[PT. 1] CHINESE CONTROL REVOLUTION: Will You Fight Back?…by LYNETTE ZANG

“The Chinese leader is extending the party’s dominance over civil society. The flurry of activity has many of the hallmarks of a new political era.â€

The world is watching China’s expanding control over their population. Do you feel horror about what you are seeing? Of course, you might say, “Well that’s China and we’re in ____†But my fear is that China is showing the world just how to fully control their population, particularly as I’m watching governments around the world manipulate popular thought and pit neighbor against neighbor, tightly control and position businesses to introduce and enforce government policy (as well as central bank policy) and remove personal rights and freedoms and even more.

Yes, this is a new political era, just remember that there is always opportunity in change. We can sit back and just allow global governments to take away all our rights, but as Benjamin Franklin said, “Any society that will give up a little liberty to gain a little security will deserve neither and lose both.â€

This assault is happening in so many areas these days that it can be overwhelming to the individual. After all, what can one little person do? But if we can come together in community, we are bigger and stronger. Certainly one of the most important ways to make our voices heard is the power of the purse.

This is where physical gold and silver comes in and why holding it outside the system, in your possession is absolutely essential. Become your own central bank and retain your freedom.

TRANSCRIPT FROM VIDEO:

Boy, I sure hope that you are ready for the new control era. We’ve got to talk about this. You need to see what’s happening, all that and more coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading, a full service, physical gold and silver dealer specializing in custom strategies. And you can tell, I am at my bug out location because we are furiously working on getting the rest of the solar installed. And I have to tell you with everything that I’m seeing going on, I personally have a major sense of urgency about where we are in this whole life cycle issue and when we may lose choices. So I’ve said many, many times you’ve heard me say many, many times that I think China is showing us the way. And we talked about Evergrande. They’ve got two interest payments that come due on Thursday. Today’s Tuesday. We’ll see what happens, but if they do not get bailed out, then I think you can expect to see more like a domino effect going through the Chinese banks and then the global banks. Because again, we are all incestuously interconnected.

I want to talk to you today about what’s really happening in China, because clearly they’re showing the world how to fully control their population and you and I have to make our choices because the reality is, is we vote with our purses. That’s how we vote. So if you just go along with what they have in mind, then you will be permanently going along with what they have in mind. I personally don’t think that that’s a very good idea, but what I can tell you is that on August 17th, the financial economic affairs committee declared it necessary to regulate excessively high incomes to ensure common prosperity for all, though, the thing is, is that there will just be a handful of people that is actually controlling that common prosperity, because when somebody is hopeless and hungry, they make choices, they would not otherwise make. And there is no government that wants to deal with that. Let alone the Chinese government. We’ll talk more about that. But the Chinese leader is extending the party’s dominance over civil society. And we’ve been watching this encroachment and they’re holding up the rich as the scapegoat because they know that people that are less fortunate than that. Well, they can get behind that. We’re going to talk more about that perception management, but perception management is not really a new political tool. It’s been around forever, in the U.S. It grew much stronger and became a real thing back in the eighties during president Reagan’s term, when he brought Rupert Murdoch over to, to guide that progress. But the other thing that I want to point out is that everybody is going, oh, well, this is just happening. They’re responding. Like this is something that’s just happening, where the reality is it’s an evolution over time.

You know, it was back in 2017 when the communist party wrote itself into company laws. So if you are a company now in this particular case, the referring to Hong Kong, but the reality is is if you are a company doing business in China, then you’re going to have a sell of the communist party at your company. And it doesn’t really matter where you’re from, because if you’re in China, that’s what you have to deal with is the Chinese political party wrote itself in the articles of incorporation. And they’re saying that it was for efforts to improve efficiency and productivity at state owned enterprises. But the reality is it’s positioning because there’s one thing that we know about the Chinese government. And that is, is that they’re very patient and very strategic. So they have been moving toward this moment in time for a long time. They’ve also allowed a lot of the tech entrepreneurs, the private entrepreneurs to thrive with mostly a hands-off approach until recently, which is probably why so many people seem surprised by it. But if you’ve been paying attention to the evolution, it should come as no surprise at all.

