THE DEBT VIRUS SPREADS: While Bridgewater Predicts $2,000 Gold Rally… by Lynette Zang

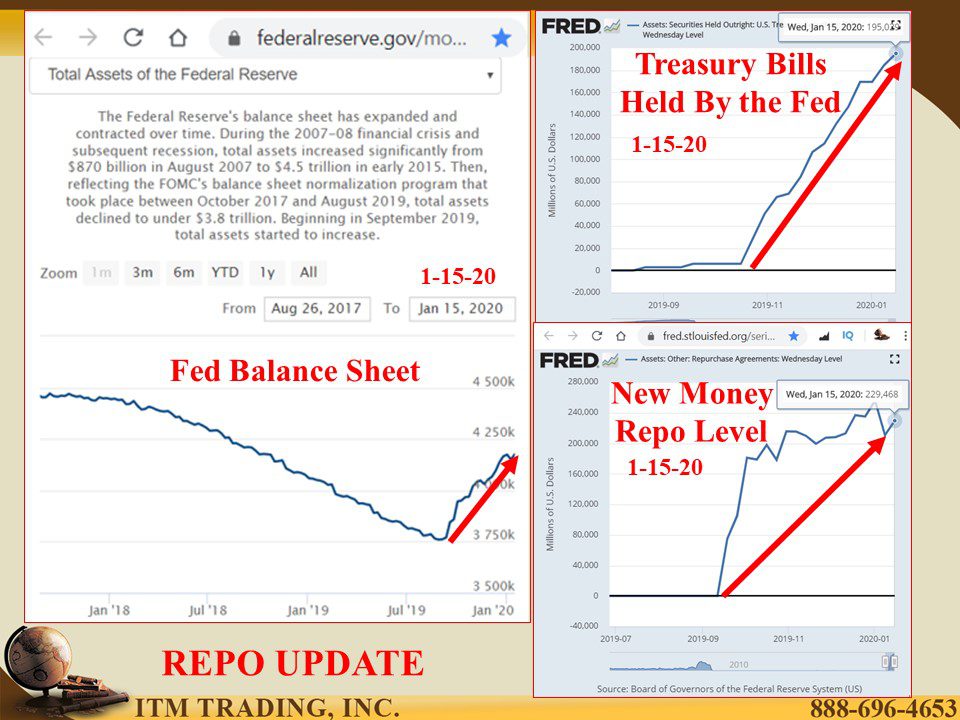

At this rate, the Feds balance sheet may surpass its previous high of $4.5 trillion by June of this year. Good thing it’s not QE, but it is new money. So while we’re told the US is growing nicely, the data and the IMF says otherwise.

Have more questions that need to get answered? Call: 844-495-6042

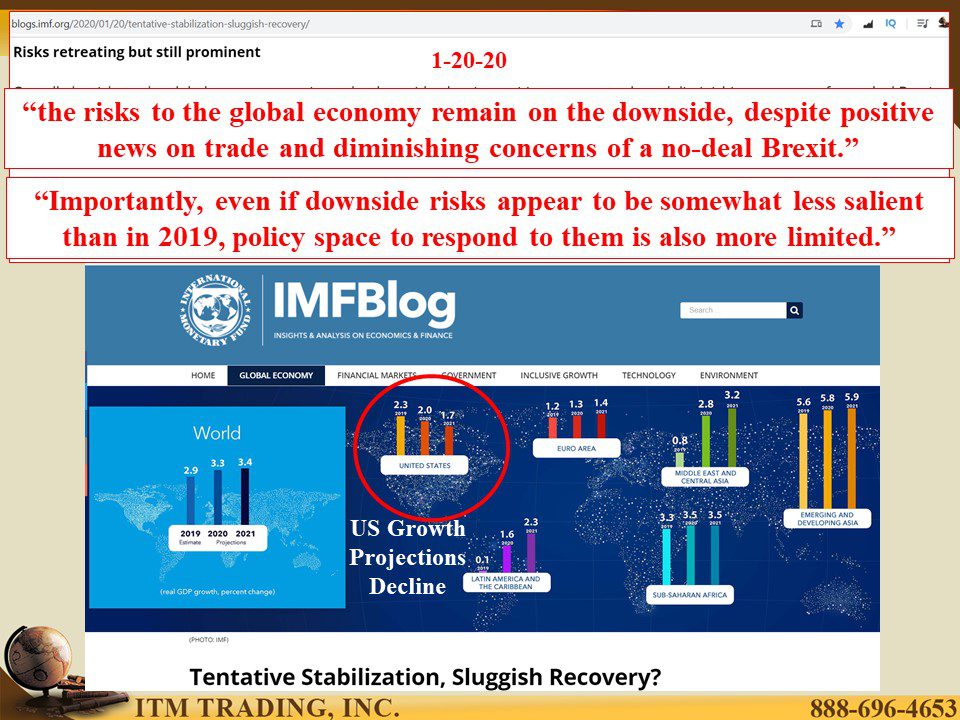

In new (1-20-20) global growth projects from the IMF (International Monetary Fund) US growth is expected to decline from 2019s 2.3% to 2% in 2020 and 1.7% in 2021. They site that “the risks to the global economy remain on the downside, despite positive news on trade and diminishing concerns of a no-deal Brexit.†“Importantly, even if downside risks appear to be somewhat less salient than in 2019, policy space to respond to them is also more limited.†In other words, when this house of cards implodes, central bankers will not be able to bail out the system. Reset required.

How can this be hidden from the general public? Using rising nominal prices in stocks and real estate to mask the death of the system. Nominal confusion is the best tool for perception management. (See yesterday’s video)

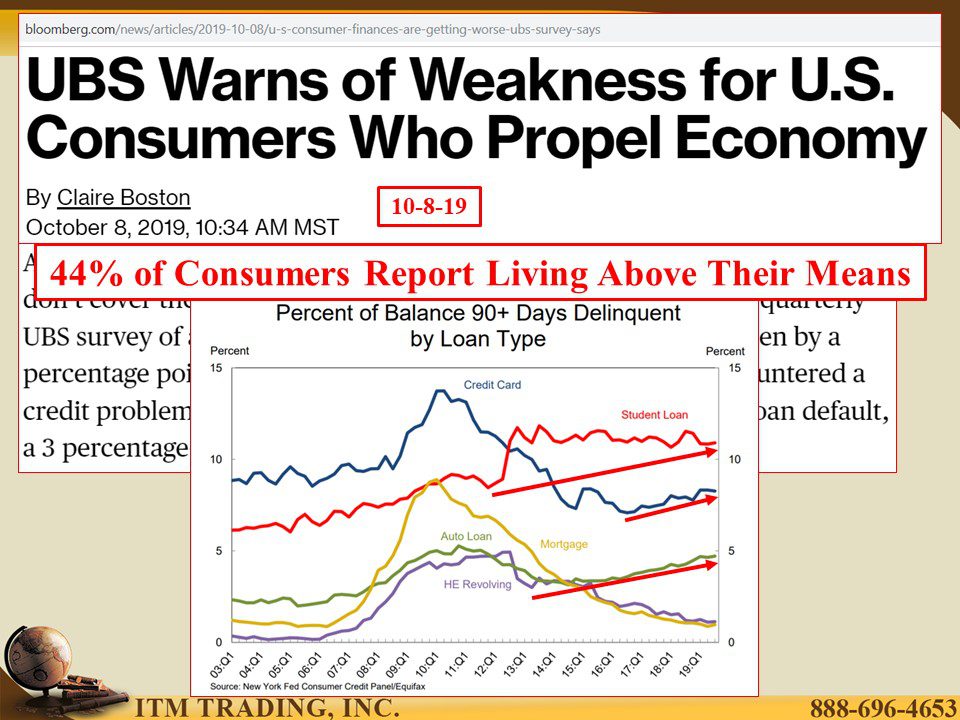

Of course, when the public felt like they could possibly achieve the American dream, that could work and certainly, we hear about the strong consumer supporting these markets, but with 44% of consumers living beyond their means, wage gains slowing, housing prices exploding and debt levels making new highs, that dream has faded for many.

This is just one reason the world largest hedge fund, Bridgewater, sees gold rising to $2,000. Additionally, they sight rising tensions with China and Iran, and the Fed allowing inflation to run “hot†above their 2% target. In other words, they will not raise rates even as inflation rises. Of course, that’s assuming they can control the monster they created.

But that still does not come close to its real value as a true safe-haven and store of value. Gee, I wonder if that’s why central banks are buying gold at the highest levels ever?

Slides and Links:

https://fred.stlouisfed.org/series/WSHOBL

https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

https://blogs.imf.org/2020/01/20/tentative-stabilization-sluggish-recovery/

https://www.ft.com/content/dc56376c-3940-11ea-a6d3-9a26f8c3cba4?segmentId=114a04fe-353d-37db-f705-204c9a0a157b

https://www.cnbc.com/2020/01/14/the-stock-market-has-never-been-this-big-relative-to-the-economy-signaling-it-could-be-overvalued.html?recirc=taboolainternal

https://www.bloomberg.com/opinion/articles/2020-01-09/this-is-the-scariest-gauge-for-the-bond-market

https://www.ft.com/content/2362a9a0-3479-11ea-a6d3-9a26f8c3cba4?segmentId=114a04fe-353d-37db-f705-204c9a0a157b

YouTube Short Description:

At this rate, the Feds balance sheet may surpass its previous high of $4.5 trillion by June of this year. Good thing it’s not QE, but it is new money. So, while we’re told the US is growing nicely, the data and the IMF says otherwise.

This is just one reason the world largest hedge fund, Bridgewater, sees gold rising to $2,000. Additionally, they sight rising tensions with China and Iran, and the Fed allowing inflation to run “hot†above their 2% target. In other words, they will not raise rates even as inflation rises. Of course, that’s assuming they can control the monster they created.

But that still does not come close to its real value as a true safe-haven and store of value. Gee, I wonder if that’s why central banks are buying gold at the highest levels ever?