RINGSIDE SEAT TO HYPERINFLATION: Ignore These Signs At Your Peril

The Fed is trying to get the public confidence back by raising interest rates. And we’re told that raising interest rates is going to stop the inflation that they caused [because of all of the money printing that has been happening since 2008]. We are going to take a look at Mexico’s record-breaking inflation that has come in at the highest level since June of 2001. Let’s take a ringside seat and see what we can learn from our neighbors that are experiencing hyperinflation.

Questions on Protecting Your Wealth with Gold & Silver? Schedule a Strategy Call Here ➡️ https://calendly.com/itmtrading/youtube?utm_vid=HN7222022 or Call 877-410-1414 ________________

🟢 FREE REPORT: “HOW TO GET A G.R.I.P.” YOUR GLOBAL RESET INDEPENDENCE PLAN ➡️ https://learn.itmtrading.com/global-reset-independence-plan?VID=HN7222022

CHAPTERS:

0:00 Headline News

1:36 Is the U.S. Entering Hyperinflation?

3:57 Mexico’s Record-Breaking Rate Hike

5:08 Argentina & Perception Management

13:04 Argentina’s Overnight 20% Price Jump

16:36 Prepare For A Recession

23:23 Emerging Market’s Debt Will Cause Global Defaults

25:55 Why Do Countries Accumulate Tons of Gold Before A Crisis?

28:23 Physical Gold is a Proven Inflation Hedge

TRANSCRIPT FROM VIDEO:

The fed is trying to get the public confidence by raising interest rates. And we’re told that raising interest rates is going to stop this inflation that they caused with all that money printing really since 2008, will it? I don’t know, that’s what we’re gonna talk about, coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading of full service, physical gold and silver dealer specializing in custom strategies. And you better have a strategy because this whole mess, this whole Fiat money con game is based on confidence and confidence is going away. That’s what this high inflation level does. It’s kind of like a tide going out and you see all the garbage, well, we’re seeing all the garbage, and we’re starting to question whether those that are in power, whether those central banks that had these money printing guns and machines that are fueling the current inflation, because it’s coming out into the public. Well, what can they do about it? How can they get our confidence back? Well, the fed wants us to believe that it’s by raising rates.

