MAJOR PATTERN SHIFT APPEARS: This Pattern Shift Always Leads to a Recession…HEADLINE NEWS with LYNETTE ZANG

TRANSCRIPT FROM VIDEO:

You know, here’s the problem with everything that you’re seeing on the current state of the economy, from the Fed statements to all the talking heads on Wall Street, frankly, there’s little that make sense at this point. Frankly, that’s also on purpose because there’s so much rhetoric that everyone gets so darn confused that they don’t do anything or they make the wrong choices or they just do what the powers that be, tell them to do, because they don’t know what else to do. Well, if this sounds familiar for you or for anyone, you know, this is a very important video for you to see, because I’ll not only translate this noise for you, but I’ll also show you the pattern shift that just happened that nobody’s talking about, but it always leads to a recession. And frankly, this next recession could very well lead to the hyperinflation that I think has already started. So I’m gonna show you what I’m personally doing along with what the central banks and anybody else that understands money is doing, coming up.

I’m Lynette, Zang, Chief Market Analyst here at ITM Trading, a thank goodness, a full service gold and silver dealer that specializes in strategies. And you better have one now because frankly this whole big Ponzi scheme is coming to conclusion. And it’s interesting because there is a pattern shift let’s just dive…Well, actually there’s some things that I wanna explain first. Sorry about that, because I wanna make sure that you understand this. So I’m gonna give you a little 101, because what I found is the yield curve has inverted. Now, many of you out there, especially if you’re new, you don’t even know why this matters to you and why it’s important. And I’m gonna to go into all of the details, but let me just explain a few things first, so that you’ll understand better. When I dig deep into this.

First of all, let’s talk about yield, right? So here, this is bonds. And I know you guys have seen me do this before, but if you’re new, maybe you haven’t. This is in interest rates. This is the price of the bond. This is when it’s issued. So this is the maturity of the bond, right? The difference between the price that you pay and the income that you get from the interest payments is the yield. When the yield goes down, the principle of the bond goes up. When the yield goes up, the principle of the bond goes down. When the yield is below the rate of inflation, then it is actually costing you money or costing you principle. Even if you don’t see it, that’s that nominal confusion right? So that’s number one.

Number two on the curve. Remember we said, this is when a bond is issued and then it goes out in maturity. So this is short term maturity going out to longer term maturity. And you can see when the yields move, that the longer the maturity, the greater the move. So the yield curve is the yield at different maturities of the bond shorter to longer. And inversion is when the shorter term yield pays more. Than the longer term yield whenever there historically, whenever there is whenever there is no exceptions to whenever the yield curve inverts typically about 18 months, ish, later you go into recession. So now let me dig in because why would a recession matter to you? Well, negative rates really, I mean, effectively are an erosion of principle. That means there’s less liquidity in the markets for the corporations then the corporations start laying people off. So jobs are lost. Recession starts, and you got a big problem. Now, let me show you what’s going on because it’s unfolding, it’s unfolding right before our eyes.

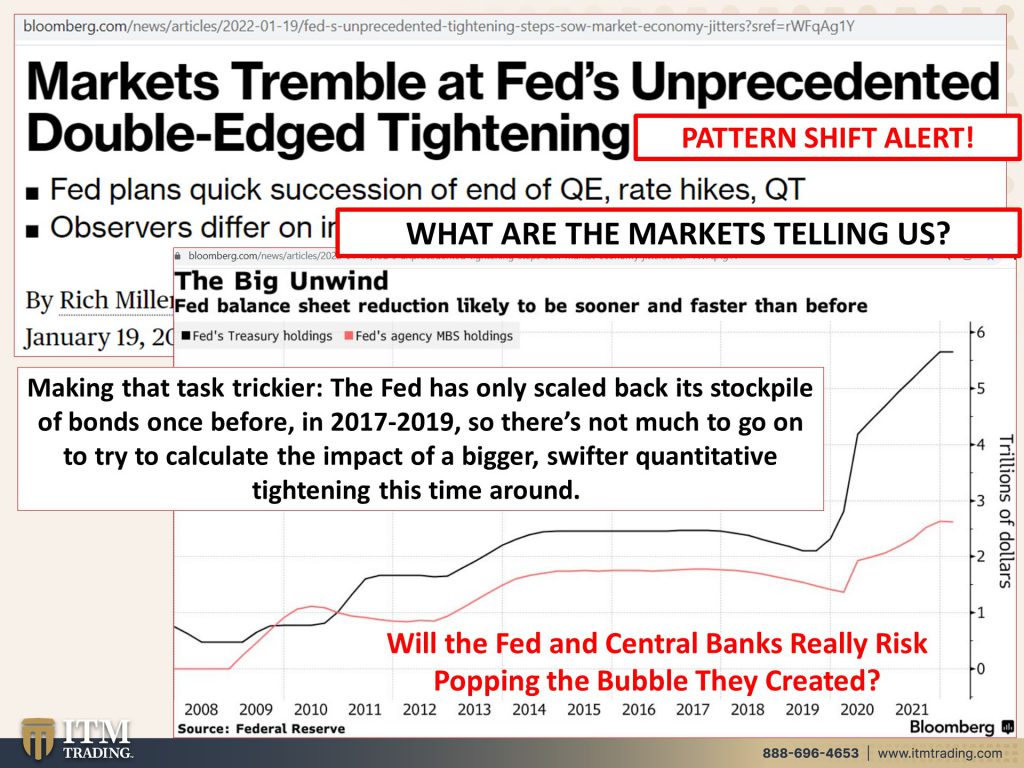

Okay. Let’s rock and roll all right. So let me show you pattern shift, but the markets tremble, at the Fed’s unprecedented double edge tightening. They haven’t done anything yet, right? They’re just talking about doing something in March. This is all garbage rhetoric. And it’s gonna be interesting. I mean, they’re gonna have to, they’re gonna have to raise rates and they’re gonna have to run off their balance sheet because otherwise they lose all credibility, but frankly, can they do it? The big unwind. This is their balance sheet. These are treasuries. These are mortgage back securities. I would like you to note, oh, and I should have circled this, but I think you can see it. See how it’s kind of flattening right here since they started the rhetoric. So they haven’t really started to tighten yet, right? They haven’t started to sell off any of their balance sheet, reduce their balance sheet. And they certainly haven’t raised interest rates yet the ones that they can control the overnight rates, but they’re talking about it. That is their forward guidance. When you hear them on TV, say forward guidance, okay? If they talk about it, then the markets start to adjust. And let me tell you, they wanna give the guys at the top of this heap, those corporations, they wanna give them time to get into position so that they don’t get as hurt. But you who every single paycheck, dutifully put money into your IRA or your 401k, or you’re sitting on an annuity and you expect institutional investors to have your best interest at heart. Think again, think again, because this is why it is the little guy that always ends up eating it in the shorts. We’ve got an early warning, signal, and you need to take it really seriously. I’m taking it really seriously. You can tell, I am not happy. I am not happy at all. Okay. Making this task, trickier rate, raising rates, running off balance sheet, the fed has only scaled back its stockpile of bonds once before in 2017 to 2019. And we know how that ended, right? The repo markets, the money markets froze. You didn’t see it because they papered over it with a whole bunch of oops of QE money printing. That’s why you didn’t see it, but it happened period, September. So they can’t do it. They cannot do it. It’s worse now than it was. Then they cannot do it. I don’t give a crap what anybody says, can’t do it. Right? So there’s not much to go on to try to calculate the impact of a bigger swifter quantitative tightening. That means instead of this, they’re doing this, okay. Quantitative tightening this time around. Yeah. Right. This is all a big flipping experiment. And we’re the Guinea pigs. Cause we are not too big to fail. I think we should and have all noticed that will the central banks really risk popping the bubble that they created when they talk about fighting inflation.

