Bank Collapses Expose Weaknesses in Financial Sector: What You Need to Know

The International Monetary Fund, the IMF just came out with its Global Financial Stability Report. And while we’re hearing talk from Janet Yellen of how great things are and how stable there is and how lending is in cut back, etcetera, this report shows something really different. So I am talking about it in the sections in more depth, but there were some very, very interesting charts and graphs. And you guys know I love my charts and graphs, and we’re gonna talk about that today.

CHAPTERS:

0:00 Global Financial Stability Report April 2023

1:12 Social Media’s Role in Markets

3:15 Impact of Rising Rates

9:01 US Insurers Illiquid Assets

15:50 Treasury Market Depth & Debt

20:15 Central Banks Buying Gold

25:10 The Thrivers Community

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

The International Monetary Fund, the IMF just came out with its global financial stability report. And while we’re hearing talk from Janet Yellen of how great things are and how stable there is and how lending is in cut back, etcetera, this report shows something really different. So I am talking about it in the sections in more depth, but there were some very, very interesting charts and graphs. And you guys know I love my charts and graphs, and we’re gonna talk about that today, coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading of full service physical, oops, physical gold and silver dealer specializing in custom strategies. And you know, it is critical to have your own personal strategy at this point so that you can be as self-sufficient and independent as possible.

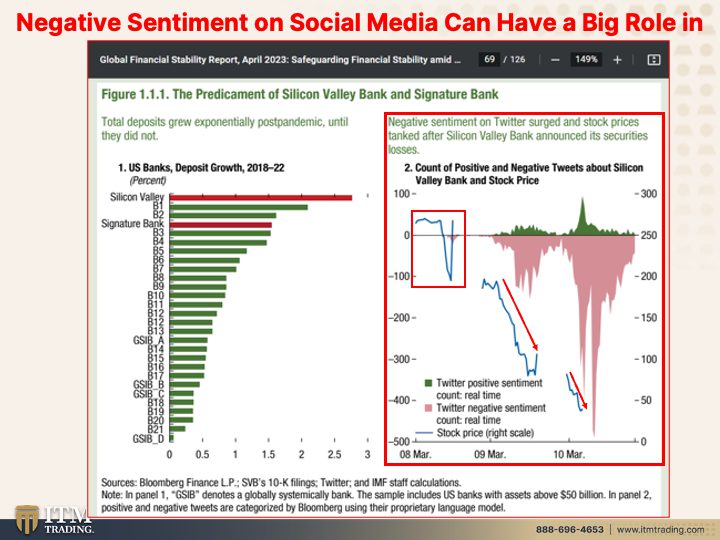

So, as I said, there are some really interesting charts and graphs in this, so I’m just gonna get right to it. And the interesting evolution is the negative sentiment. We’ve talked about this a little bit, but the negative sentiment and how social media can really have a very big role in the markets and the speed at which information travels. So particularly they were, they were doing it versus Silicon Valley Bank, but negative sentiment on Twitter surged and stock prices tanked after Silicon Valley Bank announced its securities losses. So you can see, this was when the announcement first came out and it was pretty negative. And then this is all the negative sentiment on Twitter, on social media, and it just pushed those prices down. And then obviously we had the failure, but this is a new element that’s coming into the Wall Street game and how can they control this? That’s going to be the interesting piece to see because we do know that the government was saying, well, what can we do to cut off the conversation in social media? So that remains to, to be seen what they do, but whatever their answer is, if they do cut us off, that really does indicate how much more control they wanna have over everything, because now it’s not necessarily their rendition of perception management, which is the one they want you to listen to so that you stay where they want you to stay or you move forward in a manner that they want you to. But now we have this extra element. And so it’s really getting interesting and I think it’s quite telling that the IMF on a global basis is also looking at this and discussing it.

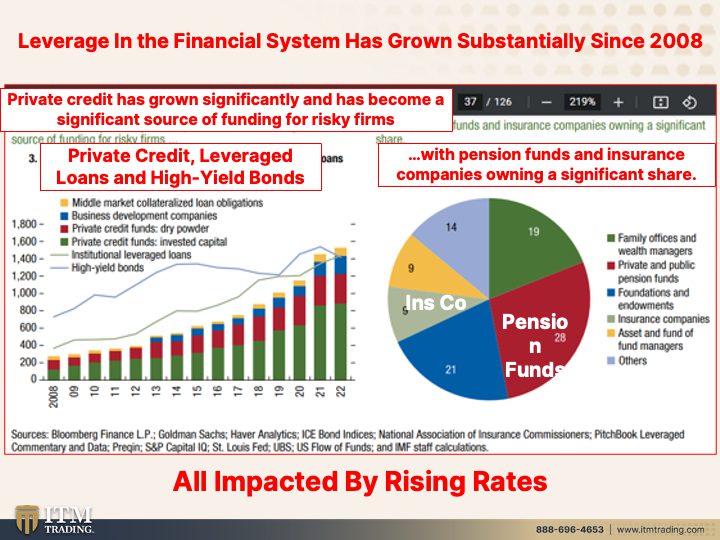

Further than that though, the leverage, which means basically you can think of it as debt upon debt, upon debt, upon debt with an itty bitty teeny weeny piece of equity. So, you know, our system is supposed to be based on debt. I mean, that’s how, that’s how money is created in this system. So look at this though, the leverage in the system, part of the big problem that we had in 2008 was over leveraged. But what you can see here in the riskiest areas, in the least liquid areas, that leverage has grown substantially, like roughly six times, no, what am I saying? Seven times greater than it was during the financial crisis back in 2007, 2008. And there’s a lot of risk. So while they keep telling us that, oh, the banks are a lot safer, the reality is, is everything is interconnected. So we’re looking at, on this graph, we’re looking at private credit leverage loans and high yield bonds, and all of those areas have grown really substantially. So who is participating in these markets? Pension funds, insurance companies, own alliance, share of this, of this market. Now, people always are counting on, we already know we have a retirement crisis, right? So a lot of people are counting on pension funds, but also annuities like an insurance companies, and they feel comfortable. People feel comfortable by saying, well, it’s in short just like the FDIC, right? Well, it’s in short, but what you’re really looking at is any contract is only as good as the counterparty to that contract. So if they can’t pay, guess what? You don’t get paid. So it’s significant to be looking at what they have in reserve in order to ensure that you’re getting paid. And I am talking about the FDIC as well as the pension and insurance companies. So just because they say it’s insured, you have to do your own due diligence and then determine, I mean, so much of this stuff is also done off balance sheet that it would even be challenging for anybody to be able to figure that out. How risky really is what I’m doing. Part of it, you can tell by how much interest is being paid. Like I just heard this morning that Goldman Sachs and Apple are doing a high yield savings account. Well, Goldman Sachs needs more funding. And so even at, I think they said it was coming out at like 4.11, well, the banks have been making more money, but they haven’t been giving it to you. So Goldman Sachs is gonna come out and do that. However, what you should always know, just like this leverage, these leverage loans and the high yield bonds, they have to pay you more to attract your money. So what you’re really doing is you are risking your principle for a little pickup and yield in this case too, particularly in the retirement area with pension funds and insurance companies, you are risking your ability to fund your insurance. Now, I used to have a set IRA, but once we hit a certain point in the trend with the dollars life cycle, a hundred percent, I knew that I needed to be in this. So I liquidated that and paid my taxes, but I know this is how I’m funding my retirement because you’re gonna be able to convert that into income producing assets. However, I thought it was extremely interesting because all of these holdings, the credit, the leverage loans, the high yield bonds, the valuations are all based oops, on the yields, right? So remember and this is the problem with Silicon Valley Bank. I mean, it’s, it’s all one big mish mush really. But when interest rates that this is interest rates and this is the principle on the loans, the bonds, the mortgages, all of that stuff, when interest rates go up, the principle, the current market value goes down. So even we’ve been hearing about First Republic Bank and how a bunch of banks went in and gave them 30 billion in deposits to tide them over to find a buyer. Well, the problem is, is that all of those mortgages that they’re sitting on are worth a whole lot less. But so are all of the mortgages, the leverage loans, the high yield bonds, all of this debt has also lost market value. So this is the keg, the powder keg that we’re really sitting on. You know, if you are, I mean, I don’t know that I’m ever gonna retire to be perfectly honest with you, but if you are counting on things like annuities and this fiat money stuff to fund your retirement, you really need to rethink that position for your own safety.

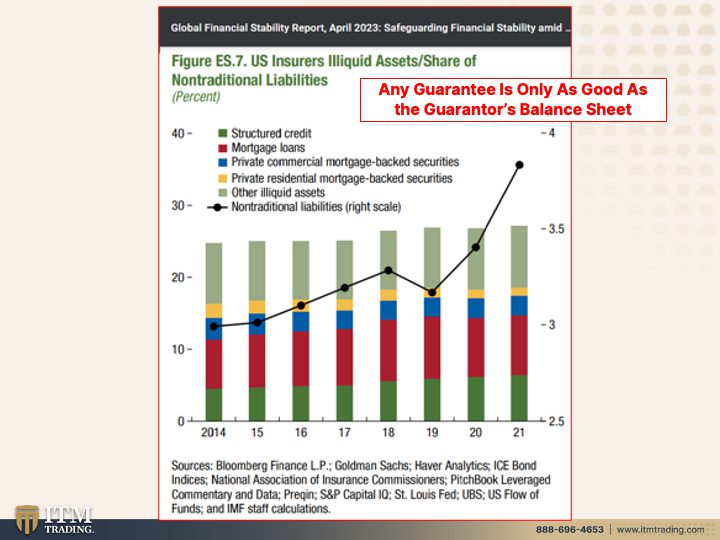

Additionally, going back to the insurers, US insurers illiquid assets share of non-traditional liabilities, that 15 years where the central banks hels interest rates near zero so that people were forced and including entities were forced to go out in risk on the yield curve for that little bit of pickup of interest. Well, this is all coming home to roost now a knot in a good way at all. Any guarantee, again, is only as good as the guarantor’s balance sheet. And because so much of this is kind of hidden, it’s hard to even know. That’s why I say in gold, silver, I trust because I hold it, I own it. It runs zero counterparty risk. And in fact, according to the Bank of International Settlements, it is the only financial asset, I didn’t say one of two or 10 of 20. It is the only financial asset that runs zero counterparty risk. All the rest of this stuff, this is a hundred percent counterparty risk and any contract is only as good as the counterparty to that contract. So it is a buyer beware, but understand that they know that nobody ever reads the fine print. And by the time you find out about it, it’s really frankly too late to do anything about it. That’s not a good position to be in. If you are in assets that you really don’t have any choice other than to hold them, like for example, the pension funds and also 403-B’s, things like that, then you wanna be truly diversified by having this to balance it. And we have formulas to calculate how much gold you would need to properly diversify your portfolio so that if what you’re holding in these assets goes away, no problem because you have this to counter it, it’s really important to have that plan and to execute it, get it executed, and frankly, as quickly as you can, because how much more is the Fed going to be able to come to the rescue?

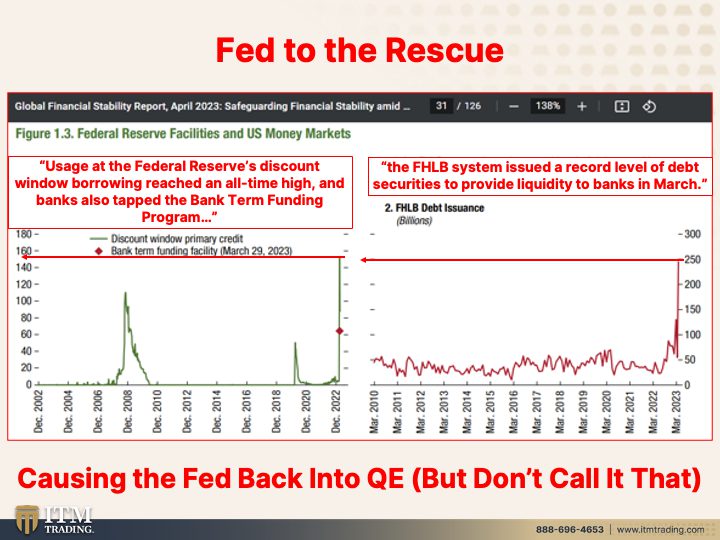

I mean, what do they have? They have this, that’s what they have. They can just print money, which then will hasten it will increase inflation, but it will also hasten the very end of this currency’s life cycle, ushering in the hyperinflation that they need to take us to get rid of all the debt that they’ve accumulated that is non payable, and usher us in to the new system, which is more of a surveillance system, more under their control. Like right now, it takes what every time they do a policy move, 12 to 18 months to see the impact of it. But once they have their finger on that button, they’re not waiting. If you’re not spending enough, they’re gonna push us into negative rates. They won’t do it right away because then you would know and you might go, no, I’m not agreeing to it. So they’re going to get you all caught up thinking that oh, this is just the same and it’s okay, and everything will be fine and the dollar can never go away, even as it’s been going away your entire life. But the Fed also has limitations and we’re testing them now. So during the crisis, the bank recent banking crisis, the usage of the Federal Reserves discount window barring reached an all-time high. And banks also tapped into the bank term funding program. So much as we will have everybody trot out, you know, Janet Yellen, J.Powell president Biden and say how strong and how resilient and how excellent the banking system is and the economy is and all of that. Well, this one chart alone shows the lie to those words because if the banking system was so strong, tell me why it was greater than 2008. The level of borrowing from banks, and much as they wanna say, you know, the discount window is really a window that banks don’t want to tap because it shows their weakness. And yet they, they tapped it higher than they ever have during any other crisis, including the financial crisis in 2008. Additionally, they tap the federal home loan bank system and they issued a record level of debt securities to provide liquidity to the banks. So here is all of this liquidity that’s coming into the system. So you tell me how safe it really is because what is, you know, we’re hearing about quantitative tightening, but what you’re looking at here is more quantitative easing. You see how the system, it’s kind of like we’re in this big storm and you, have you ever seen a bridge, a bridge during hurricane and it’s swinging back and forth because the winds are so high and then all of a sudden it implodes and it crashes. And this is showing you that action. Don’t call it QE, but that’s exactly what it is cause where did all that liquidity that they’ve created since the great financial crisis, where did all that liquidity go? You just have to think about it. Of course, the feds would never cause inflation. And if you grant them that access to that little button that they can just modify constantly, hey, they’re gonna promise you no more inflation. But you have to feel it in a very big way in order to believe their lies. Don’t believe them. Get yourself protected. And also with Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter. Get it done and get it done as quickly as you can. We’re very close to, we’re very close to June and I told you there was gonna be a crisis. Well, you know, we already had a mini one. Is it gonna get bigger? We’re gonna find out, aren’t we?

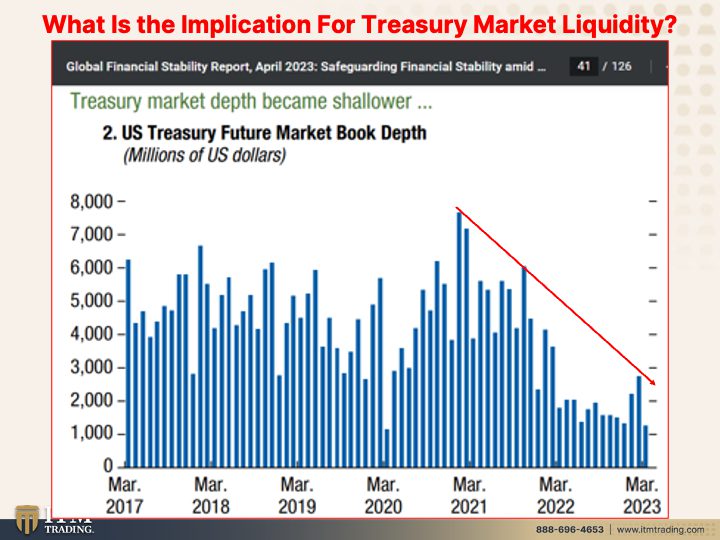

Because the foundation is rocky. The foundation of the global financial system is based on treasuries and what they’re showing you. Treasury market depth became shallower, meaning there were not as many buyers of the treasury debt. We’ve been talking about the liquidity, the lack of liquidity in the treasury market, in the foundation of the global system, really since 2015. But it’s been longer than that because it was December of 2002 where the Federal Reserve had to start buying treasury bonds. So knowing that this issue that they’ve already been dealing with this issue since 2002 was December of 2002, did they do anything to repair it? No, they just doubled down. Why? Because they know we are at the end of this great experiment and if they can shift us into the next one and remain in power, that’s the goal. I don’t want them to remain in power to be honest with you because they don’t have yours in my best interest at heart. So we have to become our own central bank, quite frankly.

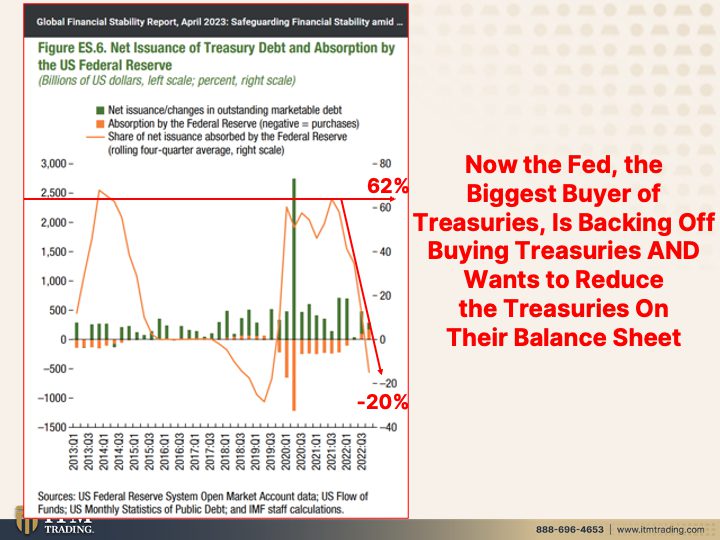

Now this is the net issuance of treasury debt and absorption by the Federal Reserve. And so what you can see is this is the net outstanding, but look at the absorption of it, right? So 62% of the treasury debt, this is recent in let’s see, it looks like Q3 of 2023, the Fed was buying 62% of all of the treasury debt that was being issued. That that’s a lot, don’t you think? That’s a lot. It was a little bit higher than that back in 2013 and we were going through a crisis. But now because they’re trying to adjust their balance sheet, right, they’re trying to run it off by allowing these bonds to mature and then just not buying more of them. Now they’re at a minus 20. That means that the rest of the market has to absorb these bonds or the treasury has to issue less. And keep in mind that we’re coming up to the debt ceiling, that’s still a big issue and they have not resolved that yet. And so, but the treasury also has to issue less because they would hit that ceiling even faster. Now talk is that they’re just going to suspend it, suspend it until 2024. And then every time they’ve done that, we’ve watched the treasury, we’ve watched the debt go up almost parabolic to a much higher level. But presumably they may put in limits and they may do it with a number that anticipates how much they’re gonna spend over the next year. We’re gonna see how this plays out. But you might recall that when they were playing with the debt limit back in what, 2011, it didn’t end very well for the US we were downgraded by Moody’s, by the grading agencies to a double a rating from a AAA rating. But no matter what the rating is, I mean quite honestly, they have to fund what they’re spending with debt. And this debt is not payable and it’s going to implode the entire system because do not forget all those leverage bets that that is on top of this. But this is supposed to be a bedrock system. The treasuries supposed to be bedrock and it’s not. Maybe it’s shale that’s very easy to break apart. That’s the scary part of it. So can we go back? Thank you. Now the fed biggest buyer of treasuries is backing off buying treasuries and wants to reduce their balance sheet. I hope you can see the problem. We are in very, very, very shaky ground. What isn’t right?