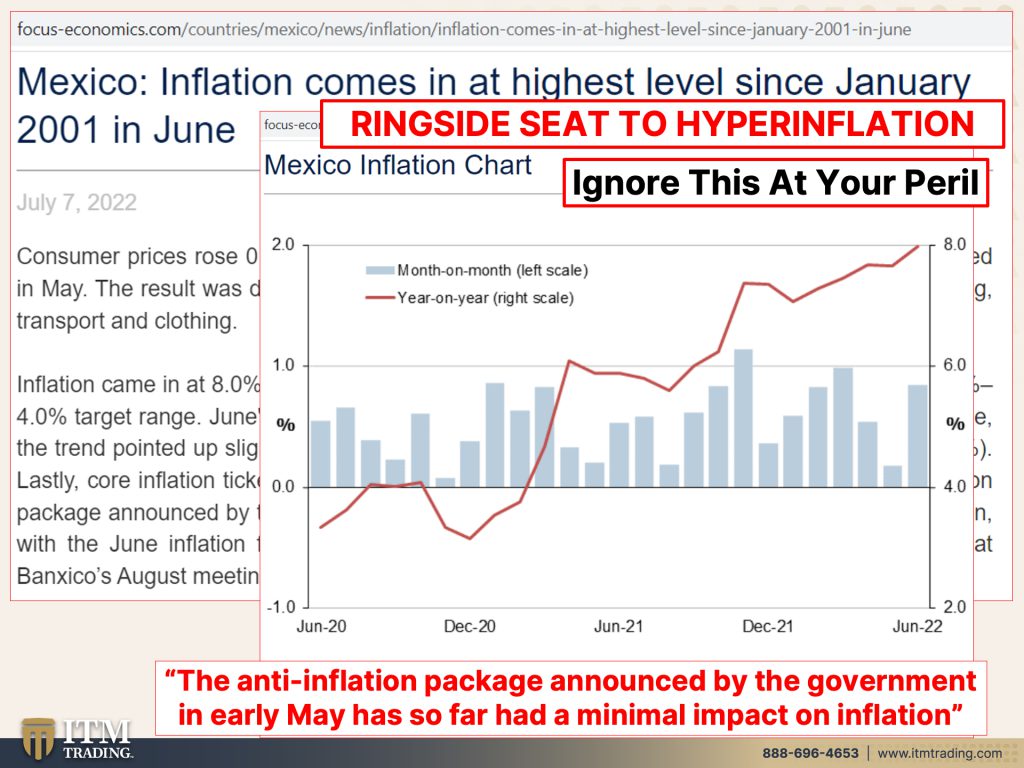

But if you go ahead and you look at what’s happening right now, what’s happened in the past and what’s happening now. I frankly, I don’t think it’s gonna work. What you’re looking at is Gold’s behavior during the Mexican hyperinflation back in 1992 and 1994, it’s really not all that long ago, but today we have a ringside seat to hyperinflation because even though I don’t yet have the technical confirmation, I am really a hundred percent certain with all of the other patterns that I’m seeing all around. This is what it looks like when you are entering hyperinflationary phase and you are shifting or resetting the whole system, the monetary system. And so let’s just take a look at Mexico’s inflation that has come in at the highest level since June of 2001. And as you can see, this is current. So inflation is raging in Mexico. And remember for a while there, we had central banks that were absolutely lockstep with each other, but then as inflation started to get out of control around the world, we’ve seen a divergence. Mexico is one of those countries that actually began to raise interest rates, frankly much sooner than many other countries. Has that actually helped their inflation? No, it has not. The anti-inflation package announced by the government in early May, has so far, had a minimal impact on inflation. So when you look at say the fed, that’s done a really a whopping 75 basis point move and we’ll see in their upcoming meeting if they’re going to do another 75 basis point move or even a hundred basis point move, they’re really not doing it to control the inflation. They’re doing it to control how you think about their ability to control inflation. Those inflation expectations.

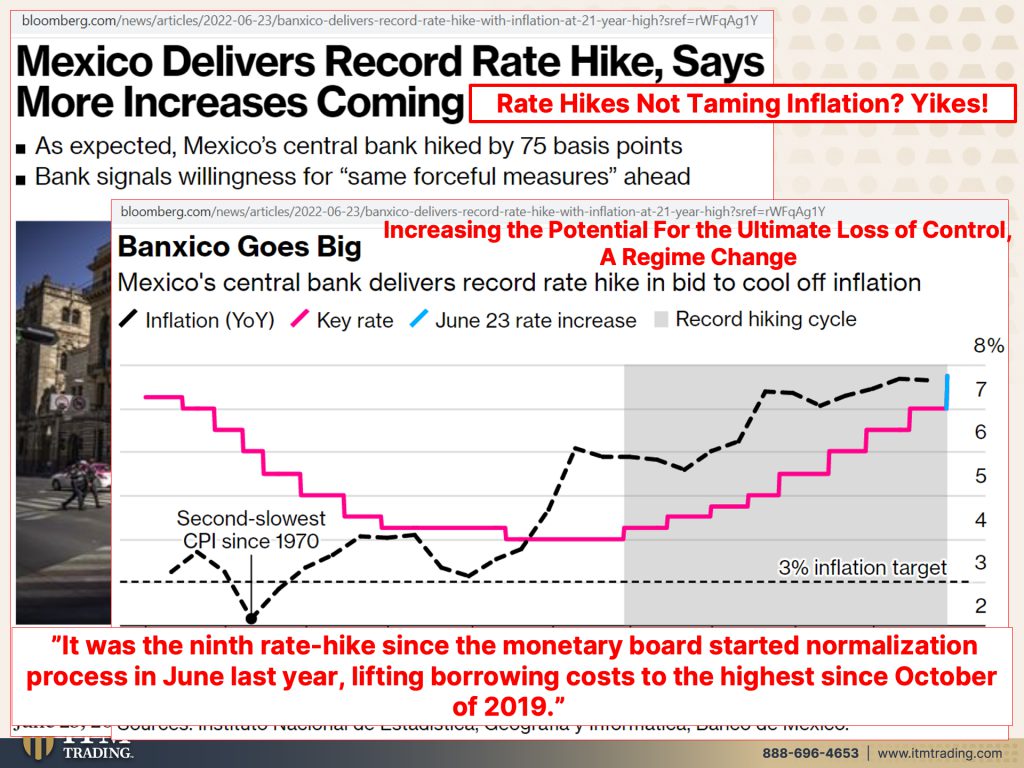

In Mexico, so far, raising the interest rates have been a, frankly, big fat fail rate hikes, not taming inflation. Well, our record rate hike says more increases are coming. What? This was June 23rd as expected. Mexico’s central bank has hiked rates by 75 basis points. It isn’t gonna work. It’s not working there. They started before we started. It’s not working there. And unfortunately, I don’t believe that it’s going to work here either. Will it solidify expectations? Will the public have great expectations that the central bank can actually control inflation? I don’t think so. It’s not gonna at tame the inflation and, and they’re not gonna be able to control it. It was the ninth rate hike since the monetary board started normalization in June of last year, lifting borrowing costs to the highest level since October of 2019. And as I showed you, it’s not working.

It’s all about perception management, but how many times can you be lied to before you know the truth? Well, frankly, as long as you believe their lies, they can keep this going for a really long time. But if they cannot get control of inflation or at least start to reduce it at the gas pumps, which may be happening right now, we’ll see because people are stopping buying gas or at the food store, which is not going to be slowing down. Well, if they can’t control it, where you and I see it on a day to day basis, then that confidence is going away. And once all confidence is lost, you will see hyperinflation in this country as well. I think we’re already at the beginning phases.

But let’s look at Argentina. Three signs show that Argentina is heading to a devaluation. So what we’re talking about is an overnight reset of the currency. So there are three signs that show that Argentina is headed to a devaluation. And how about we say, these are some signs that you and I can look for in the U.S. That we are headed for an overnight devaluation. Number one is monetary expansion. What do you think? You think we’ve expanded the monetary base here. Now we are supposedly going to be experiencing or already experiencing “quantitative tightening,” which has never happened before in this country when they attempted to do it in 2016, it ended in 2019 with a massive amount of money printing. And I think that’s what we’re gonna see again. So by me shooting the money gun, this is for the future. Once there’s enough pain in these markets and the Fed does a pivot, look, they’re already in the dot plot. They’re already showing that they’re gonna be lowering interest rates again. But I think it’s going to be accompanied by a massive amount of money printing that makes what they did in 2020 look like chump change, just like what they did in 2020 makes what they did in 2008 look like chump change. But in terms of Argentina, the peso expansion is one of the main factors that analysts see behind inflation and therefore the peso depreciation. Okay, let me say this another way. The Fed’s expansion is one of the main factors that analysts behind inflation and therefore the U.S. Dollars depreciation, which is what inflation is. It’s not that the value of these things go up. It’s that the value of the currency with all this money printing goes down, right? The value that purchasing power value, critical for you to understand that. So you can see how that’s changed. This was 2019, 2021, 30% money printing since then. And we’ve done way more than that in this country. Not a very good thing. Don’t believe the lie.

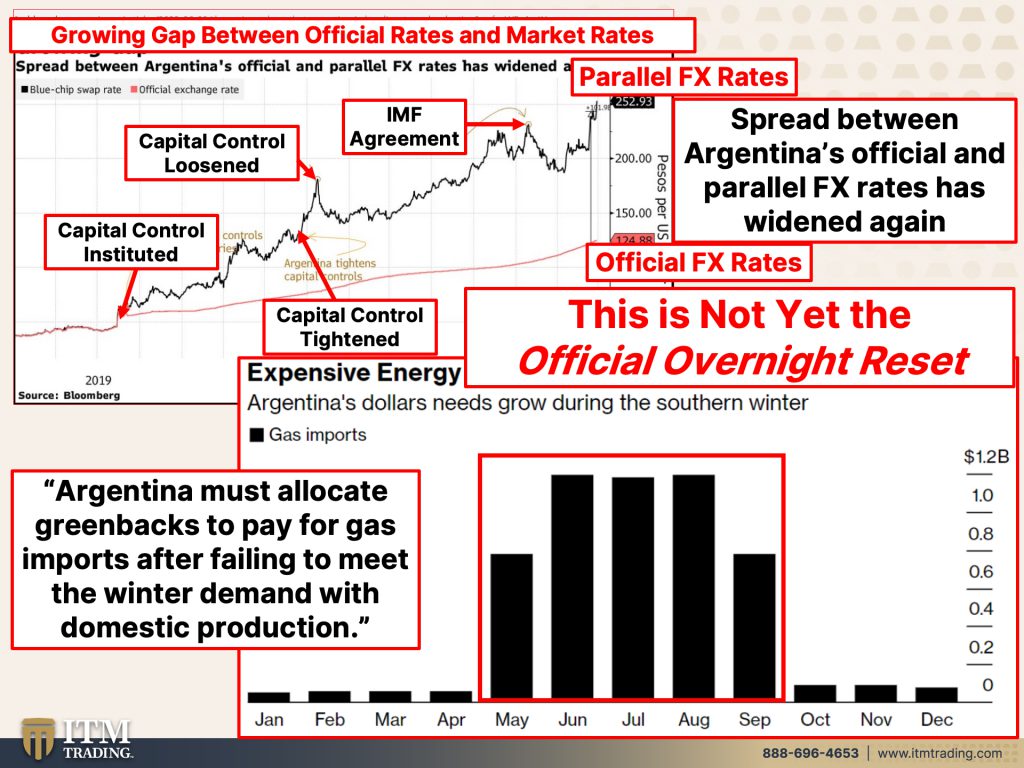

Secondly, is the spread between the official rate, right? What the government says the rate is and what the market says the rate is. So it’s critically important to pay attention to what the Fed’s rate is. And then watching what is happening at the bond interest rates, because this is when they put in capital controls. Now you may not have noticed it, but since 2008, your ability to conduct business at the banks has been growing more and more and more narrow over time. They just do like a little bit and a little bit and a little bit so that you don’t notice, but when there is a run or when you want to do something, that’s when you’re gonna discover how many fewer choices that you have, if any, I mean, what are you gonna do if the bank says, no, you can’t take any money out of the ATM?

So they put in capital controls, this is something all governments do. Maybe they loosen them a little bit, but they keep other ones in. They create these agreements. But the reality is, is this whole entire time, the peso, the dollar, the Euro, the yen are losing, purchasing power value. That’s what matters to you and me, I’m gonna do another video. I’m gonna do a video next week, actually on that comparison between that strong dollar that we’re hearing so much of and what that really means to you. But let me tell you all of it means something, even if you don’t understand what it means, that’s my job, but there is a growing gap between the Fed reality and the, on the street reality. And when you’re experiencing that high inflation, you’re experiencing that difference. I mean, do you really? Is it your experience that we’ only at 9.1% inflation? Well, maybe in caviar, but in terms of regular food, gasoline, all of that, it’s living expenses, your housing, your rent much, much higher than that. So you can see this gap. Here’s the official Official foreign exchange rate. And this is what the market is saying hugely different. And we see that all over the spread between Argentina’s official and parallel foreign exchange rates has widened again. Well, that’s what always happens. And that’s what happens with gold as well. They suppress the price, they suppress the price, they suppress the price. And then when all confidence is lost, they take this Fiat money and they take the gold money and they do an overnight revaluation. They’ll do it as many times as they can keep your confidence. This is a con game, make no mistake about it. Plus what we know is there’s artificial demand for dollars all over the place, which helps support our dollar. But as the dollar strengthens against the other currencies, well, they don’t earn dollars. We earn dollars here in the U.S. In Argentina, they earn pesos, but if they’ve issued dollar bonds, they have to pay that interest and they have to repay the principle in dollars. And if their currency gets weaker against our currency, that creates a huge problem for them simply because they do not earn dollars. Argentina must allocate greenbacks or dollars to pay for gas imports, right? The Petro dollar after failing to meet the winter demand with domestic production. So you can see the summer production and you can see the winter production and they have to use dollars because that’s the agreement. This is not yet the official overnight reset that does literally happen overnight.

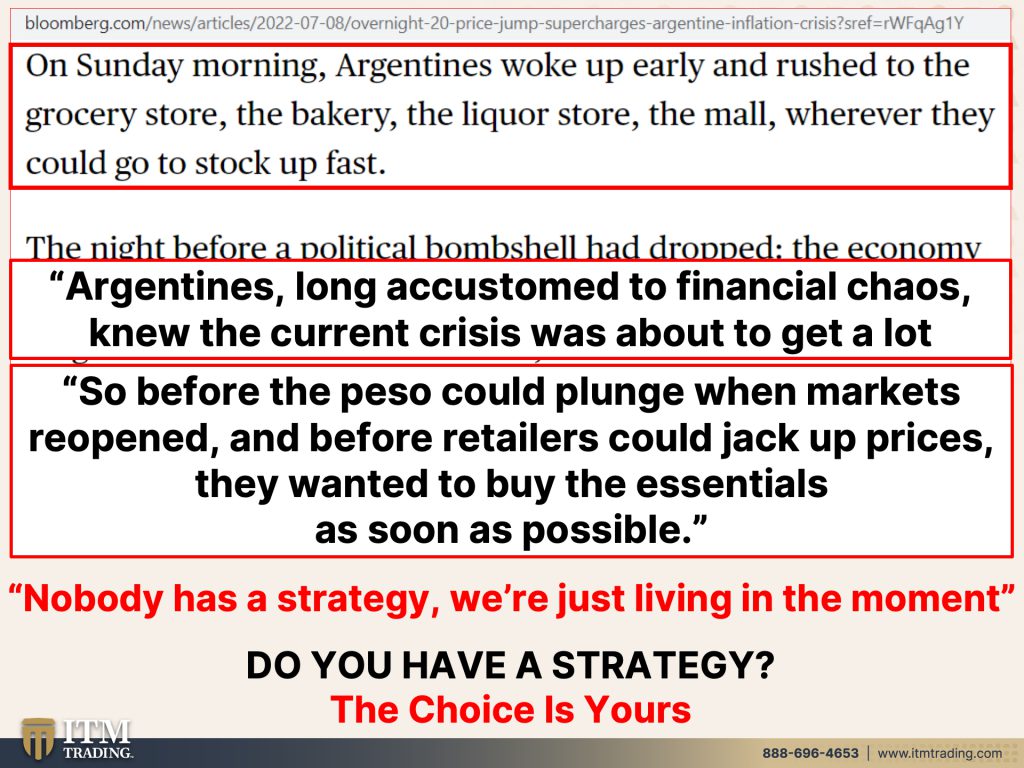

But look at this overnight 20% price jump supercharges, Argentine inflation crisis. This is what we’re all experiencing on a global basis is how quickly the prices rise is that pepper worth that much more money? No, it’s that the peso is worth that much less it’s that the dollar is worth that much less. That is the key to understand because the pepper is just a pepper and what a difference a week makes. This is an overnight price change. And this is not yet the official overnight reset businesses. Hike prices after parallel foreign exchange rate dropped 17%. So not the official, the official just stays the same because that’s something that central banks and governments have the ability to dictate, but does the market believe them? The answer is no. And that’s critical because recently our Fed made the choice to give up its credibility to Wall Street. When they kept saying, I mean, remember that forward guidance has been critical for the central bank since 2008. So they tell the markets in advance, what they’re gonna do. So the markets can get into a position to benefit from it. And then all of a sudden they’re saying 50 basis points, 50 basis points, 50 basis points. And then what they do is they do a 75 basis point move. Now that may not seem like much to you, but when you’re working in trillions of dollars, that’s a lot of money. And we’ve seen a lot of bank losses. And my guess is, is that some of those losses were also caused by that Fed not actually doing what they said they were going to do. So they lost market credibility. That’s what we’re seeing here. This is just in Venezuela, in Argentina, in Mexico. This is just in a bit of an advance to what is coming to a neighborhood near you. Retailers consumers seek to stop up on goods before increases. We’re doing that here as well. I’m doing it. I’m prepping. And I’m a proud prepper. I’m not hoarding because in March of 2020, what could you not get that you were used to getting? How quickly did those prices go up? If there was some availability? And because of what I had done, when somebody needed toilet paper, I could give them toilet paper. When somebody needed food, I could give them food because of what I’d done. So I’m telling you you’ve gotta not wait because all of this is a precursor to what is coming to a neighborhood near you. Get prepared, get your gold, get your silver, get your Food, your Water, your Energy, your Security, your Community, and Shelter, your Barterability, your Wealth Preservation. Get it done. The world is showing you where we are headed. Believe it, believe it! I know that it’s hard. I know that it’s a paradigm shift.

But staying stuck does not serve you well, because how quickly can this happen? On Sunday morning, Argentines woke up early and rushed to the grocery store, the bakery, the liquor store, the mall, wherever they could go to stock up fast, get it done now, before you really need to, I cannot stress how important this is and where we are in this trend cycle. The inflation is telling you, pay attention, do yourself a favor, get into the proper position. Now, then it doesn’t matter what happens. What if I’m right? What if I’m wrong? You wanna sustain your standard of living, put yourself in a position where it doesn’t matter, whether you’re right or wrong. I have a bug out location. Maybe I never need to use it for emergency. I mean, I hope that’s the case. Well, if that is the case, then I have a wonderful vacation compound for my family, booty hooty rooty manooty. And we’ve got plenty of food up there and water and all the things to the mantra. So whether I’m right or whether I’m wrong, it doesn’t matter. And that’s the best possible position to be in. Because guess what? If you’re wrong, you’re not gonna be able to do anything about it then. “Argentine’s, long accustomed to financial chaos, knew the current crisis was about to get a lot worse.” You and I, well, I have cause I’m old enough and anybody that’s my age. We lived through the sixties and the seventies. We know what that’s like. And you can feel the energy in the air feels the same way that it did then. And what are they talking about constantly? They’re constantly taking us back to 170, 19 80. Why? They never say that that’s when the currency transition happened from a gold back or at least a quasi gold back currency to a pure debt backed currency. No, no, no, no, no. They don’t want you to understand that that’s what was happening now. But when you see all these references to then you gotta know that there’s more underlying it. And that is because we are going into, we have already begun and we’ve actually been transitioning for a while into a currency life cycle end. You need to be ready. What is gonna put you in the best position? No counterparty risk party risk, no political risk, gold held at home runs no political risk. And right now everything else runs a ton of political risk.

So before the peso could plunge when the markets reopened and before retailers could jack up prices, they wanted to buy the essentials as soon as possible, buy them now people! Make sure that you have enough. You know, I’ve done some contingency planning and I finally actually got the plan, a hard copy. And so I’m going over it. And one of the things that were in there was how many chickens and how many rabbits and how much milk and how much I’m going to need the quantity. You know? And at first I’m like, oh, this is ridiculous. It’s just 40 people and blah, blah, blah, blah, blah. But the best part about making us look at that number was we actually got to sit down and say, okay, so we need three dairy cows. We need this many mating. So everything we’re doing, we’re gonna have a male and a female. So that it’s sustainable, right. A mating pair. But it really helped us look at how many animals and how much, what do we really need to sustain a community of 40 people? It was a great exercise and they weren’t really <laugh>. They weren’t really off in their assessment to be honest with you. So even though it sounded outrageous to me and some of it, maybe I don’t agree with necessarily, but it really enabled us to kinda look at that on a different level and plan on a different level so that we can lay in these things now before we need them, before they get more and more and more expensive. So it’s important. Planning is absolutely critical. Nobody has a strategy. We’re just living in the moment. I don’t want you to be in that position. Just like I don’t want me to be in that position. Nobody has a strategy. Get a strategy. The guys at the Fed have a strategy. The guys in the White House have a strategy. The guys at the IMF and the BIS and the World Bank, all these elites, the World Economic Forum, they have a strategy. You need one too, because truthfully you can’t just live in the moment. You’re gonna end up in abject poverty. Food becomes the single biggest issue. But when you have a foundation of good money as this Fiat money goes to nothing, that’s, what’s gonna put you in a great position fiscally, but you need all the rest. That’s why we do Beyond Gold and Silver to help you get all the rest, too. Food, Water, Energy, Security, Barterability, Wealth Preservation, Community, Shelter, get it done. This is not the time to be procrastinating we are on the brink. And it is your choice. We have consultants here that know the patterns that happen every single time. We have a strategy because I’ve been studying currency and currency life cycles since 1987, if something has happened a hundred percent of the time and we’re doing the same things, can I guarantee you the same outcome? Of course I can’t. That’s beyond my control, but what is the likelihood that we’re gonna get the same outcome? Yeah, that is the greatest likelihood. That’s what our strategy here at ITM Trading is based on. And you would have the same kind of strategy that I do, but tweaked and customized for you cause different goals, different circumstances. But I don’t want you to be left dealing with the moment by moment because it will not serve you well.

