The Gold Standard vs. Fiat Money: How the Transition Changed Everything

🗣 Explore the evolution of money and the economy with this in-depth video. From the gold standard to fiat money and the creation of the Federal Reserve, we delve into the history of financial systems and their impact on society. We also examine the collapse of the housing market in 2008 and the role of derivatives in the financial crisis. Discover the potential consequences of central bank actions, including the concept of a “bail-in” and the effects of inflation on the economy. Plus, learn about the newest development in financial systems, Central Bank Digital Currencies (CBDCs) and the potential impact on privacy and control.

CHAPTERS:

0:00 Intro

1:12 Where Did It Start

2:50 The Transition

5:00 1933 – Roosevelt

8:55 Derivatives

13:03 Reg D and Yale Law Study

19:00 Bail-ins

21:40 Hyperinflation & Reset

28:54 Revaluation

30:24 Digital Currency

33:30 Gold

TRANSCRIPT FROM VIDEO:

Eric Griffin (00:16):

Today, Lynette and I decided we wanted to come into the room together, into the studio here and talk about kind of where we’ve been in the past, to how did we get to where we are today, and then what do we really see for the future. And we wanted to do this in a different format, kind of like the format we do in Q&A, but a little bit more conversational. And just kind of, kind of present you the timeline of events in a way that we hope really translates to you in a way that, you know, you guys are always asking, can you, what’s the one video that my friends and family should watch that really explains to us explains to them what’s going on here? But we wanted to do it in a more conversational dialogue type of format without all the charts and the, you know, graphs and all those things and kind of try to keep it simple. So we’re just gonna dive in. This is something we’ve never done before, but we wanted to try to do it for you guys cause you’ve been asking for this kind of content. So, Lynette.

Lynette Zang (01:12):

Yes.

Eric Griffin (01:13):

Okay. So where do you feel like this all started? Like what was kind of the, in your opinion, like the starting point?

Lynette Zang (01:21):

Well, I think governments had a problem when we were on the gold standard because if they wanted to tax you more, you knew about it. And if you knew about it, then you might give them pushback. And they don’t want pushback. They want you to volunteer. So they needed a system that they could tax you without having to go through legislation making it visible for you. And when you’re on a gold standard, it kind of supports the currency and doesn’t allow you to inflate its value away. So the whole thing started from that premise. Plus companies, corporations wanted to pay you less money, but if you were used to getting a certain amount, you’re not gonna be willing to take less. However, if they could make what they give you spend less and put more money in their pockets, that’s what they wanted to do. So, private corporations got together with the government and they came up with this fiat money idea and they installed the Fred or the Federal Reserve in 1913. And that really started the transition. So we were still on a gold standard, but they shifted from a 20th of an ounce to a dollar, to 20th of an ounce to $2 and 40 cents, which enabled them to inflate the monetary, the currency that was in circulation by almost two and a half times.

Eric Griffin (02:51):

Okay. So the Federal Reserve was instituted in 1913 mm-hmm. What year did the, the transition from, you said a 20th amounts to a dollar to a 20th, the 20th announce ounce to $2

Lynette Zang (03:02):

And 40 cent

Eric Griffin (03:03):

What year was that about?

Lynette Zang (03:05):

That was 1913 And Oh, that was okay. That was, and so if you look at the purchasing power graph you can see on the kickoff that the purchasing power dropped roughly 50%. Yes. Because they printed $2.40. Right? As compared to the gold that they held. So that would’ve been noticeable, but at the same time, they were also for the first time enabling the normal population to get credit and to get, you know, unbacked credit. So it kind of offset it. And since there was so much more money sloshing around, have you heard of the roaring twenties? So part of the way that governments and central banks use the transition is they allow the general public to thrive for a certain period of time so that they’re not really paying attention. Okay. Because, hey, what are you gonna complain? Now all of a sudden you have a lot more, at least nominally you have a lot more money than you did.

