RATES RISING, STOCKS FALLING: Will Inflation Save Us?

Part One: https://youtu.be/m7XODkkoIGg

Part Two: https://youtu.be/pS3X3x2s_s8

Video Transcript:

We are told not to worry about the up-coming volatility in inflation. That it is really a good thing. We are told that it’s not time to worry about the rapidly growing deficits. So says Fed Chair Powell in front of Congress this week. Now is not the time to think about budget deficits, frankly, it is never the time to think about budget deficits and spending more money than we take in. The current deficit chart from the FRED, only goes through 2020. This does not reflect anything from 2021. This makes the deficits in 2008 look like nothing.

You can see where we were through 2020, but the reality is, we have printed a whole lot more money and taken on a whole lot more deficits than this. Do you really, really, really think this is not having an impact and they’re trying so desperately to generate inflation, but wow, he sure doesn’t see a burst in spending leading to high inflation because it’s all going into the stock market, the bond market, the real estate market, but it’s also going into other people’s pockets, which I’m going to show you that in just a minute, but nah, and don’t forget about that massive amount of liquidity that we expect to see coming out of the treasury and going back to the fed within a week or so. And additionally, he’s warning us. Now, remember this setup first, they had a 2% inflation target, which they never met since 2008.

Although if you look at what you buy and use every day, it’s really more like 10%, not under 2%, but that’s another story for another day. Then they went to an average target of 2%, justifying their numbers running above that 2% inflation rate. And they’re warning us. Inflation may be volatile over the next year, but frankly, it’s not like prices go up and then prices go down, prices go up and then they go up and then they go up and then they go up. You see what I’m saying? So this is all garbage for sure. And you have to think about it. So I want you to know that you, we, all of us have been warned about the massive inflation that he knows is coming between the treasury de luge and the government and their own day luge. I mean, it’s, it’s, everybody’s working in concert here. And boy, they will push that inflation because they don’t have any other tools. Now, yesterday there was a seven-year bond auction and frankly, uh, Rick Santelly can say it much better than I can. So I’m just going to let him do that:

