UNICORNS & FANTASY: The Market Trigger by Lynette Zang

Everyone asks when the hyperinflation will begin? But it became part of the fiat landscape starting in March 2009 when global central banks invented QE and used free and abundant money creation to reflate, deflating stock and real estate markets. With those markets near all time highs along with consumer and small business confidence, I’d say their intended consequences hit their mark, at least for now.

However, in the current “managed†economy, when one bubble pops another appears, intended or otherwise and we will be impacted by them all. Of course, the bubble that will force the financial system reset is the debt bubble.

What could pop that bubble? The global economic slowdown, trade wars, Brexit, the Italian “Doom Loop†between their government and failings banks, Deutsche Bank and even more that main street media discusses and then brushes off. Though all those threats are visible, there is a looming bubble that most are not looking at, that could be just the trigger to usher in the next financial crisis.

I’m referring to the rise of the corporate unicorns. A Unicorn is a rare mythical creature that does not exist in real life. A corporate unicorn is a company bleeding money, with losses as far as the eye can see, yet has a stated valuation of at least $1 billion. Does that make sense to you?

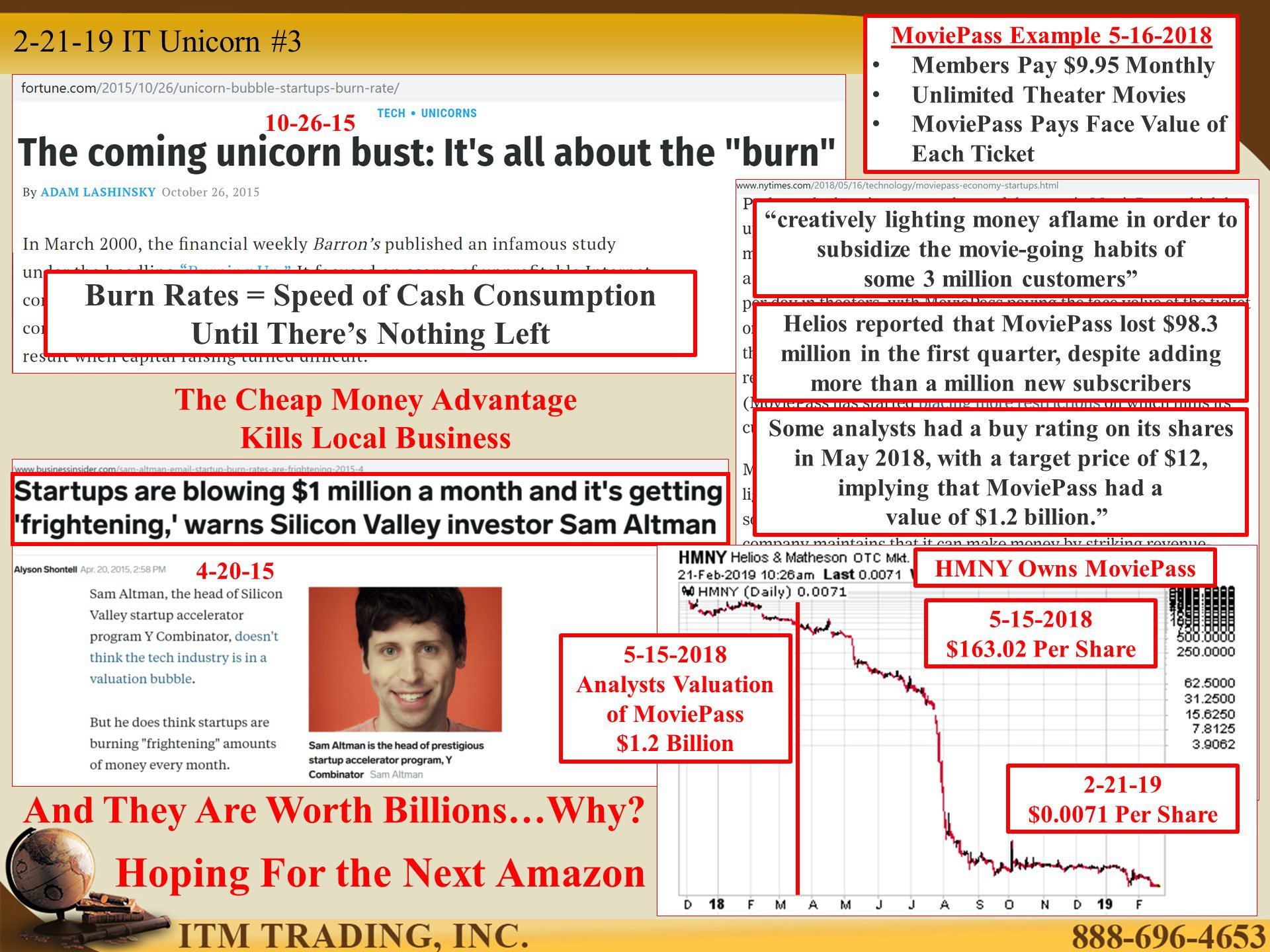

Yet that was exactly Amazon’s playbook. And after many years of losses, Amazon has emerged as a major disruptor in every market it enters, smashing competition in its path to world dominance. All thanks to its GBF (Get Big Fast) strategy. Which foregoes profits for extended periods of time. These start-ups are funded by massive funding rounds that enable them to move into an established markets and undercut competition, as issues surrounding these losses are relieved by additional rounds of funding. How nice for them.

Since most businesses (particularly mom and pop’s) need profits to stay in business, this strategy effectively kills local business, drives competition away and (in theory) enables greater price controls in the future.