The capital market will no longer become a paradise for capitalists. I mean, this is really speak to set everything up, but the reality is, is anybody that is not part of the communist party. There, and even actually some members of the communist party and political opposition parties, nobody is immune from this and what’s happening in China. And they’re really focusing target so that they’ve got a scapegoat Xi Jinping is seeking to rebrand the communist parties, image both domestically and internationally. Hmm. You think? Yeah, they are look at, we care about all of the people that’s, who we care about the most. He wants this to demonstrate that socialism is better than Western capitalism and caring for all the population. Well, to be perfectly honest with you, what we have here in the west is not pure capitalism. It is crony capitalism. So real capitalism, look, if you fail, you fail on your own. You are not bailed out. And what we have here now is not like that, right? The winners and the losers have definitely been chosen, but he wants people to think that socialism is better than capitalism. And that China really cares about their population, which is absolutely the opposite of everything that we’ve seen, but they’re calling it a profound revolution that has been in a very long-term in the making with Jinping and the communist party in complete control. And where does it start? It starts with the children.

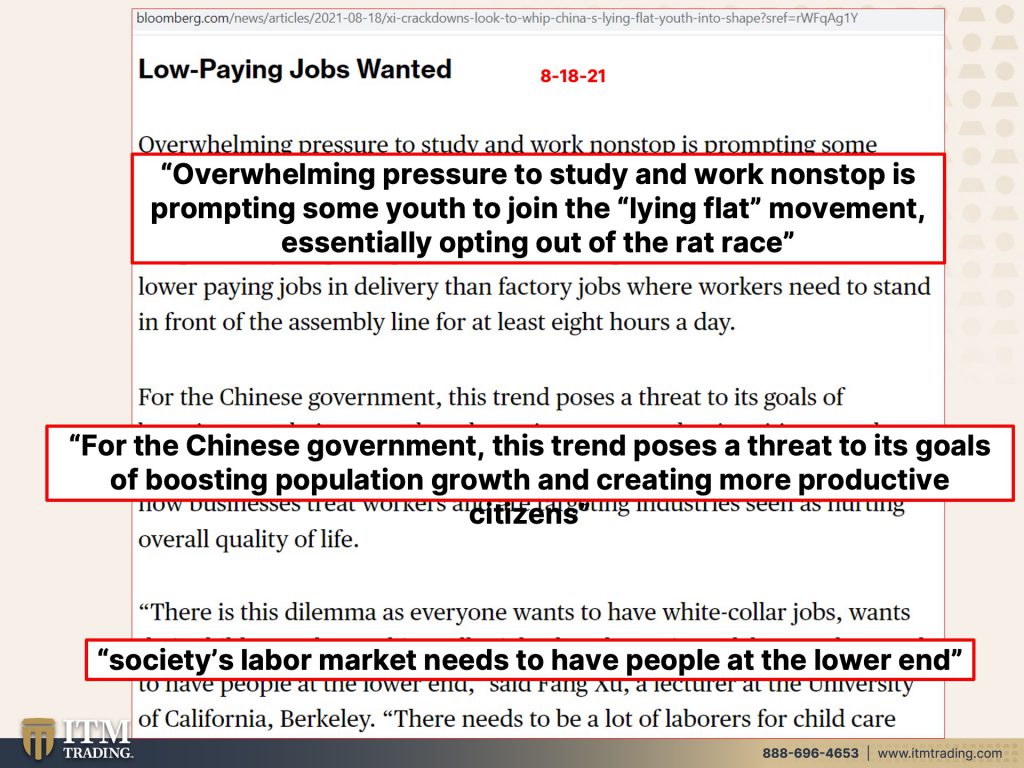

So, you know, we saw them take over Hong Kong of the first thing that they did aside from crushing any of the democratic movement there was to take over the school system because they’ve got to indoctrinate their young and they have some issues. China has some issues with an aging population and all those years of limiting population growth until they realized, uh oh, we are really in a bad way. And so they go back to the drawing board because part of what’s happening as those in China had more access to look at what was happening in the west. Well, you know, they didn’t really like the motivation in China where they just work. The kids saw their parents just work 24/7. So there’s a new movement in China called the “lying flat” movement and President Xi wants to ensure China has a strong manufacturing base. So you’ve got those at the top, but not everybody can be at the top cause you got to have a lot of workers, right? I think it’s really interesting. So the flurry of rules and state media missives targeting industries from afterschool tutoring to online gaming and entertainment are also aimed at ensuring the younger generation. Some of whom are starting to embrace a minimalist lifestyle known as lying flat. In other words, they would rather, they need a manufacturing base. So you’re standing on your feet all day long and you’re doing all of this repetitive work seven days a week, 12 hours a day. And there are some who would rather deliver food, I’d rather have an easier life. And that’s not really okay with the communist party, but even beyond that, where do revolutions start? They start with the youth, that’s where they start. So they better control the youth.

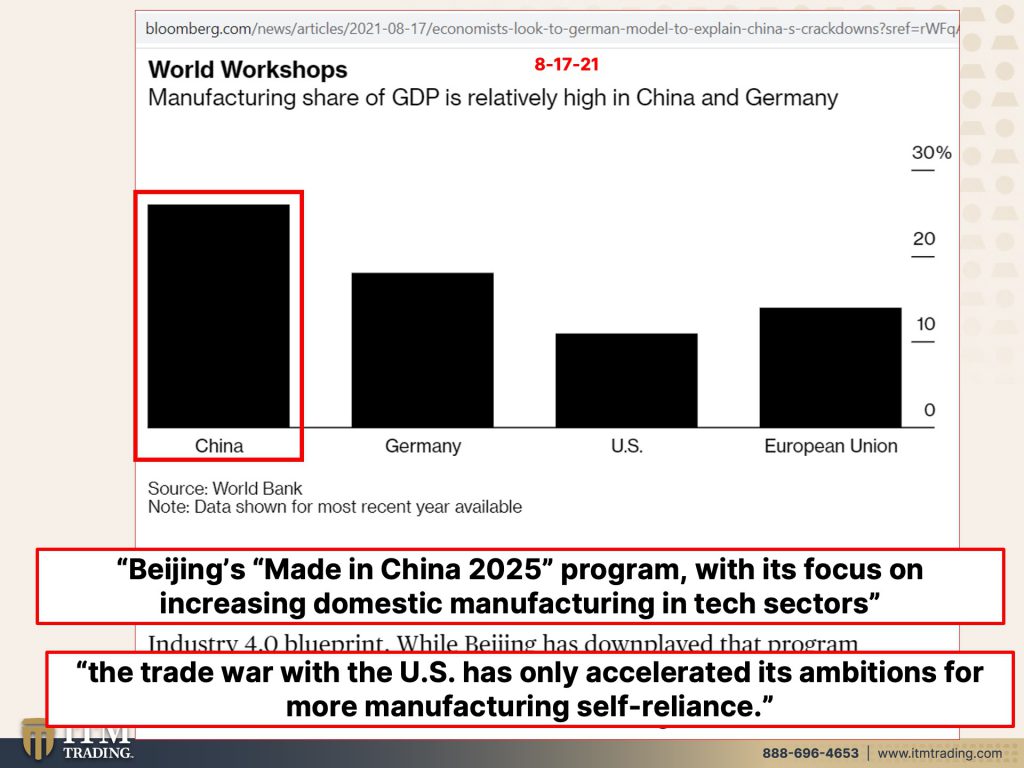

Low paying jobs wanted overwhelming pressure to study and work nonstop is prompting some youth to join the lying flat movement, essentially opting out of the rat race. No, they’ll not be having any of that for the Chinese government, this trend poses a threat to its goal of boosting population growth and creating more productive citizens. And they need that to be globally dominant. Society’s labor market needs to have people at the lower end, particularly in China, which is very manufacturing heavy. So look this is between China Germany, the U.S. and the European union. We used to also be manufacturing heavy. Now we’re service heavy China has taken over that role, but guess what it wants to maintain that role. Made in China 2025 with its focus on increasing domestic manufacturing in tech sectors. And also keep in mind. It’s really interesting because you’ve got worlds that are colliding. And what I mean by that is China has also been working, now maybe they’re changing this we’ll see, but they’ve been working on converting their population into consumers. Well, don’t we globally have a problem since we are globally, primarily a consumer driven economy. That means the consumers have to keep consuming. And I know if you’ve been watching my work recently, you have heard me mention this new phrase that keeps coming up, which is demand destruction because the supply chain is broken. And so in order to buy enough time to fix that supply chain, they need less demand at a time when the governments need more demand. And you know, we’ve talked about hyperinflation and I’ve been paying very close attention to the monetary velocity. I mean, we’ve got two worlds that are colliding, whether they’re in China or they’re globally, and we have to pay a key focus on this because I think more than Evergrande, more than anything else, this is what will hearken in that day of reckoning for everybody. I mean, how can you, how can you require demand destruction at the same time that you want demand to pick up? Am I missing something? But I can see a big problem in the offing. And really, I mean, in as many days, every, every day, I’m reading about that right now. So it’s happening pretty quickly. Additionally, the trade war with the U.S. has only accelerated its ambitions for more manufacturing self-reliance and we know that that the issues between the U.S. and China have been, I see to say the least, but I wanted to take you back in time a little bit, because if you were with me during this period of time, you would have heard me talk about that. I did not think China’s stocks be included in the MSCI index was a good idea. And the reason why I did not think it was a good idea was because of how opaque those markets are. And even when they’re taken off shore. So all you get in the U.S. is an ADR like Alibaba was, I mean, if you have a problem with them, who do you call? Who can resolve that issue? So it’s almost like some of those companies live between two worlds, but, you know, they didn’t ask my opinion and they didn’t take my opinion.

In 2018, they included China’s A-shares in that index. Chances are pretty good that I don’t know if you have a pension plan or a 401k or something else. You may very well be owning this garbage global market research and index company. Will add around 230 China listed shares to its emerging market benchmark in a two-step process in June and September. Okay, fine. And then not a year later, 2019, they quadrupled the weighting of Chinese A-class shares in global benchmarks. I didn’t think it was a good idea then. And surprisingly, we’ll talk about it, but wow. Now others are starting to say the same thing. Avoid Chinese stocks DUH!

Evergrande crisis entangles ETF investors as fallout spreads. It’s that contagion piece. That is the biggest risk because Evergrande is over in China, you’re sitting here, but it is integrated into the banks and even worse into non-bank entities, which means that what’s going on is more opaque and that could create global. And it is likely to create global repercussions. You know, I mean the Chinese government can put in some stop gap measures maybe quickly. I mean it’s two days, but this is what those MSCI shares look like. And you can see that it just broke a key support level. So the next most likely outcome is for them to go down. I didn’t circle this, but can you see that there’s a gap right there? Well, that gap has now been filled. Remember, technically speaking, whenever there’s a gap, either up or down and a gap happens when shares closed at a certain price. And in this particular case opened at a higher price the next day. So that creates that gap. And I can’t tell you when the gap will be filled, but I can tell you that that all gaps always, always, always get filled. So the gap that was created in 2020, over here was now/is now filled. And you can also notice this is as they were preparing to take, to include the Chinese, A-shares into the MSCI index. And you can see once they did that, here’s 2018 look at how much, especially right out of the gate, look at how much the volume has increased, because why? Because that brought a lot more liquidity and a lot more validity into the Chinese financial system. And they do want to become, you know well they are a world power, let’s face it.

Well, let’s see who now is say, I’m not going to do a whole laundry list, but one of my favorite, she says facetiously economists Larry Summers, who was so instrumental in blocking oversight of the derivative market, says foreign investors should feel anxiety about China. Let’s hear what else they have to say. Do you have the audio going, Edgar? I’m sorry. I forgot to tell him we are a little discombobulated because we’re up at the but the bug out house and you can let me know if the sound is better. We put up blankets on the walls. I will be dealing with the glare. So the next time you see me, it’ll look a little different as well, but we are working on that. And let’s see, Larry says bad things. Keep happening. Adverse surprises keep happening, he was on with Bloomberg. The risks for foreign investors are going up and have to be going up at a time when the greater insertion of the communist party and to every private enterprise is emerging as a very important priority for the Chinese government. Goodness gracious. They have been working on this for years….about all Fiat money products, because they are severely overvalued. Now the correction that started yesterday, okay, well, we had a little bit of a bounce. I don’t know where the markets are since I’ve been in here, but does that really mean anything? It’s all liquidity driven and we’ll see if this is the final breakdown. I don’t think it is, but because they’ll still create more money. If the stock market drops too far, they’re not going to, you know, they’re going to try and keep it propped up. They don’t want you selling your stocks. They want you to stay in the system, because that’s how they can rob you and you’re volunteering them, their wealth. Why would you want to do that?

But we do also know what happened with ma who was actually quite vocal and quite present for a long time. And then all of a sudden he just disappeared. His costliest business lesson? China has only one leader, Mr. Ma failed to keep pace with Beijing shifting views and lost an appreciation for the risks of falling out of step. According to people who know him, he tuned out warnings for years, they said, he behaved too much like an American entrepreneur. They stopped his ant IPO and now you barely ever hear from him. I mean, AliBaba is still there, but what else did they do? Oh, there’s Alipay. There’s other things. We’re going to talk about that. And part two, because this is part one, but now to get back in their good graces? Well they’re not the only Chinese tech company, Tencent and others also rushed to support government initiative to bolster social equality in China, the government does not want a revolution.

So they’re making it look like they’re putting the public first. I don’t know that that’s really true, but they have ulterior motives. And this is true, whether you’re in China or anywhere that you are in the world, governments when private enterprises are developing and being innovative and developing new products, if it supports what the vision of the government has, then they take a hands-off approach and they allow that innovation, but frequently they wait way too long on the innovation. And when these tech giants now in this case, and also in the U.S. Also globally, when these tech giants threatened government sovereignty, that’s not okay. And then they start to get pushed back. Who’s going to win? Well, governments have the ability to create laws. So I don’t know the jury is out, particularly when it comes to digital currencies. But again, we’re going to talk more about that in part two, but this is the Chinese control revolution.

