SHARKS VS MUPPETS: Wall Street vs Main Street… By Lynette Zang

Some of you might recall the 2012 scandal when Greg Smith resigned from Goldman Sachs and revealed that Goldman traders referred to unsophisticated clients as Muppets, encouraging them to take one side of a trade that Goldman had put together, while they took the opposite. Like taking candy from a baby.

From a Financial Times article, https://www.ft.com/content/910dbf8f-b880-4056-81bd-76262d294663?segmentId=b0d7e653-3467-12ab-c0f0-77e4424cdb4c “As the first casualties of negative oil prices crawl from the wreckage of the US oil market, one of the wildest trading days in history looks to have been a one-sided fight.†Further, “Small-time retail investors†meaning the public (Muppets) who thought oil was near or at a bottom and put money into oil ETFs “emerged as some of the biggest losers from Monday’s carnage, with the world’s top commodity traders and oil funds standing victorious.†Shocker!

Have more questions that need to get answered? Call: 844-495-6042

Additionally, states like Texas, North Dakota, New Mexico, Oklahoma and Alaska that typically generate a large percentage of tax revenue from oil are being squeezed from the plunge in oil as well as the lost tax revenues from surging unemployment from the coronavirus. In fact, it has taken only 5 weeks to erase all the job gained since the Great Recession, which is expected to get even worse.

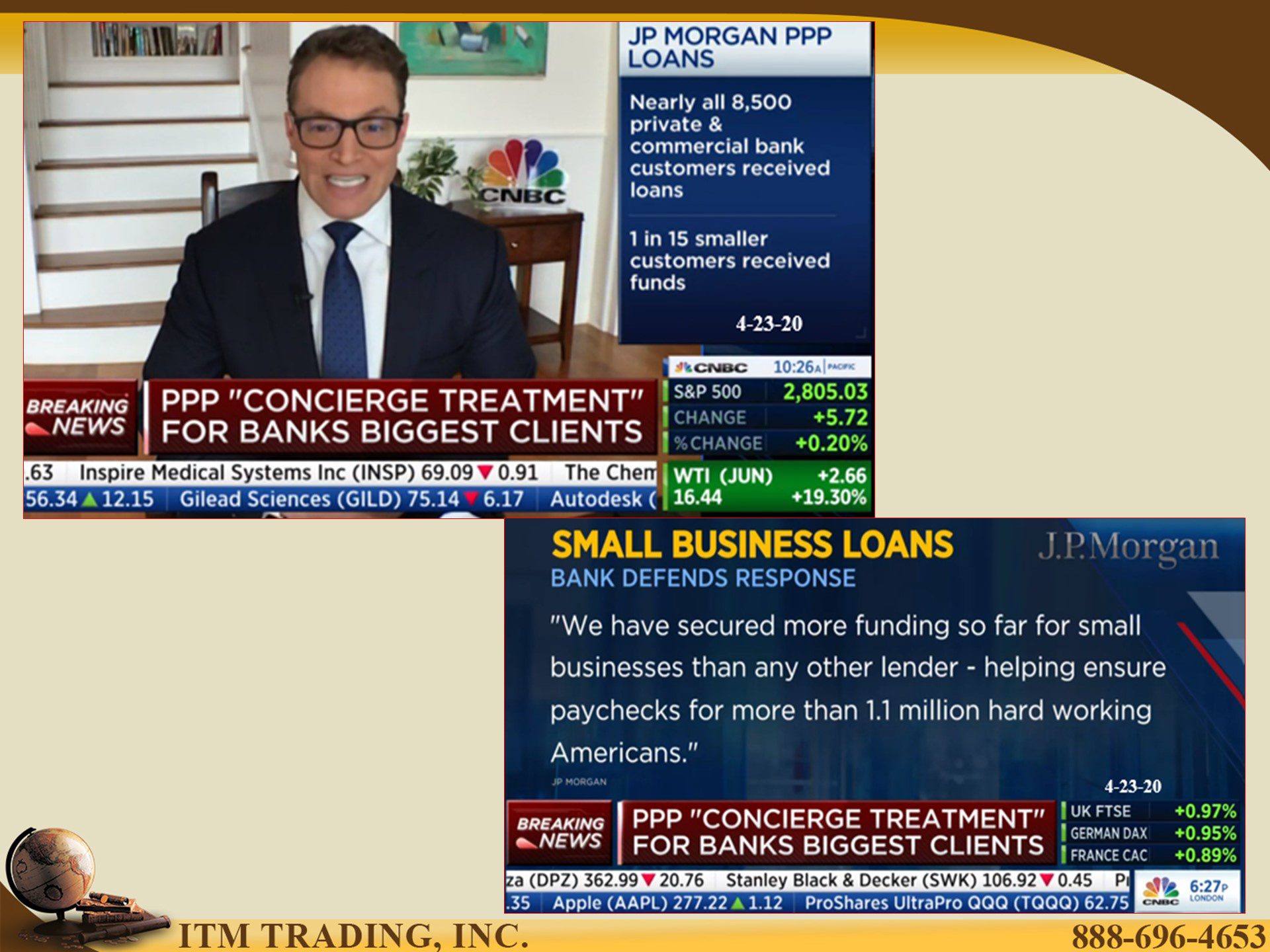

In another Muppet move, as results of the first PPP are examined, it has been discovered that over ninety public companies (listed on the stock exchanges) have received $365 million and got preferential treatment from the big banks. Shocker! But do not worry, PPP 2 is on its way and while it does not specify that public companies do not qualify for the loans, they must certify that the loans are necessary and that other sources of funding are not available. Does this mean that if they cannot issue stock they would qualify?

