READY FOR THE BATTLE? Economic Battle Lines Being Drawn Across the Globe… By Lynette Zang

Battle lines crisscross the globe as President Trump declares both internal (Jay Powell, the Federal Reserve Chairman) and external (China) enemies. Additionally, he “clashed with world leaders over the U.S. trade war with China and a host of foreign-policy issues at a Group of Seven summit†AKA the G-7. The G-7 is made up of US allies that include; Canada, France, Germany, Italy, Japan, and the UK, all of whom are battling the global slowdown. What happens when are allies become enemies united against us? The loss of “World Reserve Currency†status. As the battle is waged, black swans fly, hidden for now.

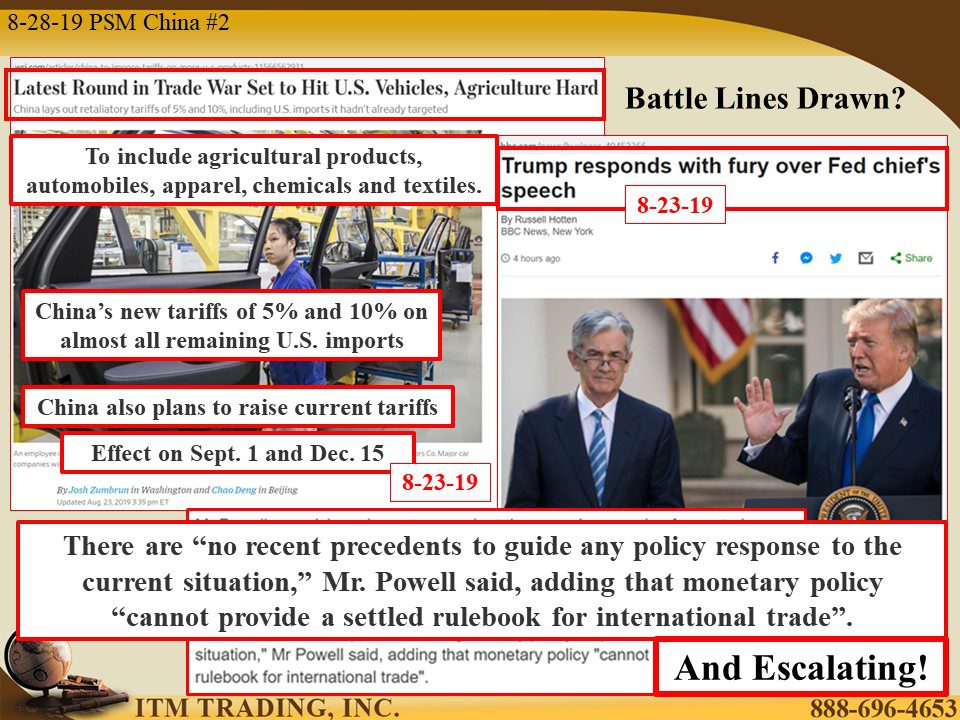

President Trump escalated the trade wars with new tariffs on China and he seemed surprised by China’s retaliation with new US import tariffs of their own that go into effect the same time as the US tariffs. In addition, turning their attention to inspiring their new consumer economy to offset their current manufacturing recession. Though as we saw in last weeks video, “China is Losing Their Footing†https://www.youtube.com/watch?v=-EoMf4D3I2o it is doubtful the consumer has the inclination to do so.

The Federal Reserve must rise above the presidential taunts that resulted from the Fed Chairs admission, in a speech he gave, at the recent central bank conference in Jackson Hole Wyoming, where he admitted that there are “no recent precedents to guide any policy response to the current situationâ€, meaning the central banks have no clue and no weapons, to fight the looming crisis as foretold by the bond markets historically negative behavior.

And while Federal Reserve Board members tell us they “don’t believe we’re seeing elevated recession risk†their key warning tool; the US 10 YR/3 M inversion, tells us the opposite. That the recession is either eminent or has already begun.

The 30 year treasury bond yield is at a new all time low, 1.935% at this writing. The 10 YR/2 YR yields have now closed inverted, with the 2 year treasury paying more than the 10 year, the worst level since 2007.

We’re told that’s because of a “flight to safety†from global investors, though recent data shows the US retail investor is buying the most thanks to “institutional investors†that “manage†investment choices for pensions, 401Ks, MFs, ETFs and other investment products. But why is an unpayable debt safe? And where is the logic in being paid more to loan money OVER NIGHT than to loan money 30 years?

Another “flight to safety asset†is the Japanese Yen, where we can see the “strength†in the Yen vs the USD as “investors” fly to its safety. Really? Since the early 1990’s the BOJ has been in an alphabet soup of monetary experimentation that includes YCC (yield curve control). Not only is their economy NOT stimulated, but their yield curve is both negative out to 16 years AND inverted out to 14 years (data as of 8-24-19). Seems like the BOJ has NO CONTROL over their yield curve and their debt to GDP (all the money that flows through their economies) which is the highest in the world. Do you think the Yen looks “safe†to you?

But there is one flight to safety asset that really is safe, at least in physical form, commodity money (gold and silver). Central bankers and Wall Street have run to their safety. Both spot silver and spot gold’s price action has smashed through previously established ceilings. Soon, I believe, you will see new all time highs.

It is clear to me that the final reset is now, fast approaching. My question to you is, are you ready?

Slides and Links:

https://www.wsj.com/articles/china-to-impose-tariffs-on-more-u-s-products-11566562931

https://www.bbc.com/news/business-49450245

https://tradingeconomics.com/united-states/manufacturing-pmi

https://www.twitter.com/realDonaldTrump

https://stockcharts.com/h-sc/ui

https://www.cnbc.com/2019/08/27/us-treasurys-investors-monitor-trade-developments.html

https://stockcharts.com/h-sc/ui?s=$JPYUSD

https://stockcharts.com/h-sc/ui

https://stockcharts.com/h-sc/ui?s=$GOLD