THE FED GIVETH, THE FED TAKETH AWAY: Experimenting with Forward Guidance? by Lynette Zang

It should be obvious that Wall Street does not reflect Main Street. It hasn’t since 2008, when the Fed decided to “manage†the markets. In fact, global central bankers “managed†the world into a global slow down well before Covid-19 was used to shut down the global economy and take the blame for all our economic ills.

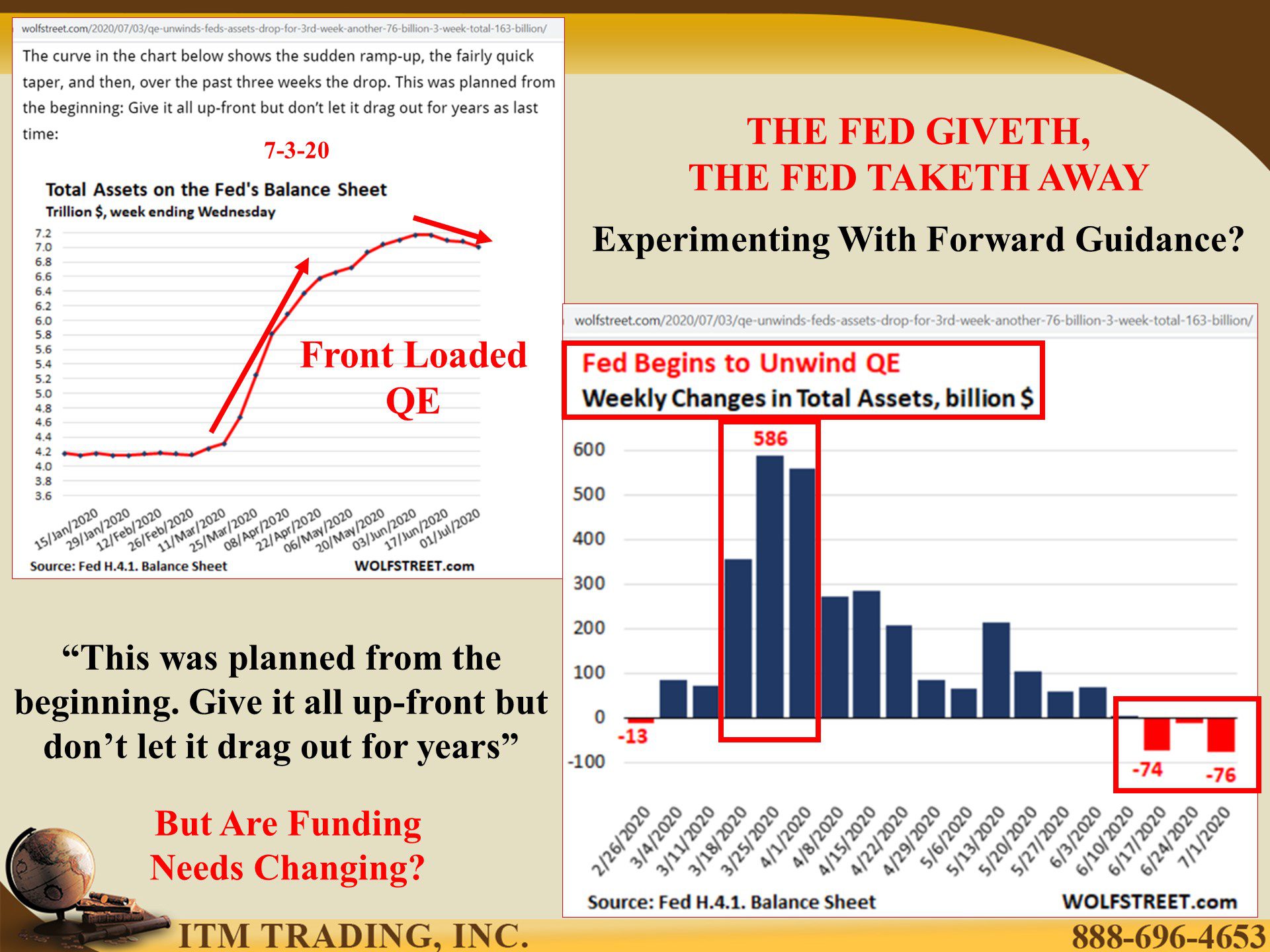

But now, it appears that the Fed’s latest QE experiment (front loading a tsunami of new money) is failing. Wolf Richter points this out in his recent piece “QE Unwinds: Fed’s Assets Drop for 3rd Week, Another -$76 Billion. 3-Week Total: -$163 Billionâ€. Data shows that the Fed is attempting to pull back support, though continuing to promise an unlimited amount of new money if needed. This is called forward guidance.

Have more questions that need to get answered? Call: 844-495-6042

The theory is that if Wall Street bankers know the Fed will step in when markets fall, Wall Street will support the markets and the Fed doesn’t have to. Additionally, governments also stepped in to support consumer spending with onetime $1,200 checks, extra $600 unemployment bonus, rent and mortgage forbearance and PPP Loans.

