U.S. Dollar Tokenization Test Goes Live

I wonder how hard it is to talk out of both sides of your mouth at the same time, because central bankers do that all the time. And even in this update in the prelude to a CBDC, Central Bank Digital Currency, what does the fed say? We’re still studying this, we’re still studying this, we’re still studying this, but at the same time, oh, don’t call it a CBDC, let’s call it a CE. I’m gonna explain that in a minute. And they’re gonna come out with something that is already being tested and guess who the Guinea pig is? Hmm? Your deposits?

CHAPTERS:

0:00 Testing the Digital Dollar

1:33 Currency Exchange

4:28 Wall street Tests Crypto Dollar

9:14 Programmable US Dollars

12:49 Derivative Contracts on Gold

15:09 Why Own Physical Gold?

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

I wonder how hard it is to talk out of both sides of your mouth at the same time, because central bankers do that all the time. And even in this update in the prelude to a CBDC, Central Bank Digital Currency, what does the fed say? We’re still studying this, we’re still studying this, we’re still studying this, but at the same time, oh, don’t call it a CBDC, let’s call it a CE. I’m gonna explain that in a minute. And they’re gonna come out with something that is already being tested and guess who the Guinea pig is? Hmm? Your deposits, coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM, Trading of full service physical gold and silver dealer. And let me tell you something. There are so many things that are going on right now and the information that I’m gonna give you today, you wanna make sure if you haven’t already subscribe and hit that bell. So we let you know when we’re airing, because what they’re doing right now is testing the digital dollar.

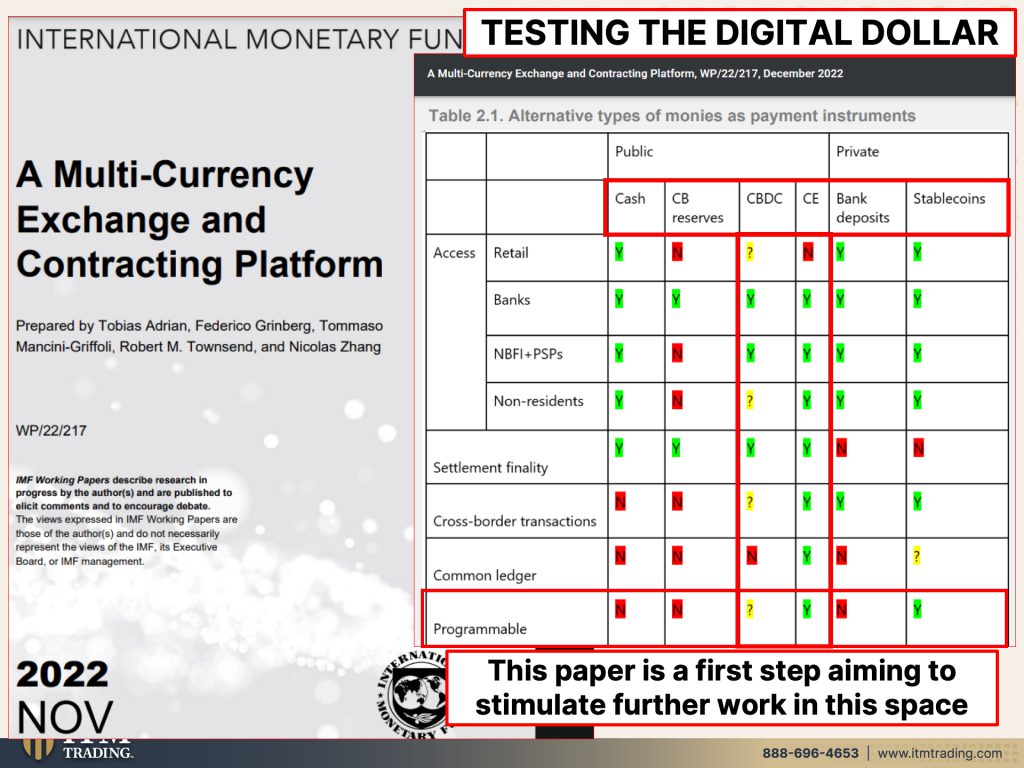

You know, I mean, they’ve been putting all of these things in place for the last couple of years and we keep being told that they’re not ready. But look at this, a multicurrency exchange, and that’s what a CE is, a Currency Exchange and contracting platform, okay. So what we’re looking at here are alternative types of monies as payment instruments, and you have public and private. So let’s take a look. This includes Cash, Central Bank Reserves, CBDC’s, CE’s, bank deposits, and stable coins. So, you know, I think that even these headers are really interesting because what, what’s a really showing you is what they’re focusing on. No, they’re not gonna take cash completely away from us. They’re gonna let us volunteer just not to use it, and then they’ll put a chip in it so they can go to negative rates. This is what they’re telling us, but they don’t want you to know that anything is changed. So they need to keep things as close to normal or what you are used to as possible. So again, cash Central Bank Reserves, CBDC’s, CE’s, Bank deposits, and stable coins are what the powers that be view as payment, instruments. And you can see by looking at the CBDC’s where they’re questioning some places in retail particularly, right? I mean basically the CBDC’s and the CE’s have a lot of similarities where they have the question marks? Yeah, I’m pretty sure those will be real similar too. And especially in here because they will be programmable. Right now the cash isn’t programmable, but it’ll get there. Give them time, give them that chip, they will put it in place. And everything that we do is programmable and maybe even set up for, I don’t know? Social scoring. I told you forever when I saw what China was doing, that everybody’s watching and that’s coming to a theater near you. Some in Europe say that they already have that foundation in place. Maybe they have that foundation in place too, because this is the first step aimed at stimulating further work in this space. So, make no mistake, this is the prelude to the CBDC, which, oh my goodness, no, they haven’t decided. Well, what? Is the US gonna be last in issuing a CBDC? I don’t think so.