Eric Griffin (04:09):

Right. So then in 1933, when the government basically confiscated the gold Right. cause they needed to be able to print even more money, and then they changed that ratio.

Lynette Zang (04:20):

Well, let’s kind of back up to move forward for a second. Sure. Because when we were on the gold standard, if, if you, as an individual did not like what your government was doing, you would simply bring money, cash dollars, federal reserve notes into the banks and convert it to the gold, pull the gold out of the system, which then, you know, when you’re on a gold standard, it’s fiscal responsibility. Governments have to be responsible. But so you would walk in with a dollar bill and walk out with the gold and that created further restrictions for the government.

Eric Griffin (04:57):

Right. They couldn’t print as much money. Correct. So then enter 1933

Lynette Zang (05:02):

They had to eliminate that

Eric Griffin (05:03):

Roosevelt confiscates, the gold. Mm-Hmm. <Affirmative> gives you the $20 and 67 cents an ounce, but then shortly thereafter raises the price of the gold to dollar ratio for $35 to one, which then reduced the purchasing power of the currency 42% overnight. Mm-Hmm. <Affirmative>. So people lost 42% after that confiscation. Right. So, so now I’m, I’m just gonna fast forward all the way to 1971

Lynette Zang (05:27):

Okay. But you could say that’s an overnight revaluation, couldn’t you?

Eric Griffin (05:30):

A hundred percent. It is Right.

Lynette Zang (05:34):

Historic norm in the US`

Eric Griffin (05:34):

It’s a reset.

Lynette Zang (05:35):

Yes, it is. Yes, absolutely. A hundred percent.

Eric Griffin (05:38):

So then in 1971, Nixon takes us off the gold standard completely under the guise of a bunch of different things, but he, then that enables the central banks to print money at will unchecked. Right. And I know you’ve said it many times that enabled the financial products that we see today. Oh hundred percent. So why you tell him about derivatives and where, where you feel like your concern is with derivatives?

Lynette Zang (05:59):

Okay, so really what was happening in the sixties the late fifties and the sixties with the Vietnam War was that the US was exporting inflation because they were inflating the currency that they were had promised to keep steady at $35 an ounce to gold. And so there was actually a run on the dollar from foreign governments, and they were turning in dollars and pulling the gold out of the system. That’s really why Nixon, they say it so nicely closed the gold window. But what he did was disallow, like they did for individuals in 33 and 71, he then disallowed other governments from sending in their dollars and pulling it out of our system to create restrictions. And then when he closed the gold window, he handed over full control of inflation to private central banks. Right. Okay. Mm-Hmm. <Affirmative>. So that’s what happened in 71, even with the promised, well, if you buy, if you buy American made products, you’re not gonna feel the inflation. Right? Yeah. Well, if you do that, except then we started on the path to globalization and we shipped all of the American jobs, or a lot of the American jobs, particularly in manufacturing. We shipped that away. And then what the central banks were doing after that, the currency was backed by the full faith and credit, no more gold that goes away. It’s just faith and credit. So if you think about those terms, as long as we trust you and we have faith, we’ll keep loaning you money. So that was then the system based upon debt, which is why we have the debt levels that we have today, because that’s how new money is created in the system. But yes, that absolutely goes to, they call it financial innovation, where they can create products outta nothing because it’s easy to fund those products with the funny money, right? Kind of works like a spoke, if you have the central bank that creates the money in the, in the center, then you have the corporations that are closest to the central bank. So other banks, JP Morgan, Wells Fargo, all those guys, well they get the money, the new money cheapest when it has most value. And then after that, that next wider circle is the government because we, the taxpayers have to pay that debt. But if Wall Street gets that money when it is the cheapest and it has the most value, it’s pretty easy then to turn that into all sorts of leverage products because that leverage creates more debt and that more debt creates more money. So that’s how they were able to grow that system and also pick winners and losers.

