STOCK MARKET TROUBLES: Are smart investors recognizing the 2019 Market Overvaluation By Lynette Zang

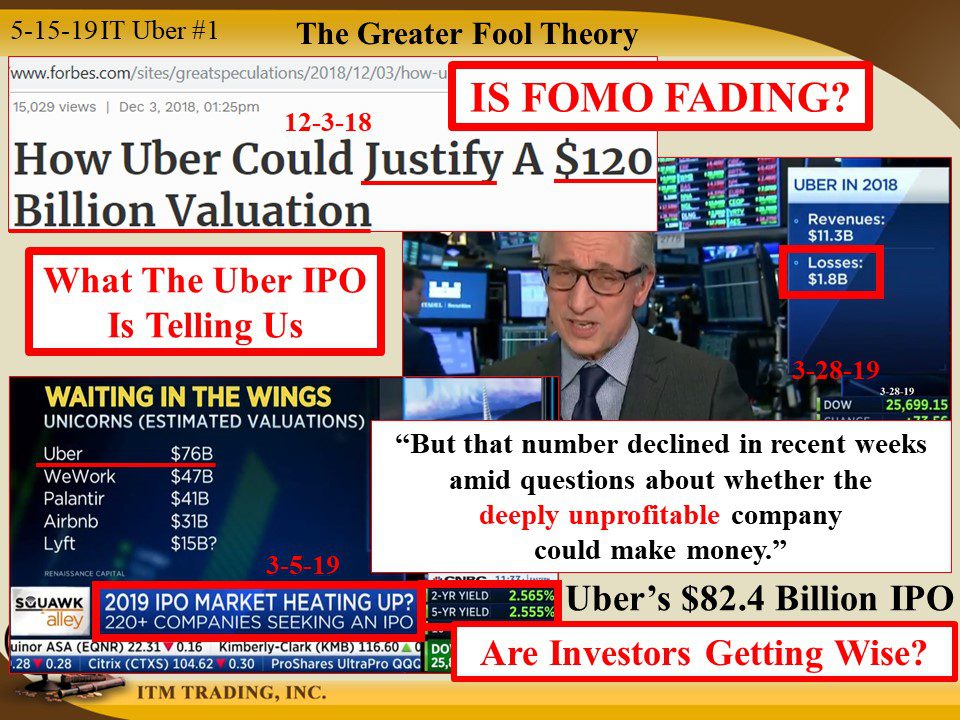

Uber’s IPO created the greatest buzz prior to coming out on May 10, 2019, with a “justified†market value of $120+ billion as recently as December 2018. In their IPO filing at the SEC, they showed continuing substantial losses and by early March the estimated market value of Uber was down to $76 billion, though still the highest valuation in the unicorn stampede. At the IPO price, Uber’s market value at launch was $82.4 billion.

