REAL ESTATE’S CRITICAL TEST: Is the Next Crisis Unfolding Now?

The U.S. is experiencing the most expensive Real Estate bubble in history and with the interest rates rising, these markets are starting to flash warning signs. Don’t wait until it’s too late to secure your purchasing power. The dollar is worth less and less every day. Protect your Wealth with Gold & Silver? Schedule a Strategy Call Here: ↓ or Call 877-410-1414 https://calendly.com/itmtrading/youtube?utm_content=HN7052022

TRANSCRIPT FROM VIDEO:

Can you hear that? Can you hear it? Wow. It’s a sound of lots of bubbles popping. We’re gonna be talking about that specifically with real estate, coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading of full service, physical, physical, gold, and silver dealer specializing in custom strategies and never, ever, ever. Has that been more important than it is today? I mean, you know, people always ask me when, when, when, well I’m gonna say open your eyes and look around because the fed giveth, the fed taketh away. They’re gonna giveth again, but at the moment, globally, central banks with all of this money printing that they did Ad nauseam created bubbles in all of those targeted asset classes. Remember after 2008, they actually came out and said that we are going to target stocks, bonds, and real estate for reflation. So big shocker that we have the most expensive, at least in nominal terms, the most expensive real estate bubble in history and with the interest rates rising. I don’t know, these markets are starting to flash warning signs.

After all global central banks, raising rates is popping the real estate bubble, adding risks that a slow down. Shocker, could ripple through the economy because remember real estate is roughly 30% of the global economy. That is a huge piece. It’s also very unaffordable for many right now, but the threat a world economy already contending with raging inflation, thanks to all of this, okay. Stock market turmoil also because they were severely overvalued and who cared about income, but we’re dealing with that. And a grueling war is facing yet another threat, the unraveling of a massive housing boom that was created by the central banks.

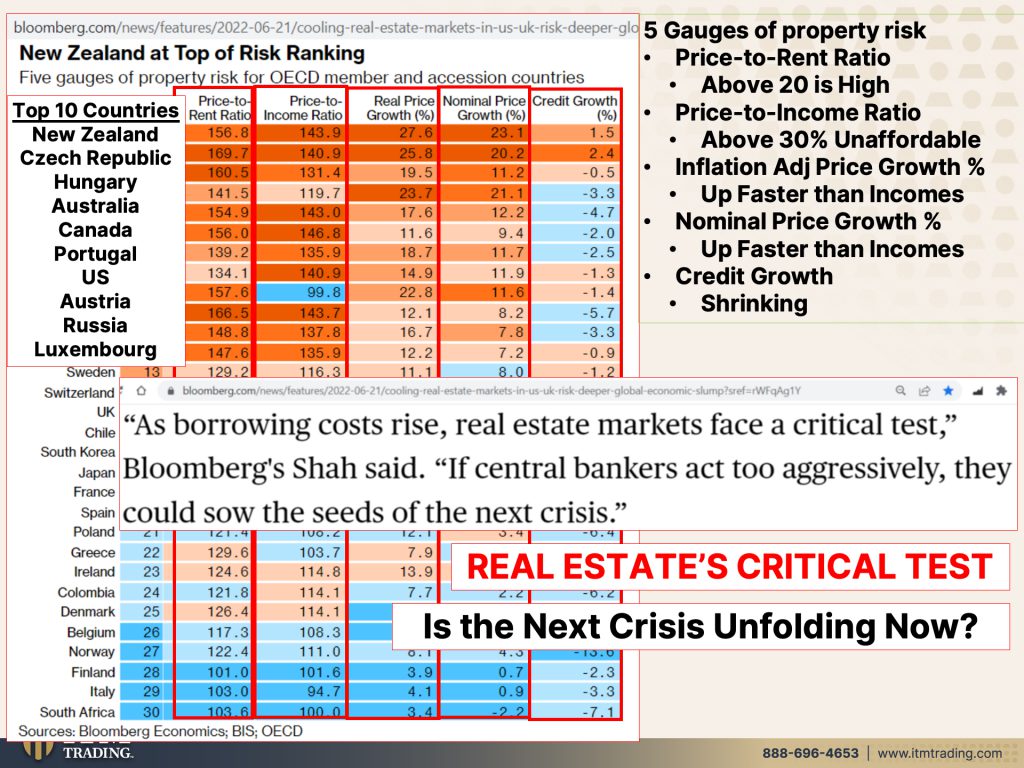

But now it’s passing a test. And I mean it’s taking a test. I would say, because if you look that’s happening in every single area, it’s happening in the cryptocurrency area, it’s happening in the stock market, it’s happening in the bond market. And it’s clearly happening in the real estate market. And are we watching this crisis unfold in real time? Because frankly, I think that we really are. Now they did a list, the, on the OECD countries of those that had, let’s see the, this is a gauge the top 10 countries with the bubbliest real estate markets. And it’s not really a surprise that the U.S. Was right here and you can see them, New Zealand, Czech Republic, etcetera, on and on and on. And the way that they do that is by a gauge of different property risks. One of those risks being the price-to-rent ratio. In other words, is it cheaper to rent or is it cheaper to buy a house now, typically above oops, a little ahead of myself above 20 is high. And if you look on this list, every single one of them is in excess of a hundred, which means that buying real estate for most people is severely overvalued. It’s not gonna happen. It’s not affordable. Well, what about the price to income ratio, including even the rents? Well above 30%. So your mortgage payment or your rent payment is above 30%. And when you look at all of these countries, wow, they’re all so far above 30%, meaning that people cannot afford real estate. They can’t afford to rent and they can’t afford to buy. This is actually a pretty big problem, because then they’re looking at the adjusted, the inflation adjusted price growth of the house. And that’s growing faster than incomes as even the nominal price growth faster than incomes. So it is not really a big shock that whether you buy or whether you rent housing, putting a roof, that shelter, right? That’s one of the pieces of the mantra, the shelter, you gotta have a place to live, but it’s become very unaffordable for most people. As borrowing costs, rise, real estate markets face a critical test. If central bankers act too aggressively, <laugh> by raising rates, they could sew the seeds of the next crisis. But quite frankly, it doesn’t really matter. If you have a fed that is presumably so aggressive. We’re gonna be talking about that actually with a guest on a coffee with Lynette coming up next week. But you know, they have to raise rates to attempt to combat the inflation. But that also is pushing us into a recession, right? Because look, there’s only one way to tame inflation. And that’s what deflation, which is what a recession is, which is what a depression is. On the other side of that, there’s only one way to fight deflation that’s with inflation. So when you know that there’s only one way to approach this. And if the Fed doesn’t raise rates, they lose their credibility. So they have to raise rates so they can lower them into the next crisis. But if they don’t lower them, then they run the risk of inflation running, even hotter. It doesn’t matter what they do. There’s gonna be, there is a policy error period, whether they raise rates fast enough, or they don’t raise them fast enough, or they keep them, or they drop them back down. Because in my personal opinion, that is exactly what’s gonna have to happen. How much pain the fed is willing to allow is going to determine when they turn around and drop those rates again, is it gonna help? No, it’s not gonna help. Raising rates is not gonna tame this inflation. Although a lot of job losses that are coming up… We’ll talk about that in just a second let’s move forward.

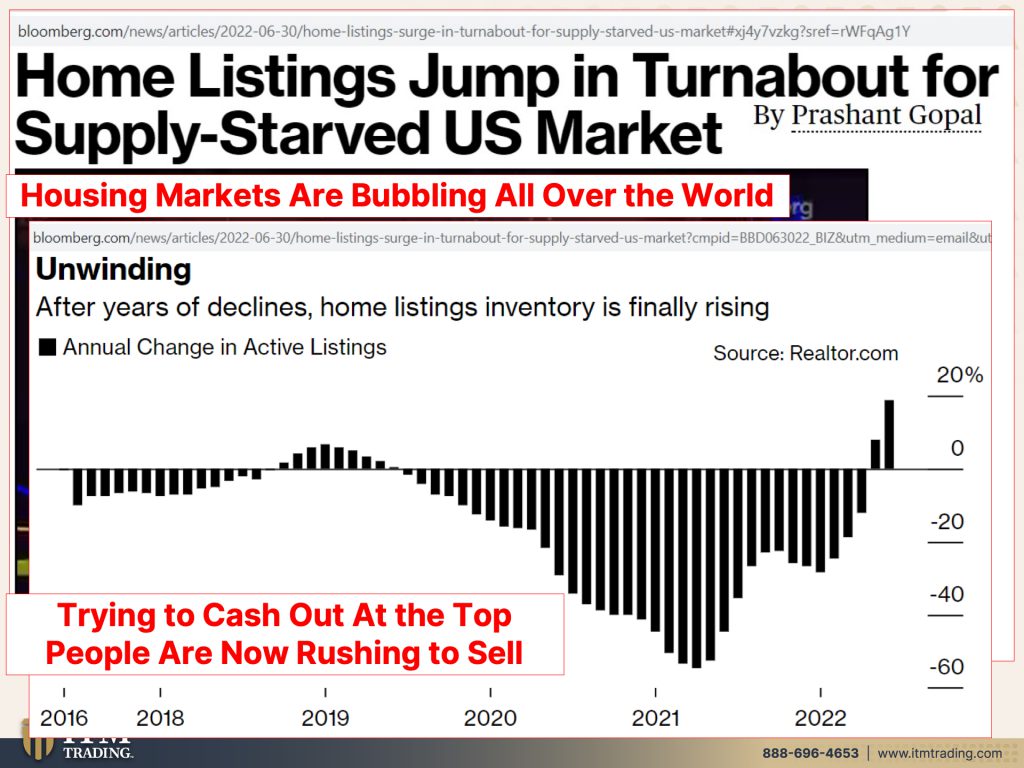

Because people are now noticing so where people were thinking about selling, but oh God, the prices keep going up. Are we gonna sell? No, let’s wait. Well now the home listings jump in a turnabout for supply starved U.S. Markets. So that means that people are now rushing to put their house on the markets so they can capture the price somewhere near a top. Well, you know, we’re not seeing a big slow down in the prices. We’ll talk about that in just a second. But housing markets are bubbling all over the world and look at this. After years of declines in home listing inventory is finally rising. There you go. Last two months, you’ve seen an increase in inventory and actually a pretty substantial jump trying to cash out at the top. People are now rushing to sell. So that is a very good indication. You might recall. It was probably about five, maybe 4, 5, 6 months ago, where we got the indicators that we were somewhere near a top. Well, now we’re seeing it.

