RETIREMENT CRISIS OPPORTUNITY: How Will You Participate? By Lynette Zang

In 1972 I was seventeen. I guarantee you that I was not putting too much thought into my retirement at that time, yet I clearly remember thinking, “Social Security won’t be there for me when I’m ready to retire.†The most likely reason I thought that was from listening to my parents, aunts and uncles talking around the kitchen table on Saturday penny poker nights.

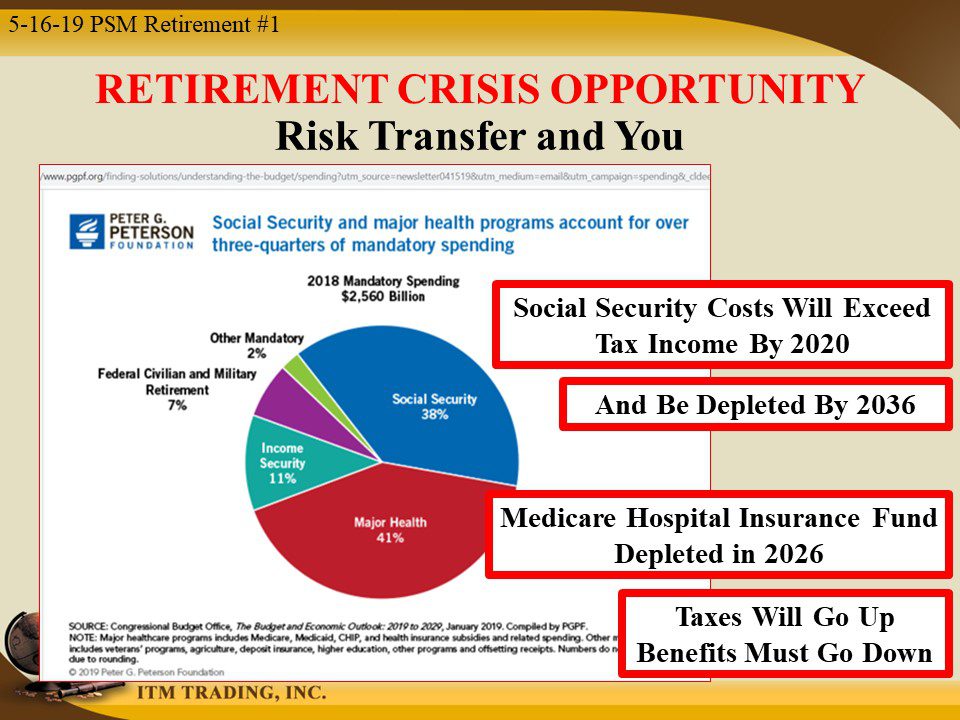

According to the Congressional Budget Office, Social Security, which is a Pay-As-You-Go entitlement program, will be completely depleted by or before 2036. Perhaps that sounds like a long way off until you see that social security costs will exceed tax income by next year, 2020. In addition, the Medicare Hospital Insurance Fund will be depleted by 2026. With people living longer, saving less, and getting sicker, we could see it depleted before that.

How can these programs lives be extended a little longer? Higher payroll taxes and lower benefit payouts. Will that solve the problem? No, but with so many retired and disabled depending on SS for most of their income, it will certainly cause a lot of pain.

It should not be new news that the global retirement crisis deepens as global aging explodes and most have not accumulated enough to retire counting on various retirement schemes to get them through. Though there is some good news too.

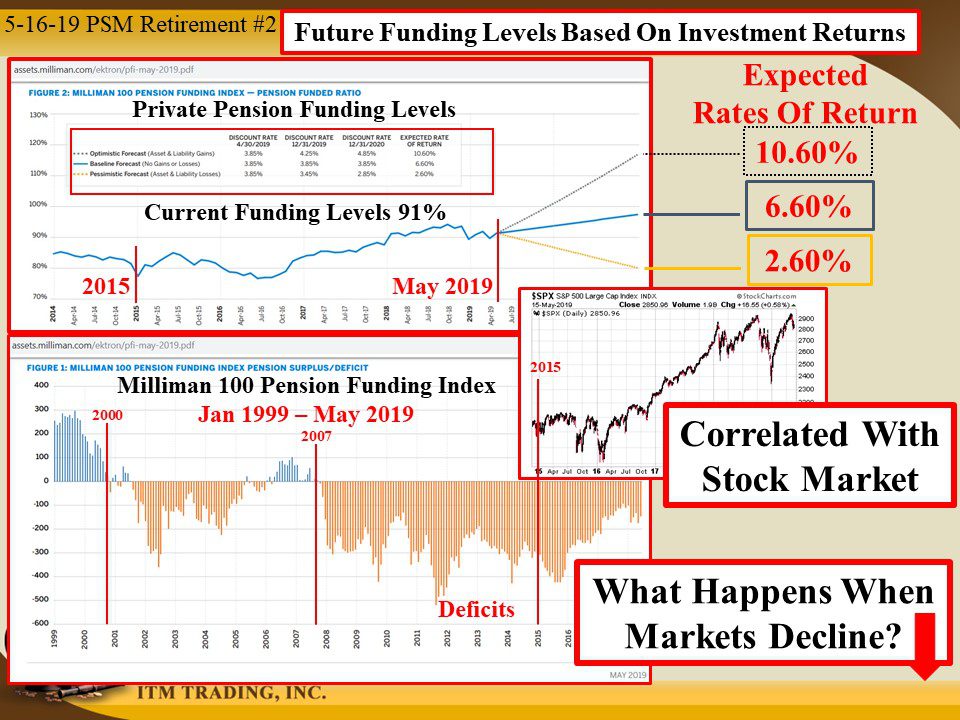

As of May 2019, private pensions are 91% funded, supported by reflated markets. Required corporate funding is based upon investment performance estimations. According to the Milliman 100 Pension Funding Report, the baseline rate of return on investments is 6.6%, even as the global slowdown accelerates and were told we’re in a “new normal†of much lower rates of return in the future.

Even at the lowest end, projected returns are positive. What will happen when markets enter a prolonged decline?

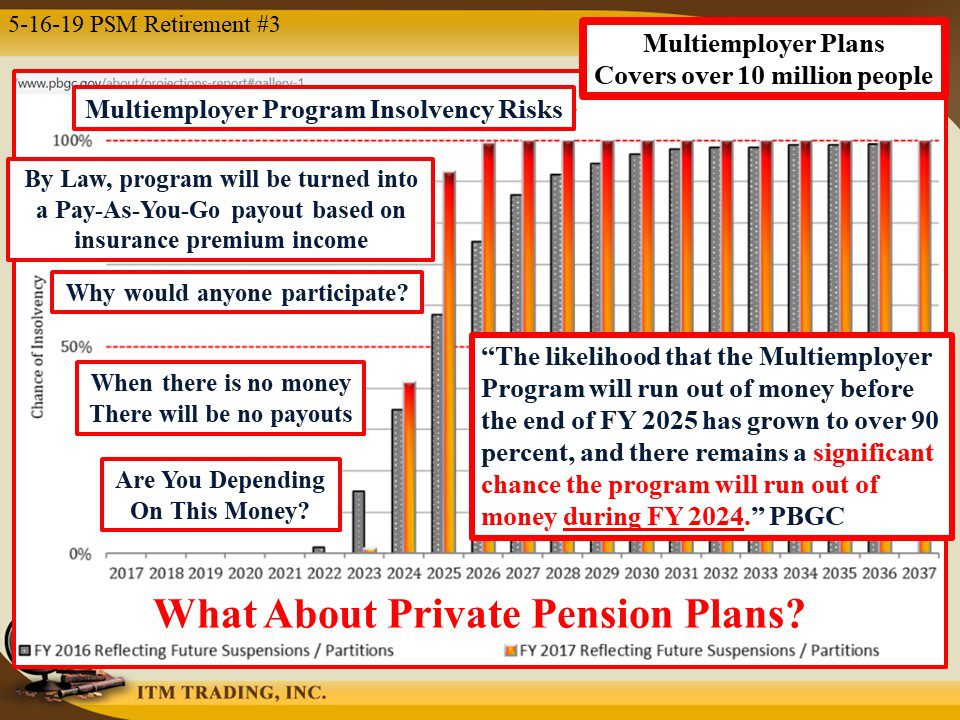

According to the PBGC insurance program, there is a “significant chance the program will run out of money during FY 2024, less than five years away. At this point, that will impact unionized workers like firefighters and teachers. Once the fund is depleted the “insurance program†becomes a Pay-As-You-Go program, by law, and benefits paid will be from premiums paid, like social security.

The premiums are supposed to guarantee YOU lifetime income when YOU retire, so if those premiums were spent on benefits for current retirees, why would anyone want to participate? See the problem?

What’s the short-term solution? Get more people to pay premiums into the multiemployer plans.

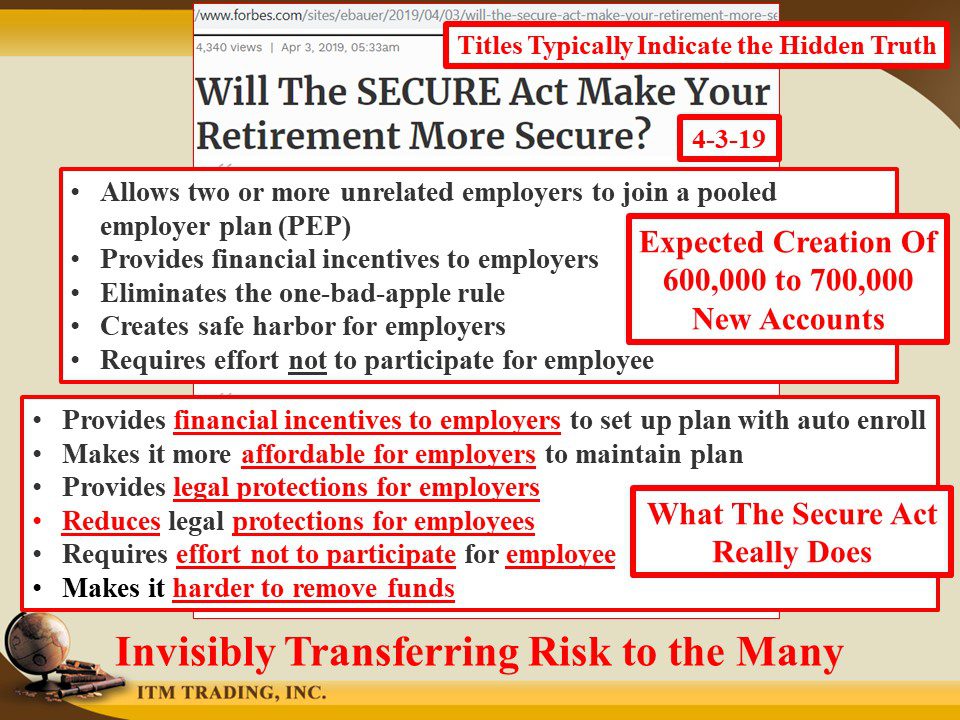

On April 2, 2019 the “SECURE Act†was passed unanimously by the House Ways and Means committee in a rare bipartisan agreement. Experience has taught me that government titles typically indicate just the opposite of what is proclaimed in the title, so I took a look and behind all the legal gobbledygook, this Act changes the rules to allow a new kind of multiemployer plan (made up of unrelated employers) and generate 700,000 new retirement accounts. Law changes inside the plan, along with financial incentives, entice small employers to set up auto enroll plans.

They know that if people have to put forth effort to opt out, particularly when they don’t understand the ramifications, they are more likely to not do anything, particularly when spun as a good thing for them. As Henry Kissinger said, “It’s not a matter of what is true that counts but a matter of what is perceived to be true.†Therefore, they are willingly putting themselves at risk.

In my opinion, what the “Secure Act†really does is to invisibly transfer risk, both in an attempt to support failing markets and for the general public that will be manipulated into participating at the same time that they are giving up legal protections.

If you are participating in fiat money retirement plans, it becomes even more important that you understand the true state of any plan that would impact you in order to protect your retirement, today and in the future.

We’ve been told about the importance of diversity. Though wall street wants you to believe you can do that with different fiat money products, like stocks and bonds, they are all based on a failing fiat money system. In addition, wall street knows that retirement plans are “stickyâ€, in other words, not likely to be removed, which means that most of the public suffers the greatest loss when markets plunge.

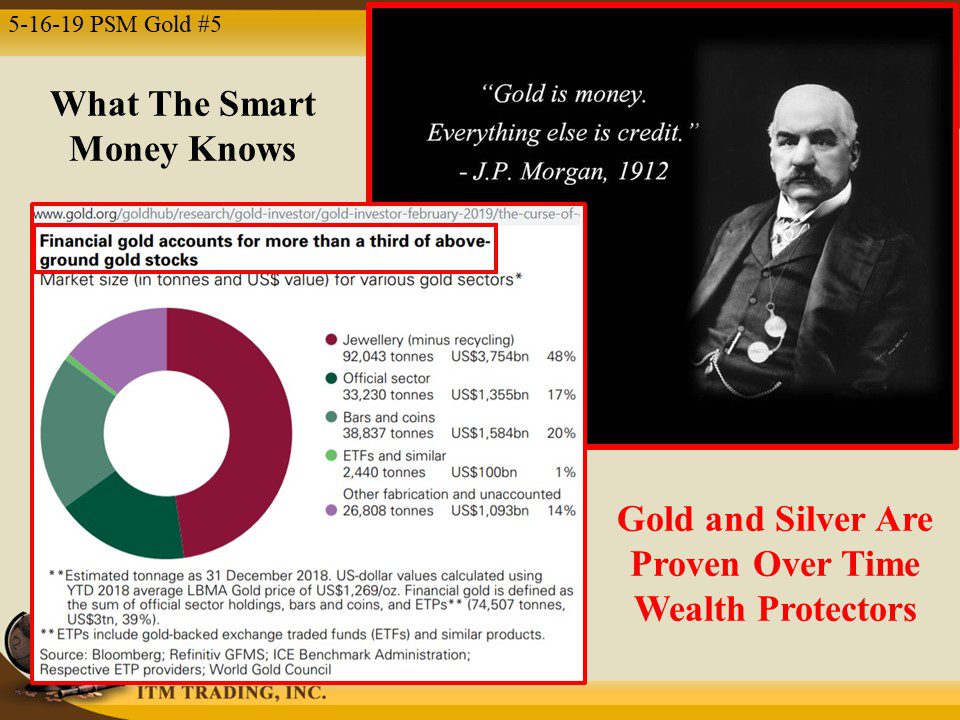

To be properly diversified you would need a proper balance of real money, physical gold and silver, to offset any losses that fiat money wealth will endure during the next market crash. This is what the smart money knows. Perhaps you should ask yourself, Is MY retirement secure?

Slides and Links:

https://realinvestmentadvice.com/boomers-are-facing-a-financial-crisis/

http://assets.milliman.com/ektron/pfi-may-2019.pdf

https://www.stockcharts.com/h-sc/ui

https://www.pbgc.gov/sites/default/files/fy-2017-projections-report.pdf

YouTube Short D

On April 2, 2019 the “SECURE Act†was passed unanimously by the House Ways and Means committee in a rare bipartisan agreement. In my opinion, what the “Secure Act†really does is to invisibly transfer risk, both in an attempt to support failing markets and for the general public that will be manipulated into participating at the same time that they are giving up legal protections.

If you are participating in fiat money retirement plans, it becomes even more important that you understand the true state of any plan that would impact you in order to protect your retirement, today and in the future.