WHY GET PROTECTED NOW? Money Printing Fails to Stop the Global Slowdown… by Lynette Zang

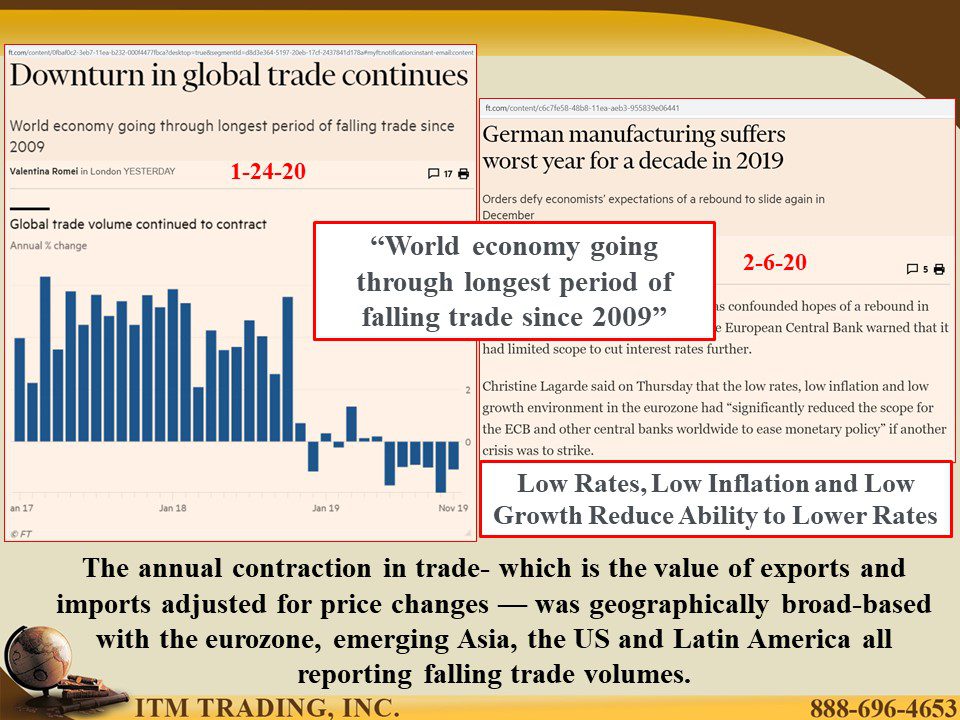

In the recent World Economic Outlook published by the IMF (International Monetary Fund) they state that “markets have again been driven by two main factors: monetary policy and investor perceptions about trade tensions.†And so, regardless of the slowing global economy, most stock markets are at or near, historic highs with valuations at nosebleed levels levitating on a tsunami of central bank money printing.

Have more questions that need to get answered? Call: 844-495-6042

To say that central banks are monetizing, not just government spending, but large private corporate spending as well would be an accurate statement and is what has enabled private equity to create unicorn companies with private market values in the billions even as profits are non-existent.

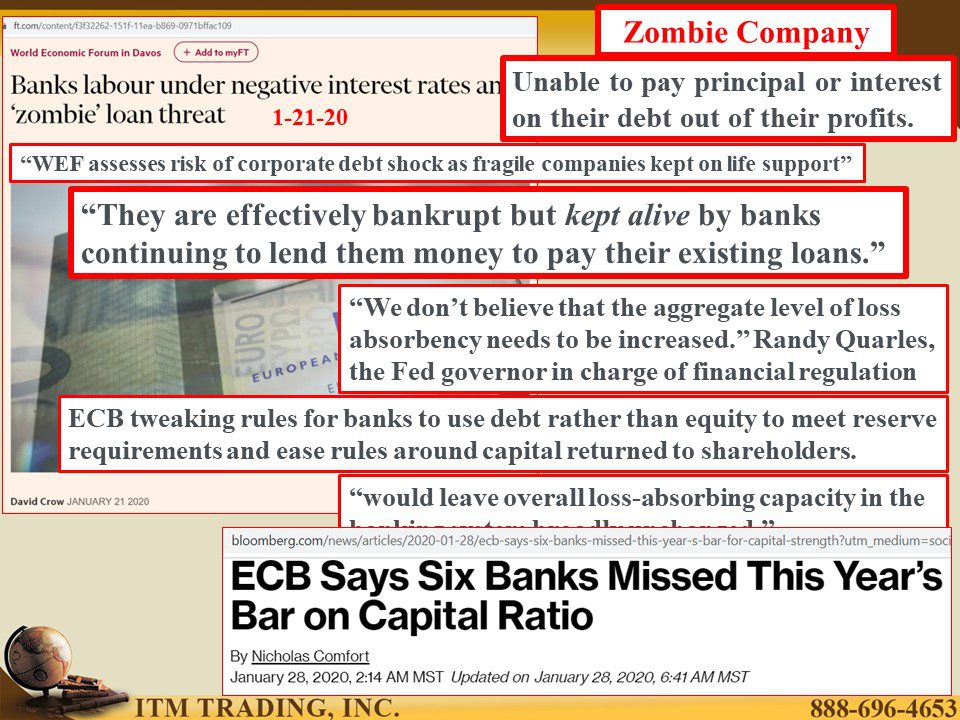

But it’s also enabled a global rise in zombie corporations that are unable to pay debt out of profits, but rather take on more debt to pay the debt they can’t afford to pay. Why would a bank extend more debt to these effectively bankrupt companies? To avoid having bad loans show up on their books and making the truth visible to the public.

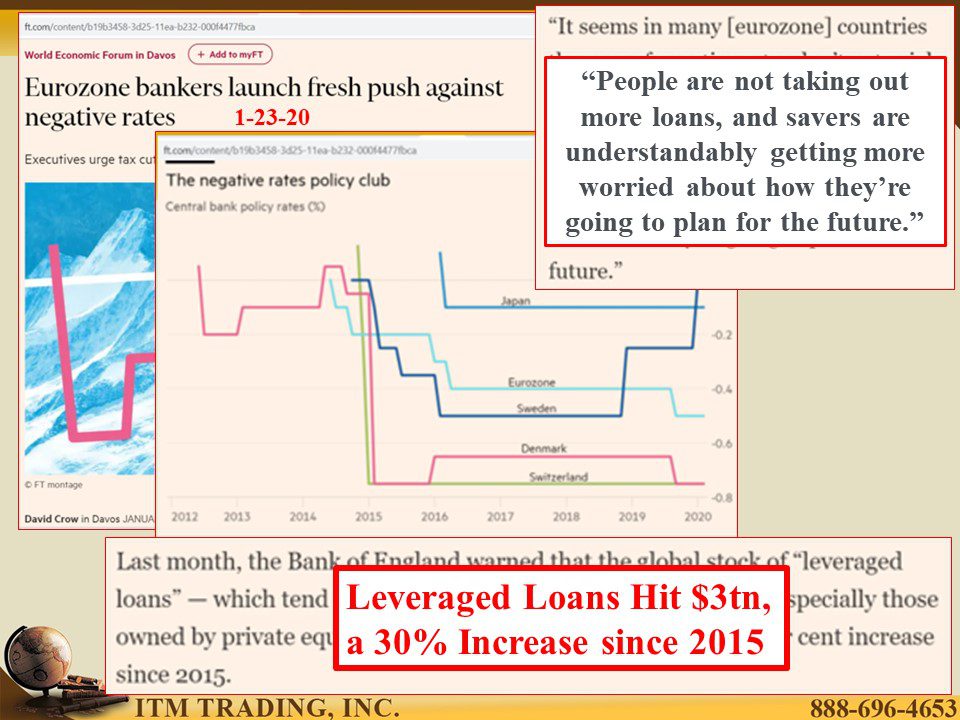

This is one reason interest rates cannot rise. The resulting default rates and devaluations would, most likely, overwhelm the central bankers’ ability to keep the problem hidden from the public and the final loss of confidence would ensue. Which is something that should be avoided as long as possible since public confidence is the last peg that enables the central bank ponzi scheme.

What is the central bank response? Even though insanity is doing the same thing yet expecting different results, they seem to think doubling down on failed policy will somehow work. Though personally, I don’t think they really believe this, I just think they don’t know what else to do. I’d say they are between a rock and a hard place.

What’s the solution? Real, savings based, indestructible, widely used money, physical gold and silver in your possession.

Slides and Links:

https://seekingalpha.com/article/4315053-golds-outlook-for-2020

https://www.imf.org/en/Publications/WEO/Issues/2020/01/20/weo-update-january2020

http://www.ft.com/content/c6c7fe58-48b8-11ea-aeb3-955839e06441

https://www.ft.com/content/b19b3458-3d25-11ea-b232-000f4477fbca

https://www.ft.com/content/f3f32262-151f-11ea-b869-0971bffac109

https://news.yahoo.com/gold-bentleys-lebanese-spend-big-salvage-savings-112041796.html