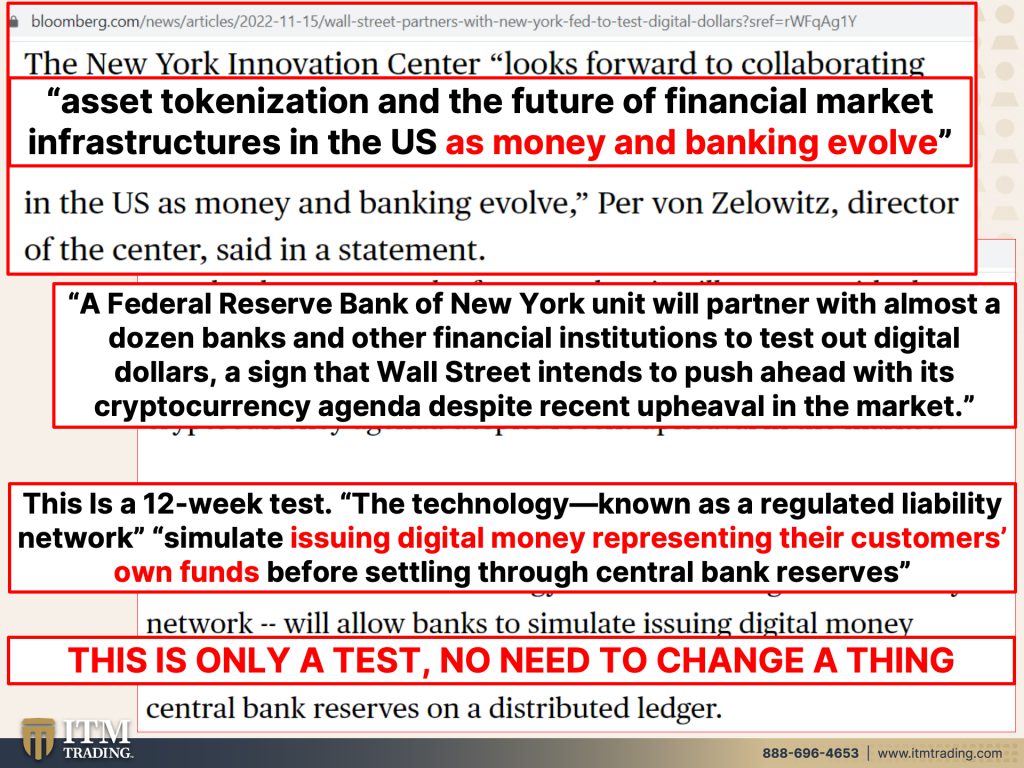

Who’s gonna be part of all of this? Oh, I don’t know. Wall Street. Because they are so trustworthy. And I hope you understand that I am being completely facetious when I say this. So Wall Street tests crypto dollars with Fed, with fed, right? Defying the FTX gloom. Now, FTX is a currency, is a digital cryptocurrency exchange. And that is now in bankruptcy taking with it a lot of other entities. Some people think that this is a prelude to getting the regulation in place that they need for the CBDC’s, I might be one of those people, but I’ll let you formulate your own opinion. Network for digital dollars will settled on a distributed ledger that will be shared, okay? Who’s part of this? Because frankly, the players are chosen. Bank of New York Mellon, HSBC, PNC Services, Toronto Dominion Bank, Toronto Dominion Bank? That must be a Canadian bank. Truist Financial Corp and US Bank Corp, along with MasterCard. I like that combination. Again, being facetious, this makes me, you know, look, I have never ever, ever said that this is not the direction that we’re going in because it absolutely a hundred percent is I will participate when I know who the winners are, when I know who’s going to survive. And I have no other choice. Right now, I have a huge choice and it’s right here. I hold it, I own it. It runs no counterparty risk.

As we’re seeing all this stuff runs, lots of counterparty risk. And what they’re talking about doing and experimenting with is asset tokenization and the future of financial market infrastructures in the US as money and banking evolve into a digital form where you can hold all of your wealth, right on your right on your smartphone. You can hold all your wealth right there and then you start to sell your equity because you’re buying other goods and services that they’re nudging you. Because we’re in a consumer driven economy, you know, before you know it, you will have nothing and you’ll be happy. Well, I don’t think you’ll be happy, but you will definitely have nothing. Oops, sorry about that. Beyond that, a Federal Reserve Bank of New York unit will partner with almost a dozen banks and other financial institutions to test out digital dollars and in a sign that Wall Street intends to push ahead with its cryptocurrency agenda despite recent upheaval in the market. So if this is Wall Street that wants to push ahead, can you please tell me why the Federal Reserve Bank of New York is participating in this experiment? Seems a little fishy to me. What do you think? Maybe you have a different opinion, but this is a 12 week test. And the technology, which is known as regulated liability network, you always have to be careful of the name because typically it’s just the opposite. What is this regulated liability? Stimulate issuing digital money representing their customer’s own funds. That’s your bank deposits. That’s what they’re talking about here. Bail in anyone? But hey, there is a regulated liability network in this. Yeah. And so they used, that’s why they had to get the New York Federal Reserve, involved in this because they’re settling it through Central Bank Reserves. Of course, they’re part of this. They were part of this from the beginning. The NSA white paper was written in 1996. But don’t worry, this is just a little test. We’re not really gonna do anything. You don’t have to change anything of what you’re doing. Keep your money in the bank because we’re gonna create digital dollars using your deposits to test with. Good. How do you feel about that? Make you comfy?

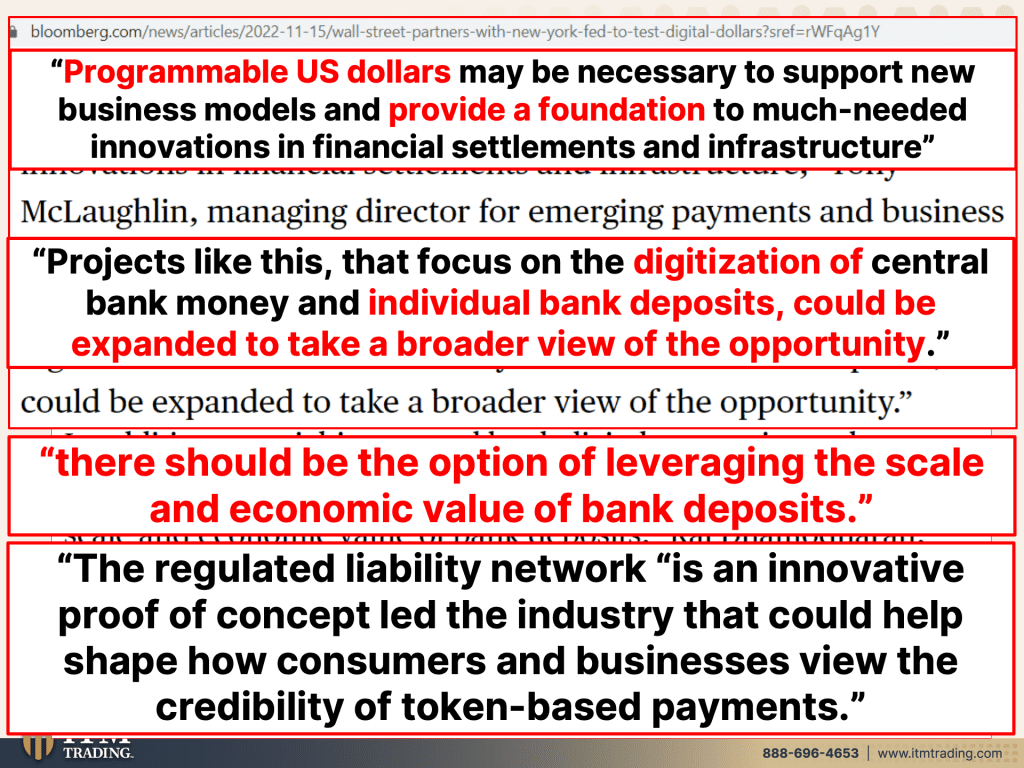

Because programmable US dollars may be necessary, you think? To support new business models and provide a foundation to much needed innovations and financial settlements and infrastructure. Cause the old system is dead. It’s dead. It died in 2008 and has been on free money life support, which should be pretty obvious is breaking down now. So they need programmable US dollars to provide a foundation to create this new system. Yeah. Let’s see. Do you think you’re too big to fail? Because I think you’re right, just about the right size. Projects, like projects like this, that focus on the digitization of Central bank money and individual bank deposits could be expanded to take a broader view of the opportunity. Let me tell you, will they take a broad view of the opportunity, but you tell me what’s your opportunity? If this is where you’re holding your wealth and it’s programmable in their control, your opportunities will be gone, gone, gone. There should be the option of leveraging the scale and economic value of bank deposits. Because clearly with Hypothecation and re-hypothecation, which is the ability of the banks to use your equity to borrow on their behalf, and in many cases an unlimited number of times, that’s not enough leverage. No, no, no. There should be the option of leveraging the scale and economic value of bank deposits. They are playing with your equity. Why is that okay with you? Whether it’s a bank deposit or it’s a brokerage account. Why is that okay with you? The regulated liability network is an innovative proof of concept. So it’s an algorithm led the industry that could help shape how consumers and businesses view the credibility of token based payments. We have got to get the people’s buy-in. Why? Because this is a con game. It’s a Ponzi scheme on top of the Ponzi scheme that has already been perpetuated on the public since 1913.

Every single person has to determine if that’s okay with them. Now, if this is the system and there’s no change, which there has to, I mean, you know, I hope Ray Dalio is right. I hope we’re seeing, we’re gonna see a revolution because none of this is okay with me. It takes absolutely every bit of control away from you, the public and me the public, and puts it in the hands of Wall Street and bankers. Do you trust them? I do not.

So let’s look at a little bit of leverage, which is, mm, what is this? Well, this is the notional amount of precious metal, meaning gold contracts. The notional, when you see that word nominal, notional, what you know is you have no idea of the amount that is really at risk. These are derivative contracts on gold. And you think with all those derivative contracts that it impacts the price that you see? Hmm. Yeah, I think it does. Derivatives are a great way to see how banks leverage gold. And they do it with silver too. And they make money on that leverage and they get you to go, oh, but look, gold is going down. I don’t wanna buy, I guess I’ll buy stocks, or I guess I’ll sit in cash or I’ll do some other fiat monies, piece. And they’ve gotcha right where they want you because this is cheap and easy and using your wealth for their benefit. Oh, that’s a good idea for them. But how about for you? Because physical gold works different. So does physical silver. It works different because that’s a true supply and demand market. So my original plan when we got to the whole other side of this mess was to convert a chunk of my gold holdings. Not all of ’em, because you always have to have a foundation anyway, but a chunk of my gold holdings into the new currency when it had a component of gold there and was stable, that’s when you’re gonna know it’s over is when they put a component of gold in the currency. But seeing all of this that they’re choosing to do, no, no, no. I will convert it as I need it. How about you?

