SOFR and REPO Updates, Phase 1 China Deal, Iran Pull Back …by Lynette Zang

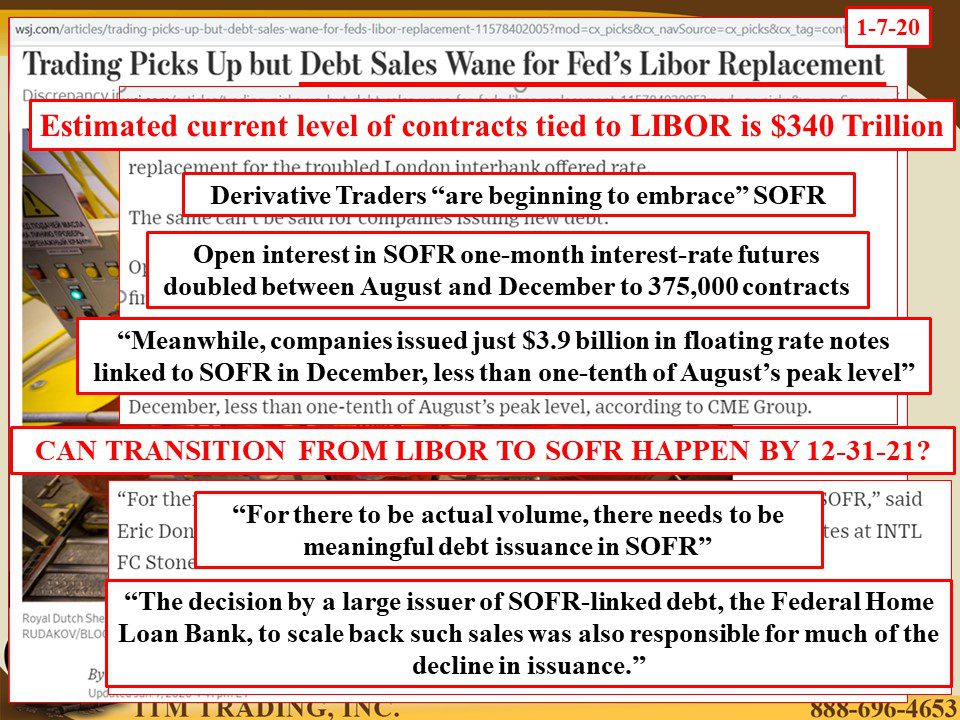

YIKES the transition from LIBOR to SOFR has hit a snag with banks & traders embracing this new way to make money, but corporations are hesitating on issuing debt tied to this new benchmark. As a reminder, LIBOR benchmark is currently tied to at least $340 trillion contracts on everything from mortgages to derivative contracts. Any contract due to expire after 12-31-21 MUST BE converted prior to that date and the fed is struggling to bring this about. THIS IS LIKELY THE BIGGEST DANGER THE GLOBAL FINANCIAL SYSTEM FACES.

