THE BAZOOKA EXPERIMENT: Bigger Monetary Experiments, and Their Chances of Working… By Lynette Zang

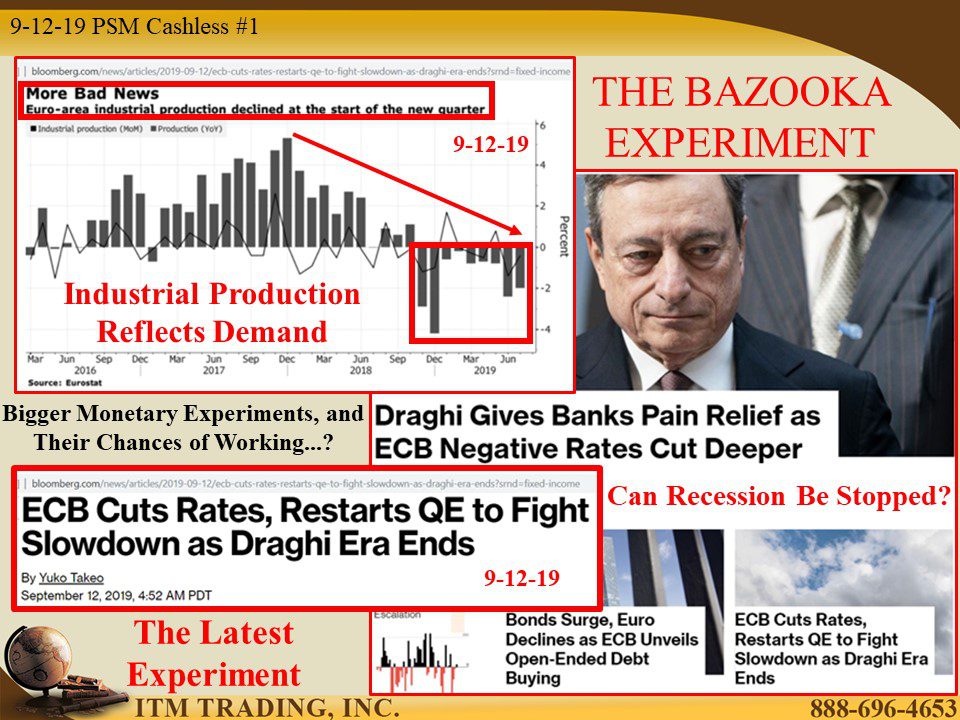

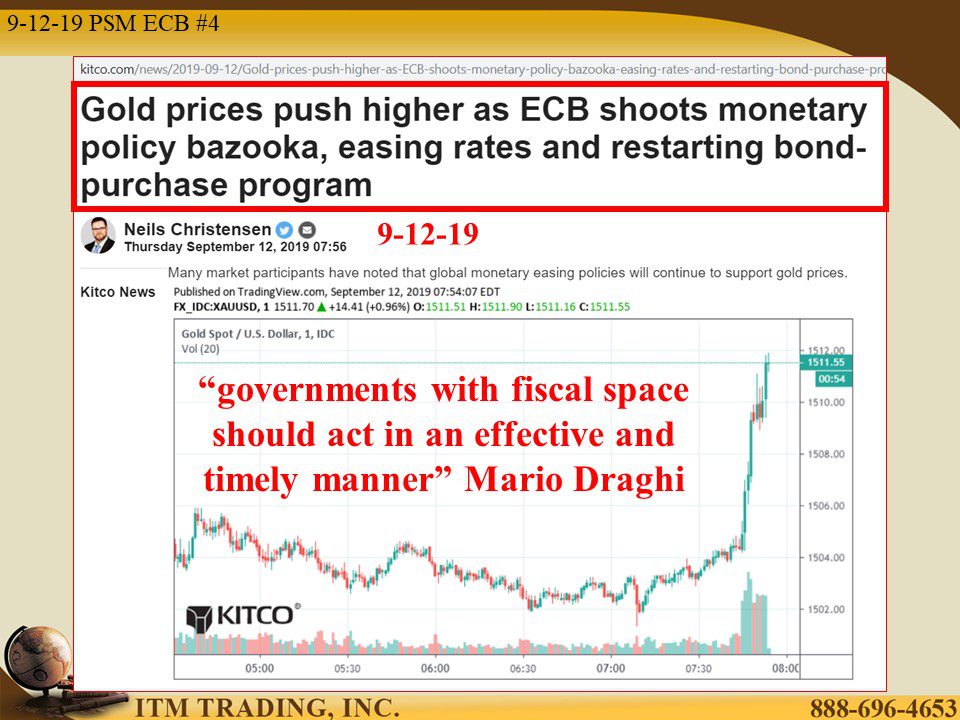

Announcing a fresh round of aggressive monetary easing, Mario Draghi says that “governments with fiscal space should act in an effective and timely manner†to encourage lending and spending to generate the inflation that would allow them to raise interest rates in the future. Problem is that central bank QE (easy money policy) has not worked in practice, as witnessed by the global slowdown that began even before the current trade wars.

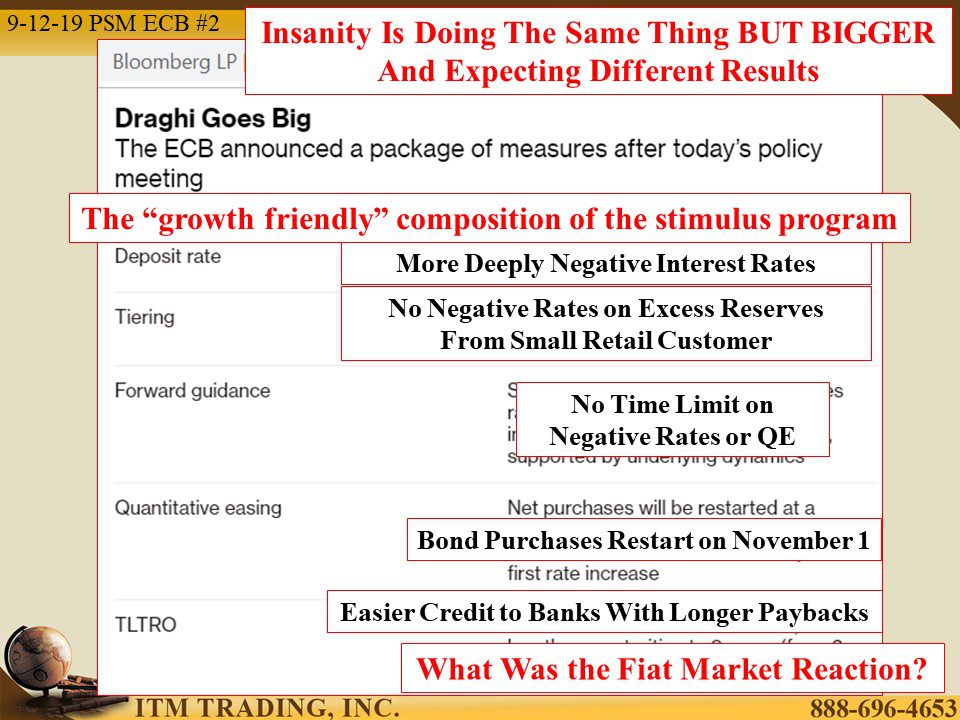

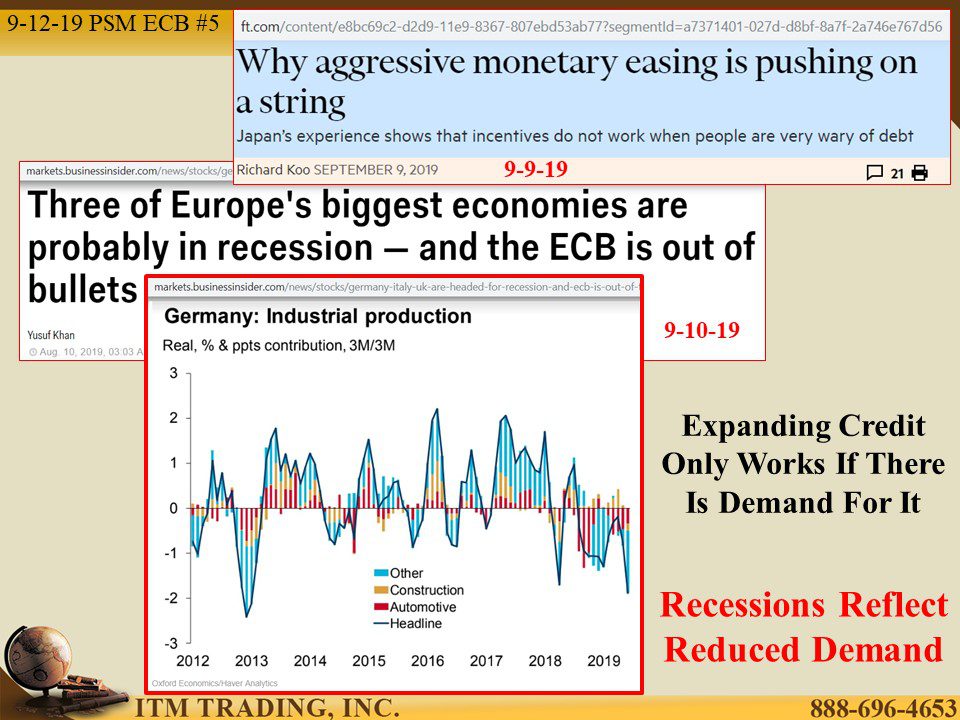

They say the reason it didn’t work was because they did not do enough, but Japan has been at it since the early 1990s with an alphabet soup of monetary easing, stock and bond buying and an attempt to control the yield curve. And while global stock, bond and real estate markets have been inflated higher, the overall global economy is struggling.

So what is the latest ECB experiment? Dropping interest rates more deeply negative, but not charging banks interest on small time deposit reserves to help with bank income declines. Restarting the government and corporate bond buying program. In addition, they removed and or lengthened time limits on negative rates, bond buying programs and central bank loans to banks, making it even cheaper and easier for banks to borrow. In other words, more of the same but on steroids, Woo Hoo!

Of course, intangible fiat markets loved this because market traders are the one who have access to the easy money. At this writing, European stocks are only 1.5% away from their 52-week high, except for bank stocks. Those are more reflective of the dangers in these easy money policies. Bond yields are down on anticipated ECB buying, ensuring bond holders do not get paid appropriately for the risk they are taking. Spot gold prices flew higher as the Euro dropped on this announcement and the anticipation of even more central bank easing ahead.

Unfortunately, this is not likely to have the stated effect because you can create as much credit as you want, but you need borrowers and spenders to move it through the broader economy. Keep in mind that a recession reflect credit demand declines and three of Europe’s biggest economies (Germany, UK and Italy) are in or near recession, it is far more likely the ECBs bazooka will be a dud.

Slides and Links:

https://www.bloomberg.com/news/articles/2019-09-12/ecb-cuts-rates-restarts-qe-to-fight-slowdown-as-draghi-era-ends?srnd=fixed-income

https://markets.businessinsider.com/news/stocks/germany-italy-uk-are-headed-for-recession-and-ecb-is-out-of-tools-2019-8-1028435638

YouTube Short Description:

What is the latest ECB experiment? Dropping interest rates more deeply negative, but not charging banks interest on small time deposit reserves to help with bank income declines. Restarting the government and corporate bond buying program. In addition, they removed and or lengthened time limits on negative rates, bond buying programs and central bank loans to banks, making it even cheaper and easier for banks to borrow. In other words, more of the same but on steroids, Woo Hoo!

Unfortunately, this is not likely to have the stated effect because you can create as much credit as you want, but you need borrowers and spenders to move it through the broader economy. Keep in mind that a recession reflect credit demand declines and three of Europe’s biggest economies (Germany, UK and Italy) are in or near recession, it is far more likely the ECBs bazooka will be a dud.