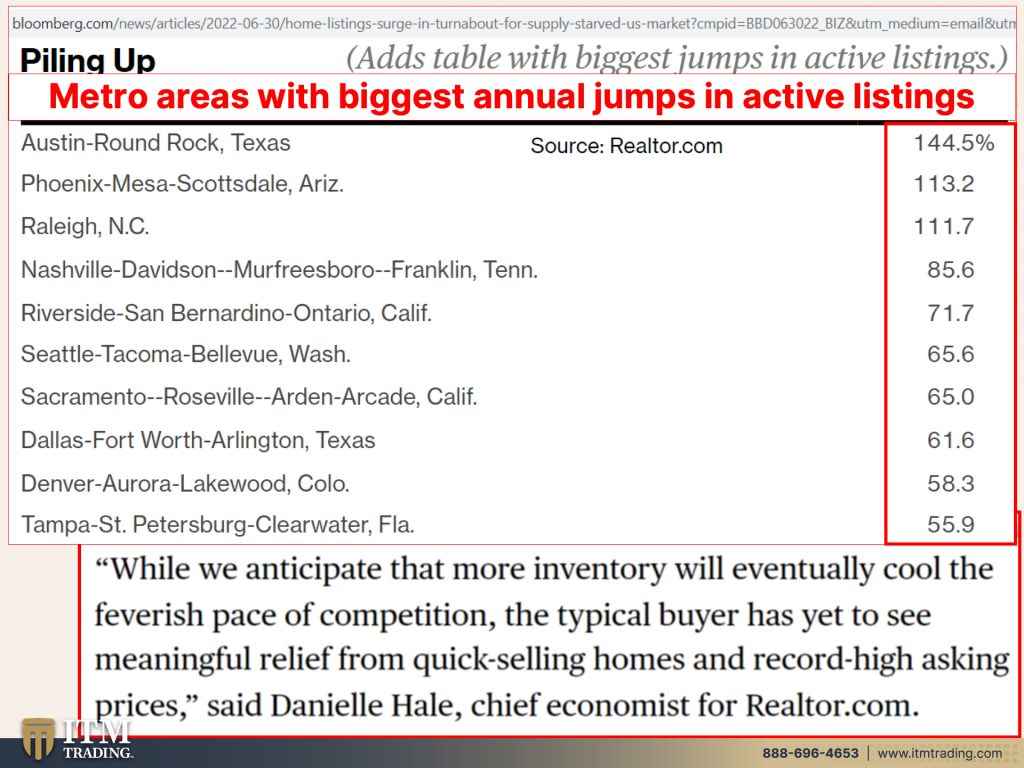

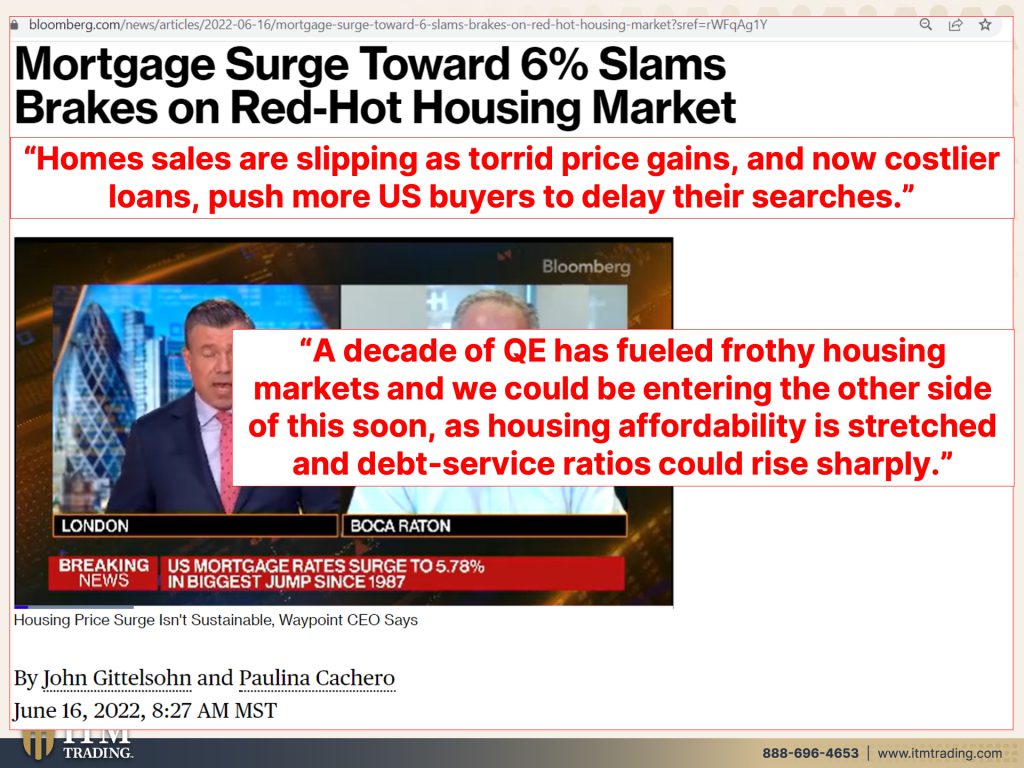

In fact, Metro areas with biggest annual jumps in active living, as you guys know, I live in Phoenix and the listings up 113.2% in Austin round rock in Texas, 144.5%. These are listings even in Tampa St. Pete up almost 56% new listings while we anticipate that more inventory will eventually cool. The feverish pace of competition, that the interest rates, the typical buyer has yet to see meaningful relief from quick selling homes and record high asking prices. So in other words, there are a lot more houses that are coming on the market, but we aren’t yet seeing a big, huge decline in prices. But I anticipate that if you’re gonna keep getting more listings and people are kind of, well, let, let me just finish this whole piece. And then you can formulate your own opinion. So the mortgage, surge towards 6% slams the brakes on red hot housing market. Home sales are slipping as Torrid price gains, and now costlier loans push more U.S. up Buyers to delay their searches. So you see you had wall street backed entities going into the mortgage market to buy houses. Did they really care how much the houses cost? No, you were getting, they were getting this money for virtually for nothing. It was free money. So you push up the price of houses and the normal person. And remember this used to be a mom and pop world. That’s not the way it is anymore, that this is now also a wall, a wall street world. And they’ve turned real estate homes, buildings into commodities, just like anything else, paper, commodities, but now it’s starting to cool off. The Fed dropping interest rates to nothing. Yeah, that definitely, it definitely created that boon in real estate. And with all that free money, just sloshing around like crazy. I mean, what difference did it make? How much something cost? I mean, I remember these arguments doesn’t matter how much something cost. It matters what the monthly payment is. Well, now that you’re looking at 6% versus 2.5% or 3%, that really makes that monthly nut a lot bigger. So you can’t afford people can’t afford as big a house. They’re going to have to go down in size or down in price. And I think we will see prices change, but that hasn’t really happened too terribly much in lots of places yet, but it is definitely happening. A decade of QE has fueled frothy housing markets and we could be entering the other side of this soon. How about now? How about we’re entering it now as housing affordability is stretched and debt service ratios could rise sharply because what has been the central bank’s answer to every downturn, more debt, more credit.

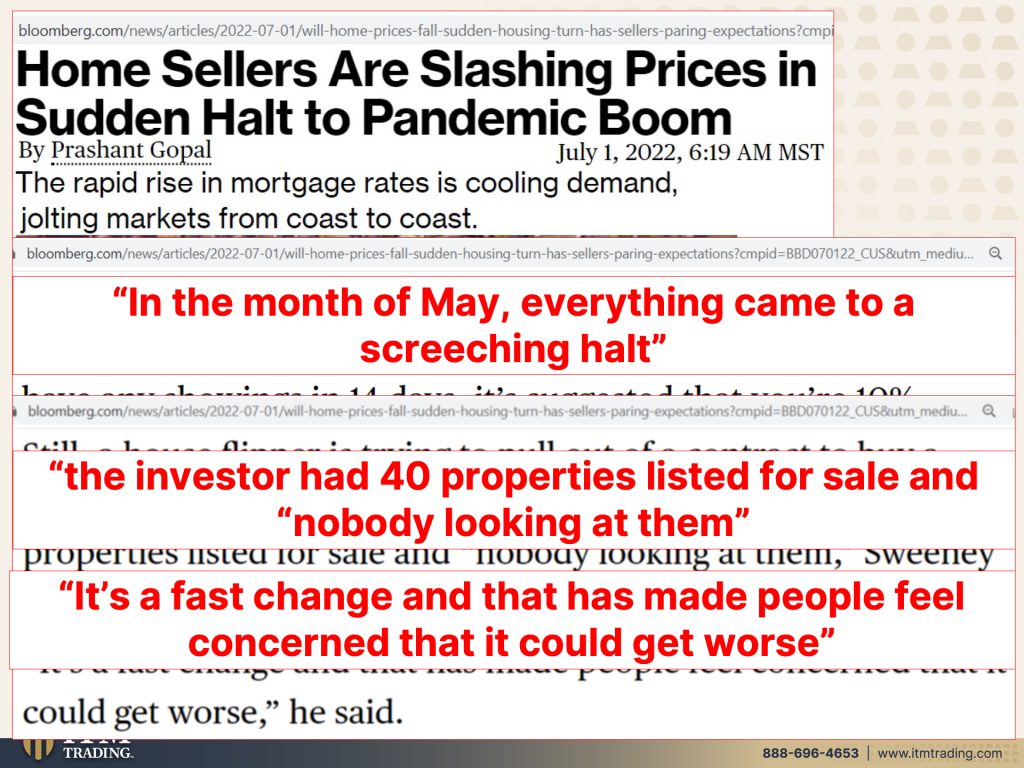

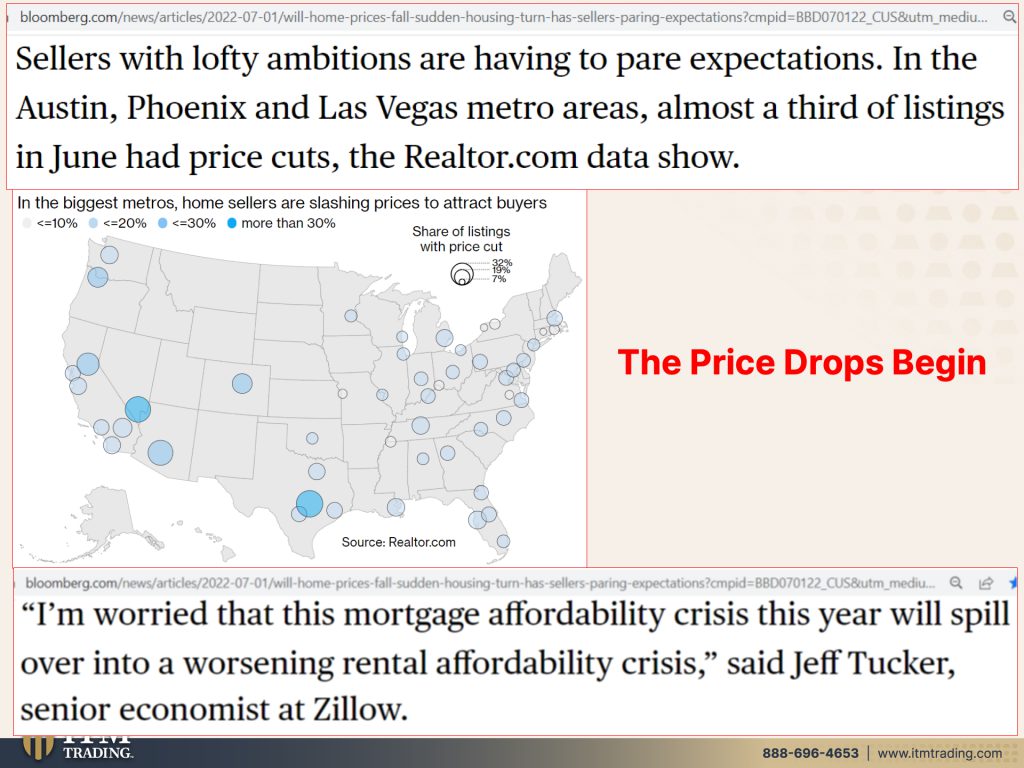

Home sellers are slashing prices in a sudden, and this is on July 1st, right? And a sudden halt to pandemic oom. The rapid rise in mortgage rates is cooling demand, jolting markets from coast to coast. Now, not all markets are witnessing this yet, but I do believe that all markets will be experiencing this and soon. In the month of May, everything came to a screeching halt. We have a rule of thumb that says, if you don’t have any showings in 14 days, it suggested that you’re 10% overpriced. Well, you know, we were in a period and we saw this too, before the, the real estate market crash back in 2007, 2000 and the formulas told us it was August of 2005 that you know, that we were, that the indicator said that we were somewhere near a top of that market. Well, this is really no different. And when things stop, they stop very quickly because you’re looking at interest on real estate now that is somewhere near 6%, still a house flipper is trying to pull out of a contract to buy a property. The investor had 40 properties listed for sale, and nobody looking at them because they’re looking at what their monthly nut would be. And also if they have something that they have to sell to get into something else, this market is shifting like really quickly, like sand underneath your feet. Are you ready for this? I hope you weren’t one of the ones that were sitting on real estate that you really wanted to sell. It’s a fast change. And that has made people feel concerned that it could get worse and it could get a lot worse. In Japan. For example, in the early nineties, residential real estate dropped 85%. Commercial dropped 95% in 2008, they only allowed the markets to drop 45% before they went in and put a floor underneath it. But the prices even prior to that had gone so far so fast that the central banks never actually allowed free market forces to equalize and stabilize the price. Instead, they went right in there and exhaust those markets, creating the housing bubble that we’re now going to experience. So, hey, you may call me crazy. And I can’t tell you, I’m not sitting here telling you a hundred percent that we’re gonna see real estate prices drop 85%, but we could, we definitely could. There is historic precedence for this and this whole market because of all this free money was just so it’s so overinflated and what goes up must come down. Could it get worse? Yeah, because the price drops have already begun sellers with lofty ambitions are having to pair expectations in the Austin, Phoenix and Las Vegas, Metro areas, almost a third of listings in June had price cuts. A third of the listings in June. Now where you’re seeing these circles, those all indicate where they have been or where there have been where they’re slashing prices. Or I don’t know that slashing is probably a good word as much as dropping prices and the darker, the blue, the bigger the price drop. And there is a question from bodyfeelgood. So does this mean that rentals will go up or down?

