REAL ESTATE TOP & DROP: New Report Shows 2020 Danger in Real Estate…By Lynette Zang

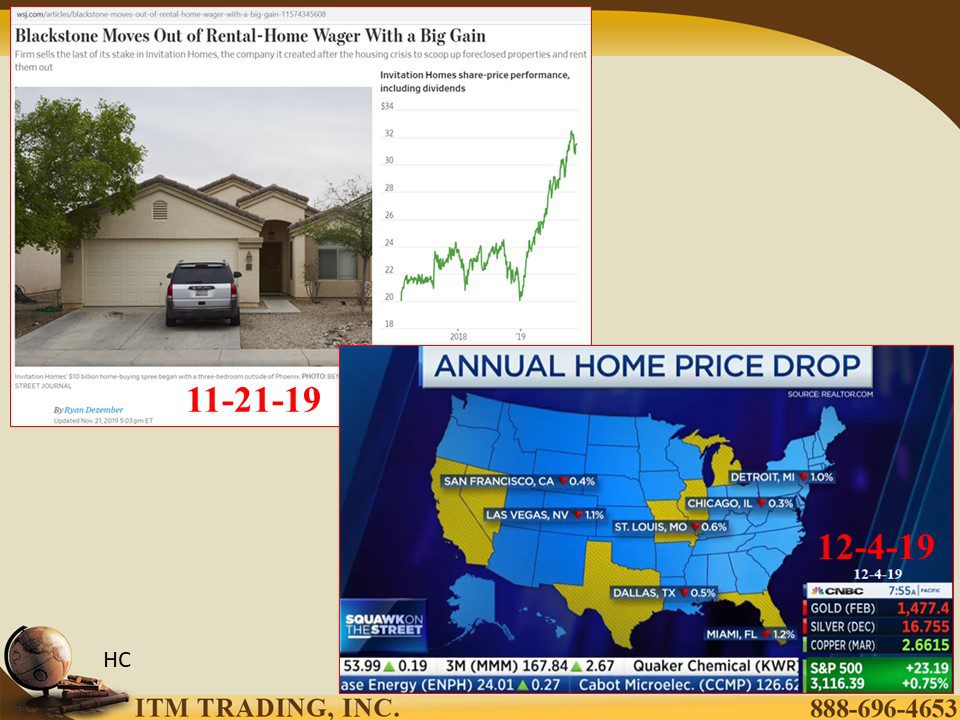

Blackstone took advantage of the 2008 housing bust by buying up foreclosed property and turning them into rentals. As of November 21, 2019, they are out of that market, with a very nice profit.

I always say you should look at what the smartest guys on any given topic, are doing for themselves and I’d say Blackstone qualifies.

A new report on the health of the housing market suggests home price declines in key cities: San Francisco, Las Vegas, Dallas, St. Louis, Chicago and Detroit.

Have more questions that need to get answered? Call: 844-495-6042

Will this spread? The Most likely answer is yes because the buyer base is shrinking as incomes have not kept pace with rising home prices or rents. Student loans are one area preventing household creation.

A federal loan forgiveness program that promised relief for vital but low-wage professions had a 99% rejection rate and could be considered an abysmal failure. With this debt now overhanging their earnings, it’s a safe bet they will not be supporting real estate prices.

But, much as governments and central bankers want you to think otherwise, a key manufacturing index remains in contraction territory, which does not bode well for jobs. In addition, a surprise contraction in the services sector could be an ominous indicator that recession is very near.

Slides and Links:

https://www.wsj.com/articles/blackstone-moves-out-of-rental-home-wager-with-a-big-gain-11574345608

https://www.nytimes.com/2019/11/28/us/politics/student-loan-forgiveness.html

https://www.cnbc.com/2019/12/02/ism-manufacturing-november-2019.html

https://www.wsj.com/articles/bank-branch-closings-weigh-on-rural-communities-fed-finds-11574722948