The Impact of U.S. Credit Downgrade in the Economy – by Lynette Zang

Recent downgrades in US credit ratings, from AAA to AA+, underscore the mounting debt crisis. These shifts affect interest rates and borrowing costs, highlighting the significance of managing national debt responsibly. Amid economic uncertainty, tangible assets like gold and silver emerge as reliable safeguards against devaluing currencies and market fluctuations. Diversifying with precious metals offers a defensive strategy against potential financial instability.

CHAPTERS:

0:00 Fitch Downgrade

7:34 Federal Debt& Debt Ceiling

11:04 $652 Billion in Debt

15:47 Fed’s Balance Sheet

18:29 Preparedness

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

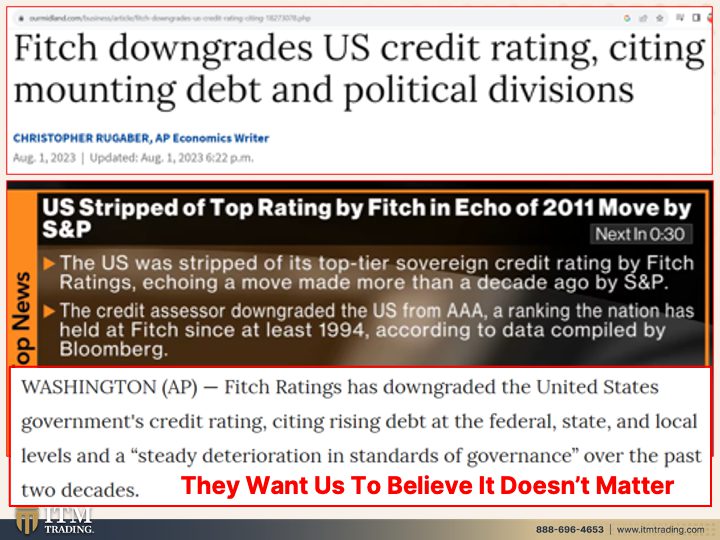

Well, Fitch just downgraded the US debt. And that means that we’ve gone from AAA to AA+ similar to what happened back in 2011 now with the S&P when there was the last debt ceiling debate. Should we pay our bills? Should we not pay our bills? Well now they want you to think that that doesn’t matter. And of course, of course today we also had Fitch come, or not…Moody’s come out and do a whole bunch of bank downgrades and put a whole bunch of other banks on credit watch. So again, they want you to think, nah, it doesn’t matter. The debt doesn’t matter. The grading doesn’t matter because after all, it’s the markets that’s gonna determine the interest rates. Well, that’s not entirely true with all the meddling that the central banks do to jury rig all of the interest rates. But I don’t know. I’m gonna let you decide whether or not it really matters to you. Coming up.

I am Lynette Zang, Chief Market Analyst here at ITM Trading, a full service physical, gold and silver dealer. And yes, you can get your gold and silver here from us. And let’s talk about what’s happening because this is good money. This is real money. This has demand in every single aspect and every single area of the global economy. What do you have here? Lots of downgrades, don’t you? That you can’t even use these as a tool of barter anymore. So is that where the US dollar is headed? Yep, it absolutely a hundred percent is.

Let’s just look at what’s going on now. You’ve got Fitch downgrades, US credit ratings, citing mounting debts and political divisions. The US has been stripped of top rating by Fitch in echo of 2011, move by S&P. The US was stripped of its top tier sovereign credit rating by Fitch ratings. The credit assessor downgraded the US from AAA ranking the nation has held at Fitch since at least 1994. So what exactly does all of that mean? Well, it means that it’s gonna cost us more as we issue debt, because if they’re not sure that you’re gonna be able to pay that debt, then they’re not, then they’re gonna demand more interest. But the US, here’s the problem. The US is still classified as the world reserve currency, which means that if you are a government, a corporation, or a citizen going outside of your borders to buy anything, you had to do it with US dollars. Now, that’s no longer true. So that puts us in even greater jeopardy. But Fitch ratings has downgraded the United States government’s credit rating, citing rising debt at the federal, state and local levels, and a steady deterioration in standards of government over the past two decades, count them. Of course, they want us to believe that it doesn’t matter. Don’t you remember when we were taught, oh, the debt doesn’t really matter and we kept going after that. So, hey, maybe this credit rating doesn’t really matter? And we can just keep going along as we are. Well, I think it does matter. I think it matters a lot.

But JP Morgan, Jamie Diamond calls this downgrade ridiculous. It doesn’t really matter. After all the markets determine that Warren Buffet says he is not worried about the US downgrade Watch. He’ll just keep buying more tenure treasury bonds. Of course, both of these entities and people have a whole lot more of this crap than you and I do. Plus they’re in the team that’s been chosen to win. ’cause Remember, as George Garland says, this is a big club and you and I are not in it. We need to create our own club and vote with our wallets. Because if you vote with staying in the fiat system, then you’re being ruled by these guys and the central banks and so much more. Now, I will say that having them come out and saying that it doesn’t matter, that it’s ridiculous, makes me feel so much better, especially since that’s what backs this. And I hope you realize I’m being completely facetious because I know the truth.

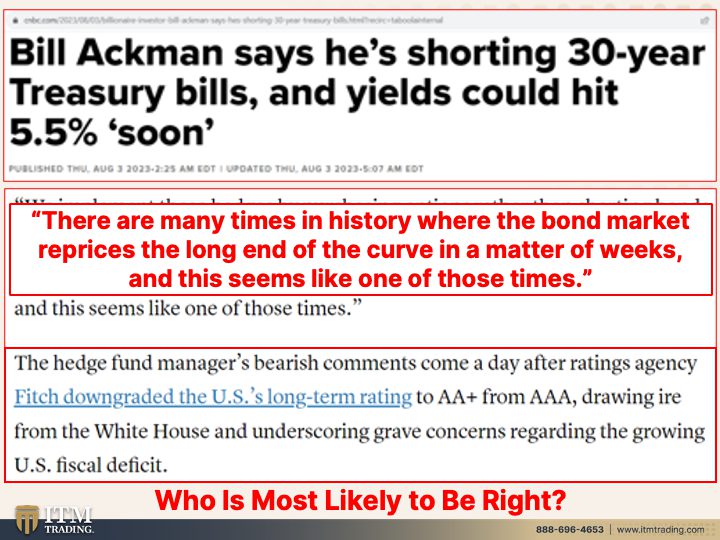

And I agree with Bill Ackman. He says he’s shorting the 30 year treasury bills. Well, 30 year is actually a bond and yields could hit 5.5% soon and they could go a whole lot higher. So all of that debt that’s been issued since 2008 when we went down to zero interest rates, remember interest rates go up, the market value of those bonds go down. Well, this looks to be the, if this is the foundation of the global financial system and it’s doing this means we got a very, very shaky foundation. And I might just point out to you, since Bill is talking about the 30 year, okay, this is when issued, this is your 30 years, you can see that when interest rates move, you have a much greater move in price the further you go out. So by going out 30 years, he expects interest rates to keep going up, okay? So that he can buy this back when the market value is even lower. And that’s how he makes his money. We implement these hedges by purchasing options. There are many times in history where the bond market reprices the long end of the curve in a matter of weeks. And this seems like one of those times. So all of those retirement plans that are sitting on all of that debt, this is what they’re sitting on. It’s kind of hard to retire on that. Further, the hedge fund manager’s bearish comments come a day after ratings agency Fitch downgraded to a AA+ from AAA, drawing ire from the White House and underscoring grave concerns regarding the growing US fiscal deficit. Is that gonna get smaller? Heck no. Oh, wait, what? But wait, what about, what about President Biden’s inflation package that he put together that’s supposed to reduce the deficit? They always say that, okay, all we have to do is spend this much money and that will reduce the deficit in 10 years when they’re long gone. It never does. It never ever does. So really, between Jamie Diamond, Warren Buffett, and the White House and Bill Ackman, who do you think is gonna be right? I’m betting on Bill. I’m absolutely betting on Bill.