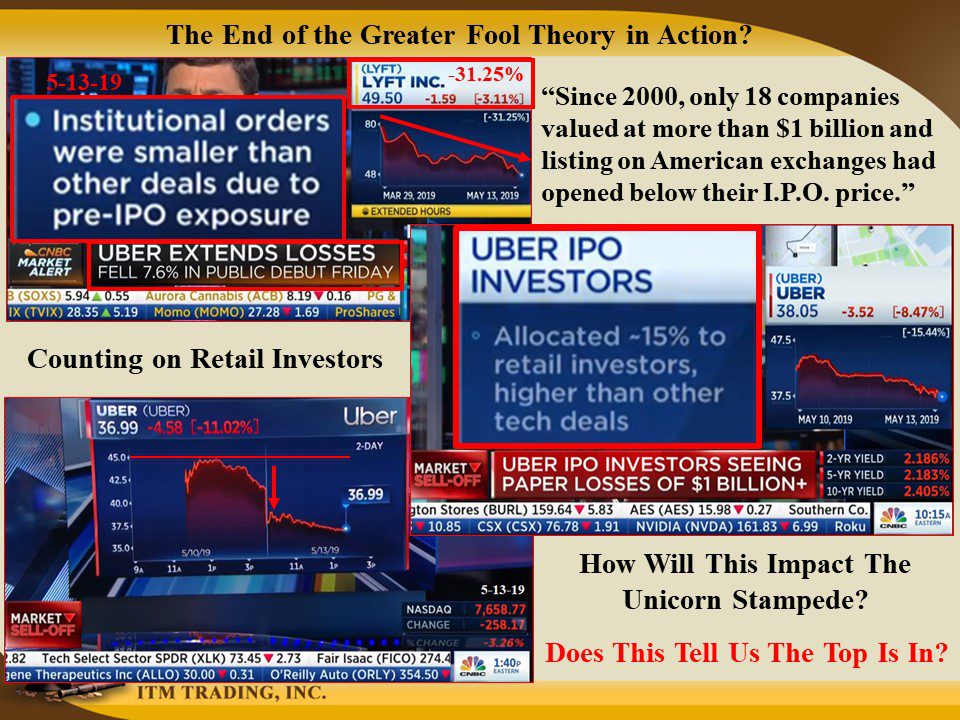

Lyft came out first with a 20% first day trade pop, and is, (at the time of writing), down 31.25% from it’s offering price. Uber’s much anticipated and touted IPO offering was a dud right out of the shoot. In fact, out of 2,360 IPOs since 2000, only 4% of all IPO’s fell on their first day of trading, regardless of losses on their balance sheets.

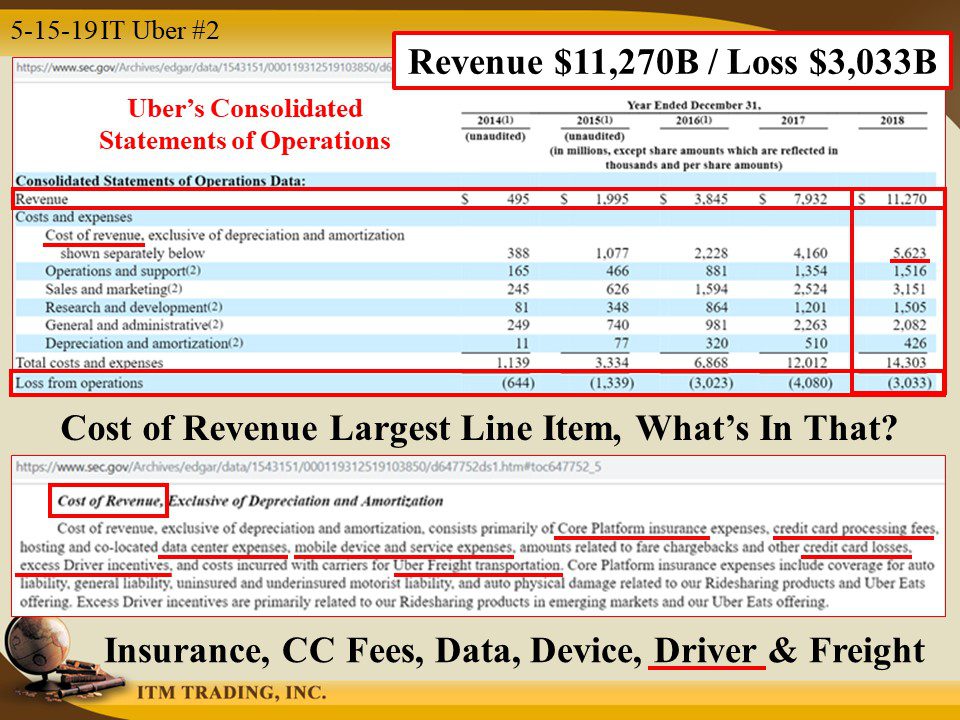

But I had a question, likely one you have too. Since Uber generated $11.270 billion in revenues, why are they showing a loss from operations of $3.033 billion? (According to their Consolidated Statements of Operations filed with the SEC)

This company is touted as a technology company and technology is supposed to make things cheaper, yet their business model shows forever losses, stating that profitability will be attained with self-driving cars. From that statement, one could deduce that drivers and the costs associated with driving, must be a very high cost to the company, which could make some sense. And indeed, cost of revenue is the largest line item in that SEC filing. Drilling down a little might even seem to support this idea…until you look at the facts.