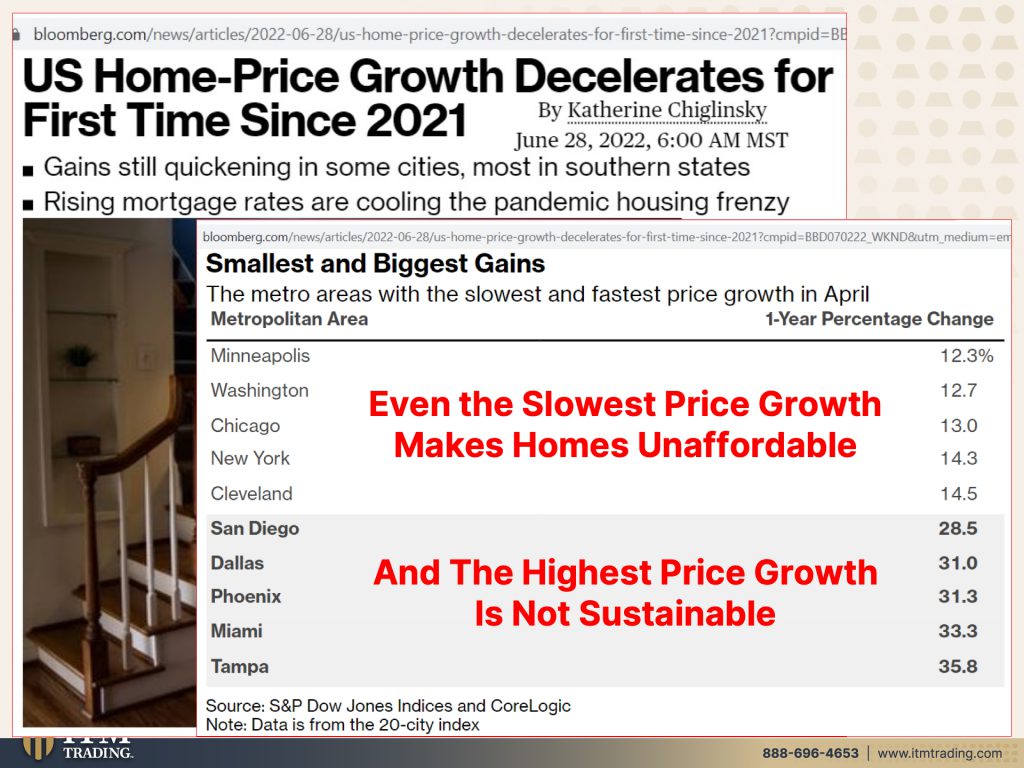

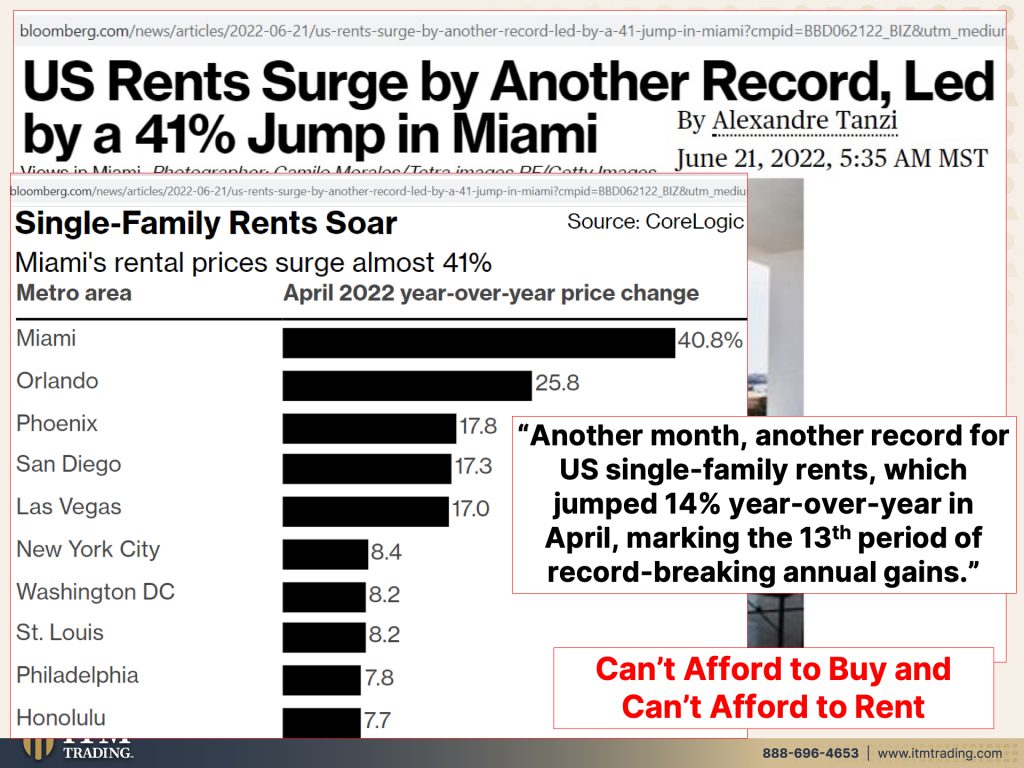

You know, that’s a really good question because I don’t think we’ve ever quite been in a market like we are right now. Rents have been going up astronomically in Miami. In fact, I think I have this in here somewhere. Year over year, monthly rents up 45% rents are gonna have to come down because of that affordability factor, but this whole market is going through a major adjustment right now. So time will tell normally when houses are too expensive, well, then you have reasonable price rental price increases because more people are renting than are able to buy. Unfortunately right now it’s kind of like the stock in the bond market, too. These markets are all of ’em are dropping, right? All of these Fiat funny money markets are dropping. And so you have the same thing when you’re looking at buying or renting, right? Both of these markets have gone up so quickly, far faster than any of the income increases that I think what we’re gonna see is I think we’re gonna see both of them drop. And we’re certainly starting to see price controls come into play. And that’s something that typically happens during a hyperinflationary event because the rents go up so high that people can’t afford it. And guess what, if they’ve gotta choose between rent or food, guess what they’re gonna choose. They’re gonna choose food. So that’s why, that’s why I’ve been saying for a long time, look, I like real estate. Real estate for me has an important function, but a lot of people have been using it like a piggy bank because the fed, you know, don’t the fed, the fed was saying, buy it, buy it, buy it, regardless of the price, buy as much home as you can. But so that’s a good question and we’re, we’re gonna find out, but I think that both prices will ultimately have to come down in both areas because people can’t afford it. And then those places, those apartments, those houses don’t do you any good if they are left empty, there is part of the strategy to accommodate all of that. Also for those of you out there that maybe earn your income through rental income, their part of the strategy is how you can replace that rental income that you’re getting in case, or when they put in those price caps or people stop paying, etcetera. That should have been laid out pretty bare that this was an important feature back in 2020. We need to make sure that if you’re, depending upon this income that you have that income replaced, that’s part of the strategy. So if you need to know more about it, just, just call our consultants, give us a call and talk to them about the strategy. But as they say, I’m worried that this mortgage affordability crisis this year will spill over into a worsening rental affordability crisis. Well, yeah, we’re already there, U.S. Home price growth decelerates for the first time, since 2021. So that doesn’t mean that the prices are coming down yet. It just means that they’re not growing as much. So even when people have lofty ideas and they put their houses on the market, and I want 2 million, I can tell you in one of my daughter’s neighborhoods, she bought that property right before. Right when COVID hit, like right before. And I was like so grateful because she’s got a big family and they would’ve been not in a good place in the small little house that she had before that. She paid in the high fives for it. And now properties in her street are listed in like 1.4M, 1.6M I mean, what can I say?

So U.S. Home price growth decelerates doesn’t mean that it went away, but in the smallest and the biggest gains, the Metro areas. So here’s Phoenix and that price appreciation was 31.3%. The fastest price growth in April, but even in the slowest levels. So Minneapolis, the prices still grew 12.3. So you’re getting a lot of conflicting information here because on the one hand, they’re talking about a third of the listings in Phoenix, cut their prices after they listed them. But it still doesn’t mean that the price growth hasn’t been 31%, maybe they were looking for 45% or 50% ridiculous numbers. The house is someplace where you’re supposed to live and have the ability to make your last stand. This is where I’m gonna be, I need to make sure that I can do Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter in this space. That’s the function of a house to keep my family safe. But, either way, whether it’s the slowest or the fastest, it’s not affordable homing homes. These days are not affordable.

