THE ETF TRAP $10,000 to $600: When Fiat Investment Products Go Wrong… By Lynette Zang

Historic first to historic first, these fiat markets continue to show us all, the breakdown of the fiat financial system.

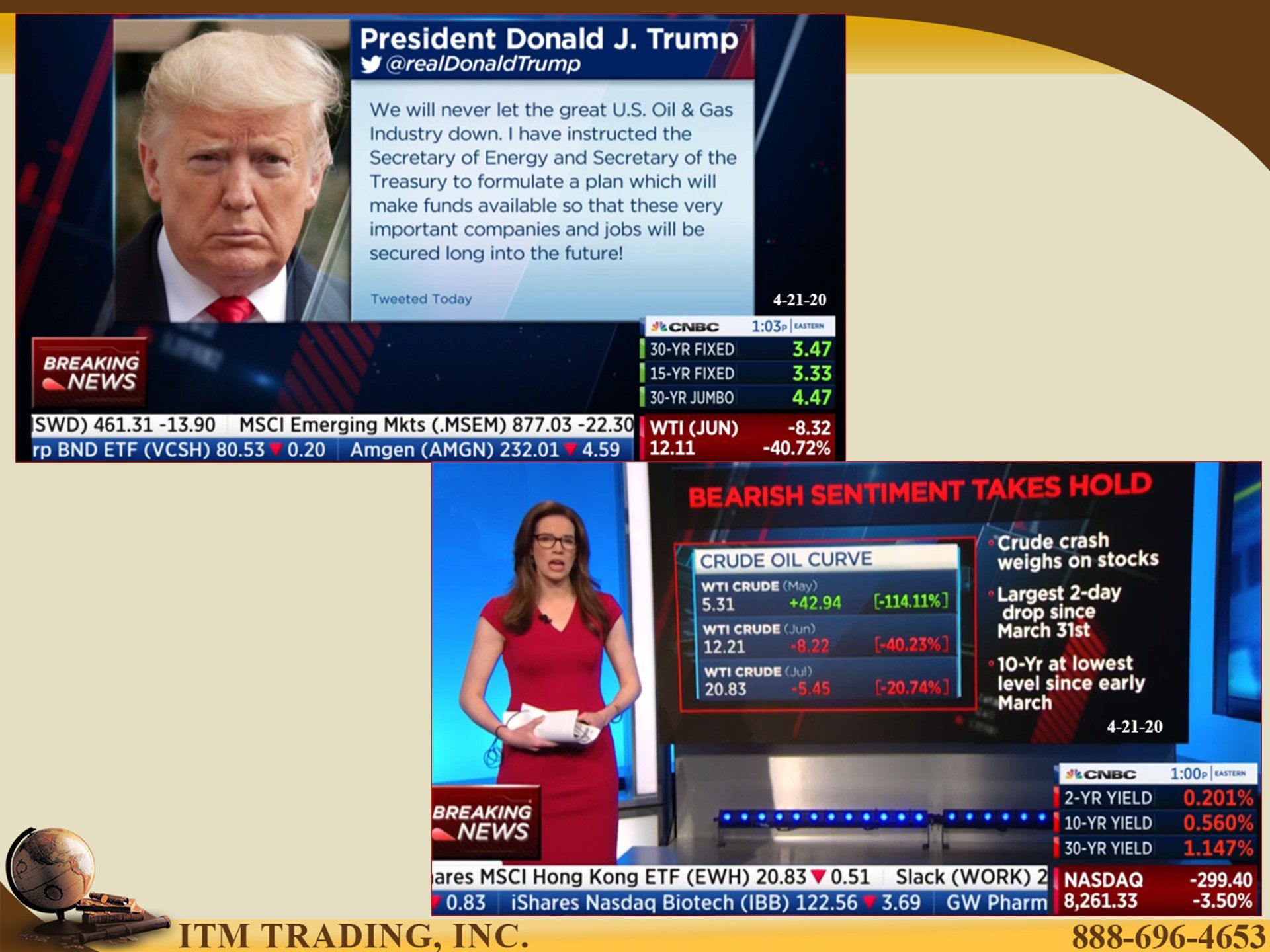

Yesterday, the May WTI (West Texas Intermediate) crude oil futures contract that expires today at 3, closed at negative $37.63 per barrel. Each contract represents 1,000 barrels of oil, so this means that those that own the contracts had to PAY $37,630 NOT to take delivery of that oil. About now you might be asking, is this even possible?

Have more questions that need to get answered? Call: 844-495-6042

In a CNBC interview this morning, Heath Tarbert, head of the CFTC, stated that they’ve been expecting and planning for this because oil speculators have been pushing the price below zero in the run up to May’s contract expiration which happens today at 3.

Yesterday, as May’s contract plunged June’s contract declined almost 20%, but held at $20.36. This morning it dropped an additional -59.57% to $8.26, which is really interesting since May’s contract rose to $8.18. Sound confusing? It should because what this is really telling you is that the fiat markets are broken.

My question is, when will the public that puts their hard-earned money into these speculative and manipulated markets learn? I hope it is before it’s too late. Case in point is the USO ETF which came out in 2006 and was designed to track oil futures contracts. Last week investors, thinking a bottom was in for oil, plowed $1.6 billion into the ETF. Monday, they suffered the consequences. But even before that, if you had put $10,000 in at the issue date, as of March 31, 2020, you would have $600 left according to CNBC.

Additionally, when the Fed stated that they would buy (bail-out) junk bonds, funds flowed in at the fastest level ever. Most of the junk bond ETFs are tied into the over leveraged energy companies in one way or another. If you’re still holding this junk, you might consider rethinking your position or at the least, making sure your wealth is protected. With the one proven asset…gold.

In 6,000 years gold has never gone to zero and is the one true flight to safety asset. This is why the “World’s Rich ‘Desperate’ for Gold With Metal in Short Supply†“will buy anything they can get their hands on.â€

Slides and Links: