[PT. 2] China Bans All Cryptos as They Increase Gold Ownership…by LYNETTE ZANG

China used to be the main engine for crypto currencies, with most of the mining and trading happening there. Crypto adoption was encouraged, because that would support the goal of getting the population comfortable with this new form of currency. But whenever the communist party feels threatened, everyone can see who is really in control.

Because that is really what programable currencies are all about for governments and central banks, though it is most obvious in China. Therefore, China loves crypto currencies as long as the communist party is in control.

Back in March the PBOC (People’s Bank of China) stated that the digital Yuan would co-exist with Alipay and WeChat payment systems.

TRANSCRIPT FROM VIDEO:

Do you really think that any government is going to give up their money monopoly? But there is a way that you can take it away from them coming up.

I’m Lynette Zang Chief Market Analyst here at ITM Trading, a full service, physical gold and silver dealer specializing in custom strategies. And I’m telling you right now, we all need a plan. And I hope that plan really includes community because that’s going to be really important moving into our future. But today I have to talk about, you know, cryptocurrencies what’s happening in China.

So let’s just begin because frankly, China does love their cryptocurrencies, but they really want to be able to control them. They really want to be able to control them. And you know, all governments when private private enterprise is developing something, they’ll stand back. They’ll give it lots of room. And it particularly when they see the benefit to them (governments/central banks) they will give them lots of room. And that’s really, what’s been happening with cryptocurrencies. And remember, Bitcoin came out in 2009.

Now I have to tell you, I am not making a statement here on whether cryptocurrencies or Bitcoin or any of those digital currencies are good or bad, or you shouldn’t, you shouldn’t have them. That is entirely up to you. But what I do want you to realize is that they are not so independent and free from the system as many want to believe and think that they are, and, you know, right along, China has really been instrumental in supporting the emergence of it, but also showing what happens when they feel like the, the the party is getting a little bit out of control. So initially, you know, Chinese digital Yuan, and of course, China is more advanced in bringing out their own digital currency than most other countries are. So at first they were like the digital Yuan will co-exist with Alipay, WeChat, etcetera.

Now, Alipay and WeChat are not digital currencies because they actually use the Yuan, but they are a payment mechanism and governments, central banks rather really want to control those payment mechanisms. That’s what they’re trying to figure out with the CBDC’s, because if they can control those payment mechanisms, at least the view of what’s happening in there, then they can determine, you know, if you’re being, oh, let’s say honest with your full income, because they can see what you’re spending and further tying it to the bank accounts. They can see what goes in. They can see what goes out, but wow, this is only back in March because we’ve talked about this topic a number of times. Yeah. We’ll just work right alongside Alipay, WeChat, etcetera. And they were bringing out and testing their own digital Yuan, which apparently kind of fails because people are really more in the habit of using in China anyway, using Alipay pay and WeChat. But you know, again, you go back to, is any government really going to give up their money monopoly when that’s really how they control the population is they get them to use their form of Fiat money as we saw the other day. But you know, as we see governments and central banks have captive audiences, captive local audiences, and that’s part of the design, because if you’re captive, like here in the U.S. Most people really are buying into, you know, dollar denominated, bonds and stocks, etcetera. So it’s kind of a captive audience, particularly when the government says, this is what you have to do, right?

The rise of the digital Yuan…I’m sorry, I’m having some challenges today. And I know that we’re alive. So, you know, this is absolutely live, but it does bring new challenges for the tech giants because the communist party feels threatened by how Western these people are behaving. We talked about that in part one of this Tencent and Ant Group spent a decade digitizing money and payment networks. Now the government wants a larger role because over the last few years of this internet technology, boom, private companies have swallowed up the markets and regulators have fallen behind. We’re seeing this really on a global basis, but at the end of the day, and it says the Chinese government will step in and reign it in. Regardless. I think that you could put any country in there. At the end of the day, there is no way that any government is going to give up their money, monopoly or central bank give up their money monopoly. It’s too lucrative for them. If they did that, then they would not be able to print the money or create out of thin air or out of debt, the money that they need to pay their debts. So it would really restrict what they could do. This is a battle Royale. I cannot tell you who’s going to win this battle, but there are Titans going up against each other. And part of it will have to be to make these companies smaller, because that way they cannot challenge the government.

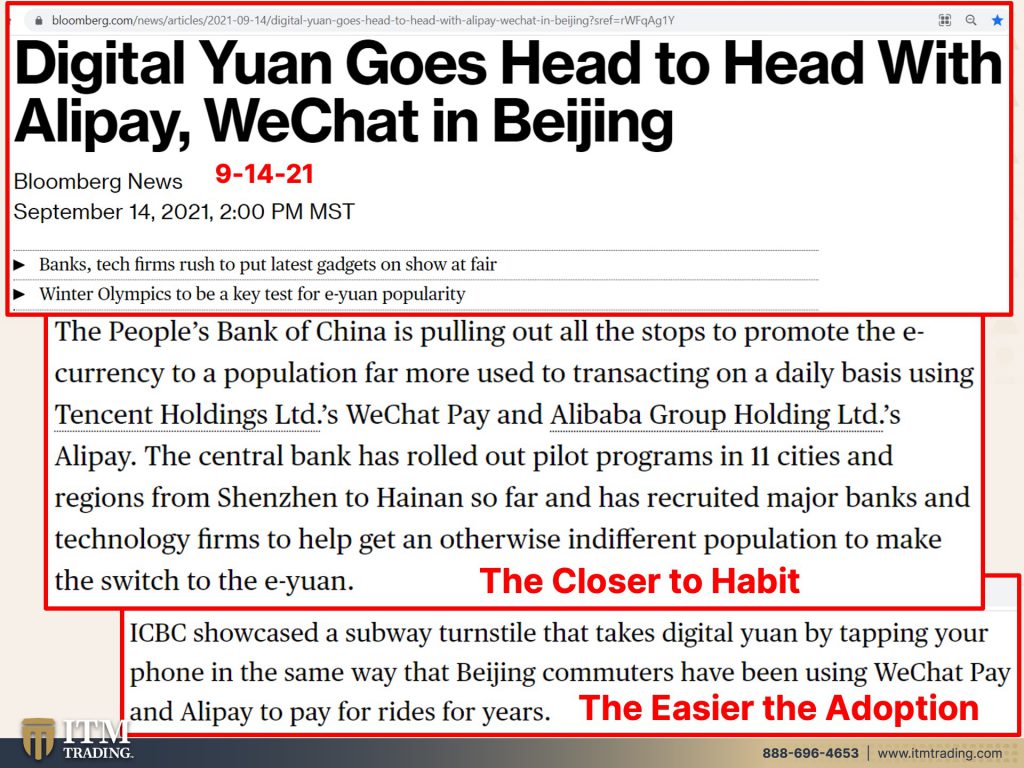

But this spring, Chinese regulators took their strongest actions yet to cut down on cryptocurrency mining. So now instead of working alongside, like they were talking about in March here we are six months later in September. And the digital Yuan goes head to head with Alipay and WeChat. Are they going to win? I don’t know, banks, tech firms rush to put latest gadgets on the show at the fair and winter Olympics is to be a key test for e-yuan popularity, but the People’s Bank of China is pulling out all the stops to promote the E-currency to a population far more used to transaction transacting on a daily basis using WeChat and Alipay pay. The central bank has rolled out pilot programs in 11 cities and regions from Shenzhen to Hainan so far and has recruited major banks and technology firms to help get an otherwise indifferent population to make the switch to the e-Yuan. So how do they do that? Well, ICBC, which is a big bank there, showcased a subway turnstile that takes digital Yuan by tapping your phone in the same way that Beijing commuters have been using WeChat pay and Alipay to pay for rides for years. We have talked about this so often, how do make a change in currencies and get the population to just go along. You keep it as close to what they are used to as possible. So that’s what the, what the central bank is attempting to do with the Yuan. Keep it as close to what they are used to as possible so that they can capitalize on that habit and it for much easier adoption.

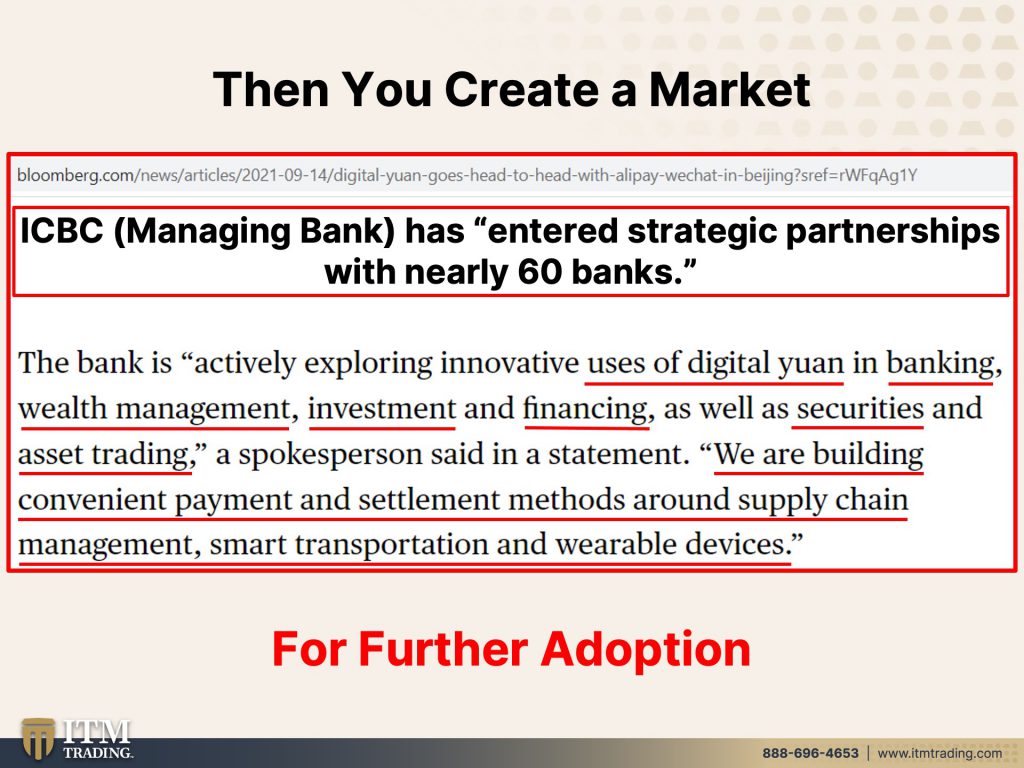

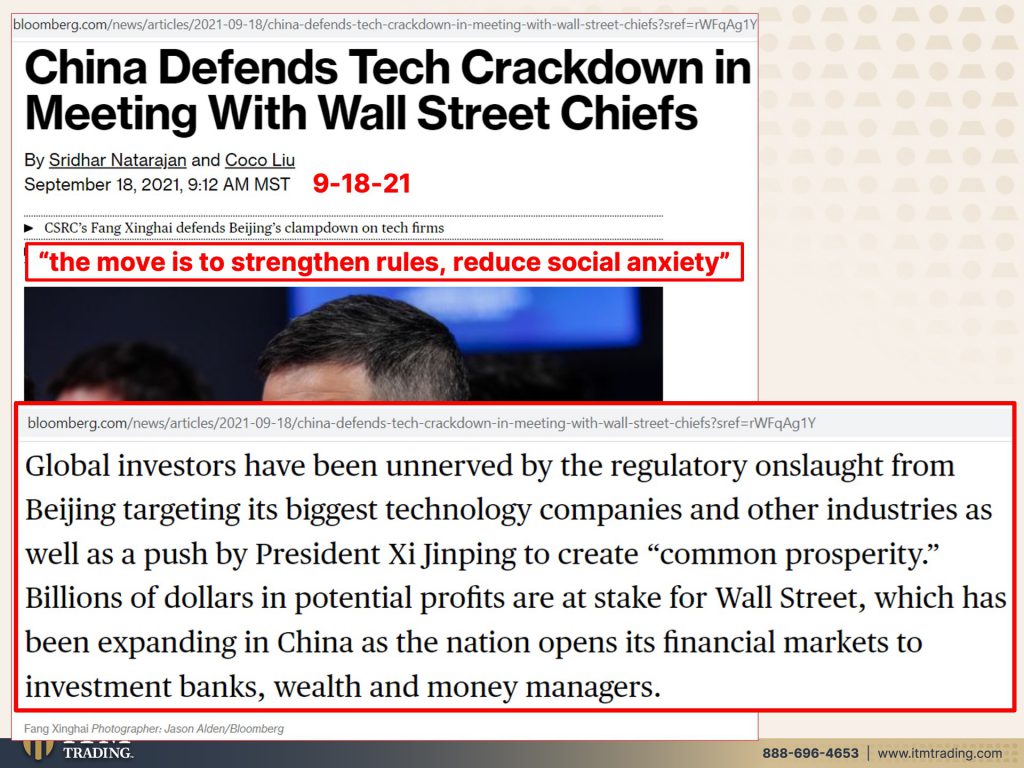

Then you have to create this market because there’s a very small market for the digital Yuan. So now that’s what they’re working on. So they’ve tested in over 360,000 application scenarios and entered strategic partners with nearly 60 banks. Okay. The bank is actively exploring innovative uses of digital Yuan in banking, wealth management, investment and financing, as well as securities and asset trading. So they are creating this market. You know, we’ve seen how Wall Street creates a market, and we’ve also seen some successes and frankly, we’ve seen some failures. China has been instrumental in making a strong attempt to create the SDR market for the IMF once they were entered into the basket. So there’s some level of experience with that, although you don’t really hear too much about how that experiment has gone. So now they’re trying to create another market where people will accept the digital Yuan, and they can transfer that into their Fiat money assets and control the markets and the populations in that way. we are building convenient payment and settlement methods around supply chain management, smart transportation and wearable devices. So you’ve got a number of banks that are working on this, using that digital Yuan in all different ways and all different fiat money products. So people just adopted easier right now. It’s fully integrated into everything that you’re doing, but it’s created from nothing and there’s no privacy. So it’s much easier to track this digital transformation. And therefore not only just in the tracking of it, but it’s also in the control of it, but they will not have any competition and Wall Street. I mean, you remember we’ve had the integration of China into the global economy, really since 2000. And then in 2018, the MSCI introduced a lot of Chinese stocks into the emerging market indexes of the Chinese indexes. And so, you know, we are an interconnected world, and it’s interesting because, you know, you have the over here and I’m not sure what we are over here yet, you know, but this is true. We are all interconnected and we’re all learning from the other parties. So if you’ve got an experiment going on