WHEN REAL ESTATE DROPS: [PT.1] Thriving with Gold & Silver during Hyperinflation & The Reset

This two-part series focuses on thriving with gold and silver during a hyperinflationary reset. Part 1 focuses on the two key things that are critical to real estate. One are the real estate taxes and the other are the mortgages. We look at the currencies of Germany, Greece, and Venezuela.

TRANSCRIPT FROM VIDEO:

Well, you’ve been asking for the 25 ounces of gold buys an entire city block, wait until you really see. Everything that I put together here it’s even better than that, coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading and of course, a full service, physical gold and silver dealer really specializing in strategies. And one of the big part of the strategies is getting everybody into position to take advantage of the inevitable collapse of the currencies. And you know, I mean, I remember back a couple years ago and I would say the reset that has already begun. And I was told, oh, you can’t say that you get, and I say, I have to say that because it’s true. And it is all setting everything up for those that are in the right position. So no, it’s not all doom and gloom. If you have your food, water, energy security, barterability, wealth preservation. So you hold your purchasing power, community and shelter. For those of us that have gotten into that position, we will have the ability to sustain our standard of living and take advantage of the opportunities. So let me show you where those opportunities actually lie.

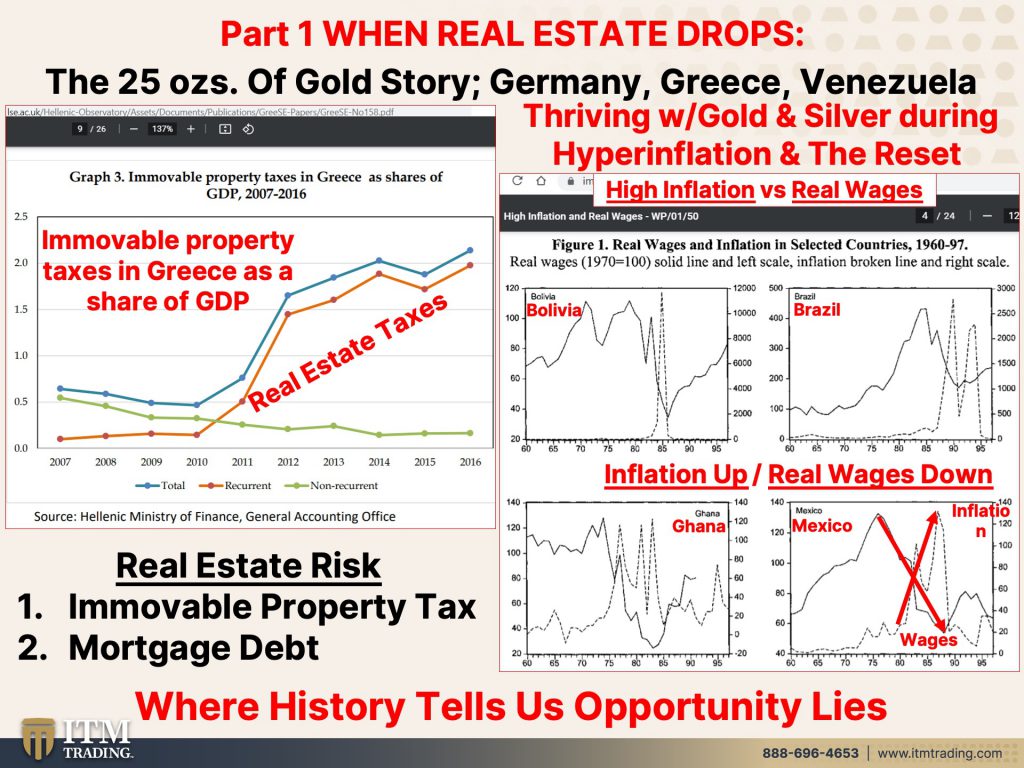

We’re going to start with, we’re going to start with thriving with gold and silver during a hyperinflationary reset. And remember I’ve told you there were two key things that are critical to real estate. One are the real estate taxes because governments use taxation to generate the income that they need to pay for all the spending that they do. How easy is it to spend other people’s money? And the other are the mortgages, and this is going to be a two part series. So I hope you’re relaxed because this is probably going to take some time and next week I’ll, I’ll go into some of this in three more countries. But today we’re going to look at Germany, Greece, and Venezuela.

So as the inflation is going up, then, well guess what the ability to pay with real wages actually goes down because one thing we know a hundred percent is that in the scheme, when they were developing this fiat money strategy, they knew that real wages would never, ever, ever keep pace with inflation. So your mortgages may be fixed, but your other costs are not food insurance, etcetera. So the ability for people to keep and maintain their real estate, or I’m going to even say these days, the businesses that have flocked in to the single family home area, the ability for them to maintain and keep that is not in my opinion, and historically not very good. And that’s what open. That’s what opens up the opportunity, you know, in the beginning, when you’re getting liftoff then what you, what the government, what the central bankers want is that leverage. And it makes you look richer. But when things shift, you have to have the ability, boom, to pay it off, which is exactly what the gold is about. Holding your purchasing power when everything else is losing it so that you can then go in and take advantage of that. So again, real estate risk that we’re going to be looking at today is the immovable property tax, because you cannot put a piece of real estate on your back and move it. You can put a piece of gold in your pocket and move it. Okay. But you can’t do that with real estate. And it is a third of the dynastic wealth. So that’s wealth that lasts and families at least 300 years. It is a third on that stool. And this is where the opportunities lie. So let’s take a look at that. I’m going to start here. If you haven’t watched this whole interview, you want to, it is amazing how little people know of history, but, you know, and they always think, well, this time is different. Do you think this time is different? And do you think that it’s going to be localized when it like it was in Romania? And when the Soviet, when Russia fell, the USSR fell, or do you think this is more global? What do you think is going on?

Well, I think the song may be different, but the tunes are similar. So it’s always with a different twist just because of how the global politics shifts. In the meantime, of course, however, the effect on the general people is always the same. It could be a different global situation. It could be a different economical situation. However, the effect on the general public, the good old, you know, nine to five people who just their only fault is that they, they haven’t paid attention. The effect on those people is always the same and it’s always suffering and losing their savings and losing their, you know, multi-generational properties forms or something like that. It’s always the same. So I try to approach it from them from their perspective, because where we have control is truly in our lives and what we do have being west and so on. We don’t have too much control about global politics. And yes, it’s good to know about those things. And it’s good to know how things shift so you can dissipate things. However, a lot of people will focus on those things where we don’t have no power and then we feel powerless and we feel that we have nothing to do well. Of course, there are a lot of things that we can do, how we can prepare. So we are not affected. Yes, it’s different in the sense this time, I think we are much more global. It was sort of global even back then because the hyperinflation situation Romania was really tied together with the post-Soviet hyperinflation of Eastern Europe and all these other Soviet satellite states and including Russia, they suffered a lot as well. So I tried to talk about their history a little bit, the one, at least from what I studied, however, this time it is, I would say a bigger empire that is really all across the world. You know, there’s very little, very few countries in the world where they don’t know what a dollar is. You know, it might’ve been different back then. People knew about the Soviet union, but they were not trading rubles or other currencies in the four corners of the world. Well, now they are, they are trading in dollars, right? They have, even in Romania today, we have exchange houses and people save in dollars. Now we’re saving euros. And then we use those currencies. Sometimes when we list property in Romania, we directly say it in euros, or we directly say it in U.S. Dollars because we know we kind of don’t have we don’t trust our own local currency anymore. So this is a much more global thing, and it will be much, much bigger. However, the effect on the general people is always the same. They just lose everything.

Absolutely. And so, first of all, I don’t want you to be the ones to lose everything. And second of all, you know, this is when wealth really shifts inside of a country. And I would like it personally, if everybody of all of the viewers were actually the ones to have the wealth shift their way.

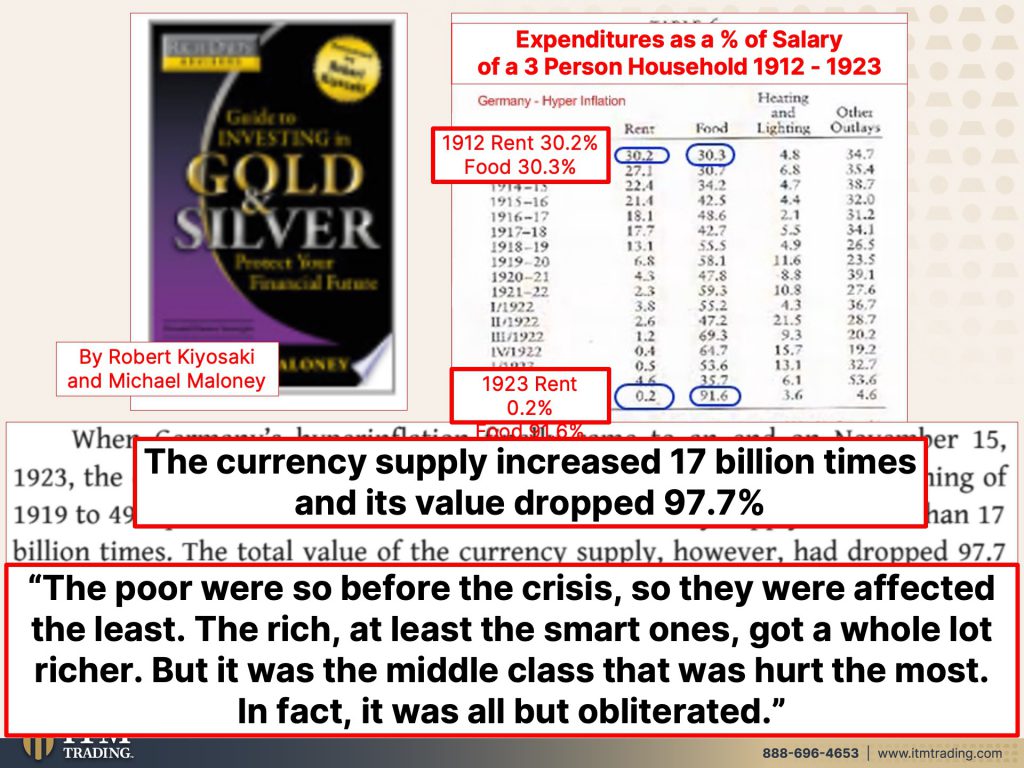

So you might recall this book that was written in the nineties by Robert Kiyosaki and Mike Maloney. And that’s actually, apparently I read that book because that’s actually where I got the 25 ounces of gold. So we’re going to start with Germany. And I’m telling you in this whole series, I’m doing six different currencies because people always say, well, that one count. And that one does well, there’s 4,800 of them tell me that all of them don’t count because this time is different. This time is not different. So when you look at expenditures, back in 1912, before the hyperinflation came in, you had basically equal amounts that were going to rent to food and then to others.

But food becomes the single biggest issue for people during a hyperinflationary event, you can live without some things. I mean, you could live without a shirt, but you gotta eat and you gotta drink. And so during the hyperinflationary event, you had what, in this particular case, in Germany’s case 91.6% of whatever money they got went to food, what are they going to pay first? So if they can’t pay their rent or they can’t pay their mortgage, what happens? They lose the property. But when Germany’s hyperinflation finally came to an end, the currency supply had grown from 29 billion. And actually it increased 17 billion times and its value drop 97.7%, probably actually more than that in reality, because they were only printing one side of the, of the currency. The other side was blank. And that’s the side that had more value, not the currency side, the poor were so before the crisis. So, I mean, when you’re poor, there’s only so far down, you can go when you’re wealthy and you have these tangible assets, okay, well then you get to expand your wealth base. It’s the middle class that gets hurt the most. And they’re typically the ones that trust the system the most as well.

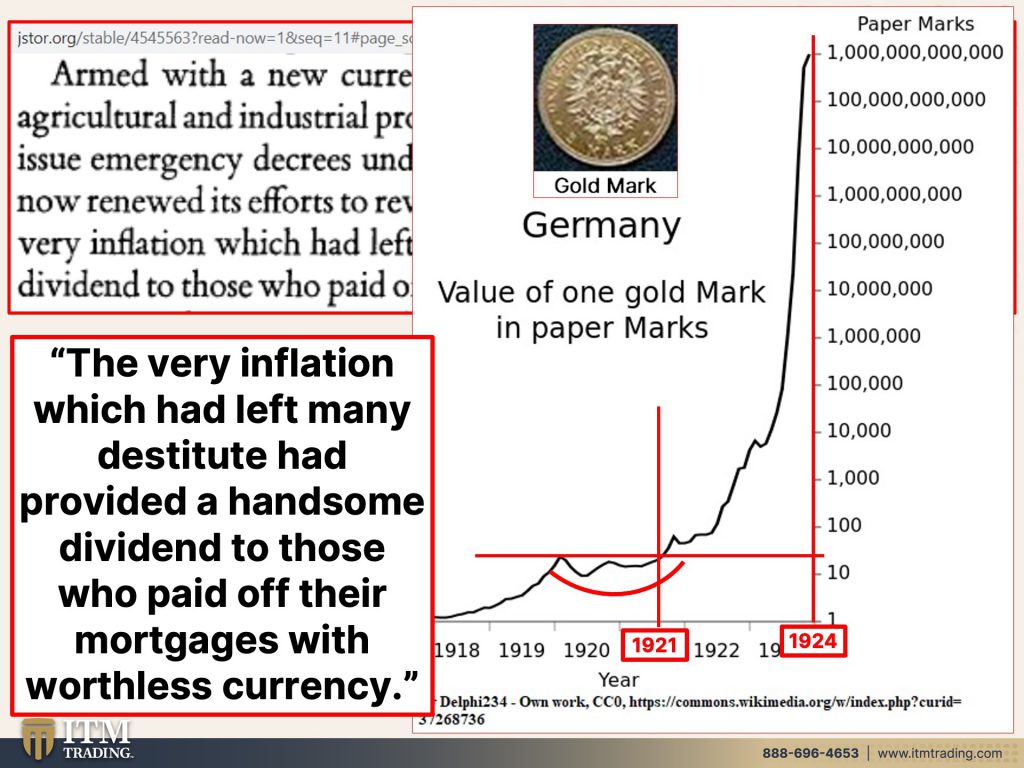

Armed with a new currency, backed by mortgages on Germany’s agricultural and industrial property and empowered by the right tag issue, emergency decree under 23, enabling act, the government now renewed its effort to revive the housing construction industry. The very inflation which had left many destitute had provided a handsome dividend oh my! To those who paid off their mortgages with worthless currency. And if you listen from the, to the interview from Arpad, he knew people that were able to pay off their mortgages, but they were in a different position than the masses because your income will not keep pace with that. So again, the very inflation that had left many destitute had provided a handsome dividend to those who paid off their mortgages with the worst Lyft currency. And so you can take real money gold converted into that worthless currency and get that mortgage paid off like that, and maybe buy a whole bunch more of then income producing currency. Now what you’re looking at here is a gold mark, which is a little bit more than a 10th of an ounce. So this is actually what this is showing you, but I’d like to point something out here because we’ve seen it. We’ve talked about it in our videos, that ITM videos, you see this cup formation. Oh my! There’s that pattern. Isn’t an absolutely smooth cup. No it isn’t. But I would also like to point out because we’ve experienced this even in the manipulated spot market, we have, we have witnessed the formation and the breakout. And then since I didn’t really actually put that in here. Okay. But you can see how there’s like a little bit of a struggle here to get it going before it hits new highs. So this my friends right here, this is where we are right now. They’re going to suppress that because a rising gold price is an indication of a failing currency. But if you hold your wealth in gold, which is proven for thousands of years, thousands of times, then your best shot is what we’re looking at right here. This is key. That’s how it works. By the time that they reset the currency. This is, you know, gold was floating. A full ounce was 87,000, but the very inflation. So this is the whole point of buying gold. Part of the strategy to convert into income producing real estate. Part of the strategy is to pay off that mortgage. Part of the strategy is to have these smaller pieces of gold. And I know that this is hard to say, this is a $1 gold coin, a $1 gold coin, right? This is a five, but you have a different variety of sizes to pay those property taxes. Because if you do not pay those property taxes, you are losing the property. You want to really keep that in mind.