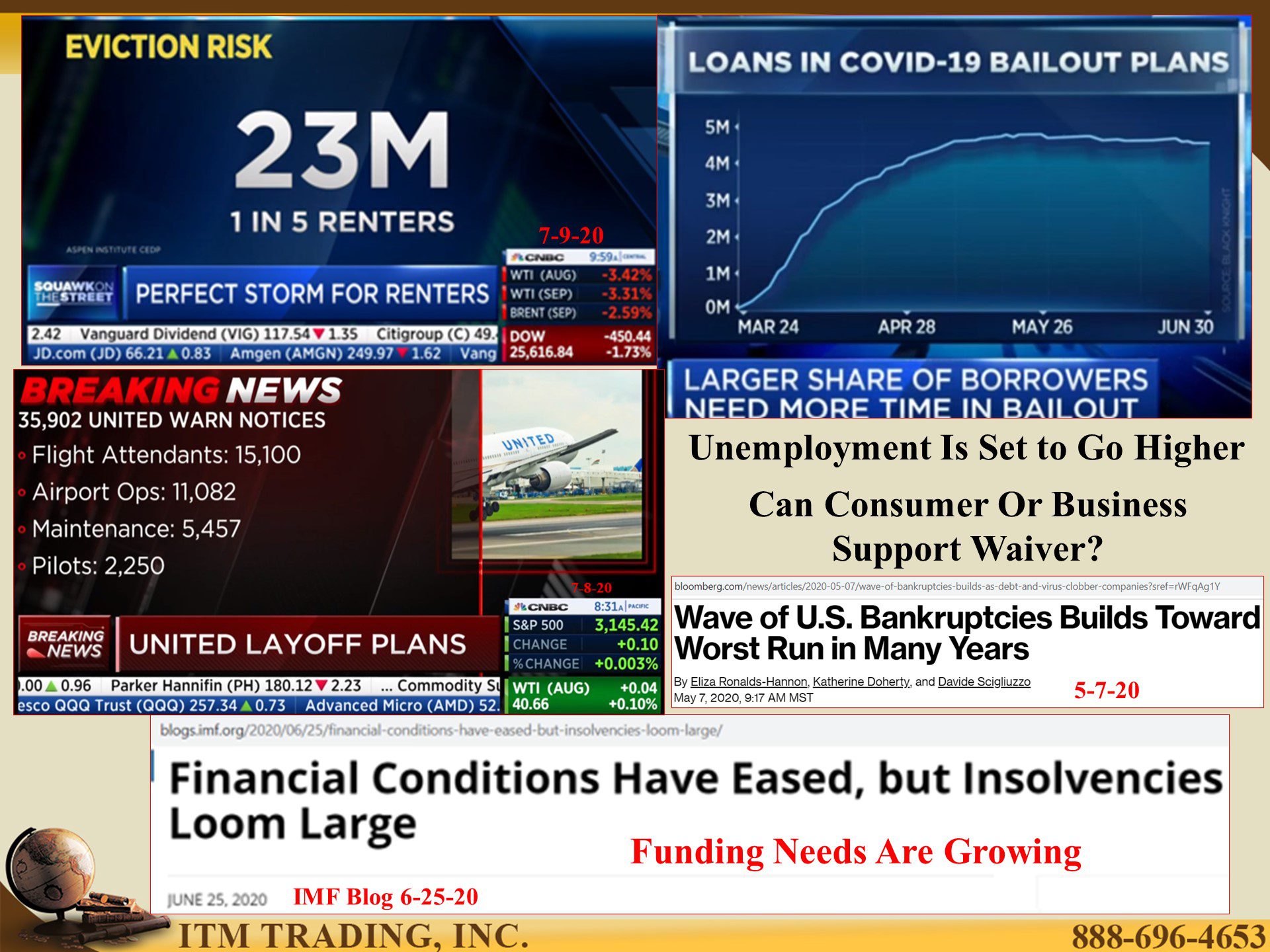

But most of these programs are quickly coming to an end with more bankruptcies and permanent layoffs looming, just as the US Treasury is preparing to fund record deficits with newly issued treasury bonds (debt).

Though the outcome lies in the future, I believe we will see another Fed pivot with their balance sheet raging to new highs in a failed attempt to have taxpayers bail out everyone. Of course, they know this is not possible, so what do most do when they know bankruptcy is near? If possible, spend, spend, spend.