Eric Griffin (08:54):

Right. So then, then, so then derivatives are invented. Essentially we see derivatives explode out of control, and then 2000,

Lynette Zang (09:03):

Well, in the nineties

Eric Griffin (09:04):

Okay. So let’s, let’s just fast forward, let’s just go all the way to 2008. Okay. So now, so now this whole money printing has gotten out of control and they’ve, it’s allowed this financialization of products, the derivatives, and now we have derivatives and they’ve gotten huge. And now 2008

Lynette Zang (09:18):

Speculative derivatives, right? Okay. and what happened in 2008 was very much like what happened in 1929. So there was lots and lots and lots of, of loose credit, right? They wanted people to borrow and spend to quote unquote stimulate the economy. And they were using I mean, we went to a period where we were going from bubble to bubble. So the central banks created that housing bubble, just like they just now created another one between mm-hmm. <Affirmative>, you know, 2008 and all of these derivative products with all of that innovation. Well, what they would do is they take a mortgage and they would pull from the mortgage your promise to pay that mortgage. And that went into, let’s say you had really crappy credit. And it’s important to understand all of this innovation, right? So the mortgage is sitting over here with the bank, but the promise to pay is pulled out of it. Now, if you somehow, with their formulas, if you have crappy credit, you know, you’d be at maybe a B or a triple C or something like that below investment grade quality. But somehow, according to their formulas, 20% of the people with that really crappy credit were likely to default. However, when you take a whole bunch of people with really crappy credit and you put ’em together, somehow magically it goes from below investment grade junk quality to AAA rated. Well, you can do a lot of things with AAA rated credit. It can go into retirement plans, it can go that that’s really the key. It can go to, into insurance products, etcetera. But the underlying theory and the underlying formulas were wrong, and they will be wrong again. And so when the credit was cut off, and these, those pools of of promises were called CDOs, Collateralized Debt Obligation, that was the promise to pay. So we know what happened in 2008. A lot of people stopped paying, didn’t they? Mm-Hmm. <affirmative>. All right. So that was the, the second speculative derivative. Implosion. Cause derivatives have been around for a while, but they weren’t speculative, they were for end user. And I’ve talked about that quite a bit over time. And so instead of the CDOs, the Bank for International Settlements is super concerned about CLO’s, which are collateralized loan obligations that have taken the place of those CDO’s.

Eric Griffin (12:06):

Right? So what you’re saying is that whole blow up in 2008, they didn’t really solve it. They renamed it papered over it, and let’s move on.

Lynette Zang (12:16):

Right! And instead of a whole bunch of individuals with crappy credit, now we’ve got these CLOs that are a whole bunch of corporations with crappy credit, and we’re going into a recession, which means not only, you know, I mean, we’ve heard of zombie corporations, which are corporations that for at least three years do not have enough income to pay the interest on their debt, let alone any of the principle. But the banks have not wanted to show that as bad loans on their books because it would hurt their stock valuations. So instead they’ve just been loaning them money so that they pay at least enough of the interest. So they’re compounding, they’re compounding interest. And the problem is, is that now interest rates are rising.

Eric Griffin (13:04):

