[Pt.2] NEW DATA ON GLOBAL RESET: The Illusions Hiding Your Losses…by LYNETTE ZANG

According to this OECD report “Rapid developments in the corporate bond market have revealed some structural challenges.†(emphasis mine) What do you think will happen when those “structural challenges†gets tested at a level that cannot be hidden? Who will pay the price and who will benefit from this next financial crisis?

“When a well packaged web of lies has been sold gradually to the masses over generations, the truth will seem utterly preposterous and its speaker a raving lunatic.†MJ DeMarco.

Most people want the truth, in fact NEED the truth to make educated choices that put their best interest first. But if the truth is hidden, even buried under layers of contracts that are written by Wall Street lawyers and turned into financial products that can be traded off exchanges, how can the public ever hope to know the truth?

With my background as a stockbroker and banker, I understand the technical language of the markets. My mission is to translate that financial noise into understandable language. Of course, you will draw your own conclusions.

Among all of the reports and papers that I read, one that I read regularly is the OCC report on derivatives in the FDIC insured banks. Derivatives leverage the price action of a Wall Street asset, like a stock, bond, credit quality, and any other bet they can think of. Just how dangerous might this be when this debt volcano blows. Trouble has been brewing under the surface from one central bank experiment to the next, attempting to keep these market bubbles floating.

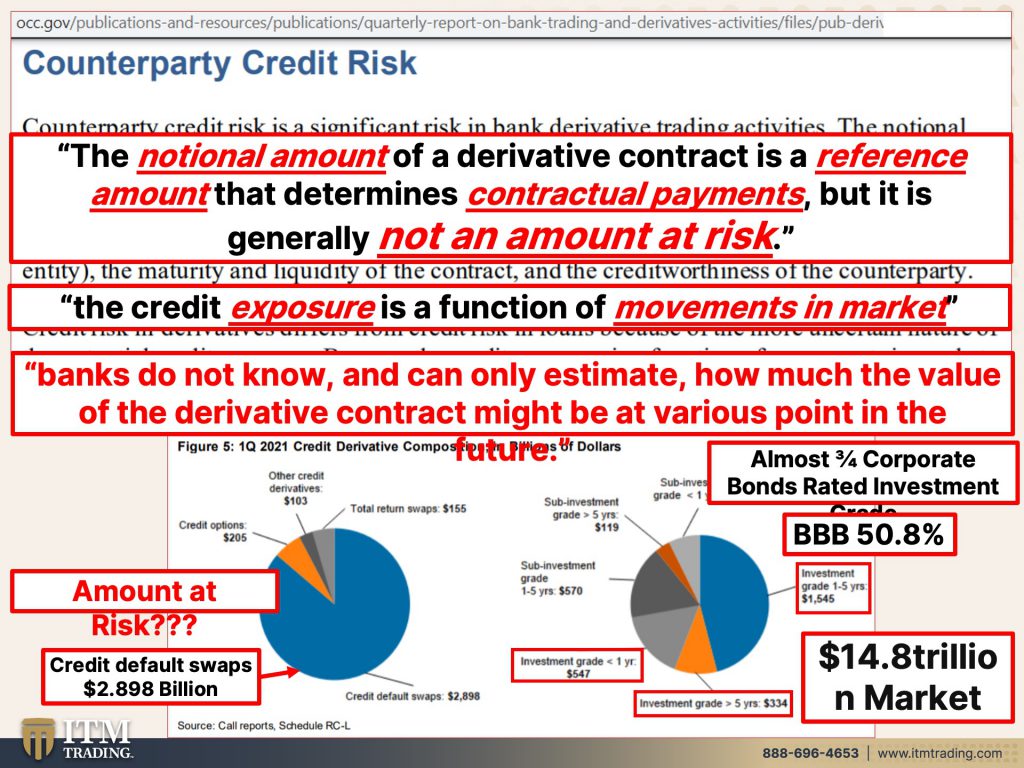

In the most current Office of the Comptroller of the Currency (OCC) report they discuss counterparty credit risk. They say, “The notional amount of a derivative contract is a reference amount that determines contractual payments, but it is generally not an amount at risk.†Further, “banks do not know, and can only estimate, how much the value of the derivative contract might be at various point in the future.â€

Since the market value of these contracts are based on price action, bubbles must continue to float.

How can you keep inflating the bubbles? Central bankers do their part with lots of liquidity and experimentation. Wall Street does their part by providing the leverage. Non-financial corporations do their part by borrowing more and more and more. Also by using buybacks and dividends to transfer wealth out the corporation, and leaving the corporation, susceptible to shock.

Keep in mind that this is all a big con game. Con games require confidence. Considering what happened in 2008 with the bursting of the CDS bubble, when the public became aware, how do you think the public might react if they know the true level of rising risk in the global financial system and with assets that we’ve been taught to think of, as safe.

They might make different choices. If you are Wall Street and like all the money generated by derivative bets, rather than changing behavior, you simply use “financial innovation†to create a new way to account for old behavior and hide the truth. Of course, part of the problem is that the truth is hidden from them too. You might say it’s the blind leading the blind…YIKES!

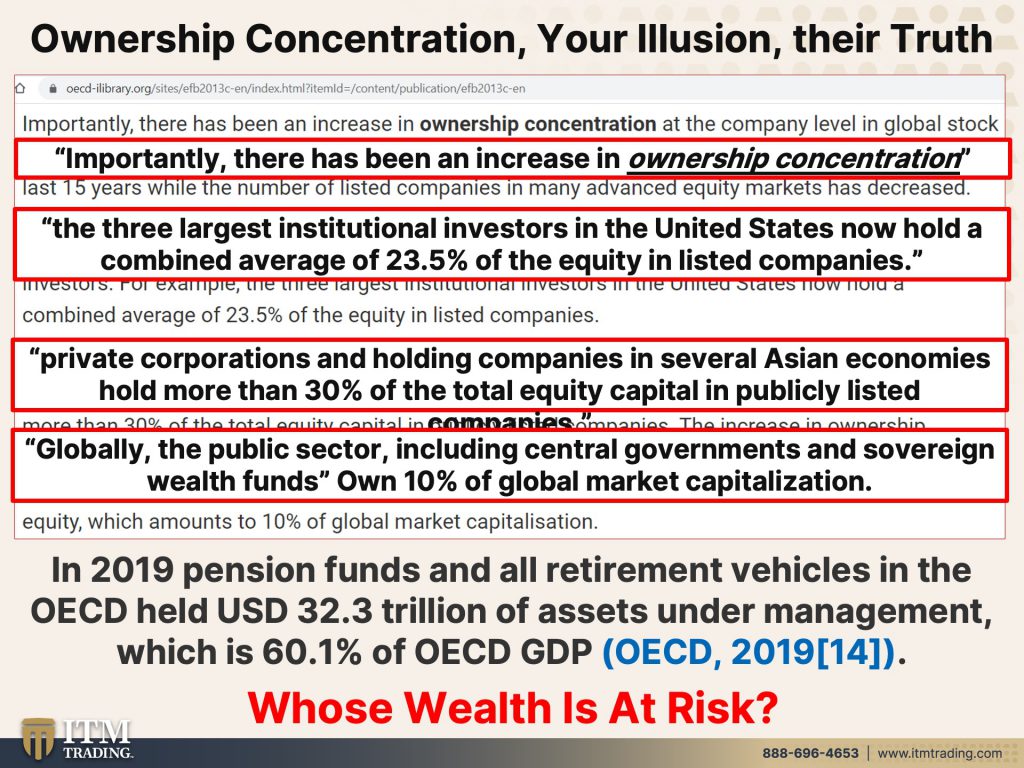

Another key point brought out in the OECD report was “ownership concentrationâ€. In other words, what market value there is out there held by a narrow base of buyer, which is a dangerous foundation for a market to sit on.

Why? Because when enough sellers rush to the door at the same time, markets can be overwhelmed and crash. Therefore, the more buyers there are for a product, like gold (used in every area of the global economy), the more stable the price. Of course, that would be true in a real free market economy. In the current market, derivatives are much cheaper to trade than the real thing. Considering that traders are short term and speculative, every penny counts in their quest for profits. Profits above people and greed is good.

A July 21st Bloomberg article headline shouts, “Gold Trader’s Chat Bragged About ‘How Easy’ It Is to Manipulate Pricesâ€. They admitted not caring about individuals hurt by their manipulations.

But what happens when this whole house of cards implodes? Whose wealth is really at risk? Mostly it will be the dutiful public that contributes to their retirement or other savings plans, which holds over 60% of OECD GDP. This unfolding retirement crisis is another reason to keep those bubbles floating.

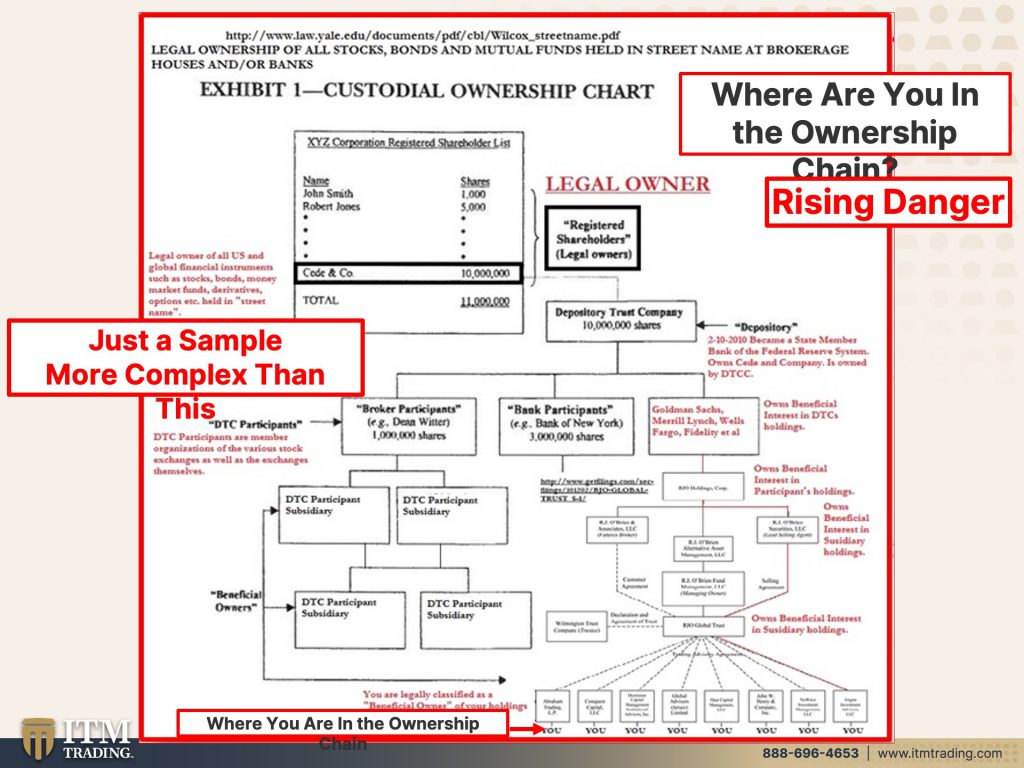

But, let’s face it, through hypothecation and rehypothecation (using equity held in brokerage and bank accounts as THEIR collateral) banks use YOUR wealth, for their benefit. “But that’s my money†you say, “I own it†you insist. But do you? True, you are the “beneficial ownerâ€, but Cede and Co. is the legal registered owner, and that carries more weight in a court of law.

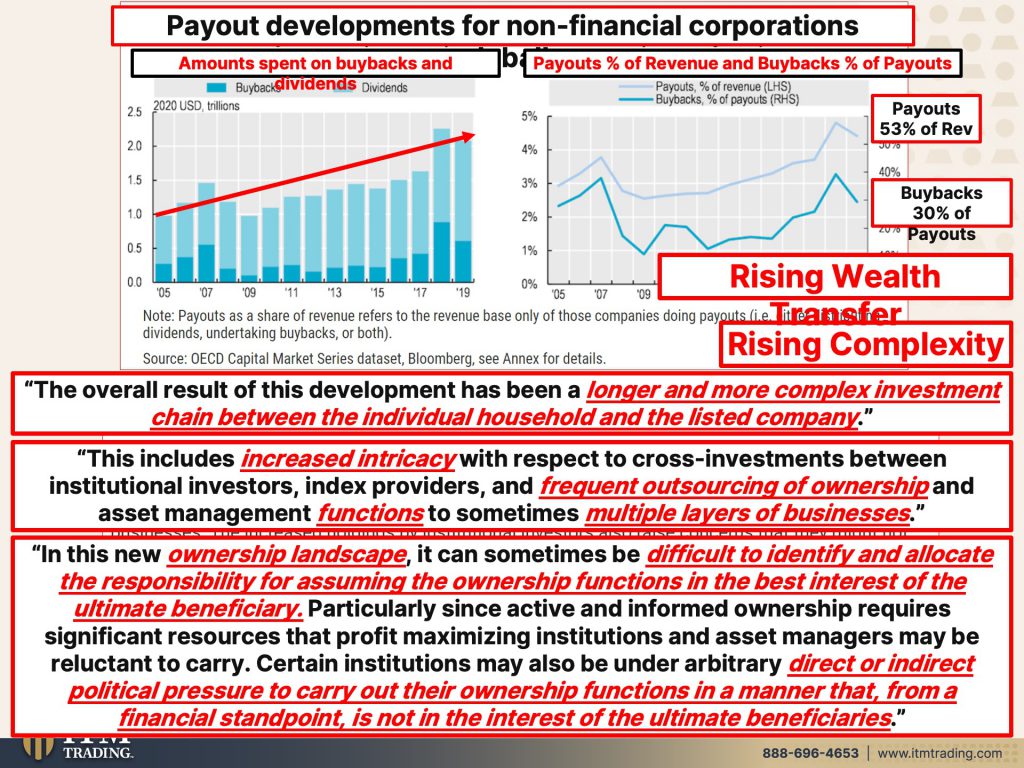

Additionally, over time, there has been developed a “longer and more complex investment chain between the individual household and the listed company.†This complexity also applies to “the responsibility for assuming the ownership functions in the best interest of the ultimate beneficiary. Particularly since active and informed ownership requires significant resources that profit maximizing institutions and asset managers may be reluctant to carry. Certain institutions may also be under arbitrary direct or indirect political pressure to carry out their ownership functions in a manner that, from a financial standpoint, is not in the interest of the ultimate beneficiaries.â€

Don’t you remember 2008? The public lost massive wealth, banks were bailed out and no one went to jail. TBTF banks are on the top of the ownership pyramid and you, the beneficial owner is on the bottom. You pay all the costs and more, at the same time you bear all the risk and don’t even know it. Do you know it now?

TYVIX Chart

WATCH PART 1 HERE ➡️ https://youtu.be/T29neLz8-Fw

To see Lynette’s slides and research links from PART 1 of this series: https://www.itmtrading.com/blog/pt-1-new-data-on-global-reset-vulnerability-risk-increase-exponentially-by-lynette-zang/

TRANSCRIPT FROM VIDEO:

Today’s video is part two of a critically important update on the global economic reset. If you didn’t see part one yet you definitely need to. Because what I found was this report from the OECD which is 38 member countries founded in 61 and they establish global economic policy. So for them to come out with this report, so specific, I have to tell you, it really scared the crap out of me. In this video. I’m going to show you the other half of my findings, which is frankly, the most important and impactful data of this entire report. Because at this point, the world’s most powerful countries, including nearly every global economic agencies, they are fully admitting in writing that we not only have structural structural challenges, structural challenges, but the true size of the value that is at risk is completely unknown because they’ve been telling that as that for a while, we need to believe them actions always speak louder than words, but when their actions support their words, this is all due to the extreme level of leverage in the derivative products. That frankly are backed by anything. They’re just big bets. So who’s going to pay the price when this whole thing topples, and who’s going to benefit because there’s always a yin and a yang and both sides I’ll show you how to be in that side. That benefits in a nice way, frankly, coming up

I’m Lynette Zang, Chief Market Analyst here at ITM Trading, a full service, physical gold and silver dealer specializing really specializing in helping you create your own personal strategy. And you’ve got to have one because I’ve got news for you. If you don’t realize this by now, the powers that be have a strategy and you, my friends are in the crosshairs. So yesterday we had part one and I showed you how the OECD showed everybody that would ever to read the report. How structurally vulnerable the bond market is. It matters because the bond market is the largest market that there is far, far bigger than stocks, but sitting on top of this whole thing are big bets just based on these price actions. And that’s why one of the big reasons why it’s been so critical for the central banks to keep these bubbles floating. But now just jump right to the data because we’re going to combine what we found with the OACD report, and also what we found from the office of the comptroller of the currency. And that’s really what brings us all to you. Whether you think you’re in the markets or you think you own bonds, or you’re not, I mean, this is going to impact everybody. What we really want to do is make sure that you are number one, any negative impact is minimized for you and any benefit is maximized for you. So let’s just dig right in just going to give you a little bit of a reminder, because despite the significant increase of BBB rated bonds, there was a declining number of downgrades relative to upgrades. And that really is because they are mindful of downgrading, BBB’s, because quite simply, there are certain entities like different pension funds, etcetera, that cannot invest your money. These are entities that work with your money into below investment grade bonds, right? So below BBB, such ratings, stability concerns may. This is the part that I like, well, I don’t really like it, but you need to be the most aware of, limit the ability of credit ratings to properly inform investors about the risks of individual bonds, because who pays the grading agencies like Moody’s and SMP and other corporations that grade the bonds that make that determination. And we have seen it before 2008 was not that long ago. And they did exactly the same kind of thing where they just kind of fudge the numbers. So it’s not a big surprise that that BBB area has grown enormously from about 19% to well over 50% and it continues to grow, but there are a lot of companies in that area that if they had used their original criteria and didn’t fudge, their criteria would definitely not be investment grade.

That’s one of the structural pieces that you need to really be concerned with because these rapid developments in the corporate bond market have revealed some structural… Look at all of this money for free, actually encourage these corporations to go out and borrow more. Now the fed may or may not have actually thought this, but the fed thought, well, let’s lower the rates. And then they could just convert that debt, roll over that debt, that now they have to pay 10% or 8%, whatever that is down to 4%, that will help them get out of debt and make the foundation stronger. But instead, yeah, did they roll that over yet? They did. But instead they grew even more debt because it takes the same amount of dollars to service, a higher level of debt at a lower level of interest. It’s kind of like what’s been happening in the mortgage arena, too. Prices can go up, payments remain the same or relatively the same because the interest because the interest is so much lower, but what that really has done is created a lot more vulnerability.

So the first thing I want to talk to you about, and this is something that I bring up regularly, and the BIS said, gold is the only financial asset that runs no counter party risk. So let’s get into this counter party risk a little bit more deeply because any contract with all Wall Street products, all of them, even the dollars that you hold in your wallet are all contracts. And any contract is only as good as the counter party to that contract. But the notional amount of a derivative contract is a reference amount that determines contractual payment, but it is generally not an amount at risk. So I go to you and I say, okay, I think the sky is going to be orange tomorrow. Let’s make a bet. And what do we bet? We bet I’ll bet you 10 bucks. Now the sky actually turned orange tomorrow. That would probably be a huge problem. Huge. And certainly it’s worth would be a whole lot more than that nominal number of 10, but I’m going to trade that back and forth, not knowing what the true risk is. The credit exposure is a function of the movement of the markets. In other words, it’s based the value, those derivative bets are based upon whether the stock market or the bond market or whatever the bet is written against whether that goes up or down. And that’s one big reason why we’ve seen the federal reserve and other global central banks. When markets started to pull back, they ran right in with lots more money to support that. And what they also did was all that liquidity was create other problems. So we’ve talked about the repo markets, the reverse repo markets, all that gobbledygook, because remember this stuff is intentionally made complex so that you don’t question it, but what all of this money printing has done, and this is so critical for you to understand what all of this money printing has actually done. It has pushed too much money in the markets and that has become a problem. Okay. So now let’s go back to this. They admit banks do not know and can only estimate how much the value of the derivative contract might be at various points in the future. So what do you think will happen? It’s like one of the fed presidents Clarita came out today and said, well, we, we might be thinking about raising rates the end of 2022 or 23. And the markets reacted to it. Let’s see, what year are we in right now? We’re in August of 2021. And the last time that they tried to raise rates ended up as a big fat failure. This time will be no different. They can’t raise rates with all this debt. They cannot do it. And this is just the non-financial corporate debt. We aren’t talking about the financial debt. We aren’t talking about the government debt, but I know that whatever it is that you’re seeing here is very similar to what you would be seeing there. It’s just that the grading agencies, well, they do, they grade governments too. We lost our status at AAA. When we had the debt ceiling issue a number of years ago, we’ve got that same issue again, but just even to say, eliminate the debt ceiling, does that mean that debt does not pose a threat to you and me and the entire global financial system, because everybody’s so incestuously intertwined, obviously not, but let’s look at this at that. When they wrote that report $14.8 trillion market, because almost three quarters of that market is rated investment grade. And over 50% of that market is BBB.

So there’s your investment grade? Okay, here, here, and here. See it, that’s it. But it’s almost three quarters of the entire non-financial corporate bond market that is investment grade with most of that, more than half of it in that BBB area. And you would have to go into their financials, each individual corporations financials, and then make a determination if you felt that they were, you know, in jeopardy, but obviously they are because of all of the debt that they have taken on. Now here’s where the real danger and the real problem lies is in these credit default swaps these derivative products. That’s what they are. Okay. And without going into too much detail, what you really need to understand is what they’re telling you up here that this 2.898 billion is only a notional amount, not the amount at risk before the BIS changed their accounting procedures. And I went in and looked at the derivatives against the gold for every one ounce of physical gold that exists. And I saw it with my own eyes. Unfortunately, I didn’t know, print screen then, but I saw it with my eyes for every one ounce of gold. There were 62,000 derivative contract ounces of derivative gold paper, gold that does not nor ever will exist. So when you look at this number 2.8, nine, eight in credit, default swaps in these derivatives, that doesn’t tell you really anything. All that tells you is what the banks and the entities that are trading these agreed the contract price was, nobody knows the result. Nobody knows the true amount at risk, but I think you can probably see why when the COVID pandemic hit and the central bank, the fed printed, ever so much more money than they did in the 2008 crisis. I think you could see why you’ve got to keep all of these, these balls in the air, everything juggling, and you better hope you don’t make a misstep. And I got news for you. They are not fed presidents and chairs. Those guys are just humans, just like you and me. Of course, they have a whole lot more power than you and me, but they are imperfect. And they are out of tools. And so what do they do over and over and over again, they don’t change the behavior. Keep in mind, in 2008, it was a CDO, a derivative product on mortgages that boom froze. And within 24 hours, that’s how long it took. Everything was imploding.

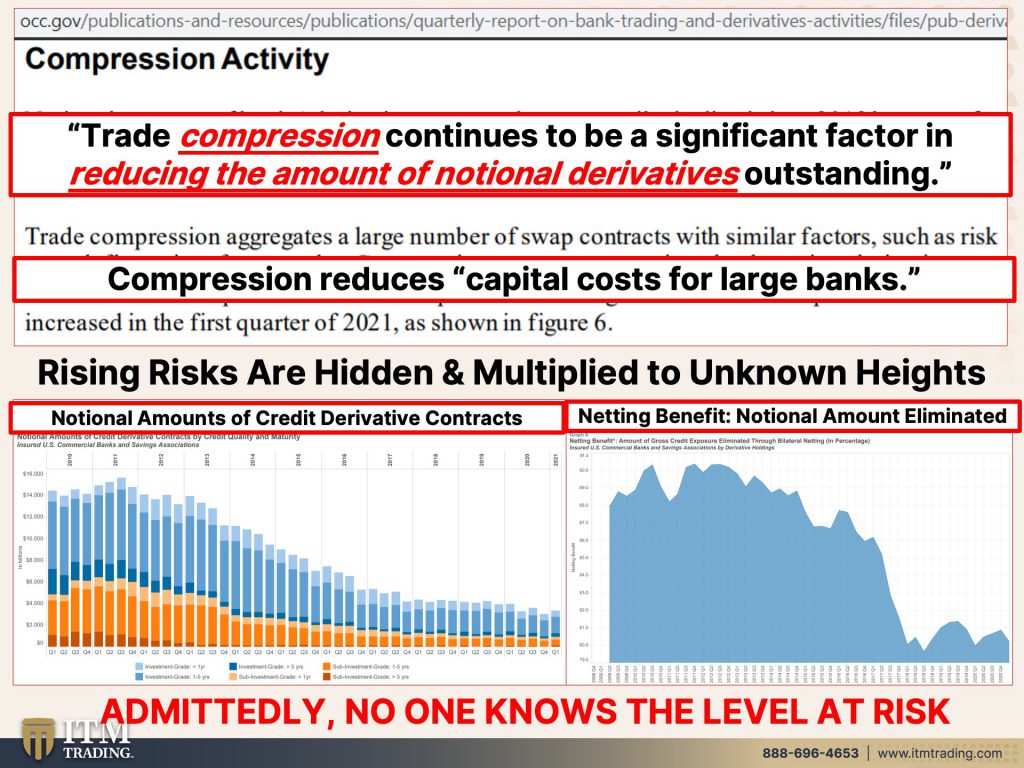

So, you know, okay. Let’s take a look at the financial innovation that they used to hide the truth. And, and you know, and here’s the other part of this, which is like amazing to me, derivatives alone, hide the level of leverage and the level of truth. But so you really don’t know, but then when you compress it down and you make it look smaller, God only knows. I can tell you this for an absolute fact. When I did another study in there at that point, I saw 1.48 quadrillion. I counted it myself. 1.48 quadrillion in derivatives, you can’t bail that out. I don’t care how much they intend to print and they will, they’ll have to. There’s no choice about that. But trade compression continues to be a significant factor in reducing the amount of notional derivatives. So always keep in mind whenever you see or hear, you know, they talk about it all the time on CNBC, the talking heads. Well, nominally speaking, notionally speaking, as soon as you hear that word, you will not know the true underlying risk. You will not. Nobody does. Nobody does admittedly, but here’s the whole point. They want to make sure that these banks and these trading desks are profitable. So what does compression does is it reduces the capital cost for banks makes it cheaper for banks. They have to hold and remember, they already don’t have to hold any reserves for your deposits. And remember they get to take your deposits, sweep it into sub-accounts and then use it. However they want to use it. You are at risk. I don’t know how else to say that you are at risk and these risks are rising and multiplied to unknown highs. So let’s take a look. These are the notional amount of credit, derivative contracts, and boy, it sure does look like they’ve gone down. Oh, okay. Must be getting safer. Well, no, because this, this is the netting benefit, which shows you the notional amount eliminated. And both of these run from let’s see this one. I can’t see, I think this is 2013, or this is, and that’s they created the netting benefit. These are the same dates, but look at how much…Does it mean that that risk went away? No, it does not. It means that that risk is hidden. The number of even the, the, the amount of those contract, it’s all hidden and it makes it look better than it really is. Admittedly, nobody, he knows the level, the amount at risk, nobody knows the risk. And I’m even talking about the self regulatory body, the ISDA, that creates an oversees, all these, which of course are all the big banks that trade in this arena.

Now, I also wanted to just remind you and bring this to mind. This is the payout developments for non-financial corporations globally. And you can see this is about buybacks and dividends. And clearly the amount spent on those two areas have been growing. Obviously they have since 2005, when the rules were changed, that opened up their ability to do more and not be looked at like, oh, you’re goosing the stock. It makes the price of the stock go up. And it benefits those few. Additionally, the percentage of revenues that are going to buy backs and pay outs has also grown a huge amount. In fact, payback, okay, here, it gets a little complicated, but pay outs are 53% of the amount of the bonds that these corporations are issuing. 53% out of that buy backs are 30% of that. 53%. The rest of it goes into corporations. Now you could say, well, why does that matter to me? And the reason why that matters to you is because once that money goes out of the corporation or they spend it on buy backs, it is not there to weather a storm. It leaves the corporation. So even if you’re sitting and owning that stock, that makes you more vulnerable, what this really is, is a mechanism for wealth transfer, a hundred percent it is a mechanism for wealth transfer. We saw this back last year with Boeing, who is very huge in the buyout and the buybacks and pay and dividend arena. And when COVID hit well, we taxpayers had to bail them out. Didn’t we? No, we didn’t. We could let them fail, but this isn’t a free market economy. So we’re not going to let them fail. Apparently. Now here’s where it gets really, really dicey. And I hope that what you can see in everything that I’m trying to show you is how you personally are vulnerable because you are the overall result of this development has been a longer and more complex investment chain between the individual household and the listed company. And we’re really talking about anybody that has, you know, retirement plans specifically. So, but it could also be annuities mutual funds, ETFs, all of it. We have been witnessing and experiencing consolidation in the financial system, really since 2000, once different rules were changed since 2000. And certainly in 2008, there was a huge consolidation in the bags. Don’t hold me to this. Cause obviously I don’t have the data right in front of me. But if I remember correctly, we went from something like 153 individual banks down to six big banks that manage everything. So it doesn’t really matter what things look like. You might have the illusion of choice. You do that when you go into the grocery store too, there’s thousands of products, but it’s all controlled by six entities. So there’s been a massive consolidation. And since 2008, that consolidation has sped up and made it even worse, quite honestly. But again, that investment chain is more complex between the individual, you down here on the bottom and the listed company, which isn’t even at the top, at the top or the banks we’ll get into that just a second. But that includes increased intricacy with respect to cross investments between institutional investors, those that invest your money, other people’s money. When you see institutional investors, think they’re investing my money index providers that create all of these SMP’s and all of these new, I mean, there’s lots of indexes for whatever you want to try and attack and frequent outsourcing of, oh, ownership, wait, what? Frequent outsourcing of ownership. But wait, I thought I was the owner. I mean, I bought it. It shows me on my statement that it’s in my account. Oh no, no, no, no. That is just an illusion of ownership that you are classified as a beneficial owner, but all these guys are classified that way too. I’ll show you that in a second and asset management functions to sometimes multiple layers of businesses. Do you guys remember with all the carnage that happened in 2008? Let’s see how many bankers went to jail, close your eyes. And what do you see? A big fat bupkis. It was because of all of, well, first of all, because it’s all contract based on who you think wrote the contracts, but now it’s gotten even buried more deeply. So when the crisis, these guys walk away, Scott free. What about you? Who are you? You going to call? Who are you going to sue? Who are you going to do anything with? And you know, let’s face it. If you lose your principle, you don’t think they have much deeper pockets than you. Even after a crisis like this, they do because you pay all the fees and take all the risks they don’t in this new ownership landscape. It can sometimes be difficult to identify and allocate the responsibility for assuming the ownership functions in the best interest of the ultimate beneficiary. Do you see what they’re telling you here? You are, pardon me, screwed because there’s no way for you to go and find whoever’s responsible for your ownership benefit. You can’t make this stuff up. You just can’t follow the links. Read it for yourself. Particularly since active. I love this part and this is absolutely a hundred percent true. This is a lot of what my work is about. Particularly since active and informed ownership requires significant resources that profit maximizing institutions and asset managers may be reluctant to carry. Yeah, cause they want to maximize benefit. You’re paying the fees, you’re taking the risk. They want to maximize their profits so they can put it into payouts and take it out of the corporation. Then when things implode, you just it’s done. It’s over there. There’s no place to go. Certain institutions may also be under certain institutions, but you all have them under arbitrary, direct or indirect political pressure to carry out their ownership functions in a manner that from a financial standpoint is not in the interest of the ultimate beneficiary. Not in the interest of you. I mean, the ownership is not in your best interest and the ownership structure is not in your best interest. They’re not going to send you an engraved invitation. You have to read this stuff. This is all in the public domain. I’m not, you can read it just as easily and as well. Well maybe I just have more education because this is where I’ve lived my life, but it’s out there. It’s just that people don’t bother to read it. And I was frankly, reading something else when I stumbled across this. And as soon as I did, I went, holy crap. And so I put it aside because I knew I needed to look at it. I read this kind of thing all the time, because not only is that rising wealth transfer up here, but it’s also rising complexity. So this next time is anybody going to go to jail? Probably not. I mean, how are you going to figure that out? Good luck. I mean, honestly.

That’s why this is so important, outside of the system people, outside of this garbage system, because they want you to think that the only options you have are stocks or bonds. Not true, not true. Okay. So ownership, concentration, your illusion. All right, let’s keep going with this. This is back from the OECD. Importantly, there has been an increase in ownership, concentration. That’s that consolidation that we’re talking about, shocker, right? The three largest institutional investors in the United States. Now hold a combined average of 23.5% of the equity enlisted companies. Why does that matter to you? What do you care about that? Because if anybody wants to exit these markets, I mean, if they really truly are looking out for your best interest and they see a problem and they want to sell stock, number one, I got news for you. You cannot turn a steam ship in a thimble of water. So these huge behemoths, well, they can’t just sell out a position like a smaller entity or an individual can, they can’t do it because it’s going to have a major impact on the entire market. And we got to keep these bubbles floating. But if they did, you have the most narrow base of buyer and whenever you’re really making an investment in something that you think you might want to liquidate down the road, what do you want? The broadest base of buyer. You want a whole bunch of people and entities wanting that asset. That’s what you want. That’s what you have with gold & silver. Because as it’s used across the entire spectrum of the global economy has the broadest base of, of buyer because that is the broadest base of functionality. What they’re telling you here in this, is that there is a narrow, narrow base of buyer. So when the markets start to implode, if they start to liquidate out into that, it makes it even worse. And then what happens to all those derivative bets? On top of that, I hope you’re starting to see the problem and why this is so critical to the reset because all of this is just a con game and it requires confidence. I’m showing you the truth. I don’t have confidence. I lived inside of the system forever as a banker, as a stock broker. I have zero confidence in these people because I read this stuff and I see what’s happening. And I would always rather be two weeks too, early, 10 years, too early. I really don’t care. Than one second too late, because that one second could cost you all of your wealth, all of your choices. And then what do you do when you lose all of your principle? How do you recoup? Especially for those of us that are near retirement age or already retired. How do you recoup if you lose all your principle? So you’re risking all your principal for a minuscule amount of interest. I mean, seriously, minuscule amount of interest. Is it worth it? Well, you have to decide that for yourself, for me. No, no .

Private corporations and holding companies in several Asian economies hold more than 30% of the total equity capital and publicly listed companies you know, look at Japan and, and I mean, there aren’t even, oh, maybe I talked about it here. Yeah, here we go. And globally, the public sector, including central governments and sovereign wealth funds own 10% of global market capitalization. Unless of course, you’re just looking at Japan who owns 90% of the ETF market. So how good is that? Are they likely to sell to liquidate? Well, no, because they could just push a button and really create money out. Well, does that mean that its value is secure? No, it does not because these guys are losing control. The wheels are falling off the bus and I hope you can see that. I hope you can really see this because in 2019 alone, the pension funds and all retirement vehicles in the OECD held, okay. So that’s 38 major countries, including the U.S. 32.3 trillion of assets under management, which is 60.1% of the OECD GDP. Well, what’s the GDP. GDP is all the money that floats through through the entire system, buying and selling, et cetera. That is a really scary number. Even if you don’t realize it, I’m telling you right now, I was freaked out about this. I really was. And so you’ll have to ask yourself, we each one of us has to ask ourself whose wealth is at risk. My wealth isn’t at risk because I’m all in right here. And I hold it and I control it. And I know the lies and why the BIS said gold held at home runs no political risk. All they can do is manipulate the spot price. That’s what they can do. So if you wonder how risky all of this is and where you are in that ownership chain, for those that have been around for awhile, you’ve seen this flow chart from Yale law that did a custodial ownership chart, but I’m going to tell you it’s a lot more complex than this with a whole lot more I mean I just don’t even have enough room to do how complex it is. Here are you way down at the bottom, itty bitty, every body. Here’s the legal owner right up here, Seed & Company, DTC. These are all the big banks that own Seed & Company, DTC, right? But Seed & Company is the legal registered owner. In fact, you cannot even buy a bond that is not in book entry, only form, which means you can’t take possession of the certificate. And they’re working really hard to get rid of your ability to take possession of stock certificates as well. But the bond market is the biggest market. That’s the one that they had to go after first. So that means that they, these big banks are in full control. And they’re the legal registered owner.

Where do you, you fall in this chain at the very, very, very, very bottom, because you are not too big to fail. Now, your family may consider you too big to fail. And I consider, I definitely do consider everybody out too big to fail, especially when they’re doing all of this garbage and putting you at risk when you don’t even realize it, when you don’t even realize the rising danger. But I hope you realize that now I know it kind of seems like gobbledygook and so complicated, but remember ignorance doesn’t make you immune. It just leaves you vulnerable. And certainly our team at ITM, they understand all of this too. So you can get into this in a lot more detail though, I am going to be taking questions after this, but I want to go back now to the oh, the OCC report.

OECD, OCC, ugh this whole vegetable soup! At any rate, this represents the notional amounts of precious metal contracts. So gold and silver contracts. And these are what are held inside of the insured. The FDIC insured banks. Now I want you to keep in mind, Basel 3 went into effect the bank of England, granted them an exemption along with anybody else that wants an exemption, but, but had they not, then they would not be able to do this. So, I mean, I couldn’t see how they would, how they would allow this market to implode because once this derivative market implodes, whether it’s precious metals or anything else, everything else implodes.

Okay. So now I also so wanted to point this out because as I was looking at this, I’m going, Hmm, this is kind of interesting, but from where you can see my cursor and all the way back to 2001, these all reflect a full year, except there’s 2013. See how it went down there. Well, yeah, they started the netting, the big, you know, financial engineering, the new formula to make things look small. They kind of looked a bit lower until they, of course started growing. So who knows how many gold & silver derivative contracts are out there, and this is your spot market, your gold spot market. So this is just through Q1 the first quarter through March, just through March of gold & silver derivative contracts. All the rest of them are fall flipping year. But this one, Nope, that is just through the first three months of the year. This spot market is also Q1. Gee, why did gold go down and silver too? I didn’t pull up the silver, but it’s the same kind of thing. Why did they go down? Because Wall Street’s gold is fool’s gold. Those ETFs, you think you own gold. You do not. You own shares at a trust that wants you, that is designed to track this and in the silver, they changed the prospectus because they couldn’t pull a full basket of physical silver in and yet you still see silver languishing at like 25 and change. I mean, really this is how they can manipulate it, but they cannot do it forever. They will do it as long as it benefits them because a rising gold & silver price is an indication of a failing currency. And if you really understood that the currency was failing and therefore all of the products with it, because last time I checked 10 trillion times zero is definitely still zero.

So what all my work is about is hoping you are no longer fooled by Wall Streets, the governments and the central banks illusion, because I got news for you, coming soon. I can’t tell you the exact moment that that’s going to happen, but this is a Jenga economy. And every time something happens, another piece of this Jenga is coming out, which will be the piece that they cannot paper over. I don’t know. But what I do know is that, because we are in such a vulnerable position and when I say we I’m really referring to the central banks here, they’re between a rock and a hard place. And they don’t really know if what they do is going to have any impact, because right now they’re juggling the repo and the reverse repo markets. They pushed all this liquidity in it’s too much liquidity. They need to pull some out, at least on a short-term basis, but, you know, can they raise rates? Can they run off their balance sheet? No, they can’t do it. And seriously? What are you talking about? Raising rates the end of 2022 and 23. It’s ridiculous. But the markets respond to it. Well, what the central bank is attempting to do, that’s called forward guidance. And they’re trying to reassure the banks that they’re still in control, but as I’ve shown you many, many times, that simply, it’s still a bit true. It is still a bit true, but that is becoming actually pretty rapidly, not true at all. And now, do we have some questions? So I hope that you could see how this plays in to the whole global full reset, because frankly it is super the whole markets. I mean, they are just vulnerable, fragile as anything. You cannot raise rates in this environment, nor can you take the punch-bowl away. As far as free money goes, you just can’t do it, or you’ll have an implosion. And that it impacts you because that implosion will be magnified. God knows how many times. I can’t tell you how many times. I mean, according to some of the IMF data, at least a thousand times, but it’s much bigger than that. It’s much bigger than that. And it’s hidden and nobody knows. And so the system has to reset. So we’ll have this flood of money. And I know that right now, they’re saying, well, look, we’ve created all this money and we barely have inflation and Hey, we want that inflation to go to out 2% target. Well, look at your bills. Really 2% garbage, 5% garbage, 10% is probably also kind of garbage anymore. And this is not going to get better at all. So this flood of the next flood of money that comes into this to try and keep all of these bubbles floating, especially since, you know, I gotta say, you know, I know I’m not seeing it in the monetary velocity yet. I know I’m not seeing it there, but it sure feels to me like the hyperinflation has already begun. We’ll see, time will tell I’ll keep my eyes on the monetary velocity.

Welshman asks, all economies rebuild after a reset. Would you say it’s inevitable that a war will signal the beginning of the reset as with previous historic economic resets? Absolutely. You know, there, there are things that happen during these periods. And one of them is a lot of different things going on and aren’t we in a war? And I can’t say, I can’t say it, but we’re kind of in a pandemic war our way, isn’t that what they call it a war? And remember also the way wars used to be fought with boots on the ground. Well, we have some of that, but the wars that are really coming into play now between countries is the digital war and all of the cyber espionage. That’s much cleaner. You do it from a distance. So we still have boots on the ground, but quite honestly, I think that’s more show than it is in reality. So, yeah, right around these resets, you definitely have a lot of chaos. You have wars. I mean think about 71, you had the Vietnam war, you had Women’s Lib, Me Too movement. You had civil rights, you still have Black Lives Matter. You had Oil Embargo look at what’s going on in the oil fields when they went to negative last year, and now they’re up around 60, 70 bucks. And before 2008, they were in the $20-$30 range. Right. So it makes everything a lot more expensive. And even though we’re, we are moving more toward a digital economy, we still need oil. We’re not done with that yet. So, so the answer is absolutely. And that’s why it’s one of the reasons why I think it’s quite probable and certainly possible that the hyperinflation has begun.

Fantana asks, what do I think about leasing land for our food part of the strategy will our lease contract get caught up in the chaos when Fiat assets die, forcing us to lose our food source? Well I mean, the, the thing with leasing is kind of the same thing with renting. You know, you’d want to make sure that that contract was structured in a way that they can’t continuously raise your rates, but there are ways to grow and secure your food source regardless of where you live and how much space you have to do it. So, you know, everybody’s got to do what they’re comfortable with, but I would say make sure that that food is close enough to you, that you can really access it when you need it help others when there is that opportunity. And you know, if you stay tuned for just a couple of minutes, I don’t mean literal minutes, but we’re, we’re putting together. Our team is putting together like minimums, what you should do for food, water security, the whole mantra, food, water, energy security, barterability, wealth, preservation, community, and shelter. So just give us another minute. And I think that that’s going to help with a lot. Okay. because you know, I mean, they’re pushing us to a place where you will own nothing and you’ll be happy. I got to tell you’ll own nothing, but you won’t be happy. So leasing and renting to me is I have not chosen to do that. I’ll say that you do whatever you’re comfortable with, but I like more control than that.

Randy asks, several podcasters are stating that the ten-year treasury is rehypothecate it, that me there isn’t any pristine collateral left besides gold. What are your thoughts? Absolutely. Do you remember the TYVIX? Edgar, would you make a note and put that on the blog? I showed it to you just recently. They took it away from us. So we can’t see where we are right now, but a hundred percent, the 10 year treasury and all other Fiat money assets are rehypothecated, hypothecated, rehypothecated. And probably those contracts were done through the city of London. So there’s no limits to how many times and what hypothecated means and re hypothecated hypothecated means that they’re used as collateral rehypothecation means that they use it over the same collateral over and over and over and over and over again, which they could definitely do with anything that you hold in your brokerage accounts, your bank accounts, etcetera, etcetera. This is exactly what we’ve been talking about as far as this complex ownership chain, because of all that hypothecation and rehypothecation. So, Randy, thank you for bringing that up a hundred bazillion percent. I agree. Without any doubt, that’s why, and that’s supposed to be the safest thing you could do. No, no, no, no, no. The bank for international settlements tells you, this is the safest thing that you can do. The central banks accumulating it since 2000, really since 2007, but net buyers since 2010 tell you that as the safest thing that you can do.

Dee asks, does market have to crash before the dollar can reset to digital? Okay. Let me, let me just kind of take a sip. Yeah. The market has to implode, which is deflationary before the whole system can reset fully because you have to lose all confidence in order for them to justify that very, very, very, very painful move. So now, does it have to crash before the dollar becomes digital? No, it does not. Nor do I think for even one second, that once they introduced the digital dollar, that everything’s fine and hunky-dory and over, I don’t think so. I think that is just a tool. So there’s only one way. And of course the market imploding is deflationary. There’s only one way to fight deflation that’s with inflation, but a lot of the other part of the problem is that every time the central bank and I, and I will be in, in two weeks, you know, next week I’ve already jumped in and I’m like five deep in the research on gold for property during a reset. So, that will happen next week. But the following week I’m going to be doing that house of Lords report on QE. And the point is, is that, and you can see it. I mean, it’s so obvious that every time the central bank was doing QA, it had less and less and less impact. It had the most impact at first. That’s why when they went in during the pandemic and they did, I mean, it dwarfed what they did in 2008. And here we are, we’re still struggling with it, right? It’s still there. They’re talking about reducing the amount of, of mortgage backed securities and treasuries. I actually they’ve just mentioned treasuries, but it could be both that they might start to reduce the amount of those assets that they’re going to buy in November from 120 billion a month to, I don’t know what, and of course, we’ve got the debt ceiling looming and we’ve got the treasury needing to dump money into the system to meet their, to meet their requirements. So I really hope even if you don’t understand it all, even, you know, even if you don’t, I hope that you can see how far we are in this, because I really don’t know should the corporate bond market implode, my bet is, is they won’t be able to print enough money to bail this one out or even to hide it. And the reason is because we don’t really know how much is at risk. We have no clue and they have no clue. It’s not like they know. And we know it’s like nobody has, nobody has a clue.

Steve asks, and this’ll be the last question I know we’ve gone really long today, but this is that important. What is the relationship between the fed and the us treasury? Well, I think with Janet Yellen as our treasury secretary, and she was the ex-head of the fed, that should probably tell you how close they are now, they’re attempting to still kind of seem independent, but look at their behavior. It’s not independent at all. It’s not. So what’s the, a relationship while they’re working together. That should be pretty clear. And they’re monetizing the debt by buying that 120 billion they’re monetizing government debt too bad. We’re hitting the debt ceiling, I’m sure it’ll be extended. I’m sure. Or it’ll be suspended again. You know, remember when it’s suspended, that means there’s really, basically no limits on how much more debt they can grow either.

So remember too, and I would suggest with how complicated this was that you listen to it again, and you can hear our podcast anywhere, anytime cause we’re on all major podcast platforms. And of course, if you have not already, please subscribe, hit that bell. We will let you know when we’re going live and leave us a comment, give us a thumbs up and share, share, share. We’re trying to go to a new level to bring more value to you. So you’ll probably notice a few changes and you’ve probably already noticed some changes, but I think that these are all good. And we’d like feedback on that too. What do you like? What don’t you like? What would you like to see that we aren’t giving you? What do you want that we’re not giving you? Because we will do our best to bring it to you. This is the time we are near the end. We are near the end. So please, you know, it is time to cover all your assets and here at ITM Trading. Yep. Here’s your foundation real money with the broadest base of buyer globally and the only assets, financial assets that run zero counter party risk. That’s what you need right now is something that runs absolutely no counter party risk. And until tomorrow and tomorrow, I’m going to do the Q&A. So if there are any other questions, send them in and I’ll do a special Q&A tomorrow. And then on Friday, you’ll see the interview that I’m going to do with Jason Hartman. So until then please be safe out there. Never has this been more important, please be safe out there. Bye-Bye.

SOURCES:

https://www.oecd-ilibrary.org/sites/d8489039-en/index.html?itemId=/content/component/d8489039-en