YOU JUST BECAME MORE VULNERABLE: Historic Pattern Shift as Financial Blackhole Opens…by LYNETTE ZANG

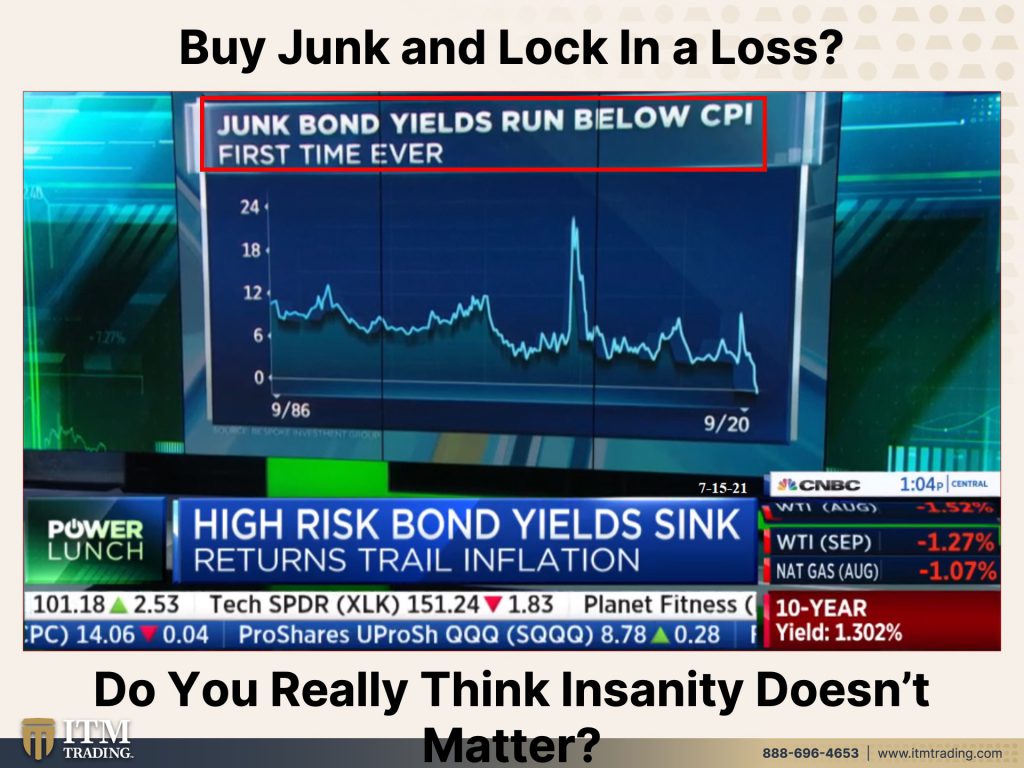

The unthinkable just happened, junk bond yields fell below the rate of official inflation. This historic first and is letting you know that the system is almost dead. You might not know what this means so please allow me to explain. First, junk bonds are issued by vulnerable companies (junk). Typically, people buy them because they pay more, since you are taking more risk. Well now, even presuming a junk company survives the economic reset, you have agreed to take a purchasing power loss. In other words, even though the nominal rate is still positive (4.5% on average) the real rate of return is officially negative since inflation clocked in at 5.4%.