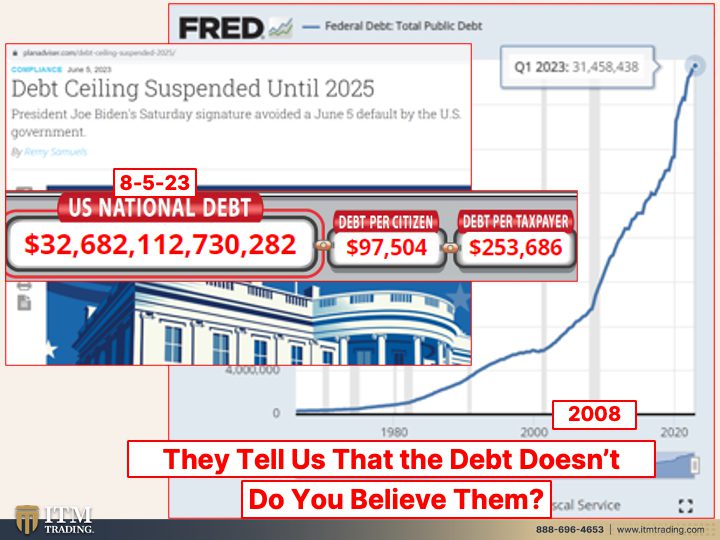

Now, this is the federal debt. Now I want to keep it, I want you to keep in mind that these gray bars are official recession. And you might notice that as we were lifting off into this new debt-based system, then when we would hit that gray bar, the debt would grow faster and faster. And look what happened since 2008. That’s a hockey stick. That’s exponential debt. Ceiling has been suspended until 2025. So basically they can spend any amount of money that they want over this next year and a half. Isn’t that convenient? But they had to do it just to avoid a default. But they really were going right up to that line. At what point will they cross that line? On 8/5, which is when I pulled these numbers from the national debt clock, we were now at $32.682 trillion in debt. That’s over 97, almost $98,000 per citizen. So that would include babies. But $253,668 per debt per taxpayer. We are the ones that are responsible for this debt and we’re not done yet. The debt is gonna get a whole lot higher and so is your bill. But they don’t tell us what this really means. It means, like they said in England, get used to it. You’re just gonna be poorer. Well, don’t get used to it. Protect yourself. Become as self-sufficient and indispensable to yourself as possible. Become your own central bank. Become your own grocery store. Become your own utility company. Get this stuff done. Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter. This is what we all need to sustain a reasonable standard of living. Because you know, you really need to ask yourself, do you believe all their garbage and all their lies? Do you believe that they’re doing this in your best interest or are they doing it? So you know, really what’s the job of the government, especially big government, is to remain big and take even more, take even more of your liberties, even more of your freedoms. CBDCs hello. And the job of the central banks is to protect the central banks. It’s not to protect you.

Well, I think it’s time we take it back and say, no, this is not okay with us. Because they’re looking at now an estimated borrowing that was up from $733 billion to a trillion in just this quarter. And that’s happening today. They’ve been issuing the debt. We’ll see where it goes. But who’s gonna be buying this back? Well, if the market isn’t out there buying it, if the Federal Reserve isn’t out there buying it, because remember they’re trying to run off their balance sheet, then who might do that? Hmm? Might it be institutional investors that are investing your money? Think about that.

The treasury said Monday that 83 billion of the increase in borrowing estimate for the current quarter was due to projections for weaker revenues and higher spending. While most of the revenues come from payroll taxes. So are they trying to tell us that they expect unemployment to grow substantially weaker revenues? And they’re certainly telling us they’re gonna keep spending money because they want things to look like they’re okay. They’re not okay.

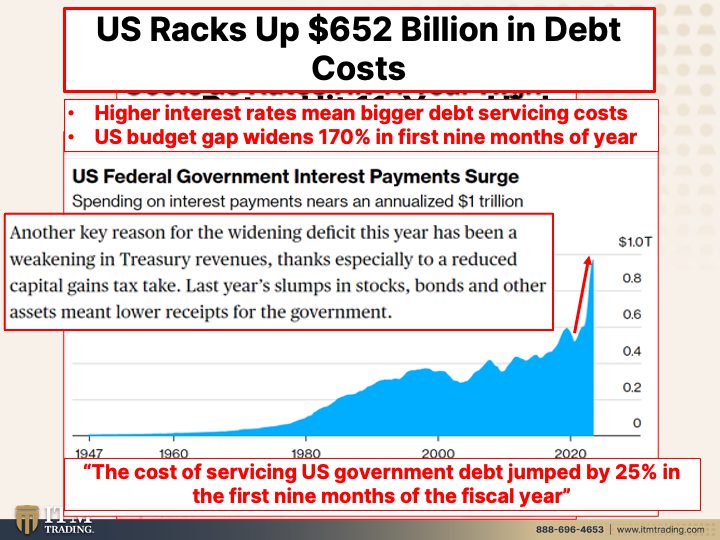

But this is what I really also wanna point out. US racks up $652 billion in debt costs as rates hit 11 year high. Now back, I think it was 2009, you know, I said to myself at that point the deficit was running about a trillion dollars, which means that they took in a trillion less than they spent. But yet the debt that we were servicing at that time was 13 trillion. Now it’s over 32 trillion, but then it was 13 trillion.And so I said to myself, well gosh, if we’ve only spent a trillion dollars more than we have coming in, why are we servicing 13 trillion in debt? You go into the FRED, you can go to the data that backs up all of these numbers. And that’s what I did and what I discovered. So even this is garbage, it’s not true. What, what I discovered when I did it and I sent it to an accountant friend of mine to make sure that I was looking at it right? ’cause I’m not an accountant. And he said, yes, you are. What I discovered was all of that was compounding interest. Because when you’re spending more than you’re taking in, you’re not even paying all of the interest on the debt. So think about you with the credit card. If you don’t pay all of the interest plus some of the principle, that interest then goes into the principle and starts compounding. So you’re paying interest upon interest upon interest. So how high is that now? Well, I haven’t done that study again, but if you stop and think about it we’re, we’re looking at maybe 1.3 or 1.5 official deficits, but we’re servicing $32 trillion in debt. So 652 billion in debt costs may be additional debt costs from the higher interest rates. But absolutely there are compounding interest. And look at how this is surging. This is just the interest rate surge that’s should frankly really scare the crap out of you because that’s not going away. And the US budget gap widens 170% in the first nine months of the year. This is savings. This is debt. I like this in gold and silver in my possession I trust. Another key reason for the widening deficit. This year has been a weakening in treasury revenues. Thanks especially to a reduced capital gains tax take. Yeah, I think it’s more than that. Last year, slumps and stocks, bonds and other assets meant lower receipts for the government. What are you trying to tell me? That the government has a vested interest in the stock and the bond markets going up? Yeah, that is exactly what they’re telling us. The cost of servicing US government debt jumped by 25% in the first nine months of this fiscal year, 25%. So the budget gap widened 170%, but the cost of servicing debt, so it’s not the debt, just the cost of servicing. It jumped 25% in the first nine months. So, and what does the Fed tell us?

Higher for longer, that they’re going to raise rates and keep them higher for longer? My bet is, is that something will break really badly and there will be a pivot. I don’t think it’ll be immediately. I think they really need to really make it happen badly first.

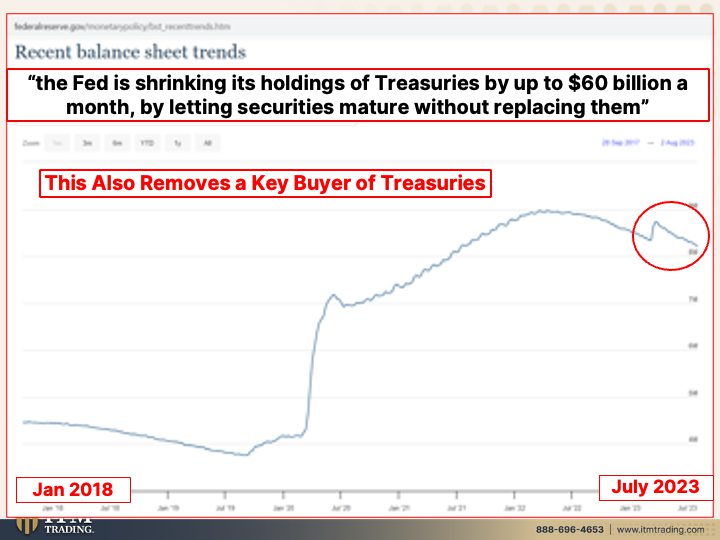

And this is the Fed’s balance sheet, presuming you believe them. And you can see this is January, 2018. ’cause Two thou prior to 2008, we’re at 800 billion. Now we are still above 8 trillion just in that little period of time. But they are not replacing the maturing bonds. So you can see this decline right there. So if the Fed who has been buying a ton of treasuries is no longer buying the treasuries, and you see this attempt to run it off and then boop, and now we’ve got another attempt, we’ll see how long this goes. Normalization what’s normal. We’ve been in extraordinary measures forever. The Fed is shrinking. Its holding as treasuries by up to $60 billion a month by letting securities mature without replacing them. So I’m thinking a lot of this debt is gonna have to be absorbed by pension plans and retirement plans and institutional investors because this removes a key buyer of treasuries. That’s not a good thing.

But fed officials tout job markets slow down, seek to pivot from hikes. Yeah, they wanna lower rates because the corporate debt, the government debt, this is a huge debt bubble that is already popping. So rather than try to reflate it, they’re trying to let it go down slowly. Is that gonna happen? Well, if history is any indicator, I would say no. ’cause There, here’s a whole bunch of currencies that have absolutely zero market value. You can’t barter with them. Maybe they have a little bit of collectible value and people think, well, I bought a whole bunch of these Iraqi dinars and and they’re gonna make this good again. No, that’s what they knew when they set up this system. And they said people cannot but hope that their currency will regain some of its purchasing power. But it never does because the design is for it not to debate to shift from how high to hike to how long to hold. Mm. Yeah. But don’t worry. ’cause They’re coming out and saying, yeah, I think the Fed can pivot. I think we don’t have to raise rates anymore. Yeah, because the system is flipping, falling apart. Do they need to pivot to control interest rates and support this bond market? Do they need to pivot so that the treasury can issue tons more debt?

You really have to look at this. They want you to think that the levels of debt don’t matter. They want you to think that the rising interest rates can, can still engineer a soft landing. It’s garbage. How many times can you be lied to when you do not know the truth? When you know the truth? What are you gonna do if you haven’t already? I hope you’re gonna click that Calendly link and set up a time to talk to one of our gold and silver strategy specialists so that you can get your own strategy in place and execute it based upon your goals, your needs put you first. That should be that way a hundred percent of the time. And you know, you gotta have this for your foundation to protect whatever you have in the fiat money system and to put you into position to not just survive this, but even thrive through it. So on the other side of it, you’re in a much better position. You are not you own nothing and are miserable, okay? You wanna also be as independent and self-sufficient as possible. So if you haven’t yet, go check out our Beyond Gold and Silver channel we’re we meet you wherever you are.

So if you’re new to the rest of the mantra, the food, water, energy, security, et cetera, we’re gonna give you some basics to get you started. But if you are an expert, come and join us and help us, help everybody because frankly, we are all in this together. And we have a great little community, thrivers community where we really do come together and help each other. So remember, we’ve had some USA to become the third world. I mean, you need to look at some of the recent videos that we’ve done because things are unfolding right now. Ignorance does not make you immune, it just leaves you vulnerable. We do not want anyone to be vulnerable. So if you haven’t yet, make sure you subscribe to this channel. Leave us a comment, give us a thumbs up and share, share, share. Because we we’re in a war here. We’re in a battle. We need as many people as possible to see, take off those rose colored glasses, see what’s really happening so that you can make educated choices that put your best interest first. ’cause Financial shields, they’re made of physical metal, gold and silver. Definitely not paper or promises because those are just lies. And until next we meet, please be safe out there. Bye-Bye.

SOURCES:

https://www.ourmidland.com/business/article/fitch-downgrades-us-credit-rating-citing-18273078.php

https://fred.stlouisfed.org/series/GFDEBTN

https://www.planadviser.com/debt-ceiling-suspended-2025/

https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm