ELITES RAISE DEBT ALARM: Can They Avert the Crisis They Encouraged?

Let’s talk about all of the debt that is about to explode and some that has already exploded. Because the elites have raised the debt alarm. Wow. and I’m wondering, do you think that we can have a soft landing? Do you, that they can avert the crisis that they encouraged?

CHAPTERS:

0:00 Introduction

1:31 Elites Raise Debt Alarm

3:51 Emerging Markets

12:30 Civil Unrest

16:57 Gold Protects Your Wealth

19:02 The Wealth Shield

TRANSCRIPT FROM VIDEO:

What? Oh, oh, I’m told tick, tick, boom. That’s what we’re gonna talk about today.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading, a full service, physical gold and silver dealer. Cause if you don’t hold it, you don’t own it. And particularly when are looking at all of the debt that is about to explode and some is already exploding. Let’s talk about that because the elites have raised the debt alarm. Wow. And I’m wondering, do you think that we can have a soft landing? Do you, that they can avert the crisis that they encouraged? Especially when, if you look at everything on TV, the surprise inflation, surprise this surprise that! Okay. I’m scared. You should be too, quite honestly.

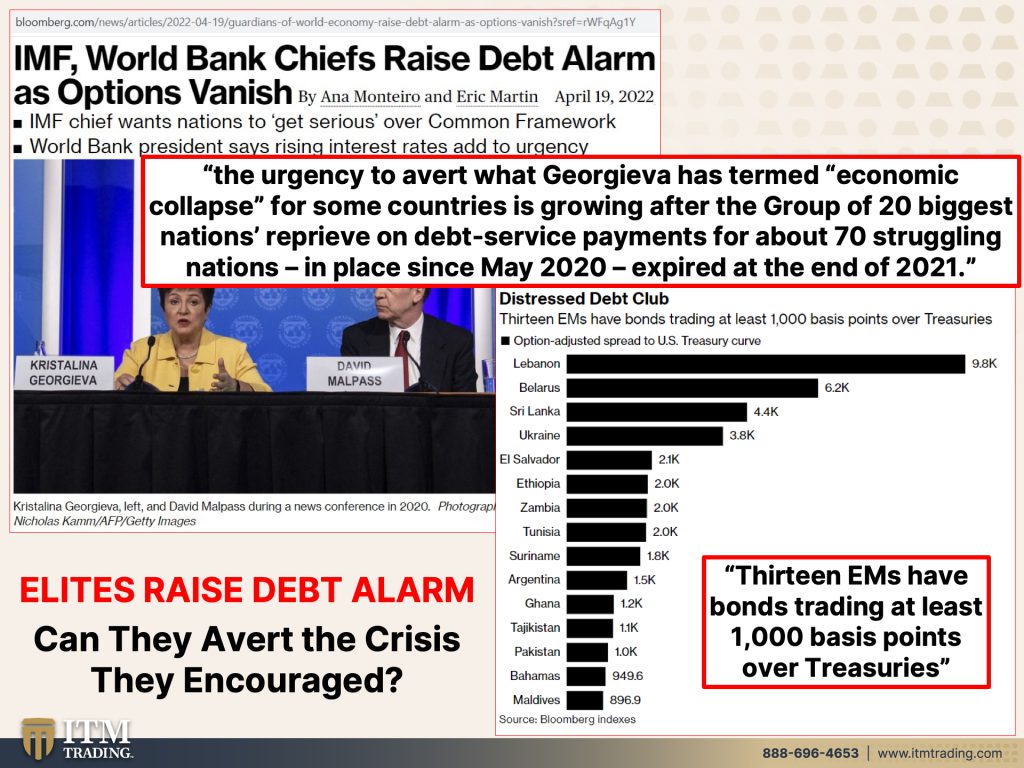

Those at the top raise that debt alarm as options vanish. And the reason why the options are vanishing is because the whole world is between a rock and a hard place. They’ve used interest rates and dropping interest rates for decades to encourage more and more and more debt. And now, oh, I guess we’ve reached a point? Because they have to raise central bankers, have to raise rates or at least, I mean, there are lots of experimentation going on. Let me tell you. But at least in theory, they have to raise rates to combat the inflation. Will it work this time? We’ll find out. But frankly, I don’t think so, but they still have to raise rates for their credibility. The problem is really in the weakest link at the moment. Although honestly, whatever I’m gonna show you here. So much of it is applicable globally because right now there are 13 emerging markets, EM’s, emerging markets that have bonds trading at a least a thousand basis points over treasuries. In other words they have to get paid for the risk that they’re taking. We haven’t, nobody’s been getting paid for the risk that they’re taking, but these 13 emerging markets are in deep doo-doo to put it bluntly. And here’s the piece of it. The urgency to avert what Georgieva has termed economic collapse for some countries is growing after the group of 20 biggest nations reprieve on debt service payments for about 70 struggling nations. It went in place since May 2020, and it expired at the end of 2021. So you see when everybody asks, well, will they just forgive the debt? Here’s an opportunity. You think they’re gonna forgive that debt? I don’t think so, but they did suspend the debt payments. Now these countries have to make these payments and they can’t do it. They’re having a lot of trouble with it. Does this sound familiar? Because it’s really happening on so many different levels. We’re just talking about emerging markets, but we could be talking about student loans. We could be talking about any level of debt, frankly, real estate, etcetera.

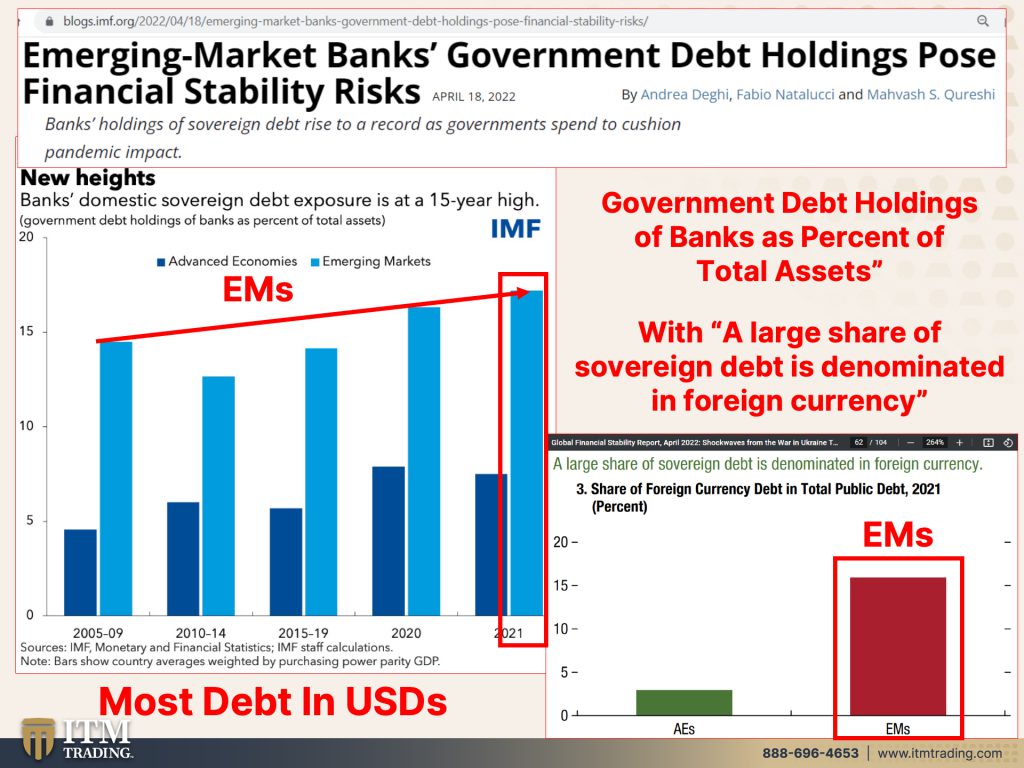

Emerging market banks, government debt, holdings, pose financial stability risks. Do you remember the doom loop that was created when Greece couldn’t make their sovereign debt payments? but you know, we’ve got this issue and we see it right now with the central banks, right? The government’s issuing all of this debt to create all of this money so that they can move, move on with their programs. At the same time, foreigners used to be buying that debt. But quite honestly, the federal reserve has been buying it since the end of 2002 December. I think 13th, I could be off on that date, but December 2002, because there have not been enough buyers. So we’re talking about emerging markets, but you gotta think U.S. too, because we are definitely losing the status as the world reserve currency. A lot of chatter about that, more than I’ve ever heard before, but let’s take a look at that. What that looks like. So this dark blue, oops, this dark blue are advanced economies like the U.S. These other, the lighter blue are emerging markets and that would include China. And you can see how much of the bank’s domestic sovereign debt exposure. Well, right now it’s at if 15 year high, but it’s gonna get higher because they gotta have buyers to issue all this debt. But with a large share of that sovereign debt sovereign is government a large share of that sovereign debt, denominated and foreign currencies. Hmm. Which, these are emerging markets. These are advanced economies. Let’s see, oh gosh. Most of that debt is issued in terms of U.S. Dollars. Do these emerging markets, all these countries, does China? Do they work with the dollar? Mm. Do they earn dollars? Mm, no. So these emerging markets don’t earn dollars, but they’ve issued debt in terms of dollars. And now the dollar is “strengthening,” right, against, against their currency. And that makes this debt a whole lot more expensive to service, starting to see the problem here? They have way too much of it. And it’s denominated in other currencies. And with the fed stance, the dollar is getting stronger against those other currencies.

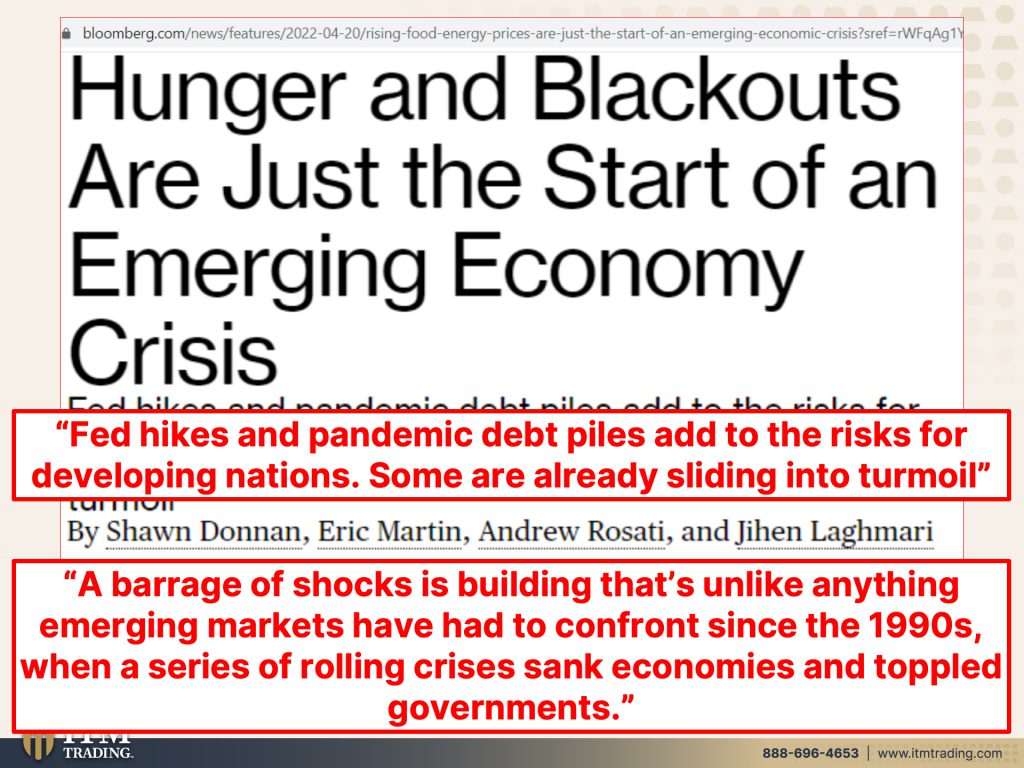

So here’s the result. Hunger and blackouts are just the start of an emerging economy crisis because they can’t afford those dollars. Fed hikes, right? So if they hike the interest rates, it makes the gover- our dollar look more attractive, attracts foreign buyers of our currency. and debt, and that makes it stronger. That makes a dollar stronger against these other currencies. Okay. So fed hikes and pandemic debt piles, add to the risks for developing nations. Some are already sliding into turmoil. We’ve talked about Sri Lanka quite a bit. A barrage of shocks is building that is unlike anything emerging markets have had to confront since the 1990s, when a series of rolling crisis sank economies. And here’s the real, here’s what keeps them up at night, toppled governments. But this is, this is what I wanna point out. This is something that we haven’t seen the nineties, but you know what else we haven’t seen since the nineties? The integration on a global scale, because globalization was just taking off in the eighties. I remember 1986, I became a stock broker at Shearson and all the talk was of globalization. Then all the talk was of globalization, right. Well today we’re watching globalization fall apart, but the interlinkage between the banks, this crisis can start anywhere and spread everywhere. And that’s really why this matters the most to you because it isn’t just, oh, that’s over there and we’re fine over here. We’re not fine. And it’s been years and years in the making.

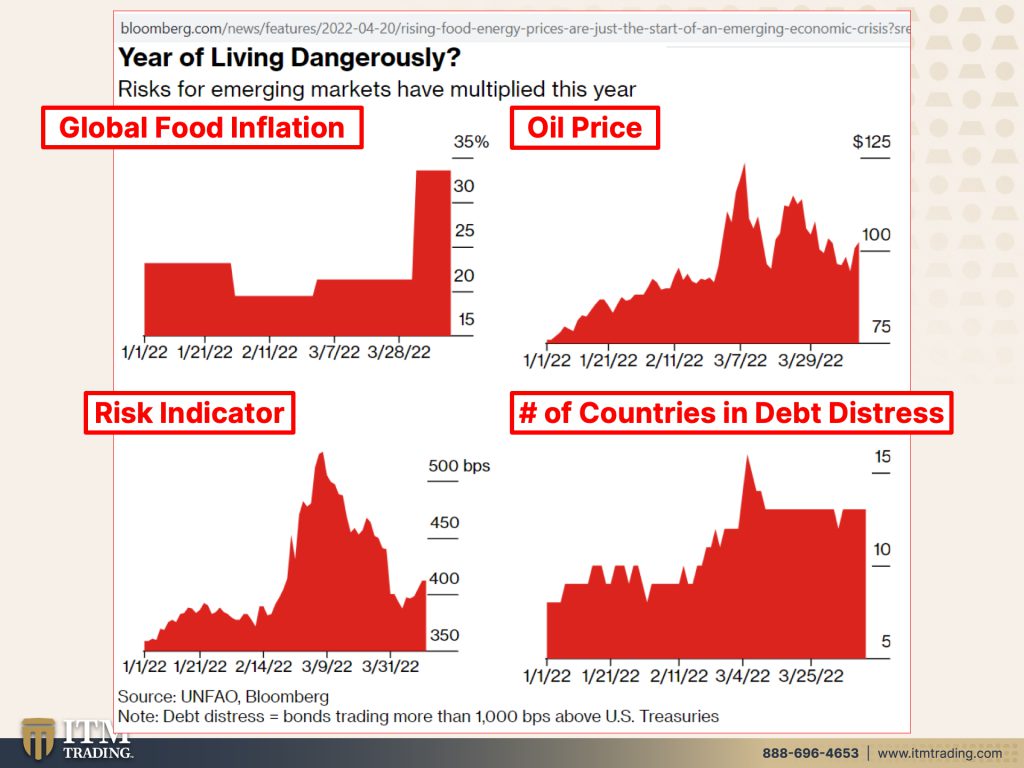

Risks for emerging markets have multiplied this year. Global food inflation, oil price shocks, overall, that’s a risk indicator and you can see that that’s on the rise and then number of countries in debt distress that will grow. And it’ll be very interesting to see. Now, look, if you’re sitting in gold and you’re sitting in something that can protect you, okay, I mean, it’s gonna happen. It puts you in a position to take advantage of the opportunities that will present in these markets. But not yet, it’s not yet, but globally investors are scared, right? They just pulled a massive 17.5 billion out of global equities. And they’re just getting started really? because you can see that shift can’t you. These are the global equities flow. So this is the accumulation so much since 2020, right? And then these, this is the index and you can see the shift. You can see where the pattern change is happening right now. Investors also pulled 8.7 billion out of bonds. 55.4 billion from cash. Wait, I thought cash was king? Oh! Pouring 900 million into gold. And that was before last Friday’s stock market rack. They’re going to safety and it’s just getting started. How do you feel about that?

Because emerging market bonds have wiped out gains of the last two years. Count them, two, as the selloff extended into a fourth month in the longest streak of losses, since what year? 2006, as we were setting up for the financial crisis and emerging market, debt sales plunge amid Ukraine, war, and rising rates. Hmm. And so developing nation, April issuance fell to the lowest. In 10 years, they can’t sell the bonds. So they gotta stop issuing, wait a minute, can a government, that’s gotta fund its spending really up issuing bonds? Or will the central bank just go into this vicious doom loop along with the government, with the banks that are forced to buy the government garbage? Oh, I mean, government debt. Surging yields are deterring emerging market issuers because it getting more and more expensive to buy it. You’ve got increased interest rates along with if they’ve been issuing or if they want to issue dollar denominated debt or foreign currency debt. So you have like a double whammy because you have the currency that you must buy to service that debt up at the same time that you have interest rates going up. No wonder these countries are in trouble, but it’s not just over there because we are incestuously interlinked. When will it overwhelm what we’re seeing in the, what we’re seeing in the derivatives markets? I don’t know, but I feel like we’re really, really close because faced with the impact on sentiment of the intensifying conflict in Ukraine and central banks turning more hawkish. In other words, raising rates, as they try to bring inflation to heal, which hasn’t been working very well, developing market borrowers have become more skid-dish and they’re going to the safety of gold because gold has been a proven safe Haven for thousands of years.

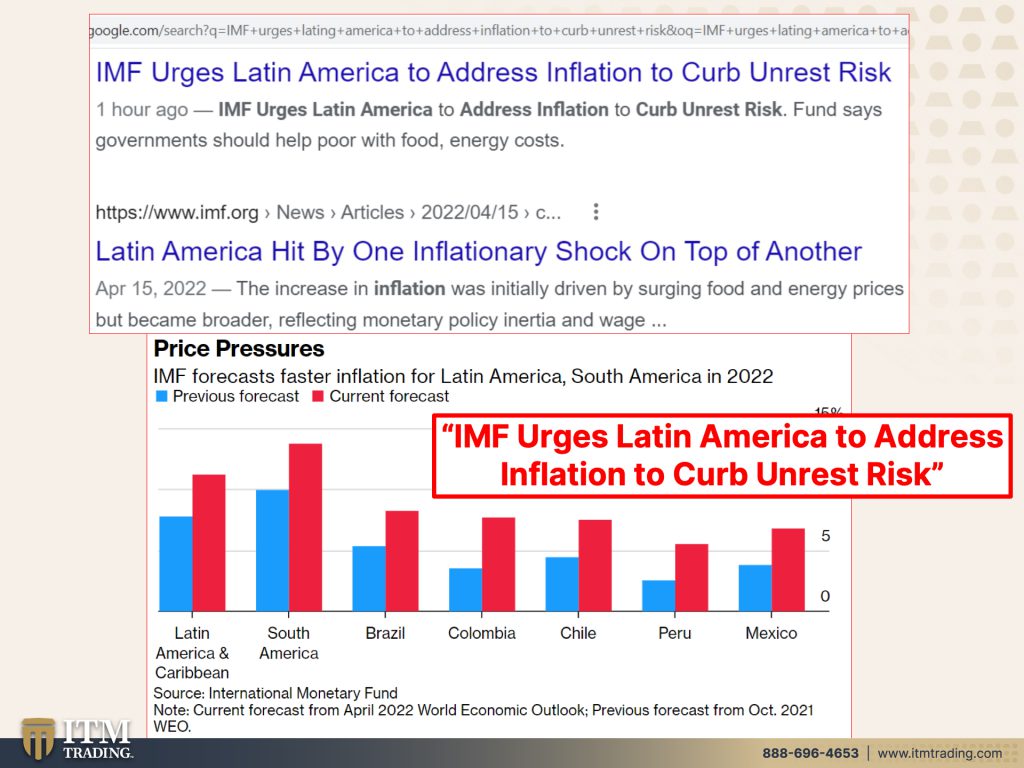

And I just pulled these, both of the are from the IMF, Latin America hit by one inflationary shock on top of another, but is it just Latin America? That’s being, being bombarded with inflationary shocks? Because we’ve been pretty surprised by the numbers here in the U.S. too. And wow. In Turkey. Wow. They’ve raised their forecasts from 23% inflation to 43% or something like that inflation. So, and we had the World Economic Forum and the IMF. I mean, everybody’s cutting growth and increasing inflation expectations, one shock after another. But here’s the real key in this. We’ll look at that. And then we’ll come back to the key price pressures. So this is Latin America. This is the current forecast. This is the previous forecast. So the blue is the previous, the red is the current. And you can see that the current forecast for inflation is spiking, right? Well, and guess what, they’re probably gonna be underbidding it, or it’s probably going to be even higher than what they’re forecasting. And here’s really the problem for the governments and the central bankers, IMF urges, Latin America to address inflation to curb here it is “unrest risk” because that’s how they lose control and how they lose power. That could work to our advantage. The little people, maybe, maybe we can get a more fair monetary system if we come together and we, we say, no, we won’t accept this garbage. We won’t accept the CBDCs. We got a shot. We got a shot.

It’s talking about the revolution. We’ve talked about the revolution potentially starting. And by the way, it’s really never a good idea to poke a hornet’s nest. Never a good idea, but U.S. blasts China’s support for Russia and vows to help India. So we’re going right in there. And at the same time, wow, this just came out April 20th, former head of state run Chinese newspaper claims high probability of war with the U.S. Whoa, in his most recent comments about the highly tense, U.S./China/Taiwan situation. We’ve talked about that as reported by Newsweek who asserted that there is a very high probability that there will ultimately be a direct military confrontation. So we have the war between, well, you know, world war II. Can you see it? Can you see it? He noted that there was a sense of crisis in Taiwan as the situation of the Taiwan straight deteriorates. We must prepare for a military struggle. Prepare for a military struggle. A commentary on Saturday, urging Chinese citizens to prepare for military struggle in the near future. When is it gonna happen? I have no idea. Is it gonna happen? Maybe yes. Maybe no, this kind of sounds like it very likely is to happen. So are we going to be dealing with war on multiple fronts? Is this really world war III time is gonna tell us, but it’s the perfect time. War is something that always a accompanies, a currency life cycle, a currency regime shift. It’s those repeatable patterns. That’s what the whole strategy is based on, the repeatable patterns that happen every single time, because I cannot guarantee tomorrow that’s way beyond my control, but I do believe that if something has happened the same way every time, and we’re doing the same thing, our most likely outcome is we’re gone to get the same result. I mean, that just makes sense.

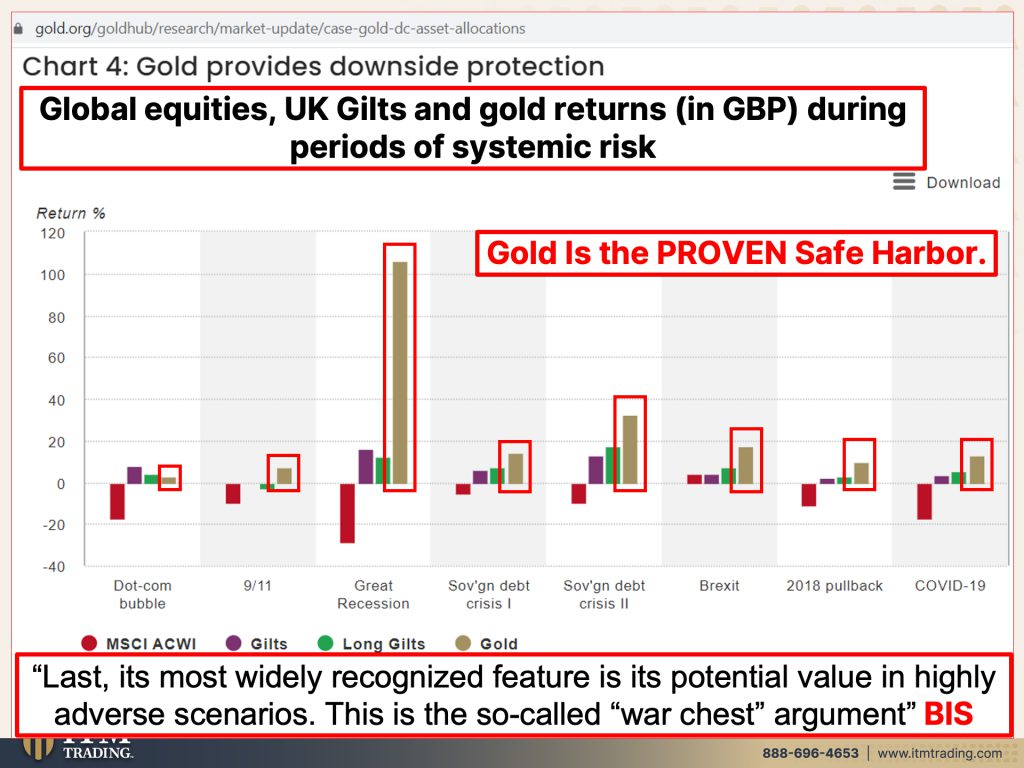

So what else is one of those repeatable patterns? Well, gold provides downside protection. This is not rocket science. This is global equities, UK Gilts and gold returns in British pounds during periods of systemic risk because gold is a proven safe Harbor. And you can see how it’s performed.com bubble nine 11, great recession, sovereign debt crisis one sovereign debt crisis two. Remember Sovereign’s government Brexit, 2018 pullback. And COVID 19. What do you wanna be holding? Because this on top of the end of the currency’s life cycle means that that we’re quickly approaching a point where the dollar will have zero, count it, zero value. Last it’s most widely recognized feature is its potential value in highly adverse scenarios. And it’s called the war chest argument, but it’s been proven over and over and over again. So I I’m good with it. And that’s how I’m protecting myself and my family. That’s also how I’m positioning to take advantage of the opportunities that present. And there will be many opportunities that present, because right now with all of the new money that’s been flooding into the system, the system died in 2008. I don’t really care what anybody says it died and they just put it on life support. And that life support was massive money printing to reflate the targeted assets, stocks, bonds real estate, because of the massive amount of derivatives that sits on top of all of it. Minimum 610 trillion notional notional means nobody knows the true value at risk. I don’t know it. You don’t know it. They don’t know it. They admit they don’t know it.

You’ve gotta have a Wealth Shield here at ITM Trading. We have a wealth shield and that shield is made of metal, physical gold and physical silver in your possession. This is critically important. It’s not the only thing you need, but it’s the foundation of what you need. Because with gold, you can maintain any of your Fiat money assets that you have. You can protect against the collapse in the markets and with the silver, you can maintain your day to day living. There are different types of gold and different types of silver. So it always has to start with your goals. But the first goal is, and should always be protection. And there’s your foundation. Then you also need Food, Water, Energy, Security. You’ve got the Barterability. The Wealth Preservation, that Community piece is critical and your Shelter. That’s what Beyond Gold and Silver deals with. But these are all the things that we need to maintain a reasonable standard of living. Get it done, please get it done. I’m so grateful that I’m in this industry and know how deeply I dig into stuff. Believe my work. So many people could tell you what you should do when they’re not doing it. I’m only telling you what I am doing for myself. You make the choice on whether or not that works for you, but I feel so strongly that you should always do what the smartest guys in the room do for themselves. And there are many things I don’t know. But one thing I do know is currency regime shifts that I a hundred percent know I’ve been studying it since 1987. Know anybody else that has?

So this is the last week, the last opportunity to join me or participate in the event that I’m doing very small intimate at the Grand Wailea in Maui on Saturday, June 11th. We’re gonna have some very deep discussions and we’re gonna be talking about a lot of things that I don’t get to talk about. If you haven’t started your Beyond Gold and Silver strategy, click that calendly link below, make an appointment with one of our consultants, have your goals in mind and get started and get finished. If you’ve started already. I’m so happy. Get it done, just get it done. I don’t like what I’m seeing. And you know, I mean, you can look and it’s just crisis, crisis, crisis, and everything is speeding up, speeding up and the loss of purchasing power speeding up. So if you like this, please give us a thumbs up. Make sure you leave us a comment and make sure you share, share, share, share, share, because ignorance doesn’t make anybody immune. It just leaves them vulnerable. And I know this is not fun to talk about or think about, but it’s not gonna be fun if you end up in that abject poverty. I guarantee that one, I can’t give you a lot of guarantees. I’ll guarantee you are not gonna like it. If you end up in abject poverty. So get your Wealth Shield intact, get it done today while you still have choice while you still can, cause it is a hundred bazillion percent time to cover your assets. And until next we meet, please be safe out there. Bye bye.

SOURCES:

https://www.yahoo.com/now/former-head-state-run-chinese-212615468.html

https://www.newsweek.com/china-us-war-horizon-taiwan-hu-xijin-1698505