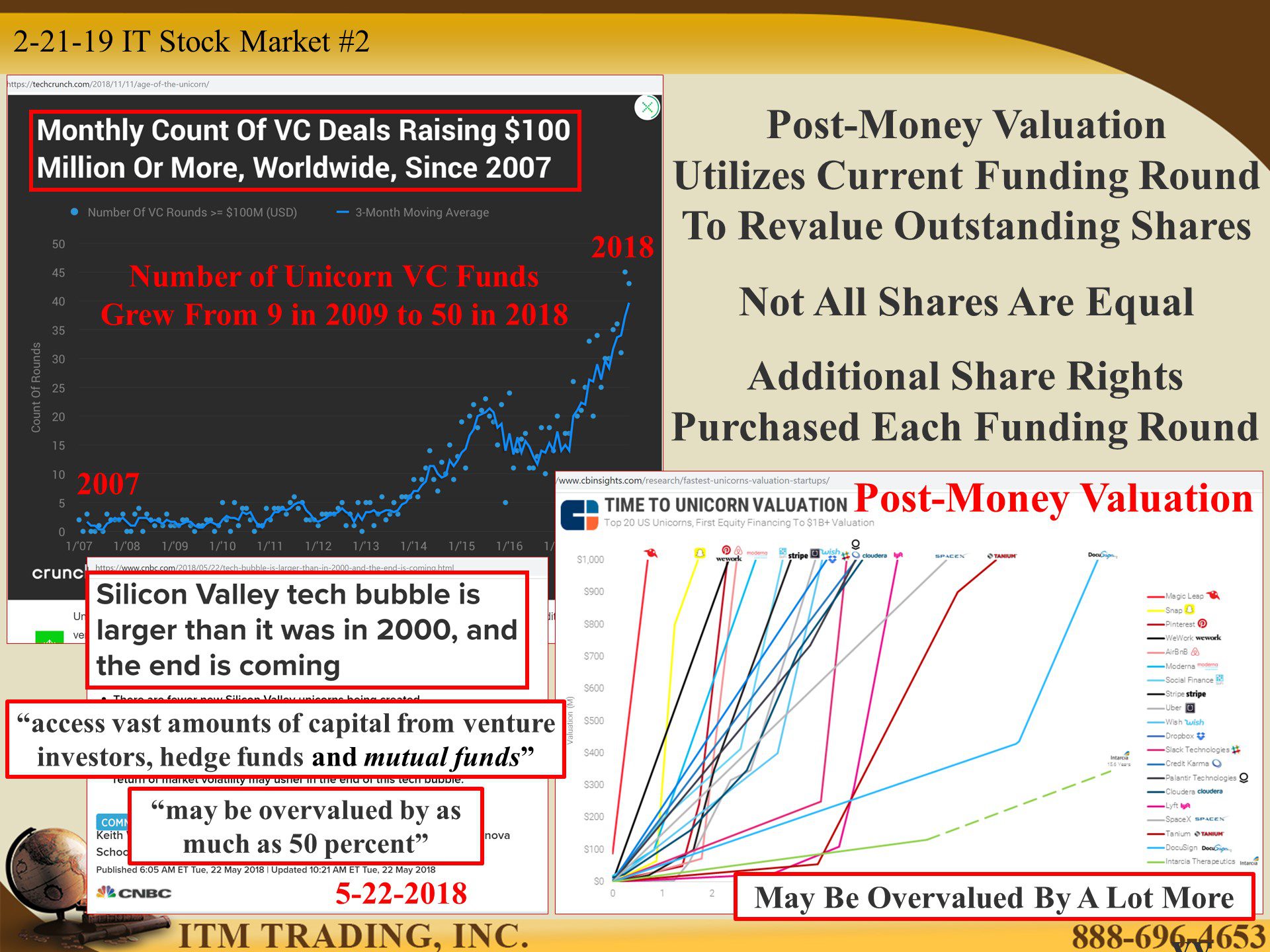

The other thing it does is hide true valuation, since valuations are subjective and based upon how much funding has been put into the start-up, which is called “Post-Money Valuationâ€. This assumes that all stock shares are created equal, but in order to attract additional funding, the corporate unicorn must give additional share rights. On average, there are eight share classes, each with different rights and therefore, different values. Studies show that this type of valuation, overvalues the start-up corporations by 50%, prompting CNBC to state “Silicon Valley tech bubble is larger than it was in 2000â€.