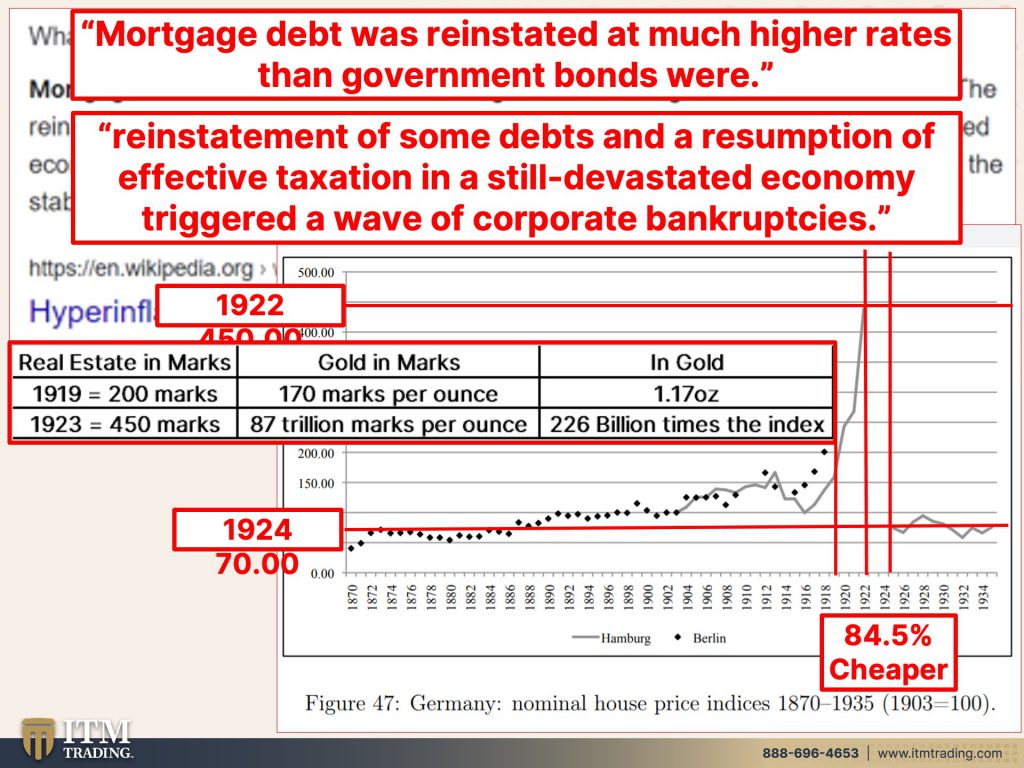

So what happens to the mortgages? Well, during this period of time, mortgage debt was reinstated at much higher rates than government bonds were. And the reinstatement of some debts and a resumption of effective taxation on is still Dave stated economy. Trevor triggered a wave of corporate bankruptcies. No kidding. Do you see the opportunity? You’re in those stocks? Do you know which corporations are going to be able to survive this? No, because they’ve all just eaten and created and generated so much more debt. And there’s so many more zombie corporations, but as we go through this hyperinflation that will be wiped out. And those corporations, all the building that you see, I mean, I see it here in Phoenix, all over the place. And if I didn’t know better, I’d say, wow, we must be in a real boom time. But all of those mortgages, and I’ve shown you, this are turned into wall street products and sold back to you. So they’ve already gotten their profits out of it. They’ve already gotten the gains out of it. You’re the one that eats it on the shorts. Unless you have gold, then you can go in and you can pick up that real estate, dirt flipping cheap. You can pick up stocks, dirt, flipping cheap. But in, in all cases, we want to make sure that it’s near a bottom. And we want to make sure that those corporations, that can’t survive are not what you’re buying. You want to buy the ones that have the ability to survive. So what happens to mortgages is they get restructured and reset. And we saw that back in 2008, when the system really died, we saw that back then. And so some people may have gotten that mortgage loan modification. I know, I know somebody that did. And when I looked at the modification, it was not really in their best interest okey-dokey so this is actually an index of 10 cities from Germany during that period of time. So, unfortunately I could, I mean, this has been, this is why it’s taking so long because it’s not like that information is easily available. It’s not. And so we’re going to be looking at an index on a nominal house prices. And this runs between 1870 and 1935. And this is 1919. What I’m showing you right now. And the index at that time was roughly at 200. So the hyperinflation was already in gear and you can kind of see it here. House prices were going up. House prices has been going up all over the world because of all the money printing and the, and the cheap credit. By 1922, that index was up to 450. But by 1920, when they did the restructuring and the reset, it was down at 70. So what does that actually look like? Let’s take a peak because real estate nominal prices dropped 84.5% to put it another way. At 1919 at roughly 200 marks, that’s 170 marks per ounce to buy gold. We saw that on the previous slide. And so 1.17 ounces of gold would buy an index. One of the indexes, that’s an average of the nominal price houses in 10 cities. But by 1922, when it hit a peak and this was the start of it. So the marks per ounce of gold were up at 396,000 marks. And we weren’t in the full blown hyperinflation yet. You could still buy a 1,031 times this index. So if you were holding gold, this is how it was actually less than 25 ounces of gold. When you do these calculations out, could buy an entire city block buildings in all.

So I hope you can see that you see how it drops, because when they reset a currency, everything drops, everything does. But if you hold your purchasing power, it’s in this sweet spot here. When they do that reset, that gives you the best advantage. And we’ll see it in the cup formation. So just stay tuned because we talk about that and I show you that all the time. So here we go. Those who could quickly adapt to a world. They had never seen before a world turned upside down prospered. And how could they quickly adapt? Because they had everything in place, food, water, energy, security, barterability, wealth, preservation, community, and shelter. They could adapt because they weren’t scared. They had everything in place. If you’ve been procrastinating, if you’ve been postponing, will you please stop? I mean, seriously, will you please stop at this time an entire city block of commercial real estate. And this is from Robert Kiyosaki’s book at this time, an entire city block of commercial real estate in downtown Berlin could be purchased for just 25 ounces of gold. But you can, you can see how that could even be expanded. Quite honestly, those who held their wealth in the form of currency became poorer and poorer as they watch their purchasing power destroyed by the government. Do we not see our purchasing power being destroyed by this government and by these central banks that are just printing money? For what? I mean Supposedly we’re in recovery. We’re not, we’re not all of the experiments that have gone on, particularly since 2008, all they’ve done is create some kind of semblance of things getting better. But if they really were, we wouldn’t have a K-shaped recovery it’s that, that wealth gap grows wider and wider as the governments and the central banks devalue the currency, because those in the know are converting into hard, hard assets, hard assets that are movable. And yes, Mark G, fixed rate mortgages do get restructured. So you want to be able to pay them off in a moment’s notice. Did you do that? Did you put that up? Okay, so good. Go ahead and do that. That’s good. Those who held their wealth in the form of gold, watch their purchasing power increase exponentially as they became wealthy by comparison. So during financial upheaval, a bubble popping a market crash, a depression or a currency crisis, such as this one, wealth is not destroyed. It is merely transferred. How many times have you heard me say that wealth never disappears. It simply shifts location. So the goal is to have that wealth shift your way, and you do that by holding your purchasing power intact. And frankly, gold and silver are the only undervalued assets. And gold is the only financial asset that runs no counterparty risk. None, you hold it, you own it outright.

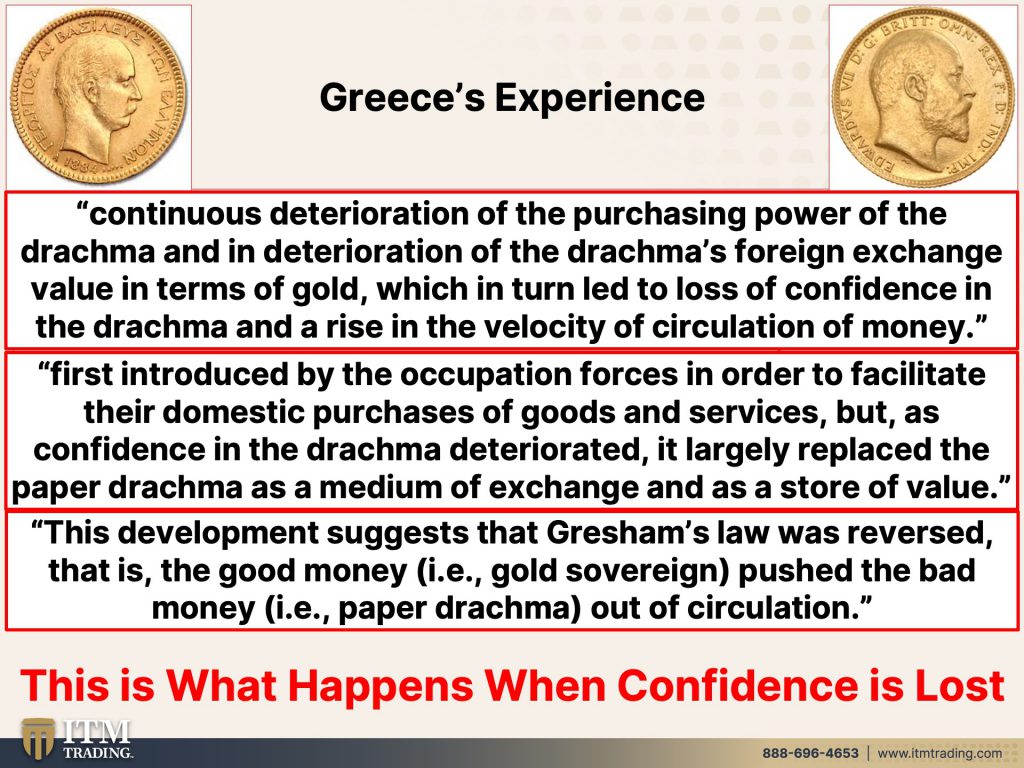

So let’s go look at Greece. Now, Greece was interesting. And I’m going to tell you the specific data on all of this is really, really hard to dig out. So I did my best. I did my best good luck to anybody else, but I definitely did my best. So they had the gold Greek drachma, and they also had the paper drachma, the interaction of non…let’s see, what’d I say, okay. Continuous deterioration of the purchasing power of the drachma and in deterioration of the drachmas foreign exchange value in terms of gold, which in turn led to loss of confidence in the drachma and arise in the velocity of circulation of money. That is the one piece that I have not yet seen reflected in the monetary velocity charts. Remember, I’m watching that pretty consistently. You guys can too. You just go on the Fred, FRED website, and you can put that in, in the search bar and you’ll be able to watch M2V, that’s the monetary velocity of money. So we haven’t seen that shift yet, but people are shopping. They’re spending money. So I’m sure we’re going to see that shortly first introduced by the occupation forces in order to facilitate their domestic purchases of goods and services. But as confidence in the drachma deteriorated, it largely replaced the paper drachma as a medium of exchange and as a store of value, why? Because gold it anywhere in the world, this is a globally accepted money. So anywhere in the world, you could go and have the same level of purchasing power. So the paper drachmas, nobody wanted to accept them. They had no confidence in it. And that’s the whole piece. That’s why all you, when you’re listening to the central banks, etcetera, what are they talking about? They’re talking about expectations and consumer confidence. It’s not reality. It’s what the public expects and how much confidence the public has in the currency, in the central banks, in the government. That’s the big key and it’s not whether one bank trusts another bank. Heck no, it’s the public. There are way more of us than there are of them. This development suggests that Grisham’s law was reversed, and that is the good money example. The gold sovereign pushed the bad money, the paper drachma out of circulation, but in the beginning, it’s just the opposite. People would rather spend that paper drachma and hoard and hold the gold. And I certainly do okay? Because I totally get what’s happening to the U.S. Dollar to this stinky piece of paper that has virtually no, it’s really, this is really officially 3 cents worth of purchasing power.

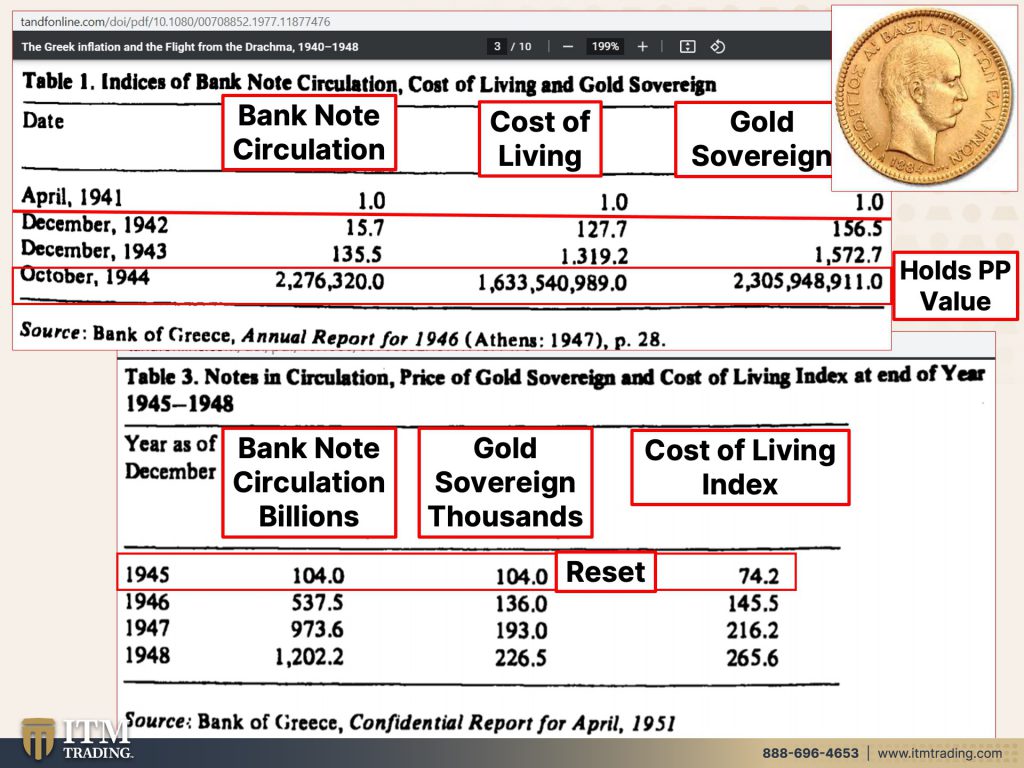

So let me show you what happens when confidence is lost. And this was, and this was during a night between 1940 and 1948. And this study looked at bank notes in circulation, the cost of living and a gold sovereign and a gold sovereign is not a full ounce of gold. By the way, it is just this sovereign is probably a 20th or a 10th of an ounce, depending upon which size it is, which frankly I can’t tell, but in April, 1941, they all were the same. Everybody started out at one, but by 1944, I made, I think that you can see that the costs, the bank notes in circulation exploded, which is what’s happening here, right? Been happening since 2008, but went on to steroids in 2020, along with the cost of living, which exploded. And I mean, is that not what’s happening here right now? Is that not what’s happening around the world right now? But the difference then was they didn’t have the paper markets to suppress the price of gold. And so gold went up as it normally would as the true flight to safety as an asset that has full functionality across every single area of the global economy. So you can see that gold absolutely maintained. And then some your cost of living, it holds its purchasing power value. That’s in my opinion, the single most important function of gold has lots of functions. It’s the most functional asset that there is that and silver, but the key here is its most important function is to hold purchasing power between 1948 and 1945 in 1948. When they did the reset, you can see that everything got reset, but it’s still outperforms the cost of living because that’s what gold does. When it’s not manipulated. But again a rise in gold price is an indication of a failing currency.

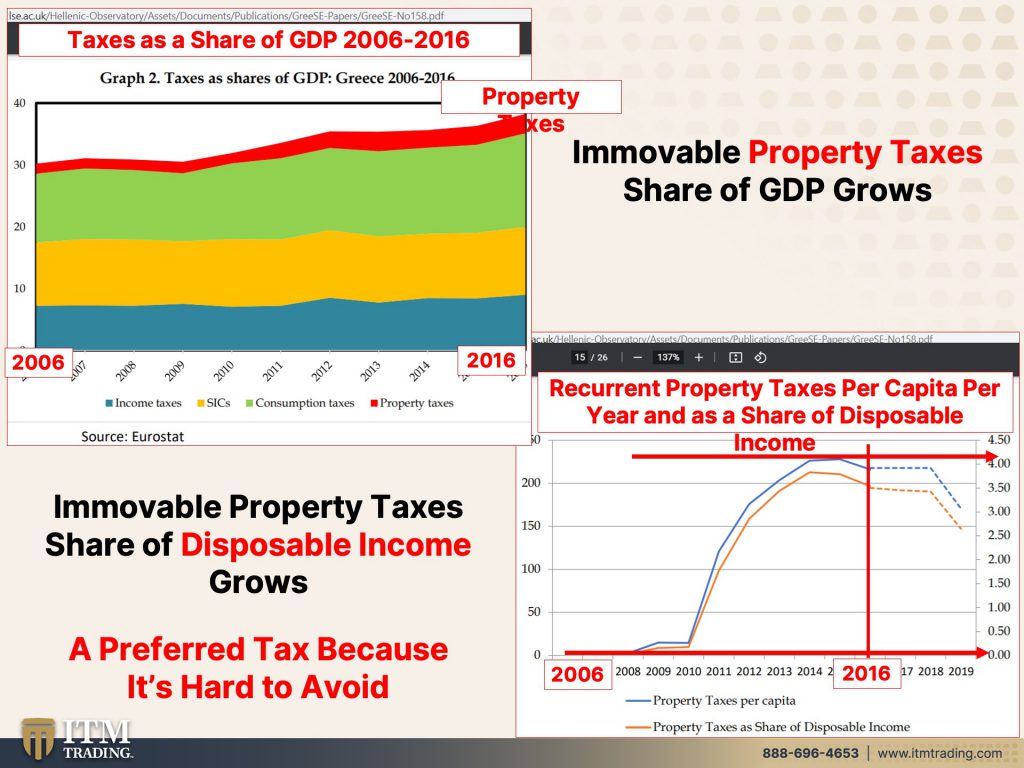

Now I’m going to take us to the most recent piece of Greece because that I could get hard numbers on, which was not also not really easy, but I love this. I love my work. I really love my work. It’s so interesting. I learned so much all the time, but these are taxes as a share of GDP. And what I want to focus on is the immovable property tax, because I think that you can see that, that expanded this red band here got bigger over time as Greece was going through the sovereign debt crisis and as recurrence. So that means annual, proper immovable property taxes per capita per year, but as a share of disposable income. Well, I mean, it’s pretty obvious where it was in 2006 and where it ended up in 2016, right? Understand too that Greek property, just like U.S. Property, just like property around the world, because frankly it’s one of the largest shares of GDP that there is, is property. It was not allowed to fully express. In other words, go down as low as it should have. So we’re not even looking at a reset circumstance because they could not hyper inflate the drachma. And I’m going to show you that in just a second, but everything grows. And by the way, immovable property taxes are a preferred tax because you can’t put it on your back and move. You can’t hide it. So it is a preferred tax that they will use to get more money out of you, which is why you need the smaller fractional pieces of gold or a lot of silver to pay those property taxes. So it kind of depends. I kind of like to do it with gold, but if you have a lot of silver, you’ll be able to do it with that as well.

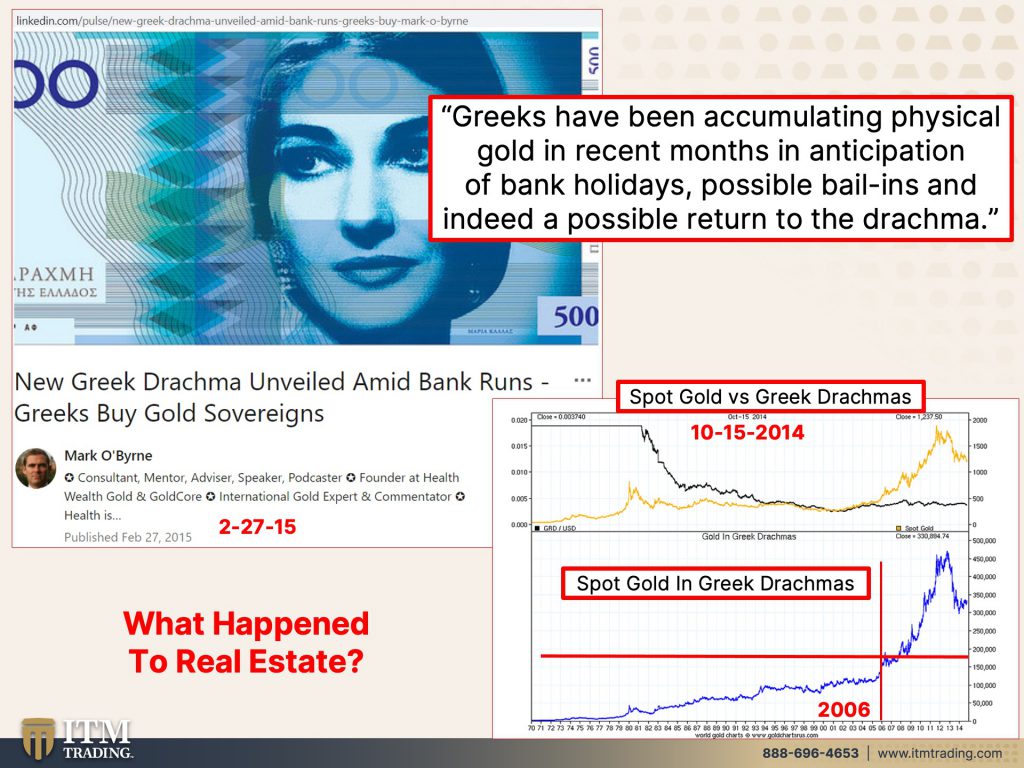

Okay. So during this period of time, I hope you can remember it because Greece was put under, you know, they got all these loans and they were put under austerity, which of course nobody’s doing austerity. This was a big experiment to see how it would fare. And it didn’t work very well, but there was a time and I personally think they should have gone back to the drachma, but they were not going to let Greece out of the Euro. They were not going to let that allow that to happen. In Great Britain. It was different because they never adopted the currency. But in Greece they did. So Greeks started accumulating physical gold in anticipation of bank holidays, which by the way, they did get and also the need to return to the drachma, which did not happen. But what did they fly to? So people we’ve been taught that gold does an old Relic, except that central banks are accumulating. It like crazy. It’s not, this has been in our DNA for thousands of years. People know that gold has value. They’ll remember it again. I promise you, they will remember it again. I did not forget it. This is spot gold in terms of Greek drachmas. And we also did it in terms of the Euro. So here we are in 2006, and this is what happened to gold during this period of time. And again, it was not allowed to fully express where it should have gone because they couldn’t, they couldn’t hyperinflate the drachma since were on the Euro.

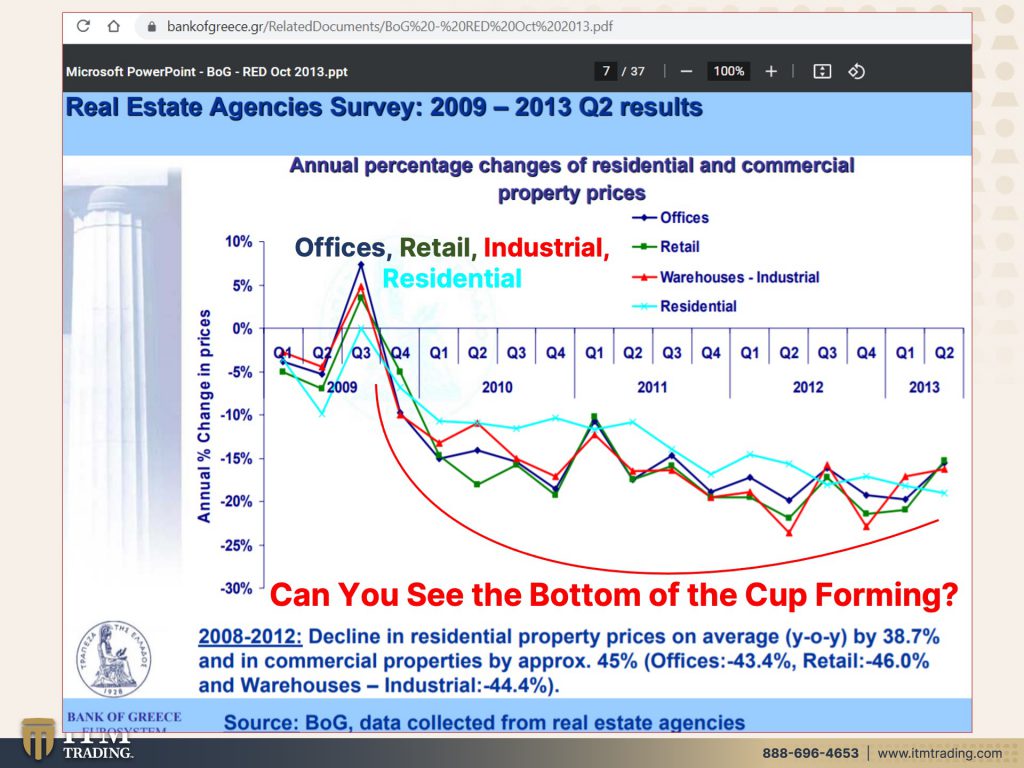

But let’s look at what happened in general to real estate during this period. And this is offices, retail, industrial, and residential. And you can see here we are 2009 at a peak. And then of course it bottomed. Now, is this a cup? Maybe it’s probably a little bit too soon to tell in 2013, whether or not we were near a bottom, but I want to point this out to you because we will be paying very close attention to this, to determine when it is time to convert what you have here. Some of it, not all of it, but some of it into income producing real estate. I mean, but can you see that at least in here it’s forming. So it looks like we probably did get a bottom there and you’re never, if you ever get into anything at the very bottom or out at the very top, frankly, that is luck, but you just want to be in there somewhere near a bottom, out, somewhere near a top, and then you’ve done really well. So we’ll be paying attention to that cup formation.

Hopefully we will get, we will see the bottom. We’ll see it, I know that. And hopefully we will be able to, if you have gold, act on it and take advantage and have the wealth transfer your way. Because even during that period of time, Greek residential real estate fell precipitously. But if you had gold and you could go in, then you could definitely take advantage of what happened because spot was up a lot more than that 467% during that same period of time. But since the Greeks could not devalue their currency, what did they do? They mined more gold locally. Look at this. This is in 2016 and the level of mining increase. What was it? Because they found more gold? No, there is a finite amount of gold in this world, whether it’s in the ground or it’s above the ground, regardless of what form it’s in, there’s a finite amount of it. So if you cannot devalue your currency and you’re trying to create a stable base and you have gold that you can mine, that’s what you’re going to do. You’re going to mind more gold. And then this is what it looked like in 2002, you could have, it would have taken you 775.5 ounces of gold to buy the average house. By 2013, it was only 117.86 ounces to buy the average house. Do see my point? And this isn’t even a fault. This wasn’t a full reset. This was just Greece being in deep do-do. Well, we’re in way more than deep do-do now because we have to reset the system, the system, no longer functions and no longer works. And I hope you can see that.