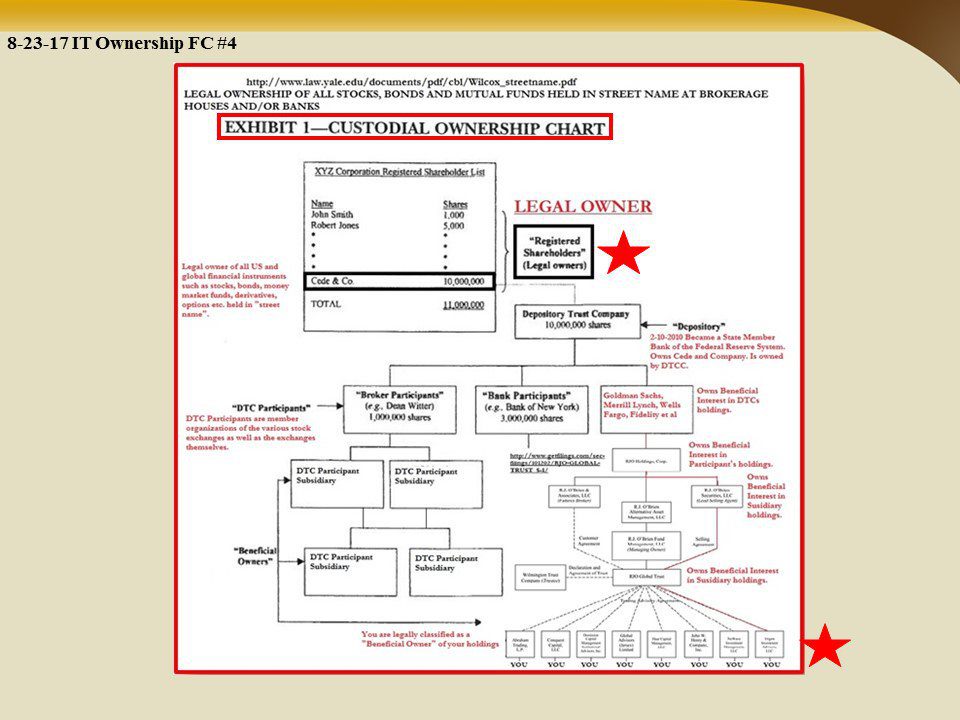

Well, so before we get to that, okay, so I think it’s important to explain cause there’s a couple of things that we already know. Derivatives are bigger than they were in 2008. Huge, right? Yes. Yes. And they’re, they’re definitely a major threat. One of the, one of the, oh, it is one of the Jenga, maybe multiple pieces of the Jenga thing that could cause the toppling of the system, right? Most definitely. So, but I think what’s important is for people to understand a little bit about Reg. D and the bail-in mm-hmm. <Affirmative>, and then a little bit about Seed & Co and the Yale law study that you found that really shows how we don’t really own anything, right? Because I think that is an eye-opener as far as, okay, yeah, cool, there’s been all this money printing and there’s been these derivatives. But I think if people see that what that is, it really, to me it drove home like, holy cow, this is, this is really dangerous. Oh yeah. So tell ’em a little bit, tell about the Yale law study.

Lynette Zang (13:59):

Well, okay, you want me to start with Reg D or the Yale Law Study?

Eric Griffin (14:02):

Either one. Either one.

Lynette Zang (14:03):