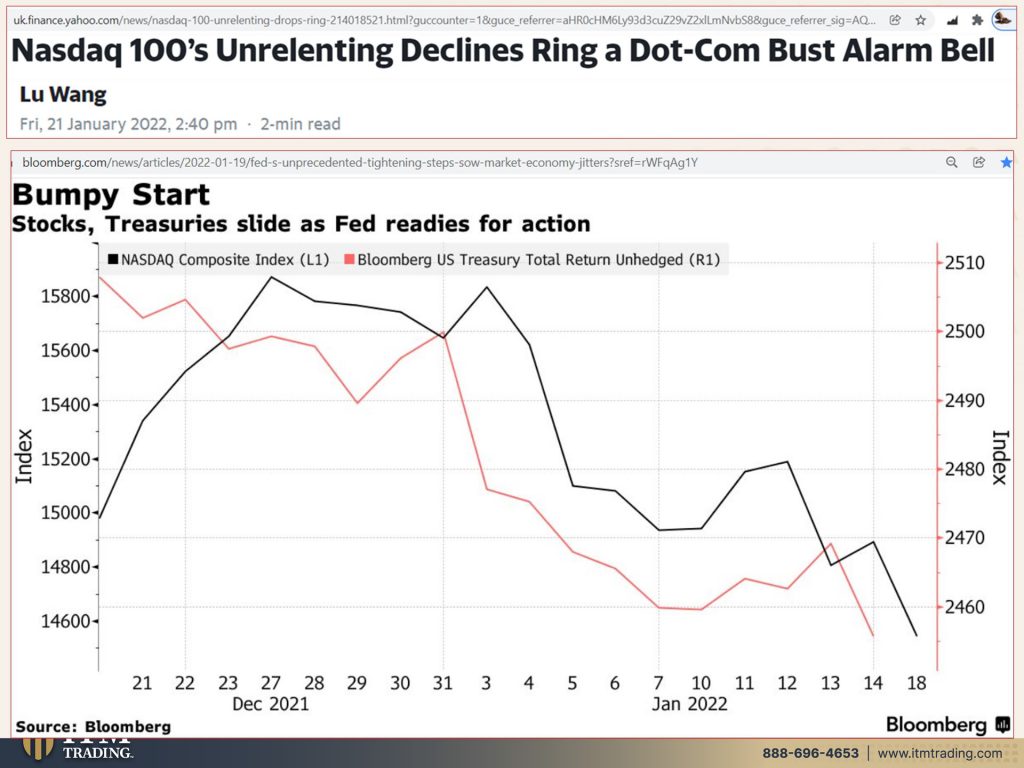

I, if I could reach through the screen and strangle them, I would because they are lying, lying, lying. Look, I don’t know if karma is real or not. I like to think that it’s real. And if it is indeed, I’m glad I’m not a central banker. That’s what I could say. I’m glad I’m not a central banker. cause I cannot stand these guys. They lie, lie and lie. So what are the markets actually telling us? Let us take a look. Well, first of all, we have had a very bumpy start to the beginning of this year. But what you’re also witnessing is that stocks and bonds are going down at the same time. Because remember, oops, where did my thing go? Okay, well I’ll use the pencil. Okay. Or pen. Remember that when interest rates go up, which is what has been happening. Bond principle goes down including treasury bonds, which is government debt Monday.