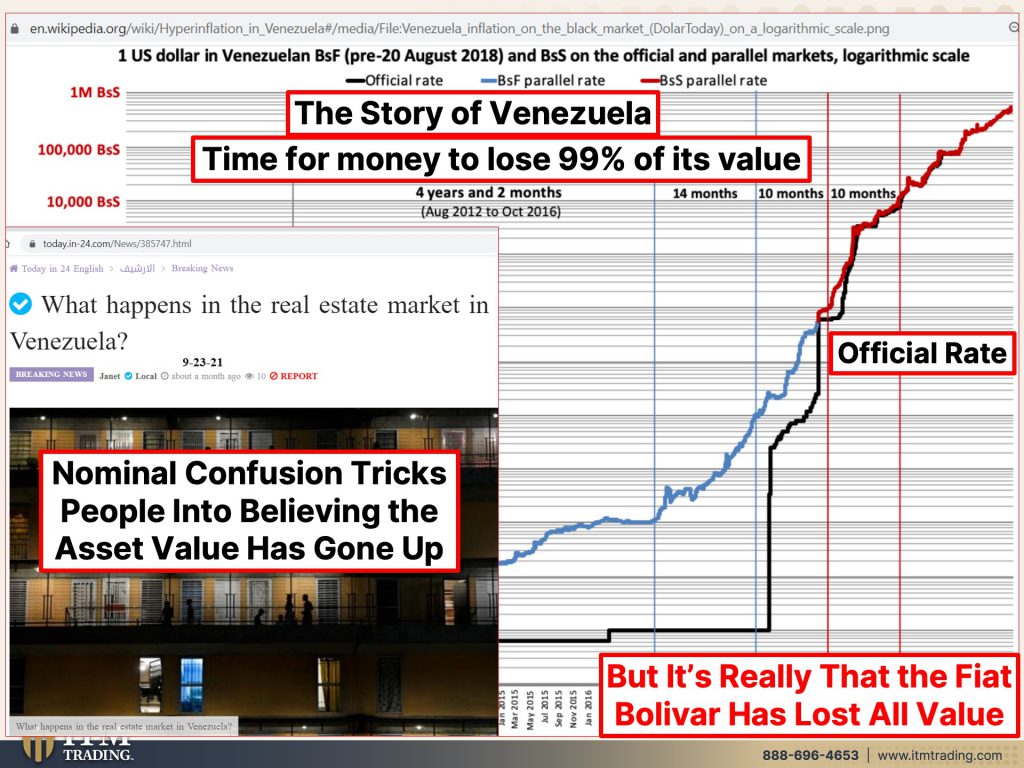

So let’s look at Venezuela. Okay. Now Venezuela is really interesting because they’re going through that right now. And again, I’m going to tell you during a hyperinflationary event, the, the data that is created is sketchy at best. If it even exists or it’s buried. So even if it does exist, I don’t know that I will ever find it, but fortunately, I’ve been watching Venezuela for a while and, and I have gotten some screenshots, but this is the amount of time that it’s taken for the money to lose 99% of its value. And Venezuela’s had three lopping off of the zeros, the most current one in October. So this is the official rate. This is a black market rate, and you can see how the official rate, just like when we look at interest, we look at gold, etcetera, it’s it’s official. So that just means that they want it to look like they want it to look, but that is not reality when you’re going out into the real world. And we’ve talked in a number of times in what happens to real estate in Venezuela, but just like in the U.S. Just like all around the world, we’re seeing property values rise in terms of the local currencies. It’s just nominal confusion because this house, the house that I’m in right now was built in 1929. Okay, well, it’s the same house for all those years. Almost a hundred years. Cause we’re going into 2022, has that changed? No, that has not changed, but the value of the paper dollars that it takes to buy, it has definitely changed. And the cost to maintain it with all of that inflation definitely changed. So it’s not that this house has gone up it’s that the currency has gone down. That’s really what happens.

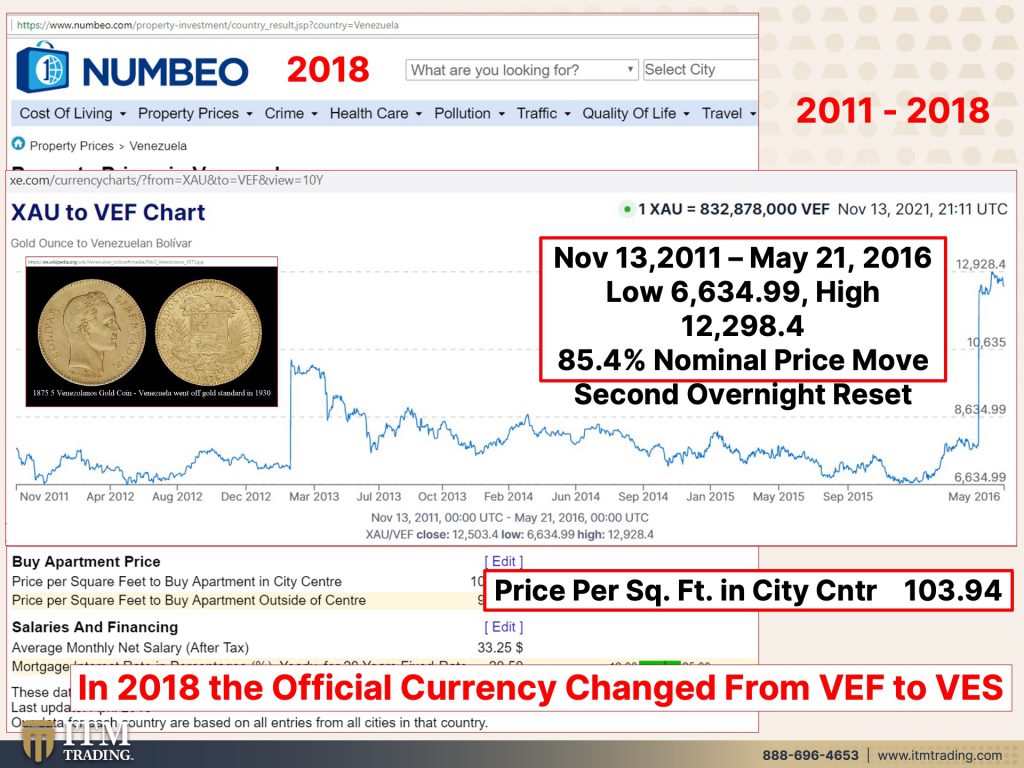

So now look at, I’m so glad that I actually had this because I couldn’t go back and get any historic data. If somebody knows how to I’d appreciate it. If anybody’s in Venezuela, and wants to do a boots on the ground or any place that is currently living through hyperinflation. Please have them contact services@ITMtrading.com. So these are property prices in Venezuela in 2018, the price to income ratio is 160.34 in 2018 in the U.S. it was 7.4. So it shows you that the price to income ratio in Venezuela is really, I mean, the average person cannot afford a house. It’s just that simple. A mortgage, as a percentage of income is over 3300% Loan affordability index 0.03. The loan is not affordable period because, and the price to rent even is at 24.33 price to rent in the city, not in the city center is a little bit higher than that, but here’s the reason why I’m putting this out because so many people have rental property and they feel really safe and secure in that, except that you get to a point where people can’t pay their rents. So the gross rental yield in the city center is 4.11%. The historic grow or actually net rental yield should be 10%. So this is gross. This is before you have any property taxes, any maintenance, any repairs, I mean, this is not a good way to generate income because it’s going to cost you more money to maintain this.

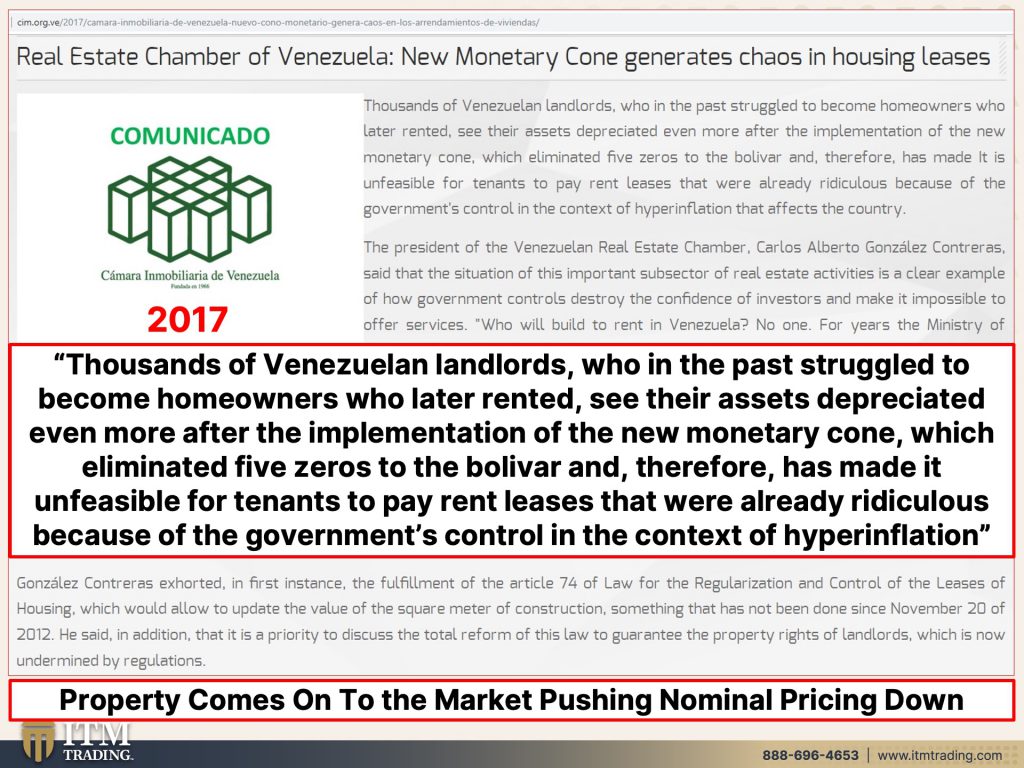

Now this remember, you know, governments don’t really want you to know what in the world they’re doing, but this is gold to the Venezuelan bolivar fuerte, the strong bolivar. Right? And this was the first reset, November 13th, 2011 to March…Okay let’s see, let’s move on. Okay. So this is between 2011 and 2016. So this was the first reset that we just looked at and it looked pretty big, right? This is the second reset back in 2016 overnight reset. So in 2018, the currency changed from VEF the strong bolivar to VES the sovereign bolivar. Hm. Did that help? Well, let’s just talk about real estate a little bit more, and we’re going to go ahead and look at that in a second thousands of Venezuelan landlords, who in the past, struggled to become homeowners who later rented see their assets depreciated even more after the implementation of the new monetary cone, which eliminated five zeros to the bolivar, and therefore has made it unfeasible for tenants to pay rent leases that were already ridiculous because of the government’s control in the context of hyperinflation. So what do you think that that does to the nominal price of the real estate if you cannot generate rent on it and you can’t pay your mortgage, it’s coming down. I mean, obviously, and you know where we’re seeing part, part of what I’ve seen. And I think we’ve seen at ITM Trading is people are going, well, maybe I’ll buy real estate instead of gold, because look at how much real estate is going up. Well, I got news for ya. Nothing goes straight up, just like nothing goes straight down. You’ve got to have some big bouncing along the way. And that has not been allowed in this environment, mortgage, moratoriums, rent moratoriums, I mean, and so many other shenanigans just to maintain the value of real estate and to push it up interest rates at zero. So, hey, I can buy a more expensive house because my payments are the same. Well look, everything works until it doesn’t.

