TARGETED WINNERS AND LOSERS: Capitalism and Socialism The Puppet Show Begins… By Lynette Zang

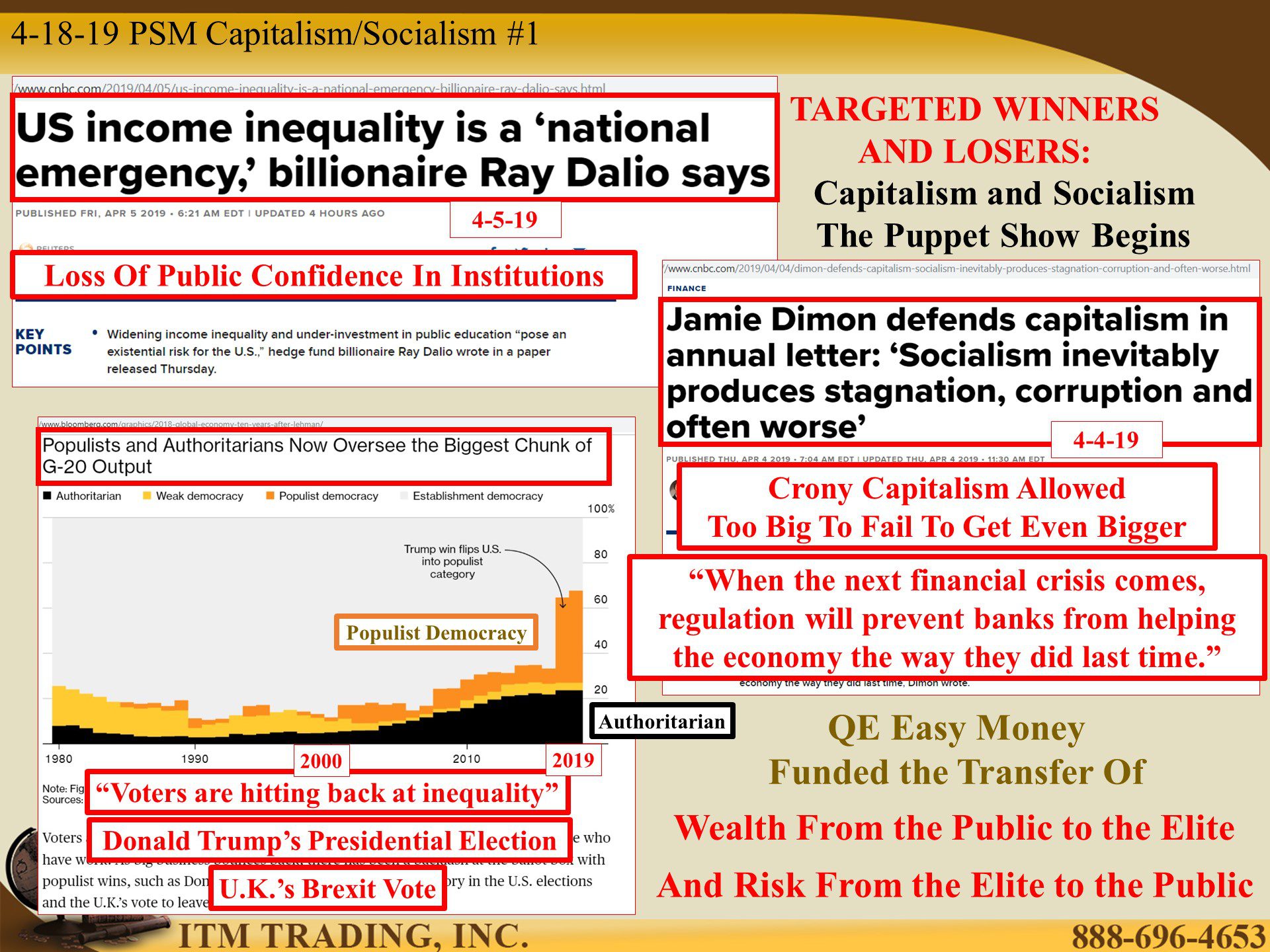

“US income inequality is a “national emergency,†billionaire Ray Dalio says†So says the headline in a recent CNBC article, and it’s true on many levels depending on which economic class you’re in.

If you are in the elite class, the emergency you face is most likely the loss of public confidence, which would be particularly problematic for central bankers and the fiat financial system they control. For governments, it’s given rise to the global populist movement, which has grown dramatically since 2000, and now accounts for 40% of G-20 (top 20 economies) output (the value of all sales of goods and services).

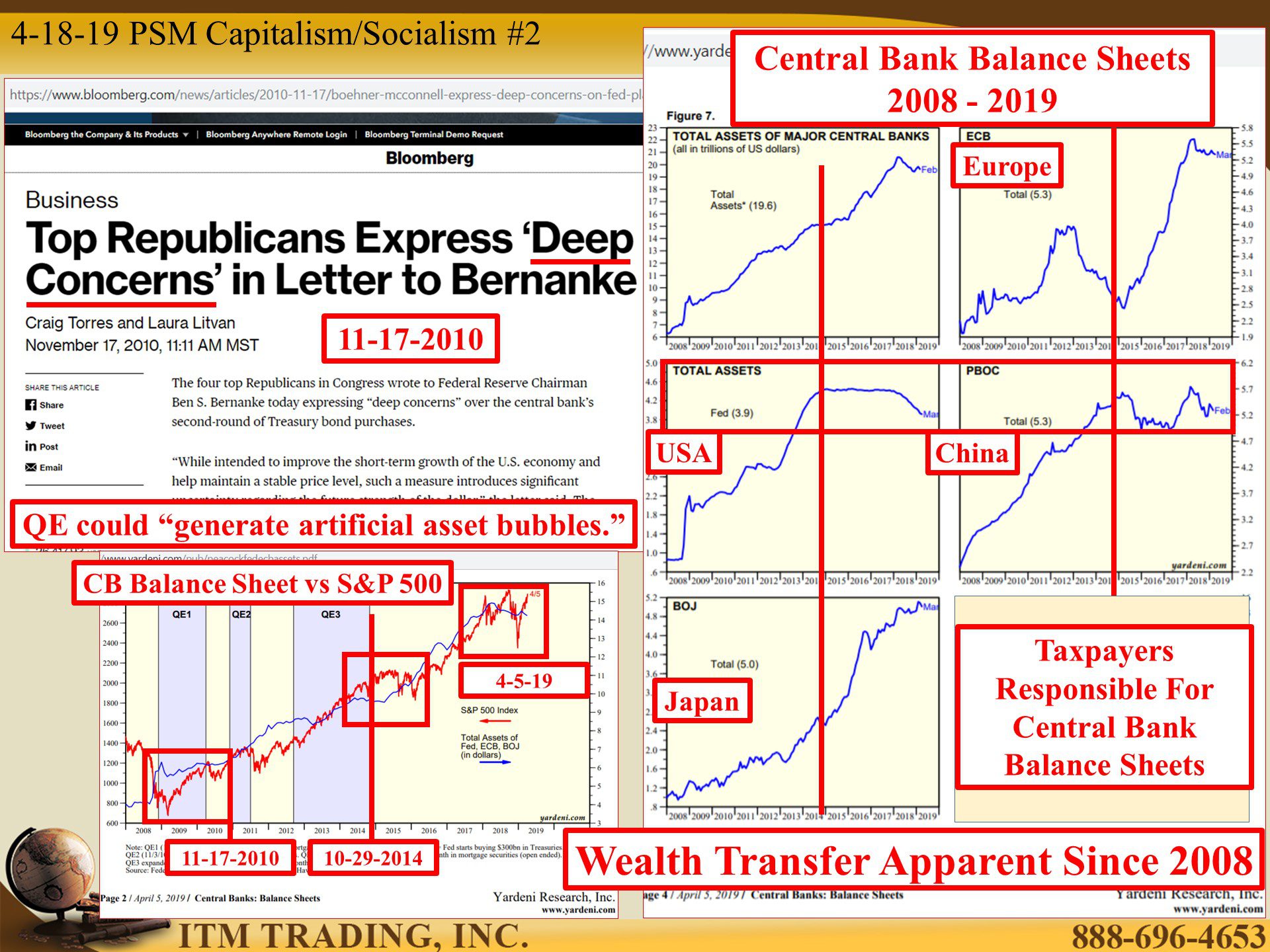

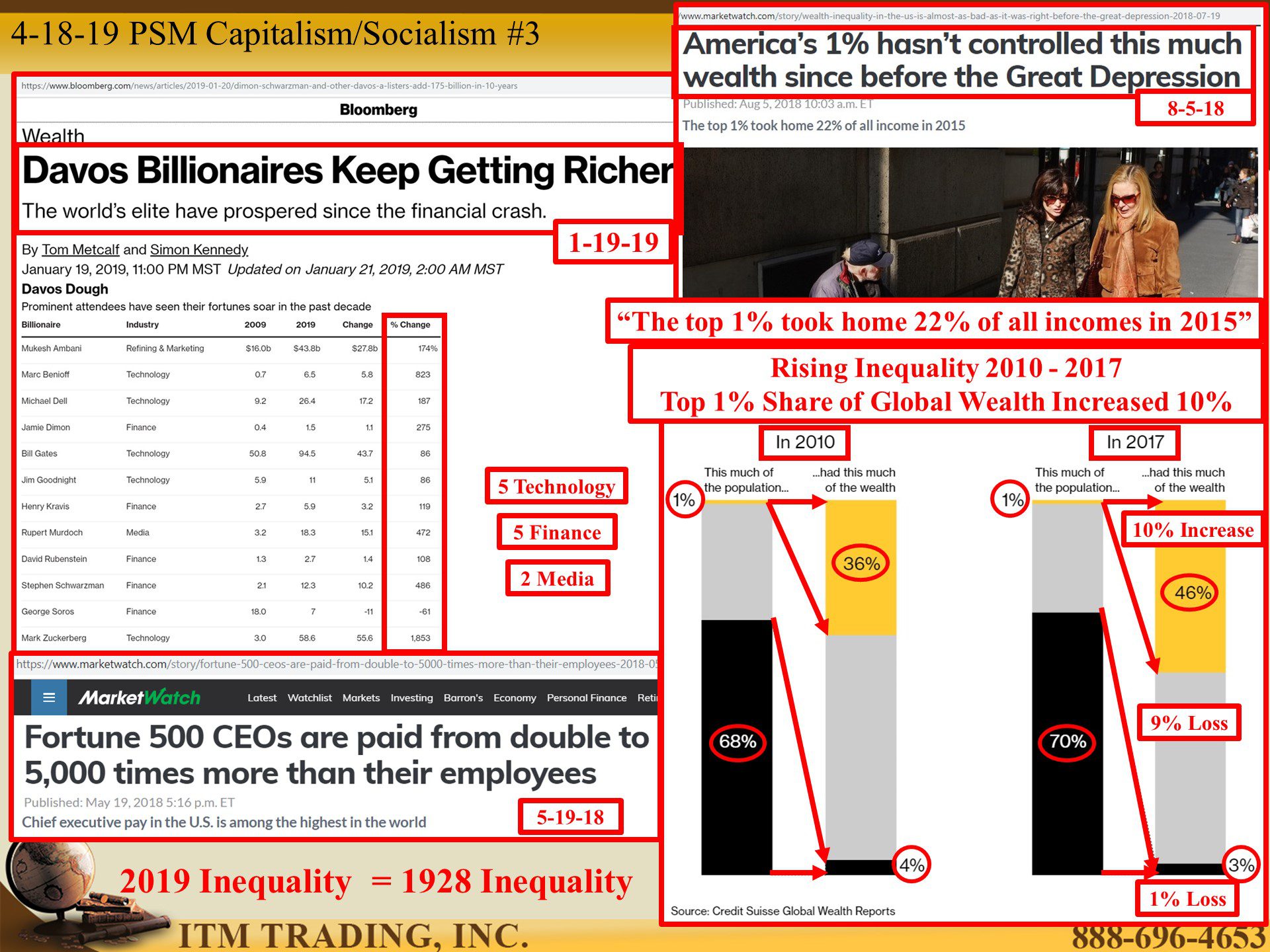

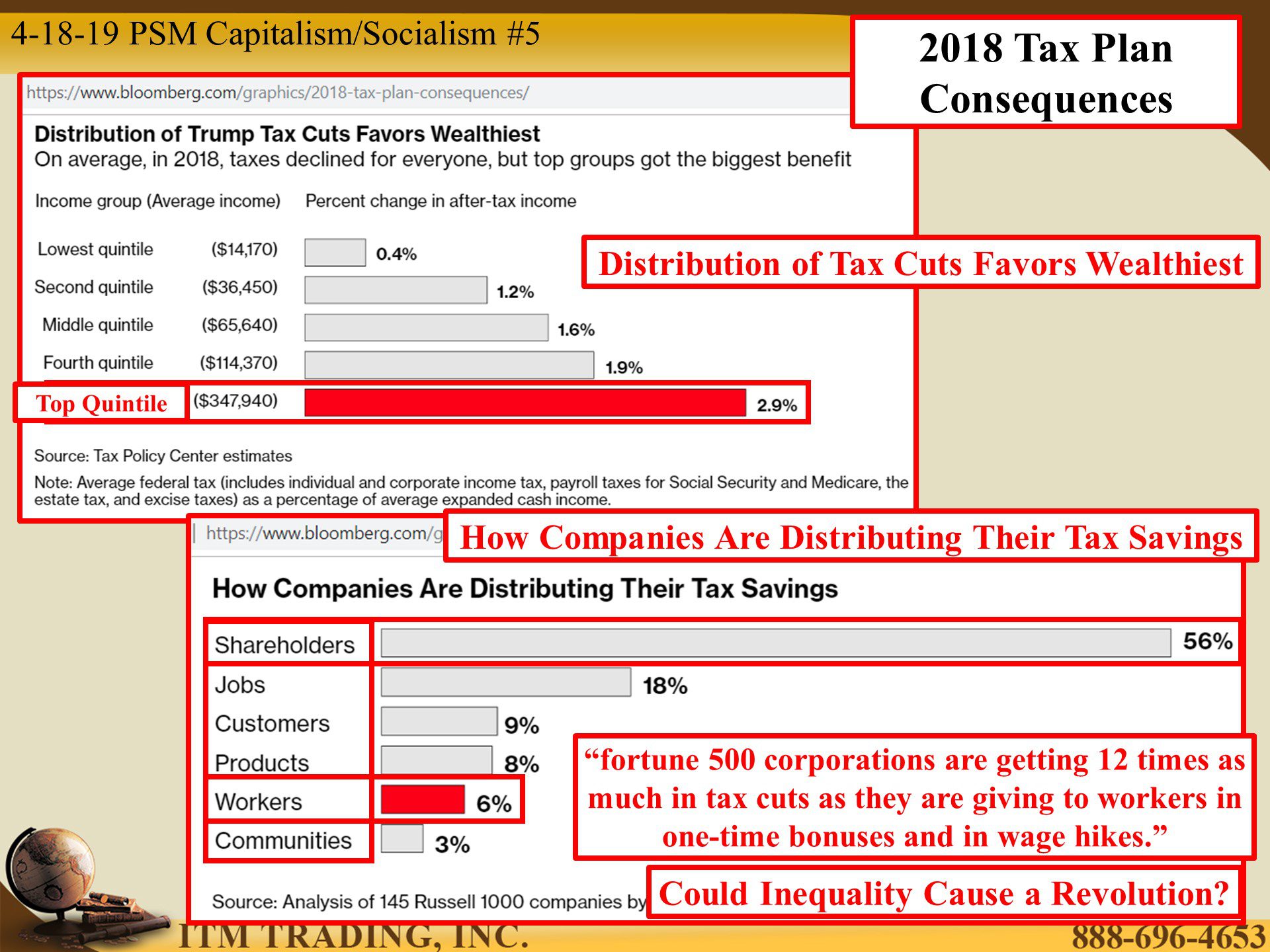

This movement surged when it became apparent that banks were bailed out at the taxpayers’ expense and zero interest policy benefitted corporate debtors at the expense of public savers, forcing investors to take on more risk in an attempt to generate income. Bottom line, since 2009 QE easy money policies funded the wealth for the public to the elite, with a 10% gain in the share of global wealth transferring to the elite. In fact, America’s 1% hasn’t controlled this much wealth since 1928, just before the crash of 1929.

Eerily similar is the transfer of risk from the elite to the public that took place then too. That was the beginning, but now we are at the end of this great fiat debt experiment and this time, voters are fighting back. The question is, can the elite control the conversation so that the public believes they are getting change that will benefit them?

Enter the debate between capitalism and socialism.

Capitalism is defined as and economic and political system in which a country’s trade and industry are controlled by private owners for profit, rather than by the state. This is what the elite, like Chase banks Jamie Dimon, want you to believe they are fighting for. But in true capitalism, the government does not choose who survives (wins) or fails (looses), as they’ve been doing in this “managed†market economy, that’s actually crony capitalism. This crony capitalism is what has enabled the shift of wealth to the top.

Socialism is a political and economic theory which advocates the means of production, distribution and exchange should be owned or regulated by the community as a whole, though typically, to produces a concentration of government power and reduces individual ambitions.

In the US, many presidential candidate platforms seem to be leaning toward socialism, particularly by way of Modern Money Theory (MMT) with government guarantees of health care, education and jobs for all, paid for with unlimited government money printing. In other words, a free lunch for all, which never really exists.

I suggest, after the reset when all the debt garbage has been burned off and we begin with a new financial system, that we go to true capitalism that works for all. Where corporations and individuals rise or fall on their own efforts. Where the fruits of productivity are more fairly shared and the money we work for and attempt to save for future use, is not inflated away.

