SILENT ROBBERY OF WEALTH: The Hidden Lies of Inflation & the Stock Market

What will it take for everyone to realize that we are living through the greatest Ponzi scheme in the history of money? From the moment the Fed was born. Inflation has been silently robbing you of your wealth. And especially once the backing of gold was gone. But it’s not so silent anymore, is it? Have you checked your food and living expenses lately? What most people don’t realize is that historically, when a currency is about to completely collapse, it is matched with both record levels of inflation and the illusion of a stock market going up. This will be the next historic transfer of wealth, and those who hold gold will be the few who maintain privacy and control over their wealth. Pay attention closely because this video will show you the clear process which is about to unfold and exactly what you can do about it while you still have time!

CHAPTERS:

0:00 Introduction

1:54 QE Colossal Mistake

3:55 Beware of a Rising Stock Market

5:02 An Overnight Reset

7:23 Purchasing Power

9:10 Zimbabwe

12:30 Turkey’s Inflation

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

What will it take for everyone to realize that we are living through the greatest Ponzi scheme in the history of money? From the moment the Fed was born, inflation has been silently robbing you of your wealth and especially once the backing of gold was gone. But it’s not so silent anymore, is it? Have you checked your food and living expenses lately? What most people don’t realize is that historically, when a currency is about to completely collapse, it is matched with both record levels of inflation and the illusion of a stock market going up. This will be the next historic transfer of wealth. And those who hold gold will be the few who maintain privacy and control over their wealth. Pay attention closely cause this video will show you the clear process which is about to unfold and exactly what you can do about it. While you still have time, coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading of full service physical gold and silver dealer, but really specializing in custom strategies. And I gotta ask you, don’t you think you need to have one? Are you looking at what’s going on in the world? Because we’re all part of that world. I mean the US is really a mess as well, but we’re not alone in it. So if you haven’t done this already, cause you really have to have a plan, click that Calendly link below and set up a time to talk with us because I’m gonna show you what it really looks like and let’s just dive right in.

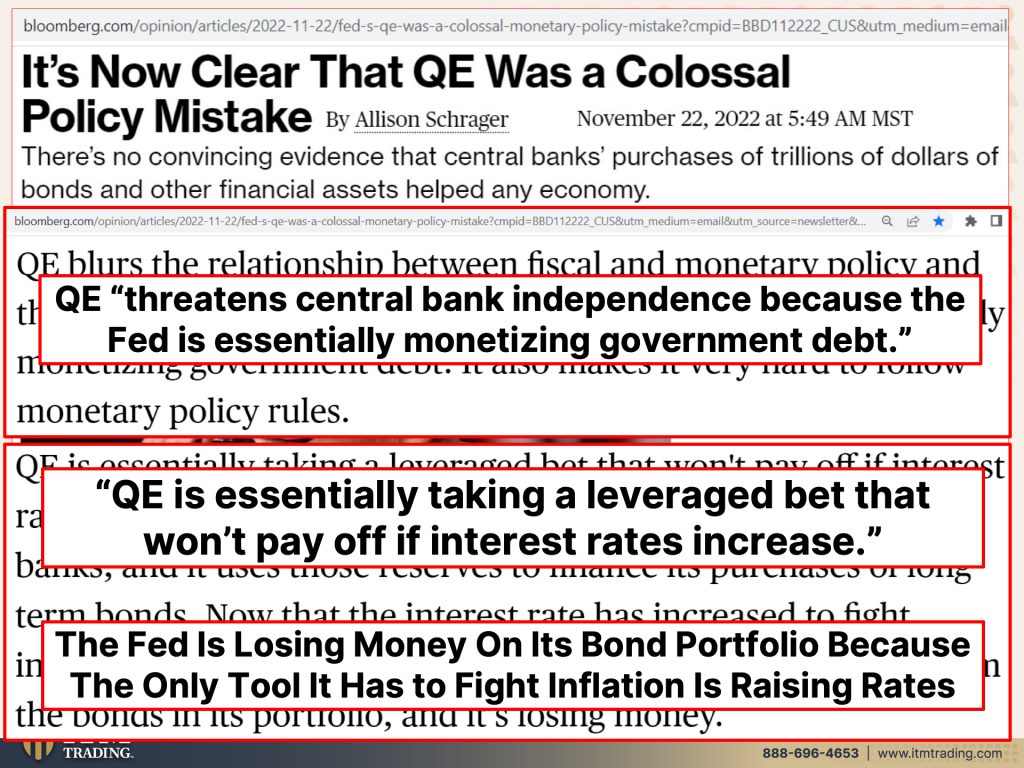

Because quite frankly it should be pretty clear that QE was a colossal policy mistake. Absolutely. What did all this money printing do but inflate these assets that as they’re trying to undo their policy are now falling. They’re gonna have to pivot. Not yet, but they will when they create this next crisis, this is the only tool that they actually have left. Because what QE really does is it threatens the central bank independence because the Fed is essentially monetizing government debt. Don’t call it that though. Let’s put another name on it, but I’m sorry. When you put a lipstick on a pig, I’m sorry, it is still a pig like it or lump it. QE is essentially taking a leveraged bet. What’s leverage it’s debt upon debt, upon debt upon debt that we won’t pay off, that won’t pay off If interest rates increase, guess what? Interest rates are increasing because they back themselves into a corner where it doesn’t really matter what choice they make. Something nasty this way comes the Fed is losing money on its bomb portfolio because the only tool it has to fight inflation is by diminishing demand by raising rates. So that means that’s true for all of the global central banks that were monetizing government debt at 0%, maybe they’ll get to 5%. Is that really gonna stop inflation? No, you wanna stop inflation, you’ve gotta go above it. But the inflation genie is out of this bottle and there is, I’m sorry, there’s just no putting it in said at the beginning of it, I thought this was a start of hyperinflation. I have seen absolutely nothing that would change that.

