REAL ESTATE DANGER: (Pt.2) Real Estate Pattern Breakdowns…Leverage Upon Leverage! By Lynette Zang

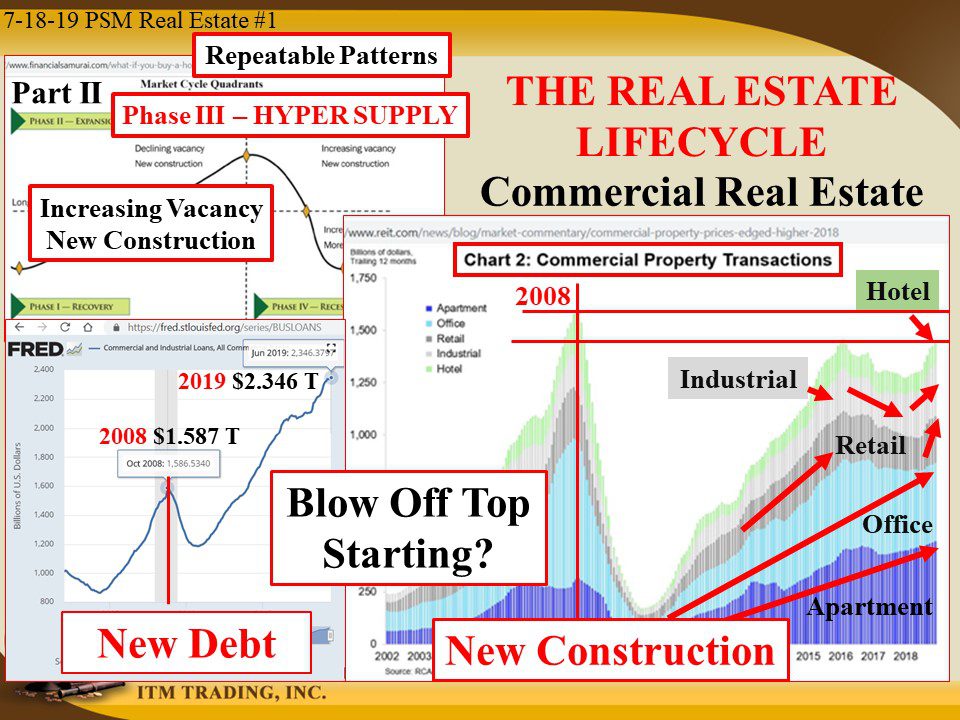

In Part I, “Real Estate Danger: Real Estate Cycle Shows Phase 3 Danger†we saw that real estate has now entered the third and most dangerous phase in the real estate trend. As a reminder, PHASE III in the real estate trend is indicated by hyper supply caused by increasing vacancy as new construction surges.

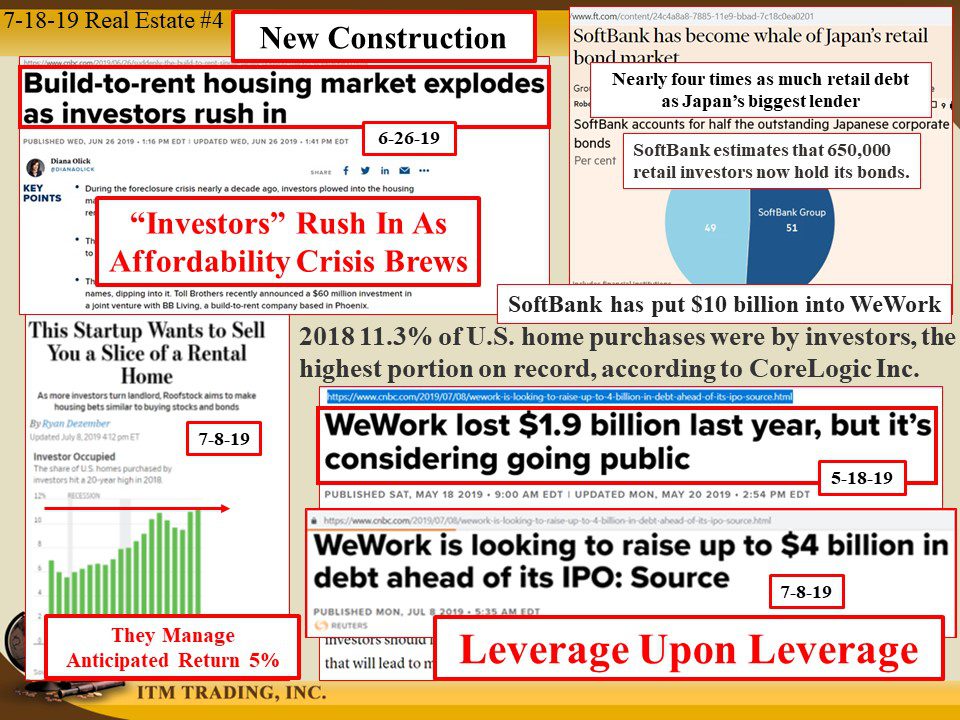

We also saw that home ownership transferred from the many mom and pop players to the few big corporate players with access to unlimited credit through both banks and leverage through markets, as this debt is converted into wall street products and then sold back to the retail investor, YOU, through Institutional Investors buying for brokerage accounts, annuities, IRAs, 401Ks and pensions. This is also a great tool to transfer risk when things go bad. My bet is that things will go bad very soon.

I say this because the debt bubble has a hole in it that is getting bigger and can no longer be filled with QE money printing, though it can lead to a blow-off top that may look great for a minute, but is really the final death throws of a dying trend. This can be seen quite clearly in the charts in commercial real estate (CRE) property transactions when compared to bank loans on CRE.

2008 saw an all-time peak in CRE transactions, bank funded with $1.587 trillion in debt. Today, while the number of CRE transactions is marginally smaller than 2008, bank funding in June 2019 is $2.346 trillion, reflecting higher bubble reflation costs. In addition, the arrested correction that began in 2016 has formed a cup and is now testing the 2016 top.

This is technically significant since a cup formation typically indicates smart money accumulation of an undervalued asset. But when created by central bank free money, it could mean something completely different. It could well represent the exit opportunity that transfers the risk from the few (elites) to the many (public). Either way, if there is a breakout, my bet is that we will have entered the blow-off part of the real estate trend.

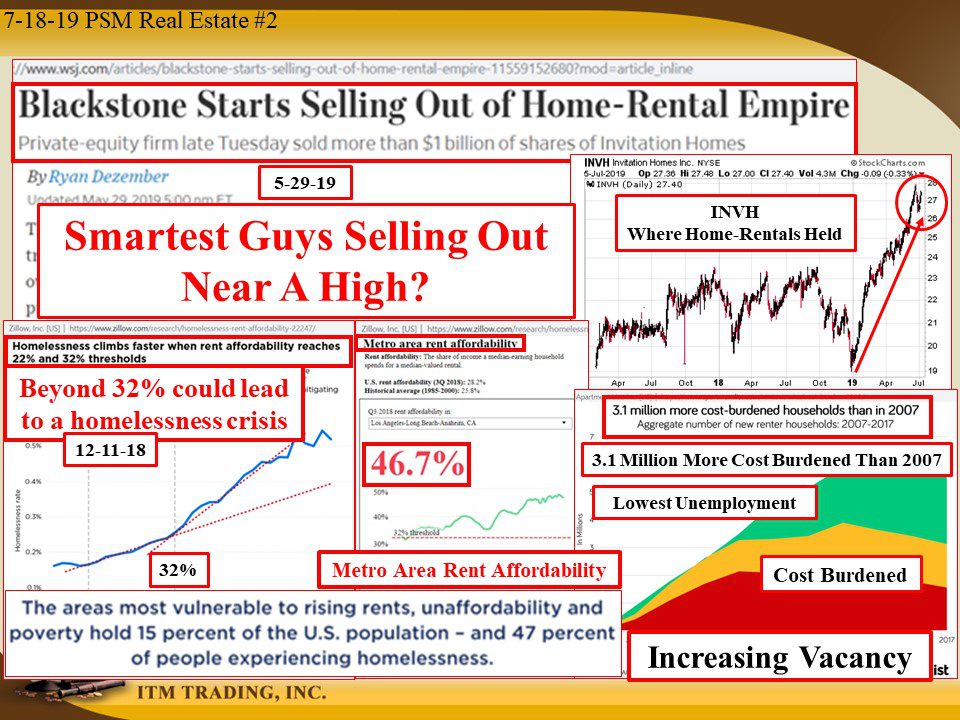

As example, one of the largest corporations that took advantage of the 2008 real estate bubble pop was Blackstone, who accumulated homes at pennies on the dollar and converted them into rentals. Creating Invitation Homes and rolling the properties into this wall street product, Blackstone has begun selling out of its home-rentals. Why would they do this if there was lots of room to run? Because they know that the rental market is breaking down.

They know this because rent affordability has broken down. Studies show that, when the cost of rent exceeds 22%, it become unaffordable for most people.  They also know that studies show that the average metro area rent affordability ratio is 46.7% of gross income and is likely to lead to a homelessness crisis. In fact, there are 3.1 million more rental cost burdened people today than there was in 2007 and this is happening when unemployment is at the lowest levels since 1969. Why? Because income inflation has NOT kept pace with housing inflation. Though according to global central bankers, there’s not enough inflation. Do you agree?

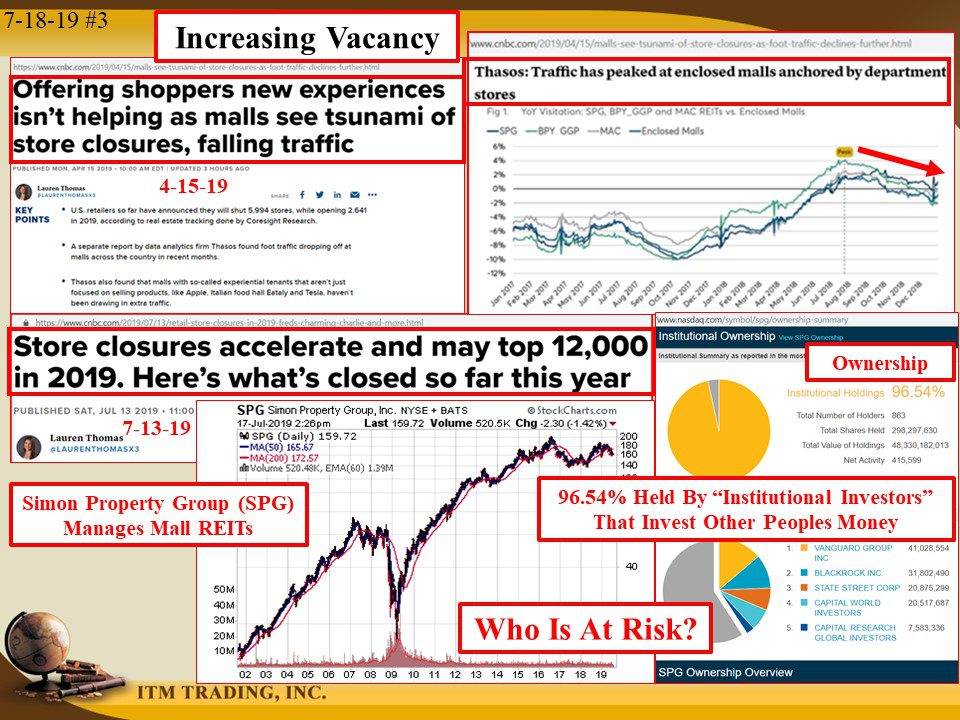

In addition, store closures are expected to top 12,000 this year as foot traffic in Malls continues its slide. These two facts, declining rent affordability and store closures, mean increasing vacancies, which would logically means falling prices, but leverage and debt has kept the real estate bubble floating, even with these holes. But don’t worry “investors†are rushing in.

Where are they coming from? Retail investors that think their only choices are wall street products and institutional investors.

As Ray Dalio, the billionaire investor who runs the largest US hedge fund said, “Most people now believe the best “risky investments†will continue to be equity and equity-like investments, such as leveraged private equity, leveraged real estate, and venture capital.†“this is especially true when central banks are reflating. As a result, the world is leveraged long, holding assets that have low real and nominal expected returnsâ€. For venture capitalists and wall street, this would be the most opportune time to get out near a top and leave naïve retail investors holding the bag.

Further he says “those that will most likely do best will be those that do well when the value of money is being depreciated and domestic and international conflict are significant, such as gold.†Which, right now, is severely undervalued. But don’t wait too long. Wall street is getting on the gold band wagon, meaning, gold is most likely about to get a whole lot more expensive.

Slides and Links:

https://www.reit.com/news/blog/market-commentary/commercial-property-prices-edged-higher-2018

https://fred.stlouisfed.org/series/BUS

https://www.zillow.com/research/homelessness-rent-affordability-22247/

https://www.mysmartmove.com/SmartMove/blog/rent-to-income-ratio.page

https://www.apartmentlist.com/rentonomics/cost-burden-2018/

https://www.cnbc.com/2019/07/13/retail-store-closures-in-2019-freds-charming-charlie-and-more.html

https://stockcharts.com/h-sc/uihttps://www.Nasdaq.com/symbol/spg/ownership-summary

https://www.ft.com/content/24c4a8a8-7885-11e9-bbad-7c18c0ea0201

https://www.linkedin.com/pulse/paradigm-shifts-ray-dalio/

https://economicprinciples.org/downloads/Paradigm-Shifts.pdf

YouTube Short Description:

Ray Dalio, the billionaire investor who runs the largest US hedge fund, said “Most people now believe the best “risky investments†will continue to be equity and equity-like investments, such as leveraged private equity, leveraged real estate, and venture capital.†“this is especially true when central banks are reflating. As a result, the world is leveraged long, holding assets that have low real and nominal expected returnsâ€. For venture capitalists and wall street, this would be the most opportune time to get out near a top and leave naïve retail investors holding the bag.

Further he says “those that will most likely do best will be those that do well when the value of money is being depreciated and domestic and international conflict are significant, such as gold.†Which, right now, is severely undervalued. But don’t wait too long. Wall street is getting on the gold band wagon, meaning, gold is most likely about to get a whole lot more expensive.