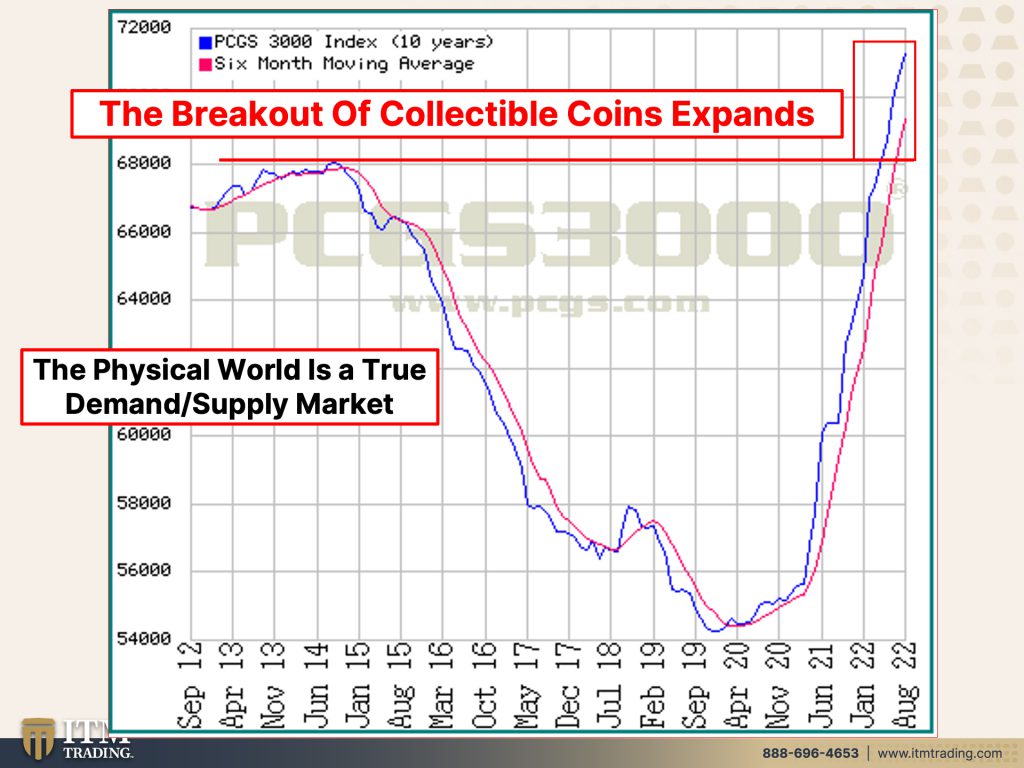

Because let’s take a look at what’s happening in the physical world in this world right here, because a few, was it maybe a month ago or something like that? I showed you that the physical collectible coins had broken out. And guess what? That’s gotten even bigger. It expands. Can you see that? It had just just done a breakout. Well, I would say that this is a definitive breakout. When are you gonna position in, oops, sorry about that. When are you going to position in? When it goes a whole lot higher? Or how about now? While you still can before they’ve got you completely under their control. Because once we go to a digital currency, they don’t want you buying gold. Boom. You push a button. They don’t want you buying anything. Boom. You don’t agree with them politically. Boom, they have you and there won’t be anything that you can do about it then. So the time to do something is now just hit that calendly link. If you don’t have your strategy in place, get it in place. Hit that calendly link below and make an appointment to see one of our, one of our consultants. They can help you create your own personal strategy. The foundation will be exactly the same as mine, but it’ll be tweaked to your goals and your circumstance and what you have to work with. But make no mistake, you’ve gotta get it in in place ASAP. We are seriously running outta time. I have said right along 2022 is a very pivotal year and it’s been proven to be a very pivotal year.

But you wanna also make sure that you watch last Thursday’s video title, Treasury to Collapse the Economy and Markets. This is critical. That’s why it’s so important for you to get your food, water, energy, security, barterability, wealth preservation, community and shelter. Get your mantra in place. And also you wanna watch this Saturday’s video on the regime shift and the changing world order. These are very important and it’s important for you to share. And if you like this, please give us a thumbs up. Again, make sure that you subscribe if you haven’t already. But it’s so critical for you to share, share, share because things are unfolding very, very rapidly right now, which means we are running outta time and we are running out of options. Please. I would rather be two weeks too early, than even one second too late because that one second is when you lose all of your choices. Make your choices now. Get yourself into position, make sure you have food, medicine, everything that you need to sustain a standard of living. Talk to us, we’ll help you based on historic precedence. We’ll help you get everything in place and until next we meet. Please be safe out there. Bye-bye.

SOURCES: