DID YOU SEE THIS COMING? How to Prevent Your Loss of Privacy & Security…by LYNETTE ZANG

A globally recognized whistle blower was quoted in an article 4 days ago, saying the latest cyber security leak is going to be the story of the year…and it’s all about your smart phone. Meanwhile tech giants petition the FCC for waivers to monitor you in your sleep, and central banks move to taxing and tracking your every purchase with digital money…did you see this coming? I did, which is why I’ve been warning you about it for years now. Well the noose is tightening, and it’s time for you to start making some imperative decisions to take back control of YOUR privacy, YOUR security, and YOUR wealth. I’ll show you what’s going on but most importantly, how you can avoid these traps and operate on your own set of rules.

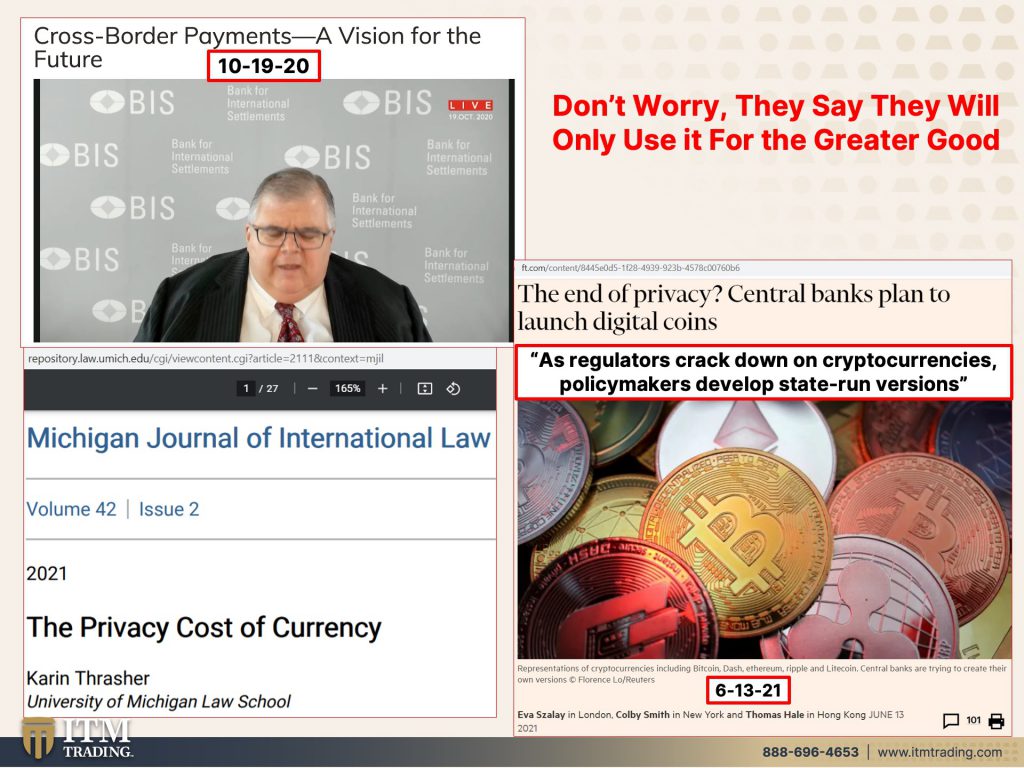

Edward Snowden, the 2013 NSA spying scandal whistle blower was quoted in a recent article, saying the latest cyber security leak is going to the story of the year…and it’s all about your smart phone and the ability to hack it with zero-click attacks. NSO Group says they only sell this technology to vetted government bodies; intelligence agencies, law enforcement agencies and military. Further they say that, even though some of these governments are known for human rights violations, these same governments promise not to use them in this way. An investigation by 17 media organizations found “widespread and continuing abuse of NSO’s hacking spyware.â€This concerns me as we shift into this new fully digital, surveillance economy, and frankly, I think it should concern you too since as surveillance grows our rights shrink. Meanwhile tech giants, already in possession of your on-line life and personal data, petition the FCC for waivers to subject you to radar that can control your phones and now, monitor you in your sleep. Don’t worry, it’s for your own good. But the digital change that scares me the most are CBDCs, Central Bank Digital Currencies. This is programable fiat money. Coming soon, governments and central banks will have the ability to track your income in real time and institute lifetime taxes. Every purchase will be tracked and your choices could be limited, since the currency is programable. They can institute negative interest rates on any savings or checking accounts as well as put time stamps on the money you work for, forcing you to spend and/or “save†in any way they dictate. The Fed has been “managing†the US and global economies openly since 2008. Today, it takes 18 months for them to see the results of their monetary policy, but with CBDCs they will know the results in real time and will make more rapid adjustments with little cost to them and lots of risk to us. And even though they know their experiments do not work, they are out of tools and have no choice but more and more money printing, fighting the inevitable hyperdeflation that will lead the work into hyperinflation. Twelve states have passed laws reinstating gold and silver as legal tender. In Basel III, global banking protocols, gold is now a Tier I asset that is so safe, it requires 0% reserves. Since 2007 global central bankers have been accumulating gold at the highest levels ever. This tells me the end draws near and those in power are getting the tools in place, not just to remain in power, but to have even more power. Gold accumulation, by the smartest guys on money, shows us all what real money is…Gold and Silver. What does it tell you?

TRANSCRIPT FROM VIDEO:

A globally recognized whistleblower was quoted in an article four days ago saying the latest cyber security leak is going to be the story of the year. And frankly, it’s all about your smartphone. Meanwhile, tech giants petition the FCC for waivers to monitor you, not just in your sleep, but all over the place. And central banks move to tax and track your, every purchase, your every move with digital money. Did you see this coming because I did, which is why I’ve been warning you about a, for years now. Well, the noose is tightening and it’s time for you to start making some imperative decisions to take back control of your privacy, your security and your wealth I’ll show you what’s going on. But most importantly, how you can avoid these traps and operate in your own set of rules, coming up.

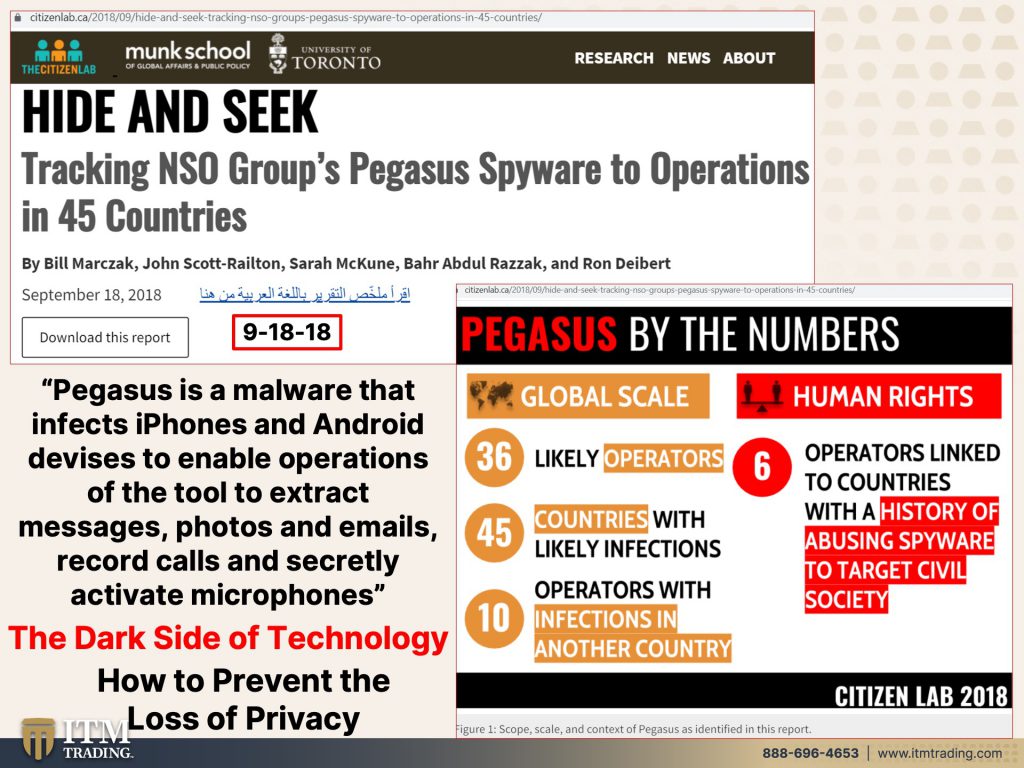

I’m Lynnette Zang, Chief Market Analyst at ITM Trading, a full service, physical, physical gold, and silver dealer specializing in strategies & frankly, we all have to have a strategy because they have a strategy, meaning central bankers and governments and corporations. No doubt about it. But today we really have to talk about how to prevent the loss of your privacy and your security, because it’s coming faster than you would even imagine. Now, this was a piece that was done three years ago, and some of you may have heard about the Pegasus spyware link, but this was a piece that was done by the Munk School of Global Affairs and Public Policy out of Toronto tracking NSO, which is a corporation NSO groups, Pegasus spyware operations in 45 countries. So very widespread now Pegasus is malware that infects iPhones and Android devices to enable operations of the tool to extract messages, photos, emails, record calls, and secretly activate microphones. It gets better. So this kind of gives you a scale of how broadly this software or the spyware is really a more accurate name is spread. Remember they don’t do anything other than spyware.

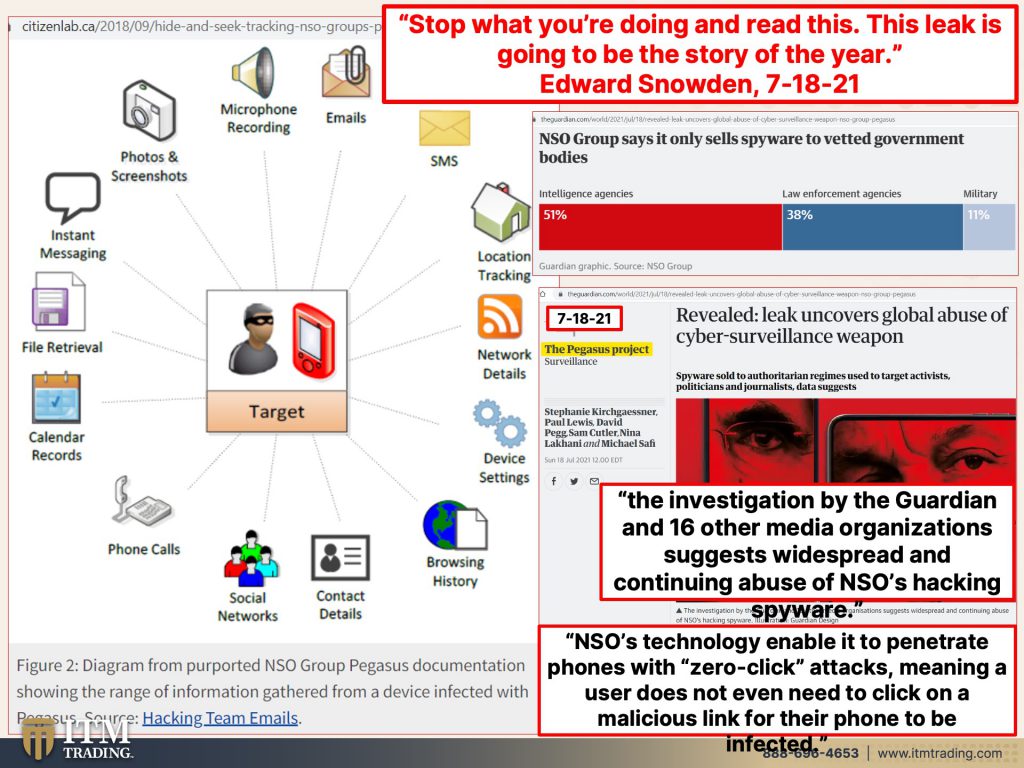

This is the quote from Edward Snowden. You might have heard of him. In 2013, he was the one that broke the NSA spying link on all of our phone conversations and how they were holding all of this information. But he says, stop what you’re doing and read this. This leak is going to be the story of the year. Now, keep in mind, all of the links are below and on the blog, right? So I’m going to encourage you to look at this more closely, because what you’re seeing here is you as a target and what you’re giving up to, whoever targeted you, any entity that targeted you. And you know, you might think that you’d have to download something. You know what, like they do that. They send you the email with the link. You click on the link and your computer is infected.

Well, you know, technology is great. And technology advances, the investigation was done by the guardian and 16 other media organization and suggest widespread and continuing abuse of NSO’s hacking spyware. I remember we were told about it three years ago. Did anything change? No. It broadened the technology, enabled it to penetrate phones with zero click attacks. So you don’t have to click on that link and download that malware into your computer or your iPhone. They can do it with zero click attacks. Meaning a user does not even need to click on a malicious link for their phone to be infected. But NSO says that they only sell it to vetted intelligence agencies, governments, right? So intelligence agencies like the NSA, maybe law enforcement agencies and military vetted, and they promise, you know, they make some promises. We’ll talk about that in a minute.

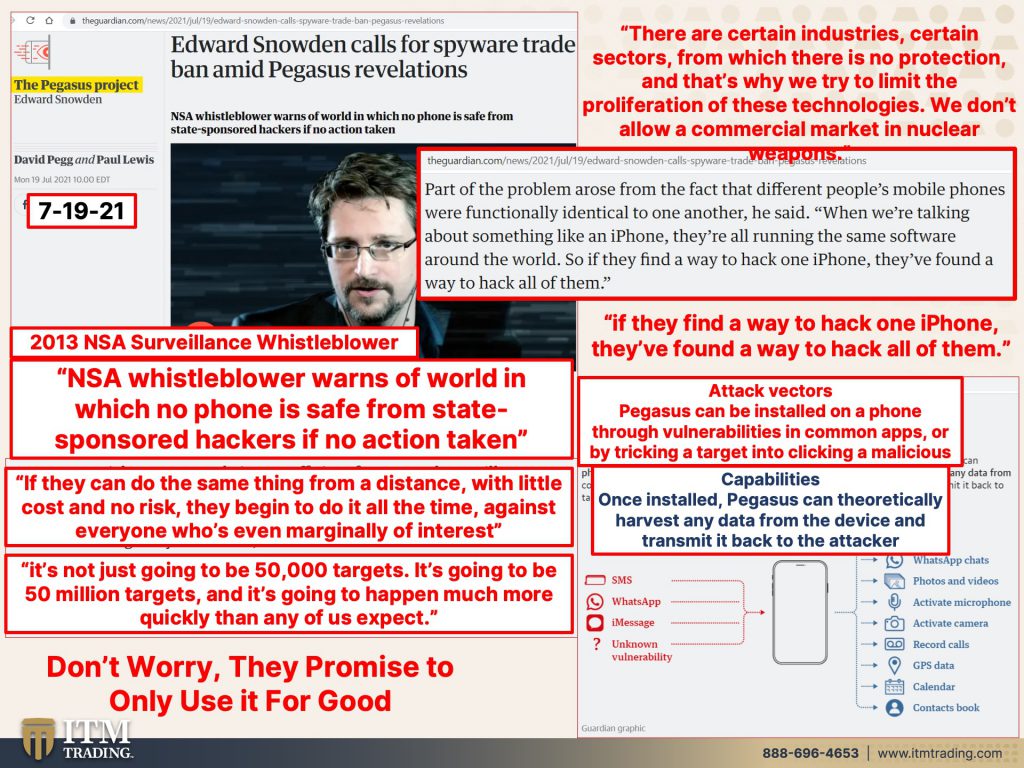

So here is this whistleblower and he warns of a world in which no phone is state safe from state sponsored hackers. And who’s the state sponsored hackers, the government, the military, any of those arms, right? If no action is taken, because there are certain industries, certain sectors from which there is no protection. And you know, we’re carrying all of our information on this phone, all of your financial info. I mean, I don’t, but many people do all of your financial information on your phone. So there are certain industries, certain sectors from which there are no protection. And that’s why we try to limit the proliferation of these technologies. We don’t allow a commercial market in nuclear weapons. And of course we know what’s been happening with Iran and their nuclear program. Another story for another day. But part of the problem arose from the fact that different people’s mobile phones were functionally identical.

We’ve seen that before, right? Functionally identical to one another. He said, when we’re talking about something like an iPhone, they’re all running the same software around the world. So if they find a way to hack one iPhone, they found a way to hack them all. Now, right now, this is just governments using it supposedly. Well, what they’re saying is against terrorists and that kind of thing, but I mean, you could draw your own conclusions. The attack vectors Pegasus can be installed on a phone through vulnerabilities and common apps, or by tricking a target into clicking a malicious, either way you’re covered, you can install it. And once installed Pegasus can theoretically harvest any data from the device and transmit it back to the attacker. So that means that they can also get any of the contacts that you have in your iPhones. They can start a recorder and hear your conversations.

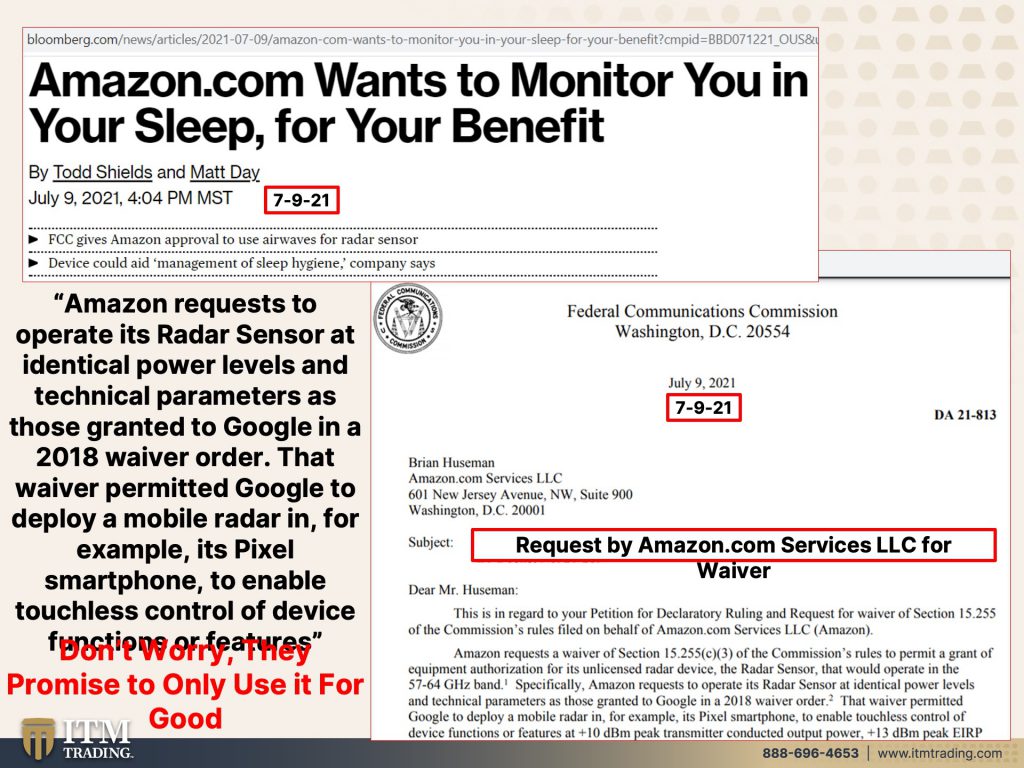

I mean, you know, it’s pretty intrusive as they could certainly track your location, if they can do the same thing from a distance. Because right now, you know, if they want to come in and bug your home or your, your house, well, hopefully they go and get a warrant. So you know about it, but they have to physically come here and put those devices in my house, on my car, etcetera. But if they can do the same thing from a distance, with little cost and no risk, they begin to do it all the time against everyone who’s even marginally of interest. And when you stop and think about what’s been happening and with the media and on the different channels where, you know, they call it misinformation. So anybody that disagrees with their view, they can be blocked out of being on websites and speaking their peace, etcetera. So think about the evolution that we’ve just witnessed, you know, and the last year or so, that’s why this news is tightening. No doubt about it. It’s not just going to be the 50,000 targets. It’s going to be 50 million targets and even more. And it’s going to happen much more quickly than any of us expect, think of that for a minute, but don’t worry because everybody promises, they will only use this for good. Do you trust them? Do you trust any of these agencies? Oh, I hope you do because I do not. Amazon wants to monitor you and your sleep…of course, it is for your benefit because they’re only going to do good with it. They’re going to help you manage the sleep. Sleep is a big problem. I mean, we’re being bombarded with stuff and you know, and of course a lot of people have lost a lot of sleep over their jobs, et cetera. And I don’t know inflation how high costs are going, how quickly they’re going up? Amazon. This is from the FCC. This is a document. This article came out on the ninth. This is an, a document from the FCC to Amazon, Amazon requests to operate its radar sensor at identical power levels and technical parameters. As those granted to Google in a 2018 waiver order that waiver permitted, Google to deploy a mobile radar. In for example, its pixel smartphone to enable touchless control of device functions or features. Now, you know, think about this for a minute. If you and our kids, our grandkids, etcetera, are really trained to go all digital and even transhumanism and living a part of your life in the, in the east is fear. I mean, you’ve got to realize that I feel like we live in a real space. I mean, I’m real. If you pinch me, I’m going to say ow, right? But yet if everything we hold is right here, how vulnerable are we that makes having physical gold and physical silver really outside of the system, at least financially, it helps you be safer. Do you really think your phone is never going to be hacked? Do you really think that they’re only going to use this for good and only with your permission? If they can get away with it? I don’t think so. And you know, we’re transitioning to a programmable money.

“Now in all our analysis of CBDC in particular, to the general use, we tend to establish the equivalence with cash and there is a huge difference there. For example, in cash, we don’t know, for example, who’s using a $100 bill today. We don’t know who is using a 1000 peso bill today. The key difference with the CBDC is the central bank will have absolute control on the rules and regulations that will determine the use of that expression of central banks legibility. And also we will have the technology to enforce that those are those two issues are extremely important. And that makes a huge difference with respect to what shape to what cash is”.

Yeah, but you know, you have to ask yourself, who do you trust these people that have gotten us into this mess? These people that have destroyed the economy, maybe your economy. I hope that’s not true because I don’t. That’s why forefathers said gold and silver legal tender, the end of privacy, central banks plan to launch digital coins. They’re going to tell you, they’re going to give you the privacy, but you aren’t even going to know you aren’t even going to know. I want to know. So, you know, it’s pretty obvious to the world that they’re moving us into a programmable money that takes away our choices that takes away our privacy. I’m old enough to value my privacy. I hope everybody out there values their privacy. And actually that is the pushback that they’re getting about 70% of people in the us and in Europe state, that the problem that they have with central bank digital currencies is the privacy issue.

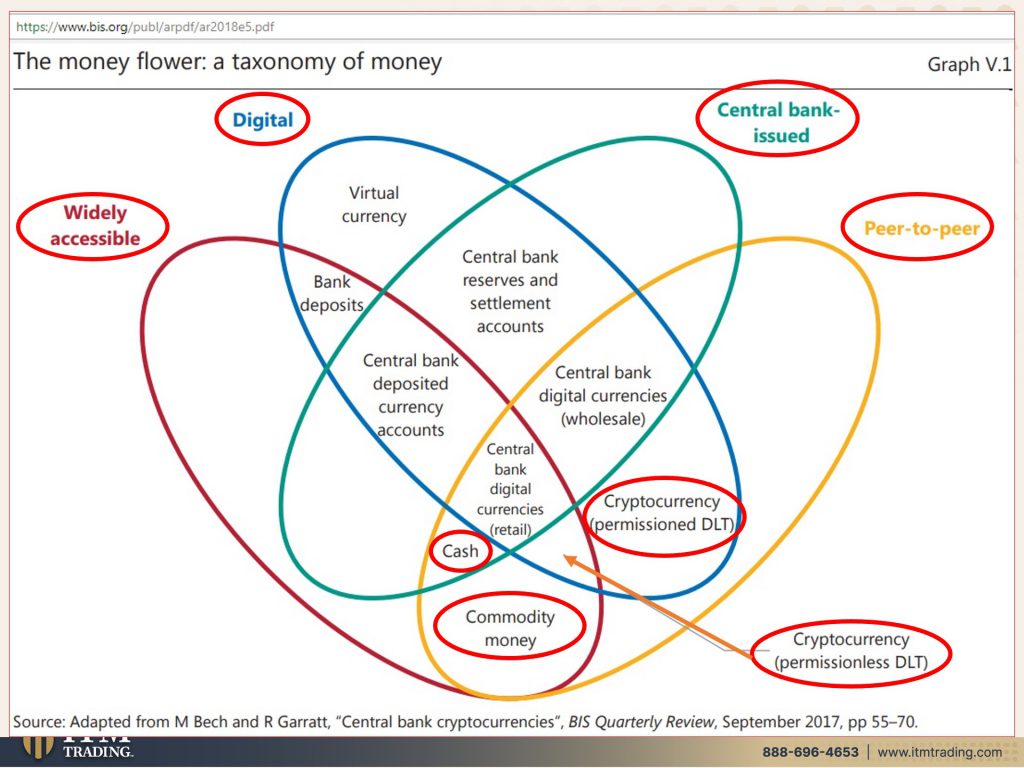

Thank goodness. But I don’t know that that’s going to completely stop them. And you know, you guys know, I talk about the bank for international settlements, money flower all the time. So here it is. And of course we’ve got the link for it. So this area that’s kind of blue and green is digital. And in the central bank control virtual currency is digital, but it’s not within the central bank issued and control. Permissioned. Cryptocurrencies are right here and permission less in a smaller little area. So maybe this is what you guys are thinking about in decentralized, but I want to show you this because of money. You want it to be widely accessible. So universally accepted and peer to peer usable, wherever you are. And frankly, there’s only this, this is commodity money. It’s physical gold, physical silver, lots of forms, but it’s physical that is truly outside of central bank control.

You have to ask yourself where you feel most comfortable. Obviously you guys know this is where I feel most comfortable with physical metals, real money, as they’re destroying the current system that we’re in and transitioning us into this new system. I’m showing you where they categorize gold and silver. We know the bank for international settlements tells us, although we knew this, but it’s nice hearing it from them. What did they say? Gold and silver. Well, actually they said gold is the only financial instrument. The only one that runs no counterparty risk that protects you from inflation and protects you from adverse scenarios. And when you hold it in your home, it is outside of government or central bank control. What kind of money do you want? The kind that is fully within their control or the kind that is not that part is up to you because frankly everybody’s got to do what they feel comfortable doing.

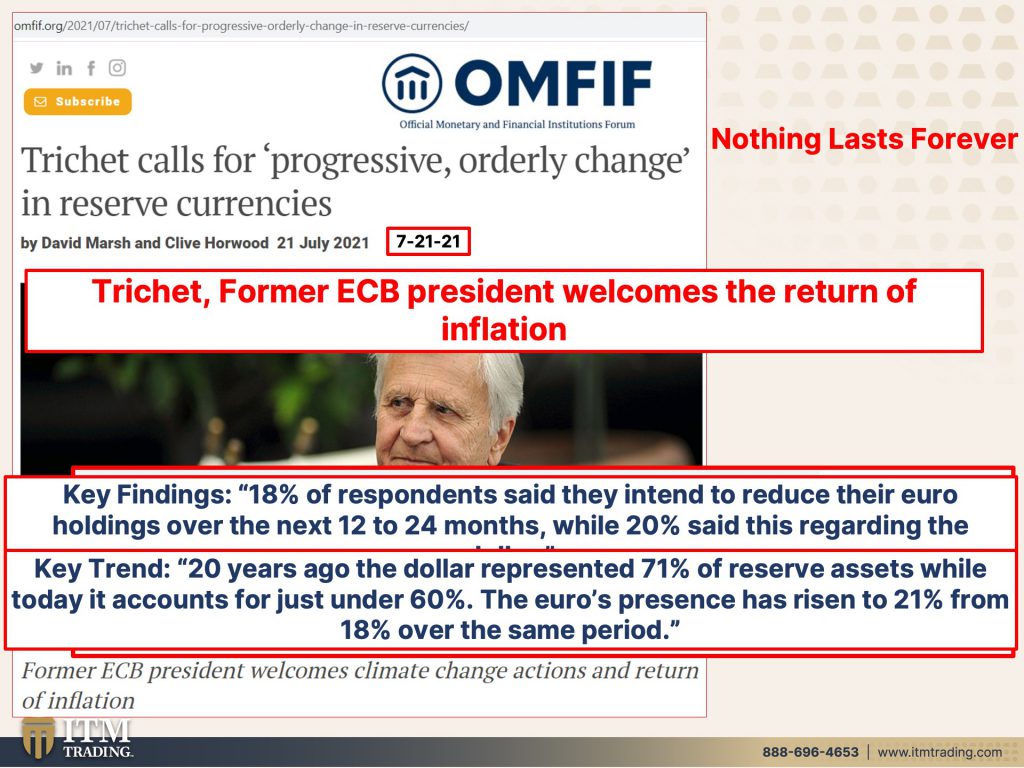

And this, I came across as I was doing some research this morning. Oh my God. Now this is the official monetary and financial institution forum. So these are the “money managers” of the central banks. Okay. That’s who these guys are. And Trichet who was a former ECB President calls for progressive orderly change in reserve currencies because nothing lasts forever. So the US dollar as the world’s reserve currency, which of course, it’s not really, I mean, it used to be just the US dollar, but it’s not anymore. It hasn’t been for a long time. We’ve been losing that status. Key findings, 18% of respondents said. So remember, these are the managers of the holdings, the central bank holdings, 18% of respondents said they intend to reduce their Euro holdings over the next 12 to 24 months. While 20% said this regarding the dollar, but it’s a trend that’s been going on 20 years ago, the dollar represented 71%. So 20 years ago, the reason why they don’t go back more than that is because the Euro was created originally to take over as the world reserve currency from the dollar, which obviously did not happen for lots and lots of reasons. That’s another, that’s a whole new YouTube video. But prior to the 20 years ago, prior to the advent of the dollar, the amount held in reserve was significantly higher because it was basically your only choice. But 20 years ago, the dollar represented 71% of reserve assets. While today it accounts for just under 60%. So in other words, 59%, the Euro’s presence has risen to 21% from 18% over the same period. Personally, I could be all wrong about this, but I don’t think I am, but we’ll find out. I believe that it will be the SDR. The IMF’s currency that is a basket of currencies.

SDR just stands for Special Drawing Rights. For those of you that are new to this, it’s just a name like any other name, the dollars just to name the euros, just to name. So I think it’ll be the SDR since it is a basket of currencies. And all of these guys are, you know, are frankly they’re members of the IMF. So that’s, that’s where I think that’s what I think the new world reserve currency is going to be. And I think they’re going to expand their basket. Whereas right now there’s six currencies in it. I think that they could put every currency in it. There’s nothing to stop them from doing that. And it would make a whole lot of sense, but I also love the pat and the fact that he welcomes the return of inflation.

Do you feel the same way about that? Because I do not. And even though we are not seeing the start of hyperinflation, because I think we’re going to have another deflationary period where prices, stock implode real estate markets, where the markets implode and then what do they do? They just turn on that money, printing spicket even faster. I mean, that’s the only tool that they have and the more they do, the less impact that it has, but you need to ask yourself, do you feel the same way about that? Do you think that inflation is good? It’s going to help you pay off your debt with dollars that have less and less value the trouble is, is you’re not going to be making as many of those dollars to cover the level of inflation. And there are a lot of people that are not, but I’m going to let somebody that knows how to say this much better than I do say it because it he’ll say it in a second.

