The Debt Ceiling Fight & the Most Likely Outcome

What is going on with the recent collapse of First Republic Bank? How you can protect yourself? With JP Morgan buying out their assets, the industry is trying to contain the situation, but the truth is that the fuse is getting smaller and smaller until the entire system implodes or explodes. This isn’t just about survival, it’s about thriving through the chaos and it’s clear that this is going to get a whole lot worse.

CHAPTERS:

0:00 Intro

1:15 Debt Limit Standoff

2:09 The Markets Are Concerned

5:31 What Could The Fed Do?

6:53 Yuan Global Bid

9:00 Where is Russian Gold

10:38 Wrap Up

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

If they’re creating a control demolition, then the debt ceiling issue, which rears its ugly head, is part of that controlled demolition, are they taking us to the very edge so that they’re creating another crisis? Are we actually going to default on our debt when we can just print the money that we need to pay our bills? What a huge advantage, cause how much longer are we gonna be able to do that? And we’re gonna talk about all of this brinkmanship and all of this garbage, coming up.

I’m Lynette Zang, Chief Market Analyst at ITM Trading. And today we’ve gotta talk about the debt limit because everybody else is talking about it. And I know it’s, it’s virtually impossible to believe that they would actually, the US would actually not pay its bills. That would be catastrophic, not just for the US. So certainly we would feel that here, but actually for the world, since it’s the US treasuries that are the foundation of the global financial system. But this system has been imploding and what they’re trying to do is a controlled demolition. But let’s talk about the debt ceiling.

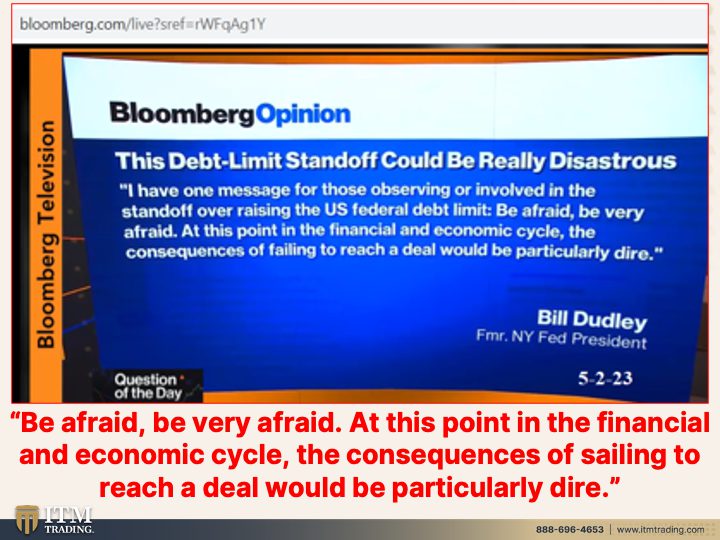

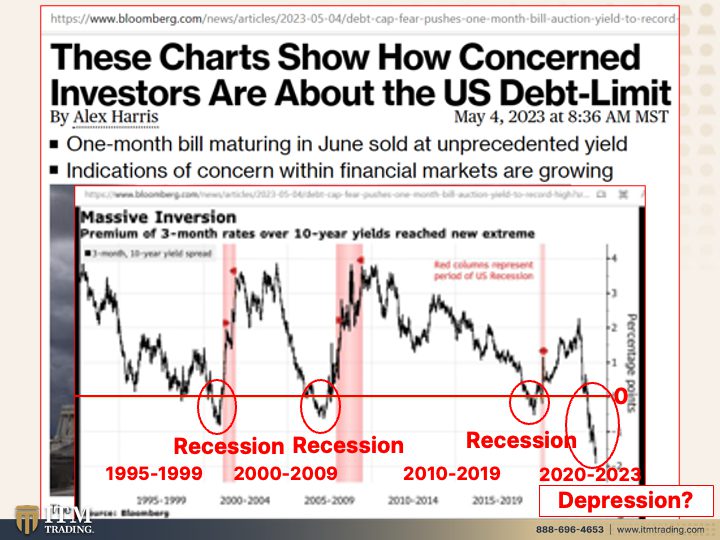

Now, Bill Dudley, former New York FRED President, arguably the most important Federal Reserve Bank says this debt limit standoff could be really disastrous. I have one message for those observing or involved in the standoff off over raising the US federal debt limit. Be afraid. Be very afraid at this point in the financial and economic cycle, the consequences of failing to reach a deal would be particularly dire. Yes, on top of everything else, the lack of liquidity in the treasury market, the breakdown of the regional banks and so much more that we can’t see. So this is the top of the iceberg, but it is coming and the markets are concerned and they should be because basically, you know, understand the debt limit is about money that we already spent. So not about new spending, which is part of what they’re talking about now. But to be honest with you, it’s too late. This debt is unpayable. So I want you to look at this. We’ve talked about the inverted yield curve many times, and it’s been inverted now at the absolute lowest level ever. Now, these red columns represent official recessions, but then again, those that call the recession could determine whether or not it’s a recession. But okay, official recessions, and can you look and see if this is zero, right? So this is neutral. You can see that this, right now we are in the greatest inversion. This happens to be the three month rate over the 10-year yields to an extreme level. So while they’re talking about, well, maybe this will be a mild recession, maybe we won’t even have a recession. What this graph is showing you, is that this is going to be not just a hard landing, but a catastrophic landing. Even into a hyperinflationary depression. Let’s just see what happens.

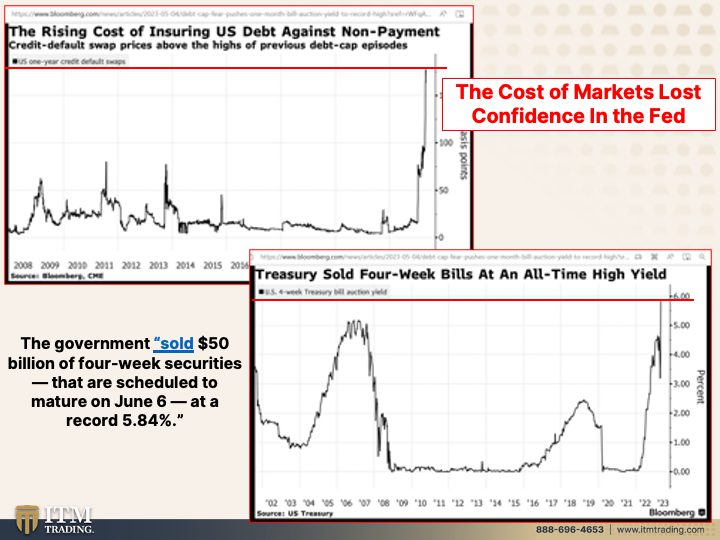

But let’s look at some of the other graphs that they’re talking about, because this top one is the cost of markets showing the loss of confidence in the FED. You remember it was last August and I said this is not good. I can’t believe that they’re handing this handing away the market confidence in the Fed, but they did. And now the markets are reacting to it. This is the rising cost of ensuring US debt against non-payment. And this is actually, I mean, this is unthought of, I mean, who would’ve ever thought that the US would not pay their bills since all they have to do is go in the back and turn their money printing presses on? That’s been the huge advantage that the US as the world reserve currency has had. But the markets don’t believe the Fed anymore. Why they gave that confidence away? Maybe because they need the crisis. Now this is the treasury sold four week bills at an all time high. So this is the cost to ensure the US debt against default. This is the yield that they had to pay when they just recently issued four week bills. So they’re getting paid more. Now, is it enough to risk your principle? No. Do I really think we’re gonna not pay that? No, I think they’re gonna come together, but hey, I could be wrong. I mean, they could need this next crisis. The government sold 50 billion. So a small amount, because of course we’ve got the debt ceiling that we’re contending with. 50 billion of four week securities that are scheduled to mature on June 6th at a record 5.84%. Yeah, no longer a flight to safety, is it? But what could the Fed do?

Well, they could buy treasuries and exchange them for defaulted debt, right? So whatever debt defaulted, the Fed could just buy the defaulted and replace them and they could accept a trillion dollar coin. So there’s that talk of doing that massive platinum coin. And also they could just ignore the default. I don’t actually think that any of these are good options or options that they will actually take on, but I think the most likely, if we were to go into default, and I really don’t think we’re going to, because that would be catastrophic. And I don’t know whether or not they’re ready for that catastrophe, but maybe they are. I don’t know. It’s hard to tell. A lot of things are opaque and they don’t let me in any of those meetings. So what does that mean? It means that the game is breaking down, this con game is breaking down, and can they continue to hide the truth from the public? If they default on the debt, then I think that they’re ready to not hide the truth from the public anymore than they are ready for the collapse. And of course, we have the Fed Now accounts that are going live in July.

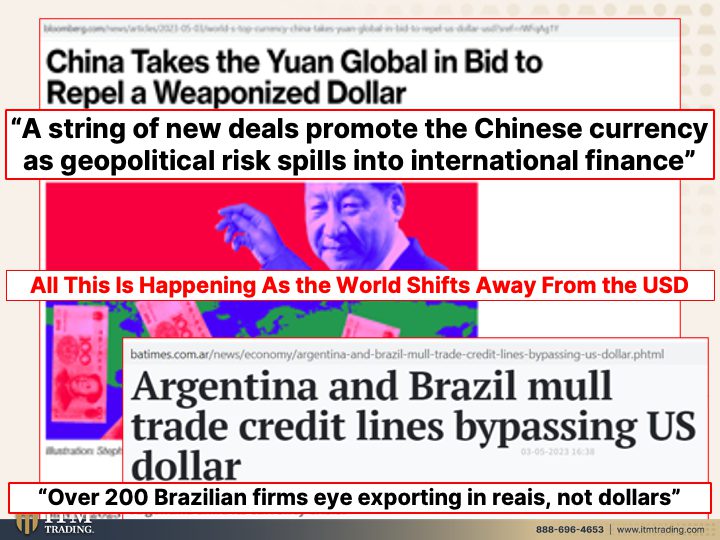

In the meantime, the whole world is watching this. And China, as you know, has really stepped up to become a world global financial power. China takes you on global in a bid to repel a weaponized dollar because we all saw everybody in the world saw what they did to Russia and how they weaponized the currency, the dollar. And that’s not the first time. Will it be the last time though? That’s the question. A string of new deals promote the Chinese currency as geopolitical risk spills into international finance. Even Argentina and Brazil are mulling trade credit lines to bypass the dollar. Over 200 Brazilian firms eye exporting in reais, not dollars. And then this Iran’s new friends having viewed Russia and China rarely for years, the Islamic Republic sees its best prospects for survival as the junior partner in an anti-western alliance. So it is, it should be really clear that we are losing our status as the world’s reserve currency. How quickly is that gonna happen? Because all of this is happening, all of the banking issues and the debt default issues, it’s all happening as the world is shifting away from dollars. So what does that mean to you and I here? Well, what it means is that more inflation, more inflation, more currency purchasing power destruction. But you know how the world has always dealt with that? Because it’s not like this is the first time it’s hard to believe. I know it’s hard to believe, but officially, we have virtually no purchasing power left in the currency. And this is true globally for all the fiat currencies.

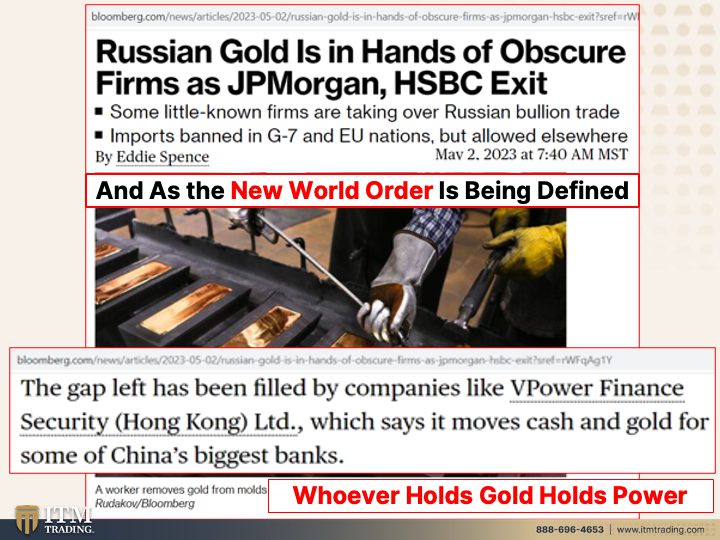

But what can you protect your purchasing power with gold? And much as they wanna think that they have control, meaning the central banks and the US, that they have control of everybody in the world. Russian gold is in the hands of obscure firms as JP Morgan and HSBC exit. So our firms, the US exits, but then there are other firms that step right in as they are defining the new world order, who’s going to be there? It’s going to be those countries that have been accumulating gold. Whoever holds the gold, holds the power. And the US has not changed their gold holding position since I think 1952, not by a 16th of an ounce. So will the world just continue to take their word for it? I think the world knows the emperor’s not wearing any clothes. I think the world knows that the US probably does not really have the gold that they say that they have. Now, the gap has left, has been filled by companies like VPower Finance Security (Hong Kong). Which says it moves cash and gold for some of China’s biggest banks. They aren’t depending upon JP Morgan or HSBC or any western company to come in and do it. But it really is that simple, whether you are a government or a corporation, and certainly as an individual, you wanna retain your purchasing power and your power? Make sure you have plenty of gold. And it is really that simple.

So if you haven’t subscribed, make sure you hit that subscribe button because you really need to know what’s going on in the world today. And also, you know, we need more than just gold and silver, but you gotta have these to establish and protect whatever wealth you’ve accumulated and to truly take you out of the system. But you also need Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter. And so we have, if you haven’t joined us yet at Beyond Gold and Silver, then do so where we talk about all those pieces and parts of the mantra to make sure that you can be as self-sufficient and independent and prepared as possible. We’ve also opened up the new Thrivers community. So come and join us, help us build that community so we can come together in places maybe on a physical basis, but either way we can help each other. And certainly if you have not yet started your gold and silver strategy, click that Calendly link below and set up a time to talk to one of our consultants and get your personal strategy in place. And the way that you start is with your goals.

What are you trying to accomplish? And then you create a strategy and you put those tools together to make it happen. And I would say if you’ve been waiting, stop, just get it done. So if you like this, please give us a thumbs up. Make sure you leave a comment. And even more important, share, share, share, because financial shields, physical gold, physical, silver, not paper, not promises, and not air. And until next we meet. Please be safe out there. Bye-bye.

SOURCES:

Janet Yellen Warns Congress US Treasury May Run Out of Cash Soon as June – Bloomberg

Debt Ceiling Deadline: When Should Wall Street and Washington Worry? – Bloomberg

Selected Charts on the Long-Term Fiscal Challenges of the United States (pgpf.org)

Debt-Ceiling Anxiety Tracker: Market Charts to Watch on Default Risk – Bloomberg