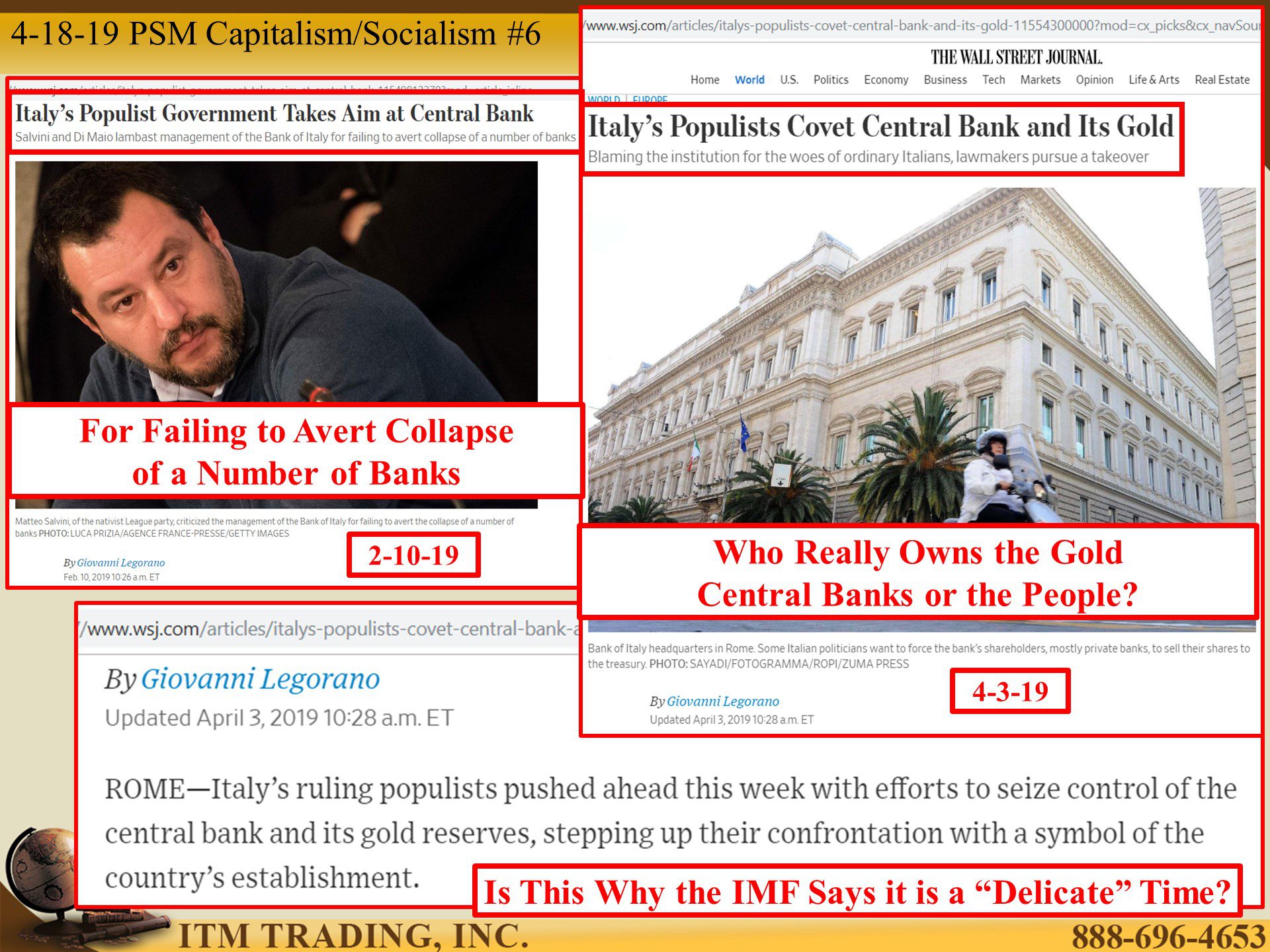

The populist government in Italy is attempting to regain control over the gold held in reserve at Italy’s central bank. This raises the very interesting question of who really owns the gold held by all central banks. If it is government gold, in theory it is owned by the public and therefore could be used to back a new money after the reset.

In the US, the debate between capitalism and socialism has begun. Personally, I see it as a distraction from the real issue, which is the destruction of the current debt-based money regime and the shift into the new system. What will back our money? What will insure that we are fairly compensated for our labor today and into the future? For 5000 years gold has provided that function. Gold backed money anyone?

Slides and Links:

https://www.bloomberg.com/quicktake/populism

https://www.yardeni.com/pub/peacockfedecbassets.pdf

https://www.yardeni.com/pub/peacockfedecbassets.pdf

https://americansfortaxfairness.org/key-facts-american-corporations-really-trump-tax-cuts/

https://www.bloomberg.com/graphics/2018-tax-plan-consequences/

https://www.bloomberg.com/quicktake/populism

YouTube Short Description:

In the US, the debate between capitalism and socialism has begun. Personally, I see it as a distraction from the real issue, which is the destruction of the current debt-based money regime and the shift into the new system. What will back our money? What will insure that we are fairly compensated for our labor today and into the future? For 5000 years gold has provided that function. Gold backed money anyone?