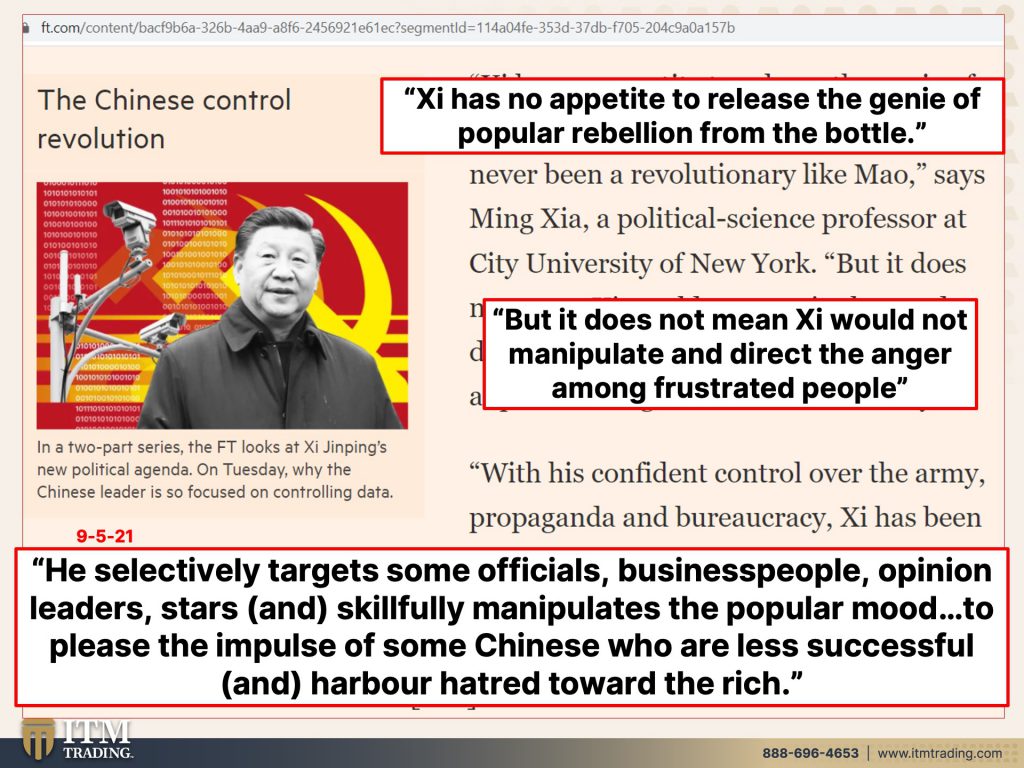

Here you go, no appetite to release the genie of popular rebellion from the bottle, because once you release it, it’s harder to get back in that bottle. So if they can head it off at the pass, that’s what they’re going to do. And a lot of that does indeed come from education and the students and the youth of the country. But this does not mean that Xi would not manipulate and direct the anger among frustrated people. They all do that. All of the governments are doing that. This is not, this is not just in China. This is globally. Look at what’s happening. And you know what? It really doesn’t matter if it’s your opinion agrees with what the government opinion where or the central bank opinion or not. It is freedom of choice that is critical. And globally governments have overreached. their power. China is just more obvious, but I think it’s pretty obvious for everybody now .He’s selectively targets. Some officials, business people, opinion leaders, stars, and skillfully manipulates them the popular mood to please the impulse of some Chinese who are less successful and harbor hatred toward the rich. So this is perception management, really almost at its finest, but we’re watching this kind of behavior on a global basis. I don’t know any country. I’m not seeing any country that’s immune. I’m not saying that they’re all doing it, but there are a lot of countries that are doing that now.

When we’re talking about the gambling stocks, well, generally speaking, wealthy people have the ability to gamble. So they’re revising the gambling laws. Again, government sets what they have on their side. They can just create these laws to include more local ownership, but they’ve also been cracking down on VIP betting and Macau, junkets. So these are well-healed wealthy, but it doesn’t matter where you are from. If you have a business in China, then this is what you have to deal with. China rules on U.S. stocks sent Wynn to worst week in a year, and it’s not just Wynn, but if they have a casino in Macau, guess what? This is what they’re going to have to deal with. Clamped down has slammed U.S. Industries from tech to education. U.S. Industries. Because if you have an office in China, there is a communist cell in your office and you are subject to their laws. You’re not above the law, but I’m wondering why anybody’s surprised because we’ve watched it evolve.

They also are going after anybody that is not following their, what they want them to do. So the reason is why is Beijing is intolerant of these movements is that they’re driven by civil groups that operate outside of the government’s control. So it’s not whether they agree or whether they think it’s okay or not. Okay. What they don’t like is that it’s outside of their control, perhaps more concerning the less clearly enunciated is the fact that LGBTQ groups, feminists, and even online gamers are freer thinkers. They don’t want that. They want you to toe the line the way they have written it in the sand they’re misfits in a society where the image of a model citizen is becoming more tightly defined. And I frankly would argue that that is happening on a global basis. The image of a model citizen is becoming more tightly defined. This is why I’m in my bug out house.