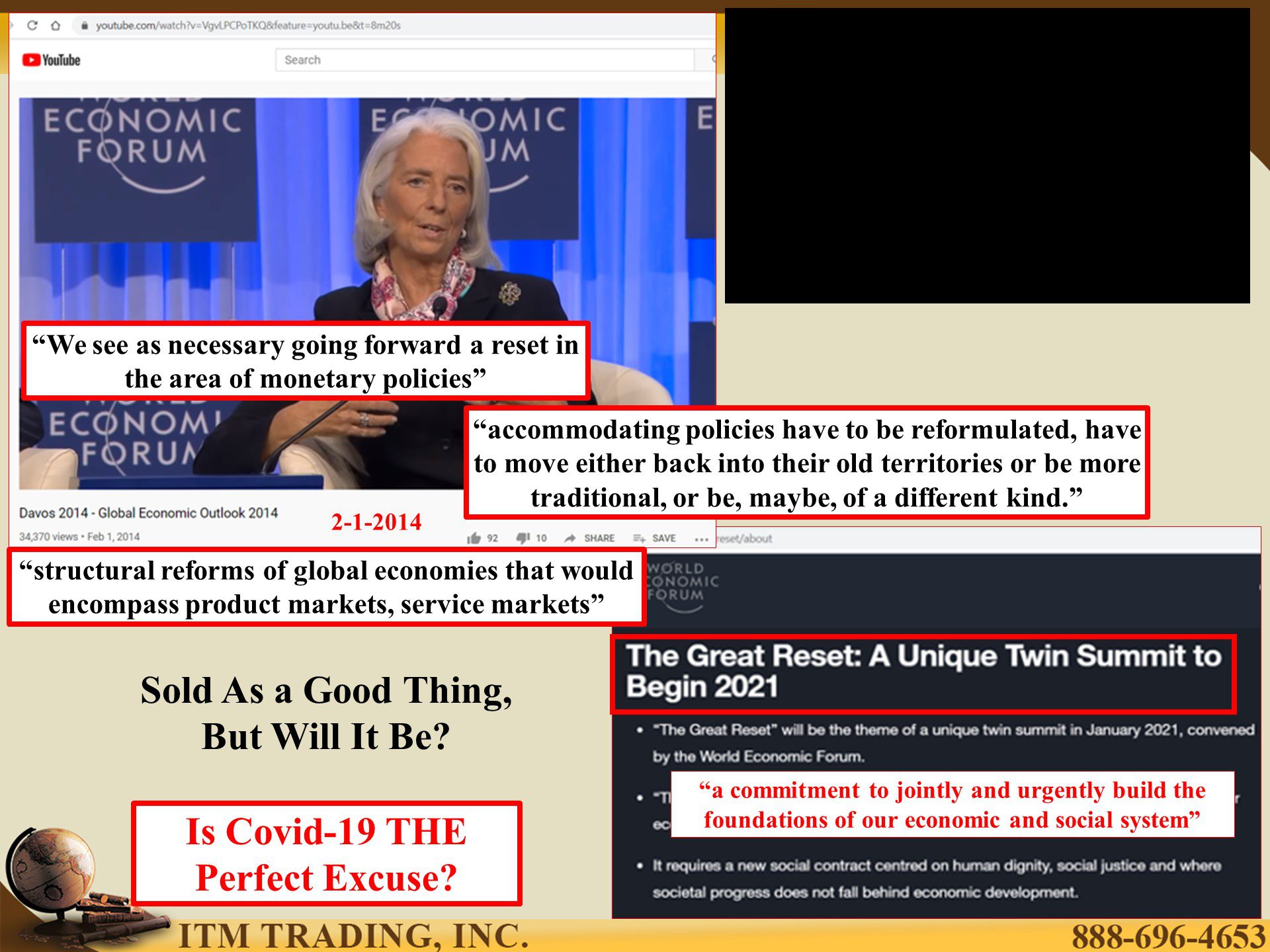

In fact, Christine Lagarde, current ECB (European Central Bank) President and former IMF (International Monetary Fund) Chair, along with the WEF (World Economic Forum) has been talking about reset since the 2008 derivative implosion killed the financial system as we knew it. They spin it as a good thing, but if those that got us into this mess to begin with, remain in power after the reset, do you really think they will put your best interest first?

That’s why you need gold. Of course, bankers prefer paper or digital gold contracts, that’s how they make money and control the physical gold while you take all the risks (read the prospectus), but are central bankers, who have been accumulating massive amounts of gold, buying Wall Streets ETFs? NO, they are buying physical gold. So am I and I think you should too.

Slides and Links:

- https://wolfstreet.com/2020/07/03/qe-unwinds-feds-assets-drop-for-3rd-week-another-76-billion-3-week-total-163-billion/

- https://blogs.imf.org/2020/06/25/financial-conditions-have-eased-but-insolvencies-loom-large/

- https://www.ft.com/content/68a72ae2-9ca2-41e8-b0e6-9d1716f42531?segmentId=b0d7e653-3467-12ab-c0f0-77e4424cdb4c

- https://www.youtube.com/watch?v=VgvLPCPoTKQ&feature=youtu.be&t=8m20shttps://www.youtube.com/watch?v=VgvLPCPoTKQ&feature=youtu.be&t=8m20s

https://www.weforum.org/great-reset/about

https://www.youtube.com/user/WorldEconomicForum

https://www.gold.org/goldhub/data/global-gold-backed-etf-holdings-and-flows