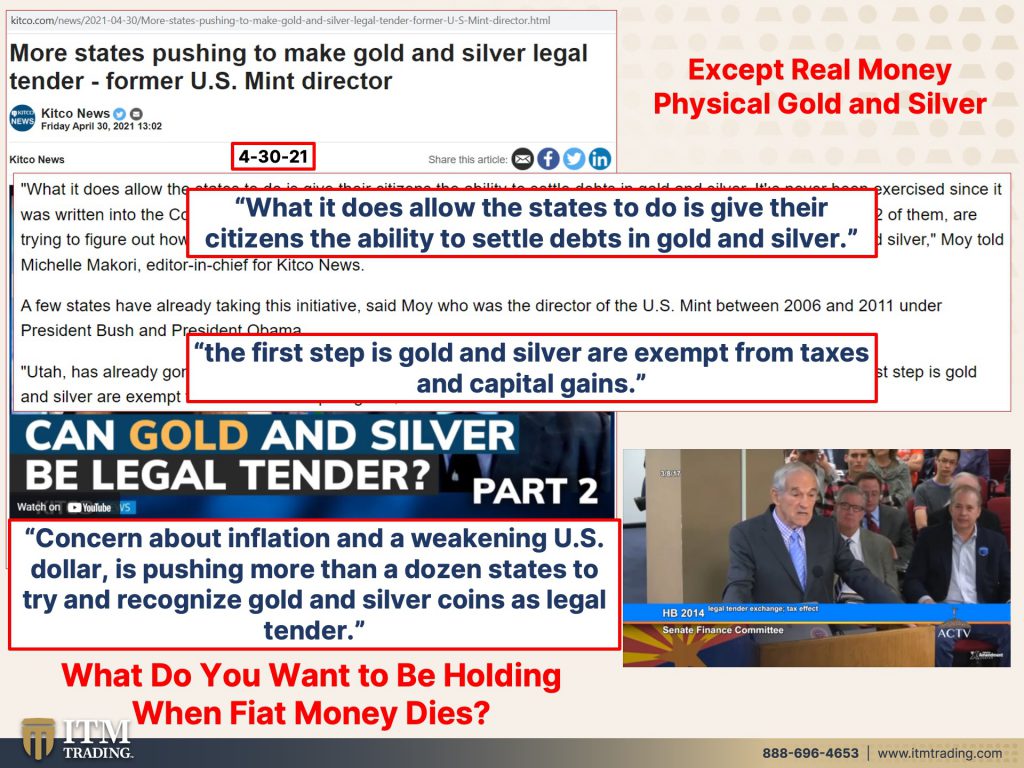

But, you know, we know that there has been a push by states to make gold and silver legal tender. And so far, there are 12 states that have done that and they do it because, well, their states job is to protect the individuals, but concerned about inflation and weakening us dollar is pushing more and more than a dozen states to try and recognize gold and silver as legal tender. So what do they have to do in order to do that? Well, it allows the states to do is give their citizens the ability to settle debts in gold and in silver. And, you know, there’s all different sizes. Part of the reason why gold is the primary currency metal is because regardless, I mean, you can cut this in half quarters. You can pound it out super thin without any loss of value. If you did that with diamonds, the diamonds would lose their value, but you can do that with gold and silver without a problem. The first step is gold and silver are exempt from taxes and capital gains. So there are 12 states where that’s true. No, not the federal government. That’s just the state governments.

“Since 1971, we’ve lost 95% of the value of the dollar. And the tragedy there is that the average person a middle-class gets wiped out. Austrian economics teaches that if you destroy the currency, you will destroy the middle class and people who will get the money that the government prints, which they shouldn’t be allowed to do goes into the pockets of the bankers and the corporations. And when the people get the money, their prices go up and they wonder why they’re getting behind. Well, my wages went up $5, $10. No, they need to be $15, but they’re looking in the wrong place. It’s the monetary issue. And that is the real problem. So what you’re doing here, the way I understand it is you’re suggesting that maybe we ought not to tax money. And I think that’s a good idea because I’d like to not tax a lot of things, but certainly it makes no sense to tax money. And that’s, that is what I understand. You’re trying to stop because, you know if, if you have currency transactions, you know, across the world, they don’t measure the value of the dollar. All your dollar value went up. So we’re going to tax you on the increase that your value. So, no, you don’t get tax for that”.

So the point that he’s making is this is real money, and certainly we are taxed to death. We are taxed over and over again. It’s not just your income tax, you know, forget double taxation. We’re somethings like a gazillion taxation, but inflation is an invisible tax on your work and on your wealth, and by design inflation wages, the average wage never, ever, ever, ever, ever, ever, ever keeps pace with inflation. So even when they raise those minimum wages to $15 an hour, I want you to stop and think about that. Is that a living wage, not when you have people making $150,000 a year that qualified for stimulus.

This has been a really scary piece for me to do, because even though we’ve been watching it, this kind of behavior is heating up. And between that, and what I see happening, you know, with censorship and who gets to choose what is censored and how, how it is encouraged to smother people’s voices that disagree with one narrative is very, very troubling to me, just like I felt good about my position, not for a lot of people, but for myself, when in March of 2020, when I could go out into my gardens and I could eat, and I could give food away to help people in toilet paper, give food, give toilet paper away to help people is the same way that I feel about the gold and the silver and its importance is growing day by day because of the noose is tightening day by day. And you really have to ask yourself a key question.

What do you want to be holding when the fiat money dies completely? Because right now you can still convert it. But I can’t guarantee when you’re going to lose that choice. So I strongly encourage you to make these choices while you still can, because there is a storm that’s coming and you’re not going to have any time. I mean, time grows short, you know, look at, look at the insanity time, grows short. And all they have left is the final destruction of this. That’s all they have left. So do you think that they won’t because they’ve done it, they’ve done it your whole life. You think they’re suddenly going to stop? They can’t stop. They have no choice, but you do at this point.

Well, this morning I had a really interesting interview with Drew Perlman on The Drew Pearlman show, and he did a great job. And he asked me questions that I don’t usually get asked. And they were really good ones. So I’m going to encourage you. We’ll let you know when the link is out. It’s probably going to be a few weeks. Didn’t he say that like two, three weeks. So it’ll be a little while, but I think that you can hear tread cat night. That’s out already. And my good friend, Eric, who asked me always, like, he always does phenomenal questions. Now, next week, I’m going to be on with Jay Martin CEO of Cambridge House. And that’s a new person for me. So I’m excited about that. And I’m especially excited about the Coffee with Lynette. I have coming up with the very, very brilliant Martin North from Digital Finance Analytics channel.

We’re going to have a lot to talk about, then that’ll be at 11 o’clock on Thursday, we’re mountain standard time. So you just put that in your calendar, because you’re totally going to want to see that one, but if you want to schedule a golden silver strategy call, just go to the Calendly link in the description, or call 888-696-4653. So you can talk to one of our specialists, and I think you’re going to find they’re all brilliant. You know, we’ve been together for a long time, but if you liked this, please give us a thumbs up. There’s so many things that are changing. You definitely want to be a registered with us and hit that bell. So we send you notifications when we go live. So just hit that subscribe button, leave us a comment, give us the thumbs up, share it with people, you know, and until next week, meet number one, remember a gazillion percent. It is time to #CoverYourASSets. And here at ITM Trading, we use the wealth shield, which is a strategy based on my studies from 1987 on currency life cycles and those repeatable patterns. It’s pretty easy to see. I can go back thousands of years and see the same pattern. Do you think this time is different because I don’t. So until next we meet, please be safe out there. Bye-Bye.