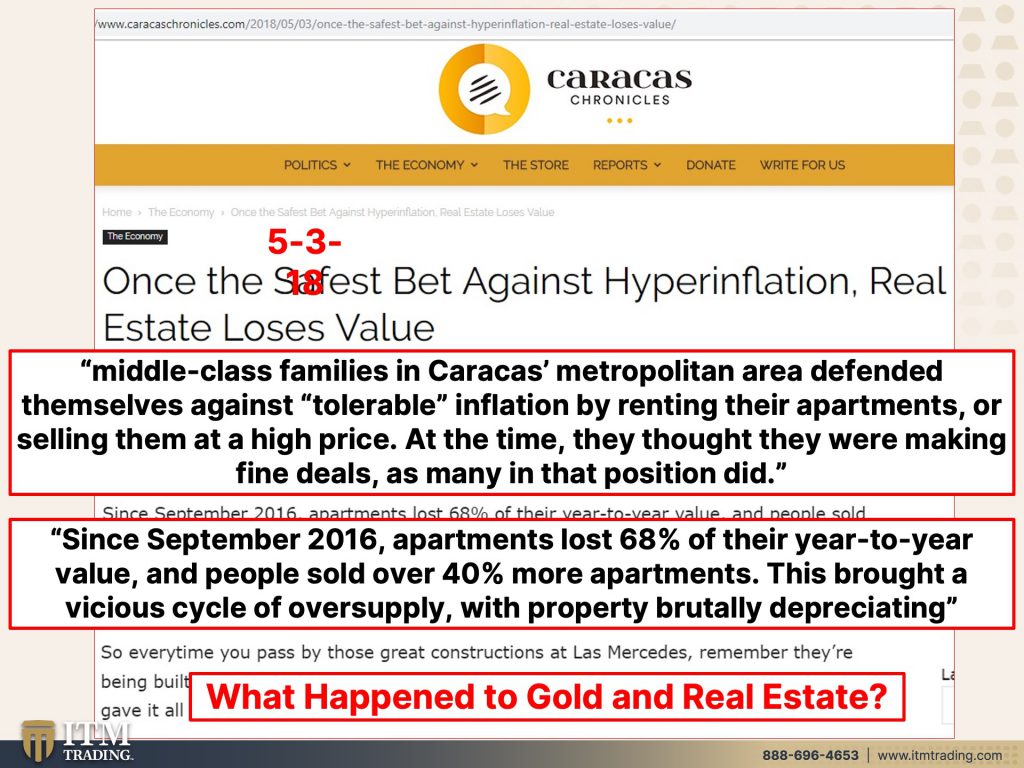

Middle-class families in Caracas metropolitan area defended themselves against tolerable inflation by renting their apartments or selling them at a hard price. At that time, at the time they thought they were making fine deals as many in that position did. But since September, 2016 apartments have lost, and this is to 2018. So two years apartments have lost 68% of their year to year value. And people sold over 40% more important apartments that brought a vicious cycle of oversupply with property, brutally depreciating. So since 2008 big corporations have come in and taken over the market. And since they can get money for free, even way better than you and I certainly, then they bid up the houses because they took all that debt and they turned it into a security that they sold back to you in your retirement or your pension plan. It’s genius. But you got to know because how many times can you be lied to when you do not know the truth. And they’re talking about now, they’re talking about the real estate market softening, which is really good for our first time home buyers and individual home buyers, because the market’s softening and the prices are coming down. No, the prices are not coming down, but the market is softening. Well, Zillow is not one of those that are in there buying thousands and thousands of houses, but they are now having to sell thousands and thousands houses. If you’ve waited this long, you might want to wait a little bit longer.

So let’s look at gold to real estate. And this is happening right now, 2021. I can’t even tell you how glad I am that I had that from 2018. Okay. 2021. All right let’s make a little comparison here. Price to income ratio, 15.39. So that was actually a little better, huh? But in the U.S., It’s 5.3 still is real estate in the U.S. affordable for most. No, it is not, no, it is not mortgage as a percentage of income. Well, it’s not over 3000% anymore. It’s still 372.73% of income. So it’s a little more affordable, but it’s not affordable for the normal person in Venezuela price to rent outside, inside the city center. Okay. The gross rental yields up a little bit, almost 8%, but that’s before you pay your taxes and all other expenses to maintain this property. So it’s not a good deal. You’re not getting paid for the risk that you were taking and that’s the risk to your principal. So if we look at between August, 2018, when they went to the new currency and October 5th, because then they locked off three zeroes or six zeros rather right here. Okay. Third, I don’t know how many times they’re going to lop off zeros, you know, on average, it’s about three times, but they definitely have at least another one in the cards. So let’s look at that in bolivars in 2018, it was 103,940. The bolivar per ounce of gold was 29 42. So it took you 35.3, three ounces of gold in Venezuela to buy the average house, but 10/5/21 Well, let’s see. There’s 1, 2, 3, 4. It takes 0.00001. So that means like a 10th of this size, a 10th of this size to buy a piece of real estate. Now, should you run to Venezuela right now and buy it? We’re going to look at that. I’m not saying that it’s time yet, because I think they got more lopping off, more pain ahead. And I’m going to give you a real life experience with this, but I hope that you can see the opportunity so that you put your wealth in something that can hold its purchasing power value. So when the time comes to move, you have the ability to do it. And here is our real life experience.

They left me the TV, they left me the mirror and well, a very rare space that this house has. I don’t understand but well there it is look he has upstairs in the kitchen I’m sure some it has some benefit. Friends friends today is a very exciting day Very freaky I’m ecstatic to share this news with you and it is that in effect as you have read on social media and as seen in the title it’s not clickbait it’s not a lie it’s not a fallacy this sheath is completely real I bought a house in Venezuela. now I know many of you are saying, “Luisio what are thinking? You have made a bad Decision. Haven’t you seen the news Luisio, don’t you know that this country is going through a situation that is very complicated. that there are many leaving or looking to move away every day. That there are no resources and even getting gasoline is very difficult.†Yes, I am very aware of all this believe me but I want to be completely honest completely transparent with you. #1 the situation is not bad for the entire country. It depends where you are, what is happening isn’t occurring in the entire territory. # 2 I honestly think it’s a good time to invest. This pod is Beautiful. Venezuela is a beautiful country and you know that I am someone who constantly likes to be looking what to do with your money I always like be investing, thinking a little about future and 1:50-2:28 when I saw the prices at which They sell the properties in Venezuela honestly I was very very surprised. You can buy a pretty house acceptable with 7 thousand 10,000 dollars this house that I’m about to show you it cost 20 thousand dollars. That is really very cheap in very few places in the world you find homes with these prices and it is a house that is in front of the sea. Really, here I am seeing the ocean right now I will give you a detailed tour. so honestly it is a very “future forward†investment for when the country is in days much much better and the prices of the properties could go way way up. that is also why I did not want to do a very large investment. buy a house that will cost me hundreds of thousands of dollars. I made bought a small but nice investment in a space that I honestly liked too much in a city that left me in love. enough context, I’m very eager to show you my new home in Venezuela. Well, here is the house tour And here is what I got in Venezuela for 20 thousand dollars. It is a department located in Lecheria in the state of Anzoátegui that it is located in the north of the country looking towards the caribbean sea. A real beautiful location this city is quite touristy, it is beautiful, come on please move to the new home on again the Venezuelan palomón nest first thing that draws a lot of attention ok is that good is also this pod we are right in front of the ocean look at this window tremendous the view towards the ocean that we have to see that beauty I am literally a street from the sea. look there is my way, a little towards there and that’s it, I’ve already reached the sea, I’ve already arrived to the ocean! the properties that were on the shore or even closer to the ocean with access straight to the beach, were a little more pricy than it was for this. I can live with having chosen a location that is close to the ocean but not as pricy. Hoping the investment does not go up so much and something that really freaked me out blew my mind is that I was sold the fully furnished apartment like this. how you are seeing it with everything as well as in the room it even has a fridge has everything so they sold it to me so this is the reception area. It is a small department but very cute very beautiful that We have the area here. You have these sofas here we have another window facing a building pretty cute you have a good view. here in this space we have a little place like to set up a mini study, what do I know? all this, they left it to me, I have installed nothing as you are seeing it It is like that to me it was given to me, it has the Furniture, hole for the keyboard and all the all the pod I did not put anything at all on this side we have the kitchen that wow they gave me quite renewed seeing all this me makes you think that the previous owners recently left the country as that they left and said they were ready sell all the pod as is or they left a long ago but they were renting it furnished and that is why it is so good so good condition also they included the air conditioning system that well, it’s much more expensive here in venezuela what to get then you are parts is difficult is how expensive it is install this kind of thing then no nothing more for the property but for how surrendered to me seems an excellent excellent deal the table over here the oven really well renovated. well brand new it came to me with the oven microwave even look at this that’s what I say makes me think that the owners/ previous ones left. because the department was given to me with flying jewels with everything look we have here that if the chopping board very freaky look coffee machine the stove is one of these like, new knives, has hood many of the kitchens do not have hoods this comes full equipped comes very, the refrigerator, very well, I already put it in here my hand of course its good beers you already have your Venezuelan rum. well this beauty, how cool It was given to me by the real estate agent He sold it that he told me it’s very top. The freezer is in operation. getting ice in many places is complicated because the lights go out in the stores. in effect, ice is difficult to get here in this country. over here I have my Venezuelan sweets/ favorites and look over here! the keys to my new home in Venezuela. the emotion is true is almost as tasty as a lollipop. Look at this nice tv, nice piece of furniture. This is a one bedroom, nothing else, it’s not as great great but it’s okay it’s quite pretty cool. here is the bathroom I like the style, it’s not like old lady but like home everything looks pretty new the sink looks like ceramic I like it a lot the shower door is a mirror. yeah you come out of bathing you can appreciate how your beautiful naked statue. It came with washer and dryer. I’m telling you, I feel that the owners said let’s get out of here and sell it as is. I consider that I benefited by a lot. here is the room, really cool, very good. they left a giraffe teddy look at this! I asked the agent who sold me the apartment and I told him the giraffe stays and Luisio told me like this how he really gives himself with everything and giraffe with everything and sheets as is on this side we have a window that has a partial view of the sea view partial to the ocean look there we can see the most beautiful, very cool and here another thing that is cool is that they left a vacuum cleaner and all things. Even hooks I don’t have to buy anything! I think the only thing missing is hand soap dish soap the only thing. Like here are the keys thanks! they also had good taste. air conditioning in the room and I repeat all this for 20 a thousand dollars, the truth is that I am someone who is constantly looking houses apartments I like to be seeing that I like to be informed in the subject and I tell them to find something like that for 20 thousand dollars that is very rare. it does happen that’s why I tell you it seems like a good opportunity to invest perhaps very forward-thinking but watch as time passes. they left the TV they left me the mirror and even look at the Mayan calendar. and well look, a very rare space that the house had. I don’t understand it, I’m sure some benefit can be taken. There, upstairs in the kitchen a small space for like a small studio I don’t know. I’ve been hearing animal noises up here I am hoping they are little birds not rats can you hear it on camera? I don’t know, I’m hoping it’s little birds and not a tremendous nest of rats. I don’t know what can be done in this space but it has all lights and plugs here you can install a bed and you can sleep someone comfortably or use it as warehouse I do not know but it is a good space to see I am not really tall. it’s not a very useful room but space is space is and it’s working. even if they look the ladder gives personality gives you beauty since we got here I loved it I was super fascinated with this city and that’s why I also said ok I think worth it I think it’s so cool. A little thing, let’s be honest with this, the paperwork and the paperwork to make an investment in Venezuela is not that simple ok. I wanted to clarify. but when one has a Venezuelan partner, many things facilitate. So on my part, and I say because I want to do this more transparent, was not a difficult situation but usually if a foreigner tries, yes it becomes harder. You need to be trusted with great confidence here in the territory if you want to invest. it is a long procedure I don’t want you to be watching and thinking that Arriving and investing is easy because it is a long process And a bit difficult. To have an ally in the country is the best option. So what next? I think that he The next step is to put it up for rent. The department is located in the downtown area, a few blocks, two streets from the main avenue, one street from the beach. It’s very well located then I don’t think it’s very difficult to rent it. they told me that this apartment can be rented to maybe about $300 a month which is what would come around a rent of this style and well who knows maybe with the months increase its value increases. we will see in any circumstance the truth is something that excites me a lot that the fact that when i come i know i have a space here to stay because I tell you I fell in love with this area of Venezuela loved it very much and is what I love the most talking to the people and knowing I have a little place there in which I can get to stay is something that really excites me fills me with a lot of joy! now we’ll see you hear many scary stories of people who have their homes taken due to various circumstances. That all of a sudden, let’s not go too much in detail, But you hear lots of scary stories of people losing their homes. Stories of people who they lose their house just because. people arrive, they get inside. the law protects them so that they can’t leave. The ones who have more have to give to those who have less… these kind of like ideologies we’ll see hopefully not pass. I’m really doing this with the best intentions and let’s hope that this does not really happen. Yes all of that is a concern to me I am not going to lie. I want to be very transparent that that worry exists, that fear, but Let’s put our hopes that it wont happen. This is a safe area and a beautiful area and everything is going to get better soon for this beautiful territory to which you know I have a lot of love and I have a lot of faith. I think this is an example of it. Well good, with this we conclude this video! It’s been really exciting to be sharing the news. You can see that it fills me with joy and has me freaking out and you know if you need a place to stay in Lecheria, Venezuela Reports with Louis only 300 dollars a month call 1-800 house-for-currency-Venezuelan. Good friends I say goodbye to enjoy my beautiful new home in Venezuela. I can’t believe I’m saying these crazy words! Well now goodbye, I’m going to enjoy my new house In Venezuela.

So that is the whole point that this is not time to rush to Venezuela because it’s not over yet. The whole world is going to be able is going through the same thing. Look at the opportunities that lie ahead of us. This is really the point of the strategy, which if you haven’t called and talked to one of our consultants, you should, it’s a strategy that’s based upon historic norms because I’ve been studying currency since 1987. So if you’re working with us, you’re doing the same strategy as me, but tweaked for your goals and your circumstances and what you have to work with. But my personal goal in all of this and why I do this work is because I don’t think it’s okay for you to work your whole life and have it shifted away from you by, I can’t even say it because I’m too much of a lady, but I think you can get the drift, right?

All you have to do is take advantage of what they are doing for themselves. They are pushing down the price of gold, because they don’t want you to know that the currency is dying. They’re buying it hand over fist. They meaning central banks. And also the very wealthy because they know what’s coming up and they want to be in a position to have the wealth shift their way so that you own nothing. They own everything. But I’m pretty sure if that’s what happens. You won’t be happy. I know I wouldn’t be happy. I wouldn’t be happy for you. I wouldn’t be happy for my grandchildren. I wouldn’t be happy for anybody. Let’s beat them at their own game. How bout that?

Because without a doubt, it is time to get those assets covered, please. And the wealth shield is a 12 parts strategy, but it’s simple because it’s based upon repeatable patterns. There’s a Calendly link below. If you haven’t spoken to us yet, call have that conversation set up a time because if you procrastinate, quite honestly, it could well be too late. And I would rather be, I don’t care, 10 years too early. Honestly, I wish I had been smart enough. And instead of buying those stupid leather persons, when I was, you know, 17 and 18 years old, that I had bought gold from my uncle. I mean, I did buy some, but I didn’t do what I should have done because I didn’t know I was young and naive. What do you know when you’re 17, but now, you know, and we’re going to talk a lot more about this. And if you haven’t already seen the interview I did with Arpad from Star Path Academy. I mean, I’m very grateful to Canadian Kyle for bringing him out and because that’s how I found him. And I’m in love with this man, because he has the experience that we all need. I haven’t lived through this yet. I mean, I’ve lived through a currency restructuring in the seventies. And so I know what that’s like, but this is a complete global reset and they got to burn off all the debt. They’ve been cumulated since the seventies. So until next we meet, please stop procrastinating, get it done. Food, water, energy, security, barterability, wealth preservation, community, and shelter. And until then, please be safe out there. Bye-Bye.

SOURCES:

https://www.imf.org/external/pubs/ft/wp/2001/wp0150.pdf

https://www.jstor.org/stable/4545563?read-now=1&seq=9#page_scan_tab_contents

https://www.dallasfed.org/-/media/documents/institute/wpapers/2014/0208.pdf

https://en.wikipedia.org/wiki/Hyperinflation_in_the_Weimar_Republic

https://www.tandfonline.com/doi/pdf/10.1080/00708852.1977.11877476

https://www.cnbc.com/2011/02/14/The-Worst-Hyperinflation-Situations-of-All-Time.html

http://www.marketoracle.co.uk/Article49617.html

http://moneyingreece.org/quantity-theory-and-greek-hyperinflation-during-german-occupation-1941-44

https://www.linkedin.com/pulse/new-greek-drachma-unveiled-amid-bank-runs-greeks-buy-mark-o-byrne

https://www.globalpropertyguide.com/home-price-trends/Greece

https://www.globalpropertyguide.com/Europe/Greece/Price-History

https://centerforfinancialstability.org/books/Makinen_excerpt.pdf

https://centerforfinancialstability.org/hyperinflation.php

https://www.pwc.com/gr/en/publications/the-greek-real-estate-market-en.pdf

https://www.bankofgreece.gr/RelatedDocuments/BoG%20-%20RED%20Oct%202013.pdf

https://www.globalpropertyguide.com/Europe/Greece/Price-History

http://www.marketoracle.co.uk/Article49617.html

https://www.ceicdata.com/en/indicator/greece/house-prices-growth

https://www.ceicdata.com/en/indicator/greece/gold-production

https://goldprice.org/gold-price-euros.html

https://www.xe.com/currencycharts/?from=XAU&to=EUR&view=10Y

https://www.bankofgreece.gr/RelatedDocuments/BoG%20-%20RED%20Oct%202013.pdf

https://www.numbeo.com/property-investment/country_result.jsp?country=Venezuela

https://www.xe.com/currencycharts/?from=XAU&to=VEF&view=1Y

https://www.numbeo.com/property-investment/country_result.jsp?country=Venezuela

https://www.xe.com/currencycharts/?from=XAU&to=VEF&view=1Y

https://www.xe.com/currencycharts/?from=XAU&to=VES&view=10Y

https://today.in-24.com/News/385747.html