensory way that, you know, I think the hyperinflation may have, I think we’re in the beginning stages of it. So for those that have been really moving forward in an expedient manner, you might just want to speed that up. I’m not kidding you!

Part of what we’re also looking at with the flashback…this was their title. The echoes of that decade are everywhere, but a shock to match Nixon’s breaking of the dollars link to gold are unlikely without an inflationary crisis first. Well, I think that the inflationary crisis has already begun, and I don’t think the central banks are going to stop it and talk more about that as we go through the piece. But the real reason why I picked this particular headline is because Vietnam was a huge fail for Nixon, a huge fail, and a lot of the reasons that justified hyper inflating our currency away, even though that’s not the way they look at it because we only hit 45% inflation and officially hyperinflation is 50% inflation, but I lived through it. So any of you out there that also lived through it can recall that you also had the civil rights movement going on at that time. And you also had, you know, the women’s lib movement going on that at that time. And you also had issues around energy going on at that time. And all of those things are happening today. It’s almost like wherever you look, there’s something major that’s happening. And that’s because we are transitioning out of the current system, there has been new, new wage data. And this is really actually kind of an interesting piece because we do know that wages have been going up as the employment as it’s been harder and harder to get workers, but let’s see. And I put that in there. There we go. Something is going on in the structure of the labor market structure, wage growth for the low skilled exceeds that of the high skilled by the most on record right there. Okay. So I’m in an interesting thing. I’m going to do a piece on China coming up soon, but an interesting thing, even coming out of China in they’re limiting the amount of online gaming that the kids can participate in to three hours a week. Well, part of that was because not because they wanted to study and all have them all engineers, but because they wanted the kids that are growing up to be able to fulfill the lower wage jobs more than anything, which I think is really interesting. It’s why they attacked online tutoring or you know, yeah. Tutoring to get into better colleges, etcetera. So we’re seeing that we’re having an issue around the lower wage worker, which is probably why there was such a big impact on unemployment insurance, etcetera, to those coming back in the workforce. But the fact that the low skilled worker exceeds that of the high skilled by the most on record is an indication of how close we are to the end of this current currency’s life cycle. Something that I’ve studied, frankly since 1987. And I know how deeply I dig into stuff. And that’s why I believe my homework.

