What The Second Largest Bank Failure in U.S. History Means for Your Wallet

Join Lynette Zang, Chief Market Analyst at ITM Trading as she breaks down the current state of the banking system and the looming threat of another financial crisis. Learn how JP Morgan’s recent acquisition of First Republic Bank is just the tip of the iceberg. Find out what this means for the future of the banking industry and how you can protect yourself from being taken advantage of.

CHAPTERS:

0:00 Bank Failures

3:38 $229.1 Billion

8:49 Regional Banking Community

12:23 Uninsured Deposits & Wages

17:46 Spot Gold & Silver

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

You know, this is just a big club and you and I are not in it, but JP Morgan is certainly in it. And so let’s look at the terms at which JP Morgan was able to acquire First Republic Bank. I don’t know. You think they got a pretty good deal? And is this the end of it? I mean, does this solve all the banking turmoil? And is JP Morgan so big and strong and Bank of America and all those commercial banks that are also sitting on an awful lot of underwater debt? Do they solve all of this issue? I don’t know. Let’s look back on history to see what is the most likely outcome in the future. I mean the future right now, and what kind of deal did JP Morgan get coming up?

I’m Lynette Zang, Chief Market Analyst at ITM Trading a full service physical gold and dealer specializing in custom strategies. And I hope you have your strategy in place and I hope you’re actually executing it because what’s going on in the banking system should be an, and the treasury markets frankly, Should be an indication to you of how close we are to the end.

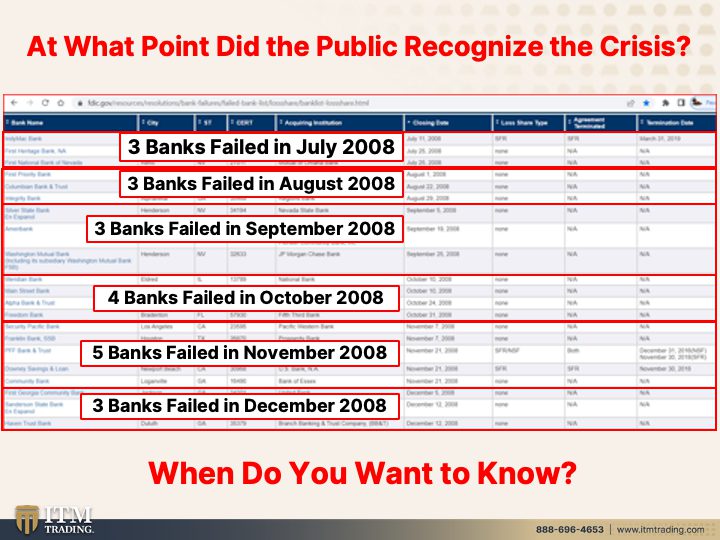

So let me just, let’s go back on memory lane a little bit to see really where we are because going back to 2008, at what point did the public recognize the crisis? Remember I had David Dubyne actually, who I think is brilliant. Ask me why I wasn’t at the bug outhouse yet? That’s because the public doesn’t recognize what is unfolding when they do. That’s where you’re gonna find me. But going back to 2008, how many banks failed? Because we were, we kept telling we were being told that the crisis was contained. You know, same thing as we’re being told now, but in July of 2008, that’s when the bank failures really started. Three banks failed. Oh my goodness. Okay. In August, another three banks failed. Now, these weren’t really large banks. A few of them were Indie Mac, etcetera. In September, three more banks failed. In October, four banks failed. And basically this was right around the time when people started to recognize that we had a problem in the banking sector. So we’ve had five bank failures now. Where are we in this? When will the public really recognize, and it’s been critically important to bail out all of depositors so that they’re attempting to do a controlled demolition of the banking system. But all of this brings more and more consolidation and that means that it consolidates the power and it also consolidates the risk. And the question is, when do you wanna know? When do you wanna be in position so that this kind of garbage and this next financial crisis doesn’t become a crisis for you and your family?

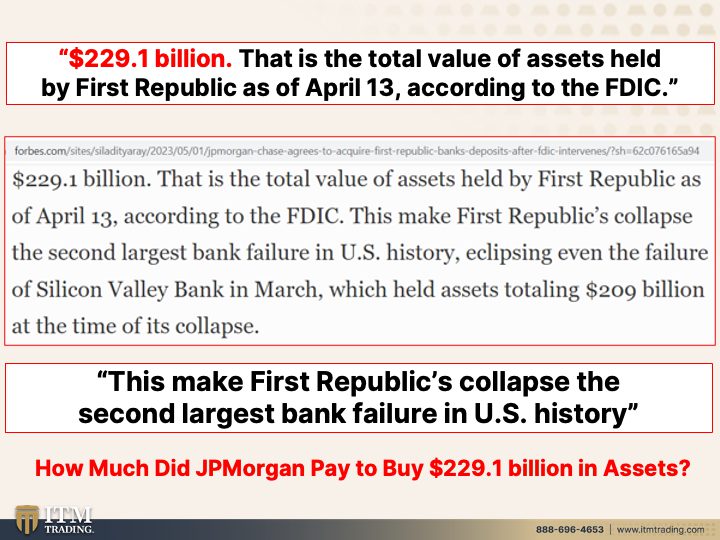

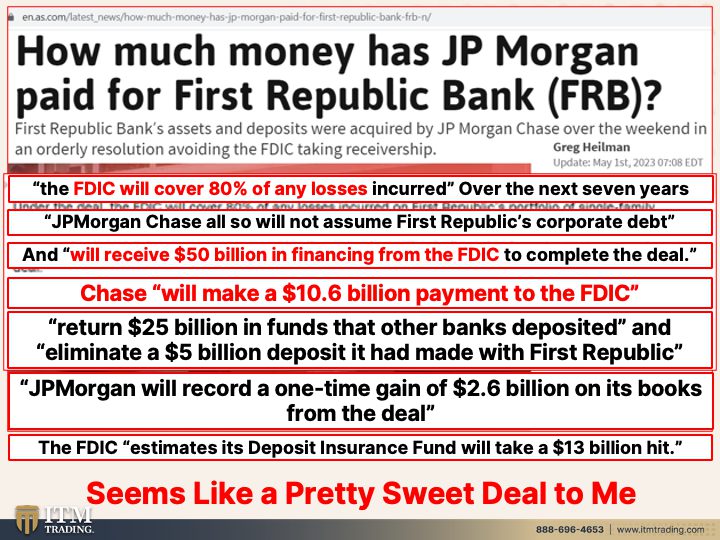

Now let’s just dive into First Republic. $229.1 billion is the total value of assets held by First Republic as of April 13th. Okay? That is the total value. Let’s see. This makes First Republic’s collapse, the second largest bank failure in U.S. History. Hmm. How much did JP Morgan pay to buy $229.1 billion in assets? Well, we now know the FDIC will cover 80% of any losses that are incurred. So all of that underwater, remember interest rates, market value of bonds, right? So all of those underwater bonds, the FDIC will cover 80% of any losses. Now if you listen to Janet Yellen, you don’t want to say, well, taxpayers aren’t gonna cover this. The FDIC is gonna cover this and they’re gonna do it by special fees on the banks. Well, what do you think? They think the banks are in business for your benefit? Heck no. Ultimately anybody that uses any of these banks are paying these fees. And oh, by the way, that’s over the next seven years. So they don’t have to sell these off right now. The hope is that they will, that when the Fed lowers the, the interest rates that they will recoup the principle. But hey, the FDIC is going to incur the losses over the next seven years. JP Morgan Chase will, will also not assume any of First Republic’s corporate debts. So FDIC will take care. Now remember, they only had at the start of this debacle, not First Republic, but all the banks’ failure, they only had 128 billion in their DIF fund. But hey, the FDIC will cover this. Where’s that money coming from? Really? And JP Morgan will receive 50 billion in financing at very good rates, I’m sure from the FDIC to complete the deal. Okay? So the FDIC will cover 80 losses. The JP Morgan will not have to take on any of first Republic’s corporate debt and JP Morgan will receive 50 billion in financing. Chase will make make a 10.6 billion payment to the FDIC. Hmm. So they’re getting 50 billion in financing, but they’re gonna pay 10.6 billion to the FDIC and they’re getting, oh, what was that number? 229.1 billion in assets. Seems like a pretty sweet deal to me. What do you think? Well, let’s just keep going. The return of the 25, remember all the 11 banks got in and gave first Republic 30 billion in deposits and that was supposed to take care of it? Well, JP Morgan out of that 50 billion I guess will return 25 billion in funds of the other banks deposited and eliminate the 5 billion that they had put up, okay? And they will record a one time gain of 2.6 billion on the books from the deal. But they’re getting a much bigger gain than that. I’m thinking the FDIC estimates it’s deposit insurance fund will take a 13 billion hit. Is that like ultimately after they’ve covered 80% of the losses and given Chase 50 billion in financing and they only got 40 10.6 billion back? You see what I’m saying here? Seems like a pretty sweet deal to me. No wonder they took it over and JP Morgan, the largest bank in America is now that much larger because they absorbed the second biggest bank failure in history. JP Morgan is definitely too big to fail.

Little banks might not be, but it’ll be when they are ready to let one go. So far, every single bank that’s failed, they have the FDIC has deemed systemic and we’ve bailed out venture capitalists and we’ve been bailed out tech companies and we’ve bailed out the wealthy. But don’t call it that. Yeah, well a rose by any other name.

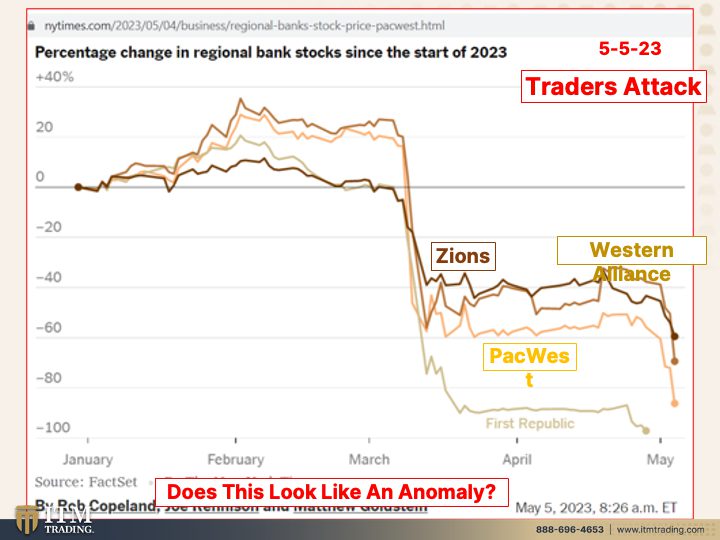

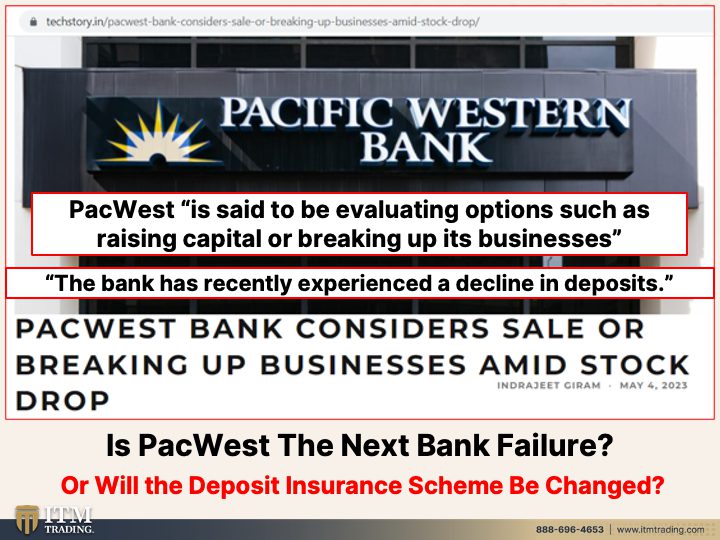

So look at what’s happening in this smaller banking in the regional banking community. What’s happening is that the market does not like them, right? And traders are attacking the stock. There’s Zions, Western Alliance, PacWest and there is First Republic. Now they wanna say that this is just a one off and this is a one off and that’s a one off and the crisis is contained and it’s a one off. Yeah. Does that look like an anomaly to you? Does that look like a one off to you? Cause it doesn’t to me. And remember, this is all about trading. It’s not about stability for the global economy. I know that’s what they want you to believe, but they’ve chosen winners and losers and you and I are not winners. That’s why you’ve gotta become your own central bank. You’ve gotta make it so that you are your own advocate, your own central bank and your own. You have to be as independent and self-sufficient inside of this as possible. Or you’re gonna be subject to the traders too because everything has become a trading instrument. Now, part of what triggered it is they’re considering a sale or breakup in business. Emit the stock drop. Well, if they’re so solid, why would they have to do that? Because they’re not really solid, but they are evaluating options such as raising capital. So what issuing stock into that route, you saw what it looks like or breaking up the business. So the system, the regional banking system is definitely in deep trouble. The bank has recently experienced a decline in deposits. So these are runs and you know what they’re gonna do? They’re gonna raise the deposit insurance level even though they can’t pay it at this level now. All right? And will you believe them? And is PacWest the next bank failure? Hey, they had two days where the stock went up but yet it was still underwater and today reversed that. They’re just going to change the deposit insurance scheme. Just like think about when that went into place. Went into place in 1933 along with Glass Steagal, which separated deposit, taking banks from risk taking banks from Wall Street banks. Have you heard even one entity, the treasury, the Fed, the FDIC, even the talking heads on tv, have you heard one person saying, gee, maybe we need to separate the deposit taking banks which are using your deposits as collateral for their trading from the trading taking banks? No, they are not talking about it. Nobody’s talking about it cause they’re not gonna do it. They don’t wanna do it. The banks make too much money on trading. Most of their profits come from trading. But also the risk that they heap on us. And keep in mind that it’s these guys, these bigger guys, not the PacWest, not the regionals, but JP Morgan, Bank of America, all those guys that create these derivatives and then can say whether or not it’s a default. It’s really kind of interesting. It’s the foxes watching the henhouse determining whether or not after a chicken is killed, if one of the foxes killed the chicken or not, who knows?

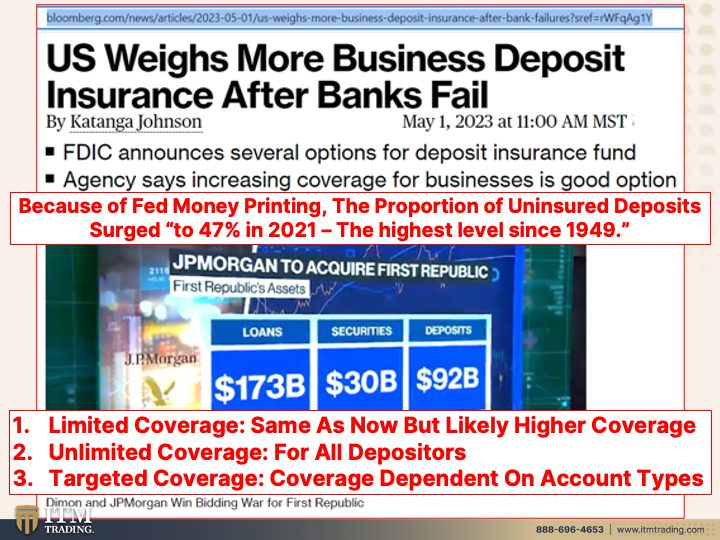

But they are weighing more business deposit insurance after banks fail. Isn’t that interesting? The FDIC announces several options for the deposit insurance fund. Hmm, what are they? Because of and they never, they never take credit for creating the problem by zero interest rate policy and all of this free money. God forbid that they ever look in the mirror and say, Hmm, maybe we shouldn’t do that. No, because of fed money printing the proportion of uninsured deposits surge to 47%. That’s all that free money in 2021. The highest level since 1949, which is when right around the time of the Brenton Woods Accord, that was a change in the monetary system and the US dollar became the world reserve currency and all currencies were pegged to the dollar. So we’ve gotta pay attention to these dates though. Nobody ever takes it to the next point. What was happening then? Oh, there was a shift in the system, right? Yeah, let’s not do that. But here’s what they’re talking about. Limited coverage the same as it is now, but higher, more coverage. They can’t afford what they’ve got, but okay, unlimited coverage for all depositors. So hey, you can hold as much as you want, but who’s gonna pay for that? Are the banks really gonna pay for that? No, darling, you and I are gonna pay for it. And targeted coverage. Coverage dependent on account types. So business coverage, get businesses get more coverage because they’ve gotta run payroll, they have to keep money in the bank for large expenses, etcetera. So they’re targeting about targeted coverage. So less for the individual depositors, more for the businesses. Who’s really gonna benefit from that? And it’s all a scheme anyway. That’s what they call it a scheme. I don’t call it a scheme, I call it a scheme cause they do.