Either one. Yeah. Because, because the Reg. D really started in earnest to the part that impacts the individuals in 1995. And the banks needed more money to fund those speculative derivatives, right? Mm-Hmm. <affirmative>. So what the law that was passed enabled when you make a deposit for them to sweep those funds to sub-accounts in the bank’s name so that they can go out and use your equity and do whatever they want with it, more derivatives, etcetera. Right? Because we do, we, it, it should be really clear to everybody that central banks and governments pick winners and losers and banks are too big to fail, but individuals are just about the right size to fail. So they put that in place and that that enabled banks to boost their earnings through trading, which today is like one of the main ways that they get their, their money, that they, they produce their earnings. So that was Reg D at the same time. I mean, really this started back in the early seventies where they started to transfer the risk from corporations to individuals. So I’m kind of, kind of back up here to move forward a little bit because prior to 1971, most people worked for corporations. Like you went in there, and I remember you just plan on working at the same place for all these years because these corporations were promising you a set amount when you retired, if you stayed with them, right? For all that period of time, which means that the corporations took market risk. But in the seventies, that’s when they created the IRA. So now they started to transfer the risk from the corporations onto the individuals because now instead of a, instead of a defined benefit, it is a defined contribution. So you put so much in your account every week or every month, however you get paid, right? And then institutional investors invest that money. So that’s important to know because at the same time that they were setting up that kind of thing, they were setting up DTC and Seed & Co, and that’s what you’re referring to in the Yale law study. And this incredible flow chart showing who the real legal owner is. Remember, they finalized and really started to formalize perception management in the eighties under President Reagan when he brought over Rupert Murdoch. Because hey, they know how to market this stuff so very quietly, I was a stockbroker in the eighties, and I remember how much they were pushing to get assets in house, assets in house, because prior to that, people held their stock certificates, their bond certificates. So those were out of the system, right? But if they’re out of the system, then the banks can’t use it for their benefit. So all of this transition and the transition of risk and the transition of who actually owns this wealth really started after the banks took over. Okay? Now, if you look at that flow chart, you have Seed & Co, DTC. Now, who owns them? All of the banks, the financial institutions, whether it’s commercial bank or an investment bank, and then all of their subsidiaries below them, right? But it’s the big banks and all the financial institutions that own Seed & Co, and DTC. Now, where do you fall on that flow chart? All the way down at the bottom. So Seed & Co, and it’s just a corporation that legally holds the legal title to everything that is titled street names. So if you have a brokerage account, whether it’s at a bank or a brokers, a investment broker, or even a variable annuity and an insurance company, etcetera, find out how that account is held. My bet is it will be held in street name. And so what you’ve agreed to without realizing it, is that you’ve agreed to just be the beneficial owner. Seed & Co, is the legal owner. If you go to a court of law, who are they going to care about? The beneficial owner down at the bottom or the legal owner at the top? It’s the legal owner. That’s why when you look at what happened in 2008, nobody went to jail because even though what they did was disgusting and evil and horrible and ruined a lot of people, it was all legal,

Eric Griffin (18:58):

Right? Okay. So, so seating company owns all, all the assets legally. Legally, mm-hmm. <Affirmative> now, and you talked about Reg D about sweeping, anytime you make deposits into the bank, they can sweep that money into sub-accounts in their name. But so the bail ends, I think is something that’s super scary to me and important. Oh yes. So I know Reg D then enabled bail-in to be able to happen, right?

Lynette Zang (19:25):

Yes. Because it’s called deposit reclassification. Because you don’t own those deposits, you may perceive that that’s your money, but it’s not. As soon as you make that deposit and they sweep it below, you are a lender to that bank. You don’t own that money at all. And so, I mean, look, these guys know what they’re doing, and I don’t mean necessarily in a good way, but also they know that we’re driving off of a cliff. So what they needed to do, and there was never any doubt, you know, you and I went through 2008 together, and a hundred percent of the time when 2008 happened, I said, that’s it. The system just died. So they printed all of this money to cover up all of the garbage, but they did not change behavior. They just changed how they accounted for that behavior. But they came out with all these rules in the Dodd-Frank, and they never even actually implemented all of them, but they did implement the bail in laws because people were really, taxpayers were really not happy that all those taxpayers went. All those tax dollars went to the banks, right? So now they created bailin, they tested it in Cyprus. Well, why’d they, they pick Cyprus because Cyprus is way over there and it’s itty bitty. So anybody else in an advanced economy is gonna go, well, that’s Cyprus. That, couldn’t possibly happen here. But while, since 2010, since they they legalized Dodd-Frank, they have dismantled almost all of the rules and regulations except for the bail-in which I find really interesting. And what that means is if your bank is failing, they get to bail in, take your money that, well, it’s not really your money, but the money that you’ve loaned, the bank that you perceive as your money, they get to just take it and leave you stock in the failing institution. Sounds fair to me. Guess who determines how much that stock is worth the bank that’s failing?

Eric Griffin (21:40):

Yeah. So between, between the Seed & Co, and the bail-in, I think those are two really, really scary points. so now we know that the money printing now has gotten out of control, right? Oh yeah. We’ve gone, I mean, what not was 9 trillion in 2008, now we’re at over 32 trillion, something like that. So I know that we talk a lot about on the shamble, hyperinflation and reset. So just yes. Briefly touch on hyperinflation and reset and what that looks like.

Lynette Zang (22:15):

Okay. Well, you know, look here, here is how inflation help s everybody, right? It, it reduces the value of the currency, and that is supposed to push up your salary so that it makes the debt that you’re servicing seem cheap. So anybody that bought their first house and thought, oh my God, this payment is so high, but over time you are at, at least it looks like you’re making more money mm-hmm. <Affirmative>. And it makes that debt payment easier. The problem is, is that officially there is roughly 3 cents left in terms of purchasing power out of the original dollars worth of purchasing power. The Fed has managed to inflate all of that value away. So we’re at the end, plus the tool that the Fed, the key tool that the Federal Reserve has to regulate the rate and speed of inflation are interest rates. But we’ve been anchored at zero since 2008.

Lynette Zang (23:22):

Right? And even when they attempted to raise it the last time, 2016 to 2019, it was a big fat fail. Every single currency that has tried to lift off of that zero bound has been forced to do a pivot, which the markets love the pivot, but what this next pivot is likely to do, okay, so we were talking about the debt, but on the books of the Federal Reserve, when we went into 2008, they went to 800 billion, which was outrageous at the time. They got as high as little bit, I think it was close to 9 trillion from the 800 billion. So it’s even worse when you added on to the, to the federal debt. Mm-Hmm. <affirmative>. So they’re trying to reduce their balance sheet. They’re trying to increase the interest rates so that when we go into the next recession, that by the way, globally, everybody’s pushing right into, right?

Lynette Zang (24:28):

Yeah. They can turn around and drop those interest rates again. But from 1982 to 1922, right? Up until that point, well, up until 2008, the average level that they have dropped the interest rate to, to actually stimulate borrowing spending was eight and a half to eight. I mean five and a half to five and three quarters percent. So if that happens right now, that’s why everybody’s calling for a pivot. And the markets are kind of going, oh, the Fed’s gonna pivot. And the Fed keeps telling them, no, I’m, we’re not gonna pivot. And that’s happening globally. So there really is a battle royale that has just gone started between the markets and the central banks, and are the central banks going to prove to the markets that they’re in control by continually raising the rates passed a point that the markets can tolerate. That’s why you might hear people talking about, you know the Fed making a mistake, a policy error.

Lynette Zang (25:37):

Mm-Hmm. <affirmative>, you know, either way, if they keep raising the rates, it’s a policy error. If they turn around and pivot, it’s a policy error because they have no more room on the interest rate front. And how much more room do they have on their balance sheet? I mean, they can still do, they can still do more as long as we have confidence right in them, but there’s no purchasing power left. We have to go to negative rates. They have to at attack. And remember when they first went to negative rates and I said, oh, here we go, they’re attacking principal. Remember that conversation mm-hmm. <Affirmative> all those years ago. So they have to attack, if they have no more purchasing power, they have to attack principal. So that’s where they’re taking us into a place where we can’t, where we perceive that we can’t escape it, we can escape it. Right? That’s what gold, silver are about. Physical outside of the system in your possession.

Eric Griffin (26:27):

So eventually what ends up happening is in my, from, you know, listening to you all these years, is that they continue down the path of printing money, printing money, printing money.

Lynette Zang (26:39):

It’s the only thing they have, growing debt. Growing debt,

Eric Griffin (26:41):

Eventually too many dollars, chasing too few goods, and that accelerates the velocity speeds up. And we go into a hyperinflationary environment where, you know, a loaf of bread that costs $4 today, now costs a thousand dollars, then a million dollars, then $10 million, right?

Lynette Zang (26:59):

But Eric, that can’t happen here. Isn’t that what a lot of people out there watching this are saying to themselves?

