WILL YOUR MONEY LAST? 3 Ways 401k Withdrawals Are Changing in 2020… By Lynette Zang

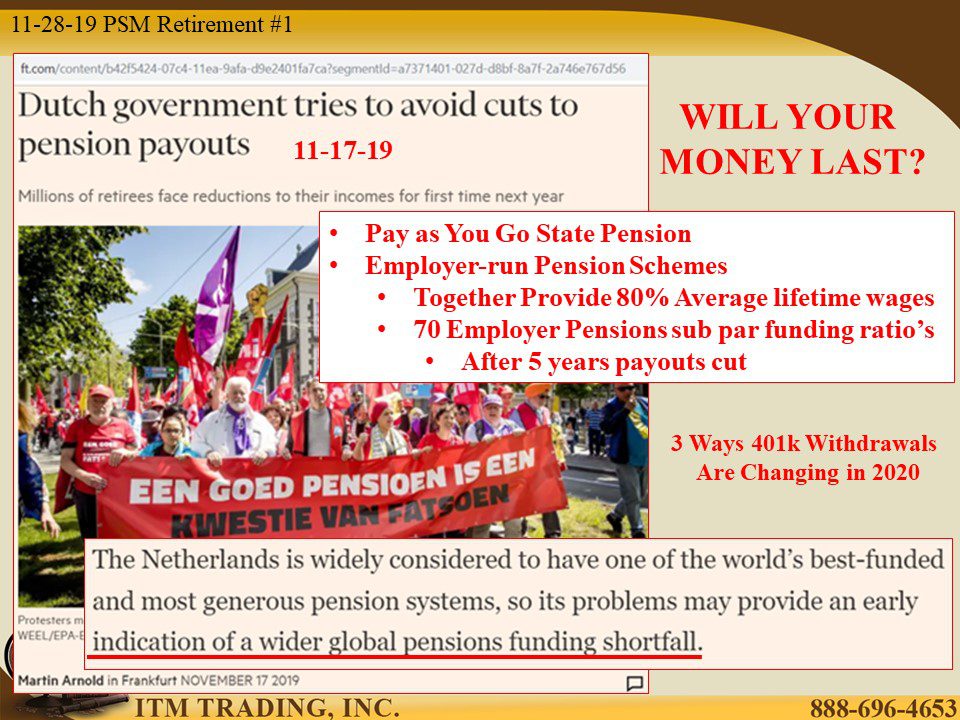

Studies have shown that the Netherlands was one of the two biggest beneficiaries of the European Union with high stock and bond markets, low unemployment and high home prices, yet today, the state of their pension systems, both public and private, threaten pensioners current payments.

In fact, the “Netherlands is widely considered to have one of the world’s best-funded and most generous pensions systems, so its problems may provide an early indication of a wider global pensions funding shortfall.†Is this the canary in the coal mine that tells us that the pension crisis is becoming too big to hide?

Have more questions that need to get answered? Call: 844-495-6042

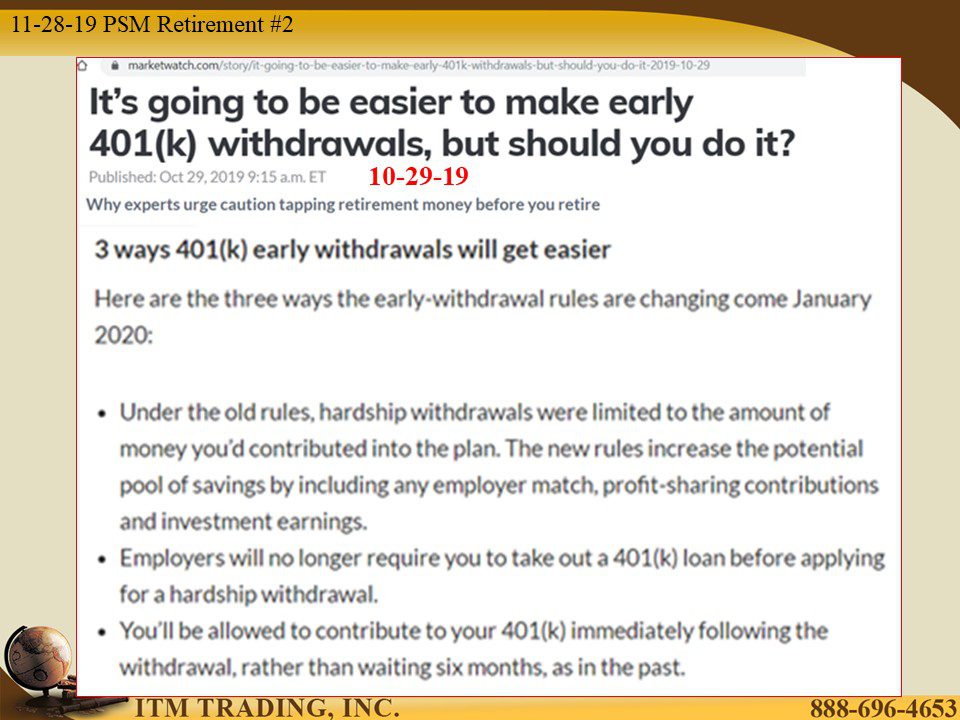

Additionally, the rules surrounding your access to an active 401K are changing too. Which is amazing since governments seem so concerned about “leakage†(early withdrawals) from your retirement plan. Yet the new rules make taking early withdrawals easier.