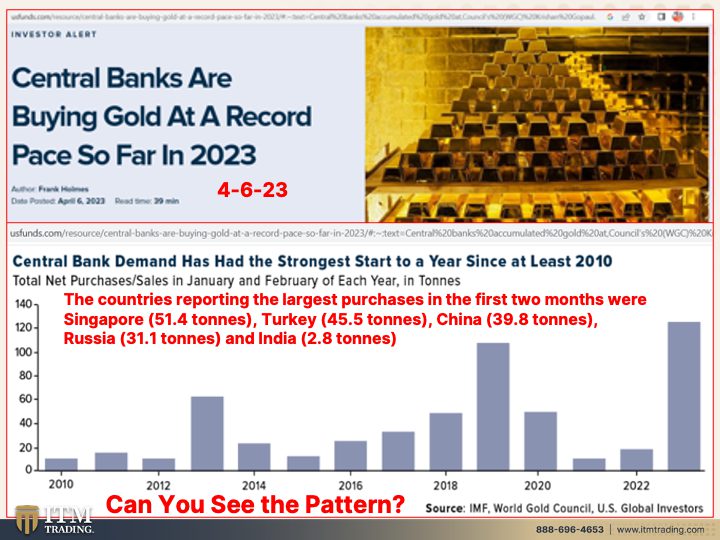

Central banks are buying gold at a record pace so far in 2013, 2023, sorry about that. I’m going back in, in years, but 2023. So not only did the central banks buy the most gold going back to 1967 in 2022, we are off to a banner year. There is something that they know they’re not telling you. They’re telling you everything is fine in hunky dory, don’t worry about it, nothing to see here. But at, at the same time, they are protecting themselves. The strongest start of the year since, well, I don’t know, here’s the start of the year. This is just it each year it’s January and February. Purchases in sales in tons. So this is higher than any buying that they’ve done. But we went from negative to positive in 2010, though the reality is honestly, central banks started accumulating gold again in 2005, two years before the financial crisis began to unfold. Do you think they might know a little bit more about what they’re doing than we do? Because they’re telling you everything is fine. But that’s not really the case. And what I find super interesting, especially with all of the geopolitical things that are happening, is that the countries reporting the largest purchases in the first two months were Singapore, Turkey, China, Russia, and India. And we’ve talked many times about the battle lines being drawn and I think it’s interesting that we’re seeing gold purchases along those same lines. So as we are watching the power shift from the west, from the US to the east to China, can you see this pattern too? Because even when you don’t necessarily fully understand why, you’ll always have to pay attention to the pattern. Cause the pattern is gonna help you understand that there’s a change, right? Where we are in this cycle and the US position of the world reserve currency, it’s coming to an end. Will it be replaced by the Chinese yuan? Probably not, but maybe a lot of people think so. Personally, I think it’s gonna be the International Monetary Funds. SDR just stands for special drawing rights. It’s just a name, just like the US dollar. It’s just a name. That’s all it is. But the reason why I think it is because everybody’s got a bunch of it. So, and it’s been around since 1969 and the IMF does not have to generate debt in order to create the SDR’s, but they can contain that SDR can contain every single currency on the planet. Making it easy to just have a local currency like in the us just the US dollar, and then have an international currency that’s easily converted because every currency is included in that. So we’ll see. I mean, I’ve been talking about that piece since 2009. That’s when China brought it up and said, Hey, what about the sdr? And I thought, well that makes a whole lot of sense. Everything’s been tested, but no matter what they do, this is what you want going into the new currency. This is more what you want as well. But this is the primary currency metal. Both of these are severely undervalue to their fundamental value. It is with gold since it’s the primary currency metal that they do those overnight resets where they take this that has no intrinsic value and converts it and and resets it into the gold, that’s when you’re gonna see gold and silver go toward its fundamental value. Not until then because a rising gold price is an indication of a failing currency. And they want you to stay in intangibles because when you’re an intangible, you can’t hold it, right? You don’t own it. It’s that simple physical gold, physical silver in your possession. You hold it, you own it outright. It runs no counterparty risk, it runs no geopolitical risk. What do you think you need to have going into this?

But really make sure that you join the thrivers community if you wanna come together with a group of like-minded people. I am so thrilled and happy and tickled to see what’s happening in there because community members are helping each other. So yes, you’ll get a lot from us, but this is so much broader, so much bigger. We’re building it out together. So that means that tell us what you want and let’s see if we can’t make that happen. So lots of new things will be happening and you just stay tuned. But you can download it on the web at www.thriverscommunity.com and also download on the App store or Google Play “The Thrivers Community” and come and check us out and join us and help us make this the community that you wanna see so that you are not so alone. And I know that people are forming groups and trying to come together even in local areas, which is wonderful, absolutely wonderful. And if you haven’t done it already and you don’t have your strategy in place, click that Calendly link below. Set a time to talk to one of our specialists so that you can get your strategy in place. Know what you have to do to truly diversify and balance out your portfolio so that, gosh, what a concept you have the wealth shift your way for a change instead of away from you. And if you like this, please give us a thumbs up. Make sure that you leave us a comment and share, share, share, because the reality is, is it’s physical metal that give you your best financial shield. And until next we meet. Please be safe out there. Bye-Bye.

SOURCES: