URGENT! Change all Variable Rate Debts to Fixed Rates, Hyperinflation Coming… -by Lynette Zang

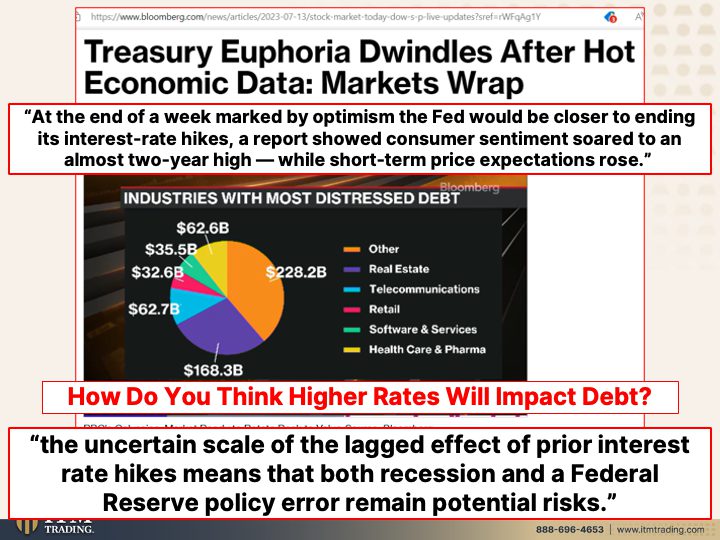

US Corporate Bankruptcies just surpassed the total for all of last year. We are in a debt-based system, and the impact of raising interest rates is now starting to be felt in a big way.