Have more questions that need to get answered? Call: 844-495-6042

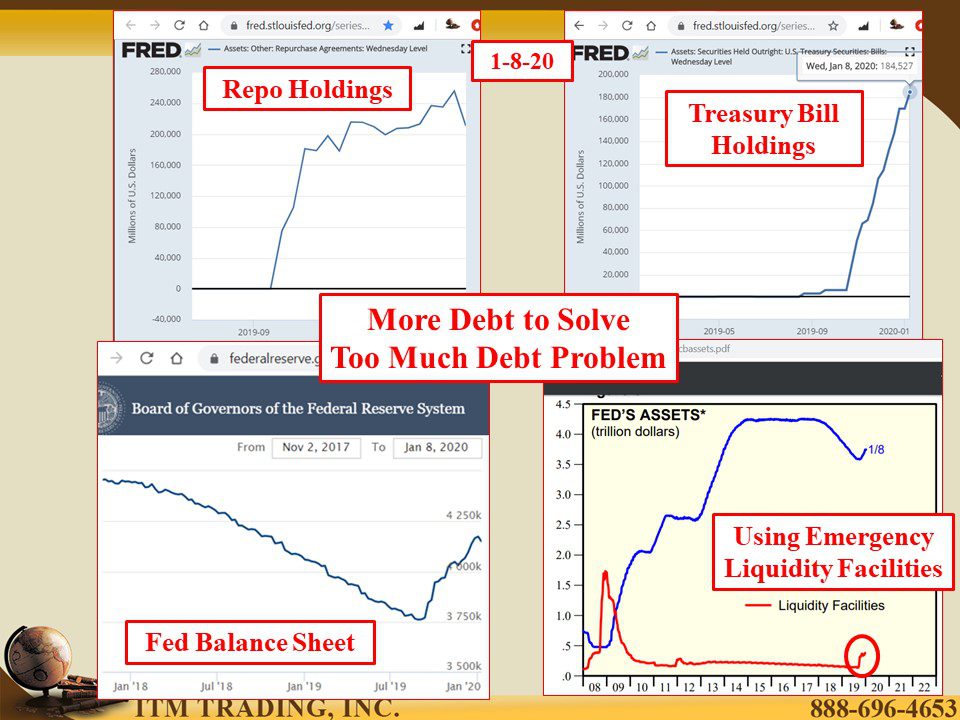

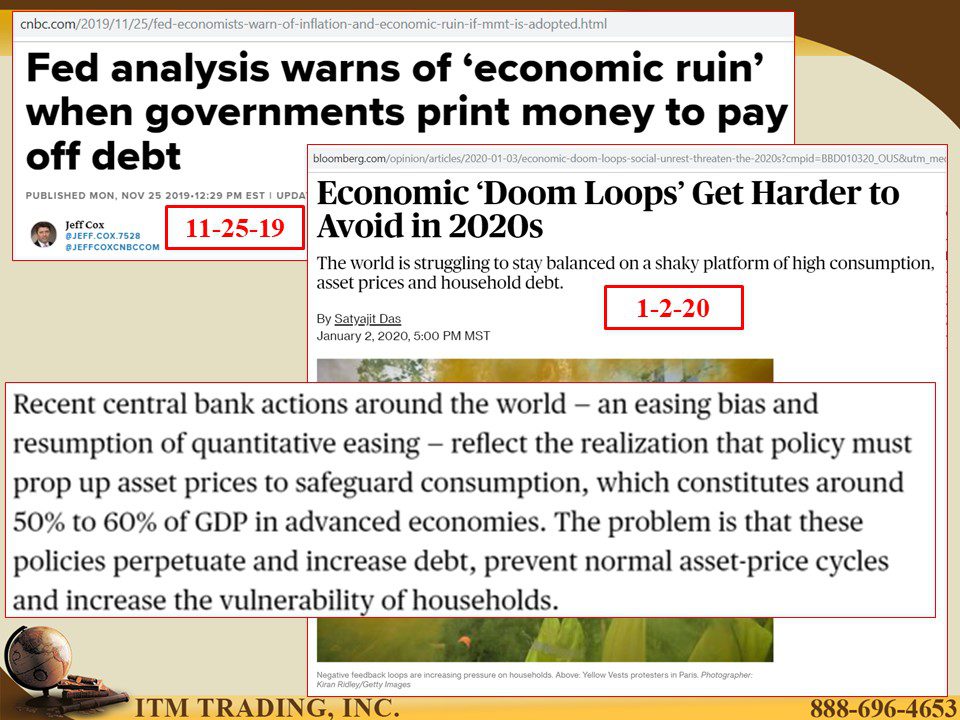

Now QE continues as the fed’s balance sheet continues to expand as its credibility is tested. Since central bank viability is based upon confidence in this institution, you can add this to the danger list. When public confidence is lost, it is game over.

Phase 1 China deal has been signed, though not by President Xi Jinping. Many think this is just a band aid to rachet back fear of the unfolding global economic slump.

The same can be said for the US/IRAN tension that threatened to explode into WWIII. The US had a three hour notice to evacuate US troops before Iran missiles hit two Iraq bases and when an Iran missile did hit a Ukrainian commercial flight, EVERYONE said that it must be a mistake, even without evidence one way or the other.

Slides and Links:

https://fred.stlouisfed.org/series/WSHOBL

https://fred.stlouisfed.org/series/WORAL

https://www.yardeni.com/pub/peacockfedecbassets.pdf

https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm