[Pt.1] NEW DATA ON GLOBAL RESET: Vulnerability & Risk Increase Exponentially…by LYNETTE ZANG

We all want to feel that our wealth is secure. That it’s real wealth when we open our statements and it tells you the nominal fiat money amount of any wealth you hold inside Wall Street’s system. But that wealth is all based on contracts. Any contract is only as good as the counterparty to that contract.

Central Bank QE has flooded the system with cheap money that has created many speculative bubbles. Since the global financial system is incestuously interconnected. The biggest bubble is the debt bubble.

As a new stockbroker in the 1980’s, I cut my teeth on bonds since I didn’t, at that time, understand the stock market yet. But treasuries were backed by the government, who could tax you to get the money to pay you. All bonds work the same and once you learn to recognize the typical patterns, no one will be able to pull the wool over your eyes.

This is what I try to help you see with all my work, because if you do, you will be able to make educated choices that put your best interest first, as it should be. I believe that you need to know what I’m here to show you because it’s all part of a repeatable pattern.

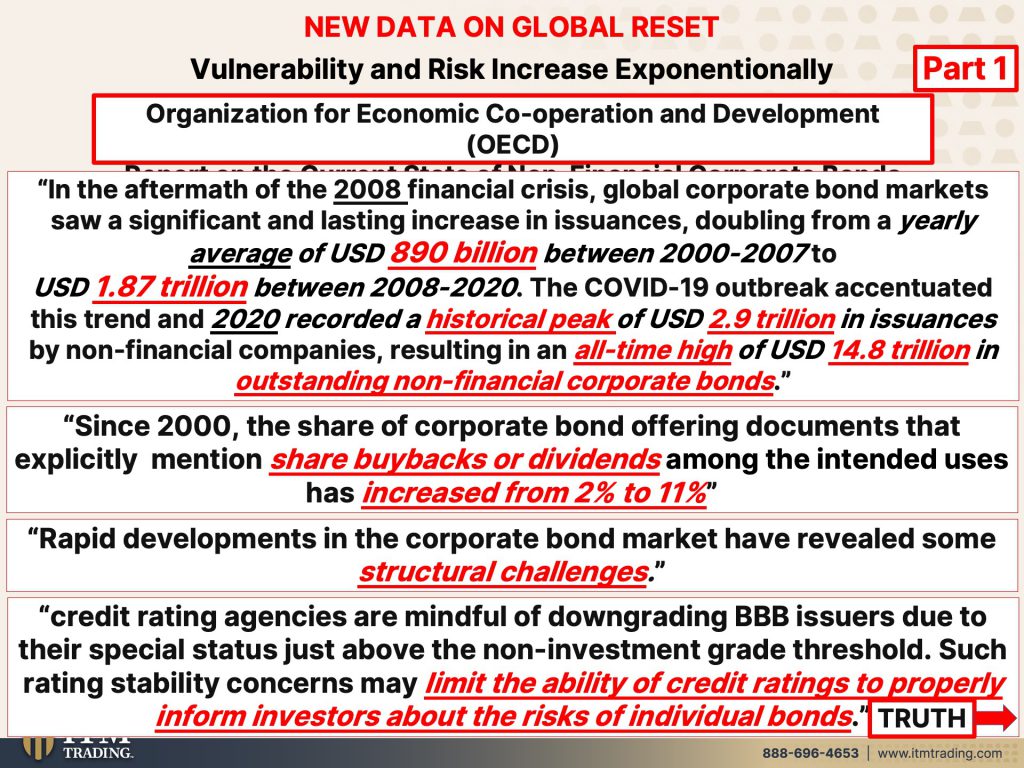

Recently, the Organization for Economic Co-Operation and Development (OECD) published a report on the current state of the Non-Financial Corporate Debt market. In this report they highlight the fact that, these new issuances were at historic highs in 2020. This resulted in an “all-time high of USD 14.8 trillion in outstanding non-financial corporate bonds.â€

Which might not be a problem if your income grows at the same speed as your debt. Unfortunately, for a growing army of corporations, income does not keep pace with their growing debt. There are two types of debt, “self-liquidating†or “non-self-liquidating†debt.