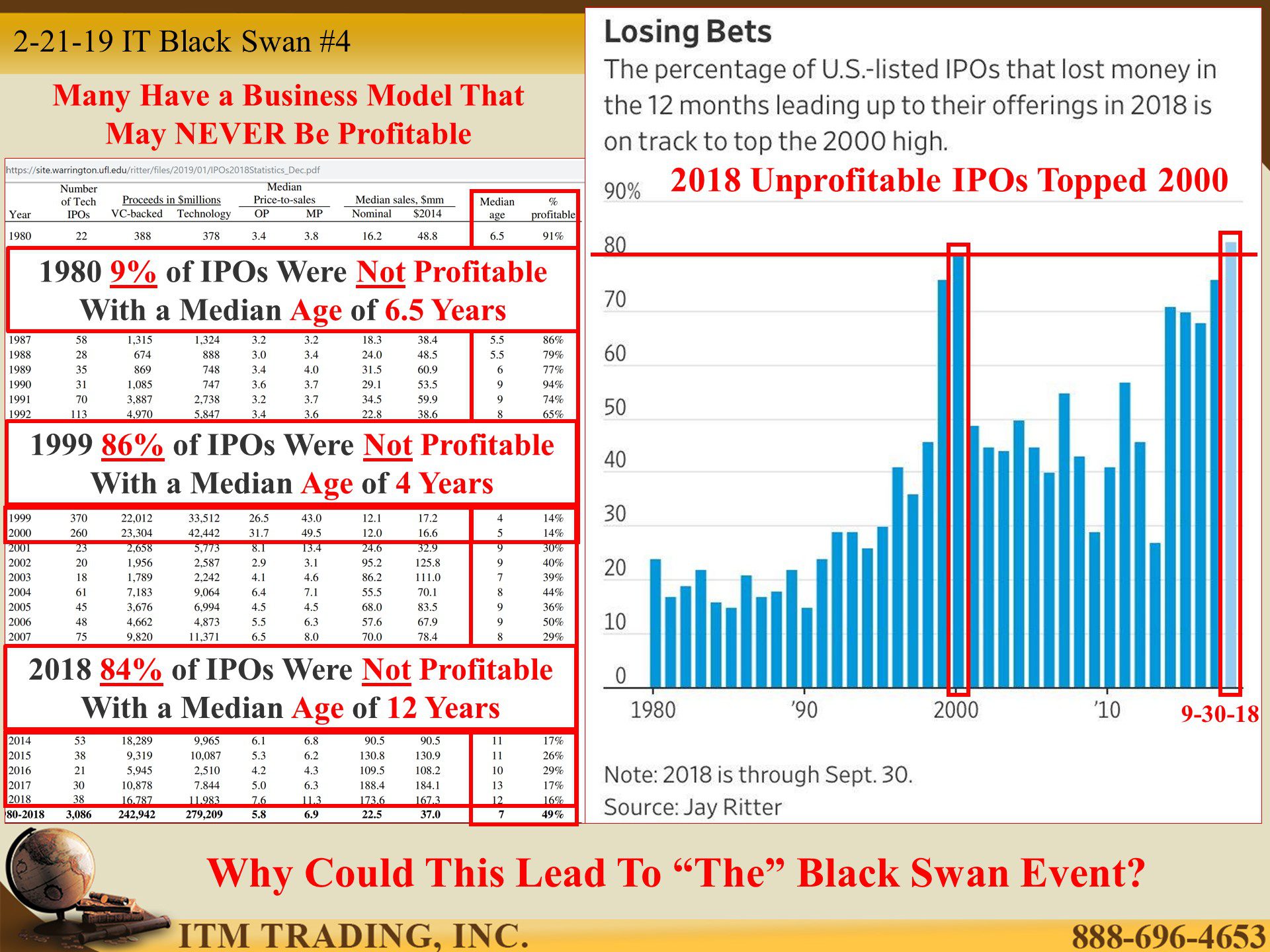

But I think it’s even worse than that since it’s really all about the “Burn Rate†or the speed of corporate cash consumption until there’s nothing left, which is a key metric for unprofitable corporate unicorns.