over here in China or in Turkey or in Mexico or anywhere else in the world, I guarantee you all the central banks are paying attention to see how that plays out, but there’s still going to have to placate Wall Street because Wall Street still has the largest market. Now, if China can grow that market and do it in a digital way, well, you know, then they could take over really the power and the control from the U.S. So they’re saying that the move that they’ve been doing with really going after the tech Titans and, you know, the whole move towards shared prosperity, although there’s still just a few at the top that control all this stuff for those at the bottom, but it is to strengthen rules, and this is really the piece, reduce social anxiety, because the last thing they want is a revolution. And there are a lot of things that are happening in China and around the world, frankly, that might be telling us that there is a global revolution that may be taking hold. I don’t know, but we’ll see.

Global investors have been unnerved by the regulatory onslaught from Beijing targeting its biggest technology companies and other industries, as well as a push by President Xi Jinping to create common prosperity. Billions of dollars in potential profits are at stake for Wall Street. Isn’t that really what matters all those profits. And they’ve been expanding Wall Street and U.S. Companies, corporations have been expanding in China as the nation opens its financial markets to investment banks, wealth and money managers, until they control until they close it again, which is highly. I mean, it’s possible. We do know that if you are a company doing business in China, you’re going to have a sell from the Chinese communist party as part of your organization. This is all part of knowing what’s going on. And also having a higher level of control. And China is all about a higher level of control and a full surveillance economy. And I wish I could just say, well, that’s over there. We don’t have to worry about it here, but I can’t say that that’s how I feel about it. I think all eyes are on China to see how to do it, and then they may tweak it so that it looks a little different. But unfortunately I think we’re all going in that same direction.

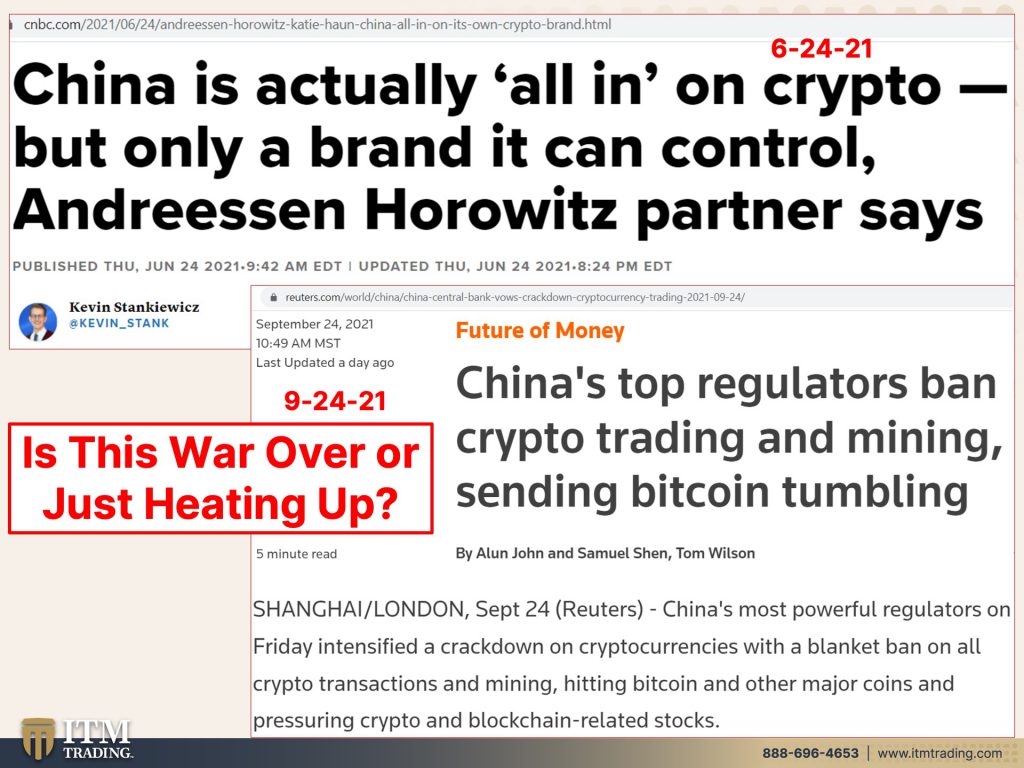

So we know China’s actually all in on crypto, but only a brand it can control. And that’s a simple fact. So when we’re looking at the future of money, well, China came out just recently and banned crypto trading and mining, and many other areas. In fact, all areas China’s central bank said, all cryptocurrency related transactions are illegal and must be banned. All cryptocurrency related transactions, illegal must be banned all crypto currencies, including Bitcoin and tether are not fiat currency. Fiat is by decree, that’s what it means and cannot be circulated on the market. The People’s Bank of China said on its website. Cryptocurrencies out of the system? Because what can governments do? They can make laws, regulations, rules, they can shut it down. They can determine many, many things. That’s, that’s the biggest power that they have, but this is a battle Royale. And I think it’s fascinating to watch competing currencies, one Fiat government decree and the other private kind of private anyway. But how do you counter all of that? And what actually can you do inside of this battle? Now, you all know that I have not bought into the cryptocurrency space because I am a long-term investor. I am not a short term trader, but, and I also know that this battle is going on. So when the battle is over and I see who is actually won, I can tell you, I’m going to be able to buy into it at much lower prices than I can right now, because even in that cryptocurrency space, you’re going to convert it into dollars, in order to get to do anything with it. So I want real money that holds its value until I see. And we come to the other side of this mess and we get settlement, right? Who’s going to win. Maybe it will be Bitcoin and tether. I mean, it certainly looks like that is a strong possibility because certainly Wall Street has created all sorts of products around that. And that’s the other piece, not outside of the system. So they’re making it easier and easier and easier for the average Joe to buy it. I have not made that attempt myself yet, but you can buy it through Square, lots of other places and there’s ETFs, which is even better for them buy the ETFs, because then what you have is a contract that tracks and underlying, but the point is, is that it is not as invisible and as private as we want to think that it is, but this is, and this is because when I hold it, I own it outright, no counter party risk. Can you see all the counterparty risk and everything that we’ve been talking about today?

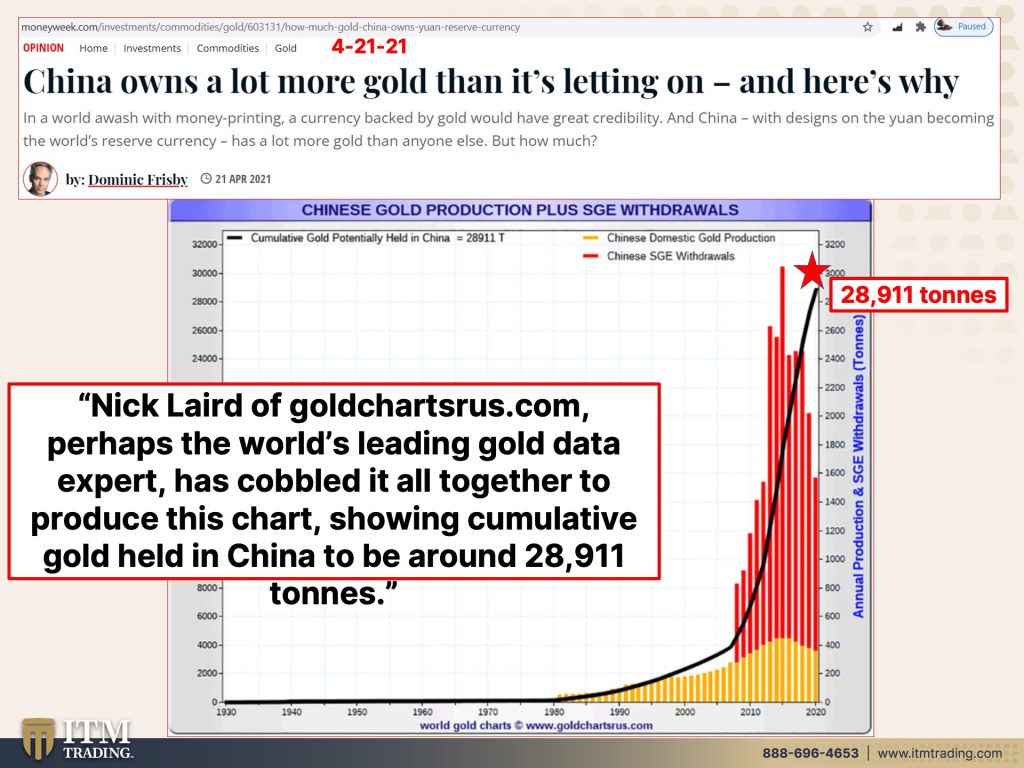

We know that China has been definitely accumulating gold. And what we don’t really know is exactly how much gold they actually have. Now, this is a chart from gold-charts-R-us and I have to say, they cobbled it all altogether to produce this chart, showing cumulative gold held in China. And they calculate that out to be almost 29,000 tons, far more than the 8,200 tons that the U.S. supposedly has. But the reality is, is it could be much, much, much, much, much, much higher than this because this just accounts for domestic gold production, which frankly, they don’t really publish those numbers. So who really knows how much gold they’re producing, no gold leaves the country. So if you go and visit China and you’re wearing a gold, any kind of gold or a gold necklace, you better declare it on the way in, or you’re not taking it out. And it also represents people taking physical delivery from the Singapore gold exchange, what is not on here, and I couldn’t find it I looked I couldn’t find it, but in 2006, China allowed their citizens to own gold again. And they made it super easy to buy it through the bank and hold and have the bank hold the physical gold, which means that if the Chinese government felt that they needed it, they could easily go in and confiscated at will. So this number, in my opinion is likely to be a lot higher than that. Why does this matter? Because whoever controls, whoever controls the physical gold, whoever holds that can maintain control because they’ve got purchasing power and they can go in and they can buy up all sorts of assets when nobody else can. And if they do indeed even hold 29,000 tons, that means that they hold more gold than any body else by a huge wide margin. Because I definitely do believe that China’s holding the physical metal itself. I can’t, I can’t say one way or the other for the U.S. Because we can’t really audit it. And they have done so much with leasing and convoluting this whole market who knows. So therefore that does really put China in the driver’s seat when this whole world goes into hyperinflation if they’re holding that much gold, that would make a really, really interesting when you stop. And you think about it. If China is indeed holding all of this gold and nobody else can even come close, because the truth of the matter is, and we’ve already seen this starting to happen when governments need to raise money and, you know, they’re limited on their taxes and other things. Then they start to sell off assets. China’s been a big buyer of global assets using their Fiat money or enabling debt, but we’ve got a big, we’ve got the battle Royale of money right now, what the deal is is the cryptocurrencies versus the CBDC’s. I know the Bank for International Settlements came out with a paper today. I haven’t read it yet, but I will. They came out with a paper today on, you know, why it’s a bit of a challenge central bank digital currencies. Most of it just as a cursory glance, because this has been in their documentation before is they’re concerned that during the next crisis, that the population would bypass the banks and go right to the central bank feeling more secure. So one of the big concerns are bank runs because they will not. If they have a central bank digital currency, how are they going to prevent that bank run? Well, they could put fees and gates like they do with money markets so time will tell on that, but we have to pay attention to this battle in China, because I do think that it’s showing us a way forward and we’re going to see the results of it.

And I think other central banks and other governments are going to follow suit. You know, we are seeing the threat of legislation on a global basis. So this is really starting to heat up. And we’re also, well, I don’t think this is going to pass, you know, but Janet Yellen would like the banks to report $600 or more. If you have in your account for all of your transactions, guess what? Once we’re in the CBDC, they won’t have to ask for permission for that, because they’ll just have all of that information and all of that access. So for me, if I want to prevent that, which I personally do, I mean, you’ve got to make your own choice, but I personally do. This is out of the system. And as the business says, it is number one, the only financial asset that runs zero counterparty risk or even political risk, but what do they say? Gold held at home ,in China most of the gold is held in the banks so it’s pretty easy to confiscate, but gold held at home runs no political risk. I like that because I think right now we are running all political risk.

Now this week has been a really, I mean, in many ways, a great week because I got to talk to, you know, Greg Mannarino and that was a very interesting and fun interview. And we’re not going to let that much time go. So I hope if you haven’t watched it yet, you definitely want to do that. And next week I’m going to be live with Jake Ducey up at my bug out house. So you want to definitely follow us for behind the scenes and also pay attention to Instagram @lynettezang And I’ve also been tweeting quite a bit, and some of the other consultants have been helping with that. So, because I know we’re all paying attention and we all work together on this. So, you know, if you liked this, please give us a thumbs up, make sure that you share, share, share, and we’re going to be paying attention to this circumstance and see how it unfolds.

Can China really get away with clamping down on cryptocurrencies or will the Chinese population figure out a way to go around the system? I don’t know, but I do know it is time to cover your assets. And here at ITM trading, we use the wealth shield and the foundation is gold and silver, but as we’re also witnessing all of these massive price spikes, which I’m certain are only going to get worse. Remember Food, Water, Energy, Security, as well as Barterability, Wealth Preservation, Community, and Shelter. And until next week, please be safe out there. Bye-Bye.

SOURCES:

https://www.cnbc.com/2021/09/15/chinas-retail-sales-grew-far-slower-than-expected-in-august.html

https://moneyweek.com/499249/how-much-gold-does-china-have-a-lot-more-than-you-think