What else are they saying? This crackdown on business could go on for years and years. This is not over. This is just the beginning, but it’s an evolution that has been happening for many, many, many years in 2000 when the U.S. supported China’s role in the world and encourage the development of their manufacturing base in globalism, because Hey, it was a lot cheaper to manufacture in China and ship it globally. Well, that’s when it started. And they were going sort of for a hybrid version of communist capitalism, but it looks like they’re veering away from that now, but since they are so integrated globally, that’s going to have repercussions for everyone. And the repercussion that I’m most nervous about honestly, is China showing the leaders the way to control an entire population. The Chinese government has availed a five-year plan, outlining tighter regulation of much of this economy. It says, new rules will be introduced covering areas, including national security technology and monopolies in the world’s second largest economy. The 10 point plan, which runs to the end of 2025 was released jointly laid on Wednesday by China’s state council and the communist party central committee. It said laws will be strengthened for important fields, such as science and technological innovation, culture and education. The plan also said the Chinese government to tackle monopolies and foreign related rule of law. Regulations relating to China’s digital economy, including internet finance, artificial intelligence, big data, cloud computing, etcetera, will also be reviewed. They will be controlling everything. And I think this is the direction that many governments are moving toward. So what does that mean for you and for me, why should we even care about this? Because it’s your loss of freedom. It’s your loss of control. It’s your loss of choice and things are speeding up. And if you don’t make choices to protect yourself, now, I can’t tell you when you’re going to lose those choices, but I can tell you, you will lose those choices. And as we know, the bank for international settlement says gold held in your home, runs no political risk. I don’t want this political risk. Do you?

So I had a great interview this morning with Antonio over at B.A.B.Y. Investments. And we will share that link when it’s out, but it was really, it was a great conversation. And I think you’ll really, really enjoy it. And we talked a lot about this and other things as well. And next week, I’m very excited because Gregory Mannarino is going to be back. And he is definitely a fan favorite. And that is always a very spirited conversation. And we have a lot, a lot to talk about. So which day is that Edgar? Thursday. Okay. So that’ll be live Thursday at one. You do not want to miss that, but if you haven’t yet put a strategy in place, you know, you need to do this, please. We are running out of time. So if you want to talk to one of our consultants, click that Calendly link below, or give us a call and we will set up a time, you know, you’re going to establish your goals, and then you build everything around that, but time is running out. So really, really, really please get it done, please get it done. And I think, have you been publishing a lot of, right? So there’s a lot of things that are going on at the bug out house. And like I said, in the beginning personally, I’m feeling a lot of urgency. I’m watching things evolve. And so I’m rushing to get as much done as I possibly can. So you want to watch this so however you can apply it to your circumstance and your getting prepared, do it, please do it. And again, this is a great time to subscribe because here at ITM Trading, we know a gazillion percent. It is time to cover your assets. And we do that here with the wealth shield and the foundation of the wealth shield is physical gold and physical silver in your possession. Cause there runs no political risk, no counterparty risk. And it protects your purchasing power. So tomorrow we’ll do Q&A with Eric. And until then, please be safe out there. Bye-Bye.

SOURCES:

https://www.ft.com/content/bacf9b6a-326b-4aa9-a8f6-2456921e61ec?segmentId=114a04fe-353d-37db-f705-204c9a0a157b 9-5-21

http://m.cyol.com/gb/articles/2021-08/29/content_J7n6YUZyw.html

http://m.cyol.com/gb/articles/2021-08/29/content_J7n6YUZyw.html

https://www.ft.com/content/e9669b5b-29eb-457a-bb2b-762dc9545002?desktop=true&segmentId=d8d3e364-5197-20eb-17cf-2437841d178a#myft:notification:instant-email:content 9-21-21

https://www.ft.com/content/bacf9b6a-326b-4aa9-a8f6-2456921e61ec?segmentId=114a04fe-353d-37db-f705-204c9a0a157b 9-5-21