DOLLAR BONDS, INFLATION & VENEZUELA…HEADLINE NEWS WITH LYNETTE ZANG

TRANSCRIPT FROM VIDEO:

I’m Lynette Zang Chief Market Analyst here at ITM Trading, a full service physical gold and silver dealer, specializing in custom strategies to help you survive and thrive through the reset that, I mean, I really hope that it is apparent to you because you guys know if you watch the video yesterday, I am freaking out because I’m seeing what I’ve been talking about for so long, actually unfolding. And it is not the time to be a deer in the headlights, because what happens to those deer that get caught in the headlights. That’s what happens. And this is where we are.

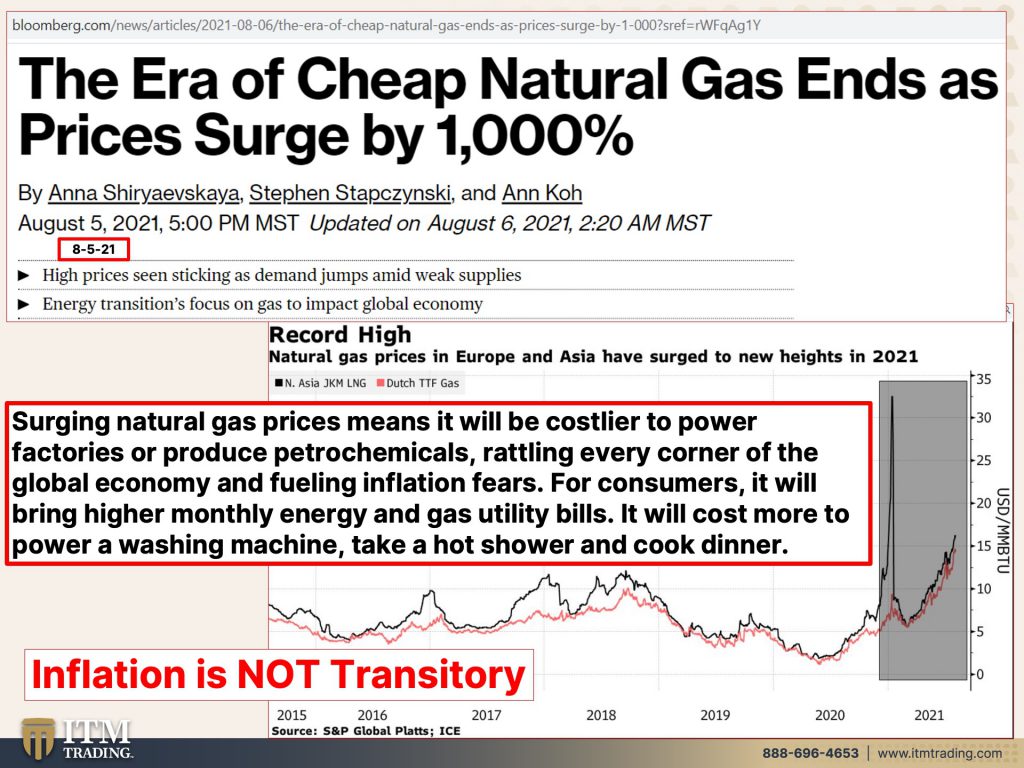

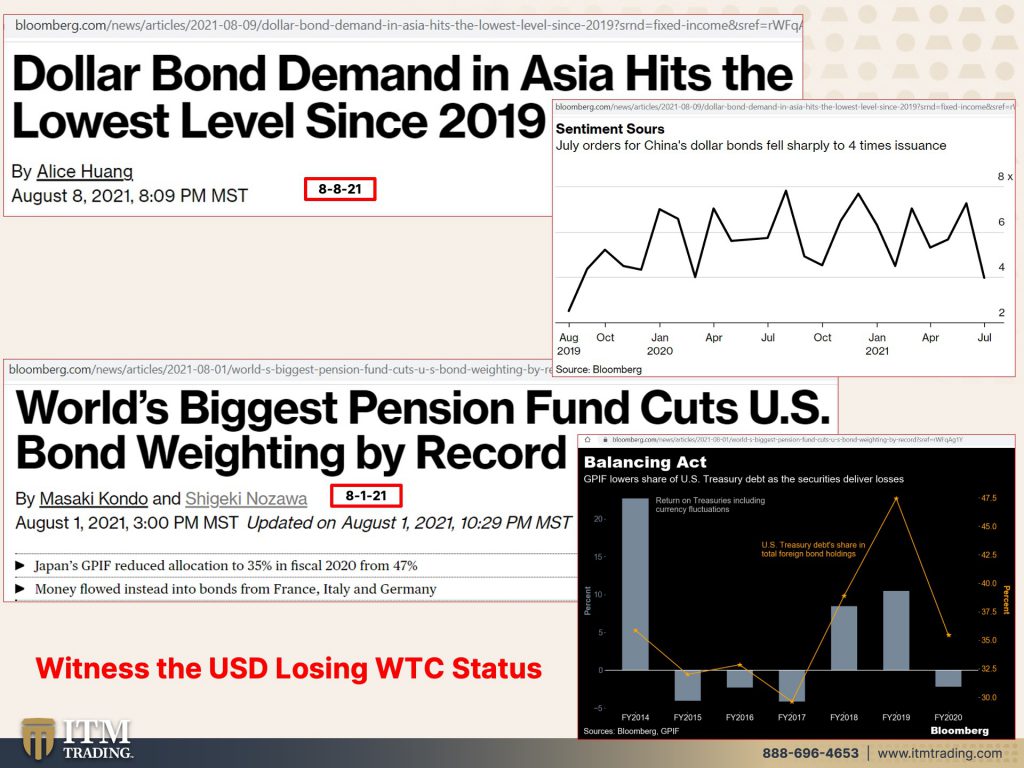

So let’s first start talking about inflation. Consumer inflation expectations hit an eight year high in a New York Fed study. Now, when here’s the problem, it’s not the actual inflation because that is built into the very foundation of the Fiat currency. It is if you expect inflation, and if you especially expected to run hot, well, then it’s harder for central banks to control even more inflation. You know, typically if you think there’s going to be inflation and you’re going buy a car or you want to buy a big ticket item. You will pull that purchase forward. But in this environment, they want you to think that it’s transitory so that everything stays balanced. And mostly so the central bank stays in control, but they are not in control anymore. They have the semblance of control, but everything around them is getting to be more and more expensive on an ongoing basis. So, you know, frankly, no inflation is not transitory. Look at what’s happened with natural gas. Now, why does natural gas matter? Maybe you think you don’t use it or you use a little bit of it, or what have you. I mean, I have gas here and you know, the, bill is not that (high), although it’s changed a lot since I bought the house, but it’s not that bad. I think it’s something like, I don’t know, 60 bucks now or something like that, but surging natural gas prices means it will be costlier to power factories or produce petrochemicals rattling every corner of the global economy and fueling inflation fears for consumers. It will bring higher monthly energy and gas, utility bills. It will cost more to power, a washing machine, take a hot shower and cook dinner and it might just be noticeable. That’s been the problem for them with inflation, as long as they could say, well, if we haven’t hit our 2% target, which in the real world, we have more than hit that 2% target. But if people hear that and believe that, well, then the fed still remains in control. And remember, this is all about confidence because this is a con game. So what’s happening right now with inflation is that it is testing the confidence of the consumer. And I have a feeling and remember the only thing that’s really keeping this whole system together at this point is the public having confidence in the dollar in the stock market and I say that with hesitancy because I have no confidence in it because I’ve watched its erosion. And I’ve also now watched the SDR, get into position with that massive injection of new SDRs. And if you haven’t seen the video yesterday, go watch it because their positioning to take over as the world reserve currency and the country that’s going to be impacted the most from it is going to be the U.S. Because the dollar is the world reserve currency. I mean, arguably, that really hasn’t been true since like 99, when they created the Petro dollar, however, we still have the title of it and where they say that the reason why we retain that title is because we have the deepest and most liquid markets, all of this and the inflation and losing trust in the central banks ability to have the markets back and therefore to have your back and therefore have the ability to keep pushing the markets up. And we’re going to be talking about that at the end, when we’re going to go back to Venezuela and you want to make sure that you stay through that because I have an audio on how they’re using gold to actually buy food and goods and services. So this is coming to a theater near you, but it’s already happening at the same time. That demand for the dollar, for the dollar bonds is declining. And I’ve been seeing more, more of these headlines. Now, dollar bond demand in Asia hits the lowest level. What they’re really referring to is corporations issuing dollar denominated bonds. They don’t earn dollars, but they’ll issue bonds denominated in dollars. And that means they have to go out and buy dollars in order to pay these bonds. So this is the lowest level, and it’s showing a loss and confidence further loss in confidence is Japan’s, the world’s biggest pension fund, cutting the bond, weighting the U.S. Bond weighting by a record. And I’m seeing more and more of these kinds of headlines. So if this is all about confidence. The world is also losing confidence in the U.S. Dollar. Why do you care about that? Because they’ll utilize, the world will utilize, the substitution fund over at the IMF and they will convert those dollar denominated bonds and, and currency into the SDR, denominated, bonds, and currency. So that means that all those excess dollars have to come back to the U.S. Now in theory, because it hasn’t been tested, so the theory is that the IMF will have the ability to determine how quickly those dollars come back to the U.S. But of course, that’s all going to be based upon whether or not they remain in control. And that’s the problem. And that’s the problem with expectations.

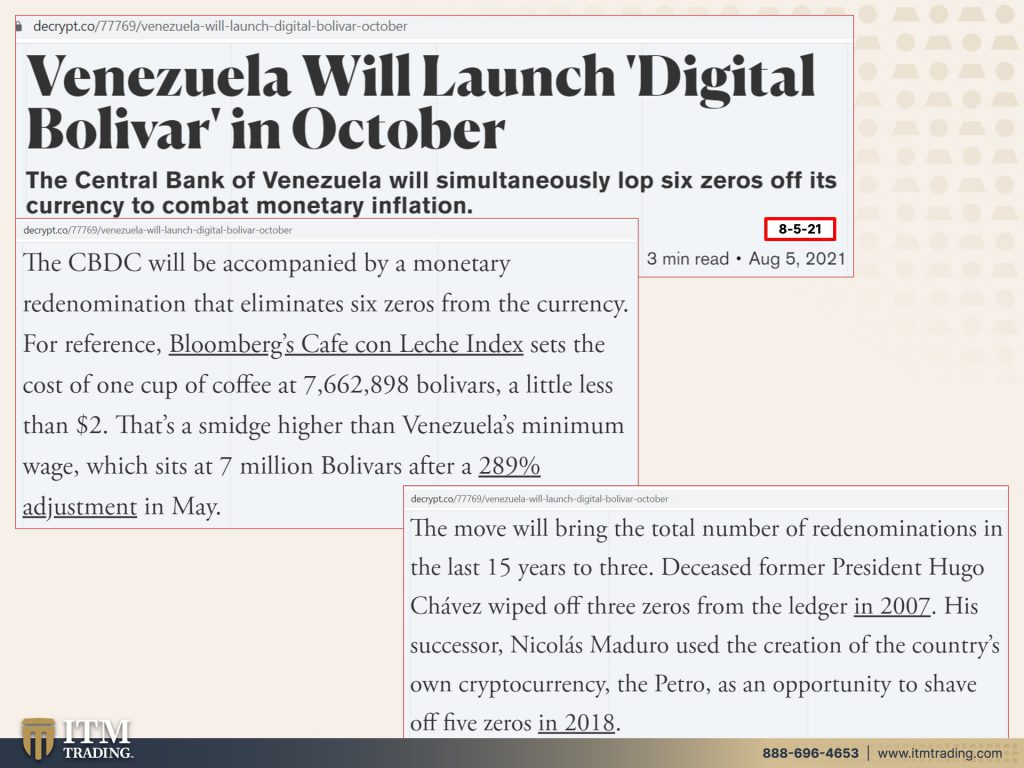

Now, a week or two ago, we talked about Venezuela lopping off, or getting ready to lop off zeros from their currency yet again. So this just came back, but at the same time that they lop off those zeros, they are going to be issuing a digital bolivar. So the question that I got on Q&A last week was about the digital dollar. And what I said was, and this proves the point and it will prove it over time as well. That once we go to a digital dollar, that’s not over yet because behavior is not changing. And the only way that they can go into a brand new system is if they get rid of all of the debt from the previous system, and, you know, the infrastructure bill, I mean, there are some numbers coming out there that, between all of the spending, it’s going to be 7 trillion. Now that may not sound like much, except there’s no income to fund that. So that’s all deficit spending and we’re already at 3 trillion in deficit spending, excuse me, you know, if this were you, if you were an individual, could you do this? The answer would be no, just because you get a new credit card. It doesn’t alleviate all of the other debt for a minute it may enable you to spend, so the CBDC will be accompanied by a monetary redenomination that eliminates six zeros from the currency for reference Bloomberg’s Cafe Con Leche index. Let’s see sets the cost of one cup of coffee at 7,662,898, bolivars, a little less than $2. That’s a smidge higher. That’s a smidge higher. Than Venezuela’s minimum wage, which sits at 7 million bolivars after a 289% adjustment in May. So all of these minimum wage increases, which of course we’re doing here as well. I got to tell you it by design, it will never keep pace with inflation never, ever, ever, ever, ever here’s proof. And here’s also showing you, and we’ll keep following this all the way through. Do you really think that Venezuela’s hyperinflation is going to be over because they launch a digital bolivar? I don’t think so because they already tried launching a digital currency when they did the devaluation of 2018, the move will bring the total number of re-denominations in the last 15 years to three, which is the average number. I don’t know whether it’ll be more this time or what it’ll be here globally, I can’t tell you, but to three. Deceased former president Hugo Chavez wiped off three zeros from the ledger in 2007, his successor Nicolas Maduro used the creation of the country’s own cryptocurrency, the Petro, as an opportunity to shave off five zeros in 2018. But if you do not change behavior, nothing really ever changes. And we know that, that country, 90% of the population is in abject poverty.

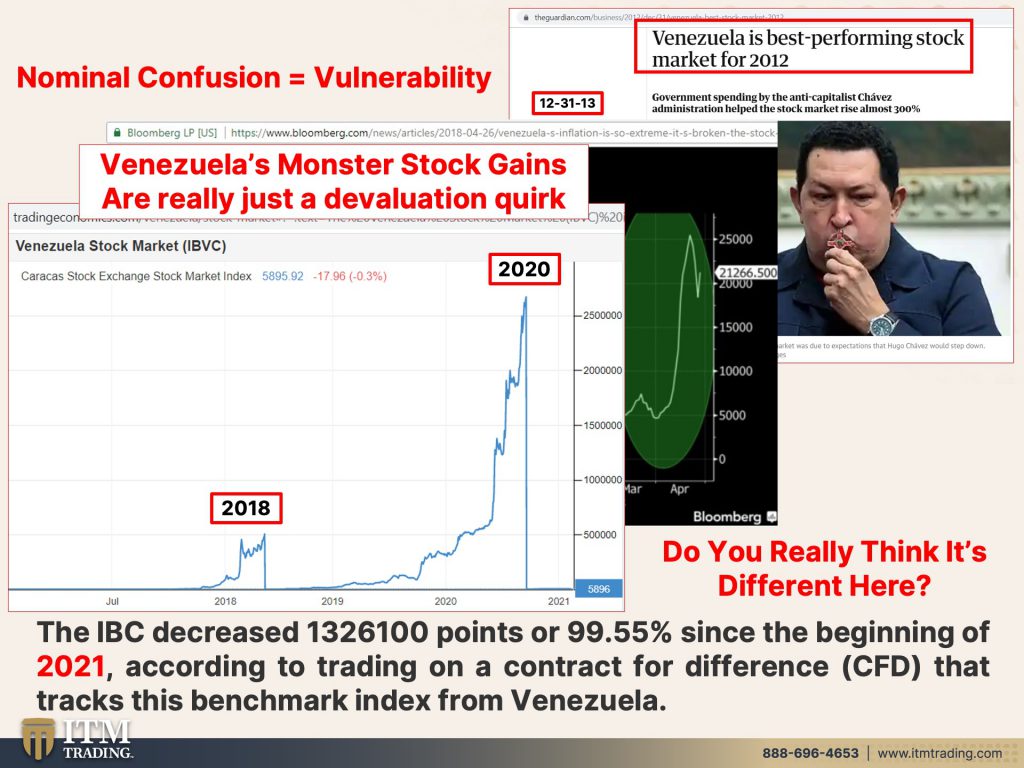

Nominal confusion, which is a key tool. When they designed the currency system, the Fiat currency, they knew that nominal confusion would hide or that inflation really causes nominal confusion. So people see the stock market’s going up and hey, they’ve got a raise. You know, they raise the minimum wage or you’re making more money than you were before. But if the cost of living is greater and grows faster than your increased income, then you’re really not better off. In fact, you’re worse off, but I want to talk a little bit about the stock market because from 2012 through 2018, as the hyperinflation was really kicking into gear, Venezuela had the best stock market. You’ve heard me say that many, many times. Well, there you go. Best performing stock market. These monster stock gains are really just a devaluation quirk. We think we’ve been taught to think that there’s no other choice, but stocks and bonds and ETFs and mutual funds, all these paper, Fiat money assets, but we have good choices. We have real money choices that are out of the system, actually decentralized, actually invisible and not vulnerable to inflation abuse, they can be manipulated. Anything can happen in the short term. I mean, we just saw that gold, I mean, enormously, Friday and Monday. I was just doing an interview, which you guys are gonna love, but, you know, and they said, well, you know, why, why would they do that? Because rising gold price is an indication of a failing currency. And without fail every time there was a major occurrence. And I’m not saying that you saw the major occurrence, mind you, but there was a major occurrence like that issuance of those SDRs, like when China entered the SDR basket and many other times, I mean, look, what happened to the silver squeeze? They can’t put a flippin the basket of silver together for SLV. They had to change quietly, change their perspectus, but you’ve got gold and silver down at these levels. It’s a flippin gift don’t believe Wall Street, don’t believe them because they don’t have your best interest at heart. To them, you are simply a number from which they can transfer wealth and they can get you to pay for all of their fees. Take all of the risk as they March off with all of the wealth. And you know, this is the Venezuelan stock market. Here’s 2018. Here’s 2020. And it kind of looks like it’s not done anything. Well, that’s not actually true. The Venezuelan stock market, the IBC decreased 99.55% since the beginning of 2021. Now, you tell me if all you can do is convert those stocks and to feed that money, the fee out money has no value. And they consistently read denominate, which will happen here. It’s going to it’s it’s happening everywhere. It’s got to happen everywhere. This is we’re at the end of the system’s life cycle. Are you better off in stocks or are you better off in physical metals that hold their value? The Bank for International Settlements says, this is inflation fighting. This is also private gold held in your home, runs no political risk. And it’s great for a crisis. And I do think, you know, I think that what’s coming up is going to make 2020 look like chump change. And that was pretty significant. And honestly, you have to ask yourself the question because people will go, “well that’s over there, this is over here, this is different”. We aren’t doing anything different than they’re doing really, our debt to GDP is over a hundred percent. I think it’s close to 150% and we’re growing more debt. I mean, oh and another New York fed person is now going to be overseeing the stock markets. So that gap between the federal reserve, if there is one, which I don’t really think there is, but if there is, between Janet Yellen and this new New York fed person, which I’ll tell you more about that later, this is brand new news that just came out and I didn’t have a chance to create a slide on it. But I mean any distance that there was between them, because that 7 trillion or however much the whole infrastructure package is going to be okay. The fed is going to finance that through the government’s going to issue debt. The fed is going to buy it. So when they talk tapering garbage, garbage, garbage, they talk about raising. We will raise weights in 2023. I mean, give me a break. It’s just stupid. It’s just theater. That’s all it is. But I do get a lot of questions all the time about how can we use our gold? And this video came out on Tik Tok, it’s it’s in Spanish, but the translation you can see here. And so that’ll be on the blog. And I’ll also read it as she’s talking because they’re using gold. So she says:

[Girl] Tell me what payment method you use in your town, I’ll start. [girl] Here I am at a Chinese supermarket, we are seeing that the unit prices are in dollars/bolivars. The prices per bulk, labeled 0.4, 0.6, etc, That is in gold. Everything in bulk is in gold. Okay, then we are going to review the small items where they are all marked in dollars. Then I am going to weigh what corresponds to me in this pot weighing in gold. [girl] How much is it? [cashier] In gold, one dollar. [girl voiceover] Here, I bought one soup and paid in gold. [girl] How much is it? [cashier] One point. [girl] Here it is. [girl voiceover] Here we use the low-denomination banknotes to wrap the gold. In this case we weighed a point and the rest was measured in cash, bolivars. [cashier] Everything else in cash? [girl] The rest in cash!

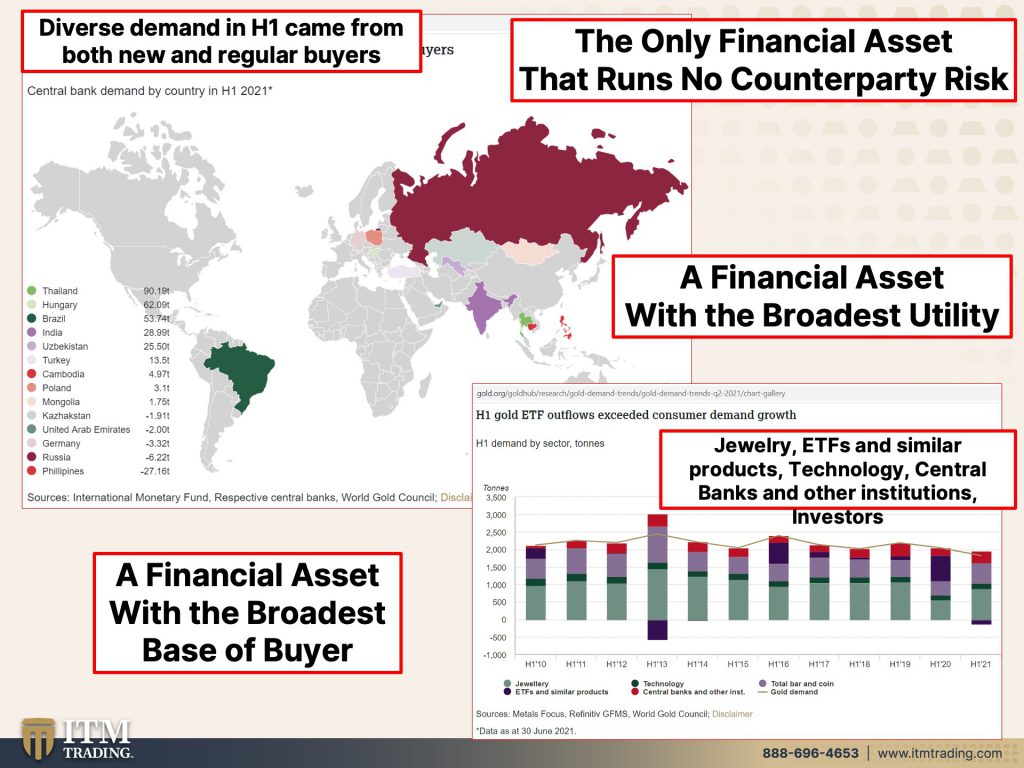

During hyperinflation, everybody is so crystal clear of how rapidly the currency is losing value and shopkeepers cannot replace the goods for what they’re charging in terms of the currency, they would rather have gold. They would rather have silver. They would rather have what will hold its value. And why does gold and silver hold its value? Because it is broadly used. It has the broadest base of functionality. And even now diverse demand in H1 came from both new and regular buyers. Of all financial assets. It has the broadest utility because it is used across the entire global economy, jewelry, ETF’s, Wall Street, so mutual funds, etcetera, similar products, technology, central banks, and other institutions, as well as investors. So maybe this one’s a little bit lower, but this one is up higher and it never has gone to zero and 6,000 years. You can’t say that about currencies. You can’t say that about stock markets. You can’t say that about anything other than physical gold and silver. This is why, I mean, it’s not rocket science.

So I had a great interview today with wall street, silver, with Jim Lee and Ivan. And I mean, I have to admit, we have a lot of fun when we get together and you know, he’s like, you’re on fire yesterday. Well, yeah, I was freaked out and I’m still freaked out and that’s not going to go away. Maybe I’m a little bit calmer, but I’m telling you the reason why I’m doing so many more videos is because things are unfolding faster and faster. And it feels to me like we’re coming to conclusion seriously. Next week I’m going to be on with Martin North, Walk the World channel over in Australia. So it’ll be good, you know, we had a conversation a week or so, a couple of weeks ago, and it’ll be good to see what changes have happened, but for behind the scenes and updates, follow me on Instagram (@lynettezang) and Twitter (@itmtrading_zang). And if you haven’t already, you definitely need to be subscribing and turn on that bell. So I can tell you when we’re going to go live, if you like this, please give us a thumbs up, share, share, share, share, share, please. People need to know what’s really happening. Because if you’re not showing them, they’re just believing the lies. And how many times can you be lied to when you do not know the truth. And without a doubt, it is time to cover your assets. If you haven’t done it already, get ‘er done, get ‘er done while they’ve given you this, this gift. Tomorrow, we’ll have a chance to talk to Eric. And so we can talk about how Friday and Monday impacted the pricing. I don’t work in that arena. So he’ll have better information about that than I do. And I am still working on the piece on ounces of gold during the reset. But you know, the SDR kind of grabbed my attention. So please bear with me. I am thigh deep in it. I still have more research that I want to do before I finish putting it together. So we’ll give it a shot for next week. And I also need to get that House of Lords done, because that’s a critical piece as well, but I’ll keep working on it. And until tomorrow, please be safe out there. Bye-Bye.

SOURCES:

https://www.bloomberg.com/markets/fixed-income?sref=rWFqAg1Y

https://decrypt.co/77769/venezuela-will-launch-digital-bolivar-october

https://tradingeconomics.com/venezuela/stock-market

https://vm.tiktok.com/ZMdogrDn8/

https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-q2-2021/chart-gallery