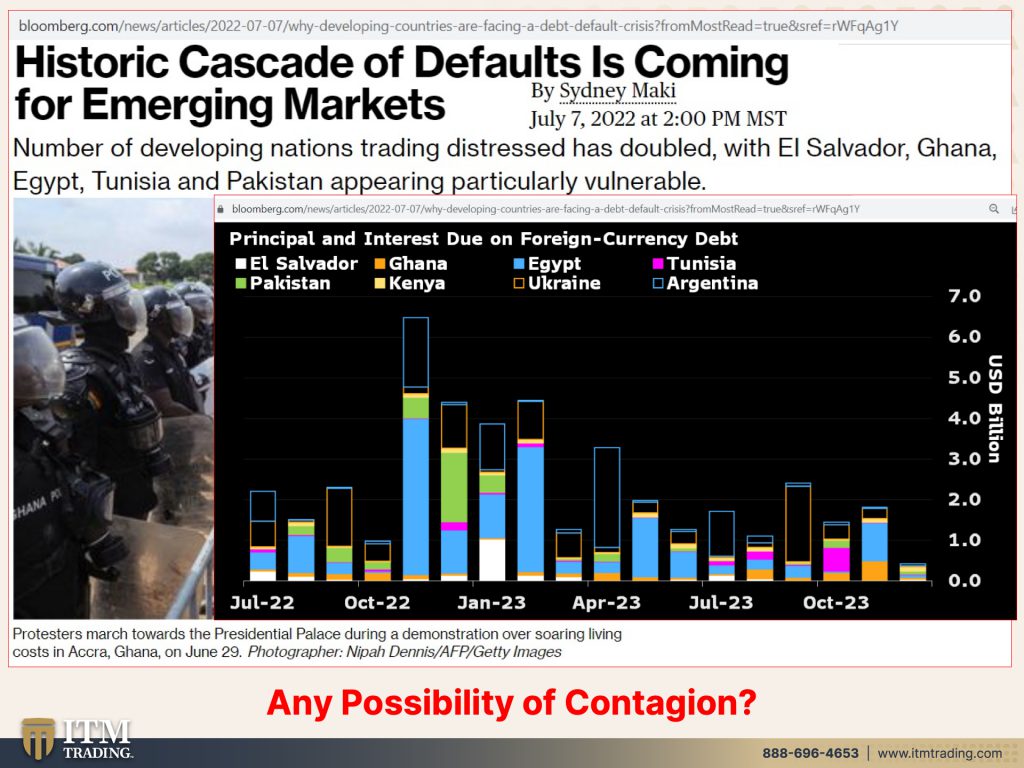

Historic cascade of defaults is coming for emerging markets. I think as we’ve seen this week with all of the banks having to put back reserves for loan losses, you know, I think that we could change this title to say historic cascade of defaults is coming for all over the world. They’re specifically referring to emerging markets because emerging markets, you know, China is one of them, but there are a lot of emerging markets that as you know, we’ve talked about it so much have issued debt in terms of dollars. So with that strong dollar, it makes it harder and harder to service that debt. And that’s why they’re thinking that there’s going to be a cascade of defaults coming. There is going to be a cascade of defaults. Absolutely. But I don’t think that it’s going to be just segregated in the emerging markets. I think this is global because interest rates are rising and a lot of this debt is short term, which means it has to be paid you know, so serviced or rolled over or it’s gonna default. Well, if it was, if it gets more and more expensive to roll over this debt, I mean, globally, you’re seeing central banks raise interest rates to fight this inflation that they created with all of their money printing. Okay? So we are going to see a rash of defaults. Why don’t you have something that runs no counterparty risk? You don’t default on gold or silver, physical in your possession. No counterparty risk. That’s the safest thing that you can do. No counterparty risk, everything else. It’s all counterparty risk, to be honest with you. And is there any possibility of contagion considering the fact that we are all incestuously intertwined? Yeah. You will see this go around the world, just like you saw synchronized central banks before now we’ve got this divergence and interest rate policies. You’re going to see a synchronized, most likely outcome is a synchronized cascade of defaults globally.

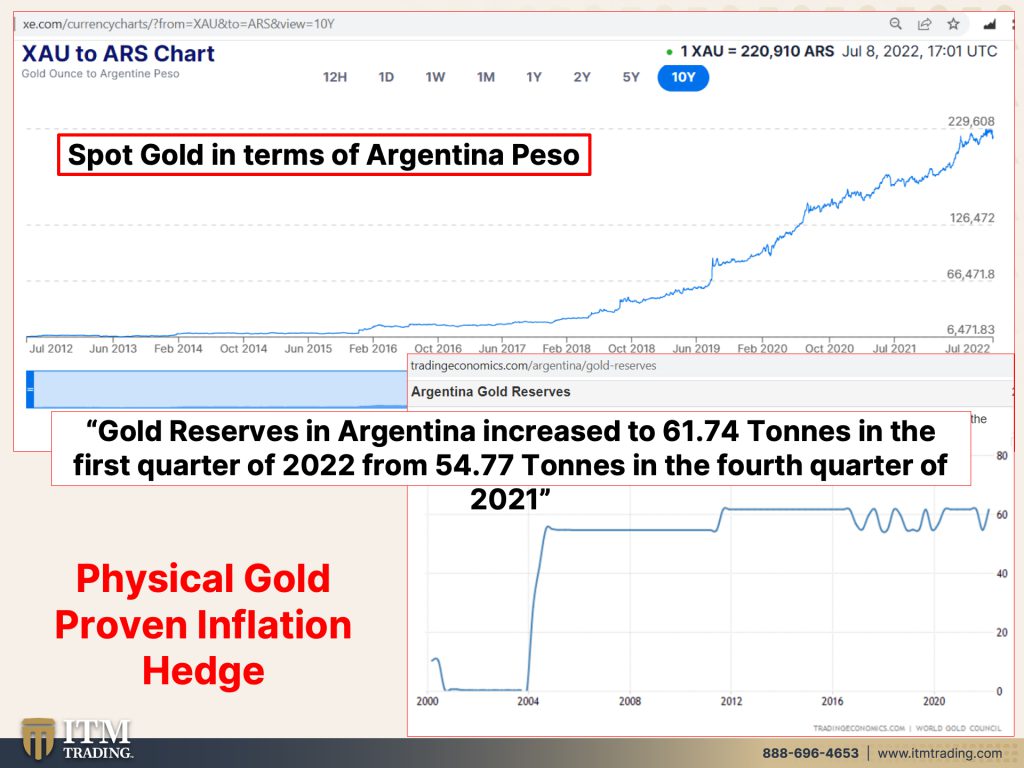

Yeah, it’s coming. Are you prepared for it? Now this happens to be spot gold in terms of the Argentine peso. And you can see in this particular case because of how far along they are in the trend cycle, that that spot gold, which is a contract gold. It still is not representative of the true fundamental value of an ounce, but you can see how it’s protecting the Argentine purchasing power. You can always convert little pieces into the current currency. If you need to buy something with it, but you need a strategy and you need to have your foundation. I mean, that’s it. And this are, these are the Argentine gold reserves. So you can see that they’re protecting themselves with good money gold. Is the U.S. doing that? Nah there hasn’t been even one 16th of a change in the reserve since the 50s, of course it hasn’t been really audited either. However, what we know is for 6,000 years, gold has maintained its purchasing power. That’s its job. It’s got many jobs, but that is the single most important job. Why? Because it has the broadest base of utility and the broadest base of buyer. And that’s what we need to have going into a financial crisis and a currency conversion. You want something that has the broadest base of buyer only gold has not gone to zero all Fiat currencies. They have gone to zero by design gold reserves and Argentina increase to 61 point 74 tons in the first quarter of 2022, up from 54.77 tons in the fourth quarter of 2021. What are they getting ready for? We saw Russia accumulate a lot of gold in anticipation cause of their strategy and plan to, to go into Ukraine, right? They’re going in with real money. They’re going into a crisis. And so should you, they definitely so should you because gold, physical gold is a proven inflation hedge. Silver is secondary. This is your barterable position [silver]. This is your wealth preservation position [gold]. This is also your growth position. Actually, both of these could be considered growth because they’re so severely undervalued. Unlike every other asset, you gotta really understand this cause it’s critically important.

And make sure that you watch this week’s video on Zimbabwe issuing gold coins as well as the Fed’s stress tests. Cause remember those stress tests were designed after 2008. So you would’ve confidence in the banking system and keep your wealth there. Also check out the progress as we’ve been doing on my off grid property as well as my Urban Farm in the middle of central Phoenix on our Beyond Gold and Silver channel, we started that channel so that you could be fully prepared because you’ve gotta have gold and silver as a foundation, but that’s what it is. You need more than that. I can’t eat either one of these. I can buy food with it if it’s available, but what is the most important thing during hyperinflation? Most people starve. So you’ve gotta have all the rest Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter, and what we don’t cover on the ITM channel. We are covering on the Beyond Gold and Silver channel.

So if you don’t have your strategy in place yet, click that Calendly link below and go ahead and set a time with one of our consultants and get yourself a strategy. The powers that be have one, you should have one too and oh, by the way, it does include gold. Absolutely. So if you haven’t already, please make sure to subscribe, click that bell and we’ll let you know when we’re going live. Leave us a comment. Give us a thumbs up, share, share, share, because ignorance doesn’t make you immune. It just leaves you vulnerable. And I don’t really want anybody to be vulnerable to the evil that I see at the central banks at the government level. No, I don’t want you to be vulnerable to their plan. I want you to have the ability to retain your choices. Cause a hundred bazillion percent, you gotta get your assets covered. Here at ITM Trading, this is the foundation, physical gold, physical silver in your possession and then tell and until next we meet, please be safe out there. Bye-Bye.

SOURCES:

https://tradingeconomics.com/mexico/consumer-price-index-cpi