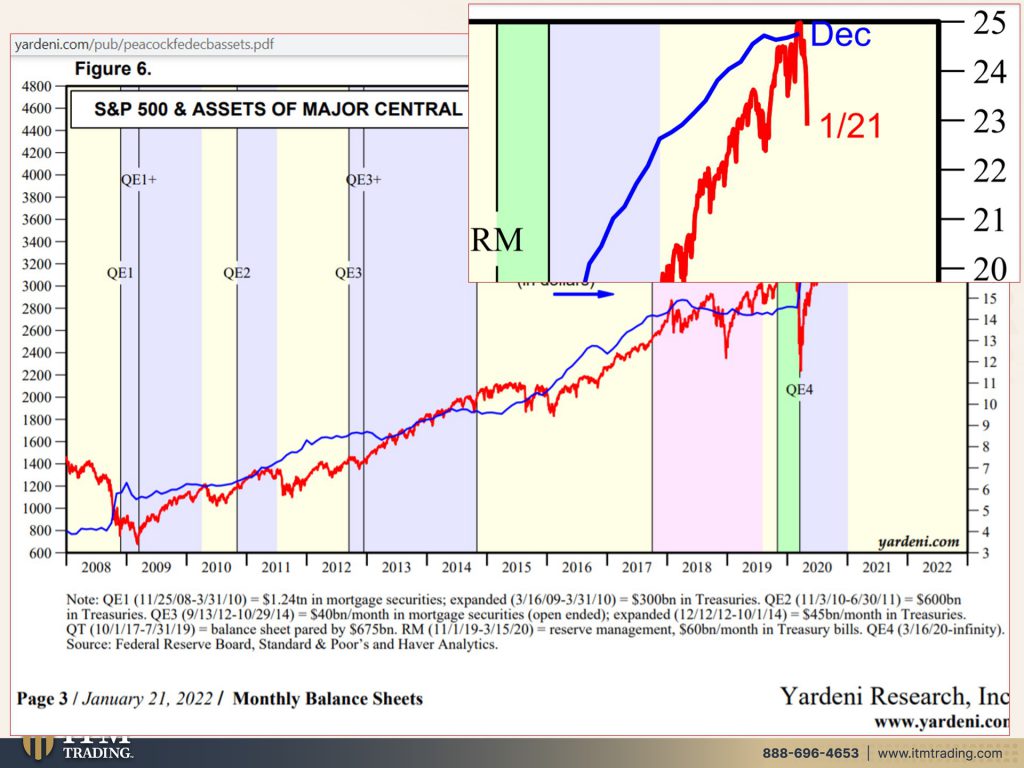

That was yesterday. I love this. I mean, I don’t love this, but I love this. Monday was one of the biggest market comebacks of all time. Well guess what happened at one point the Dow was down 1,150 and then it ended up closing 93 points higher. Wow. How did that happen? Guess what it’s happening today too. At what point? The Dow was down 850 points. And now I think it’s down or at least before I came in here down 30. Wow. Look at how resilient those markets are. Although I think maybe it could be, I don’t know the plunge protection team. We’ll talk more about that. But what you’re looking at here is, and many of you will know this is the Yardeni. I don’t really agree with a lot of what he says when he’s on TV, but I love his graphs. So you’ve got the red is the S&P 500 and the blue are the central bank balance sheets of the Fed, the ECB and the Bank of Japan. Okay. The fed the ECB. Now you will notice how correlated they are. Right. But what I also want you to critically see, and I tried to show you this in the little chart, this one shows you better. It isn’t that they sold anything it’s that they slowed down their buying. They slowed down expanding their balance sheet, creating new money. They just slowed this down a little bit. That’s all. And what happened to the markets as my grandson Warner would say. I mean, really, I think that gives you a very clear view. How far will the central banks allow these markets to go down before they go right? And crank these up. Cause they’re not gonna have a choice.

They are not gonna have a choice. It’s so simple. And you know, it depends on who you talk to. Because one thing that I find quite interesting is how these central bankers will say, or even other quote on quote, economists will say, oh, but inflation is gonna ebb in the second half of this year, really? Because they never bother to tell you how, what is going to change to make that all we really hear about is how much tighter the supply chain is getting, right? I mean, they only have five days worth of chips to make cars. You go on the car lot. There’s no cars. The grocery store shelves are barren and we’re having trouble getting the product to the shelf. And by the way, these are all things that happen during a hyperinflationary event, which we are not in yet, but it is a signal of a, of really, really, really broken system.

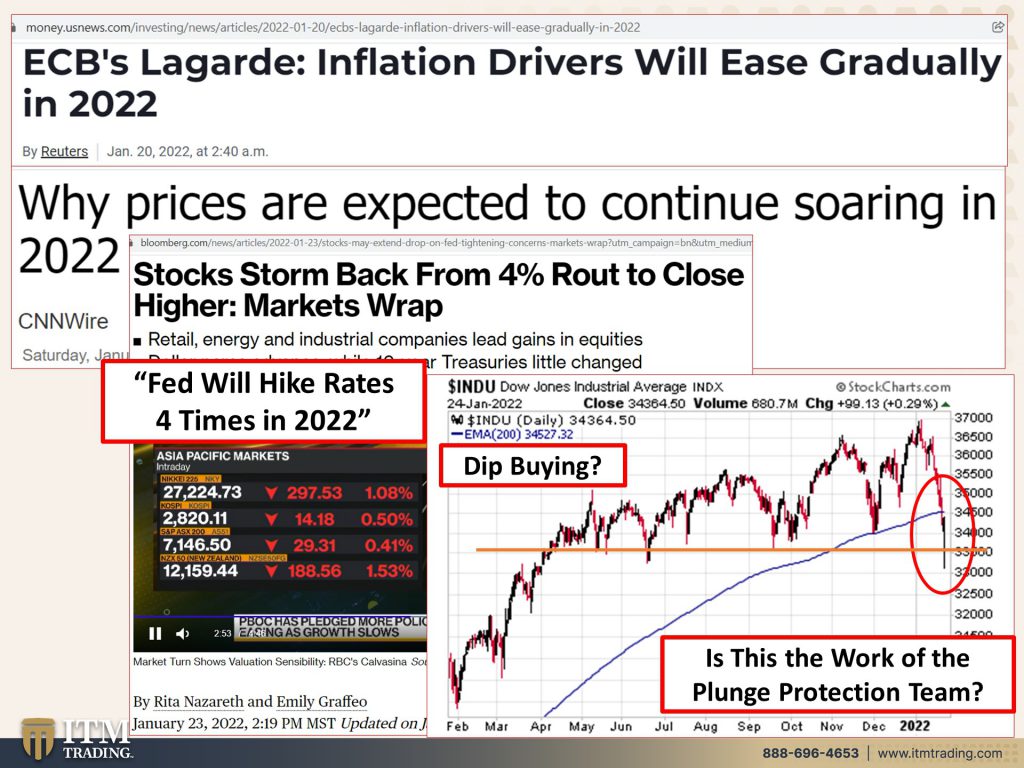

But then you hear why prices are expected to continue soaring in 2022. Right? So it’s, it’s you get all of these different messages and people don’t know who to believe. And that’s true on a lot of areas. If you just think about it, there’s so many conflicting messages that what happens, Ugh, we should have taken the deer and the truck. I’m sorry. I didn’t pull those out to think of it, but we should have, because people end up like deer in a headlight and oh my goodness. Maybe I better not do anything where they panic because, we’re taught that the only investments that matter are the ones on Wall Street. Well, they are the investments that matter most to wall street because that’s the easiest way to transfer your it’s much harder to come knocking on my door and going, give me your silver, give me your gold. That’s much harder to do. And there’s not a lot of people that hold that. So they’re not likely to do that, but Hey, the markets go, there goes your wealth. But don’t worry. Does the fed still have your back stocks bounce back from a 4% route to close higher yesterday? And we’re not at a market close yet, but we’re getting close and it looks like the same kind of thing is going to be happening today. At the same time that they’re talking about fed will hike rates four times in 2022. Look, I’m certainly not sitting on the board of the federal reserve. So this is certainly not something that is with in my control, but I would be willing to bet anybody that you’re not gonna get four rate hikes this year, but let’s say that you do for one minute, let’s just say that you do right. So what are they gonna do? Are they gonna raise it a quarter of a point? Because right now the rate that they actually can do that with directly is sitting at, I think it’s 18. So if they do four rate hikes, that’ll take us just above 1% with inflation, official inflation, which we know is a joke anyway, running at 7% is that gonna tame inflation. No, no, no. The interest rates have to be higher than the real inflation in order to even have a shot, but they gotta do it for their credibility. They’ve gotta do it for their credibility because this is what happens when they’re not credible. So a couple things, because this is a significant par shift as well. And this is the Dow Jones industrial average and look at this is the 200 day moving average. Okay. The 200 day moving average, it kind of works like a water ski if you’re going behind a boat, right? And when you go when you’re skiing behind the boat, you’re going in a certain direction. So just think of this as the wake, when that happens, there’s only so far above or below that it before coming back to center. So the markets technically severely over bought and maybe technically severely oversold. These are huge outsized moves, but look at how choppy it’s been. Yeah. We’ve had a bad start of the year, but the choppiness started before. So can the fed rate raise interest rates four times? My answer is no. And they’re gonna try, but how much of this kind of behavior do you think that they can tolerate? Right? We’re gonna see another fed pivot and what is that going to do to their credibility? Now they want to think that this is dip buying. Maybe it is. I don’t know, but my bet having been there on black Monday in 1987, witnessing it firsthand, and then knowing that they created the plunge protection team afterwards, because they don’t want you out of these markets. They need your wealth held in here so that it’s easy for them to take away. And who you gonna call Ghostbusters? Well, Ghostbusters can’t do anything about this now. Can they now ITM can, but Ghostbusters can’t and we’ll get to that more in a minute.

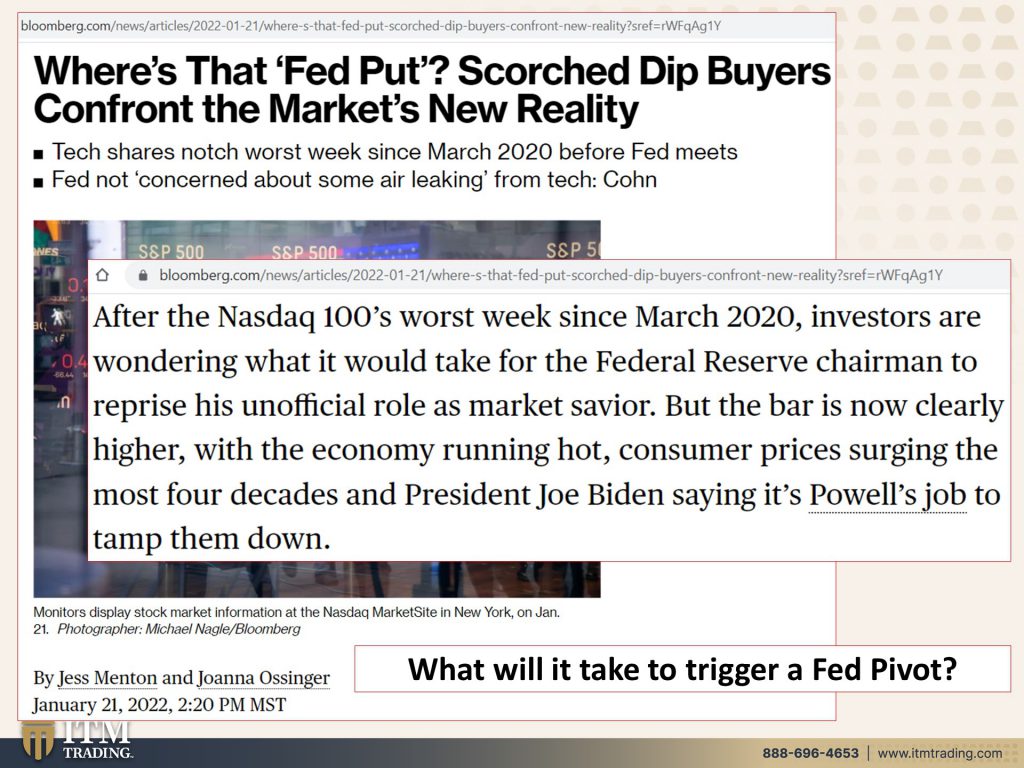

Where is that fed put? Scorched dip buyers confront the new market reality after the NASDAQ one hundreds worst week since March of 2020 was happening in March of 20. Oh yeah. It was the breakout of the pandemic and markets were imploding and hitting new bottoms. So boy, a lot of wealth transferred that way. We know about the K-shaped recovery where the few really benefited and the most did not, but I digress investors are wondering what it would take for the federal reserve chairman to reprise his unofficial role as market savior. But the bar is now clearly higher with the economy running hot, meaning inflation consumer prices, surging the most in four decades and President Biden saying it’s Powell’s job to tamp them down. So the question is what will trigger that Fed pivot, and we’re gonna find out we’re just gonna pay attention. And we’re going to find out because they are between a rock and a hard place. They are out of tools because the single biggest tool that they have to quote on quote flight, the, the inflation that they create are interest rates and interest rates are anchored at zero. That’s why they have to raise the rates so that in the next crisis, they can lower them again. I mean, seriously, I’m not making this stuff up. This is a fact, you know, I mean, there’s so much talk about how Paul Volker got us outta that recession and it was, you know, but it was really the transition to a new monetary system. And history does not read it this way. So you gotta know this is my opinion, but since it was now, since the full control of regulating the rate and speed of inflation, when Nixon closed that gold window, that control was given to the central banks and the tool that they use to control that rate is our interest rates. That’s it. So they want to speed up inflation. They drop down interest rates, more people borrow and spend. They wanna slow that inflation down. Well, they raise interest rates and fewer people borrow and spend. The problem is, is that this is not just a supply or a demand side inflation. So it’s not the consumers borrowing and spending. That’s creating the inflation. It’s a supply side as well as a demand side. And they’re not equipped to deal with that period. They’re not take my word for it. Do your own research. They’re not, they have, they are out of flipping tools. And what they’re trying to do is give themselves some tools to work on this.

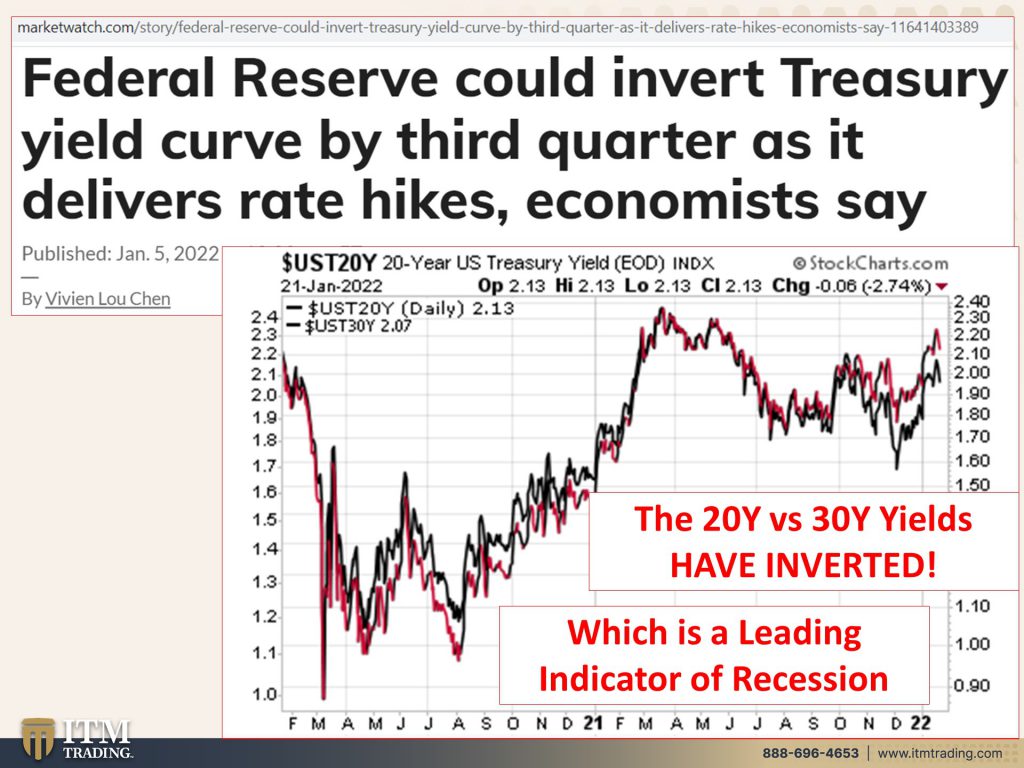

So even though they say that the fed could invert the treasury yield, meaning pushing shorter term rates higher than longer term rates. And you can see this is the two year note, right? So that’s a two year bond. And then I have the 10 year, the 20 year and the 30 year in here. So the shorter rates are moving up faster than the longer rates. And if the fed then the only control that they direct control that they, that the fed actually has on interest rates are very short term. So that’s the concern. They could convert the treasury yield curve by the third quarter, as they start to deliver rate hikes. Okay, now you can guys, you heard it here first, it’s already happened, not the shorter term rates, but it typically starts with the longer term bonds. So what we’re looking at here is the 20 year bond and the 30 year bond and the interest on the 20 year bond, the short term is higher than the 30 year. Why would you loan somebody money for 30 years? If you get paid more to only loan them money for 20 years, and frankly, you’re not getting paid for any of this stuff. Plus, when we take into account inflation, the yields are actually negative, right? Because what are you getting paid? I mean, look at here 2% on the 30 year for 30 years, you’re gonna loan somebody. You’re hard earned money for 30 years for 2%. But Hey, even if you believe the official inflation rate at 7%, you’re getting paid 2%. Your money is losing value 5% faster than that. You’ve got a problem. Do you see it? If you don’t let Edgar know, he’ll put it up on the board because it’s so critically important that you understand what I’m trying to show you here, this right here, you’re looking at it. It is an early warning sign because eventually what’s going to happen. And I don’t mean long term eventually. I mean, short term eventually when the fed actually starts to raise the short term rate, though, this could happen before that because the markets could make this happen with or without the fed. Right? But they will start to push up short term rates faster. And then the inversion will go down the food chain to shorter and shorter and shorter maturities. When the two and the 10 invert. I mean, those that have been watching me for a while, watch that whole thing play out. I think it was December, 2018 and darned if we didn’t have a recession, 18 months later almost to the flipping day. So you have been warned, this is a leading indicator, take head. I’ve been telling you to get ready. I’ve been telling you food, water, energy, security, barterability, wealth, preservation, community, and shelter. Get it done, get it done. I’m freaking out! When I see this kind of stuff, it freaks me out. I’m sorry. It is because I understand what it means. This is where I’ve my life. My pretty much my entire life. I mean, really, I started studying the markets on different levels when I was 10. Thanks to my uncle Al, okay. I mean, I know what this stuff looks like. I had been groomed for this moment in time and I’m telling you, get it done, get it done. Food, water, energy, security, barterability, wealth, preservation, community, and shelter.

Because these guys, these central bankers, do you think that they might know something that you don’t because what did we keep hearing? And actually from what I’m hearing, they still believe that this inflation is transitory. It’s not transitory it. You’re gonna take away all the raises for the people that you just gave raises to? No. How about those house prices? We have not seen yet. The house prices go into the inflation numbers. That’s still in our future. How about those supply chain bottlenecks that hasn’t gone away? What about the chips? I mean, there are so many things that are happening that they think it’s transitory they’re out of their minds, but they are. I mean, my mom used to say to me all the time, don’t you think Allen green spans smarter than you Lynn? Don’t you think he’s smarter? And I’d say, boy, I certainly hope so because he has a whole lot more influence than I do. But if he actually believes the garbage that’s coming out of his mouth, then no, he is not smarter than me because he had a different tune before he became part of the federal reserve.

And guess what? After he became part of the federal reserve after he left the federal reserve, I should say, he’s saying a different tune. He’s trying to save his legacy, but boy did he do a lot of damage in between? They all do because they’re human beings. They might be brighter than some others, but they’re still human beings and human beings are not perfect. And this is one big experiment. And today the IMF comes out and says, whoop, we’re gonna cut that global forecast because wow, the U.S. And China, the recovery wanes, we’ve got this, we’ve got that. Yeah. You think because I’m thinking seriously thinking that this next recession could absolutely trigger the looming hyperinflation, all that money that’s been held in the markets, it goes someplace. Wealth never disappears. It merely shifts location. My goal for everybody watching is to have that wealth shift your way. And you do that by understanding, you don’t have to, you don’t have to know, you know, or have the experience that I’ve had. If you can learn the patterns that I’m trying to show you in all of my work, certainly not just today. Then when you can recognize those patterns and you can also learn how to define the true value of any asset or instrument, I call that the fundamental value, because at some point that’s where it’s going. That’s what happens to every asset. It goes toward its true value. If you can know those two things, nobody can pull the wool over your eyes and you get to make educated choices that actually support your best interest first. And that’s my goal. That’s my goal.

Now we’re on the verge of war again. I mean, there are a lot of hotspots where work can pop up, but we certainly know what’s happening in the Ukraine and with Russia. And this was what yesterday us orders, diplomat families out of Ukraine citing war risk, because guess what wars can do. First of all, they can really justify ramping up those, those guns. Again, they can really justify that. Okay. So whoop-dee-doo, they can make that happen and that a grand old thing, but what it all so does is it can hide. What’s really happening, which is the transition to a whole new system. Life is different than it was before. Well, frankly before 2008, because that’s really when system died and I don’t care what anybody says, I have absolutely the evidence of it. And all that’s happened between then and now is that the system’s been put on life support so they can get into proper position. They say that they don’t have the CBDC ready. I’m not so sure about that. We’ll see, because really, if they have everybody distracted by the war and the other chaos. I mean it, isn’t just one thing, because then you would be able to focus on, you know, maybe two things. Oh no, there has to be a lot of chaos going on so that you’re looking and here and here and here and here and here and here and here, but you’re not looking over here. And that’s where all the damage to you really happens.

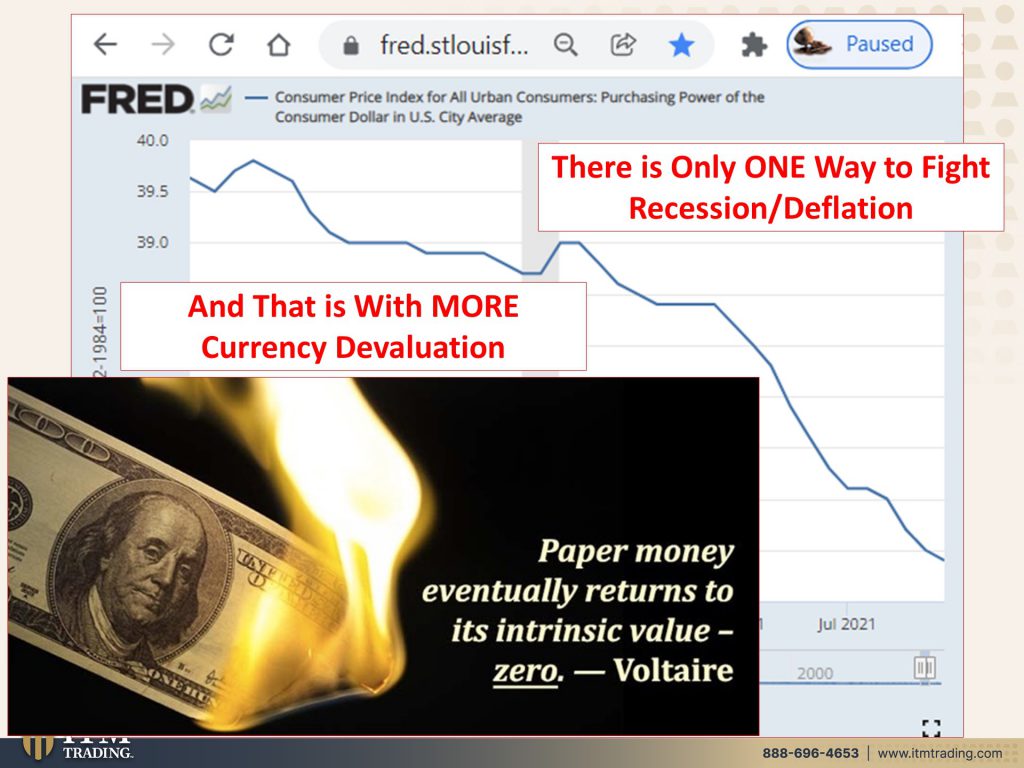

I hate these people. I’m sorry. I just do, I cannot stand it when people are lied to that’s why I’m data gal. That’s why give you all the links go and do your own due diligence because the real trend is not whatever is happening in the stock market or the bond market or any of that stuff. The real trend is what’s happening to your purchasing power. This is just from 2000, right? Because a lot of things shifted in 2000. And this was actually when we had 98 was when we had the first derivative implosion with long term capital management. And you tell me how this looks stable because this looks declining purchasing power to me. So when the feds talk about fighting inflation and, and, and protecting your purchasing power, keeping, keeping, purchasing power level, this ain’t level by flipping design, you are the Guinea pig. You are not too big to fail. In my opinion, you are too big to fail, but in the Fed’s opinion, oh no, no, no, no. You’re just about the right size. Cause what are you gonna do about it? So the time to do something about it is now you can probably tell that I’m trying to push you. Well, I am because complacency will not serve you well, and ignorance does not make you immune. It just leaves you vulnerable. And I don’t want you to be vulnerable. You follow these links. You go in you who do your own due diligence. And if you have a different opinion, Hey, I will support your right to have that different opinion, but do not listen to these talking heads because they don’t give a crap about you. They’re just chills. And they’re just doing their job to get you and keep you sucked into the system so that they can take your wealth away. Wealth never disappears. It just shifts location. And it should be pretty darn obvious to everybody right now that the wealth has shifted to those at the top away from those at the bottom and in the middle. What middle class? What middle class they’re gone. That’s started in 2002, by the way. Thank you very much, Amazon, who doesn’t have to pay state taxes that doesn’t have to make a profit mom and pops have to pay taxes. Mom and pops have to make a profit in order to stay in business. It’s a good thing. You gave me a good big glass of water today, cause I need it. I mean, I am so ticked off about this because the other thing that I really wanna point out is the speed of this decline, the speed of this decline. Can you see it? Oh, let me show it to you a little better. Now I show this chart a lot as you well know, and the link to the Fred, one of my very favorite websites, you can access this it’s on its march to zero because there’s no choice. And oh, by the way, this inflation that we’re in, Hmm. Only one way to fight inflation. And that’s with deflation. So we gotta have a recession if they’re really trying to fight the inflation, but that’s not true. They don’t really wanna fight the inflation. They wanna control it so that you stay in it and you don’t realize what’s happening. But there are more and more of the, of us frogs out there that are starting to wake up and going, you know, this, water’s getting kind of hot. And I hope that if you’re one of those that are just starting to wake up and go, you know, something’s going on here, that doesn’t make sense when it doesn’t make sense, you really need to believe it because the only way that they can pull us out of a recession is with more currency devaluation. And I didn’t put this on there. I have on many others and it goes, what are you worried about 35.5. That’s actually 0.0355 cents. And you know, it was a little bit higher than that. The last reading and little bit higher, the reading before, etcetera, you, you get my point. It’s going down and there’s only 3 cents left. And the reality is this has happened over 4,800 times. The Fiat money will go to its intrinsic value. Its true value, its fundamental value, which is a big fat zero goose egg. I mean, look, this is, I mean it says it on here. Let’s see, copy, let’s see copy money, right? Because if this were real well, it’s still, it’s all counterfeit. You know what? It’s counterfeit to. It’s counterfeit to this. It’s what it is. This is real money. This which I could go shopping with is real Fiat money. Let’s see what? Oh federal reserve note. Oh yeah. A note is a debt instrument, but this note doesn’t pay any interest. So you borrowed it from the federal reserve and the inflation that we’re looking at is your fee for owning this note. Can we go back to the slides please? Right? This is your fee. It doesn’t charge interest. It doesn’t pay you interest. Well it does it charges you inflation for holding it.

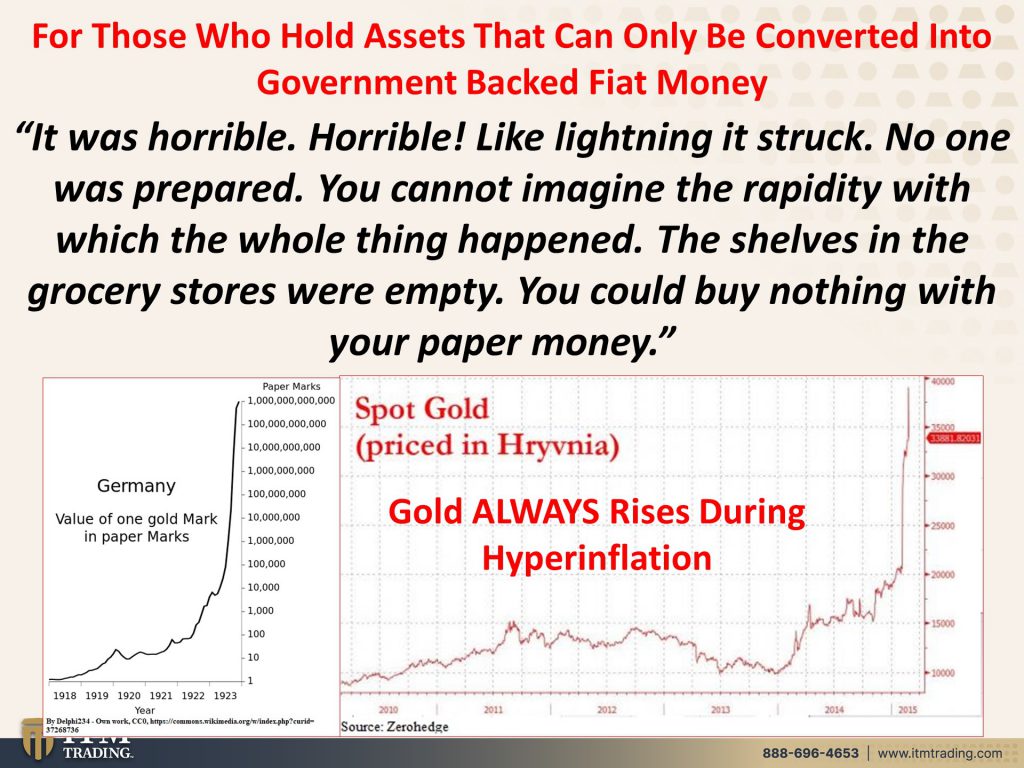

But for those who hold those assets that can only be converted into Fiat money. So stocks and bonds and I’m sorry, cryptos. At this point, they’re not really a tool of barter yet. Right? ETFs mutual funds, annuities, CDs. You can only convert that into the local Fiat money. Now when you hear me say Fiat, that is a government Fiat means literal translation is by decree. So that’s why you hear me refer to it as government debt based money. The government says, this is money and they can also say, oops, no longer money. This is a state of Florida bill, right? This used to be negotiable. It used to be, barterable not barterable anymore, no longer money. It’s not the only U.S. Currency that has gone through that. But that’s another story for another day. And then this is what we will ultimately experience. If we do not get prepared today, it was horrible, horrible like lightning its struck, no one was prepared. You cannot imagine the rapidity with which the whole thing happened. The shelves in the grocery stores were empty. Ooh, they’re pretty empty right now. Aren’t they, you could buy nothing with your paper money or your digital money, I’ll just kind of add that. But what happens to gold? That spot market that right now is being so conveniently controlled by the central planners and the commercial banks, JP Morgan, Wells Fargo, bank of America, etcetera. Well guess what? There is always a black market that emerges even if the official U.S. price is suppressed because this, is the broadest base of, of buyer that there is since it is used across the entire global market does not require a government to say that it’s money. That’s why this has never gone to zero. This Fiat money. Any of this stuff has gone to zero every single time, a hundred percent of the time and insanity is doing the same thing and thinking you’re gonna get different results. We’re not getting different results. You just saw that in the purchasing power. So it really doesn’t matter. You need to decide what you wanna be holding when we go into this hyperinflationary event because I’m sorry, there really is no choice. We are at the end. I have studied currency life cycles since 1987. There are repeatable patterns that happen over and over and over every single time. And I’m watching these patterns evolve and I’ve been watching them evolve for many, many years when I came to ITM in 2002 it’s because five of the formulas had confirmed that this was likely to be the end. And I thought that’s too many confirming the same thing. So I came in June of 2002 and in October I got my last confirmation. I knew it was the end. Do you know it’s the end? Because really interesting when I did that recent George Gammon event, which was a phenomenal event and I, you know, met a lot of wonderful people and I did my little dog and pony and now people thought it was great, blah, blah, blah. But I knew that it wasn’t. And I’ll tell you why, because I spoke to what I thought George wanted me to speak to. So the food, the water, the energy, the security and all of that kind of stuff. But I didn’t speak to what I know better than anybody else I know. And that is currency life cycles. So with this next event, coming up, be prepared. It’s gonna be different because I’m gonna talk about what I know better than anybody else that I know I’ve studied it since 1987. Think I know my stuff, but you can decide. You might not think I do, but follow the links and see if you don’t end up agreeing because spot always rises in terms of this funny money. As the funny money dies, stock markets go up too, because people don’t realize they have an alternative. The difference between a rising stock market and a rising gold price is that this has the broadest base of buyer and those stock markets. You can only convert into Fiat money that is going away. It’s dying, that’s what you’re looking at here in hyperinflation. It’s the final death now. And we are so close.

We are not, I, you know, look, I can’t tell you that this is gonna happen on Tuesday morning at 8 35. I just really don’t know the exact moment when all control would be lost, but I see fear in the central bankers eyes, fear. They’re trying whatever they can think of because they are losing control. And I think more and more people actually understand that they’re losing control and they’re starting to fly to the safety of gold, regardless of what the spot price is doing. Easy to manipulate that. But anybody that’s flying to $GLD, which is simply shares of a trust are in the wrong pew, right Church, wrong pew. Because all you have is a piece of paper that was designed to mimic the rig spot market. You can’t take possession of the underlying gold. So what good does it do at the end of the day?

Gold gains is inflation, woes persist. Are they going away? Do you think, do you, I mean really ask your self this question. Do I think that this inflation is transitory? Do I think that, is it going away? No, it’s not going away. Will it slow down to the desired 2%? Because at 2% they still get your wealth, but you don’t notice it at 7% and really with food at 40% and housing at 28% and cars at 36%, whatever those high percentages are. You notice that don’t you? Now, hey, if you’re sitting in a house, you’re not trying to buy one, but you own one already. Well now I feel really rich because look at how much my house is worth. Hey, maybe I’ll take out a second mortgage on that and take that trip to Tahiti. Guess who’s gonna end up owning that house at the end of the day? Probably, I’m sorry. Probably not you. I hope that’s not true. If you have gold, you can offset any debts, fixed rate debts that you have not variable rate, but fixed rate debts. That’s part of the strategy. That’s why you talk to us because we’re the only ones that have the strategy. And I know that for a fact, because I created it based on my studies that I’ve been doing on currency lifecycle since 1987 and nobody else has me. So there you go.

When you hold physical gold, physical silver, you’re holding it. I hold it. I own it. There is no counterparty risk. That’s according to the BIS and this, I found to be an extremely interesting graph. So if you bear with me, I wanna go through this with you. Real yield. So gold investors don’t care about the stock markets taper tantrum. The only reason why I care is because I care for you. That’s the only reason why I give a crap about what’s happening in the stock markets and the bond markets. What wall street is saying, what the IMF is saying, what the feds are saying, because my job is to educate you so that you can make choices that support your best interest. First, their job is subter for you, right? But real yields have soared in 2022, but are still well below zero. Right? So going back to that, I don’t know what I did with my chopstick, but anyway, so going back to that, right, as yields go up, Principal values, go down in the high yield, which is the junk bond market, which are issued by corporations that don’t earn enough money to pay their stuff.

So maybe they will default and maybe they won’t. You are getting paid 5% interest on average 5%. Okay. Let’s go back to the official inflation rate of 7%, which of course is much lower than it really is. But if you are risking your principle in the junk bond market, you are actually minus 2%. So you are paying them 2% to borrow your money. I know I’m giving you a second to digest that, right? Because, but wait, I’m getting paid 5%. Yeah. But everything is costing you on average 7% more. So you are behind the eight ball. You are actually paying them 2% to loan them on how about the safe things? Okay. Because this yield is on the 10 year treasury and it is at not even a half a percent. So therefore, if inflation is really on 7%, you are basically paying them. You are losing six and a half percent. And it’s much worse than that because we know they juggle the numbers and your personal experience is way different than 7%. But gold holds its value like it has for 6,000 years. I don’t care what happens in the market. Cause I don’t have any money in there. I don’t own a stock. I don’t own a bond. I don’t own a crypto. I don’t own any of that stuff. That has not always been true in the past. Well, I haven’t owned cryptos, but that has not been true in the past and in the future. I’m anticipating that. That won’t be true in the future, but let this stuff wash out, fly to safety, safety, safety, first safety first. I don’t care what happens with spot gold. I do care what happens to the Fiat money. That’s why gold always goes up during hyperinflation. Cause it hold your purchasing power. So if you are in the stock market, some people have no choice where some people are living on hopium and they wanna believe everything is gonna be okay. Well ultimately way down the road, it will be. I’m not saying this is the end of the world, but this is the end of the system that we know. This is a different social system, economic system and financial system. And you need real hard assets to move into the system with. So you can convert it into that new currency and hold your purchasing power intact and protect any wealth that you need to hold in those markets. I’m not saying, I mean, I’m, it would be really hard for me to say, go buy stocks, go buy bonds, go buy this, go buy that. Right? Because if the foundation of those assets, if you can only convert them into dollars or euros or yen or any government money, then the real trend is down because the central banks have destroyed all the purchasing power. That’s their job to just regulate the speed of that. So you don’t know it, oh, frog in a pot of boiling water.

So people don’t understand, but we have a plan and it’s called the wealth shield strategy. And it’s based upon the studies that I did since 1987, but then all of us at ITM come together and work on this. And there are some very, very smart people at ITM and we meet regularly and we talk about this and we, our goal is to make this plan better and better and better. And a lot of people need wealth protection. And so they ask how do I create an insurance policy for your existing wealth and your assets? Cause some people can’t or don’t wanna move them. Some people like to experiment with new stuff. That’s fine do that, but get a foundation of real money just in case, right? I like to ask myself what if I’m right and what if I’m wrong? I wanna do what will not matter whether I’m right or wrong. And that’s what gold and silver do for me. So you wanna ask what are the medals that are best for securing your assets? Cuz I know a lot of people really love silver and I do too. I own it. Right. But I own it for barterability for wealth protection and wealth preservation. Actually this is the kind that I use. Yep. Collectible. Yep. I’ll say it right out. Why? Because history, U.S. History has shown that our government confiscates gold and desperate governments do desperate things. So I personally believe that that’s gonna happen again. So I want the kind of gold that the very wealthy hold now there’s, there’s a really interesting thing that’s been happening and I I’ve been tracking. I think I told you about this conversations with the wholesalers at the auction houses, the highest, most expensive coins are going for far more Fiat dollars than they ever anticipated. Right? We saw maybe, I don’t know, two or three weeks ago in China, people are putting their money into Rolexes, into hard assets, gold, silver Rolexes, and away from the housing market. That’s crumbling there. And I’m talking to a high end antique dealer friend of mine. He’s just getting back from a show, best show in 25 years. So the smart money, the real money, the people with wealth because are all three of these are high level. Right? Very, very, very, very expensive. They’re going to tangibles. They’re going to real wealth, dynastic wealth, dynastic, wealth get ‘er done, get ‘er done please. Cause there’s three parts to it. #1 Portfolio diversification. Wall Street wants you to think, oh stocks and bonds, now you’re diversified, garbage because they’re all dollar denominated. You can only convert them into dollars. You need hard assets. That’s outside of the system for true portfolio diversification. #2 Levy recuperation, right? Levy, taxes fees all that garbage, right? Well this is so severely undervalued that when the whole system resets you’ll recoup any of those fees, any of ’em no big deal. It’s a no brainer. #3 Asset preservation. The primary function of gold, in my opinion, is to hold your assets even. So an ounce of gold bought a men’s suit in 1900. And guess what? At 1850 or wherever it happens to be at this moment, 1,850 bucks still probably buys a pretty darn nice men’s suit. It’s not the gold going up. It’s the dollar going down.

That’s why I like the collectibles, but there are different kinds for different functions. So the first thing that you always wanna do is establish a goal. What am I trying to do? Am I trying to protect a portfolio that I’m gonna hold over here or a speculation that I’m gonna hold over there? Am I trying to make sure that I can always pay my property taxes or if I have, I hope nobody does, but if I have a chronic health issue, am I trying to make sure that I can always have my medicine? These are a part of the wealth shield strategy. Call us talk to one of our consultants. I’m sure you’re gonna find they’re very smart if you haven’t. And certainly anybody that has can verify that they’re very smart. We are here to be of service. It has never been more important than it is in 2022. I told you 2022 is a pivotal year. It’s a pivotal year and it sure is starting with a bang and I don’t want you to get shot. So please, please, please get ‘er done.

Gosh, you know, we have podcasts. So even if you don’t have time to listen, cause I know this is a long one, leave us a review on Apple or Spotify. Listen to us anywhere. Anytime on all major podcast platforms, leave us a comment. Give us a thumbs up. Make sure that you share, share, share, share, share, share, share this video with everybody. I mean offer them an ice cream or whatever you need to offer them in order to watch because ignorance does not make you immune. It just leaves you vulnerable. If you care about them, I know you don’t want them to be vulnerable. And I know that it’s hard. I know that you feel alone out there, but you are not alone. There’s an army of us. I don’t know how many people are gonna watch this, but I certainly have some videos that have gotten, you know, a million views, 800,000 views, 26,000 views, a hundred, whatever it is we need to get as many people understanding what’s going on and then getting themselves protected because that’s the only way that you are gonna be able to weather this storm the only way.

And that’s what I want from you for you. So until next we meet, please be safe out there. But bye-bye I’m pooped. Bye-Bye.

SOURCES:

https://www.yardeni.com/pub/peacockfedecbassets.pdf

https://abc7.com/inflation-prices-2022-increase/11414260/

https://stockcharts.com/h-sc/ui

https://www.ft.com/content/f76d5033-ed8f-46fa-9313-e93597cee06f

https://fred.stlouisfed.org/series/CUUR0000SA0R

https://ca.finance.yahoo.com/news/investors-sticking-gold-despite-easy-002938442.html