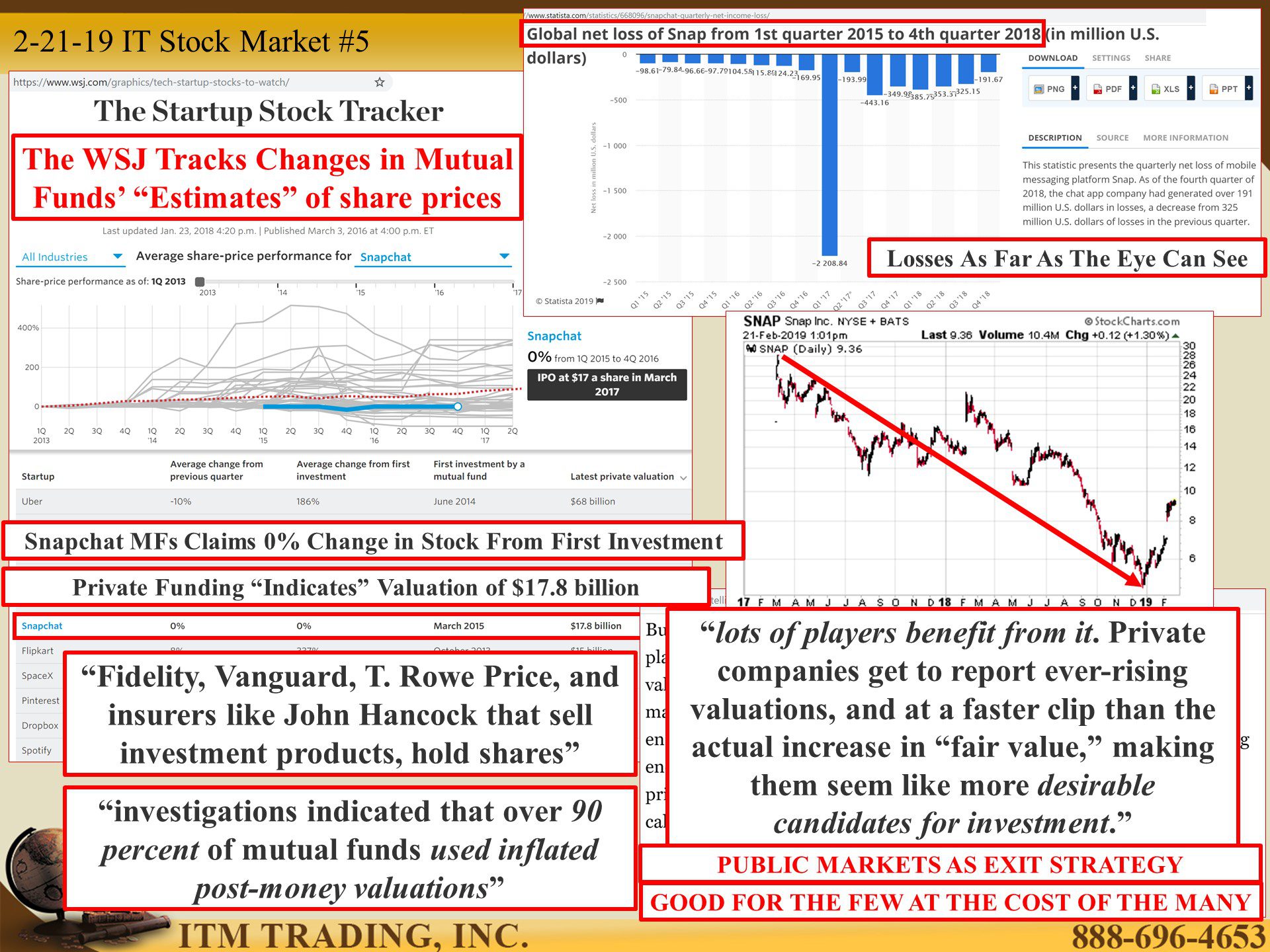

Why should you care? Because, if you hold wealth inside a mutual fund or ETF, you probably hold some. According to an article in nymag.com “Fidelity, Vanguard, T. Rowe Price and insurers like John Hancock that sell investment products, hold sharesâ€. In fact, “investigations indicated that over 90 percent of mutual funds used inflated post-money valuations†as the stated value in the funds that hold them.

And as the world sinks deeper into recession, the early investors want to take gains, preferably bloated, overvalued ones, and so, these unicorns are now coming to market. Public scrutiny is likely to show the world the sham, and because of these mythical corporate stocks are held by so many, discovery of the truth, could easily trigger a market implosion too big to bail.

Slides and Links:

https://www.nytimes.com/2018/12/06/technology/lyft-uber-ipo.html

https://www.barrons.com/articles/unicorns-what-are-they-really-worth-1510974129

https://sharespost.com/insights/articles/unicorns-charge-ahead-in-2018/

https://techcrunch.com/2018/11/11/age-of-the-unicorn/

https://www.cnbc.com/2018/05/22/tech-bubble-is-larger-than-in-2000-and-the-end-is-coming.html

https://www.cnbc.com/2018/12/14/get-ready-for-the-200-billion-ipo-shakeup-in-2019.html

https://www.nytimes.com/2018/12/06/technology/lyft-uber-ipo.html

https://www.barrons.com/articles/unicorns-what-are-they-really-worth-1510974129

https://sharespost.com/insights/articles/unicorns-charge-ahead-in-2018/

https://techcrunch.com/2018/11/11/age-of-the-unicorn/

https://www.cbinsights.com/research/fastest-unicorns-valuation-startups/

https://www.cnbc.com/2018/05/22/tech-bubble-is-larger-than-in-2000-and-the-end-is-coming.html

https://www.cnbc.com/2018/12/14/get-ready-for-the-200-billion-ipo-shakeup-in-2019.html

http://fortune.com/2015/10/26/unicorn-bubble-startups-burn-rate/

https://www.stockcharts.com/h-sc/ui

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2955455

https://www.nytimes.com/2018/05/16/technology/moviepass-economy-startups.html

https://www.businessinsider.com/sam-altman-email-startup-burn-rates-are-frightening-2015-4

https://www.barrons.com/articles/unicorns-what-are-they-really-worth-1510974129

https://site.warrington.ufl.edu/ritter/files/2019/01/IPOs2018Statistics_Dec.pdf

https://www.investopedia.com/terms/d/dual-class-ownership.asp

https://www.cnbc.com/2018/05/22/tech-bubble-is-larger-than-in-2000-and-the-end-is-coming.html

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2955455

https://site.warrington.ufl.edu/ritter/files/2019/01/IPOs2018Statistics_Dec.pdf

https://www.wsj.com/graphics/tech-startup-stocks-to-watch/

https://www.statista.com/statistics/668096/snapchat-quarterly-net-income-loss/

YouTube Short Description:

A Unicorn is a rare mythical creature that does not exist in real life. A corporate unicorn is a company bleeding money, with losses as far as the eye can see, yet has a stated valuation of at least $1 billion.

If you hold wealth inside a mutual fund or ETF, you probably hold a corporate unicorn. According to an article in nymag.com “Fidelity, Vanguard, T. Rowe Price and insurers like John Hancock that sell investment products, hold sharesâ€. In fact, “investigations indicated that over 90 percent of mutual funds used inflated post-money valuations†as the stated value in the funds that hold them.

And as the world sinks deeper into recession, the early investors want to take gains, preferably bloated, overvalued ones, and so, these unicorns are now coming to market. Public scrutiny is likely to show the world the sham, and because of these mythical corporate stocks are held by so many, discovery of the truth, could easily trigger a market implosion too big to bail.