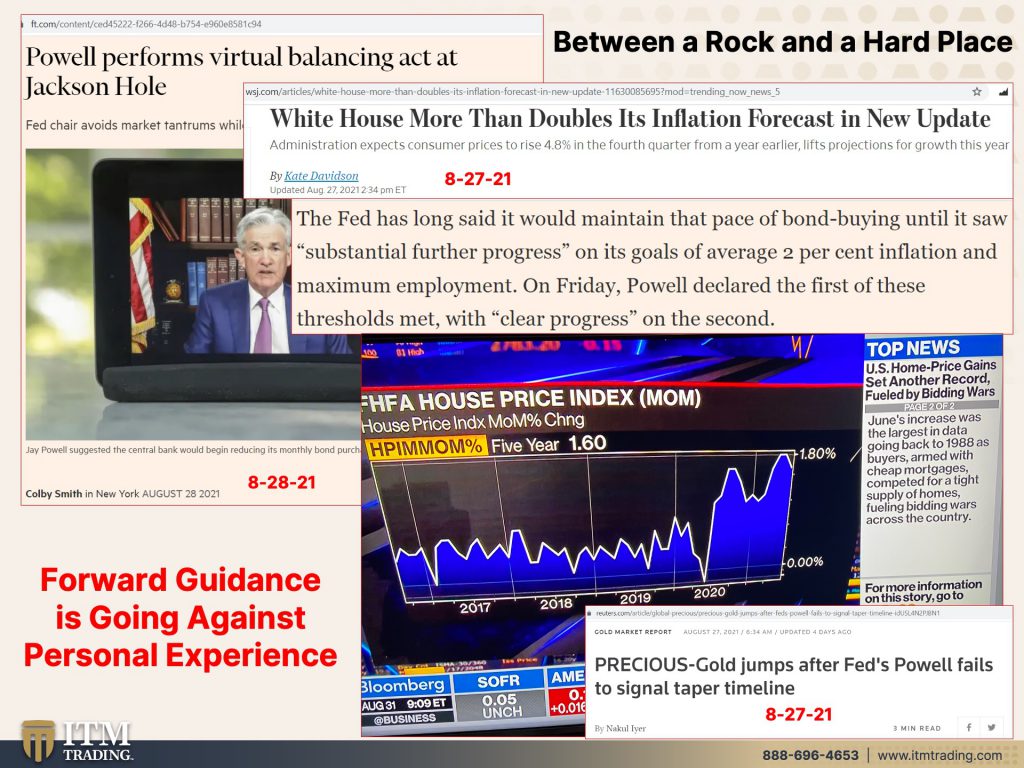

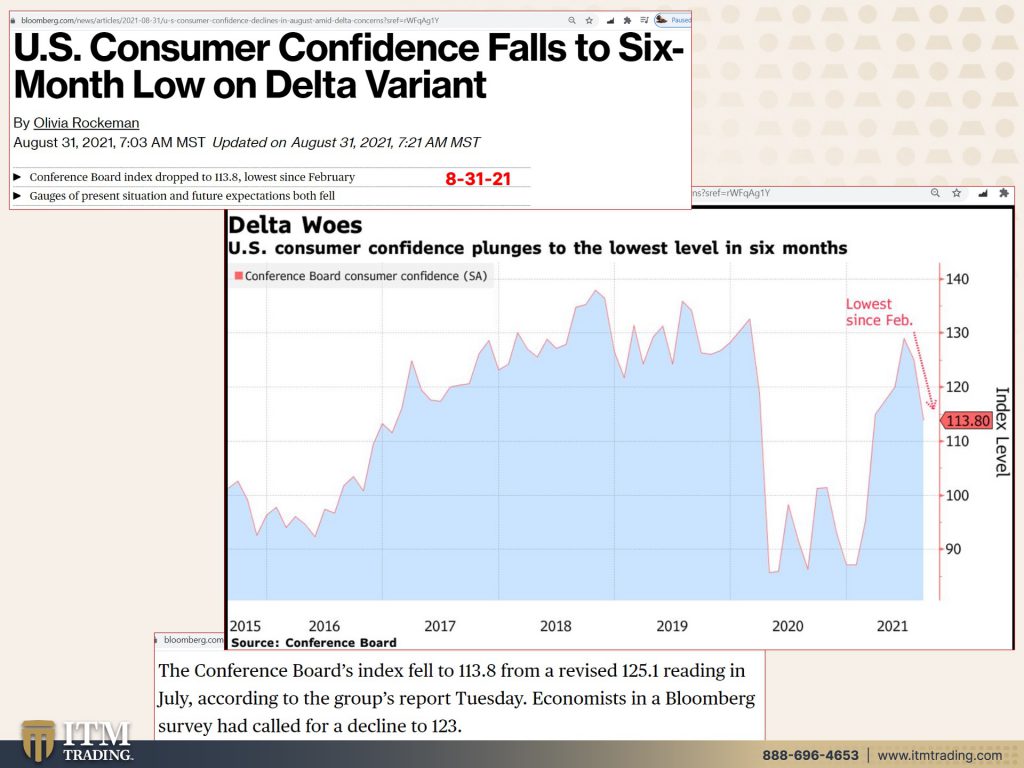

Because frankly, all of the powers that be are between a rock and a hard place, but a shock, big enough to force a global financial system reset most likely has to come from the U.S. as the world reserve currency, because of course currently dollars are still used in the lion’s share of transactions. That’s been going down, but still the lion’s share of transactions. And so it comes from, you know, Powell and well at the moment, Powell, whoever the central bank chair is at the time when the collapse happens. But here’s the thing about Jackson hole, he’s between a rock and a hard place where, you know, they’re talking about tapering and what that tapering is, is just not buying as much, but you know, they basically own the mortgage backed security market. So if they want the real estate market, we’re going to talk a little bit more about that in a few slides as well. But if they want to continue to support the real estate market, well, they have to keep buying those mortgage backed securities, because that’s what gives the money to that market. And how about government deficit spending and government spending? They have to keep buying treasuries because that’s what supports the government’s spending. So that’s why I say, you know, can they, can they lower that? No, can they raise rates? No. Will they try? Yes. Will they fail? Well, time is going to tell, but if I had to wager a guess and I would be willing to wager this guess, yeah, they will try and they will fail. They will fail, fail, fail, but the fed has long said it would maintain the pace of bond buying until it saw substantial, further progress on its goals of average, 2% inflation. Remember I told you, inflation was going to run hot when they came up with this game and maximum employment, which they haven’t really clearly defined what that is on Friday. Powell declared that the first of these thresholds met with clear progress on the second. So in other words, woo-hoo, remember there’s only one which makes it so easy. One way to fight deflation and that’s with inflation. So yeah. You know, when people say, well, I’m worried about deflation…you got to worry about both of them because only one way to fight it. It’s the battle that central banks globally have been waging since we were on a fully debt-based system. So yeah. Woop-dee-doo! We’ve got massive inflation and I think it’s getting worse and worse. And I don’t think that this is temporary or transitory. I think that, technically, I’m not saying that this has yet been confirmed, but I do think that we’re at the start of it. We are. Even the white house more than doubles its inflation forecast in the most current update and look at these house prices, oh my God, U.S. Home price gains set another record. Now look, this was 2016 through 2020 housing…because of all of this free cheap money and all of the central bank programs, can they stop these programs? What do you think will happen to the real estate market? If they stop these programs, they can’t stop it. What do you think is going to happen to the real estate market if interest rates rise, you’ve got the house prices up at nosebleed levels. The only reason that anybody can continue to afford them is because interest rates are so low. If interest rates are higher, that means that the prices of the houses have to go down because they can’t sell any other than to Wall Street. Who’s securitized is all of that debt anyway. This is wealth transfer. Make no mistake about it. So, you know when we see on the spot market where gold went up because Powell fails to signal taper timeline. That’s cause he can taper. I mean, he’s going to try, he’s going to try buying a little less. It would be very interesting to see what it’s, what 120 billion a month now, are they going to go to 119 billion a month or something like that? We’ll see, because what we’re really witnessing is the loss of confidence in the central banks. And this is critical to maintain the markets, the real estate market, the stock market, the bond market, particularly that confidence piece is absolutely critical. And so they’re telling people that this is temporary. They’re telling people not to worry about it, but there, and that’s forward guidance. And they’re telling people they’re going to run this off and raise rates at a glacial rate speed. Well, they can’t do it. And so the forward guidance is going against the personal experience, which it frankly always has. The difference between when they had the inflation rate around 2%. Is you didn’t notice those price increases so much. Now they’re very obvious. And they were very obvious around 2008, if you recall. So what do we have? We’ve been getting a lot of bad data, not this is consumer confidence. We’ve had consumer sentiment that have not met target. We’ve had PPI that have not met target. We’ve had a lot of data that has not, that has been well below what was anticipated. Oops, sorry about that. Which is why I’m saying that people are starting to notice and realize and lose confidence and lose that faith in the feds that they can actually pull this off and that they can actually remain in control U.S. Consumer confidence, plunges to the lowest level. Well, in six months, considering that of where we came from 2020 with the Cerveza issue, but look at how far back you would have to go. And I didn’t draw a line here as we’ve been going through 2008, I should pull a chart that goes back even further than this. I’m sorry that I didn’t, you know, but however, you can see that these things are dropping. The Conference Board’ss index fell to 113.8 from a revised 125.1 reading in July economists in a Bloomberg survey had called for a decline to 123. So a decline. Yes, but only a couple of points nines versus 12, 12! That’s a lot. That’s huge. That is not a good thing. And it’s not just happening here. This is what we’re seeing on a global basis because globally the new data that’s coming in is not good. And Hey, has the world not been calling for inflation?

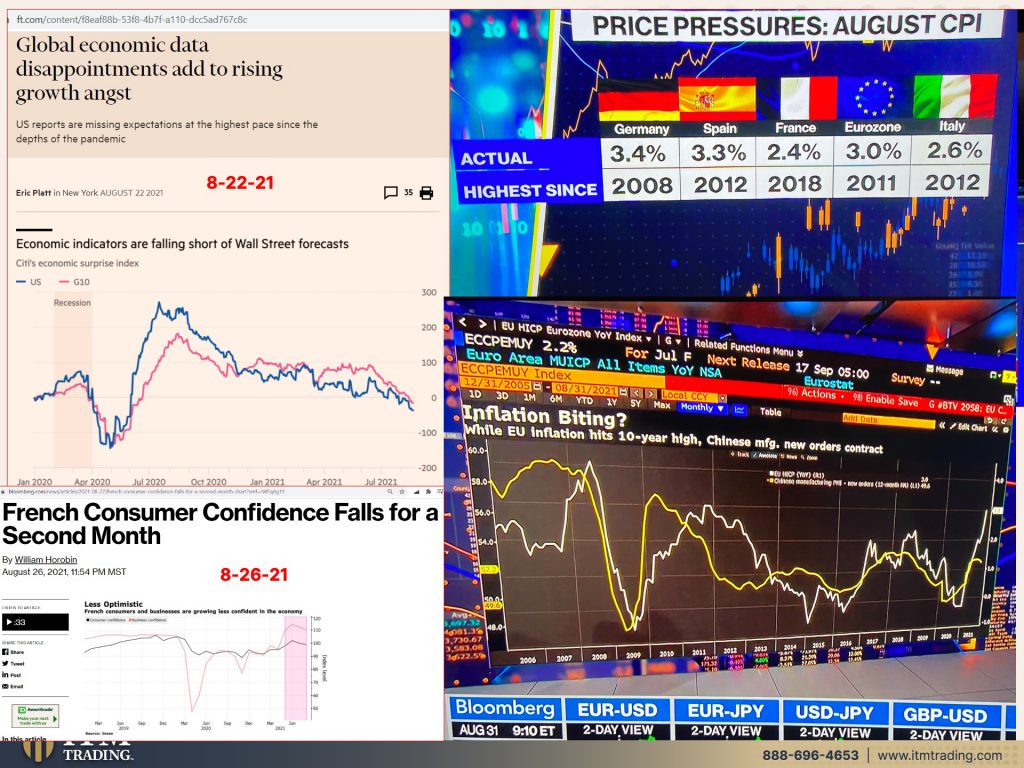

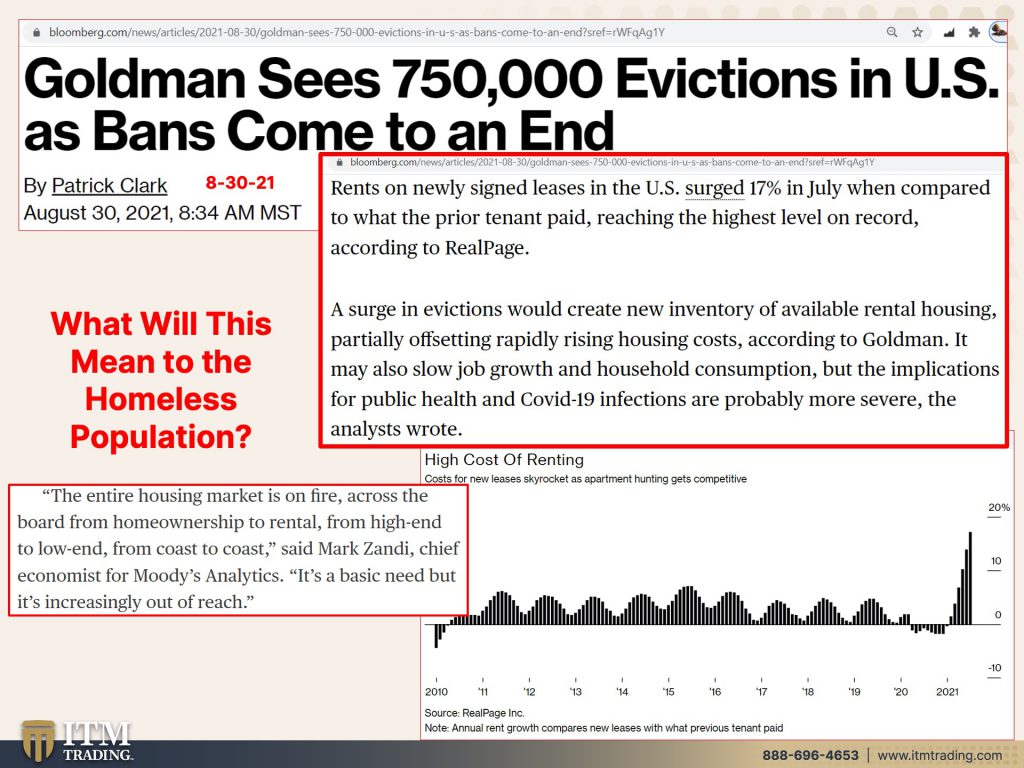

So do we have a win here because European inflation, Germany 3.4% the highest since 2008, what else was happening in 2008? Oh, the great financial crisis, Spain, 3.3% France, 2.4% Eurozone, 3% Italy, 2.6%. All of a sudden they couldn’t hit their 2% target. Of course they changed, like we did, how we were going to gauge this and ba-bam, they’ve got inflation. And remember, you know, do really trust that this is all the inflation that these countries are experiencing. It’s just the way they jury rig the, the way they calculate this out. The formulas don’t change behavior, change the formulas. And here it is in graph form. But what I also want to point out here, which is pretty, pretty significant while EU inflation hits ten-year high Chinese manufacturing, new orders contract. Oh, I thought I did a circle around it. I’m sorry, but it’s right here. Now you can see how that really did all flow up until this point. So we have to keep our eye on it. They’ll use the excuse of the supply chain. They’ll use the excuse of the shipping and all of that. And I’m not saying that that’s not part of it, but they never use the excuse openly of all of the money printing when that is certainly a very big part of all of what’s happening. And so consumer confidence is falling everywhere. Now here’s the thing. This has become a consumer driven world, not just the U.S. And consumer and consumerism. So, if the consumers don’t want to consume if they’re nervous about what their income is, what their future prospects are. Then they cut back consumption. Also, if rents or their cost of living or costs and necessities rise, spectacularly then whatever little bit of money they have. That’s where it needs to go to. And now we’ve got the eviction bands that are starting to come to an end. They’ve been postponed, postponed, postponed, but now they’re coming to an end.

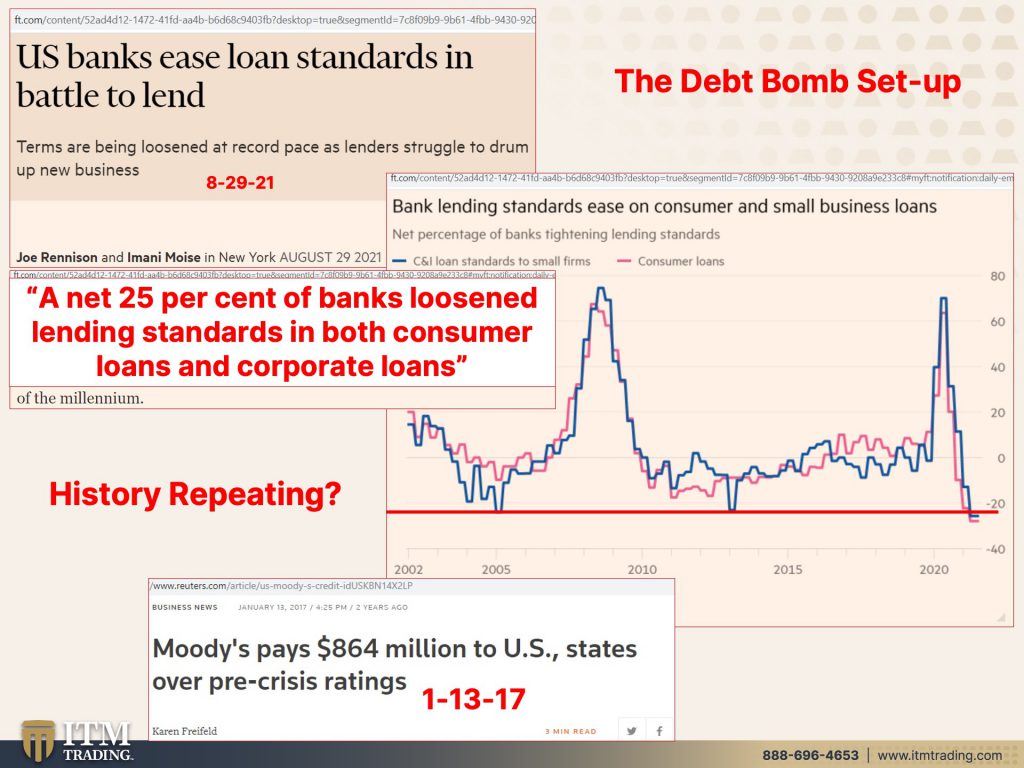

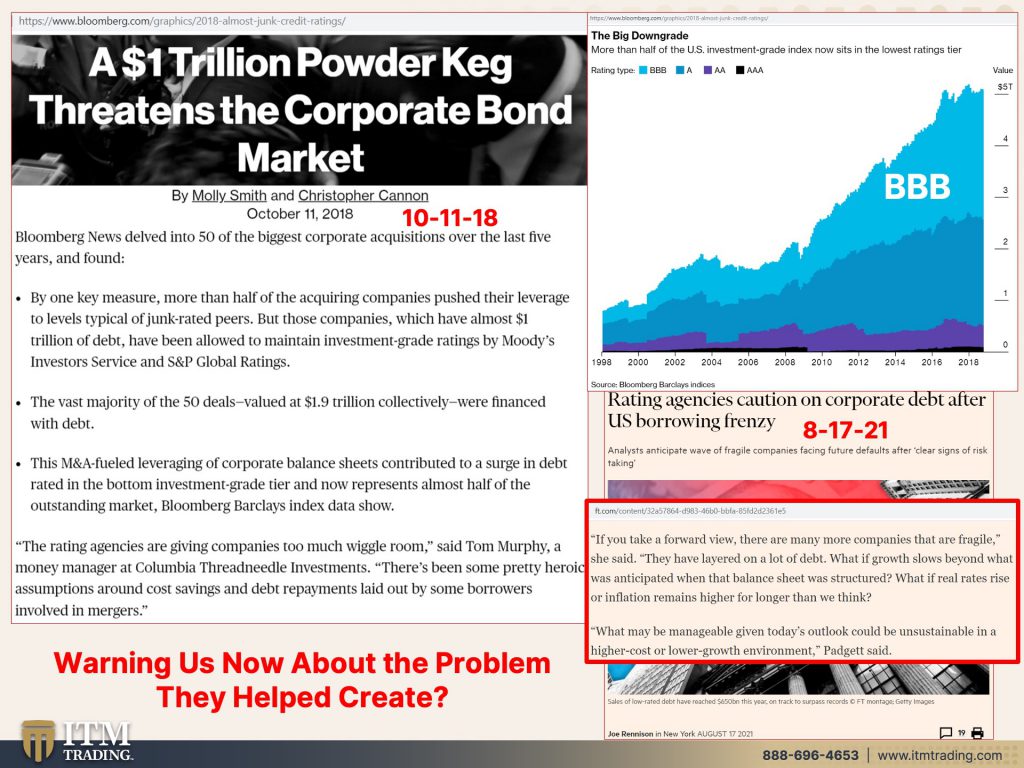

So actually, even though Goldman sees 750,000 evictions in the U.S. I think it’s likely to be a whole lot more than that. Rents are newly signed. And of course we know what’s happening with rents right on newly signed leases in the U.S. Surge 70% in July when compared to what the prior tenant paid, reaching the highest level on record, a surgeon evictions would create new inventory of available rental housing, partially offsetting rapidly rising housing costs. According to Goldman, it may also slow job growth and household consumption, but…okay, I’ll read this because it’s part of it, but the implications for public health and Cerveza 19 infections are probably more severe the analysis wrote. Well, where are all of those people that couldn’t afford their rents? Where are they going to live? Because the entire housing market is on fire across the board from home ownership to rental, from high-end to low-end from coast to coast said, Mark Zandi, Chief Economist for Moody’s analysis. It’s a basic need, but it’s increasingly out of reach. I’m not saying that they should continue with the moratorium. So I don’t want you to misunderstand what I’m saying. What I’m saying is this is another reason why I think we are really close to the end because it’s a trickle down effect for all of those owners of that rental property that could not get rent, but their costs continued on. It became a big, huge problem. It forced a lot of mom and pops out of the market. Okay. They captured greater gains in terms of fiat, but they also lost that potential income. It is really is about wealth transfer. But when people are hopeless and hungry, they make choices, they would not otherwise make. And additionally, they lose confidence in those that they thought were supposed to take care of them. It’s probably one of the reasons why president Biden recently raised food stamps. They need to, people have to eat the level of starvation in this country is, and in the world, you know, it’s horrendous, thus food security, grow a little garden, if you’re not wanting to do that, go ahead and get some dried food that can hold. But, you know, you saw, you had that experience in March of 2020 when the grocery store shelves went, bare food is the number one issue for most people during a reset. And as someone recently reminded me, medicine as well. So if you have a chronic illness, you better make sure that you can take care of that chronic illness when you do not have access to the meds. It’s really important. Or you know, grow medicinal plants as well, stay healthy, eat to stay healthy. What a concept, what could trigger this? You know, I was on earlier with Jake Ducey. I don’t know when it’s going to be released, but he asked me about the Black Swan event, especially since Palantir recently bought, you know, so much gold in preparation of the Black Swan event. And frankly, this, the debt bomb is what could push us over. If we cannot maintain that. U.S. Banks ease loan standards in the battle to lend. Well we do know that bank lending had been down, but it actually had been moved over into the more opaque private markets. So now banks are battling back and a full 25% of banks loosened lending standard in both consumer loans and corporate loans to smaller companies. And if you can see this line right here, right? Well, this was leading up to the 2008 crisis when they lowered those standards. And we’ve been talking about that. So now those standards are below that…see the problem? But I’d like to also remind you that it was Moody’s, S&P’s, all those grading services that made all of these conditions that gave AAA rating to garbage. That was not AAA rated. And they paid 864 million to the U.S. States over pre-crisis ratings. And we’ve talked about it over time that they’ve been really making their standards quite looser for corporations and growing that corporate debt danger market. Again, a trillion dollar powder keg threatens the corporate bond market. Well, here’s the corporate bond market, and here’s your BBB rating. And this particular graph goes from 1996 to 2019. And you can, you can see where that was. The BBB was just a little bigger than AAA, right? And it was kind of in the middle, but look at how much that BBB has grown. And that is a powder keg. And now they’re telling us rating agencies caution on corporate debt after U.S. borrowing frenzy. Oh my God. I mean, you just can’t make this up. What are we forgetting that, you know, it isn’t just, oh, well that was yesterday. This is today? No, no, no. It’s a continuation of the problem because the guys that pay the rating agencies are the guys that are issuing debt. And that’s true whether it’s corporate or it’s municipal. So I know there’s been a huge flight to municipal bonds as well, but, you know, are the states really better off? Is everybody really better off or as the economy really growing, or is it just growing free money? And that has less and less impact the more that they do. But if you take a forward view, then there are many more companies that are fragile. They have layered on a lot of debt. What if growth slows beyond what was anticipated, which is exactly happening when the balance sheet was structured. Okay. So what if growth slows beyond what was anticipate when they structured their balance sheet? What if real rates rise or inflation remains higher for longer than we think what may be manageable given today’s outlook could be unsustainable and a higher cost or a lower growth environment. Can the fed chair raise rates? No, can’t do it. This is just corporate debt. And it’s much worse now because this doesn’t even cover what happened in 2020 or 2021. Could this be the black Swan event? Yeah. A big rash of defaults. Yeah. And we’re told that bonds are so safe. Bonds are not safe. Government bonds are not safe. Corporate bonds are not safe. Municipal bonds are not safe. Bonds are not safe. You cannot solve a too much debt problem with even more debt. That’s what they’re trying to do. Doesn’t work. But I love how in 2021, they’re warning us about it. It’s a joke where they try to point the finger away from them who helped create this problem, because after all who pays them, those that issue the bonds.

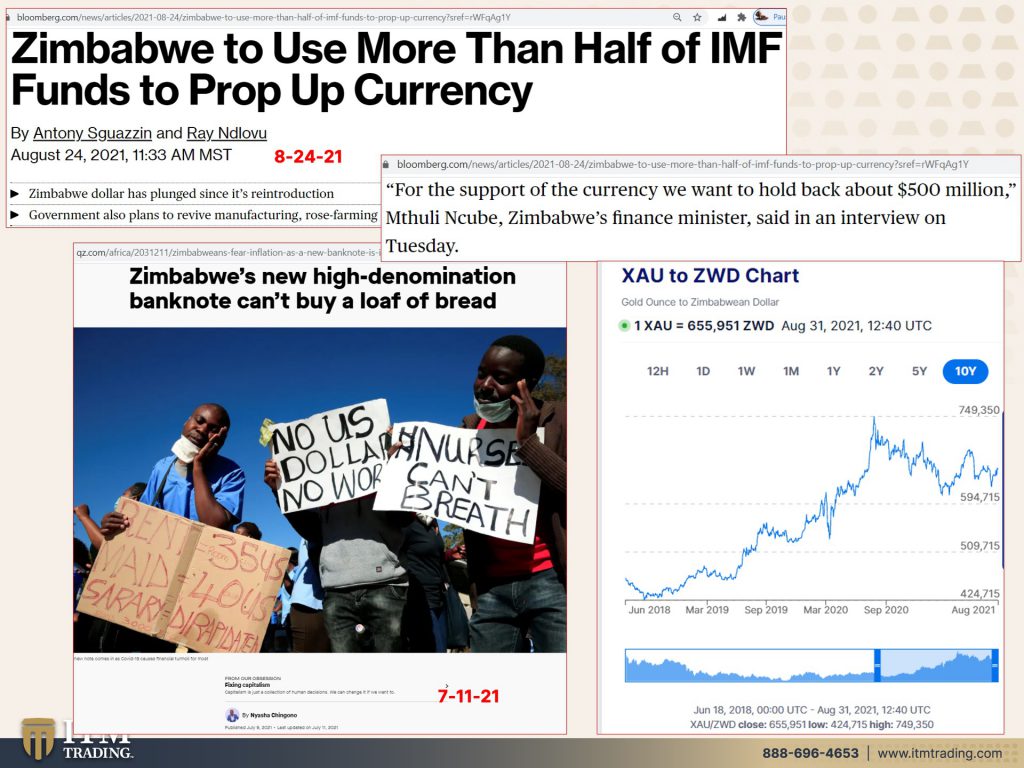

So this is where we’re headed, Zimbabwe. Now, Zimbabwe got that issuance of the SDRs. And rather than putting it all towards social programs, they’re going to use half of it to prop up their new currency, right? They’ve had their iterations that they came out with a new currency in 2019. Well, their new high denomination bank note that they just came out within July, can’t even buy a loaf of bread. They do not change behavior. They just change the formulas. This is why you got to have this (gold & silver). I mean, can I say it more simply, this is why you got to have this. Because if you are counting on central bankers and governments to maintain the value of our currency, when they’ve been robbing you since the day you were born, you better become your own central banker. You better make sure that you have this in place. And I don’t care how much you have. You never have enough. You never have enough because this is what’s going to protect you from what they’re going through in Zimbabwe and Venezuela and lots of other countries. This is just showing you what is going to happen for the support of the currency. We want to hold back about 500 million for the support of the currency? What that means that they’re going to buy these worthless Zimbabwe dollars? How about you change what you’re doing? How about you create a foundation to build on and to raise your population for support of the currency. Good, because you know, who’s responsible for all of that, for everything that the IMF issues for everything that the fed issues for everything that the federal government issues? Taxpayers, taxpayers are responsible. Everybody’s going to pay for this. Everybody’s going to pay for this. You want to pay a little less, get real money that holds your purchasing power and do it as quickly as you can do it while you still can. This is gold in terms of the Zimbabwe dollar, right? What do you really want to be holding something that can’t even buy you a loaf of bread or something that’s real that not only can it buy you a loaf of bread, but it can buy you real assets. It can buy you all the food. You want, everything. Now I promise this, I’m not done yet, but I am really, I have finished all the research and I’m now compiling the program on that piece about how much gold you need to buy, how much land during a reset. So I don’t think I’m going to be done with it today or rather this week, because there’s a lot of data to wade through and analyze, but I’m pretty sure, sure. I can have it for you next week. It’s gonna be a good one. I mean, it’s like one of the biggest research pieces that I’ve done for sure. And you want to watch this because this is the opportunity. There’s always opportunity and change, but there are changes that these guys in mind for us that scare the Hades out of me.

The internet of bodies, that George Gammon. I mean, if you haven’t watched that interview, watch it again. Because I recently talked to two people that I really admire so much. Gerald Celente & George Gammon, they are so sad. I’m glad I’m surrounded by beauty. It’s what helps me maintain my sanity, but they see what’s coming. We all need to see what’s coming. It isn’t just that gold and silver is going to protect you. We have to stand up for our rights. We cannot, we cannot allow these evil people to rule every single aspect of our lives. We vote with our purse. That’s how we vote. You choose to stay in the system. Then you will get what they have in mind for you. If you choose not to stay in the system, food, water, energy, security, barterability, wealth, preservation, community shelter, medicine. Then you need to become as independent as you can possibly be. And if people think you’re crazy, come join us. There’s lots of other like-minded people out there. Come join us. We have to stand up and say, no, there are more of us than there are of them, but we have this herd mentality that we just go ahead and do whatever we’re told. Stop listening to them. Start thinking, start, start feeding yourself. So you can think clearly and make choices that actually support, not just your best interest, but your family’s best interest because they don’t have your family and you in mind, they have themselves in mind. They have wealth transfer in mind. They have keeping empower in mind.

This has no counterparty risk (gold) And that’s according to the bank of international settlements. The only financial instrument that runs no counter party risk. And it has the broadest base of buyers. I’ll put this in there with it, the broadest base of buyers, the broadest base of functionality. That’s why it holds your purchasing power. And it’s out of the system. It’s virtually invisible. I mean, you hold it, you own it, but it can’t be traced and tracked and controlled. They could control the spot price. I mean, easy peasy. That’s nothing, that’s cheap. That’s a button push. But at the end of the day, we need to come together like minds and say no and vote with our purses, food, water, energy, security medicine, barterability, wealth preservation, community shelter, get it done, get it done, get it done! Please get it done.

As I said earlier, I was on with Jake Ducey today. And we’ll let you know when that link is out. Just we’ll share it on our socials. And next week I’m going to be on with Jay Martin at Cambridge House. So I’m excited about that as well, because we need to build this community as much as we can. And that’s why, you know, that’s why I’m online. And I do these interviews. And if you haven’t already start your gold and silver strategy, there’s a Calendly link below. Click it, make an appointment with one of our consultants. We all work together and we’re all here to be of service, seriously. And if you haven’t already, subscribe and turn on that bell notification and share, share, share, share, share. I know that they don’t want to hear it. I know that this is ugly stuff, but the other part of it is the opportunity. There are opportunities that present in crisis. So you can have a choice. You know, you can own nothing, but Hey, look at the rents. You think if you own nothing and you rent everything, guess who controls the price? Better you should be the owner, better others should rent, and then you can make choices. That’s the way I feel about it. It is time to cover your assets. Please get them covered now. And until tomorrow, please be safe out there. Bye-Bye.

BITCHUTE: https://www.bitchute.com/video/K_hHXtzWd9s/

SOURCES:

https://www.nytimes.com/2021/08/21/opinion/us-afghanistan-pakistan-taliban.html

https://www.ft.com/content/ced45222-f266-4d48-b754-e960e8581c94

https://www.ft.com/content/f8eaf88b-53f8-4b7f-a110-dcc5ad767c8c

https://www.federalreserve.gov/data/sloos/sloos-202107.htm

https://www.ft.com/content/32a57864-d983-46b0-bbfa-85fd2d2361e5

https://qz.com/africa/2031211/zimbabweans-fear-inflation-as-a-new-banknote-is-introduced/