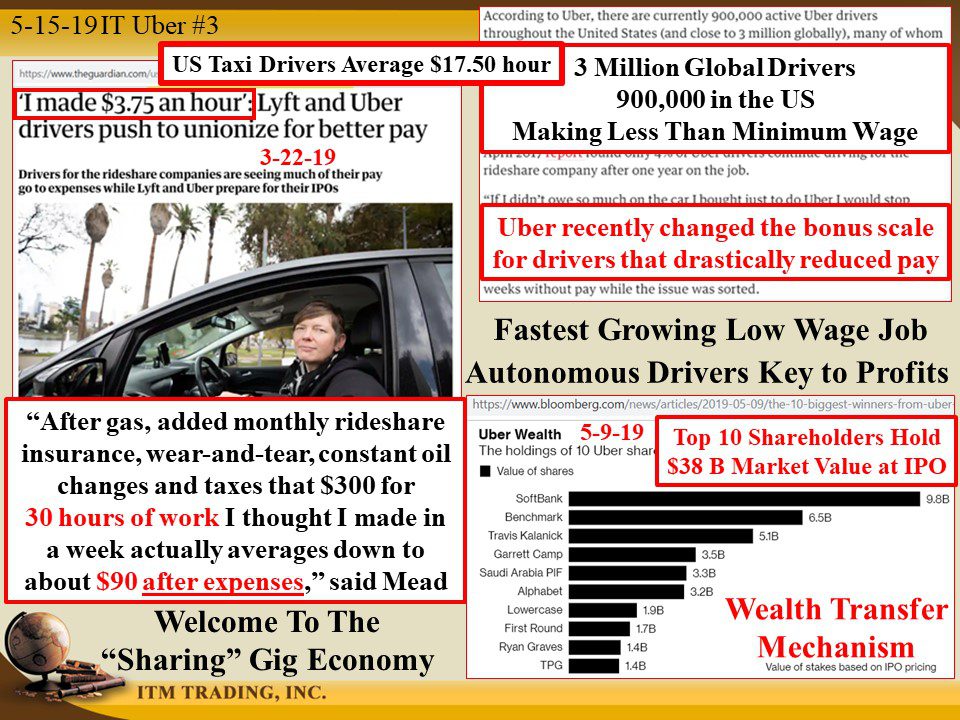

The 2008 financial crisis gave birth to the “gig†economy where families were forced to supplement their main income. Driving for Lyft and Uber seemed like a good opportunity, since you could set your own hours and be your own boss. In addition, there were driver incentives that seemed to provide a reasonable income. For some, it even made sense to buy a new auto in order to become a driver since they could anticipate a possible $17.50 an hour, looking at the average income of a typical taxi driver in the US.

These unicorns have money to burn in the Get Big Fast (GBF) business model, and a growing amount can be spent on lobbying state and federal governments to influence laws and bend them to their benefit. Uber’s lobbying costs show this fact as does the average wage of Lyft and Uber drivers, who are responsible for their cost of gas, monthly rideshare insurance, wear-and-tear, maintenance and taxes is averaging $3.75 hourly, after all costs.

What this really means is that the company is not likely to be profitable even into the future. Looks a lot like the Nasdaq valuations in 1999 – 2000 don’t you think.

The big question is, are investors beginning to see value more clearly? Is FOMO beginning to fade?

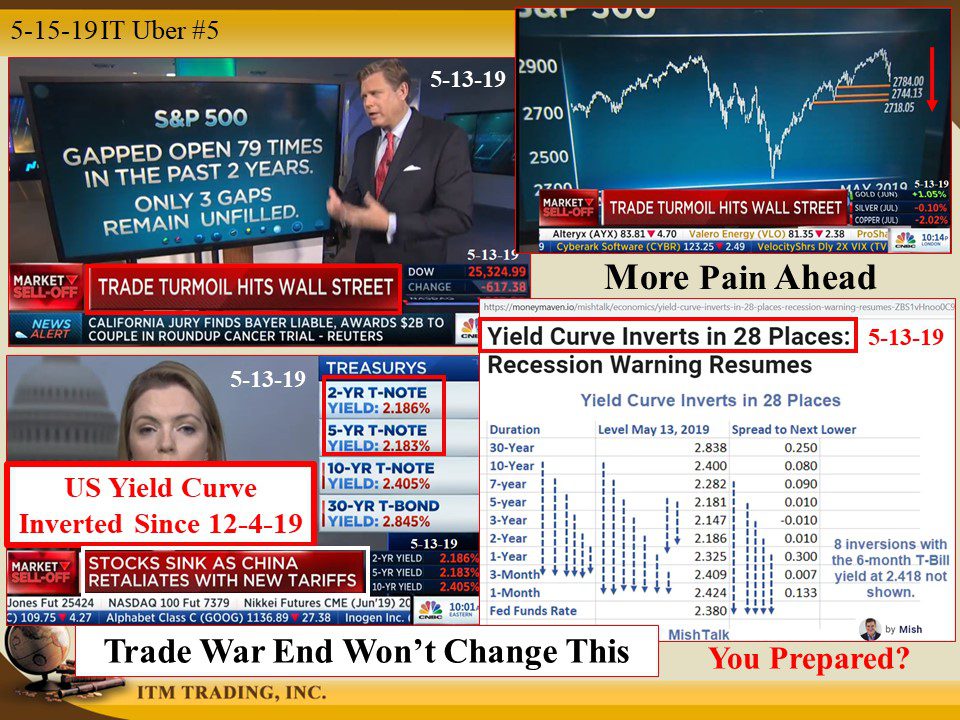

Because the broader markets are also breaking down in a similar way. It’s technically troubling that market valuations failed to breach the all-time highs reached last October, even with central bank help. Of course, wall street is blaming it on the trade wars and saying all will be well when the trade wars are over, particularly if the fed would just lower rates. I’d say the global “growth†damage has already been done and cannot be undone.

The yield curve in the US has been inverted since December 4, 2018. As of May 13, 2019, the US yield curve is inverted in no less than 28 places. TWENTY-EIGHT!

Presuming history repeats, the globe is headed for a major crisis and ending the trade war, whenever that may be, will not stop what’s coming. Central bankers know this and have been accumulating gold in preparation.

If the market top has indeed been put in, this may be your last opportunity to get out of the bears way through liquidating your fiat money positions while you can. For those who continue to hold wealth in these markets, this may be the cheapest level you’ll be able to buy physical gold and silver.

It is the time to ask yourself what you need to be prepared. Then I urge you to act. I’d rather be two weeks too early, than one second too late. How about you?

Slides and Links:

https://www.sec.gov/Archives/edgar/data/1543151/000119312519103850/d647752ds1.htm#toc647752_5

https://www.nytimes.com/2019/05/10/technology/uber-stock-price-ipo.html

https://www.theguardian.com/us-news/2019/mar/22/uber-lyft-ipo-drivers-unionize-low-pay-expenses

https://medium.com/notes-from-the-freak-show/are-uber-airbnb-and-facebook-the-new-nra-814ce373f12f

https://www.bloomberg.com/news/features/2015-06-23/this-is-how-uber-takes-over-a-city

https://www.sec.gov/Archives/edgar/data/1543151/000119312519103850/d647752ds1.htm#toc647752_5

https://www.nytimes.com/2019/05/10/technology/uber-stock-price-ipo.html

https://www.theguardian.com/us-news/2019/mar/22/uber-lyft-ipo-drivers-unionize-low-pay-expenses

https://medium.com/notes-from-the-freak-show/are-uber-airbnb-and-facebook-the-new-nra-814ce373f12f

https://www.bloomberg.com/news/features/2015-06-23/this-is-how-uber-takes-over-a-city

https://www.nytimes.com/2019/05/10/technology/uber-stock-price-ipo.html

https://site.warrington.ufl.edu/ritter/files/2019/04/IPOs2018Statistics-1.pdf

YouTube Short Description:

Uber’s IPO created the greatest buzz prior to coming out on May 10, 2019, with a “justified†market value of $120+ billion as recently as December 2018. Uber’s market value at launch was $82.4 billion and (as of this writing) has fallen ever since.

The big question is, are investors beginning to see value more clearly? Is FOMO beginning to fade?