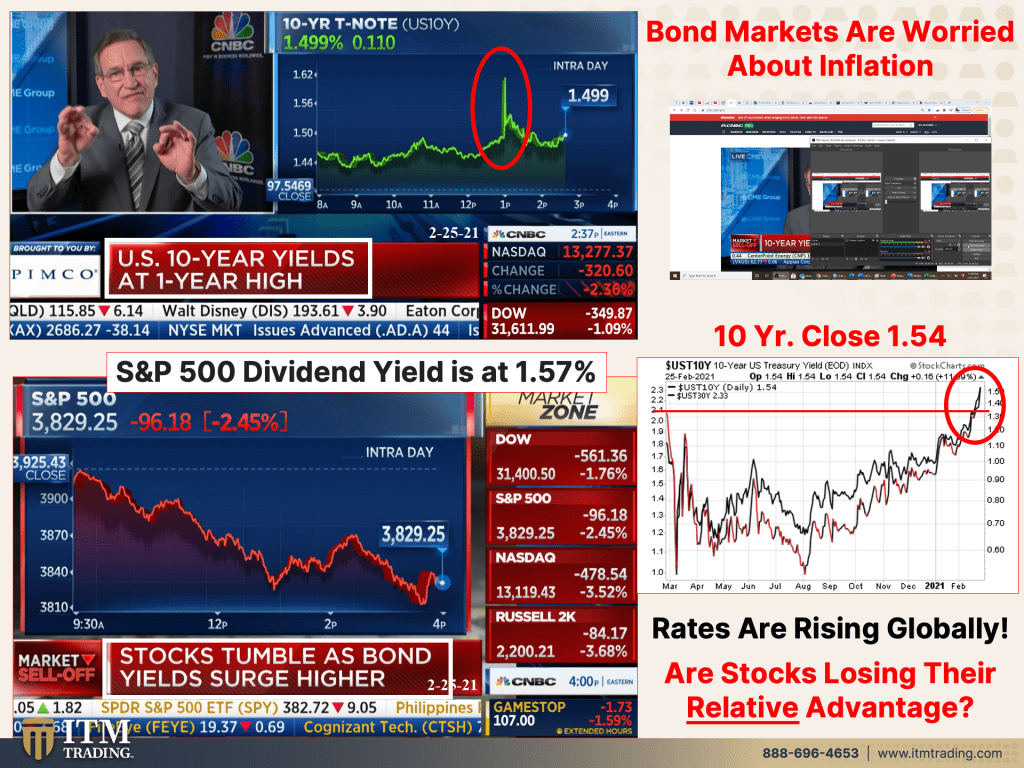

“Man, like right now, Rick, how’s this I’m Holy my nose for anybody watching the radio. This was not a good auction. Matter of fact, this might be one of the worst options I’ve graded ever. First of all, it’s 62 billion, which is tied for the record size. The last auction for sevens was 62, two years ago. These auctions were like 32 billion. Just give you an idea. The yield at the Dutch auction was 1.195, which is like four basis points above where it was trading in the one issued market, higher yield, lower price. That pretty much says it all that gives you your D minus right there. Now, when we go through the numbers, it’s sort of shocking the bid to cover 2.04. I couldn’t even find it 2.04 since the seven years been around, uh, 38.1 was indirect. That’s the worst since Thanksgiving of 2013. And if we look at the only bright spot direct bitters at 22.1 best since December of 19 head swans mutual funds, they jumped in to some extent, but nobody else did, which meant primary dealers took the most they’ve ever taken since September, 2014, a whisker under 40%. These numbers are atrocious, but it shouldn’t be shocking considering how much higher yields have moved over the last several weeks and drew back to you. Okay. I need a prediction though, on the ten-year cause everybody’s going crazy about where that’s trading at right now. We just hit over one five here and the whole equity market is trading off of it. Yeah, no, I think we’re going to definitely do some pausing in the one 50 to one 55 area. But I think ultimately Andrew, I told Joe this about a month and a half ago, ultimately one six, seven to my next real resistance level in ten-year note yields, but don’t underestimate the low one fifties. We have some key bottoms there from about a year and a half ago. Okay. Rex.”

Okay. So is the appetite for treasury bonds declining? That was a D minus. You heard all of that just at a time when the government is not just releasing a lot of liquidity back to the fed and into the markets, it’ll be forced fed into the markets, but also at a point when the government is issuing a tremendous amount of debt. Now here’s the, here’s the key because rates are rising globally. This is not just happening in the U S this is a synchronized movement. So we need to be aware of that. But the yield, the dividend yield is at 1.57 on average, on the S and P 500. So when we get 10 year yields near that level, that’s why you’re seeing the stock market’s decline because the bond markets are saying this inflation is not good. I don’t care what fed chair Powell says.

It is not. What’s about to happen. I mean, it’s a tsunami. Are the markets breaking down? What can I say? But if you listen to the talking heads, what are they relatively speaking? So when you had interest rates on the 10 year, which is the bedrock of the global financial system down below 1%, and you could get a better yield on stock that was justification for the stock market’s rise. There’s lots of reasons why the stock market’s rising and all of that has to do with leverage and debt and margin, which is more debt, more leverage. But these rising yields could well be the pinprick that we go into a major correction at. I don’t know, because they want to keep these markets flying. So how can they do that? Well, there are a number of ways that they can do that more QE free money, but let’s look at the fact that we are now moving closer and closer to universal basic income.

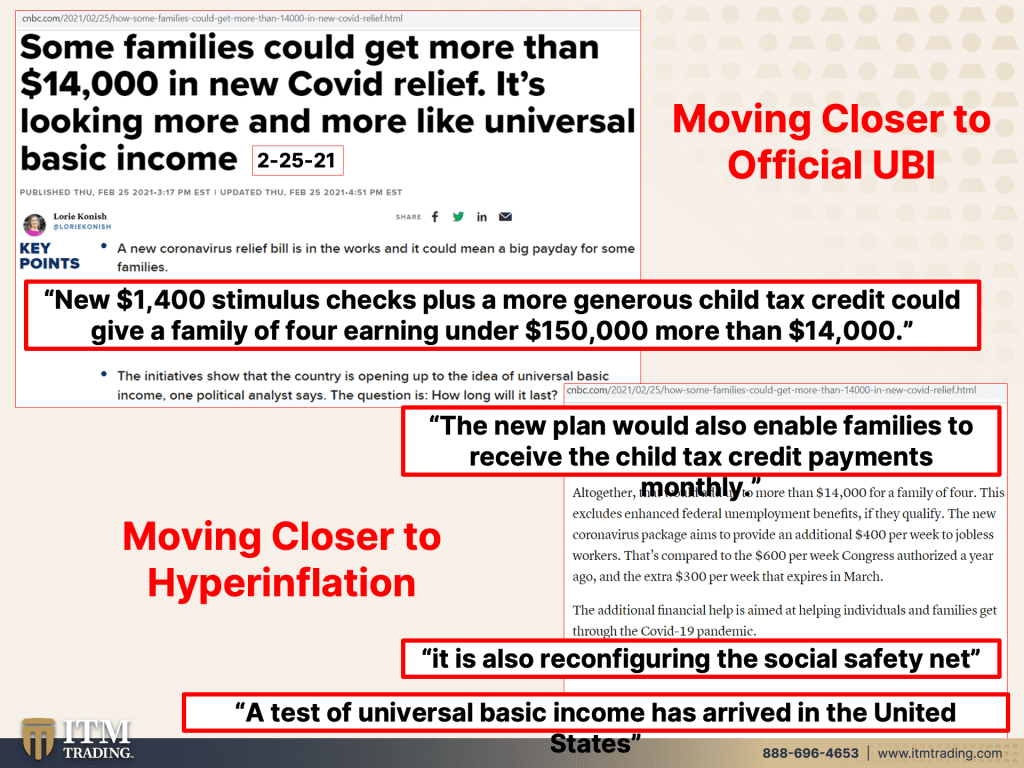

I thought this was really quite interesting. Some families, these are families that make 150,000 that would qualify for a whole bunch of benefits to get stimulus and tax credit at $14,000. And what I also found super interesting is that this new plan, which is not fully passed yet, it’s going to the Senate, but the new plan would enable families to receive the child tax credit payments on a monthly basis. So we are definitely moving closer and closer to UBI because part of what we’ve seen in all of this has been the rise of the individual investor, meaning if you’re making 75,000, 150,000, you know, to some people that sounds like a lot because the average income in 2020 was about 48,000. And I’m going to show you that in a minute as well. So, you know, you’re, you’re looking at getting stimulus checks and these do not include the enhanced unemployment benefits.

So if somebody qualifies for all of that, they’re getting more than 14,000 a year and breaking it down into monthly payments. Interesting. So should this pass. It is also reconfiguring the social safety net, which we saw how well that worked. I mean, I personally know people that certainly qualified independent, uh, massage therapists, et cetera, that absolutely qualified under the new plan for unemployment benefits that didn’t get them, didn’t get them. So it’s not that everybody that qualified could get them, but it is reconfiguring the social safety net to include U B I, a test of universal basic income has arrived in the United States. If these families don’t need all of this money, cause there’s a lot of it that’s going into savings, which is also kind of, as we talked about the other day, creating some headaches for the banks to absorb that treasury cash.

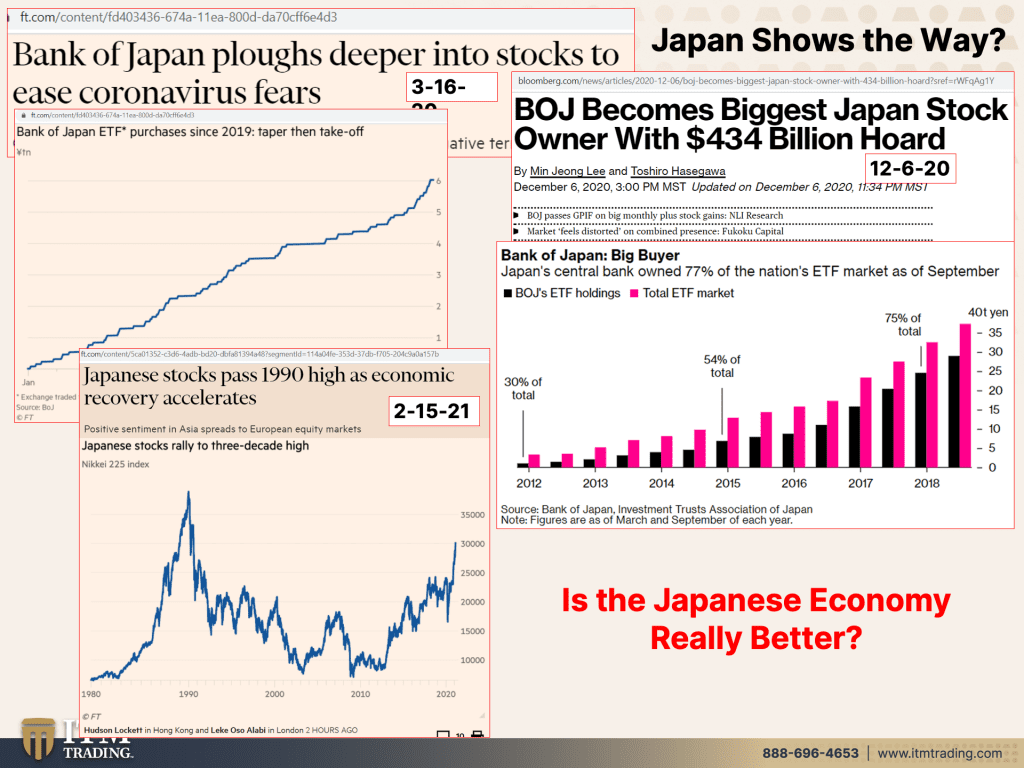

I mean, we are between a rock and a hard place, but we are a consumer-driven economy. They’ve got to keep the economy at least and giving it an appearance of being okay. UBI is here today. We are moving closer and closer to hyperinflation. And of course, Japan in many ways shows the way to keep these markets rising. Now I’m not saying that Japan is in hyperinflation, but we all know that they have been in deflationary mode since the early nineties, and they’ve never been able to pull out of it. And so the way that they have kept their stock markets going is by buying up a markets for both stocks and bonds. Now we’re doing the bonds 120 billion a month. And that’s, as far as the eye can see, and we’re even doing some things in the corporate debt market, et cetera. But, you know, bank of Japan has been really the first to do so many things and they have now become the biggest stock owner. So they’re really also picking the winners and the losers. You tell me who has more fiat money than those that can create it. The central banks, government pension agencies, et cetera, 74 in 2018, they were already at 75% of the total ETF market. So is that going to come here? Yeah, I’m thinking it well, we’ll wait and see time is going to tell, but I love this because this just came out recently, Japan, Japanese stocks past 1990 high as economic recovery accelerates.

I mean, you just can’t make this stuff up. Do you really thinks that nobody pays attention to the fact that these stocks are making new highs because the bank of Japan is buying them. I mean, it’s really ridiculous. And you have to ask yourself just because the stock market is back to 1990 levels, right? It’s past 1990 levels. It’s not up to there yet. Mind you, it really makes the economy better. It’s the stock market rises, but the real economy is floundering because that’s what’s happening here too. No, it doesn’t make it better. It just makes things a lot more extreme. And we are moving into the digital age and there are things that we have to really pay attention to. And you have to think about what could happen once everything. Well, not everything because obviously we’ve got to live in a tangible house and sit on a tangible chair and drink from a tangible glass. But what happens when we hold our equity and our wealth in digital form, what could possibly happen with that?

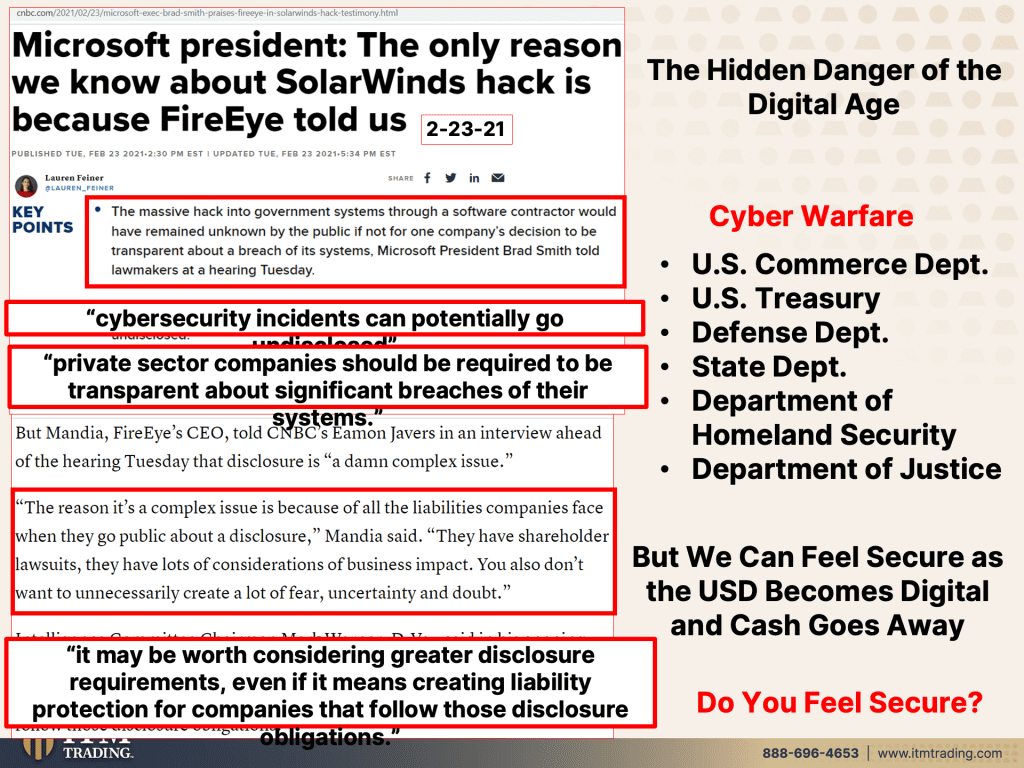

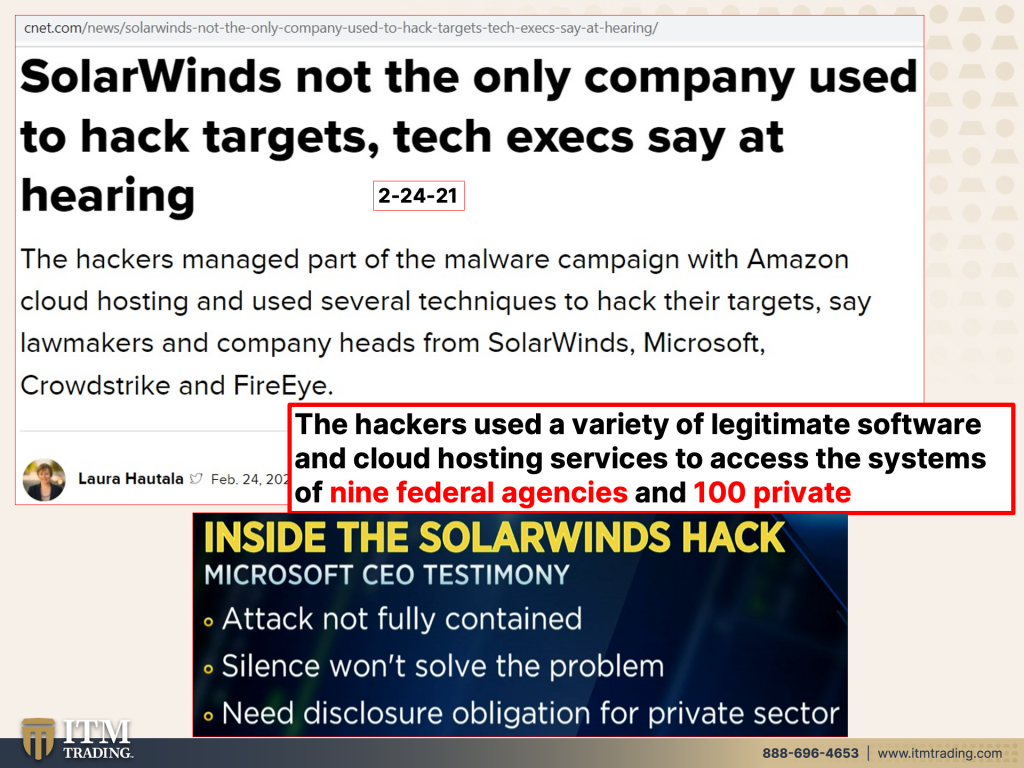

We’ve talked about the solar winds hack attack back in January, but here it’s coming back again because of course now key players are in front of Congress explaining things, Microsoft president, I love this. Do you love this? Because we’re just going about our lives. We’re not paying attention to any of this. We’ll go online. We buy things, we do things. They want us to hold all of our wealth in digital form, you know, the, the equity in your house. So it makes it easier to transfer that wealth. And it’s also makes it easier to steal it. But the only reason that we even knew about the solar winds hack is because FireEye told us, one of the agents told us the massive hack into government systems through a software contractor would have remained unknown by the public. If not for one company’s decision, to be transparent about a breach to its systems.

And that was Microsoft president, Brad Smith telling lawmakers at that hearing. Okay. How many of these hacks do we not know about? Because it poses a risk and a, an illegal risk to the company’s cybersecurity insurance incidents. I liked, they say, P can potentially go undisclosed. Most of them do go on disclose until it’s leaked or there’s some other problem that comes up. So now they’re talking about cybersecurity, private sector companies should be required to be transparent about significant breaches of their systems. Well, let’s see what systems were hacked. There were a hundred companies and at least nine or 10 government agencies, commerce department, treasury defense state department, department of Homeland security, and recently admitted department of justice. These were all hacked, but you know, can we feel secure as the us dollar is becoming a digital dollar and they get rid of cash.

This is why I keep telling you, you want to have a real diversified portfolio, not wall Street’s version, where you have stocks and you have bonds and your lead ETFs, and you have mutual funds. You heard Rick San tele say who’s buying whatever little bit of bonds that were bought mutual funds and entities that spend your money. You’re the one that takes it on the shorts. If that’s what you’re invested in, that’s why it’s important to have physical gold and physical silver in your possession that you can convert as needed. I do not intend to hold a whole lot of digital dollars. I intend to hold a lot, a lot more golden, silver and convert as needed. Additionally, the reason why it’s a complex issue to have the companies disclose is because of all the liabilities companies face. When they go public about a disclosure, they have shareholder lawsuits and they have lots of considerations of business impact. You know, we were hacked to maybe we don’t want to do business with them. You also don’t want to unnecessarily create a lot of fear, uncertainty and doubt. No. Why would you want anybody to make an educated choice? My goodness. That’s crazy. Talk. Let’s just keep it all hidden. So when it happens, you cannot be prepared. I would rather be 10 years too early than one second, too late.

And I think you might want to be that too. It may be worse. So here our government, it may be worth considering greater disclosure requirements, even if it means creating liability protection for companies that follow those disclosure obligations. I mean, I don’t even know what to say about that. And it’s not often I’m speechless as well. You guys know. So you got to ask yourself, do you really feel so secure, especially as they transition us into the digital dollar and to more on the solar winds. Okay. So that was the 23rd. This is on the 24th solar winds, not the only company used to hack targets. So they get in there and then they use the normal channels of the, um, cloud hosting services to access the system. The hackers used a variety of legitimate software and cloud hosting services to access the systems of nine federal agencies.

And actually it came out after this. So I would say 10 federal agencies and a hundred private companies could now, do you know if one of the companies that you work with was hacked? I know no, but they’re saying still that the attack is not fully contained, so it’s still going on and they haven’t gotten rid of it and it’s not contained, but you’re not really hearing that much about it or you cause silence. That’s the thing, silence won’t solve the problem. Don’t look at the man behind the curtain with all of this money printing. Can you see all of these different balls that are being juggled? You think any of them are going to drop? They need disclosure obligation for the private sector, not the government sector, mind you, the private sector needs disclosure obligation. Yeah. That’s actually something that I would absolutely want to know.

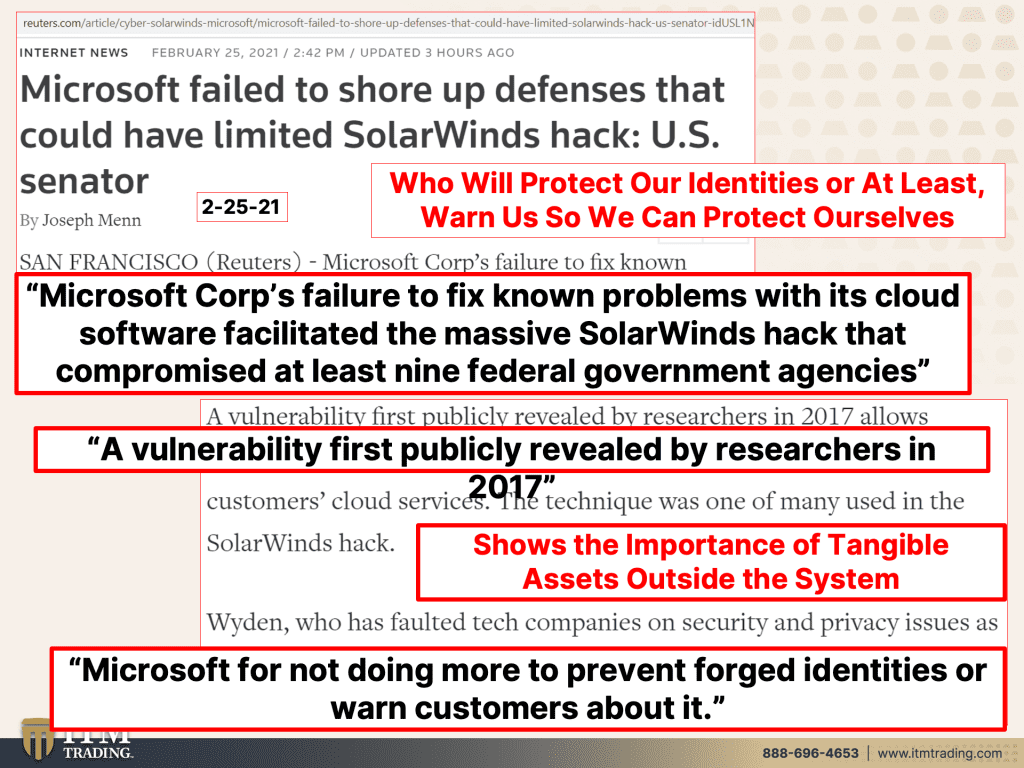

How about you, because if we can’t trust these major technology companies who have now, you know, and been determining who could say what, when and where, who will protect our identities or at least warn us so that we can protect ourselves, we need to be as independent and self-sufficient as we can possibly be. You need to have wealth that is not inside of this fiat money digital system. You need to have tangible wealth. Absolutely. A hundred percent because Microsoft failed to up defenses. They’ve known about it since 2017, they’ve known about this problem. Microsoft Corp’s failure to fix known problems with its cloud software facilitated the massive solar winds hack that compromised at least nine federal government agencies, at least because they don’t really know how broad spread that hack is. They don’t know that yet. It’s not contained. It’s not contained, right? He told you that Microsoft is for not doing so. W who has faulted tech companies. So Wyden who has faulted tech companies on security and privacy issues says Microsoft for it. Well hammers Microsoft for not doing more to prevent forged identities or warn customers about it. When do you want to know about any of this stuff, any of it afterwards or before, and are you brave enough to take the steps, to protect yourself and make sure that you can sustain your standard of living and take care of your family?

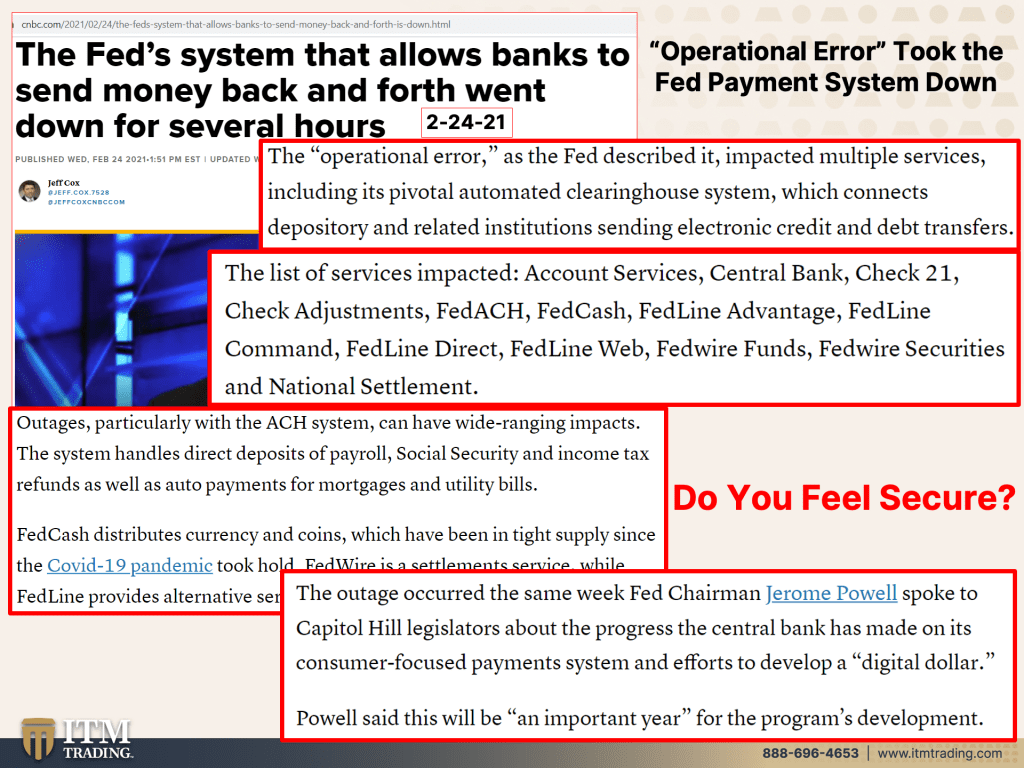

The fed system went down for operational errors, but here’s the problem. I mean, they’re now wanting to expand their payment system in a very aggressive way. The operational error, as the fed described, it impacted multiple services, including its pivotal automated clearinghouse system, which connects depository and related institutions. So, so banks sending electronic credit and debt transfers the list of services impacted account services, central bank check 21 check adjustments, fed ACH, which we use the ACH at every week. Fed cash fed line advantage fed line command fed line direct fed line web fed line wire funds fed wire funds fed wire securities and national settlement. That’s what it impacted, but it matters because particularly with the ACA agent. And like I said, that’s something that we use here because we’ve got payroll, um, can have wide ranging impacts.

The system handles direct deposits of payroll, social security, and income tax refunds, as well as auto payments for mortgages and utility bills. The fed cash distributes currency and coins, which have been in tight supply since the COVID-19 pandemic took hold and fed wire is a settlement service while fed line provides alternative services to the ACH system. So we’re talking about the systems that you and I would use on maybe a daily basis, maybe even for some on an hourly basis. These are key services that all went down. The outage occurred the same week. It loves this. I love this so much. You just can’t make this stuff up. The outage occurred the same week, fed chair, chairman Jerome Powell spoke to Capitol Hill legislators about the progress the central bank has made on its consumer focused payment system and efforts to develop a digital dollar, which I promise.

I promise I’m promised, we’re going to talk about next week. Pal said, this will be an important year for the programs development and they plan on bringing it out by 2023. And again, you got to ask yourself, does this make you feel secure in having your digital life, everything online? Because it does not make me feel secure at all. And this is why, I mean, honestly originally in my plan, um, I had anticipated converting a lot more of, you know, other than the legacy goal that I hold all of the other gold into fiance, into income producing assets, et cetera. But once I saw that they were taking us digital, no, because it’s easy for it to disappear and a hundred percent of the time because I can always convert anything that’s physical into any currency. I see. No, I will convert it as I need it because that’s how I feel more secure.

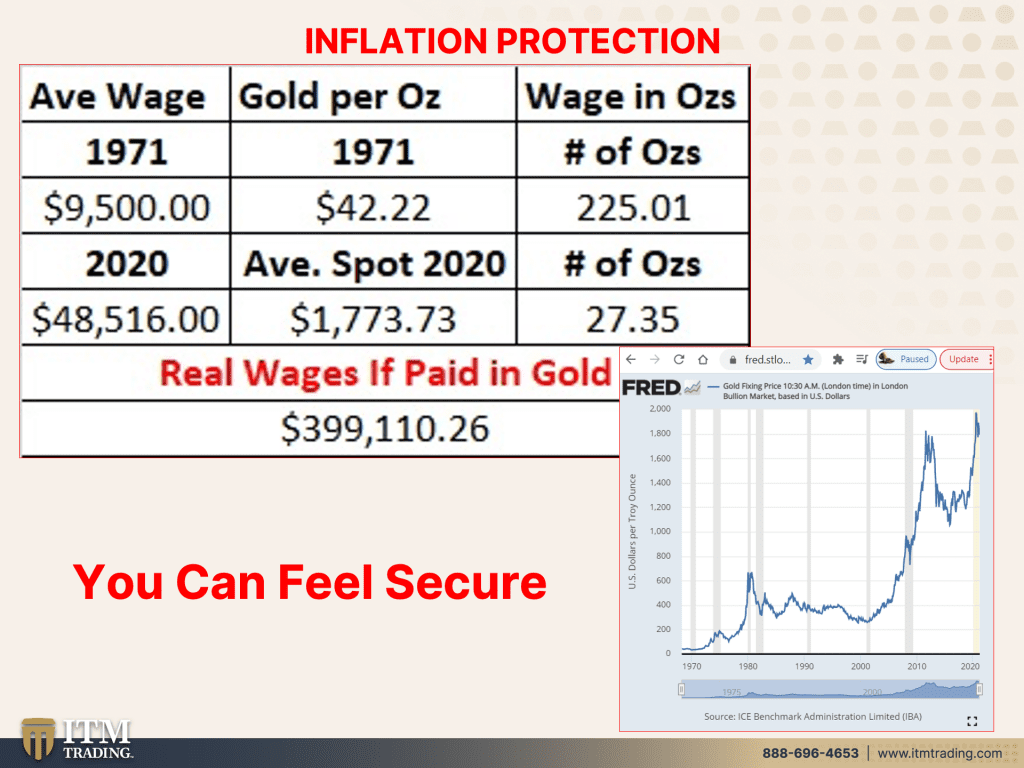

It’s really going to give you that inflation protection. Well, here you go. Average wage in 1971 9,500 bucks average wage in 2020, 48,516. Whoa, Whoa. It really sounds like I’d much rather have 48,516 though. Mind you, you’re getting stimulus checks. If you make 75,000 a year, right? And in 1971 price per ounce of gold, 42, 22 average spot in 2020 $1,773 and 73 cents. Look at how much gold you would have had if you had just gotten at 9,500 bucks, 42, 22, you would have had over 225 ounces of gold for payments. If you did not get a raise, but you were paid in the same amount of real money, gold, that would have been $399,110 and 26 cents. You probably would not need the stimulus payments at this point. I mean, as we go into hyperinflation, once the UBI goes through and people feel confident that they’re going to keep getting that money, they will go out and start to spend it.

And that’s when we will see the hyperinflation in earnest, but make no mistake. We have a lot of inflation. This is just the spot market since 1971. I don’t know. What do you think holds its value better? That’s true. That’s its primary function. It is to hold its value over time. The short-term manipulations and gyrations. Yeah, they can look. It was designed to keep you away from gold, but don’t believe the garbage because at the end of the day, that is how they reset. The currency is against gold. That’s when you will see it express somewhere near its true fundamental value, I’m probably overshoot it because that’s what always happens. Get to safety, make sure that you feel safe and secure. This is critically important.

Now, uh, this week I was on with David modal and it’s been a while and it was really fun getting back with him again. And the link is in that description next week should be super interesting though, because I’m going to be on rice TV, X channel with Chris rice and Lee from PMPs investment chat. And we had a great time. The last time we’re going to, I’m pretty sure we’ll probably be talking about different currencies, et cetera, but you know, make sure that you check our socials for real-time information update dates. And I know because I see Edgar doing it all the time. Those behind the scenes look at ITM, whether we’re in the office or we’re here and beyond that, it is absolutely. If you liked this, please give us a thumbs up. Make sure that you share this. This is critically important at this period in time that you share with as many people as you can.

And I know not everybody wants to know this. It’ll be up to them. You can lead a horse to water, but you can’t make them drink, but at least, you know, you let him there. And that means a lot because one of these days they’ll go, boy, I wish I had listened to you, but I hope that you’re listening to me. I hope that you’re positioning into golden silver while you can, but also food, water, energy, security, shelter, and community, because that’s what they need in Texas. Right now. All those people were unprepared. We don’t know. Think about what happened to you in March last year. Were you prepared? Get prepared, please get prepared. Can you see all of the balls they’re juggling and all the insanity that’s going on? We’re running out of time. I can tell you it’s going to be tuned Tuesday morning at eight 35, but it could be. And I’ll be just as surprised as you not shocked because I’m prepared and I won’t be upset. I won’t be caught off guard because I’m prepared.

How do you eat an elephant one bite at a time. Get started eating that elephant please because a hundred percent, a hundred percent, it is time to cover your assets here at ITM trading. We do that with the wealth shield, which is based upon my studies of currencies that I’ve been studying since 1987. And then we’ve got a whole bunch of very, very bright people there that have been in the markets forever. And we all work this stuff together. We want to help you be prepared in every way that we can. And so we’re going into a weekend. I hope you have a wonderful and fun weekend. Maybe go out, digging the dirt a little bit, plant a garden, make sure that you get prepared until next we meet. Please be safe out there. Bye bye.

Slides

Sources

Slide 1: N/A

Slide 2: N/A

Slide 3:

https://www.cnbc.com/2021/02/25/how-some-families-could-get-more-than-14000-in-new-covid-relief.html

Slide 4:

https://www.ft.com/content/5ca01352-c3d6-4adb-bd20-dbfa81394a48?segmentId=114a04fe-353d-37db-f705-204c9a0a157b

https://www.bloomberg.com/news/articles/2020-12-06/boj-becomes-biggest-japan-stock-owner-with-434-billion-hoard?sref=rWFqAg1Y

https://www.ft.com/content/fd403436-674a-11ea-800d-da70cff6e4d3

Slide 5:

https://www.cnbc.com/2021/02/23/microsoft-exec-brad-smith-praises-fireeye-in-solarwinds-hack-testimony.html

https://www.wsj.com/articles/solarwinds-discloses-earlier-evidence-of-hack-11610473937?mod=hp_lead_pos7&mod=article_inline

Slide 6:

https://www.cnet.com/news/solarwinds-not-the-only-company-used-to-hack-targets-tech-execs-say-at-hearing/

Slide 7:

https://www.reuters.com/article/cyber-solarwinds-microsoft/microsoft-failed-to-shore-up-defenses-that-could-have-limited-solarwinds-hack-us-senator-idUSL1N2KV071

Slide 8:

https://www.cnbc.com/2021/02/24/the-feds-system-that-allows-banks-to-send-money-back-and-forth-is-down.html

Slide 9:

https://fred.stlouisfed.org/series/GOLDAMGBD228NLBM