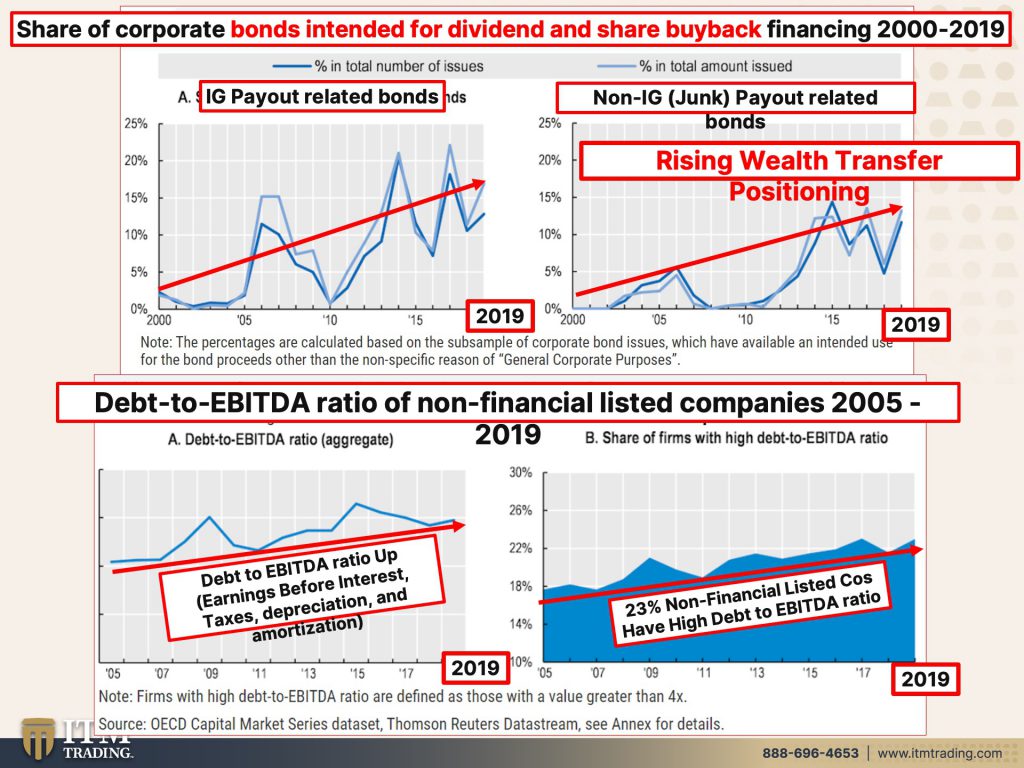

If a corporation invests the proceeds from their bond sales into some form of expansion, which would then potentially, increase sales and income, that debt pays itself off over time. Thus, self-liquidating debt. But a growing share of bond proceeds are now going toward share buybacks and dividends. While these figures may not reflect all debt proceeds that go toward, among corporations that responded to an OECD survey, “Since 2000, the share of corporate bond offering documents that explicitly mention share buybacks or dividends among the intended uses has increased from 2% to !!%.â€

Debt proceeds that go toward these types of investor benefit, lift the stock price, but do nothing to generate new income to repay the debt, therefore, this is non-self-liquidating debt. This is the kind of debt that compounds and certainly, one reason that debt is growing so quickly, particularly in this easy central bank money environment. This kind of debt enrich shareholders while leaving the corporation less able to weather an economic shock, like we saw with Boeing in 2020 as one great example.

As corporate balance sheets grow, investors grow more vulnerable. We are talking about individuals that invest in mutual funds, ETFs, annuities, or any fiat money wall street product. You might know my favorite saying, “Ignorance does not make you immune, just vulnerable.â€

For those wanting to make educated choices and trust the grading services, the report had this to say, “credit rating agencies are mindful of downgrading BBB issuers due to their special status just above the non-investment grade threshold. Such rating stability concerns may limit the ability of credit ratings to properly inform investors about the risks of individual bonds.â€

First consider who pays the grading services, the corporations that want to sell bonds. BBB is considered investment grade (which means lower interest rates). Additionally, many pension and retirement programs cannot buy or hold junk bonds. So, if a bond gets downgraded, particularly from BBB to BB (junk), the results to the corporation and bonds holders could be devastating. Of course, for every looser there is a winner, but more about that shortly.