Eric Griffin (27:07):

For sure. But it’s only a matter of how much time before the all the money printing comes home to roost. Exactly. Right? And we can get into all those details, but trying to keep this video somewhat short, right? So then, so then we get to the point where we say, where they go and say, okay, we need to, we need to reset the currency, right? And there’s, but see there’s a couple of different, there’s two different kinds of resets, right? That you’ve talked about one where it’s like a reevaluation. A reevaluation, right? A reevaluation and then a complete reset. Right?

Lynette Zang (27:37):

Right. Well see, all of this hinges on confidence because this is totally a con game, right? Mm-Hmm. <affirmative>, and that’s what makes, but remember last summer when the Fed, and not just the Fed, but the ECB and a number of other central banks actually kind, you know, shocked the markets and destroyed in many ways the confidence that the markets had in the fed’s forward guidance in central bank’s, forward guidance. Because the Fed was saying, this is what we’re gonna do. And then the markets could get into position, wall Street could get into position to benefit from it, but all of a sudden they said, this is what we’re gonna do. And then at the last second they did something different. It’s that loss of confidence from the public, which is what happens with rapid inflation. That puts the confidence that puts the Fed in jeopardy. And that’s when the hyperinflation really starts,

Eric Griffin (28:35):

Because that’s what creates the velocity of money, right?

Lynette Zang (28:38):

Exactly.

Eric Griffin (28:39):

Velocity of confidence.

Lynette Zang (28:40):

Exactly. And that’s why they are are always checking to see what are those inflation expectations? What is consumer confidence? Because it’s, it’s what the public thinks. There’s way more of us.

Eric Griffin (28:53):

Right. So we go into a hyperinflation. Yes. Right? I mean, that’s the obvious.

Lynette Zang (28:57):

And then you’re seeing

Eric Griffin (28:58):

Future problem that we have, right? Hyperinflation and then explain like the, the overnight revaluations, the resets that occur. You want to explain that real quick?

Lynette Zang (29:08):

Briefly? Yes. Because what happens then as, as the public loses confidence and the currency starts losing value rapidly, right? Which is why everybody’s raising rates right now, cuz they’re trying to prevent that, then ultimately people stop using the dollars, right? If they have a choice, they stop using the dollars, they’ll use anything else but them because nobody really wants them. So the only entities that take them are some kind of government or quasi-governmental agencies that are actually forced to take the dollars. And like you said, the loaf of bread can go to a thousand dollars or you know, Zimbabwe, it went to 80,000 Zimbabwe dollars. So that first overnight revaluation, what they’ll do is, well, they will lop off of a bunch of zeros. And I can’t tell you exactly what that ratio’s gonna be, but the most normal one, the typical one is a thousand to one. So if you have a thousand bucks in the bank and you go to sleep overnight, when you wake up in the morning, there’s one

Eric Griffin (30:18):

Right. And then that happens again. Correct. And then typically it happens again

Lynette Zang (30:22):

Because they don’t change behavior.

Eric Griffin (30:23):

Right. So what you know, you and I have talked about in the past is a one way that they hope to right control all of this and try to get out in front of all this. But we know that it’s a major threat to our way of living. Oh yeah. Is the central bank digital currencies.

Lynette Zang (30:42):

Oh yes. Because that gives them full control, right? I mean, when, when we were on the gold standard, you just have to kind of look at this, when we were on the gold standard, the public had control cause they didn’t like what the government was doing. They pulled the gold out of the system. Then we went on the paper standard. So the Federal reserve notes, which is a debt instrument that neither charges interest nor pays you interest. So that means that it’s got a zero interest rate. So that’s a problem for governments because it, it inhibits their ability to go below zero. And, and they ran that test for quite some time since 2009, up until just recently mm-hmm. <Affirmative>. Right. And it really, it definitely inhibited them. So now with the advent of technology, they wanna go to that CBDC, which is programmable money, at least when we’re on the paper standard. If you hold the bills in your wallet, they’re invisible and you cannot protect your purchasing power, but you can protect your principle. Well they gotta take that principle. So they need you all your wealth in a system that makes it easy for them to have their finger. And they’ve talked about this constantly tweaking mm-hmm. <Affirmative> because right now, when they issue policy takes roughly 18 months to go through the system for them to know is this working or not? Well, once we’re, once they’re in full control and they’re gonna sell it, like there won’t be any inflation once we control the cbdc. No, it’ll be deflation because they’re gonna charge negative rates to force you to do what they want you to do. And that’s the thing, programmable money. So you have, it’s completely in their control instantly. And you have no privacy because they know everything that comes in. They know everything that goes out, they know where you’re spending it. They can dictate, I mean you can look at China and see full surveillance economy and hey, you’re crossing the street and you’re jaywalking by the time you get to the other side, that money’s pulled out.

Eric Griffin (32:46):

Yeah, it’s fine. Well and they, and programmable means they can tell you how much of your salary that you’re earning you can spend on your mortgage, how much you can spend on your car, how much you can spend on your food. Oh. And if you didn’t do what they wanted you to do, they could just freeze your bank account and make it so you can’t spend your money. So CBD CS are a major threat and it’s something that they’re gonna spin as awesome. But yeah, we should all be very concerned about central bank digital currencies having total control.

Lynette Zang (33:11):

Right and Eric, that’s why I own gold because I can always convert it into wherever I am in the world, I can convert it into the local currency.

Eric Griffin (33:21):

Well and it’s a hundred percent no vote.

Lynette Zang (33:24):

Exactly

Eric Griffin (33:24):

Hundred.

Lynette Zang (33:25):

You vote with your purse, you vote with your purse.

Eric Griffin (33:26):

No vote, to central bank digital currencies. To inflation, hyperinflation it’s a no vote to everything that they’re up to. Exactly. And, and one of the reasons why we believe so much in what we do here at ITM Trading, which is create strategies with gold and silver to help people survive and thrive. What we think is what we know is coming, right?

Lynette Zang (33:47):

I mean this is right, right. This is just a repetition of history.

Eric Griffin (33:50):

But even the BIS and the IMF admit that gold is the only, on the money flower, the only asset that runs no counterparty risk and is not controlled. You say it better than I do. Yes.

Lynette Zang (34:03):

Right on, on the, the Bank for International Settlements creates this money flower and gold and silver as commodity money are, are the only money that is, that is universally accepted but is outside of the purview of the central banks. Everything else is inside the purview of the central banks. And I love the fact that you said it’s a novo because people don’t realize that they vote with our purses. Right. We, we do. How do you spend your money? So if you keep your money in the stock and the bond market, that’s a vote.

Eric Griffin (34:37):

And it’s in the system.

Lynette Zang (34:38):

And it’s in the system.

Eric Griffin (34:39):

Gold and silver?

Lynette Zang (34:41):

That’s also a vote. And it’s outside of the system and it is decentralized. And here’s the other thing that nobody ever talks about except for me. I think I’m the only one that I ever hear say this. And that is that the reason why gold, silver never have gone to zero is because it has the broadest base of use throughout the global economy. It doesn’t require a government to say this is money, this is this. Like the fiat money does the government based money full faith and credit. It is, it has been globally accepted as money for 6,000 years and it has the broadest base of buyer.

Eric Griffin (35:23):

So hopefully that gives you an insight into where we, where we came from in the, in the 1913 forward and it tells you why we ended up getting into a financialization of the money products. Oh yeah. Where the problems are what the central banks fuel the solutions are, and what the threats of hyperinflation in a reset look like. And also why we do what we do here at ITM trading. So hopefully that helped like, subscribe, comment below, tell us what you think about this video. Did we do a good job? Did we tell you this in a way that you could understand it? We hope we did.

Lynette Zang (36:02):

And if we didn’t and you let us know, we’ll try again. We’ll try again. We will try again. Cause our real goal is to explain this stuff in a way that, that not only can you understand it, but you can actually get some practical experience. How can I put my best interest first and protect my family and myself.

Eric Griffin (36:24):

So till next time.