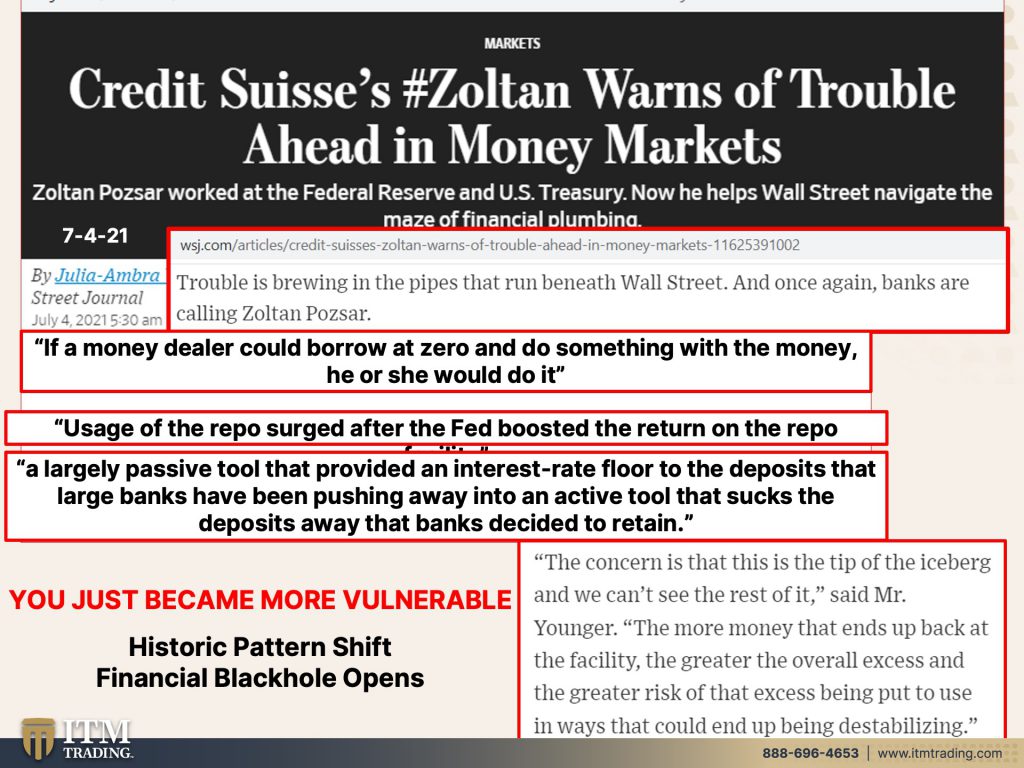

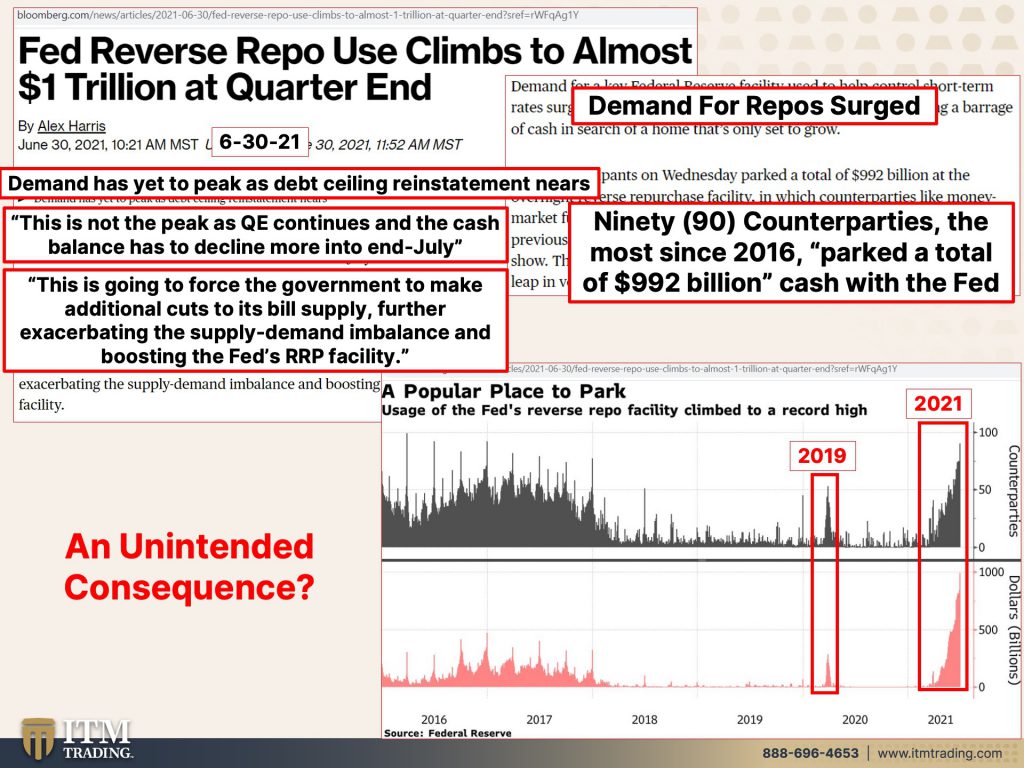

This is how the central banks have “managed†the markets since 2008. But now the financial system plumbing may be in trouble yet again. The RRP experiment (Reverse Repo Program), created in 2013 to sop up excess liquidity caused by QE (Quantitative Easing) with the goal of putting a floor under interest rates is groaning under the strain of massive amounts of cash in the system, and it is likely to get worse.

In a zero-interest rate environment, even a .05% rise can cause upheaval as pensions, insurance companies and hedge funds reach for yield and a tsunami of cash shifts from banks to the Fed.

Is this the unintended consequence of massive money creation when a government and a central bank, together, turn on the money spigot?

You might be wondering why you should care? You need to care because this shift threatens the foundation of the financial system and once that breaks, you lose all chance of protecting your wealth and your standard of living.

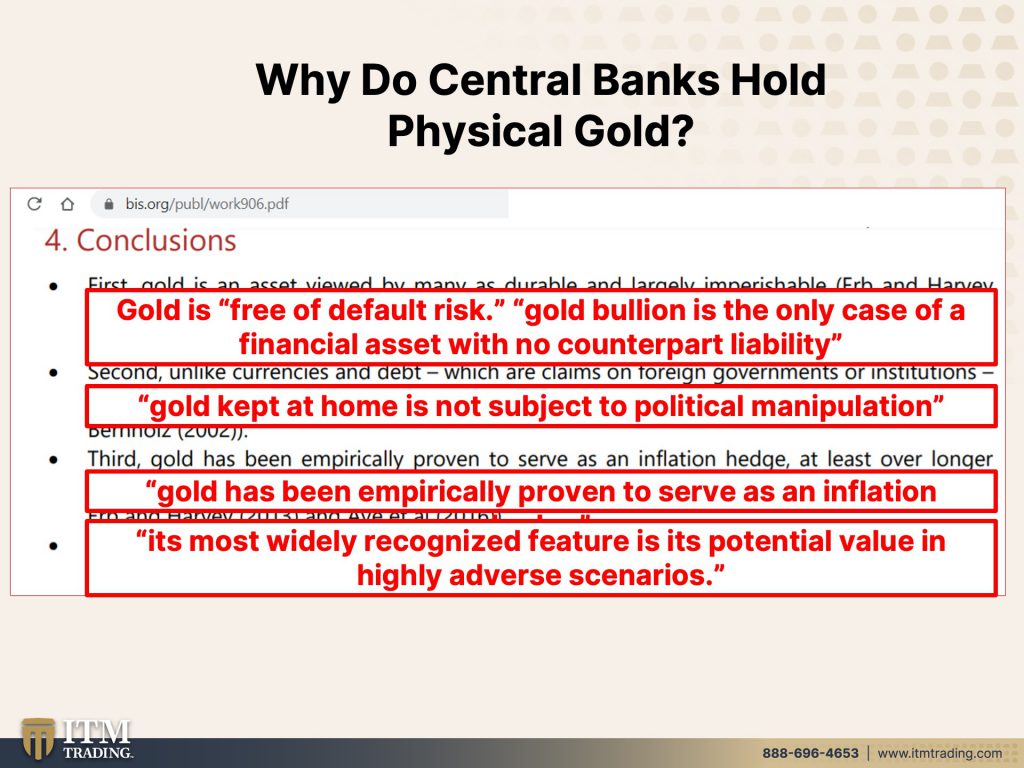

ANY wealth you hold in fiat money and fiat money products are vulnerable and in jeopardy. It is time to cover your assets with physical gold and silver. The ONLY financial instruments that are free of default risk, which is critically important today. According to the BIS (Bank for International Settlements) “gold has been empirically proven to serve as an inflation hedge†and “its most widely recognized feature is its potential value in highly adverse scenarios.†Like the one we are facing now.