Second, interest rates have been anchored near zero since 2008 forcing a reach for yield. With yield in focus, corporations were able to modify bond contracts by removing many investor protections. After all, who reads the contracts?

Considering that central banks have been net buyers of gold since 2010, I’m betting they are preparing to remain in power by holding real money that cannot be inflated away.

According to this OECD report “Rapid developments in the corporate bond market have revealed some structural challenges.†(emphasis mine) What do you think will happen when those “structural challenges†gets tested at a level that cannot be hidden? Who will pay the price and who will benefit from this next financial crisis?

Part 2, will answer these questions and more.

TRANSCRIPT FROM VIDEO:

I have critically important data to share with you on the global economic reset. This is based on a new report that just came out, showing, I mean seriously, the most alarming financial numbers that I have personally seen so far in my time in the markets. If you have any money in the bank or the markets, including IRAs, 401ks stocks, bonds, annuities, ETFs, and virtually any other fee out money investment. Well, I got to tell you, you better take heat and what I’m going to show you today because frankly, this report comes from the OACD. They’ve been around since the early sixties, the U.S. Joined in 1961 and they are critical in policy decisions. So I’m going to show you this latest report. Make sure you stay to the end because I’ll be uncovering the insider strategies of central banks themselves, which I can guarantee you don’t really watch it and know about coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading, a full service, physical gold and silver dealer, specializing in strategies. And you better have one because Lord knows the powers that be the central banks, particularly they have one and you know, let’s face it. You are just not too big to fail. So there’s a lot of data to cover. But remember, after this, we’re going to have 15 minutes of Q&A, and I would like the questions to be on this particular topic. We’ll do more Q and A’s later, but I want to really make sure you understand fully what I’m going to show you. Because when I went through this report, I mean, when I really sat down and looked at it, you guys know I’ve been researching it for a couple of weeks. It just blew me away. It just blew me away.

That’s why it’s a two-parter and it’s really significant. So what we don’t really realize until it’s too late is how vulnerable we are. And that’s why you have to have physical gold and silver outside of the system, because anything in the system is that vulnerable. So let’s just dig right in, in the aftermath of the 2008 financial crisis. Global corporate bond markets saw a significant and lasting increase in issuances, doubling from a yearly average of us, dollar 890 billion between 2000 to 2007, to us, dollar 1.87 trillion between 2008 and 2020 bad enough, right? But the COVID-19 outbreak accentuated this trend and 2020 record recorded a historical peak of U.S. Dollar 2.3 trillion in issuance by non-financial companies resulting in an all time high of 14.8 trillion in outstanding non-financial corporate bonds. Now, before I go on with this, what I want to tell you, and you’ll see it as we go through that, some of these graphs and charts go through 2019, some of them go through 2020, and some of them even bring us up to the edge of where we are or close to where we are right now in 2021.

I’m pretty sure that they had the data to do it through 2021 on all of it just saying, just saying, I just wanted to point that out and I’ll bring it up again as we go through. But since 2000, the share of corporate bond offering documents that explicitly mentioned share buybacks or dividends among the intended uses has increased from 2% tool, 11% more than five fold. Now here’s the reason why that matters because when a corporation borrows to expand their business, then they have a chance of generating additional income to pay that debt off. But when a corporation borrows for share buybacks or dividends, that wealth transfers out of the corporation. And so when there is a big shock that comes in, think Boeing back in 2020 taxpayers had to bail them out. So this is a very, very big deal. It’s what happens. You’re leaving everybody else, holding the bag during the next crisis. This whole thing really ticked me off. I can’t even tell you I was completely obsessed with it. Okay. Rapid developments in the corporate bond market have revealed some structural challenges.

That’s not good because that means that we can see it topple at any given moment. And these systems are so fragile and so vulnerable. That’s exactly what we’re likely to see happen soon. I don’t know if we can make it to 2023, where they have all these big plans. I don’t know, but on top of that, and this is critical credit rate and this, even if you just shared this one slide with people that won’t look at anything else, do so, you can call. If you’re working with one of our consultants, call them up, they’ll print it out for you. Go on the blog. You can print it out. Yourself. Credit rating agencies are mindful of downgrading, triple B issuers due to their special status, just above the non-investment grade threshold, such rating stability concerns may limit the ability of credit ratings to properly inform investors about the risks of individual bonds.

