RED FLAGS ARE FLYING: When Will The Central Banks Wings Fall Off?… by Lynette Zang

You probably know that stock markets are making record highs, supported by accommodative central banks. Keep in mind that when central banks create new fiat money, that money must go somewhere, and stock markets are one of the beneficiaries. But red flags are flying.

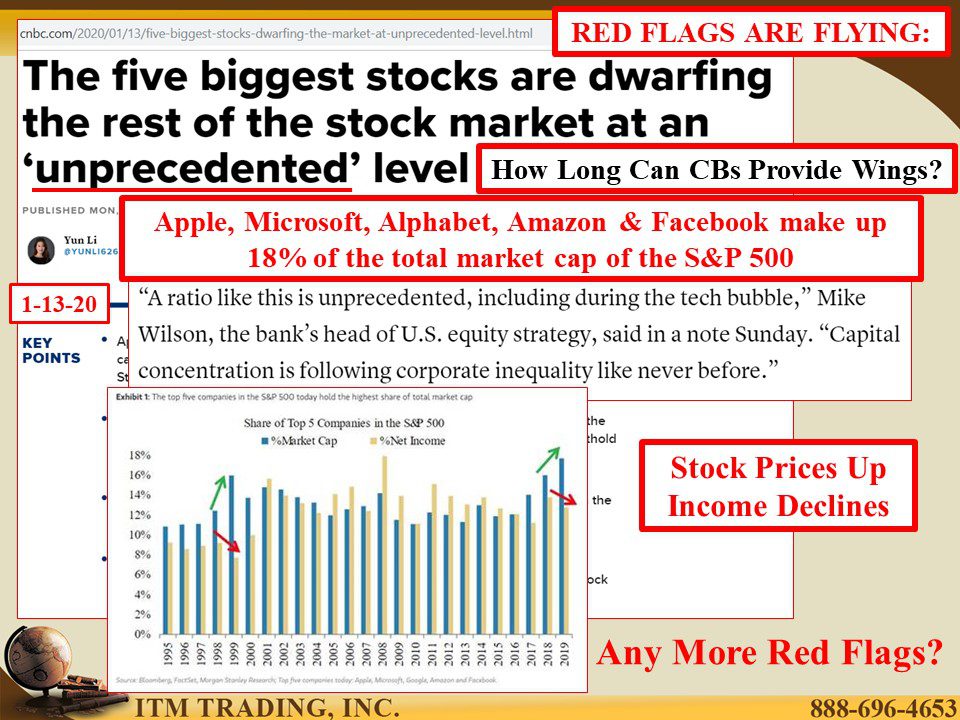

One big red flag is the price rise concentration due to just five of the biggest market cap stocks: Apple, Microsoft, Alphabet, Amazon and Facebook, which now make up 18% of the total market cap of the S&P 500. This level is higher than the concentration risk seen in the 1999 Nasdaq bubble, which was the previous record high.

Have more questions that need to get answered? Call: 844-495-6042

This matters because unmanaged ETFs are also heavily weighted in these same stocks. And while it works well on the way up, as we saw with the bursting of the NASDAQ bubble, it’s very nasty on the way down.

Are these prices justified? No, because as prices have climbed, earnings have declined. Can that change? Afterall, unemployment is near all-time lows. Historically, in a tight labor market, wages increase to attract workers and these higher wages support more spending.

To many analyst’s surprise, the hard won wage gains experienced from 2014, have declined in 2019 even as it’s become harder to find workers.

At the same time, as wages were rising, the hours worked have declined. We’re being told that workers are choosing to work less, but I’m thinking they still need to pay their bills, which have only gotten more expensive since 2014, so frankly, I question the truth in these statements.

This is a problem since corporations are counting on consumption and stagnant wages to grow their earnings and justify these severely overvalued levels.

Can the markets keep flying? Yes, if central banks keep providing liquidity; and the way they do that is by creating debt.

In the US, between January and December 2019, deficit spending (spending more than income) grew 17.1% from the same period in 2018, which had grown 28.2% from 2017.