And finally, my favorite, “gold kept at home is not subject to political manipulationâ€, which is also critically important as we transition into a new financial system. These are the reasons we all need physical gold and silver. Truly outside the system and absolutely private.

TRANSCRIPT FROM VIDEO:

Something amazing happened today, a historic first critical pattern shift. We are going to talk about that. Plus what’s going on in the repo markets. I can’t wait to show you all of this coming up.

I’ll tell you the truth. I could not be happier to be the Chief Market Analyst here at ITM Trading, because it means that I pay attention to stuff closer than I would if I were just living out there and doing a normal kind of life. And I’m so grateful, but you might also recall that I told you that if  you have not already subscribed, you want to do so and hit that bell. So when we go live, because when something major happens, I’m going to come on air and I’m going to tell you about it as soon as I know, and something major happened today, and I’m going to start with that. And it actually really flows into everything else that I want to talk about today, surprisingly enough. But do you know that junk bond yields have now fallen below the official inflation rate that has never ever, ever, ever, ever, ever, ever happened before?

Essentially you’re locking in a loss, which is what negative rates do anyway, nominally, they’re still positive. They’re on average, maybe four to four and a half percent, but with inflation running at 5.4%. And do you think that’s really going to slow down? I know we’re told as transitory, but he never said how long, Fed Chair Powell never said how long transitory is. So do you really realize the implications because junk is junk is junk, right? So you’re looking at corporations that are in doo-doo fiscally anyway, may or may not survive the debacle that we’re going through. Most likely not because they’re already loaded up with junk. Not only have you not been getting paid for the risk that you were taking, but now essentially you’re at negative rates with that.

People ask me all the time. Well, can’t they do this forever? No, no, they can’t. They can do it longer than you would think possible. So you might get discouraged because after all, even though gold and silver up today, they’re not up that high. And why aren’t they spiking with everything that’s been going on? Understand a rise in gold price is an indication of a failing currency. What these junk bonds are showing you and what I’m going to show you in the repo markets they’re telling you, the system is failing the experiments that the central banks have put together to prolong this mess are failing. They’re failing. Let’s talk about the repo markets because it’s really significant. And frankly, you just became a whole lot more vulnerable. Even if you don’t have wealth in the Fiat money systems, all of us are a lot more vulnerable.

You know, I pay attention to pattern shifts. This one is historic. We may not fully comprehend exactly what this means yet. You don’t need to. What you need to know is that whenever a pattern shift happens, it means something. And to me, this is a very negative pattern shift, but it should not be a surprise because we’ve been watching the patch that the central bank put on money market funds last September 2019. Well guess what? That patch is falling apart again. And what we’re really looking at is trouble. Look what do we all want? We want to be safe in our homes. We want to have financial security to know that we can maintain a reasonable standard of living. But you’re up against the global central banks that don’t want you to maintain a reasonable standard of living. They keep attacking your purchasing power wealth in what you work for an attempt to save.

You need to have a tool that can protect you because “Hey I’m from the central bank, I’m here to help.†I don’t think so! If a money dealer could borrow at zero and do something with that money, he or she would do it. You think?. Now, can you and I borrow a zero? No, but can the corporations and the banks borrow at zero. Yes. Even the federal on the debt can’t borrow at zero, but corporations and banks can. After the fed boost the return on the repo facility, which we’re going to look at just a minute here from 0% for Mr. Pozar, who is really the expert in the plumbing of the repo markets and the plumbing of the financial system. He was a central banker, and now he works for Credit Suisse. The move turned the facility from a largely passive tool that provided an interest rate floor to the deposits that large banks have been pushing away into an active tool that sucks the deposits away that banks decided to retain. What all that means is that with all of the money printing that the central banks have done. And the government, the treasury has done that everything is a wash in liquidity. Now we do know that it costs the banks money to hold deposits that can move quite quickly, right? So a hedge fund or a large corporation, maybe they make a deposit here and they pull it out there. But banks like to use our money to trade, to make money. We’ve seen this in the earnings that most of those earnings are coming from trades, banks trading, for that, they need sticky money. That’s yours and mine because we are not likely to change banks quickly. Unlike entities like edge funds, etcetera. But here’s the concern. The concern is that this is the tip of the iceberg and we can’t see the rest of it. The more money that ends up back at the facility, meaning the fed, the RRP, the greater, the overall excess and the greater risk of that excess being put to use in ways that could end up being destabilizing trading. And I think honestly, you know, I mean, I can’t, I can’t sit here and tell you absolutely that hyperinflation has begun, but I think that that is a highly likely scenario. And you might want to timestamp this one for the future Edgar because, well, I’m not going to go a hundred percent…I think the hyperinflation has begun. And I think that that’s, what’s what all of this is telling us because it’s sloshing around the system. It has to go someplace.

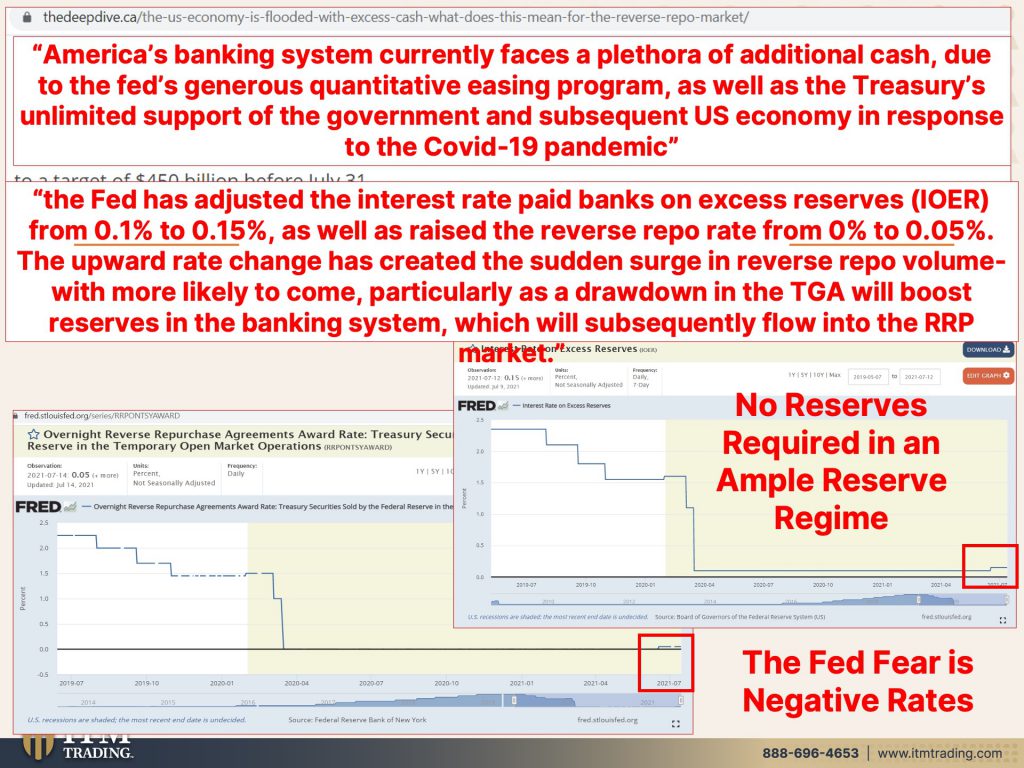

America’s banking system currently faces a plethora of additional cash due to the Fed’s generous quantitative easing program, as well as the treasuries unlimited support of the government and subsequent us economy. Yeah. In response to, okay. Let me kind of digest that one and chew that up a little bit for you now normally would think, well, the banks would like cash, but they really aren’t doing too much lending these days because there’s so much cash that’s been put out there. Corporations and individuals are not borrowing as much as they did. So that is the traditional way that a bank made its money. And so this huge influx of cash, actually, this is one of the reasons why we went into that Banks don’t have to hold reserves because we’re in an ample reserve regime, which we’re going to look at in just a second. Okay. The banks have too much cash. They don’t have to hold reserves for it anymore, but it’s just sloshing around in the system. And they can’t really even use money that will fly in and out quickly for their trading purposes, yours or mine, they can, but the hot money that’s, what’s referred to, they can’t, the fed has adjusted the, now why they did this I can’t say, some think that they made a huge policy misstep when they did that. And everything is so fragile, frankly, they can’t afford to make a misstep, but it’s not like they have a playbook on how to do this. This is all a huge experiment. So the fed has adjusted the interest rate, paid banks on excess reserves.

Wait, I didn’t think they had a whole, oh, they stopped letting us know what that was and what may or June. Yeah, that’s right. They took that information away from us, but they adjusted the interest rate, paid to banks on excess reserves from 0.1% to 0.15% as well as raise the reverse repo rate from zero to 0.05%. The upward rate change has created the sudden surge in reverse repo volume, and I’ll show you that in a minute, with more likely to come, particularly as a drawdown in the TGA, which is the Treasury’s government account or cash count will boost reserves in the banking system, which will subsequently flow into the RR paid market. So we’ve already shifted to an ample reserve regime. I mean, I think this is like a really interesting, to an ample reserve regime and required the banks not to hold reserves on your deposits. And yet they’re raising the interest rate on excess reserves, which is something they never did prior to 2008. So it’s experiment after experiment that works for a while and then starts to break down. So can you see, this itty bitty little blip up? That is the, from a 0.01% to 0.015%. And that convoluted a little bit. This is the interest on the RRP. And again, yeah, there’s that itty bitty little blip up and it’s creating a lot of havoc in the markets. So much, as they say, oh, they’ll raise rates they’ve got these tools to fight this inflation. No, they do not have the tools to fight the inflation because historically in order to fight inflation, they raise interest rates. They can’t do it. They tried to do it in 2016. And we saw the results of that and run off their balance sheet, which is another tool that they can do. I mean, they’re still buying 120 billion a month in mortgage backed securities and treasuries, which is part of what’s creating this imbalance and the challenge that we have. But if that’s little

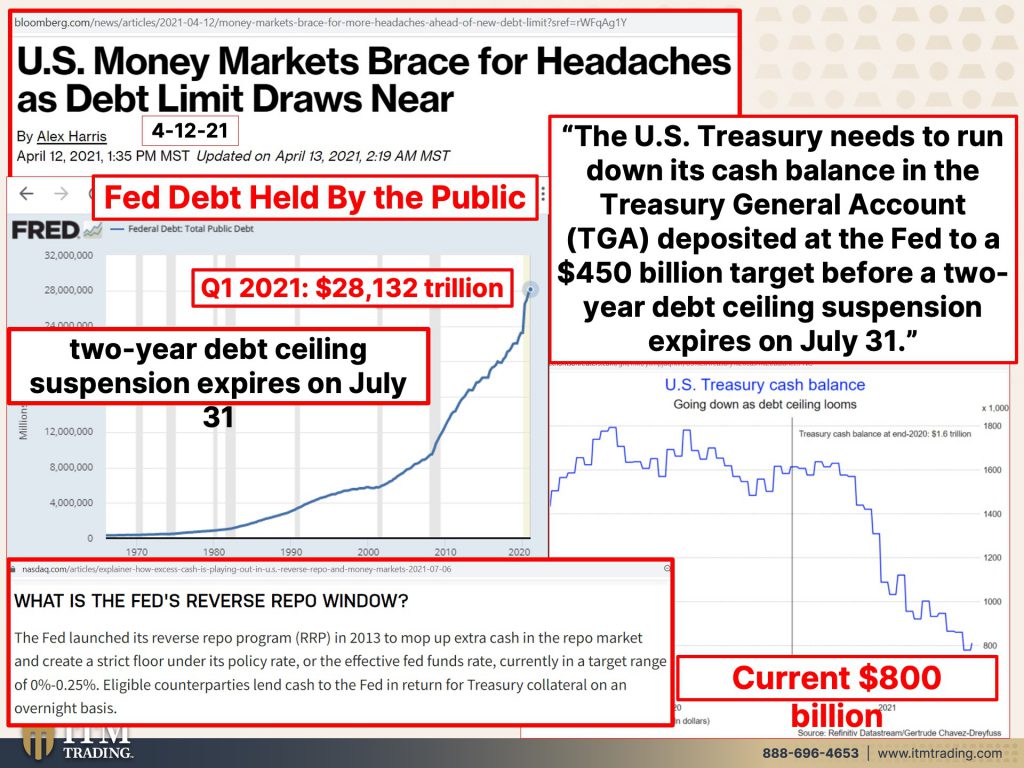

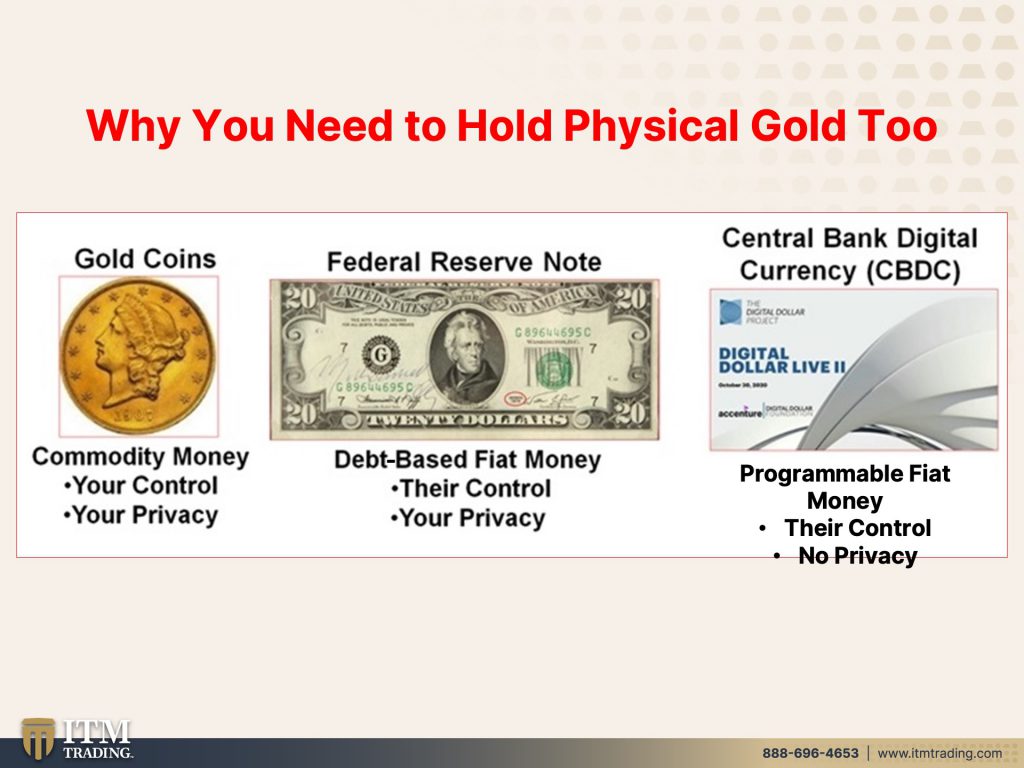

Itty bitty, teeny weeny move can threaten the entire plumbing of the global financial system. Do you think they can really raise rates? No, they cannot. And what do they fear? Negative rates. And why do they fear negative rates? Because you and I will notice, I mean, we’re going there anyway. We talked about this. We have to go there because there’s no room left, historically, in a crisis they have about, they drop rates about five and a half, five and three quarters percent. Can they do that? They couldn’t barely raise them. And you get this. Additionally, we talked about this back in April, that money markets brace for headaches as the debt limit draws near that’s, by the way, July 31st. Okay. So in a couple of weeks, unless Congress, which they probably will, either raises or eliminates the debt ceiling, which they did, they suspended the debt ceiling for two years. Takes us back to 2019 and we can see the results. We’ve got over, and this is just the public debt so this is the total debt. This is just fed debt held by the public, right. It’s above 28 trillion. Cause this is just from the first quarter of 2021. So this isn’t even reflective of the second quarter yet. I mean, can you see the problem? Are they going to raise the debt ceiling? Of course they’re going to, they always do. Maybe they’ll suspend it. Maybe they’ll suspend it permanently. Does it mean then that the debt doesn’t matter if they were indeed to do that? No, that is definitely not what it means because the more debt that they take on, the less that any debt that they take on the less impact it has, this is why we have to go to a new system. And also by the way, this is why we have to hyper inflate because the new system they have in mind for us, the CBDC’s, Central bank digital currencies are also at least at this point, from what I could find based on their ability to create more debt.

So how would those CBDC’s help us? All it would really do is give greater and direct control of you and may to the central banks. They have to burn off that debt. That’s why, you know, people ask me all the time. Well, what about deflation? That’s the battle that the central bankers have been in since we went on a debt based system has been against deflation. As we’ve expanded to globalization, it’s deflation that we’re fighting, that they’re fighting and there’s only one way to do it, only one. So it makes it simple. That’s inflation. I’m sorry. I’m really, I’m really upset with the information that I have to give you today.

So on top of it, with that debt ceiling out two more weeks, the us treasury needs to run down its cash balance in the treasury general account deposited at the fed to 450 billion target before that two year debt ceiling suspension expires on July 31st. So they’ve been working on it, but guess what? They still have 800 billion in there. So they have to reduce it by almost half. That is more cash, more liquidity into a system that is already saturated with it. Of course, this is all going to the corporations and the banks and those that they can borrow for free. A little bit of that is going to the public. And oh, by the way, today, you might check your bank accounts because the child tax credits go out today and some will be automatically deposited.

Now, before you go, as a little aside, before you go and spend that money, you just want to make sure that on your next tax filing, you won’t have to repay that money because you might, there are there attachments to it, but at any rate that too went out today, which I find really interesting. So back to the slides, because we have to talk more about the feds reverse repo window. The fed launched its reverse repo program in 2013 to mop up extra cash in the repo market and create a strict floor under its policy rate or the effective fed funds rate, which is an overnight rate that the fed actually controls. I’ll show you this in just a second.

Currently in a target range of zero to 0.25% eligible counter parties lend cash to the fed and returned for treasury collateral on an overnight basis. Well originally on an overnight basis, it’s still overnight, but there are different lanes of maturities. As they’ve been trying to tweak this new program to make it remain viable and to do the job that they wanted to do. So this is where entities will come in and trade cash for treasuries. Now, if the federal reserve is also buying a ton of treasuries, then that makes that market quite tight, right? It can train supply, and therefore you have the supply demand imbalance. That’s a big part of the problem.

So, the reverse repo use climbed to almost a trillion at quarters end demand for repos has surged, and I find this interesting, and we’re going to go into this a little bit more, 90 counter parties, cause it’s all contracts. And frankly, any contract is only as good as the counter-party. This whole Fiat money system is all contract based. All counter-party based. Gold is the only financial instrument and silver physical. These two, that do not run any counter-party risk. Okay. So 90 counter parties the most, since 2016 parked a total of 992,000 billion cash with the fed. Demand has yet to peak as debt ceiling reinstatement near. So we’re going to see this get worse and worse. So that’s why it’s important to pay attention. Now, get prepared. Now, if you haven’t bought physical gold and silver yet, what are you waiting for? I mean, really? What are you waiting for?

This is not the peak as QE continues. And the cash balance has to decline into July at year end. This is going to force the government to make additional cuts to its bill supplies. So not only do you have the demand supply imbalance because the fed is buying up so many treasuries, cuts the government to make additional cuts to its bill supply issuing fewer of them. I’m telling you destabilizing, you think? Yeah, very destabilizing and this really matters to you that further exacerbating the supply demand imbalance and boosting the feds, our RP facility. Now this is 2019 when the fed had to stop raising rates and start lowering them again, as well as starting again to inject cash into the system, more heavily, more heavily, but it is dwarfed by what’s going on now.

So this is when it came out and it was heavily used to keep those rates. So it was supposedly inactive to keep those rates low, but at the Fed’s target at the feds target, therefore the fed created a new tool to try and help them maintain not going below zero, but it looks like the market’s taken over to me. Doesn’t that look like to you? look at that huge surge higher than when it was even created higher than through 2016, is this an unintended consequence? Because for every action there is a reaction and maybe that reaction is delayed. Maybe it’s hidden for most people’s view until it can’t be hidden anymore. And I think that’s where we’re, we are highly likely to get to that part.

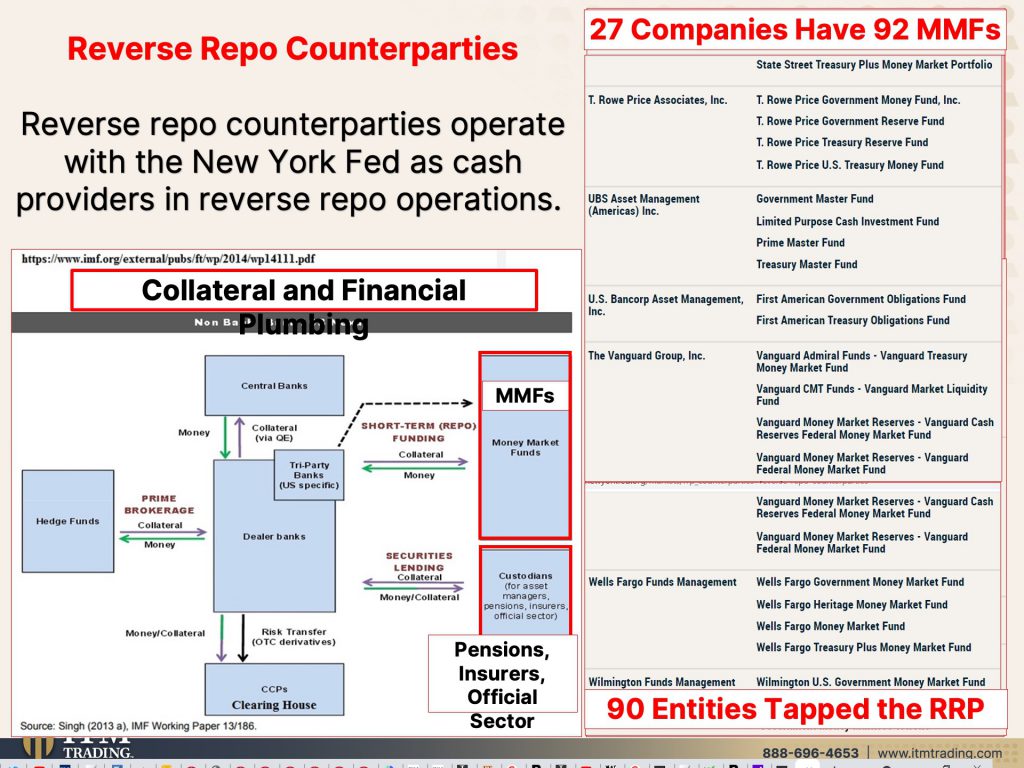

So reversed repo counter parties operate with the New York fed has cash providers in reverse repo operations. So they put the collateral in. Now they’ve got to take it out. So they’re, they’re juggling a lot, a lot of balls. These aren’t the only balls they’re juggling. And this is a flow chart of the collateral and financial plumbing. These are money markets by far the largest contributor. So you think that money markets are the same thing, kind of like savings? No, it’s how they fund the global. Well, aside from new money printing, how they fund the global plumbing, financial plumbing, and down here are things like pension plans, insurers, the official sector. So like Fannie Mae, federal home loan, actually federal home loan bank was in this a lot. Could be Atlanta could be in New York. It could be the different states, but they were in there a lot. Now keep in mind that there are 27 money market companies. So this does not account for the GSEs, the government companies like, like the federal home loan bank or the commercial banks like JP Morgan chase.

What I just showed you, is just the money market funds. Now there are 27 companies. They have 92 money market funds. There’s really no choice. There’s just the illusion of choice. And frankly, if I went up the food chain, there’d probably be a whole lot fewer than 27 companies, but even just on its surface on its surface, okay. 90 entities tapped the RRP? I couldn’t exactly tell which ones they were, were they all of these money markets that you’re holding your money in thinking they’re safe because they’re like a savings account. Do you still feel safe in them?

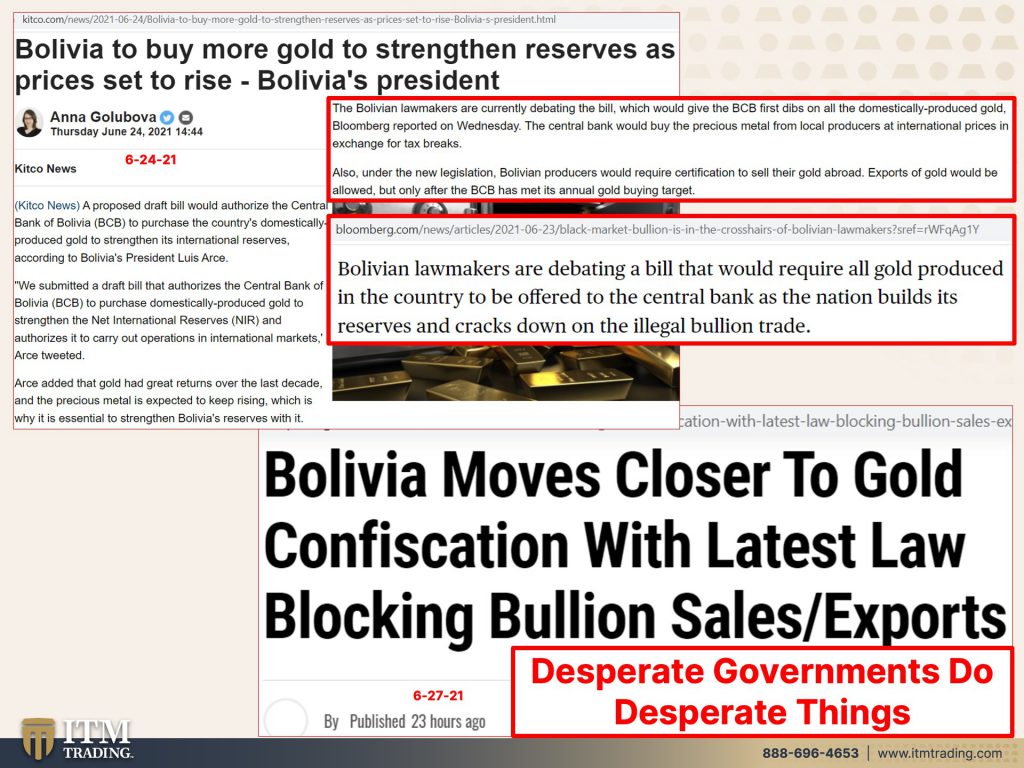

People want to be diversified? Well, if everything that you hold is intangible. I don’t care if it’s a stock or a bond or a REIT or an insurance contract. It’s not diversified. This is what you need. Tangible, real money outside of the system to be truly diversified because this is what we also know. Desperate governments do desperate things. So which particular government, well, they’re all doing some pretty desperate things right now, but in Bolivia they are, well they’re not the only country. We do know that central banks have been buying gold hand over fist since 2000. And it shows like 2010, but frankly, 2007. Okay. The Bolivian lawmakers are currently debating a bill, which would give the BCB first dibs on all the domestically produced gold, Bloomberg reported on Wednesday. The central bank would buy the precious metal from local producers at international prices in exchange for tax breaks. Also under the new legislation, Bolivia producers would require certification to sell their gold abroad. Exports of gold would be allowed, but only after the BCB has met its annual gold buying target. Let’s see, is there another country that does not allow gold to leave its borders? Oh wait. That’s China. But typical, when they’re setting up for confiscation, Bolivian, lawmakers are debating a bill that would require all gold produced. Oh, we already did that. Okay. Produced in the country to be offered to the central bank. As the nation built its reserves and cracks down on the illegal bullion trade, because they can write the laws. They can legalize anything they want. Let’s crack down on what we don’t like. Have we seen that? And so many believe, and I would have to be in agreement with this Bolivia moves closer to gold confiscation with the latest laws, blocking the sales and the expert exports, desperate governments do desperate things. You want to be protected from that. I cannot use this one enough and I would really suggest everybody follow the links. The links to all of this are over on the blog. You need to go there because what does the bank for international settlements say in this report that they did looking at foreign exchange reserves because gold and silver are real money.

Gold is free of default risk. Everything in the Fiat money system is contract base. That means everything else runs that default risk in this environment. Are you seriously willing to risk your wealth & your hard work to default risk? Do you really think this can happen here? Do you not see the insanity? Gold bullion is the only case of a financial asset with no counter-party liability, no counter-party liability. And if you keep it at home, it is not subject to political manipulation. Now the form of it may or may not matter. I can’t say that one way or the other. So personally I don’t hold any bullion gold because that accounts for about 98% of all the gold that is above the ground. This is the way that I like it. This is the way that I buy it for me. Thanks to Uncle Al.

Even this is pre 33. Thanks to my Uncle Al. He showed me how you could hold thousands of ounces of gold legally in 1964 when it was illegal to hold more than five ounces. But if you keep it at home, truly is invisible. Plus, gold has been fairly proven to serve as an inflation hedge. Now, the fact that it’s barely moved even as inflation is surging, was that tell you, do you really think when you look at wall Street’s prices that you’re looking at a true supply demand market, uh no. It is a manipulated market, admittedly so over and over and over and over again, even into what happened with Basel III, naming gold as a tier one asset, we’re going to talk about this more next week. I need to dig a little bit, but we’re going to talk about this more next week.

Finally, according to the bank for international settlements. It’s most widely recognized feature is its potential value in highly adverse scenarios. We are entering. We have already entered, what am I saying we are entering. We have already entered a highly adverse scenario. The insanity that’s happening tells you about that. Why do you need to hold physical gold in addition to all of those reasons? It’s because it is in your control and it is private. And we’re going to a CBD system, which is programmable fiat money. Please, if you know of something that the government or the central bank has done for your best interest, let me know. Because the system was designed against you we’re in a car club or there’s a club and we ain’t in it as Gerald Celente my friend says, I think somebody else said that too, but it’s true. We have to create our own club. How about the wealth preservation club? How about a sustainable life club? Because you need more than gold and silver. The advantage each of these is that they’re universally barterable and their money, wherever you go. And they have the broadest base of buyer, but what else do you need to sustain a wonderful standard of living? Food, water, energy, security, community, and shelter. We need all of that. That’s what we’re talking about. That’s what the strategy based upon repeatable historic patterns, that’s the same strategy that we execute at ITM Trading. That’s the strategy that I developed for myself before I even went there based upon those repeatable patterns. And because there’s so many brilliant people there, we’ve just made it better and better.

Now, I had a great interview on Tuesday with Michelle Holiday over at Portfolio Wealth Global and we really dug into CBDC’s. That was by far, that was the main focus of that interview. And I thought she did a phenomenal job. So you really want to go and watch that we will, we will share the link when it’s out. And this morning I was with Patrick Vierra over at Silver Bullion TV. And we did talk about that, but we broadened out what we talked about. We certainly talked more about the repo markets we serve. We talked about everything and you know, he always does such a fantastic job. I know you guys are going to really enjoy that interview. Now, next week I am also interview heavy, which is fine with me because I’m definitely willing to work more because of where we are in this trend cycle for goodness sakes.

So I’m going to be on with Eric over at TradCatKnight channel on Tuesday. I think that one’s live isn’t it? I’m pretty sure that one is live. So I don’t know what he’s going to ask me, but he always asks great questions and you’re going to want to see that or listen to that one. And I’ll also be on a new channel, which is exciting. The Drew Pearlman Show on next Thursday. And I can’t tell you if he’s going to record that or he’s going to run it live, you know for me personally, I prefer to do them live because you get what you get and I don’t have to worry about when it goes out. So I do prefer that. But again, I consider this a really important one. So I’m going to ask you guys, share, share, share, share, share.

I cannot encourage that enough if you haven’t already subscribed, please do so. I think  that there will be more and more surprised things that I’m going to have to make you aware of. So hit that notification button. We’ll let you know when we’re going live and you can hear all of this anywhere, anytime available on all major podcast platforms. So wherever you are, you could still participate. And this is the time to be paying attention because there is absolutely zero doubt in my mind that it is time to cover your assets. And here at ITM Trading, you guys know we use real money as the foundation for that, with the wealth shield, but it also incorporates all those other mantra pieces, which we’re going to be talking more about as we move forward. Anything can happen over this weekend, who knows it’s crazy out there and sanity can rain longer than you would think, but not forever. And we’re all vulnerable. You want to not be as vulnerable plus food, water, energy, security, community, and shelter until next we meet, please be safe out there. Bye-Bye.