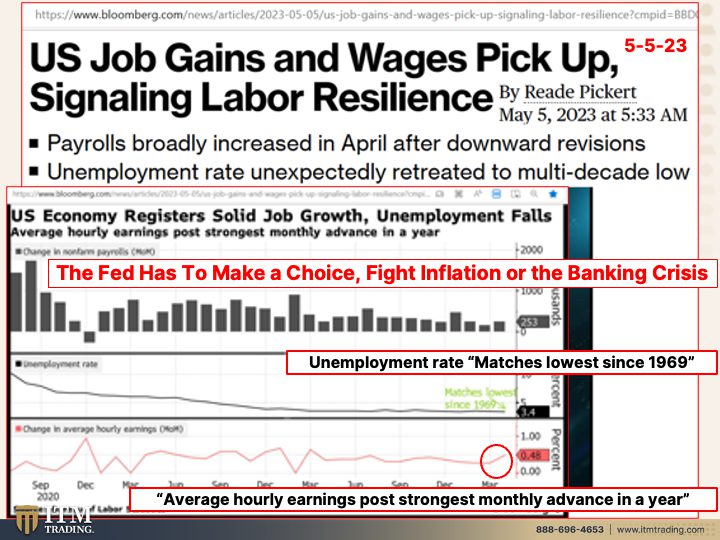

And there’s a problem because job gains and wages are signaling labor resilience. So honest to goodness, what does that mean for the Federal Reserve? Because he’s afraid. They’re afraid of a wage price spiral, right? So everything costs more people ask for higher wages and then things cost even more, etcetera. That’s that wage price spiral. So what is the fed likely to do? I have to keep raising rates, right? It is really pretty interesting. The US economy registers solid job growth. That’s this change in non-farm payrolls right up a little bit. But look at the change in hourly wages. So this is, the unemployment rate matches the lowest since 1969. What was happening in 1969? Oh, we were transitioning from a gold backed currency to a debt-based currency. So you see all of these dates, they’re really interesting and they are so telling because you always have to look at what was happening during that period of time. And then is that the same reason that this is happening now? Because at the same time that we have the unemployment rate at the lowest since 1969. So things are great, but the Fed wants higher unemployment so that they, that employees don’t have as much power in negotiating wages. Average hourly earnings post the strongest monthly advance in a year. Putting pressure on the Fed. The fed has to make a choice. Do they fight the inflation by raising the rates or do they lower the rates to deal with the banking crisis? You see there between a rock and a hard place. But either way it doesn’t really matter, does it? Right? If they continue to raise rates to fight the inflation that they caused, well then you’re gonna see more and more cracks are gonna become obvious. Right now we’re seeing the tip of the iceberg, but most of it is underneath here. So as the water goes out, we’re gonna see more and more and more of this iceberg as they continue to raise rates on the other side of it. What do they do when the economy starts to sputter and the banking system starts to implode and the treasuries start to implode? Well, it’s pretty simple. They drop rates back down to zero and they start their money printing machine. That’s what they do. So what are they gonna do in this case? Well, time’s going to tell, but you know, they raised them a quarter a point for their credibility, not because it really did very much one way or the other. And they’re saying, oh, well, okay, so inflation is kind of cooling off so we can maybe hold back on rates. Well, let’s just see what happens.

But in the meantime, what I know needs to happen is we all need to protect ourselves. And we know we’ve got Silver. City analysts predict near perfect conditions for silver’s. Ongoing bull market experts suggest $30 an ounce, a possibility. Well, have you tried to buy a one ounce silver dollar? Cause you’re paying more than 30 bucks for it. So is that even they’re talking about the spot market where you can create as many silver contracts as you want that they don’t have to have, and they don’t have the actual physical silver underlying. Whether it’s silver or it’s gold. What you need to understand is it’s a bargain at this juncture. It is a bargain. And so severely undervalued, it’s ridiculous. So what are central banks doing? They’re loading up. Don’t you think you should too? You think they might know something that you don’t know? You can see the resistance level over here at the beginning of 2023. You got a breakout and guess what? You got another breakout. Now, is this pervasive? I don’t know, we’ll see. And 30 bucks an ounce, you gonna sell your silver When it gets to 30 bucks an ounce, you can’t replace the physical, you can replace the paper, but you can’t replace the physical for 30 bucks an ounce. And it’s severely under value. It’s time to execute your strategy, get it in place, gold, silver, Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter. Because really severely undervalued and so is gold. Central banks are buying it hand over fist. What do you think? You have this. It’s out of the system, it’s invisible and it’s a perfect for me, silver is the perfect tool of barter in any form. I don’t care in any form. So if you haven’t done so already, make sure you subscribe, leave us a comment, give us a thumbs up and check out our other channels beyond gold, silver, ITM Insights and ITM Espanol. And remember, financial shields are made of physical gold and physical silver, not paper, not promises, and not air. And until next we meet. Please be safe out there. Bye-Bye.

SOURCES:

https://en.as.com/latest_news/how-much-money-has-jp-morgan-paid-for-first-republic-bank-frb-n/

https://www.cnn.com/2023/05/01/business/first-republic-purchase-hnk-intl/index.html

https://www.nytimes.com/2023/05/04/business/regional-banks-stock-price-pacwest.html

https://techstory.in/pacwest-bank-considers-sale-or-breaking-up-businesses-amid-stock-drop/

https://www.fdic.gov/news/press-releases/2023/pr23035.html

US Jobs Report April 2023: Payrolls Rose 253,000, Unemployment Rate Fell to 3.4% – Bloomberg