Those changes are:

- Old rule – Hardship withdrawals limited to employee contributions only New rule – Hardship withdrawals include employee contributions, employer match, profit-sharing contributions and investment earnings.

- New rule – You will no longer be required to take out a 401K loan before applying for a hardship withdrawal.

- Old rule – After hardship withdrawal, there is a 6-month waiting period before you can make a contribution. New rule – Immediate contributions after hardship withdrawal now allowed.

These changes go into effect in January 2020 and make me wonder why have they made it easier to take early distributions? Particularly knowing how underfunded Social Security, government and private pension plans are, perhaps this rule change can be used to point the problem finger at you?

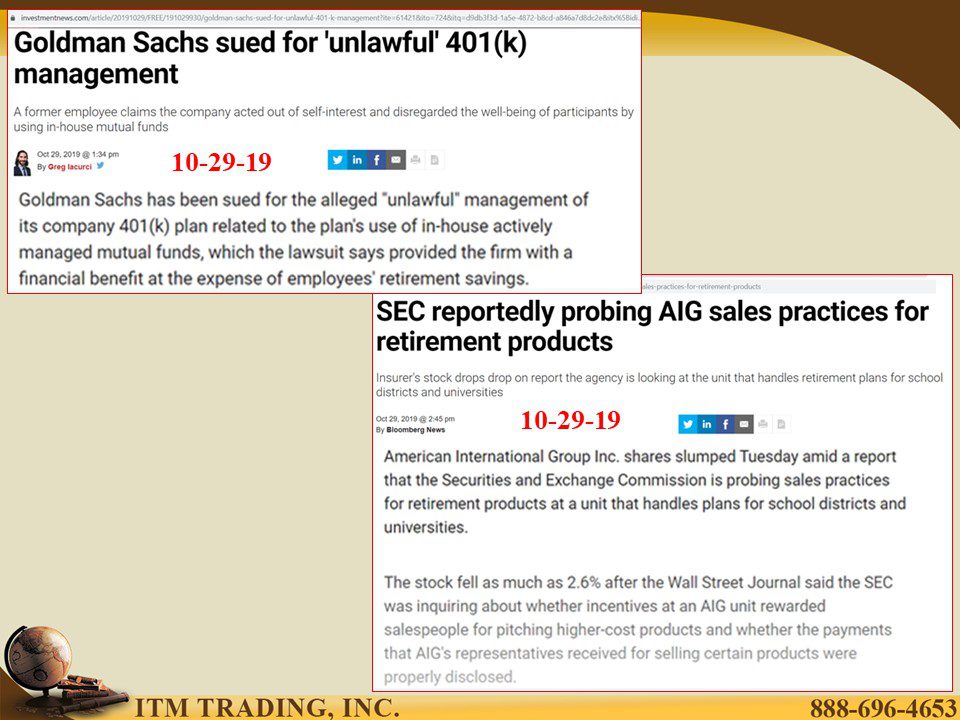

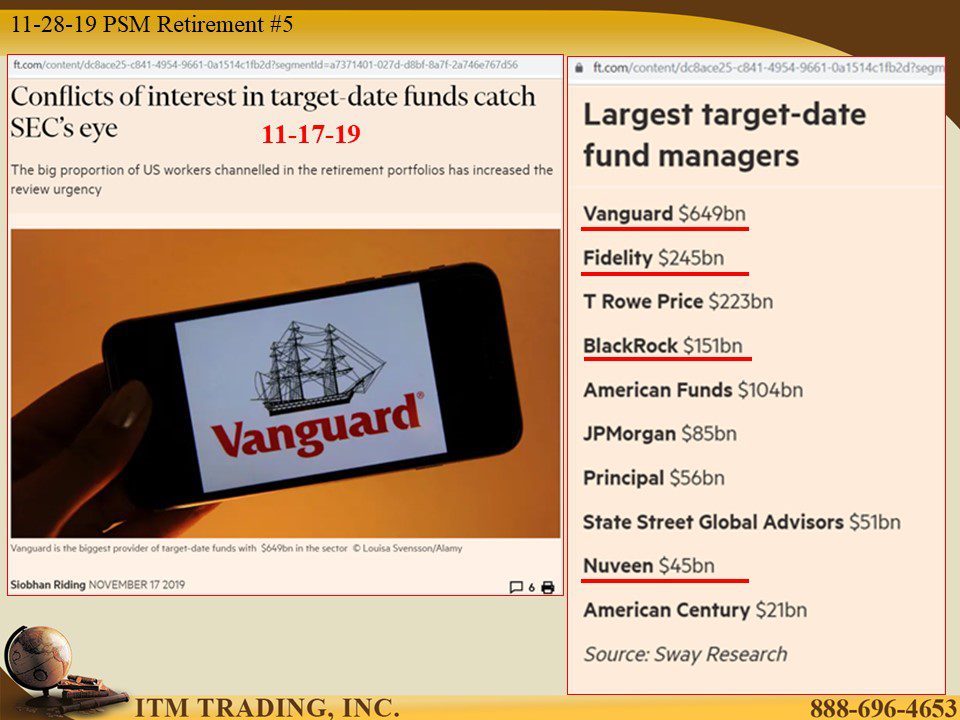

Because, even with stock markets making new highs, pensions remain underfunded. But what about investments in 401Ks? Those are provided by administrators and conflicts of interest now catching the interest of the SEC (a wall street self-regulatory body).

Specifically, target date funds that turn out to be created, managed and recommended by the same institutional investors that invest your retirement money. Why is that a problem you ask? Because, your choices may be directed to what benefits the fund manager the most, rather than you. Now that would be bad enough, but there is a hidden danger that has grown exponentially since 2008 and you, most likely, don’t even know about it. But you should.

It’s called “Interfund Lending†and it makes the safest fund in a fund family, as risky as the riskiest in that same fund family.

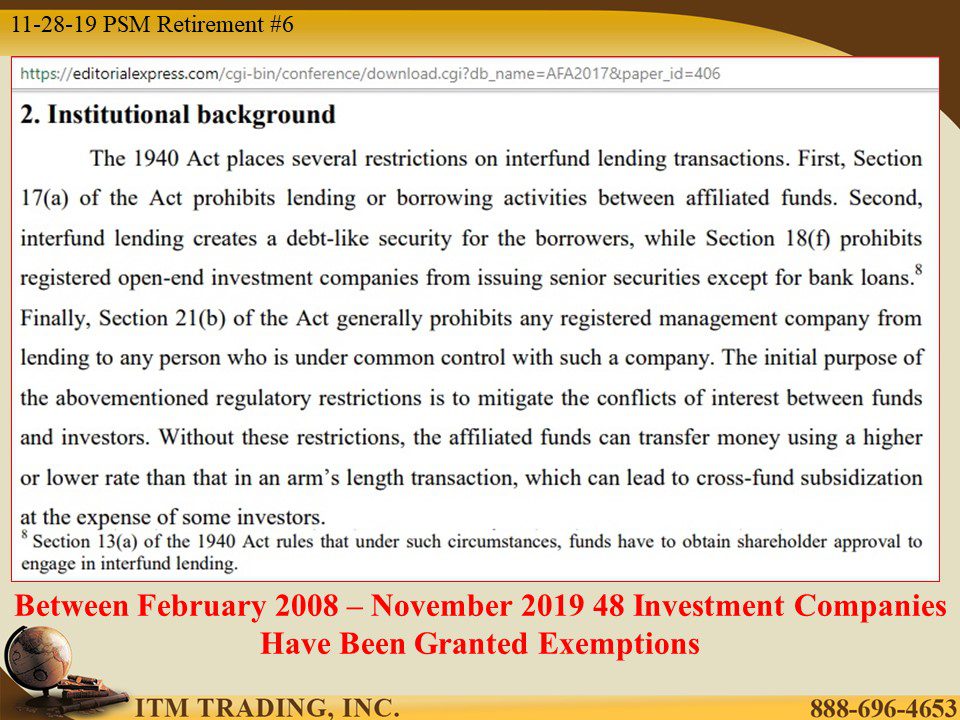

The Investment Act of 1940 prohibited interfund lending because it “can lead to cross-fund subsidization at the expense of some investors.†Section 13(a) allowed a waiver if funds obtained shareholder approval. Since 2008 the SEC has granted 48 investment companies’ waivers. Do you remember giving your approval? Perhaps that’s because you are not the legal registered owner but merely a beneficial owner, so they didn’t have to legally ask you. Do you trust them?

I don’t and it appears that some Americans don’t either, as witnessed by the highest level of savings since 1993 and that’s a problem for the Fed who wants spending, not savings. This could also be an indication of erosion of confidence in the public, which is the real problem for them.

Unfortunately, dollars won’t save them, though they work for the first line of defense when the economic fireworks begin. For real wealth preservation we need real money, gold. Over 6,000 years only gold has proven to hold value as fiat currencies purchasing power is inflated away.

That is one reason the smart money is accumulating physical gold. Are you in that camp?

Slides and Links:

https://www.gao.gov/assets/700/698041.pdf

https://editorialexpress.com/cgi-bin/conference/download.cgi?db_name=AFA2017&paper_id=4-6

https://www.sec.gov/rules/icreleases.shtml#interfundlending