WHAT WILL GOLD BE WORTH? New Dangers of Negative Rates & How to Calculate Gold’s Fundamental Value by Lynette Zang

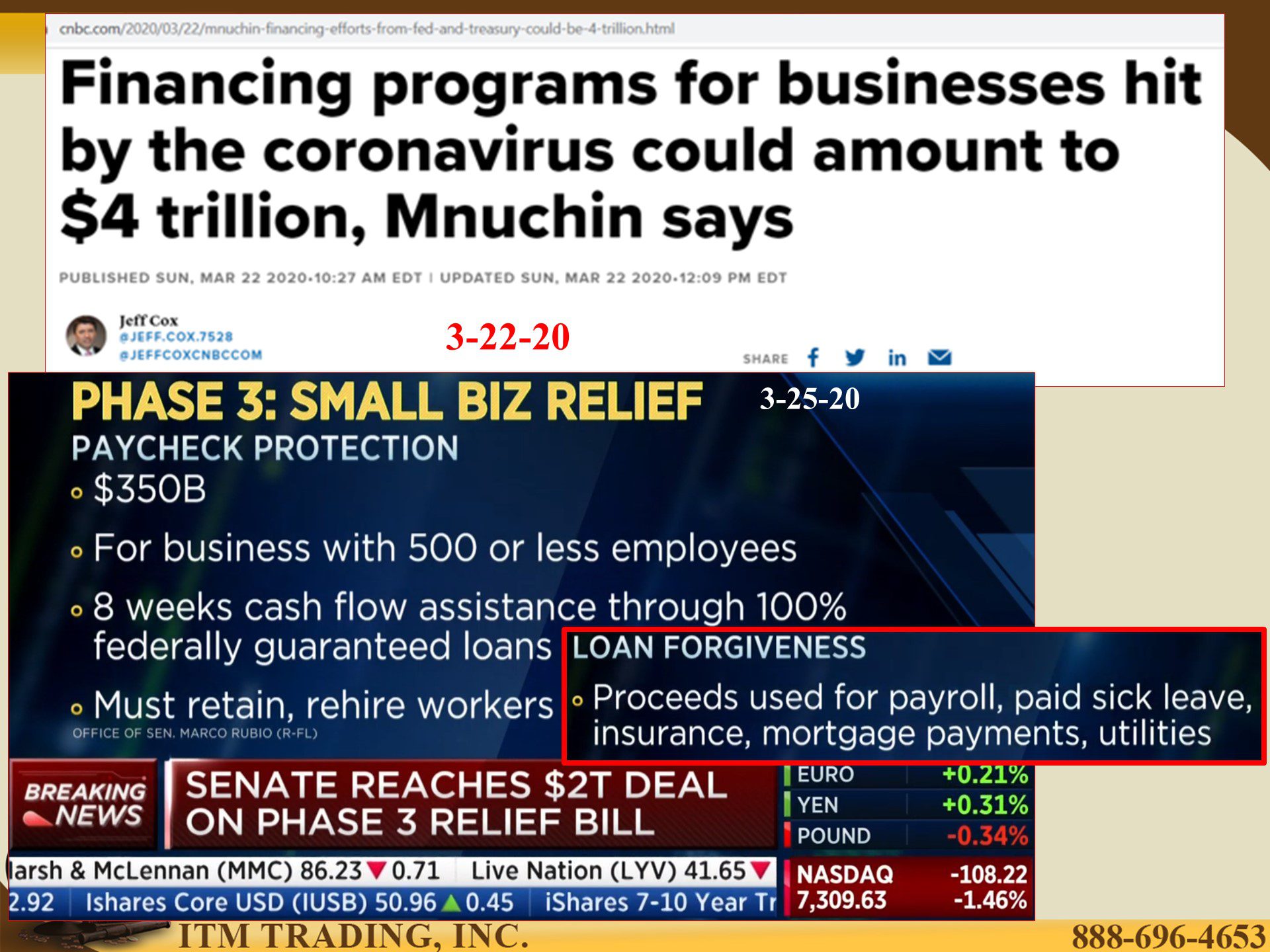

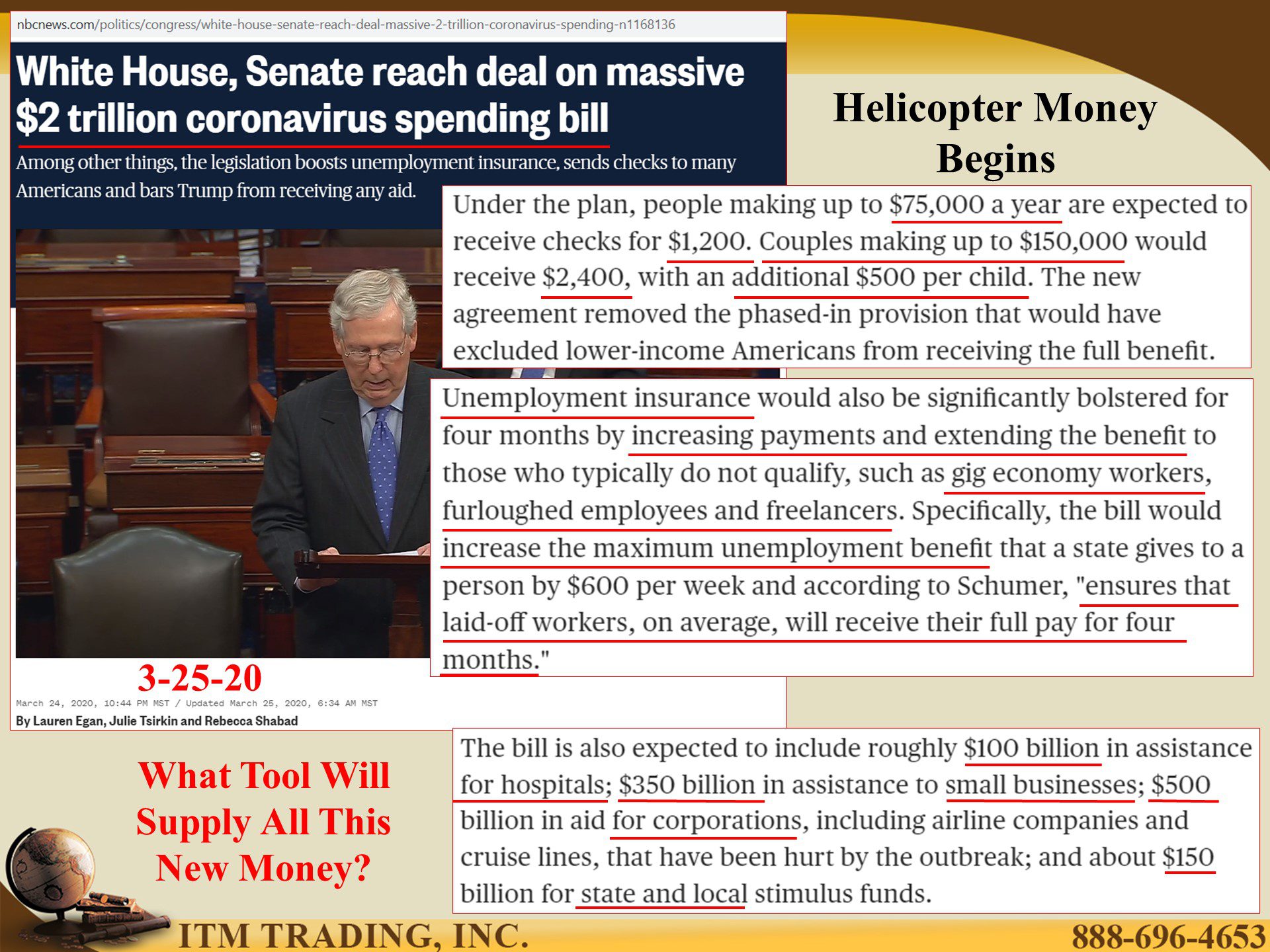

Let the helicopter money begin. The Fed’s alphabet soup of QE roars in with a vengeance with a promise of unlimited free money, but they cannot reflate the economy alone this time, they need help. Enter new government programs that are starting at $2 Trillion in new money, but, in my opinion, will likely be much higher. All of this is supposed to be temporary, but one look at history shows it never really is.

Please let me make clear that the general public needs government help at this time. Small and medium businesses that employ the greatest share of workers, are shuttered. Gig and independent workers have seen their incomes abruptly stop. Corporations that spent gains on stock buybacks and shareholder dividends but are strategic for the US and employ thousands of people, will have to be “bailed-outâ€. In fact, most of the world needs a bail-out, but where will all this money come from? Debt.

Have more questions that need to get answered? Call: 844-495-6042

But the debt bubble was already popping as witnessed by inverted yield curves and negative yields. In fact, today markets sent the short-term treasury bill yields negative! Is this a flight to safety or the canary in the coal mine telling us that a worse financial crisis lies ahead?

What does all this mean for our money? History and Fed charts tell us that the purchasing power value is going to zero. Many will think they can protect their wealth in the stock market, as new Fed money is likely to reflate the stock market, but 1,000,000,000,000 x 0 = 0 as we saw in the 2018 Venezuelan stock market that was the best in the world for years, as hyperinflation pushed stocks up and the value of the bolivar down.

How do you know what to do? Discover the true value of any asset or instrument, that I refer to as the fundamental value.

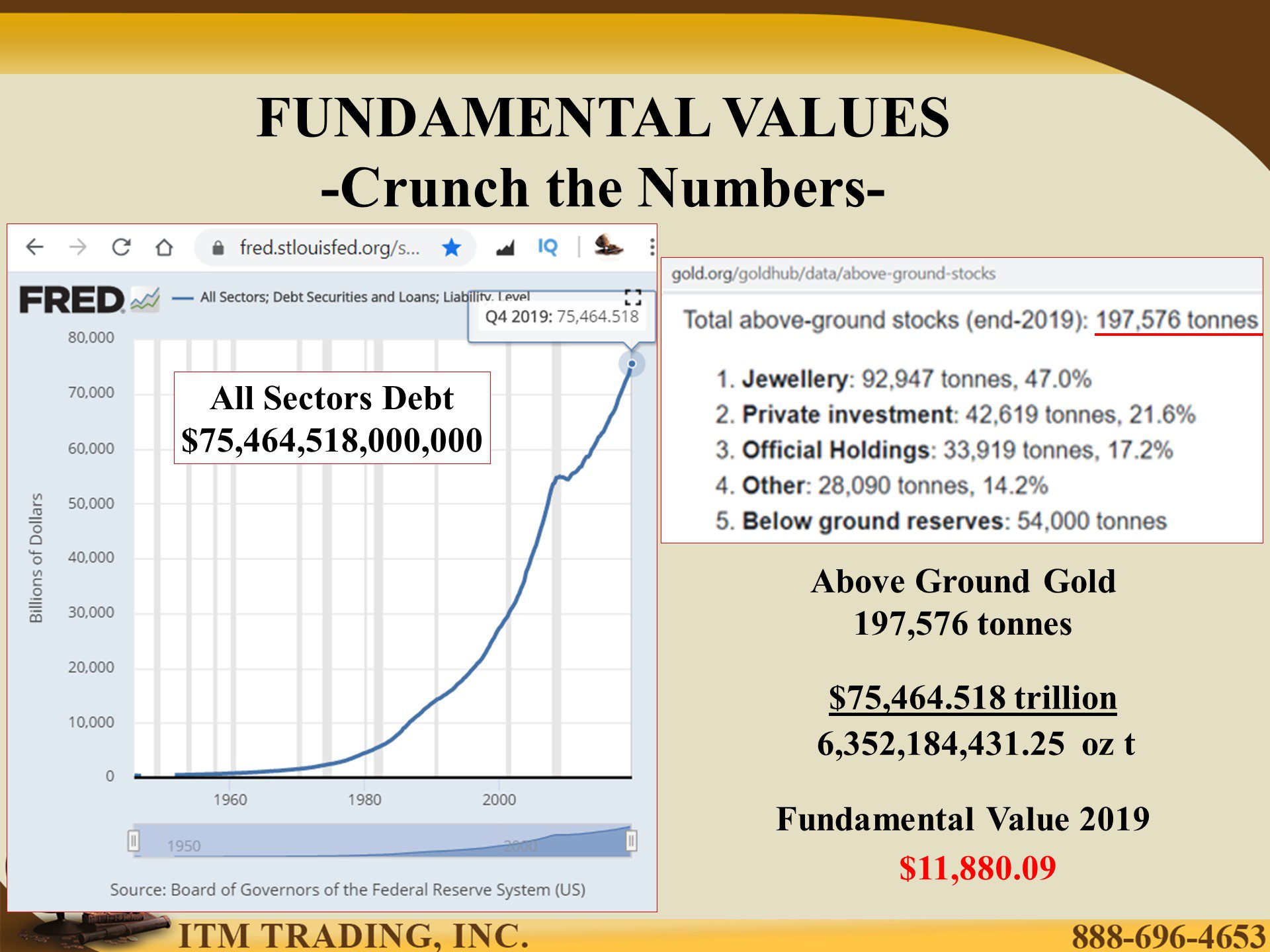

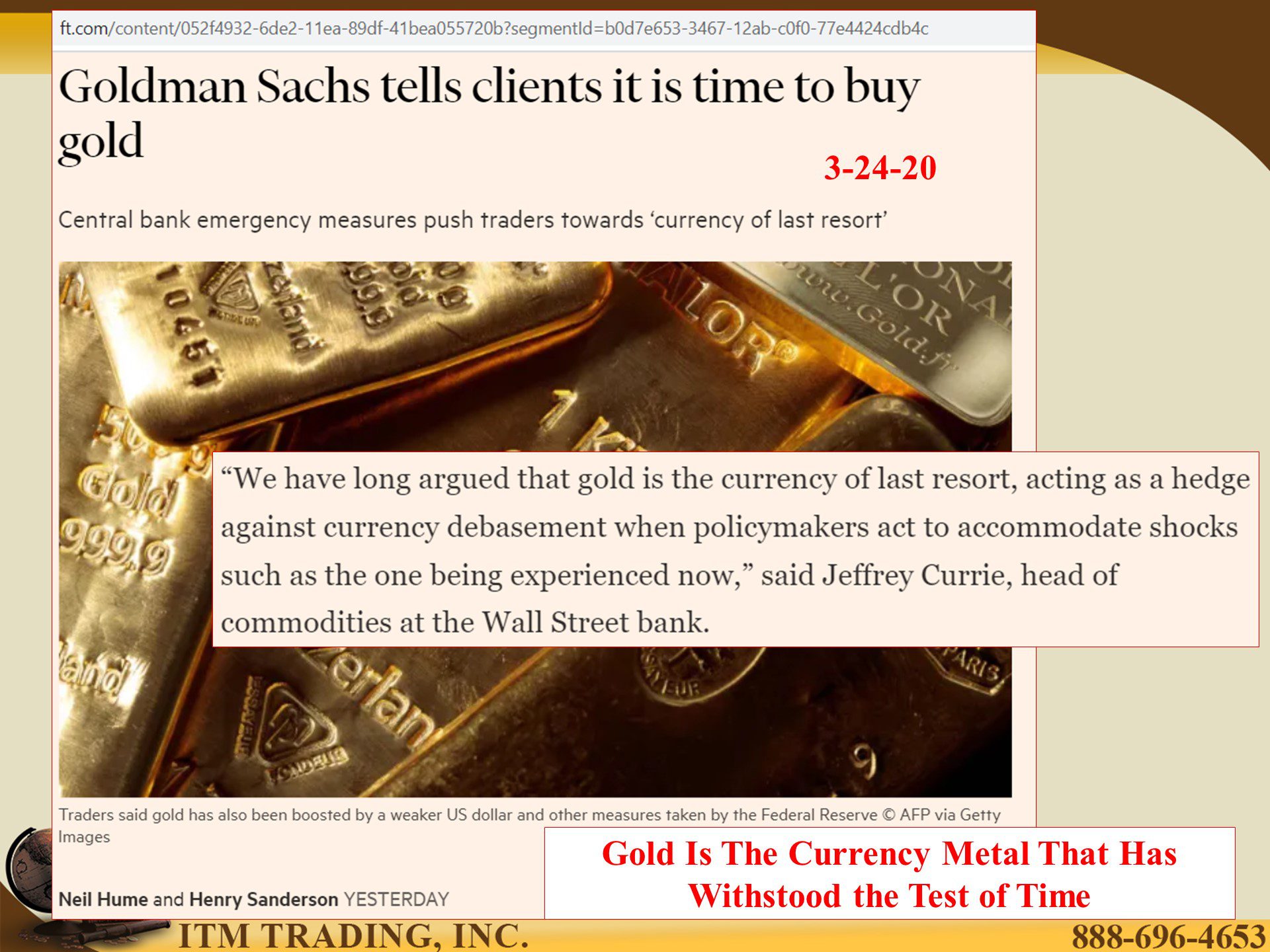

Many people ask me how I know that gold and silver are undervalued. They see spot gold manipulation and believe Wall Street and central bankers’ lies. But there are relatively easy ways to discover true values and therefore can determine if an asset is undervalued, fairly valued or overvalued.

First, you must determine the single most important function of that asset for its creator.

Let’s talk money. Money is a tool that is used to value your labor. Any money that is saved for future use needs to retain its value so that no matter when you want to use it, the value of your labor remains intact. Therefore, the most important function of money is to hold value over time.

Gold money does that because it is labor based and used across every aspect of the global economy. Therefore, there is always demand from the broadest buyer base.

Fiat government money is debt based and loses value over time through inflation. Additionally, government money only has value in the local economy (For example, you cannot use dollars in Mexico) therefore fiat government money has the narrowest base of buyers.

Additionally, value is based upon scarcity. There is a finite amount of gold that has been and can be mined, yet an unlimited amount of debt that can be issued.

Simple math, dividing current debt levels by above ground gold gets us close to the true value of gold money. Using the Federal Reserve’s numbers for all sectors debt through 2019, of $75,464.518 trillion and gold.org’s above ground gold amount of 6,352,184,431.25 troy ounces, gives us a fundamental value for 2019 of $11,880.09. Though that is before the massive money printing of global governments and central banks justified by the coronavirus pandemic.

Additionally, on the other side of this virus, when people begin to spend that free money, any remaining value in the global fiat currencies is most likely to evaporate in a hyperinflationary surge taking any wealth held in fiat money products with them.

When we get to the other side of this pandemic. Everything will have changed, including our financial system. If you want to hold on to your wealth and independence, I suggest you do what the smartest guys in money are doing, buying physical gold.

Slides and Links:

https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

https://www.cnbc.com/quotes/?symbol=US3M

https://stockcharts.com/h-sc/ui

https://fred.stlouisfed.org/series/TCMDO

https://www.gold.org/goldhub/data/above-ground-stocks

https://stockcharts.com/h-sc/ui

https://tradingeconomics.com/united-states/currency