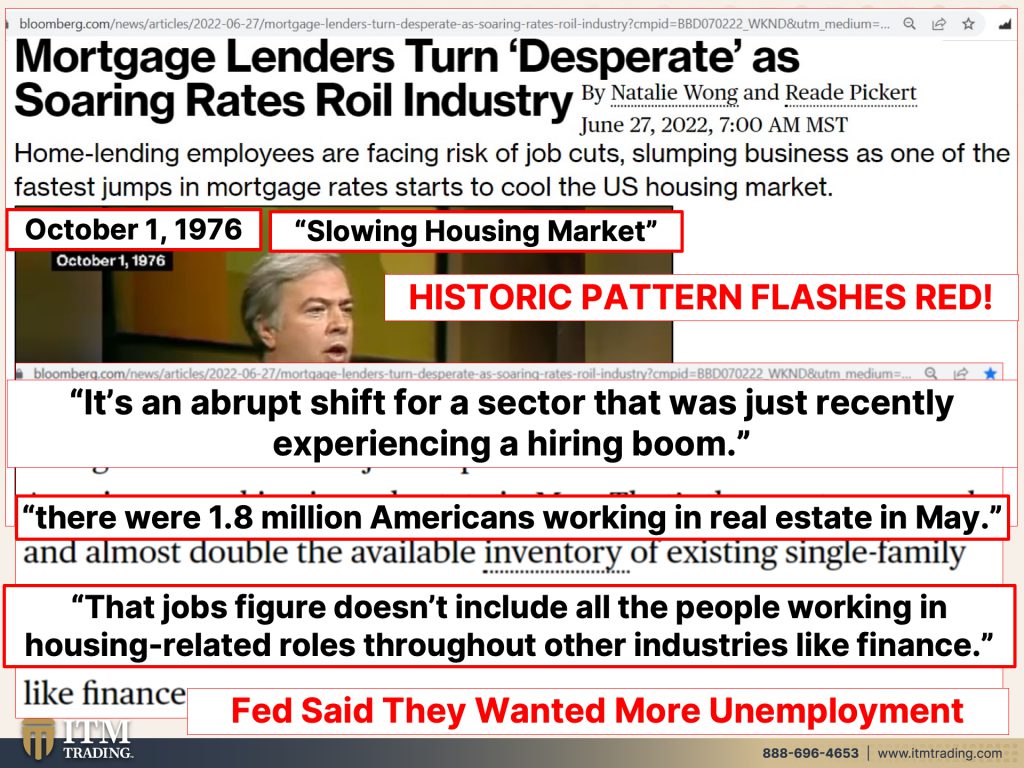

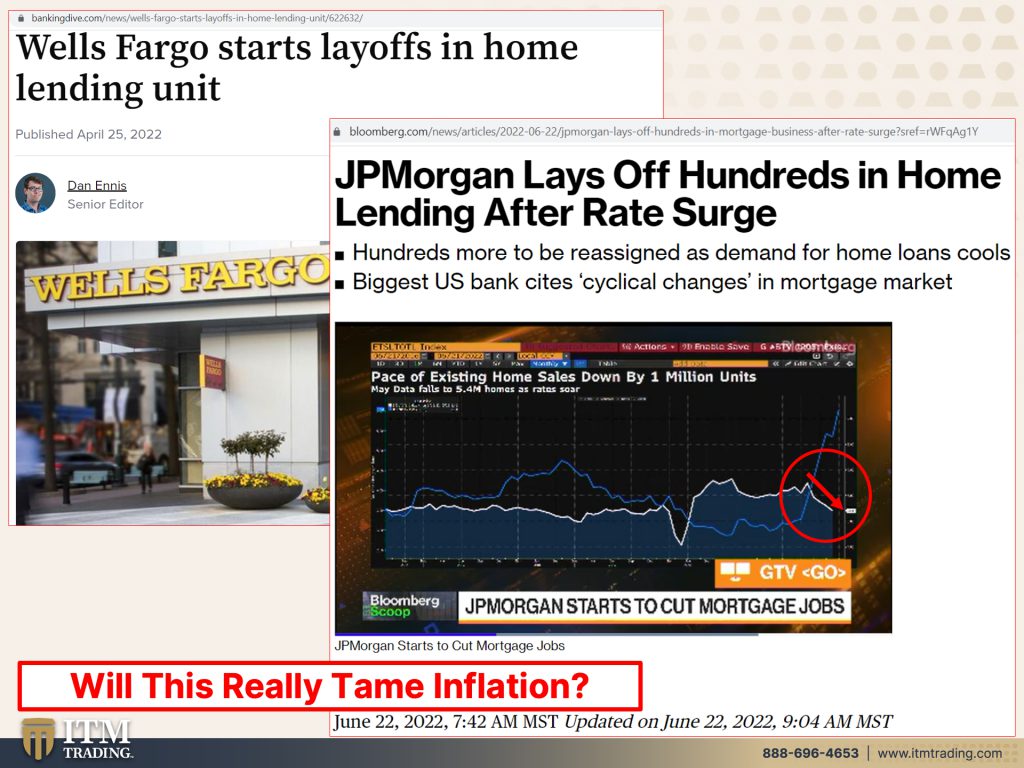

But in a flashback cause the piece that everybody seems to miss this isn’t a normal inflation or recession. This is the end of the currency’s life cycle. And the last time that we were at an end was back in the seventies and I found this so interesting. Remember you’ve got the links to everything in the blog. So go in and listen to this Pierre Rinfret speak about the real estate bubble. And it’s popping back in the seventies because it sounds awful lot like what we’re seeing today, when again, central banks and governments were trying to goose the housing market because that’s one of the largest components. If not the, no, I think financial service is larger, but that is one of the largest components in the global gross domestic product. All the money that flows through the whole system. It’s an abrupt shift for a sector that was just recently experiencing a hiring boom, because these mortgage lenders now all of this hiring now they’re starting a fire. So the federal reserve wanted unemployment to tame that inflation. Well, good, good gummers looks like they’re getting it. There were one, but this is the piece that you have to understand. It’s like a domino effect. It’s not just this one little piece that we can see or like an iceberg is a better example. It’s all those pieces underneath. There were 1.8 million Americans working in real estate in May. That jobs figure does not include all the people working in housing-related roles throughout other industries like finance or I don’t know how about big box stores like Home Depot or ACE Hardware or any of those. This is all real estate related. Painters, etcetera, furniture stores. Well, you should always be careful of what you wish for cause you may just get it. So all that hiring boom is now turning into a firing boom.

Wells Fargo, layoffs and home lending union. JP Morgan lays off hundreds in home lending after rate surge. And this is the pace of existing home sales down by 1 million units and you can see it right here. This was back in 2020. So we can see what’s happening in here. And they want to say that this will tame inflation. It’s not gonna tame inflation. You’re just gonna have less income along with rising prices. This is the supply side issue, but it’s, this is what it is. It’s all that money printing that they did and the impact that that’s having on all of the assets, what goes up must come down.

And when you have a boom, you’re also gonna have a bust. This is what I was talking about before. So you’re asking, well, what’s that gonna do to rent? Look at we’re in an over expensive real estate market, in both to buy and in, to lease and in to rent 41%. I mean, this is ridiculous. It’s never been sustainable. I mean, this is a place where you have to live, but once Wall Street comes into it, do you think they give a crap? No, they do not. They only care about squeezing every last dime out of you and with rents exploding at that level. And income’s definitely not going up at that level. Do you think it’s possible that their income to rent or income to mortgage ratio if they’re buying is above that 30% because that 30% is really, I mean, I remember back in the day in the seventies, since my father was a developer and I worked in banking then and I was doing mortgage origination. We were looking at a 25%, not 30%, but they had to raise that income to rent or income to mortgage ratio. They had to increase that because of how quickly the prices were going. So if a reasonable amount was 25% of your after tax income and these things are well above 30% of most people’s income, we’re gonna have a problem. Do you see that? It can’t go up forever. Everybody always thinks things can just go up forever and ever and ever they can’t. It’s not the way markets work. Even when you have an accommodating Fed another month, another record, which you, us, you as single family rents, which jumped 14%, that’s an average year over year in April making the 13th period of record breaking annual gains. Woohoo, except there is that little affordability factor in there can’t afford to buy. Can’t afford to rent we’re in deep Do-do.

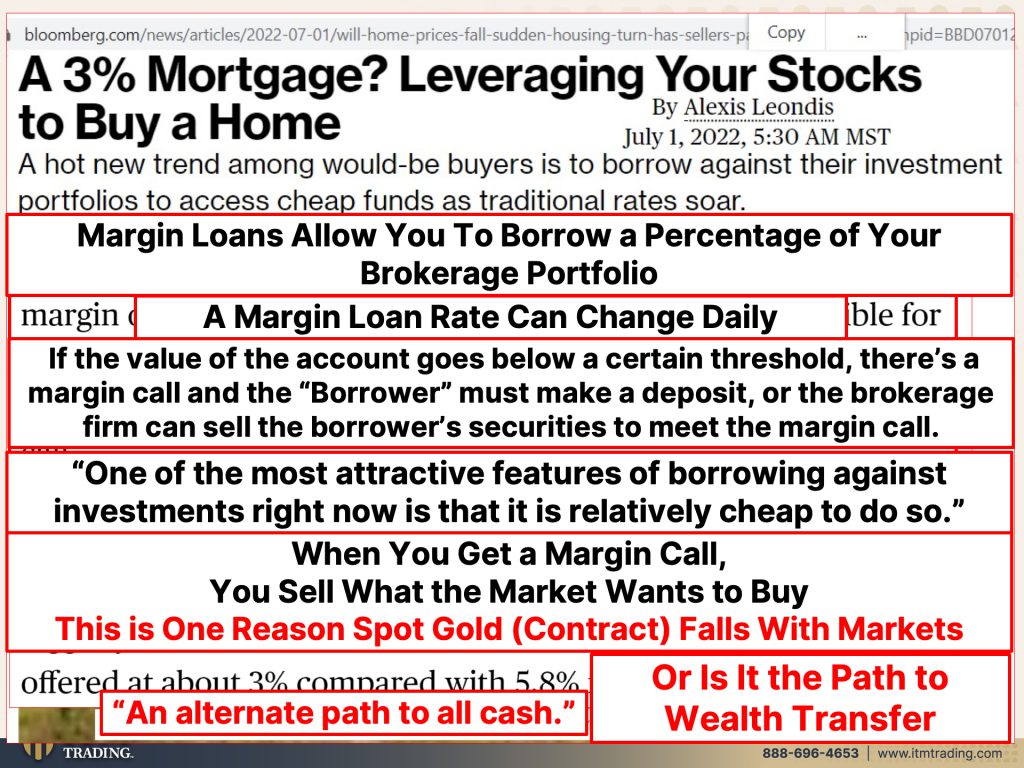

I came across this and I don’t know who ever thought this was a good idea, but leveraging your stocks to buy a home. Margin loans, right? We talk so much about margin, borrowing to buy stocks, but you see if people wanted to cash out of their stock portfolio to put it into the real estate market. Did Wall Street want them to do that? Oh no. Wall street does not want you to take your money out. They make money off of your equity. They want you to take that money and leave it in their system so they can make money off of you in oh, so many ways. But a hot new trend among would be buyers to borrow against their investment portfolios, to access cheap funds as traditional rates. Soar and it’s called an alternative path to all cash and it works fine. As long as all of the markets are rising, maybe not so well on the other way down, if the value of the account goes below a certain threshold, there’s a margin or maintenance call where the borrower responsible for depositing additional money into the account. Otherwise the brokerage firm can sell the account holder securities to meet that call. Now, why would people do this? Well because when the markets were going up and the house real estate was going up, it was like, how can you lose? But to do that and a margin account, at least at this point is definitely less expensive at 3% than a mortgage at 6%. So, you know, I mean, and when I think back to those adjustable rate mortgages prior to 2008 and the same similar kind of thing that happened in Europe, where with the Swiss Frank, when it was so cheap against the euros. So people took out that earned euros took out mortgages in terms of Swiss Franks. Well, both of those things have ramifications that people are still dealing with today, including in Switzerland. And now they’ve come up with this one. Yeah. I mean, I’m not really sure that this is such a great idea for most people, but the margin loans allow you to borrow a percentage of your brokerage portfolio though, those rates change daily. And if the value of the count goes below a certain threshold, well then you gotta come up, you as the borrower have to come up with more money or they’re gonna sell out your stock portfolio. So now you bought an overvalued house that’s dropping in price and the stock markets are dropping in price. Yeah. Can you see that you also have a mismatch in terms of maturity because these margin loans are a day to day basis, but real estate, you know, is not as liquid as that. It’s not on a daily basis. I know people were thinking about it like that, but I think we’re getting a wake up call. Now, when you get a margin call, you have to sell what the market will bear and wants to buy, not necessarily what you want to sell. And so I get this question a lot. Well, how come gold is going down when all the markets are going down. I’m gonna show you that in just a second, but you’ll notice that gold holds up remarkably better, but that’s why you’ll see spot gold drop at the same time, you’ll see the stock market drop as well because they’ve gotta meet borrowers, have to meet these margin calls and they’ve gotta sell what the market will buy. Doesn’t matter what you wanna sell or not. It may not be liquid. You may not be able to sell it. But I think this is more a pathway to wealth transfer just like inflation is right across the board.

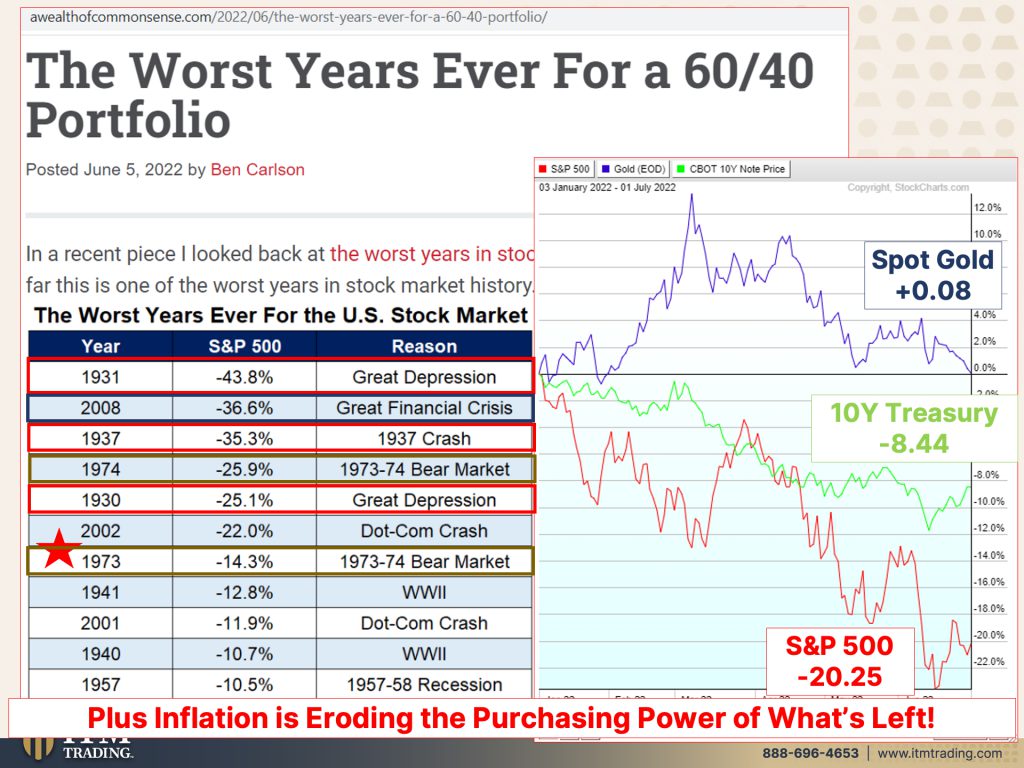

So when you’re looking at putting up your portfolio to buy a house, this is the worst years ever for a 60/40 portfolio. In other words, 60% stocks and 40% bonds. They’re both going down at the same time, but I thought this was super interesting. So I wanted you to talk to you about this. You just saw the three lit red boxes cover year 1930, 1931 and 1937. This is when they were really big time kicking off the Fiat money experiment. I mean, it started obviously in 1913 and then you had the roaring twenties because one of the things that central banks and governments always allow when they’re making a currency regime shift is that they want the public to not be paying attention to what’s really happening so make money. They let them make money. We’ve just seen that in the cryptocurrencies quite honestly, but we had the roaring twenties as they were shifting and the public got involved in it. They made money until boom credit dried up, liquidity dried up. And we had 1929. And then we had 1930 with the decline in the S&P 500 of over 25% 1931 down another for almost 44%. And then 1937, which was still part of that kickoff. So after the first 31, then more credit was available, supported things again. But then again, you had some fiscal tightening and you had another crash. So these are the crashes, the stock market crashes that happened as we were kicking this experiment off. And then as we were going through another transition, 73 to 74 bear market, that’s when we went off of a quasi gold standard into a pure debt based standard. And now here we are again, because interestingly enough, when I checked it. So through July 1st, the S&P 500 was down 20.25%, which would put it right here between 1973 and actually 2002, they’re calling that the.com crash and it was the “.com” crash. But just before that was long term capital management, it was the derivative, the first speculative derivative implosion. I didn’t wanna get too complicated on this, but I want you to take a look at how stocks, bonds and spot gold that’s contract, spot gold is a contract cheap, easy to manipulate. Okay. So where we had the S&P down -20.05, we’ve got spot gold, essentially, even so no losses, right? And you’ve got the treasury bond market. This is not the yield. This is the principle price down 8.44%. So out of these three stocks, bonds, gold, which one do you wanna be holding? I know what I’m holding. I’m holding gold because what none of this actually even takes into consideration is the inflation that’s eroding whatever purchasing power is left in the value of those currencies.

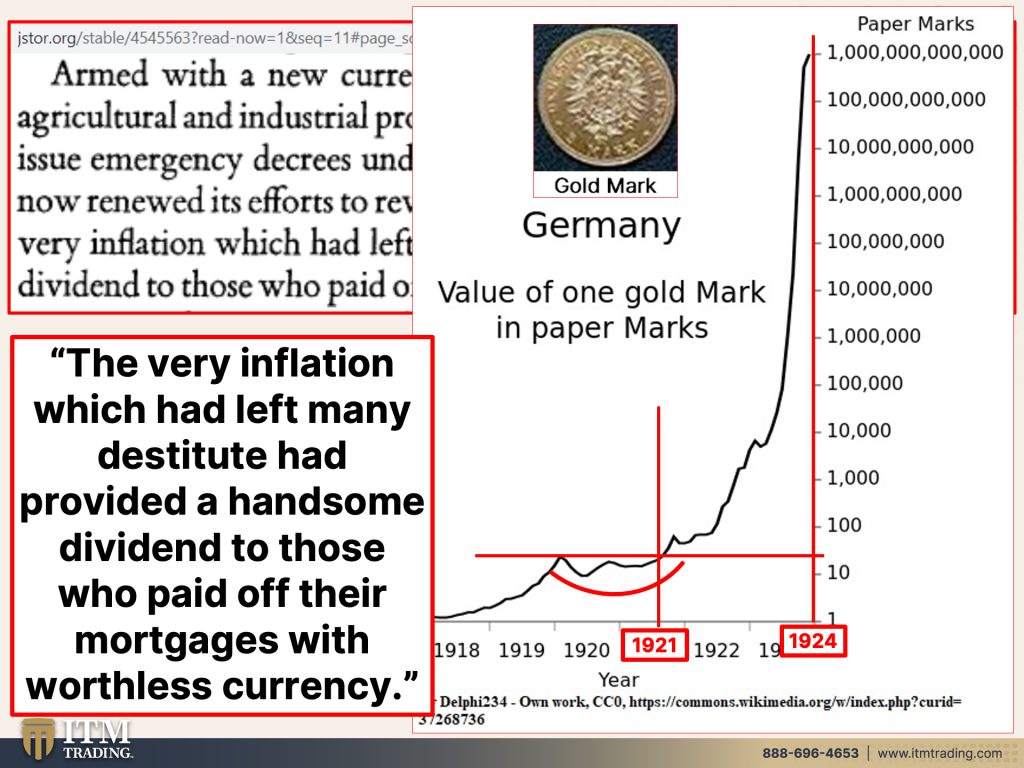

So, you know, this, these are just nominal numbers, but I wanna take you back in history because history repeats itself armed with a new currency, backed by mortgages on Germany’s agricultural and industrial property and empowered by the Reichstag to issue emergency decrees under 1923, enabling act, the government now renewed its efforts to revive the housing construction industry. The very inflation which had left many destitute had provided a handsome dividend to those who paid off their mortgages with worthless currency, because what happens to gold when we go into a hyperinflationary event? And I’ve been saying, since inflation kicked in that, I think that this is it. And I’m gonna sit here and I’m gonna tell you, I think this is it. So we’re running out of time, but this is what happens to gold every single time. Could this time be different? No <laugh>, if it’s happened well over 4,800 times, a hundred percent of the time, it’s not gonna be different this time because gold is real money. This is by the way, I will tell you what this specific coin is, June 28th was my 20 year anniversary here at ITM trading, 2002. Wow, it’s gone fast. And this was a gift for me achieving my 20 years here. It’s a wonderful gift because this is what protects myself and my family and those people that I love and that I care about, cause my family’s pretty broad. I’m not talking about necessarily blood family. I mean, we can be family on many, many different levels, but this is what I know holds my purchasing power intact so that as we go through this, will real estate drop 85% on residential and 95 on commercial. I don’t know maybe, but history has proven time and time and time again and Edgar, maybe you can put that link to the 25 ounces of gold buying an entire city block in Berlin buildings and all in all these different countries. It happens over and over and over again. And this is what I know. There will come a time where I will take my, some of my gold, not all of it, for sure, but some of my gold and convert it into income, producing real estate and other assets so that I cannot ever outlive my retirement and voila. I have a nice stable income for my family and generations to come because I would really like to think that I will leave a legacy that gives them enough so that they have their choices. They can, they can dream and they will have the ability to make those dreams come true. But I don’t wanna leave them so much that they do nothing, cause that’s just a wasted life and we are all here to be of service. That’s what we’re here. We’re here to share our gifts. And that’s how we build this community.

Part of what’s really important is not just gold and silver. I mean, that’s gotta be your foundation because that’s what enables you to maintain what you have and expand what you have. But you also need the Food, Water, Energy, Security, Barterability, Community and Shelter. And so if you’ve not yet gone to Beyond Gold and Silver channel, please do so and make sure that you subscribe because frankly there’s a lot of content from my off grid property that is posted on an ongoing and constant basis because we’ve gotta be ready. We’ve gotta be prepared. So I’m showing you specifically what I’m doing for myself and hopefully these are some things that will benefit you because we’re really trying to approach it at a number of different levels. So wherever you are, whatever your budget is, whatever your skill sets are and whatever your need is, that we’re meeting you there. That’s what we’re working on hard. But if you haven’t already established a strategy, click that Calendly link below, make sure that you, that you get with one of our wonderful gold and silver strategy specialists that can help you develop your own personal strategy. It’ll look similar to mine because the that’s the foundation it’s, it’s the same, but we all have different goals. So this is specifically for you. And if you haven’t done this yet, please make sure you subscribe and gives us that thumbs up. It helps spread the word more and that’s critically important these days. So I hope you know that it is time to cover your assets, get them covered. And this is how you do that. Do not be a deer in the headlights, get it done.

Can you see that the system is imploding under its own weight? Will the Fed turn around and do a pivot and print more money than we ever thought possible? Well, look at that. They ran out. No, if they never do, that’s a button push, but guaranteed, guaranteed. They are destroying what itty bitty bit of purchasing power is left. I want you to have choices. That’s why you have to have physical gold, silver in your possession and you have to have a garden or some kind of food source. Look at Security, Security and Food in Water, in Energy, in Shelter and in your Community. Get it done. Please get it done. No more waiting. No more hesitating. When’s it gonna happen? Look around you. It’s happening now. And until next we meet, please be safe out there. Bye-bye.

SOURCES:

https://www.bankingdive.com/news/wells-fargo-starts-layoffs-in-home-lending-unit/622632/

https://awealthofcommonsense.com/2022/06/the-worst-years-ever-for-a-60-40-portfolio/

https://stockcharts.com/freecharts/perf.php?$SPX,$gold,$ust

https://www.jstor.org/stable/4545563?read-now=1&seq=9#page_scan_tab_contents