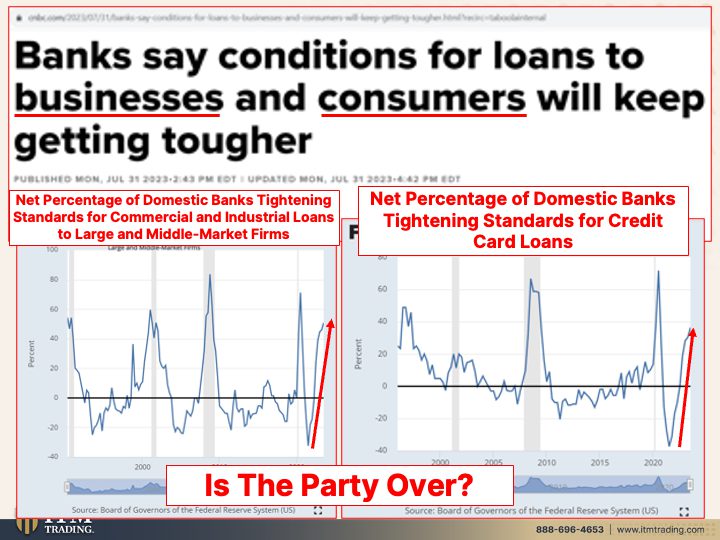

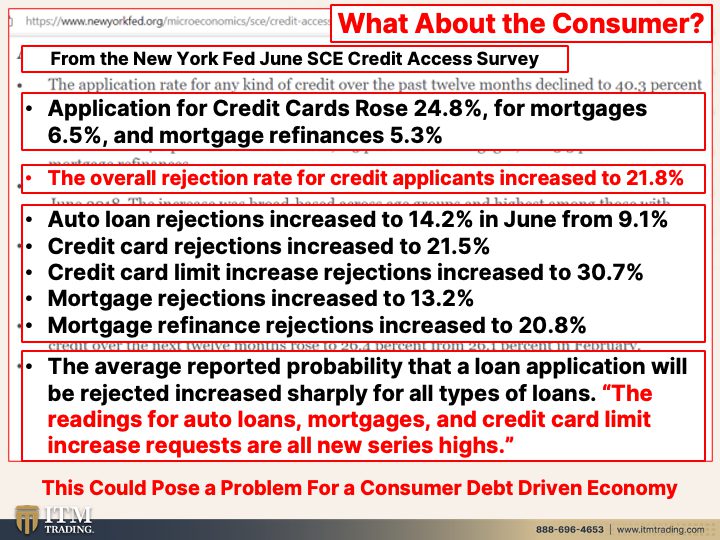

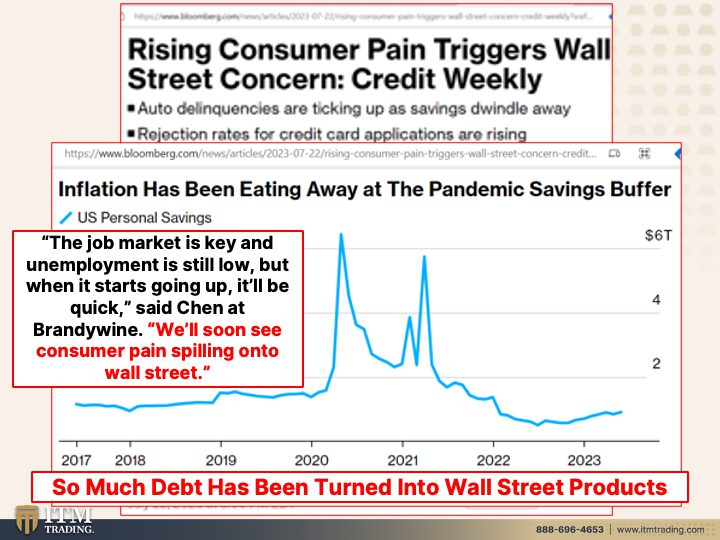

The increase in the cost of borrowing and the cost of servicing debt for both businesses and individuals is leading to defaults. Corporations and commercial real estate businesses are unable to refinance due to credit tightening and they’re being forced into bankruptcy. This is leading to job losses and decreased consumer spending which will impact other businesses and trigger a downward spiral of events.

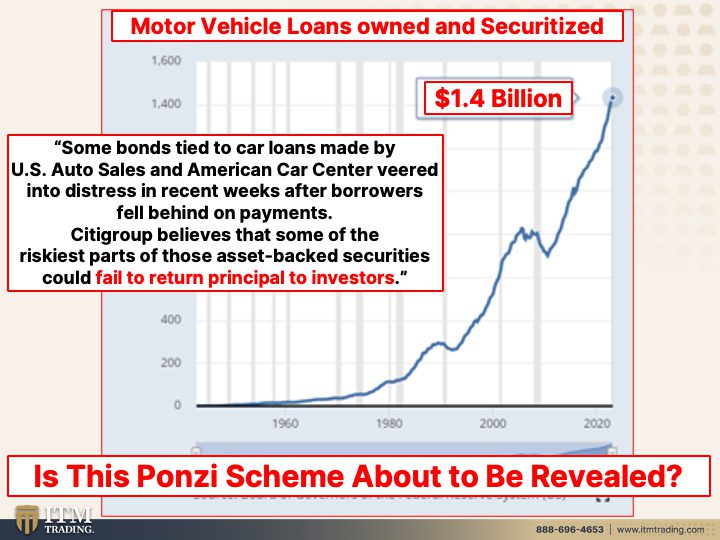

This economy is driven by the unsustainable compounding of debt and derivatives that are now being sold as all the wall street products your financial advisor recommends to you. Well guess what, the ponzi scheme gets revealed today…coming up!

CHAPTERS:

0:00 Corporate Bankruptcies

2:00 Distressed Debt

4:32 Domestic Banks Tighten

5:55 New Zombies

9:18 What About The Consumer

13:59 Student Loan Pause Ends

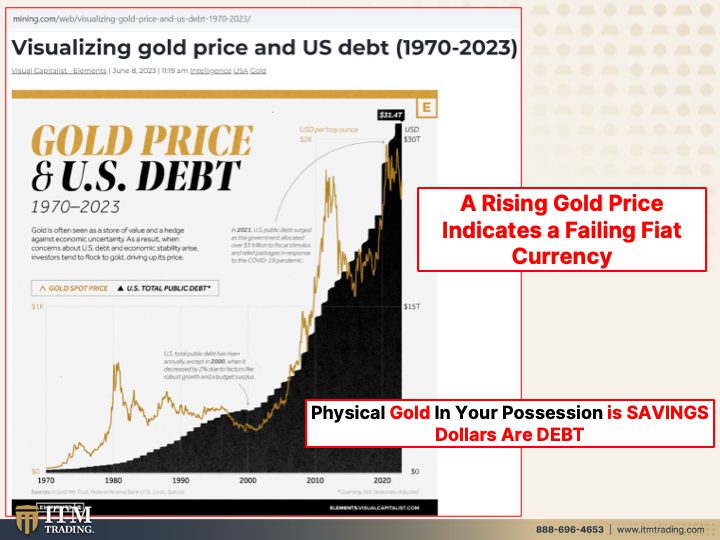

15:36 Gold Price & US Debt

SLIDES FROM VIDEO:

SOURCES:

Stock Market Today: Dow, S&P Live Updates for July 14 – Bloomberg

https://fred.stlouisfed.org/series/DRTSCLCCcc

https://fred.stlouisfed.org/series/DRTSCILM

https://fred.stlouisfed.org/series/SUBLPDRCSN

https://www.msci.com/www/quick-take/cmbs-dominates-first-wave-of/03740236548

SCE Credit Access Survey – FEDERAL RESERVE BANK of NEW YORK (newyorkfed.org)

Rising Consumer Pain Triggers Wall Street Concern: Credit Weekly – Bloomberg

https://fred.stlouisfed.org/series/MVLOAS

Student Loan Pause Ends With Chaos Looming for 28 Million US Borrowers – Bloomberg

https://fred.stlouisfed.org/series/SLOAS

https://www.mining.com/web/visualizing-gold-price-and-us-debt-1970-2023/