You see, when a bond comes out and it’s investment quality, you didn’t get a much better interest rate and pensions and some mutual funds, et cetera. They can invest in investment grade bonds. But once you go below that to a BB, these are BBB to a BB, well then the interest rates go up and we remember what happens. Interest rates, principle, when interest rates go up, the principle value of the bond goes down. So that impacts any holders of that bond and all of those entities that by law, in their perspectus, they can only invest in investment grade. They can’t invest in them and they would have to liquidate their holdings if they liquidated their holdings, that would drive the interest rates up in the principle down, even more sure, just like what happened in 2007, where the grading services kind of fudge this because who pays for them anyway, the corporations pay for them.

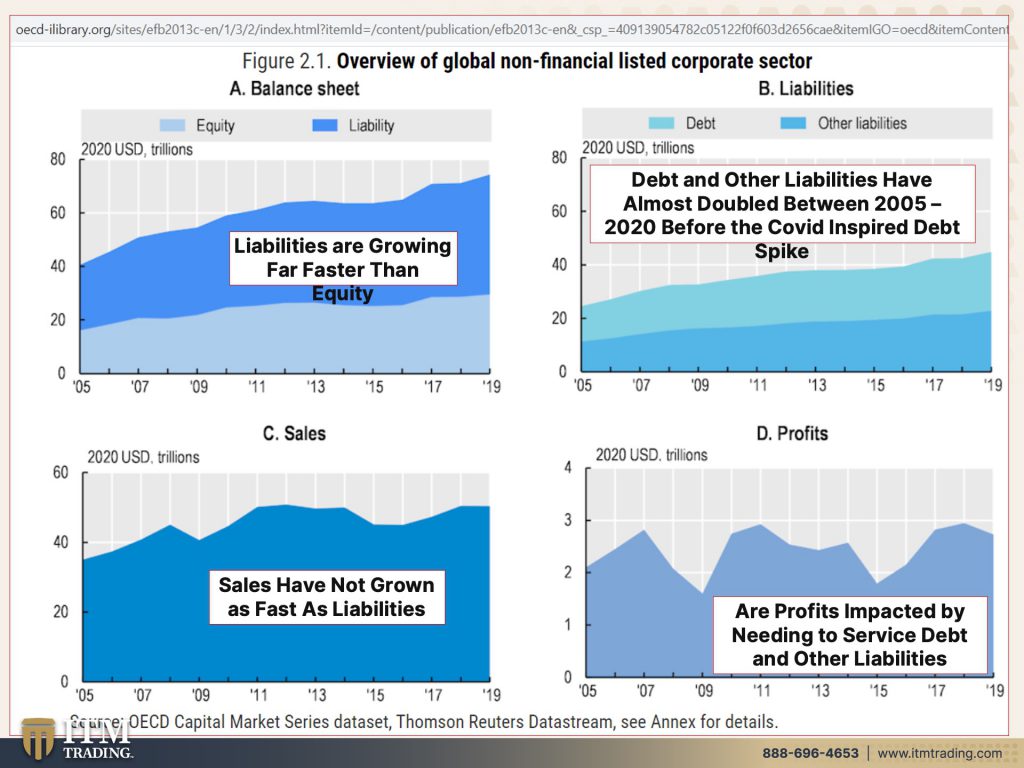

So they have, you know, they have a reason to make sure that they stay at that BBB level. We’ve talked about this before, but wait until you start seeing the data on this, because it’s really pretty scary. So they give us all these graphs for truth. And I would definitely follow the link, read this one yourself as well. I mean, you know, I still am limited by the number of slides, but this would be one that you want to read. Now they’re giving us an overview of the non-financial corporations and their debt. Now, remember there’s of course there’s banks. So that’s not included in this because that would be financial. So it’s all non-financial liabilities are here. Equity is here and it should be pretty clear that the liabilities are growing much faster than the equity, which leaves a corporate, a whole lot more vulnerable debt.

And other liabilities have almost doubled between 2005 and 2020. And that was before COVID. So you’ve got to, you know, you got to think about that because we know that the most debt that’s been grown has been, well, I’ll show you this in a minute, but, but the COVID pandemic really made a great excuse to grow a whole lot more debt. I’ll I’ll say that. And just wait until I’m going to show you this, crazy, sales have not grown as fast as liabilities. Now we’re hearing about this great reopening and it’s true people have been cooped up for almost two years, year and a half anyway, and they’re out there and the government has, and the central banks, the government’s given them lots of money and they are spending, of course, we also know the inflation. So those dollars by less and less and less.

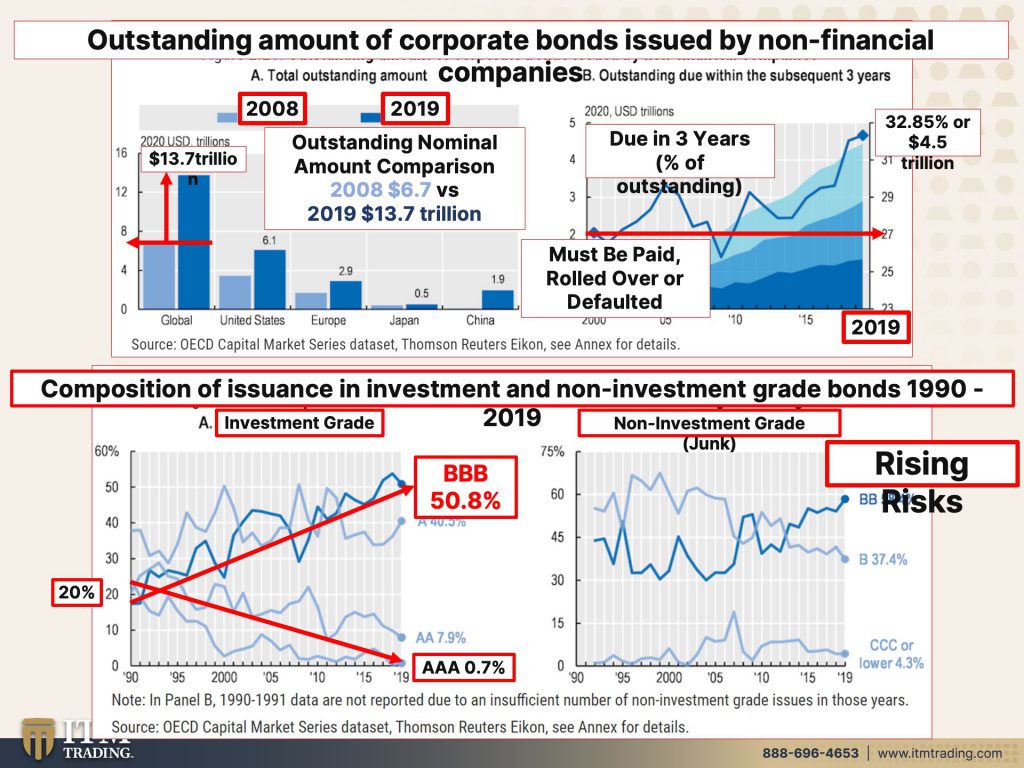

And then finally, you know, now there’s really, you know, how they talk about the K-shape recovery? Well, the same thing is true with corporate profits. You’ve got the big guys while their profitability has expanded enormously, but the vast number of corporate entities, not so true because whatever profits they do have or whatever cash flow they do have, well, since their debts are growing faster in this low interest rate environment, they could grow more debt and have a cost them the same as if they had more debt. This was supposed to be an opportunity to reduce their debt & reduced their liabilities and instead corporations, most of them did just the opposite. They took on more debt and this debt is short term. So outstanding amounts of corporate bond issued. Let’s just take a look at that here for a minute, because this is global. And this was in 2008. Now I had said many, many times I stand by this today that in 2008, the system died, period. It died and it went on life support. And what was that? Life support, lots of new debt, lots of new money and virtually zero interest rate environment. This one is just through 2019. So it does, doesn’t reflect anything that happened in 2020, nor does it reflect anything that happened in 2020 much, much higher than that outstanding nominal. So remember nominal, as soon as you see that word nominal, what you really know is you don’t really know the value at risk, but if you make a comparison, it’s more than doubled. And that was before the impact of COVID, but it’s also gotten a whole lot shorter. So rather than, locking in these low rates for a longer term, they’re going shorter.

And I’m seeing that Keely has asked me to please clarify K-shape recovery. I asked for help from all of the consultants at ITM that are, that have the opportunity to watch this, because I want to make sure that you understand, and sometimes I can go too fast. So the K-shape recovery is where you have these billionaires and the people that only assets that are doing really, really well. I mean, their wealth has grown massively during this period of time, but then you have most of the people, the normal people, the service people in the lower wages, and they’re struggling, they’re still starving. They’re still struggling. So that’s a K-shape recovery. And I would say that that was true in the bond market as well. You have a few entities that are doing enormous, you know, Amazon, apple, Google, you know, the names, Microsoft, all those guys, but most of the corporations are not having that same kind of profitability. Let’s say.

So again, just to kind of bring it back. Most of this debt is due or a lot of this debt is due in three years. When you have debt, you either have to service it. You have to roll it over or you have to pay it off. So mostly what happens is that it gets rolled over in this interest rate environment. I mean, I certainly think that we can keep interest rates at zero forever. Don’t you doesn’t that make sense? No, it doesn’t. But 32.85% of the bonds issued are issued for three years or less in maturity. And so they will need to be most likely rolled over in some way. And this goes through 2019 by the way. Okay. Now let’s look at the composition of the issuance for investment to non-investment grade. And what you’re looking at here year is prior , this is in 1990s. It was less 19% of the bonds that were issued were BBB. So right on that border now, where is it? My goodness. Oh, and AAA was also, that was about 21%. Now you’ve got AAA that’s less than 1% and you’ve got BBB that’s over 50%. Hmm. That doesn’t that mean you kind of wonder, but again, are you going to get the truth from the grading agencies? No, we didn’t in 2007, we’re not here in 2021 and that’s only going to get worse. And so what we have are rising risks into this vulnerability, into rising vulnerability. Further than that, the sheriff corporate bonds intended for dividends and share buybacks. And again, this only goes through 2019. We’re seeing that this has gone up substantially as well, non investment grade or junk, they’re called junk bonds for a reason. Those have also grown, but you can see the BBB’s have that area has grown a whole lot more. Now you have your money and maybe you’ve got a pension plan plan or a 401k, and you’re putting your money into look, if they do a target date, right of when you’re going to retire, you’re going to have bonds. You’re going to have probably some of these bonds to tell you the truth, most likely outcome. If you’ve got something like that, you own this crap. And crap is exactly what it is. The debt to EBITDA, which is earnings before interest taxes, depreciation, and amortization. So this is debt before the earnings before all of that stuff. And you’re growing the debt to the earnings. As we talked about, let’s see, 20, 23% of non-financial listed companies have a high debt to EBITDA ratio. That’s not good.

What happens during this next crisis? We’re still in the one that started well from September, 2019, and the Fed’s been pumping more and more and more money, but what this really does, it sets you up for a wealth transfer. That means that when these companies get into trouble, well, what happens to their bonds, and who’s really left holding the bag? We’re going to be looking at that. We’re going to be looking at that more tomorrow, by the way. So you don’t want to miss part 2 either, but this, the sheriff corporate bonds with covenants that restricted payouts now covenants are protections that are built into the bond contract. And it’s pretty clear to say these are investment grade bonds with payout restrictions. Basically they’ve all gone away. There used to be a whole lot more dividend buy back restrictions on what a corporation could do, because they used to be that you wanted to retain some capital for such emergencies.

And then this is the non-investment grade, which has also gone down substantially & remember with interest rates anchored near zero, there has been, what’s called a reach for yield. Look, if I’m depending upon my investments to generate my income. And it goes from 5% well got when I became a stockbroker, it was up at like 12% on like a 10 year treasury. Something like that, 10-12%, right? If you’re now generating less than pretty much zero, then you’re going out on the risk spectrum. And this was all planned. This was the intention to support those stock markets, etcetera. You’re taking more risk to generate that income, but have any one of you ever read a bond contract? My bet is no, nobody has done that. Well, they know that you’re not going to read this contract. That’s this thick. And even if you did read it, it’d be written in such a way that you couldn’t understand what you read anyway way.

So you’re taking more risk and you don’t even realize it. And I got to tell you, if you lose your principle, there is no way to recover coop that how are you going to recoup that? So yeah, you need to retain your purchasing power. You need to retain some real dry powder so that you can go back into these markets. After all this garbage is burned off. Okay? So disappearing investor protections, and now the share of the junk bond market that, and looking at the default rates, because I hope you can see that they are rising. Now, all of this stimulus money has really helped. Hide this, can they do that forever? They could do it longer than you would think, but we’re coming to an end because all of the stimulus that they’re doing. I’m going to do a report. You know, I really appreciate when I get to go on other’s channels. And I, and I hear things that I did not Martin north brought to my attention, the bank of England and the house of Lords report. So I haven’t really had a chance to read through that yet, but it’s on…they’re looking at the impact of all of this quantitative easing all of this new money printing and there, and the House of Lords is saying, it’s not doing anything. It’s not working. What it’s doing is making the rich, richer and setting up wealth transfer. So these are the rising risks that we don’t realize that we’re taking with them. And when we have our money invested in here and you know, is that really okay with you? That’s what you have to ask, because truthfully what they say is, trust us, everything is fine. I mean, listen to Powell. Yeah, we can do this. We can stop whenever. If we see inflation getting away from us, what are we going to do? We’re going to pull out those tools and we’re going to fight that inflation. Well, what is it? You have to fight that inflation with interest rates was her anchor to zero and his balance sheet, new money, which is not being as impactful as he would like it to be, or other central bankers, or even as they want us to believe that it is so this fiat money system and the central bankers are supporting the Fiat markets. And they will do that until it becomes too expensive or they lose control. And I’m kind of what I’m seeing in this report. And what I’m going to show you tomorrow is that they are losing control. And you’re going to see why in 2008, nobody went to jail. And if this happens, whatever this happens in the 2020s, whether it’s 2021, 2022 or 2023, or whenever it happens to be, who’s going to pay for this because everything is not fine. It should be pretty clear just from this one chart that the markets absolutely require all that new money to keep floating and everything. Single time, a central bank creates new money. What happens? The money that’s already out there loses value. and by the time it gets to you in may, that’s why you see grocery store prices going up and everything else, all your cost for everything. Okay. Real money supports independence. And we need to be independent in this environment as self-sufficient and independent as possible.

So what are the central bankers doing for themselves? They are buying gold and this little blip right in here where they couldn’t do it in 2020, they didn’t buy much gold. Cause this is net. So this includes all the buys and all of the cells from the global central banks buying and selling gold, right? This shows you gold doing exactly what it was designed to do, because there were a number of governments that needed the support needed to sell some gold so they could help their economies survive this. But as soon as that shock was over, would they start doing again? They’re net buyers. Why, if it’s such an old Relic, if it has so little relevance in today’s financial system, then why would they be doing that? They wouldn’t right? It’s because they want to stay in power. They want to be independent. And don’t, you want to be independent too. Don’t you want to be able to stand in your own power? But you need more than gold and silver to do that because you need to be as self-sufficient and independent as possible via food, water, energy, security, community, and shelter, as well as your barterability and your wealth preservation. You need to hold your purchasing power. For 6,000 years, gold has held its purchasing power. Why? Because it has the broadest base of utility and the broadest space of buyer. It’s not rocket science. It doesn’t require a special formula to make it look like this or to make it look like that. Well, I shouldn’t say that cause that’s not entirely true, but because of all the derivatives on gold and silver that they create to manipulate the price, but that’s still doesn’t eliminate its value across every single segment of the global economy. That’s why central banks buy gold. That’s why you need to be buying it too. That’s why I’m buying it in any form. Gold is real money at its base.

Now, do we have some questions? I won’t be distracted now because I’ve just got to pay attention to the questions…Eric asks, I wonder about the mechanics of exchanging press precious metals for daily goods and services. Do you see small community banks acting as depositories, personal barter, other? And the answer is yes, there are several different ways that you can do that. First of all, you work with a reputable dealer. They will convert that into whatever the currency happens to be. But additionally, and you’re going to see this this week, I’m not quite ready to show it to you on these two films, but in Venezuela, they’re actually pricing food in terms of gold and I have a video showing exactly how that’s working. Interestingly enough, the gold was wrapped in a 20, 20 thousand bolivar bill. So yes, well, we’re going to talk more about that. I promise.

