WILL YOU BE FOOLED NEXT? Repo & Money Market Lies Fuel the Collapse… by Lynette Zang

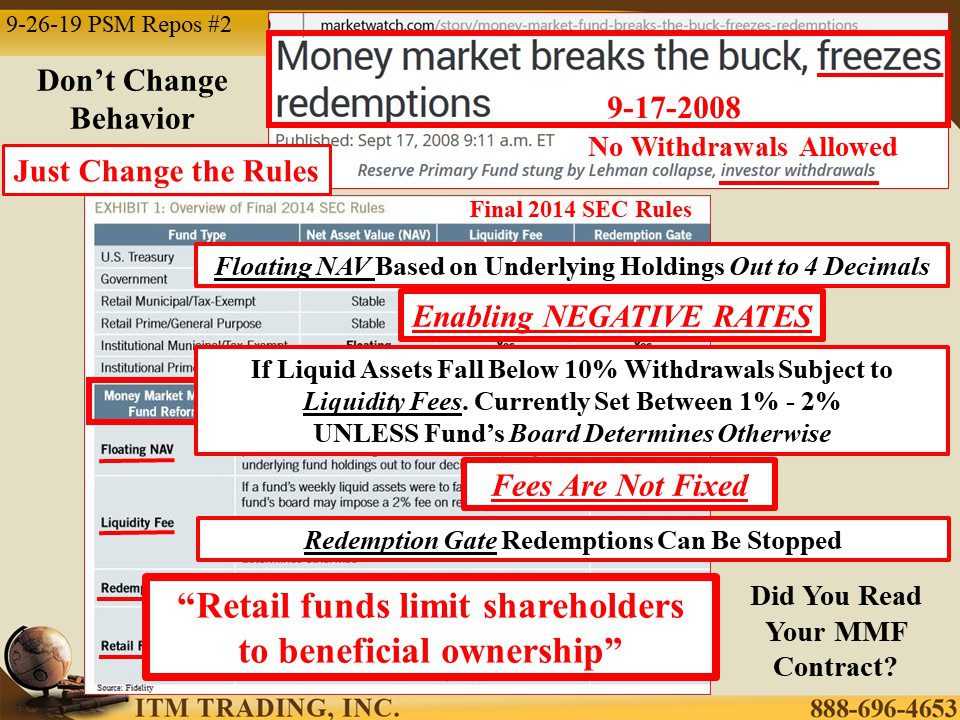

In 2008, the fiat financial markets were ultimately made visible because of a lack of liquidity in the interbank funding markets, causing the Reserve Primary money market fund to drop below $1 per share and freeze redemption’s, which then caused a run on money market funds and forced the government to step in with guarantees to calm public fears. Then they quietly changed the rules as the public began to think everything was back to normal.

The central bankers were forced to experiment with a tsunami of free money adding lots of liquidity that subsequently reflated targeted assets, (real estate, stocks and bonds) to new highs, as value was being ignored by the markets that demanded more and more free money, so they could blow bigger and bigger bubbles.

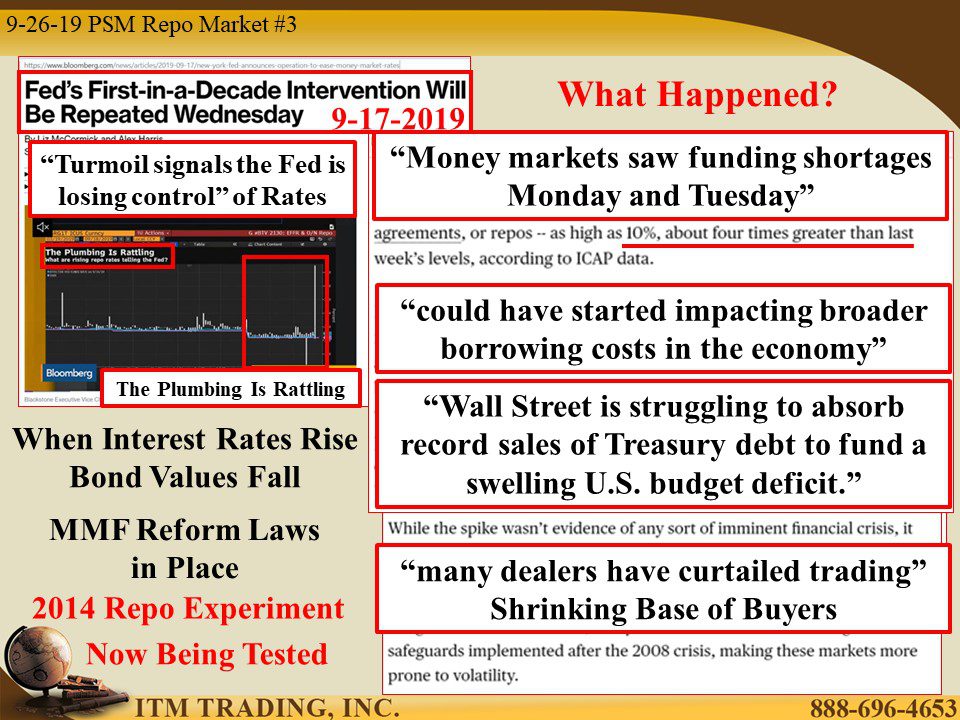

After more than quadrupling their balance sheets, the Fed attempted to “normalizeâ€. In 2014, the Fed began maintaining vs growing their balance sheet, but what could make up for the loss of liquidity provided by balance sheet expansion? Repo’s and reverse repo’s.

In a repo transaction, corporations borrow cash from each other by putting up securities (treasuries, MBS, agency debt) as collateral with a promise to buy the collateral back at a later date, for a higher price. This provides liquidity to the markets using existing collateral. Repo transactions temporarily increase the quantity of reserve balances in the banking system. A reverse repo, it’s just the opposite. Central bankers use both in an attempt to hold interest rates within a preferred range.

Where do banks and corporations get the cash? Mostly from money market mutual funds (MMFs).

Individuals typically hold MMFs inside brokerage or bank accounts. It’s sold as a cash alternative and many people feel “safe†holding MMFs. Of course, people’s memories are short, and most don’t read the fine print in the prospectus contract they’ve agreed to, which is to be a “beneficial owner†as the banks use your equity for short term trading and funding strategies.

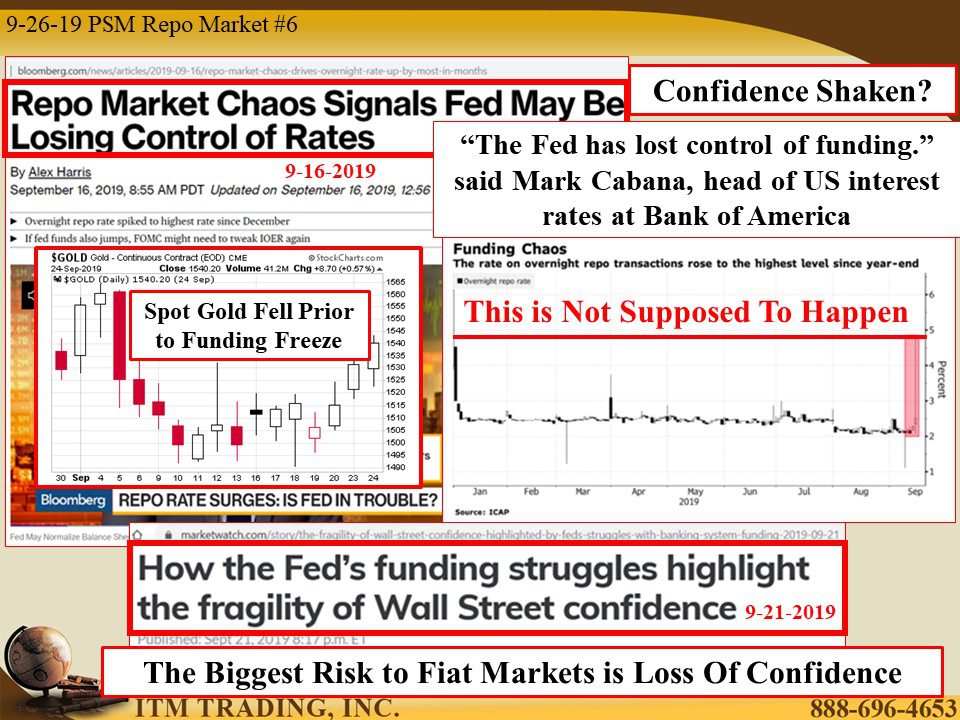

But last week, there were far more borrowers in need of cash than there were counter-parties lending that cash, creating a cash shortage in money market funds that threatened broader contagion to the rest of the markets. What that means is that YOU almost knew about it because money markets could have frozen again, like they did in 2008. Just what do you think that would do to confidence?

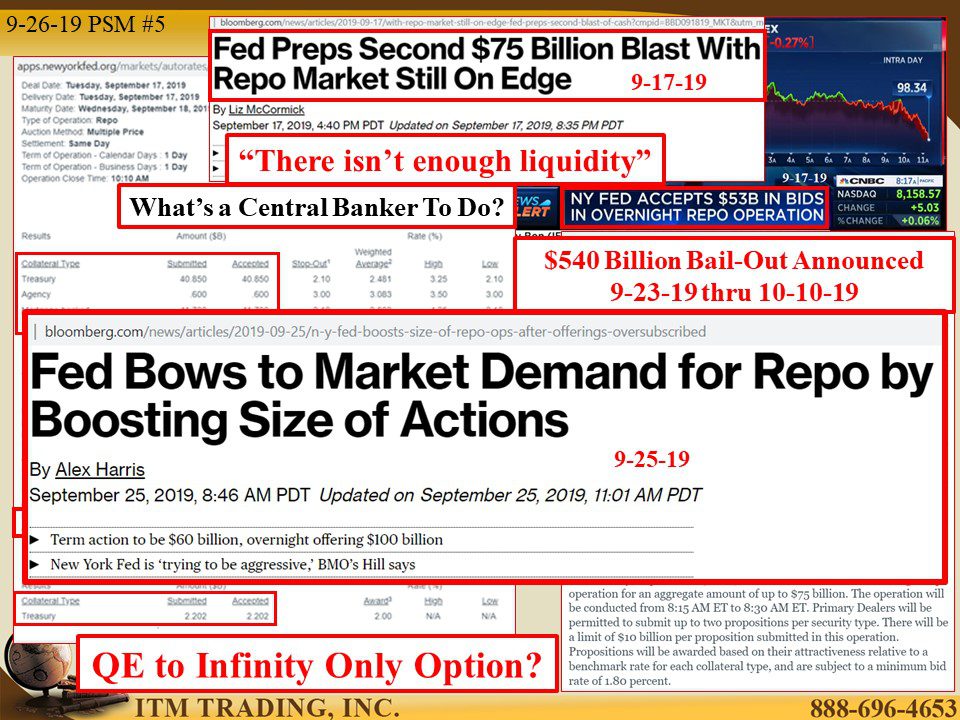

So even though they have not used the “QE†word outright, through September 24th, the Fed has promised to buy up to $540 billion worth of treasuries, agencies and mortgage backed securities from banks. On September 245th they upped the ante, but we’ll have to wait until they officially adjust the Repo and Reverse Repo Operations found here https://apps.newyorkfed.org/markets/autorates/temp

To put that into perspective, the initial bail-out number in 2008 was $700 Billion, remember how outraged the public was? Remember how congress over road the will of the people?

But what can central bankers do? What tools are left? Have they really lost control of interest rates? What does that mean for the markets? Implosion, which is highly deflationary. There is only one way to fight deflation and that is with inflation.

Central bankers know they are in trouble, their QE experiments are unwinding and there is only one thing they can do. Create and unlimited amount of free money.

The Fed is now bailing-out the banks again, but my guess is that this time, they will also be forced to bail-out the public through MMT or helicopter money.

Can the current system hold through the upcoming election? Who knows, but I’ll tell you this, you’d better be ready now because it is possible that the Fed has lost control of short term interest rates and desperate bankers do desperate things.

Slides and Links:

https://www.imf.org/external/pubs/ft/wp/2014/wp14111.pdf

https://www.marketwatch.com/story/money-market-fund-breaks-the-buck-freezes-redemptions

https://www.sec.gov/rules/final/2014/33-9616.pdf

https://fred.stlouisfed.org/series/EXCSRESNS

https://www.newyorkfed.org/markets/opolicy/operating_policy_190920

https://apps.newyorkfed.org/markets/autorates/temp

https://stockcharts.com/h-sc/ui

YouTube Short Description:

In 2008, the fiat financial markets were ultimately made visible because of a lack of liquidity in the interbank funding markets, causing the Reserve Primary money market fund to drop below $1 per share and freeze redemptions, which then caused a run on money market funds and forced the government to step in with guarantees to calm public fears. Then they quietly changed the rules as the public began to think everything was back to normal.

Can the current system hold through the upcoming election? Who knows, but I’ll tell you this, you’d better be ready now because it is possible that the Fed has lost control of short term interest rates and desperate bankers do desperate things.