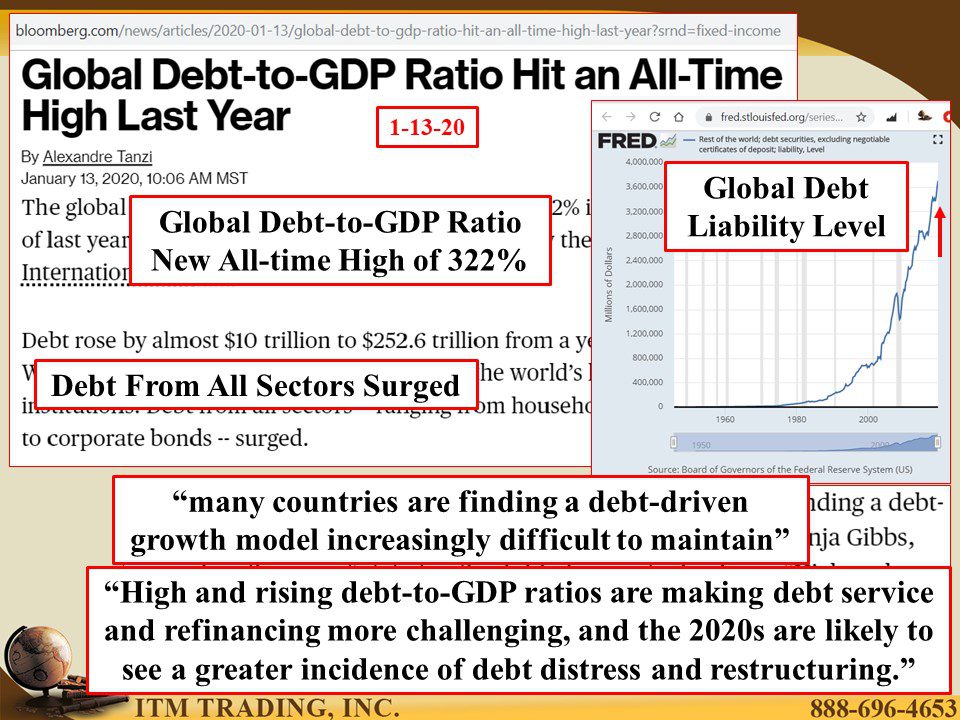

Globally, the debt-to-GDP ratio exploded to historic highs of 322%, with debt surging in every sector, government, corporate and individual. What would happen to you if your surging debt could not be funded by current income?

Welcome to the melt-up phase. Fundamentals don’t matter, only central bank liquidity does. The rising stock market will fool many. They will think they are “making money†when the truth is just the opposite.

I say this for two key reasons: First is that the more new fiat money the central banks creates, the less value all fiat money has. The last time I checked, $1,000,000,000,000 x 0 = 0. Second, the federal reserve promised ample liquidity for banks, not for individuals. As we’ve seen many times in the past, it is typically the public that feels the most pain when the tables turn. Do you really think this time will be different?

Global central bankers don’t. In fact, central bank gold accumulation has escalated again, growing by 11% YOY (Year Over Year). Considering that 2018 saw the greatest global central bank gold buying in history, what can we conclude? Perhaps that central bank fiat money has already lost all value.

Officially the USD is at $0.0389 (from the original 1913 dollar) and central banks, supposedly unable to hit their 2% inflation target, are willing to let inflation run above current targets. I believe they’re preparing for the inevitable final wealth destruction. They know that gold money holds value and fiat money does not. They’re getting prepared, are you?

Slides and Links:

https://www.cnbc.com/2020/01/13/five-biggest-stocks-dwarfing-the-market-at-unprecedented-level.html

https://www.newsweek.com/economy-recession-downturn-cfo-deloitte-survey-1481175

https://fred.stlouisfed.org/series/CP

https://www.cnbc.com/2020/01/03/ism-manufacturing-index-december-2019.html

https://fred.stlouisfed.org/series/FYFSD

https://fred.stlouisfed.org/series/ROWDESQ027S

https://www.gold.org/goldhub/gold-focus/2020/01/central-bank-demand-remains-course-remarkable-2019

YouTube Short Description:

Can the markets keep flying? Yes, as long as central banks keep providing liquidity and the way they do that, is by creating debt.

In the US, between January and December 2019, deficit spending (spending more than income) grew 17.1% from the same period in 2018, which, in itself, had grown 28.2% from 2017.

Globally, the debt-to-GDP ratio exploded to historic highs of 322%, with debt surging in every sector; government, corporate and individual. What would happen to you if your surging debt could not be funded by current income?

Central bank gold accumulation has escalated again, growing by 11% YOY (Year Over Year). Considering that 2018 saw the greatest global central bank gold buying in history, what can we conclude? Perhaps that central bank fiat money has already lost all value.

Officially the USD is at $0.0389 and central banks, supposedly unable to hit their 2% inflation target, are willing to let inflation run above current targets. I believe they’re preparing for the inevitable final wealth destruction. They know that gold money holds value and fiat money does not. They’re getting prepared, are you?