Kim asks, during the reset, could a bank adjust a loan principle amount, payment amount or interest amount due to their valuation of the new currency. Of course they can, they can do whatever they want, but the bank couldn’t adjust it. That would have to come from the government, unless it depends on the contract, right? Because all of this Fiat money stuff is all based on contracts. So actually embedded in most of, actually all of the contracts, they’re all tied to a certain interest rate benchmark. Most of them still tied to libor, which died in 2012. And they’re trying to establish a new one in this country. It’s the SOFR, I’ve done a lot of videos on that. And that transition was originally supposed to be completed December 31st of this year, but it has been postponed until 2023. So the answer is yes, it’s in the contract that they can indeed do that as I’m thinking this through.

Diana asks, Do, do you recommend listing your physical gold and silver with the renters or home insurance? No. Do you suggest keeping it off grid despite potential risk of threat? You know, there are ways that you can do it that doesn’t get very specific, but you know, most people who’s going to think that you have any gold or silver, so you need to be intelligent about it and have it in a way, like, you know, I used to hold it in my home. This was before I bought this house. But since I’m so visible, there are private vaults that have a whole lot more than just gold and silver and they’re super secure. So there are a number of ways that you can hold it to avoid that risk, but you can also do a special rider, but you don’t get specific with it. And because it’s physical, I mean, to be really honest with you, this is the kind of thing that I like to give for weddings. This is the kind of thing I like to give when somebody has a baby or, or something like that. So, because it’s physical who’s to say that you couldn’t give it away, but I have a trust. And in my trust, it is just it’s blanket. It’s not specific, just all my worldly possessions.

Ethan asks, closing on my house in a few days, plan to buy a homestead property cash. Where is the best safest place to keep the cash while I’m looking for the right homestead? You know, again, I would probably go into a private vault and put it there. That’s probably the safest place.

Paul asks, this will be the last questions. What about borrowing Fiat to buy metal? The only challenge that I have with that, because I have, this has been a question that’s come to me many, many, many times over the years. It is not a choice that I would make because as long as Wall Street and the central banks still have some level of control over the markets, I mean, it’s the timing we know what’s going to happen. And I can even tell you what I think it’s likely to happen, but I cannot guarantee that. And also you want to make sure that it is a fixed rate. If you do make that choice, like the person that’s buying the homestead, he’s paying cash for it, which, you know, everybody’s got to do what they’re comfortable doing, but you could take out a fixed rate mortgage on it and then have used the rest of the money to buy gold. Then during the reset, then you can liquidate some of that gold and pay off that mortgage. So there are lots of options. There’s no blanket answer for everybody. That’s why we have a whole team of consultants. And I would suggest that you go ahead and call them and have this conversation on your personal individual circumstances with them, because they’re going to be able to ask questions and really help give you educated information. That’ll help educate you so that you can determine what is in your best interest. And we all need to be looking at this. And I think we’re running out of time. I mean, you look at the levels that they’ve gone to and remember so much of this. We just went through 2019. Come on, they have data through 2021, at least through the end of 2020. I wonder I can’t prove this. So he can’t hold me to this, but I really wonder why they didn’t use all of their data.

So tomorrow part two, we’re going to be talking about the ownership structure. We’re going to be, I’m going to be showing you more data from the OCC, the Office of the Comptroller of the Currency that examines derivatives in the FDIC insured banking system and wait until you see some of those most current numbers. It’s amazing. Now today I filmed a video with Dustin Nemos over at Nemos News Network. We will share the link when it is available. And on Thursday, we will be talking a lot more about real estate because I’m going to be on doing a Coffee with Lynette, with Jason Hartman and that’s Thursday at 11. So until then, remember, if you need to talk to us, we’re just a phone call away. If you have not subscribed, make sure you do wait til you see what I’ve got to show you tomorrow. Because here at ITM, we use the wealth shield and well shields. What are they’re made out of physical gold, physical silver, but also food, water, energy, security, wealth preservation, community shelter, barter ability. You got to have it all. And until next we meet, please, please be safe out there. Bye-Bye.

SOURCES:

https://www.oecd-ilibrary.org/sites/efb2013c-en/index.html?itemId=/content/publication/efb2013c-en

https://www.yardeni.com/pub/peacockfedecbassets.pdf

https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-q1-2021/central-banks