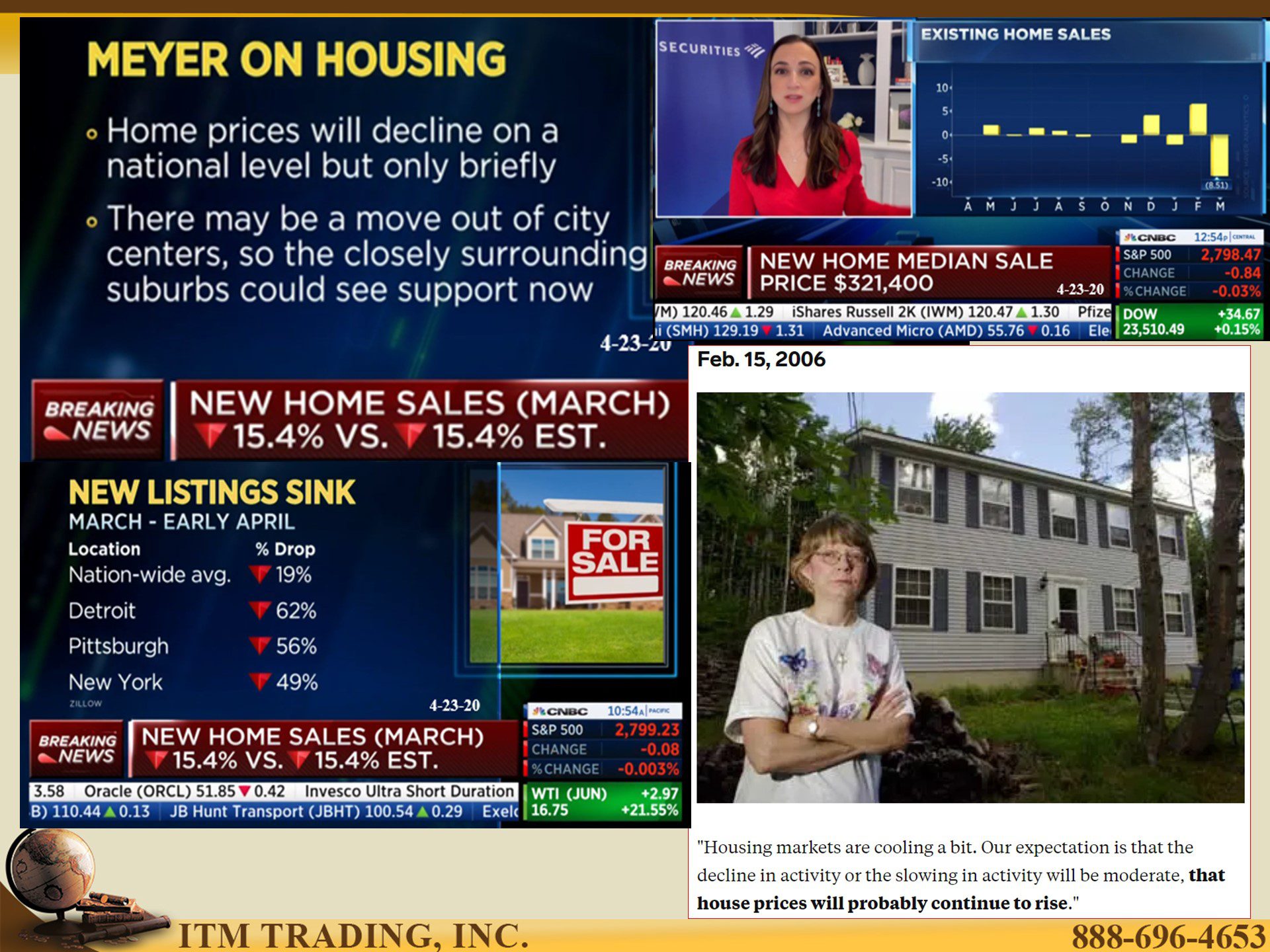

In another flash-back to the Great Recession, we are being told that while home prices will decline that should only be for a brief period of time. Ben Bernanke, Fed Chair in 2006, also said “Housing markets are cooling a bit. Our expectation is that the decline in activity or the slowing in activity will be moderate, that house prices will probably continue to rise.†He was wrong.

But since then, global central bankers have been gobbling up as much gold as they could and many, including me, believe that this is likely to be the “Last Great Buying Opportunity of This Decade.”

Slides and Links:

https://www.nytimes.com/2020/04/23/business/stock-market-coronavirus-live.html

https://finance.yahoo.com/news/gold-forecast-last-great-buying-170410978.html

Additional Resources:

- https://www.ft.com/content/98b7e9ef-2ce6-4962-b872-6cff29603581?segmentId=114a04fe-353d-37db-f705-204c9a0a157b

- https://www.wsj.com/articles/chinas-gdp-warning-to-the-west-11587117587

- https://www.wsj.com/articles/the-stock-market-is-ignoring-the-economy-11587160802

- https://www.wsj.com/articles/stress-endures-in-market-where-big-companies-turn-for-cash-11587385996

- https://www.nytimes.com/2020/04/15/business/economy/coronavirus-retail-sales.html

- https://www.nytimes.com/2020/04/13/business/business-roundtable-coronavirus.html

- https://www.nytimes.com/2020/04/07/business/coronavirus-ppp-small-business-aid.html