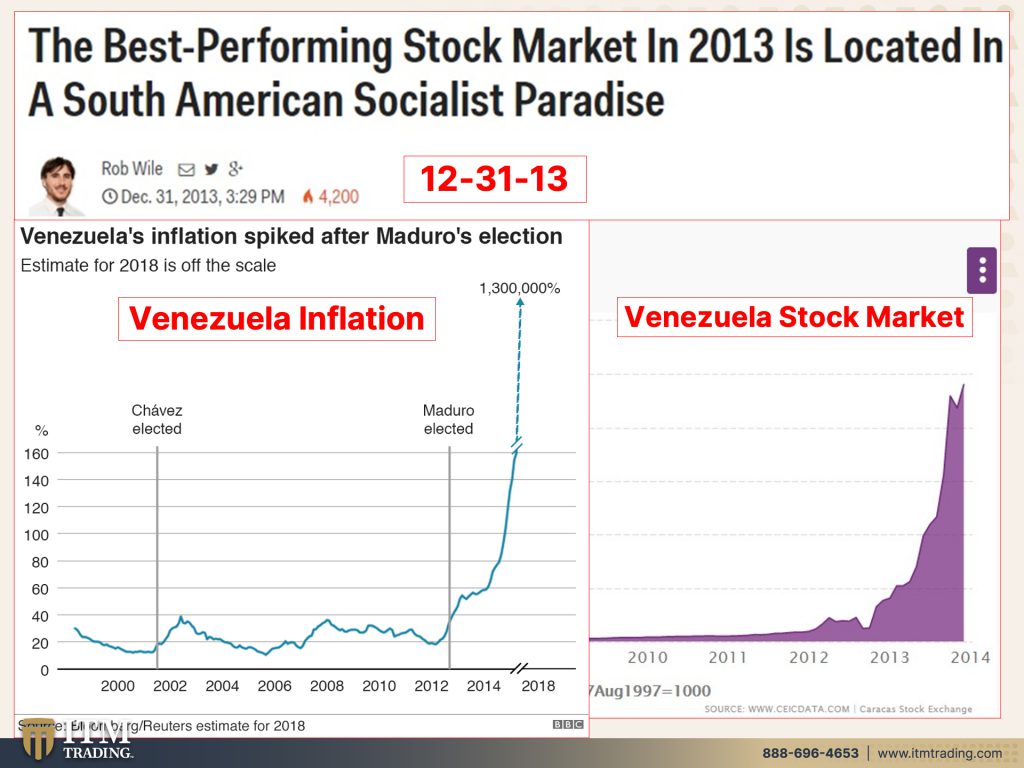

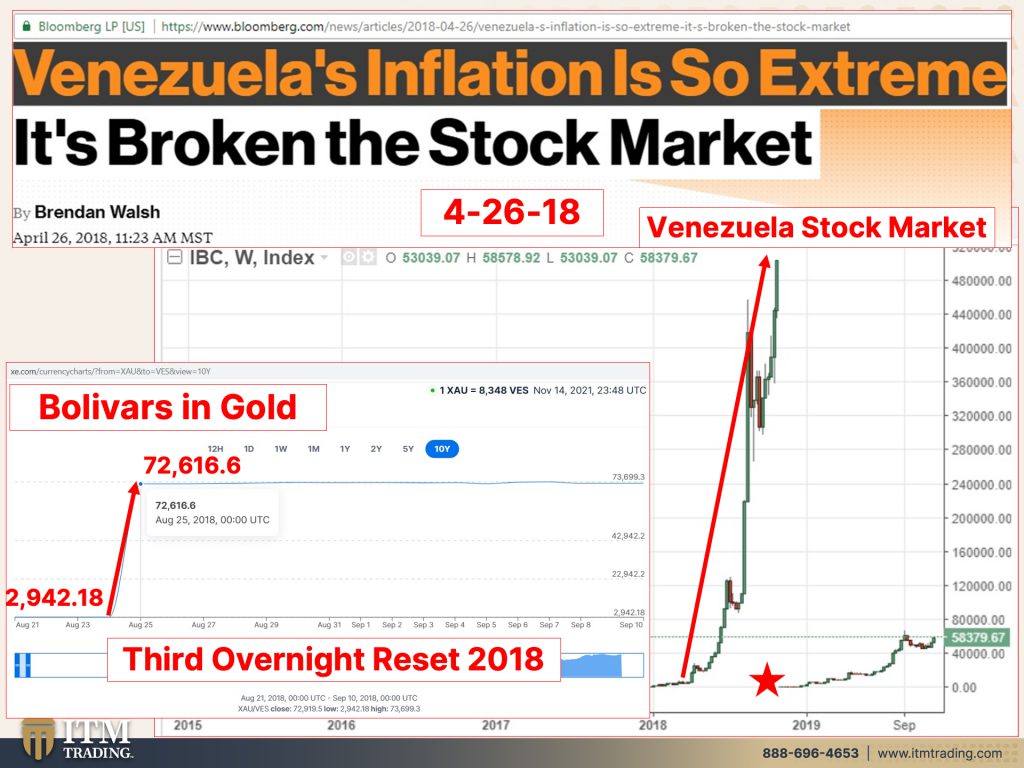

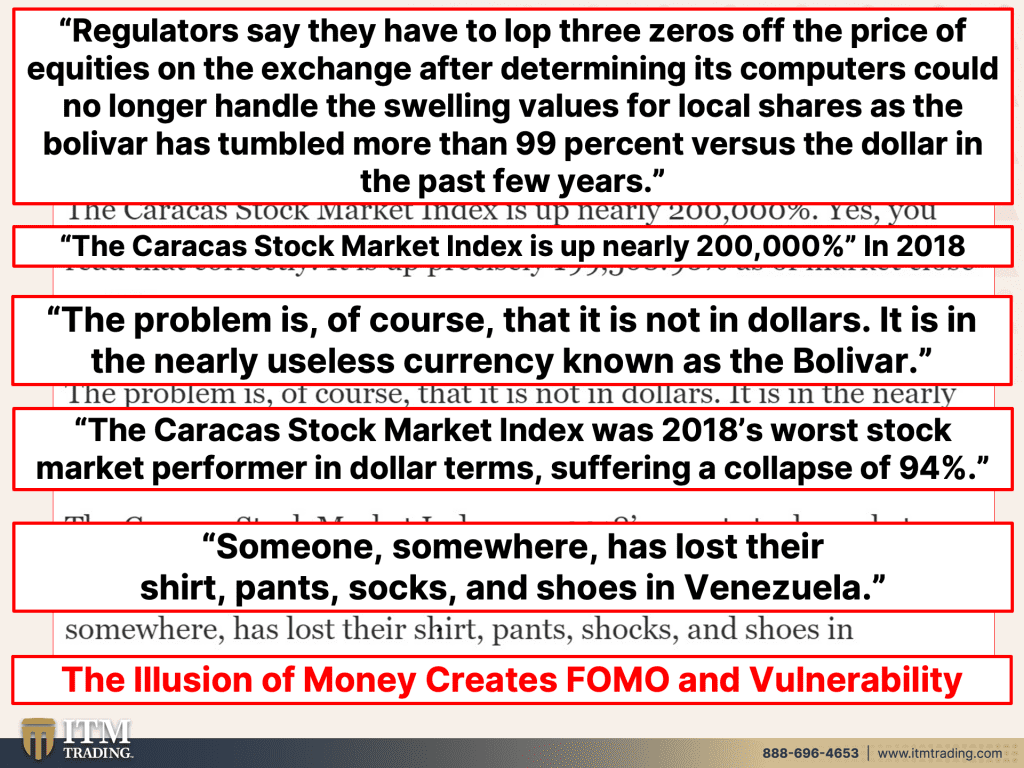

But if you look at even where the stock market is right now, it’s overvalued. You’ll get a rally here, you’ll get a rally there. That’s to sucker you into keeping your wealth inside of the system. So let’s look at a few instances and bring them current so you can see what’s really happening. Because you’ve heard me talk about Venezuela many, many times and in 2012-13, basically through 2018, they had the best performing stock market in the world, but they also had the highest level of inflation. So people will run to these fiat money products, but what they’re really missing is what the real trend is. It just creates FOMO, fair of missing out look, it’s going up except that the value of the currency that you can only convert this fiat money product, whether it’s stock markets, bond markets, ETFs, all of that garbage is into dollars and inflation is showing you that that’s going away.

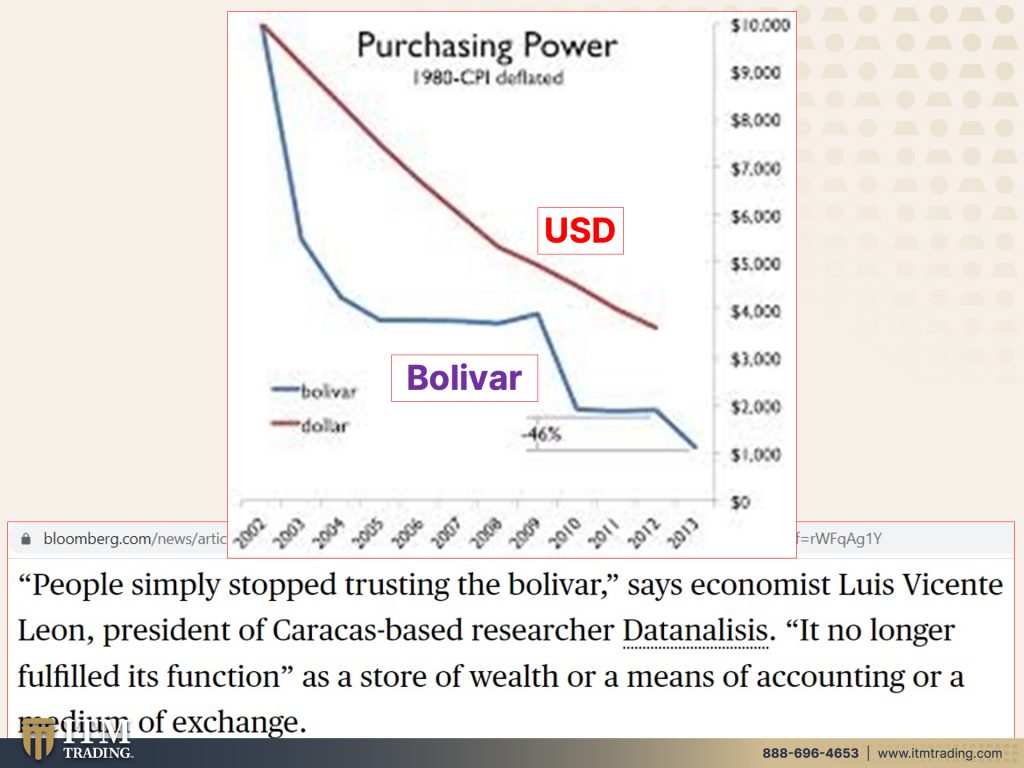

But during that same period of time, there’s your overnight reset. Can you see it right there? Boom. That was the first overnight reset the inflation, the hyperinflation started before that and they just kept suppressing the price. So what happens is like gold is like a spring, right? So government forces suppress it because the rise gold price is an indication of the failing currency. They don’t want you to understand that they want you to stay in their products, but when they remove it and they do that overnight revaluation, the amount of currency that you have in the bank. And this particular case declined by, I think it was 94.5% and gold goes up. Do you see that opportunity? Now it didn’t express to its full fundamental value yet, we’ll talk about that. But the second overnight reset happened in 2016. I mean you can see it and then they push down the price of gold so that you don’t realize it until they have the next reset. So globally, historically there are on average three Venezuela’s already been at four, I’ll show you because this also was in 2018. And look at that stock market up to the moon on lorna doone. Look, this same thing can be said with any fiat money product. I’m using stock markets as an example. But look at what happened, boom, when they did that overnight reevaluation, not very pretty, but what happened to gold? Well, there you go, you can see what happened to gold. So now this is really the spot market too. So we’ll talk more about that. That was the third revaluation. And I want you to listen to this because regulators say they have to lop three zeros off the price of equities on the exchange after determining its computers could no longer handle the swelling values for local shares as the bolivar has tumbled more than 99%, then they’re saying versus the dollar. So Venezuela is not doing so great, but I’d like you to take a look at this purchasing power chart. Now this just goes through 2013, it’s much more rapid now and it’s comparing the bolivar, the loss of purchasing power to the US dollar. What I’d like you to note is they’re both going down <laugh>, it’s just a matter of degrees. It’s really ridiculous. But this is the confidence piece that I keep talking about. People simply stop trusting the bolivar. It no longer fulfilled its function as a store of wealth or a means of accounting or a medium of exchange. So we already know that at some point in the recent past, the Federal Reserve has taken out store of wealth, long-term store of wealth. And when they convert to the CBDC’s, they’ve taken out the short-term store of wealth. So you’re never gonna get paid fairly for your labor. Well, when everybody recognizes that, when the confidence in the system is lost, that’s when we go into hyperinflation and then you can’t even use it as a medium of exchange. Then you’re going to barter because this or anything will have more value, especially gold, especially silver will have more value than pieces of paper. It’s nothing. It’s nothing.

Okay, well they’re not the only ones and Zimbabwe is another country that I’ve been talking about for years. And you can see people fly to the stock market because we’ve been taught that there’s no other choice besides stocks and bonds. Garbage. There is a choice, there is physical gold, physical silver, you got a choice, but people flock to that. Nominal confusion changes the perception, not the real value. So what is that nominal confusion? Well, you might think about it like this. If you had a $20 bill 10 years ago and you’ve got a $20 bill today, nominally they’re the same. But what that $20 bill would buy then versus what it would buy now, is vastly different. That’s nominal confusion. That’s why a family of four could survive with one paycheck in 1971 at $9,500. And yet you had to be stimulated at, what was it, two 250 or 150. But people are, that make like 200,000 a year are paycheck to paycheck, right? I mean, wouldn’t you rather have 200 than 9,500 except that that bought you a whole lot more in 1971 And what happened to gold during that same period of time? It went up to. So it helped maintain your purchasing power. And as they say, the major challenge we face therefore is confidence in the monetary and fiscal systems of the country. Ya, think? Because it is a con game and all con games require confidence. And so that’s why they’re always looking at consumer confidence and this confidence and that confidence and what is the answer when enough people try to sell? Especially we’re hearing all this talk about the lack of liquidity and that we should be prepared for a big shock. Well, you think the government might shut down the stock market or the bond market or any of those fiat markets that they can easily control? Yes, they’ve done it before. They’ve done it in this country, they did it during 2008. They can shut those down and that’s where your wealth remains. And you tell me who are you gonna complain to? There’s nobody to complain to. There’s nothing you can do.

But let’s come forward now because investors excited to buy Zimbabwe plan to mint gold to curb that inflation while la our investors, those are entities that can actually afford to buy that one ounce gold coin. The masses, you think that they, they can have billions of Zimbabwe dollars and they can’t afford eggs. They’re not buying the gold. So basically what we’re seeing here is that the winners have been chosen and it wouldn’t be if God forbid, but it wouldn’t be you or me if we were in Zimbabwe because we’re the public and we’re just the right size to fail. It’s the same, oh pardon me, it’s the same saga over and over and over again.

And what about Turkey inflation tops? 85% as they rule out interest rate hikes. So you see, it doesn’t matter what they do, whether they hike interest rates, we still have rapid inflation or they don’t. Central banks and governments are between a rock and a hard place. So officially Turkey inflation rose 85.5% year over year for the 17th consecutive month as food and energy prices continued to decline, food prices were 99% higher than the same period last year. 99% higher housing rose by 85% and transport was up 117%.

So I’m not really quite sure where they got the 85%, but okay, what about the stock market? Woo-hoo, Turkey stock markets 80% rally fuels world top gains in 2022. Interesting, isn’t it? Because you can see right here, and this by the way is November 3rd, this headline and this headline is November 22nd. So what are you looking at here? Stocks are not keeping pace with inflation, especially when we enter into the hyperinflation. They don’t because there’s nothing there to reinvest. And by the way, what we’re looking at now, and they’re talking about how all the stock markets, how so much of the stock market gains were based on buybacks and companies took on lots of debt to do that and blah, blah blah. Well there you go. I mean this could not have, when I saw that, I went like, ah, even caught me by surprise to have it so blatant.

But what are they doing? Well, Turkey Uzbekistan continue to buy gold and speculation grows that China is buying anonymously cause China doesn’t really want the world to know how much they have. And you know, it was 2006 when they allowed their public to start actually buying gold. And where could they hold that gold? Oh, in the banks, how convenient. I mean really, who wants to store all this stuff? Why would you want to bother to do that? And I’ll tell you why. Because if you don’t hold it, you don’t own it. And it truthfully is just that simple. And by the way, what has gold done in terms of the Turkish Lira? Well, here you go. It’s at a high. Now I looking at this as a technician, I can see 1, 2, 3, that’s a triple top, right? So there’s some kind of pressure that’s holding it, probably it’s spot gold. So you know, that’s easy enough to do. It’ll be interesting to see what happens when it breaks out, but it will break out. I’m a hundred percent certain of that. I have absolutely zero doubt. So spot gold does provide some level of protection, but physical gold and physical silver in your possession is the best protection. That’s why I own it. I don’t do bullion, as you guys know, because we’ve talked about this so much because I can see the potential for, and I don’t know, maybe they will do it overt confiscation, maybe they won’t. But all of this manipulation, frankly, is a form of confiscation. All of this stock market, all of this money printing to make these assets look like they’re going up. When in reality it’s the value of this that just keeps going down. They don’t want you to understand that. Because if you hold your wealth inside of the system and the system goes, what are you gonna do? There’s no one for you to complain to.

Make sure you watch last week’s video title, Regime Shift and Changing World Order. You’re gonna get so much outta that because we are, you know, I said all along to 2022 is a pivotal year. Well, 2023 for me is a scary year. But if you haven’t done so yet, you wanna watch last week’s video on real estate. And finally, do not forget to visit BGS because we do need, this is, this is your foundation. But we do need to think about Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter. It’s all part of the mantra. And you need to be secure in every single way because you need to make sure that you can provide those things for yourself. If you haven’t already, click that Calendly link below, meet with one of our consultants. They’ll help you establish your goals if you don’t have them, I mean, if you have ’em, talk about ’em because that’s what any strategy should be based on. And if you haven’t done this yet, make sure that you subscribe, leave a comment, give us a thumbs up, please, and share, share, share. And until next time, please be safe out there. Bye-Bye.

SOURCES:

https://www.xe.com/currencycharts/?from=XAU&to=VES&view=10Y

https://tradingeconomics.com/zimbabwe/stock-market-turnover-ratio-percent-wb-data.html

https://ftalphaville.ft.com/2008/06/23/13987/the-mad-market-of-zim/

https://www.goldonomic.com/zimbabwe.htm

https://www.exchangerates247.com/currency-converter/?from=XAU&to=ZWD&data=historical

https://www.indexmundi.com/g/g.aspx?c=zi&v=65